This proposal sets out the background and rationale for change, the impact on roles and

reporting lines, timeframes, and support available for people affected by the proposed

changes.

This is a key initiative for ACC and we welcome your views and feedback – please send this

to [email address].

Consultation on the proposal closes at 5pm on Wednesday 7 May 2014, after which we will

consider all feedback and make final decisions.

Sid Miller

General Manager, Claims Management

10 April 2014

2

Contents

1. Background.................................................................................................................... 4

2.

Why change is necessary.............................................................................................. 4

a.

Challenges with the current structure.................................................................. 5

b.

Implementing the new Counter-Fraud Outcomes Model..................................... 5

c.

Improving fraud and corruption risk management ............................................... 6

d.

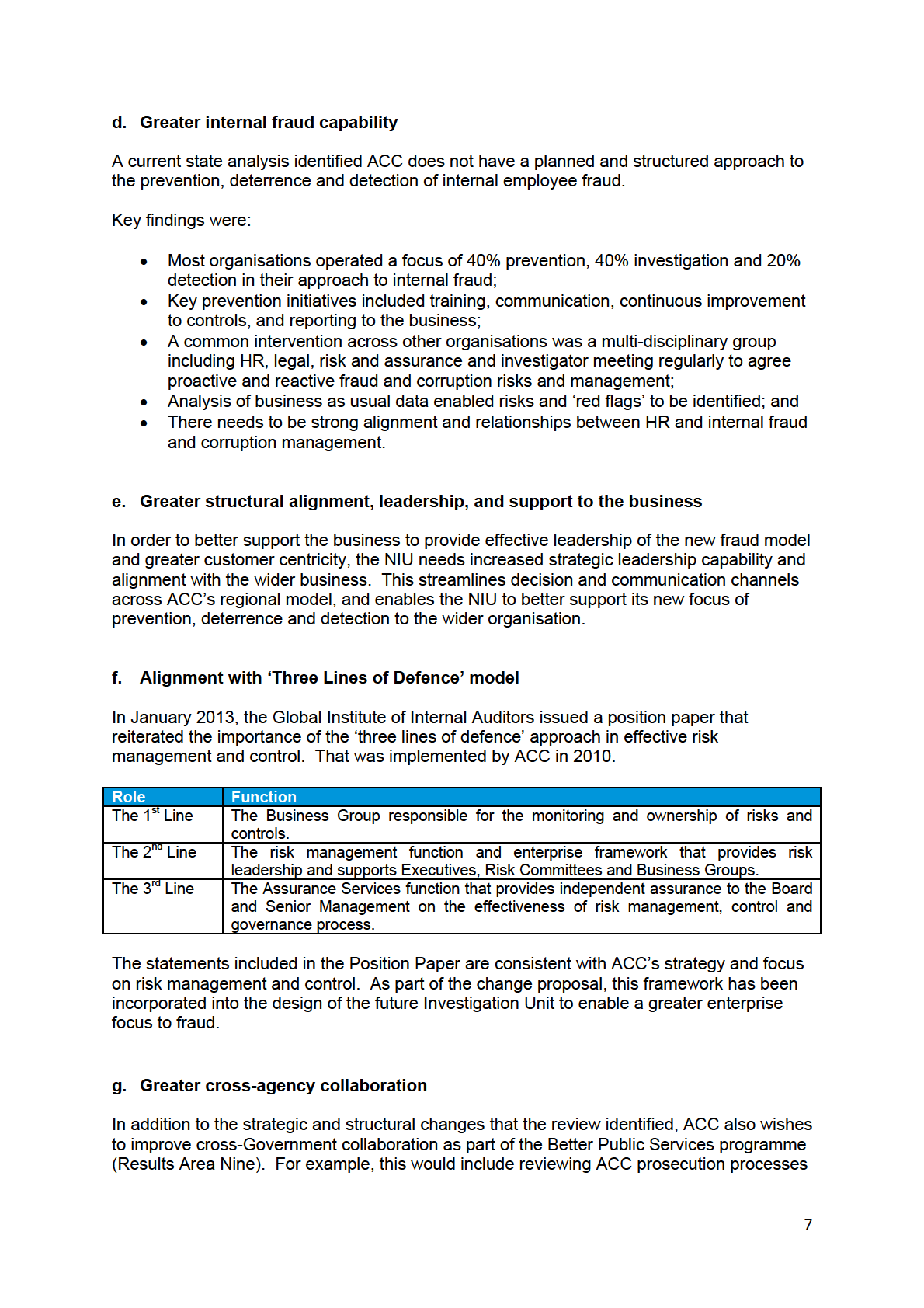

Greater internal fraud capability .......................................................................... 7

e.

Greater structural alignment, leadership, and support to the business ............... 7

f.

Alignment with ‘Three Lines of Defence’ model .................................................. 7

g.

Greater cross-agency collaboration .................................................................... 7

3.

Key objectives of proposed change............................................................................... 8

4.

Impact on National Investigations Unit .......................................................................... 8

5.

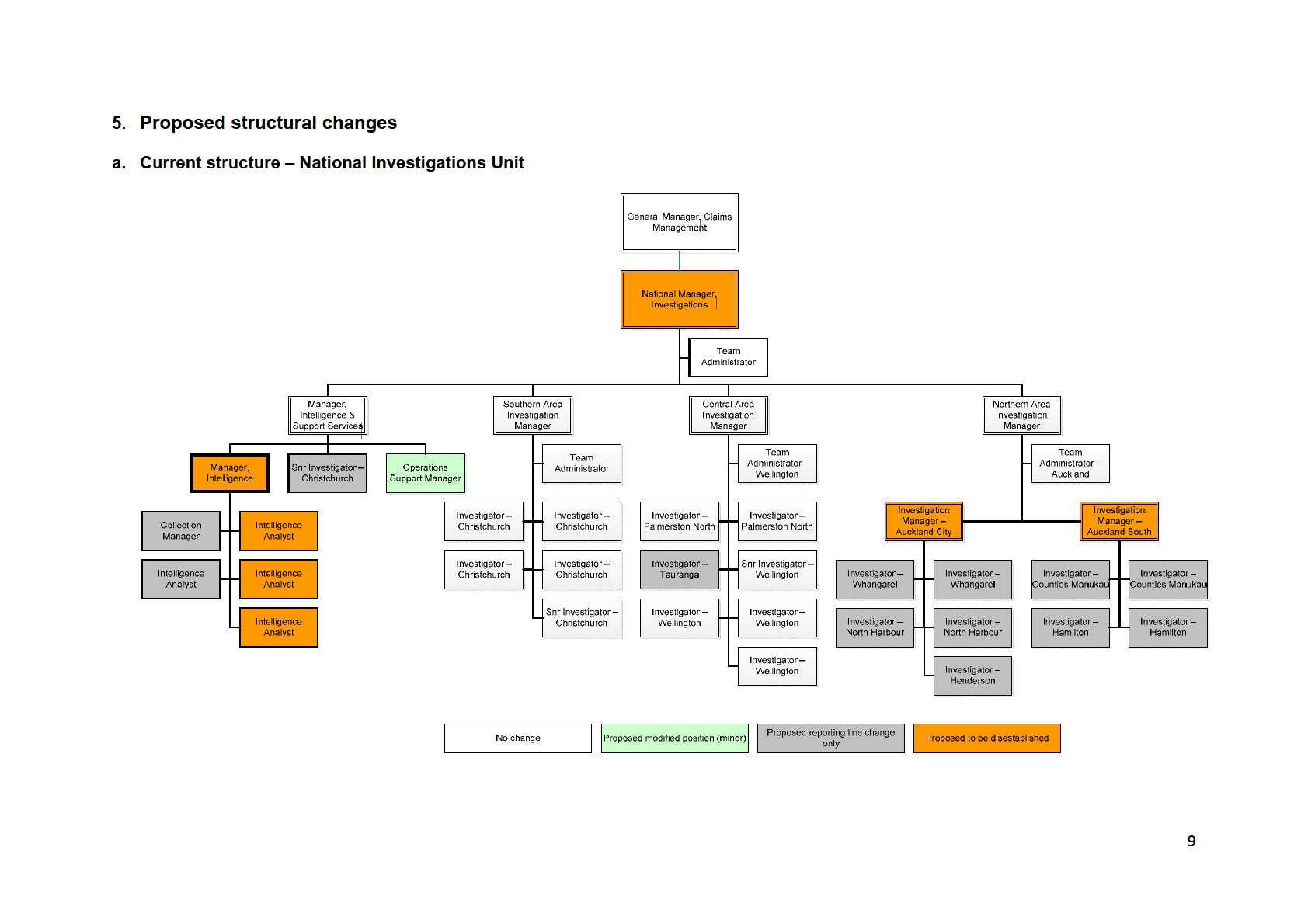

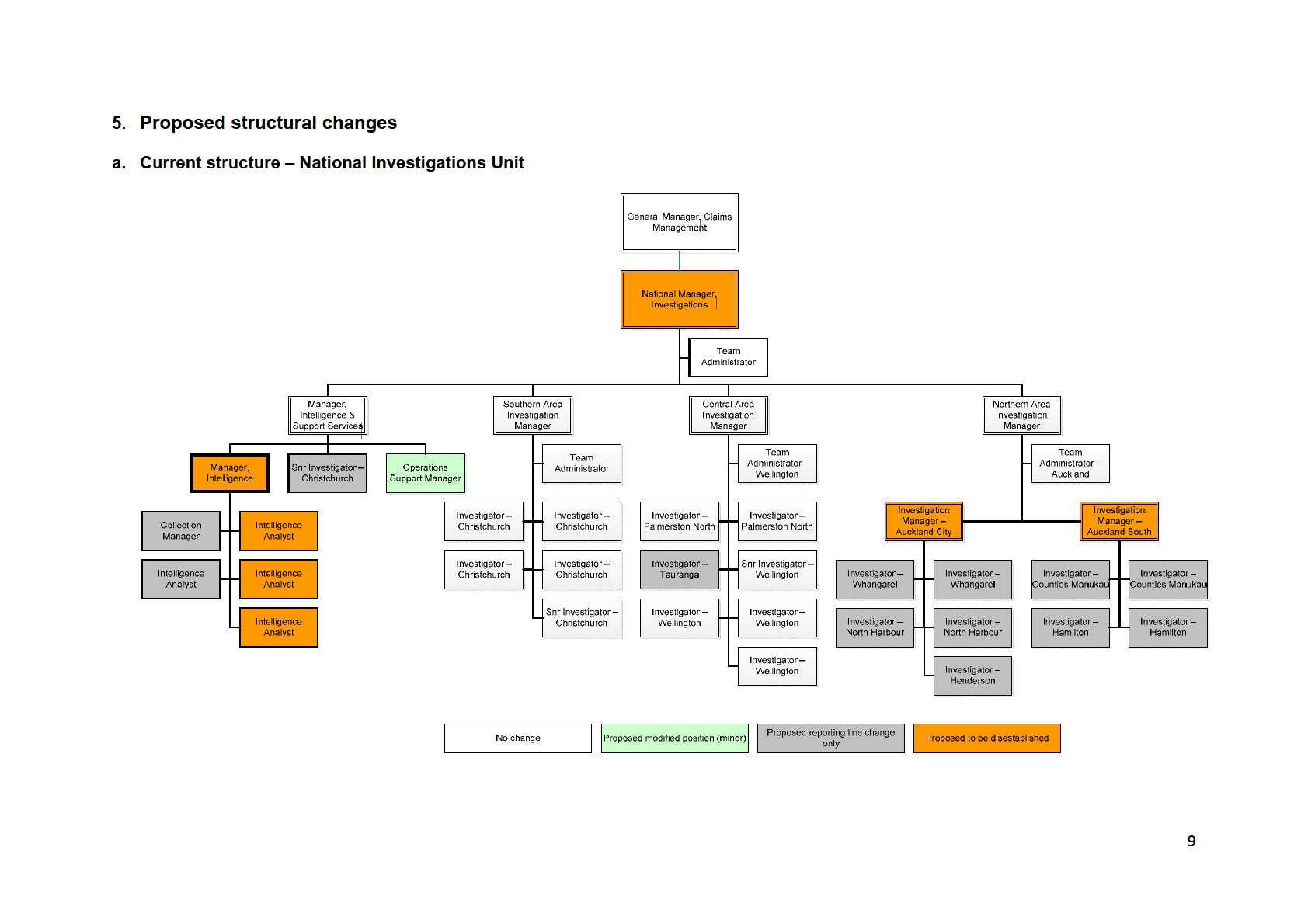

Proposed structural changes ......................................................................................... 9

a.

Current structure – National Investigations Unit .................................................. 9

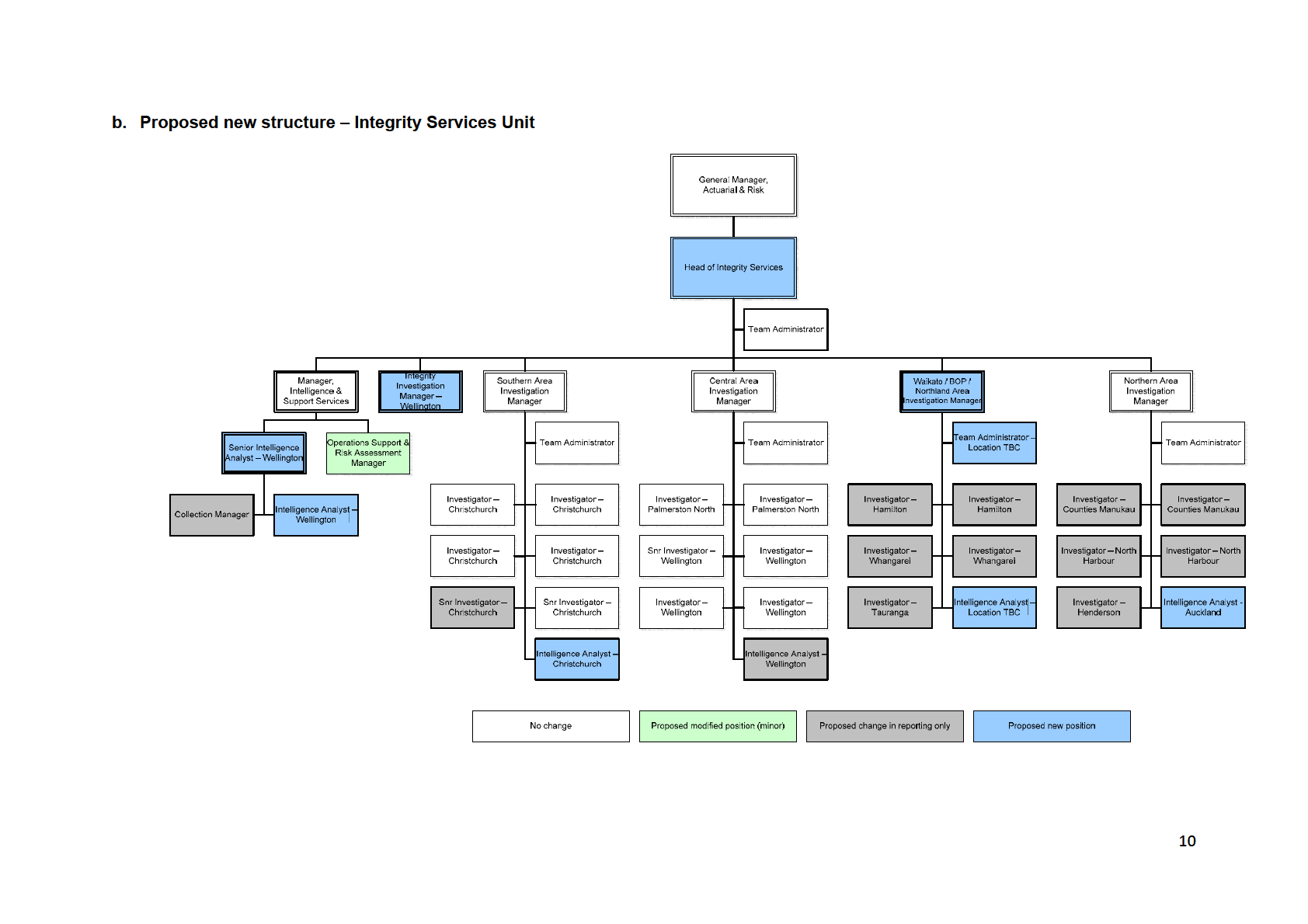

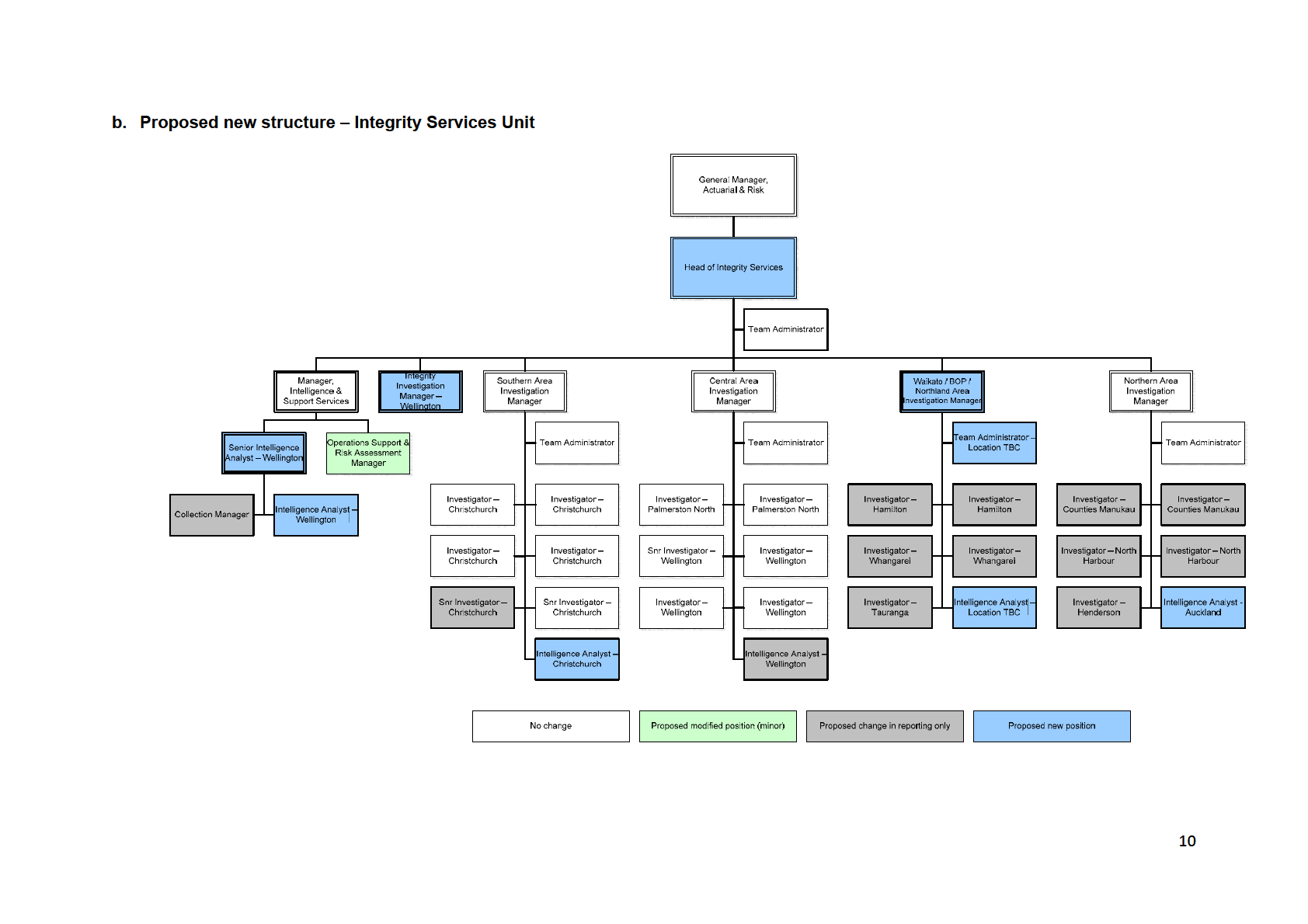

b.

Proposed new structure – Integrity Services Unit ............................................. 10

c.

Proposed new positions to be established ........................................................ 11

d.

Proposed positions to be disestablished ........................................................... 11

e.

Proposed changes in reporting line................................................................... 13

f.

Proposed minor change to position................................................................... 13

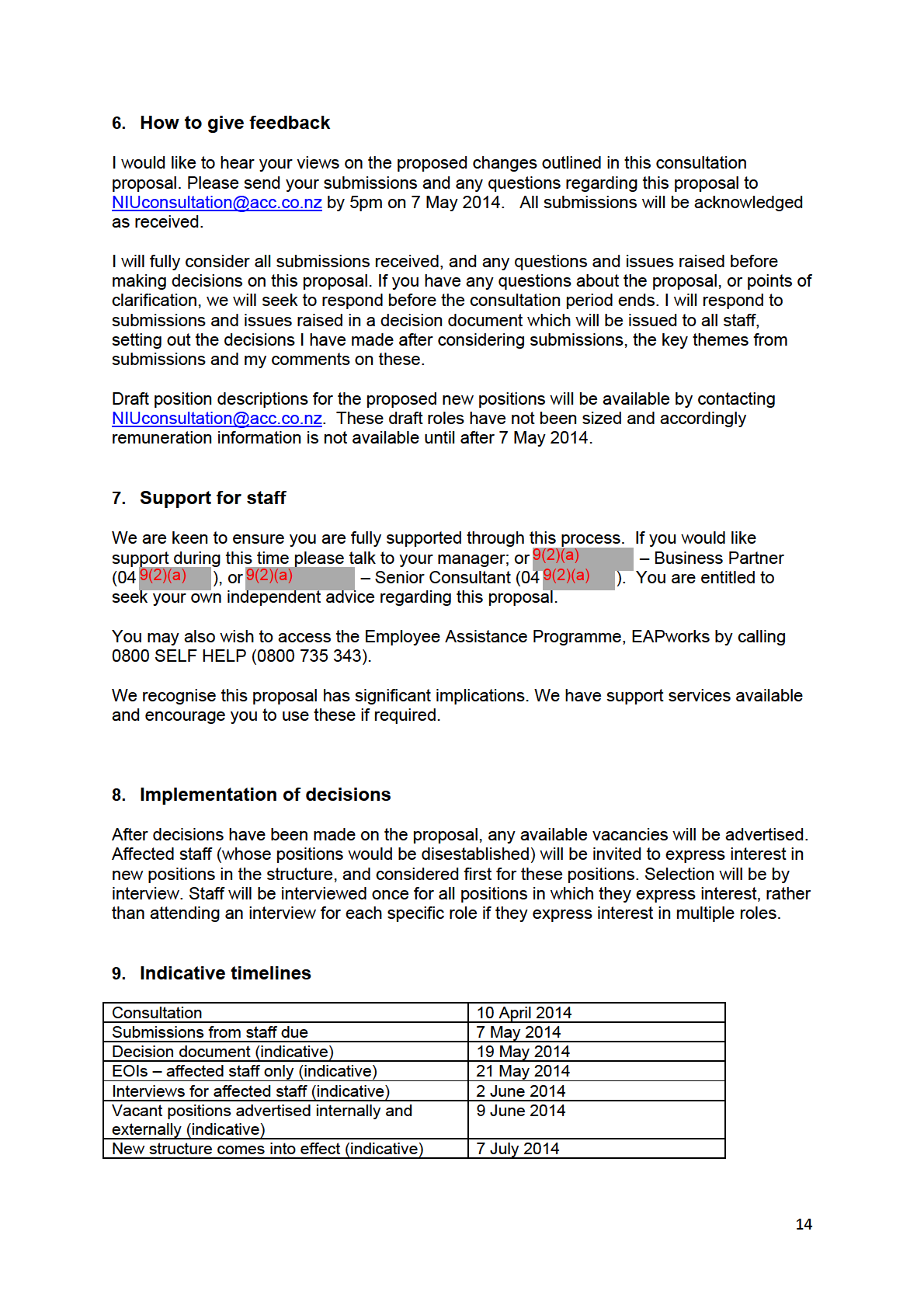

6.

How to give feedback .................................................................................................. 14

7.

Support for staff ........................................................................................................... 14

8.

Implementation of decisions ........................................................................................ 14

9. Indicative

timelines ...................................................................................................... 14

Appendix A: Deloitte Review – ACC Investigation Capability Review (enclosed) ............... 15

3

1. Background

The NIU is currently based within Claims Management Group (CMG). An independent

review of the NIU was commissioned in 2007, which resulted in changes to the structure and

focus of the unit to achieve greater alignment between the Fraud Unit and the wider

organisation.

Since then, the unit’s focus has been to investigate situations where there are indicators that

clients are acting dishonestly towards ACC for the purposes of financial or personal gain.

A further independent review was commissioned and undertaken by Deloitte between March

and September 2013. The scope was to review the following key areas:

Internal Fraud Capability;

Fraud & Corruption Risk Assessment; and

Review of the ACC National Investigations function.

A copy of the report from this review dated 28 November 2013 is provided as Appendix A.

The 2013 review included:

An assessment of the NIU’s implementation of agreed changes following the 2007

review;

A gap analysis on how ACC currently approaches internal and external fraud and

corruption risk, compared to other organisations considered to reflect best practice in

this area;

An action plan to close these identified gaps;

A proposed organisational model (the Counter-Fraud Outcomes Model) to better

manage fraud and corruption risks; and

A proposed organisational structure to better position ACC to manage fraud and

corruption risks internally and externally, aligned to the Counter-Fraud Outcomes

Model.

The review also identified there was not a planned and structured approach to managing

internal employee fraud. It recommended ACC seek further information about best practice

organisational approaches to the management of internal fraud from a range of public and

private sector organisations.

The benchmark organisations used, who are considered to reflect best practice risk

management in this field, included the Ministry of Social Development, Inland Revenue,

Ministry of Business, Innovation and Employment and New Zealand Police.

2. Why change is necessary One of the key findings of the review was the NIU has almost an exclusive focus on

investigating client (external) fraud, which aligns with the unit’s placement within the CMG.

This focus has not fostered a balanced approach to managing fraud risks by achieving

prevention, deterrence, and detection outcomes with clients, providers and levy payers. To

address this, a more holistic view to countering fraud and corruption risk is proposed. It

would focus not only on investigations but also prevention, deterrence and detection

initiatives for all three groups at all levels across the unit. In addition, the review

recommended the NIU leads ACC’s management of internal fraud risks.

4

Another key finding was that the Intelligence capability is not currently well aligned to the

Investigators or the business groups they support. This has resulted in inefficiencies arising

through a lack of communication and shared purpose. The regional location of the

Investigation teams was cited as effective in promoting greater customer centricity with the

wider business.

a. Challenges with the current structure

The review identified the following issues with the current NIU organisation structure:

It is not aligned to ACC’s ‘three lines of defence’ risk framework;

The multi-layered structure across some units does not provide a basis for efficient

and timely decision-making;

The centralised model for Intelligence does not meet the needs of its customers i.e.

regionally based investigators;

Clear accountability for decision-making is not embedded within the structure; and

The structure does not support clarity around roles and responsibilities for fraud and

corruption management in the organisation, i.e. what is the responsibility of the NIU

and what is the responsibility of the business groups they support?

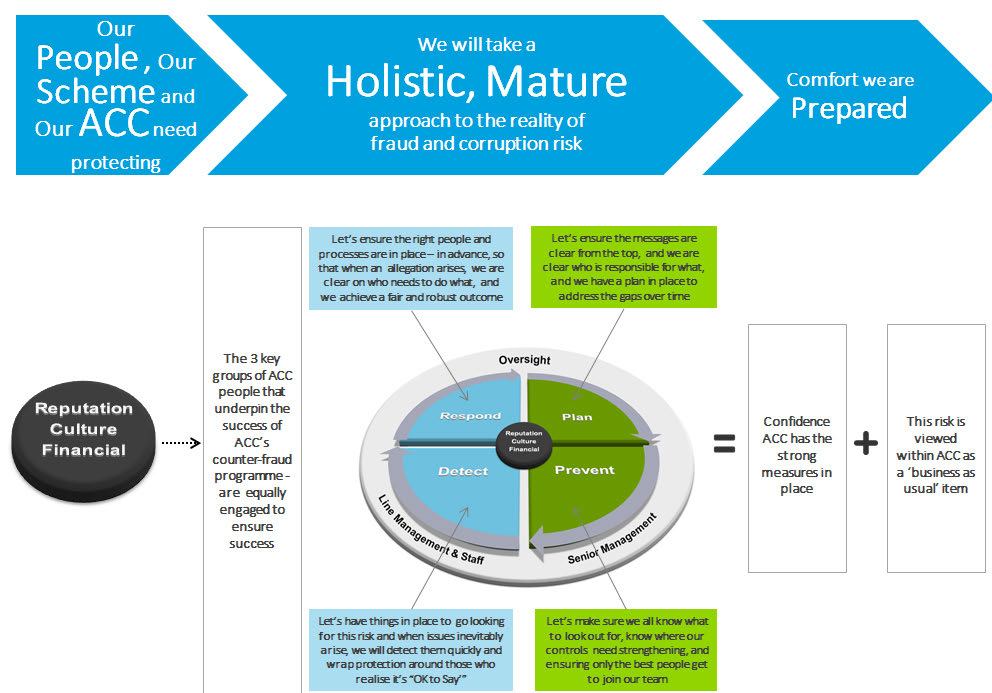

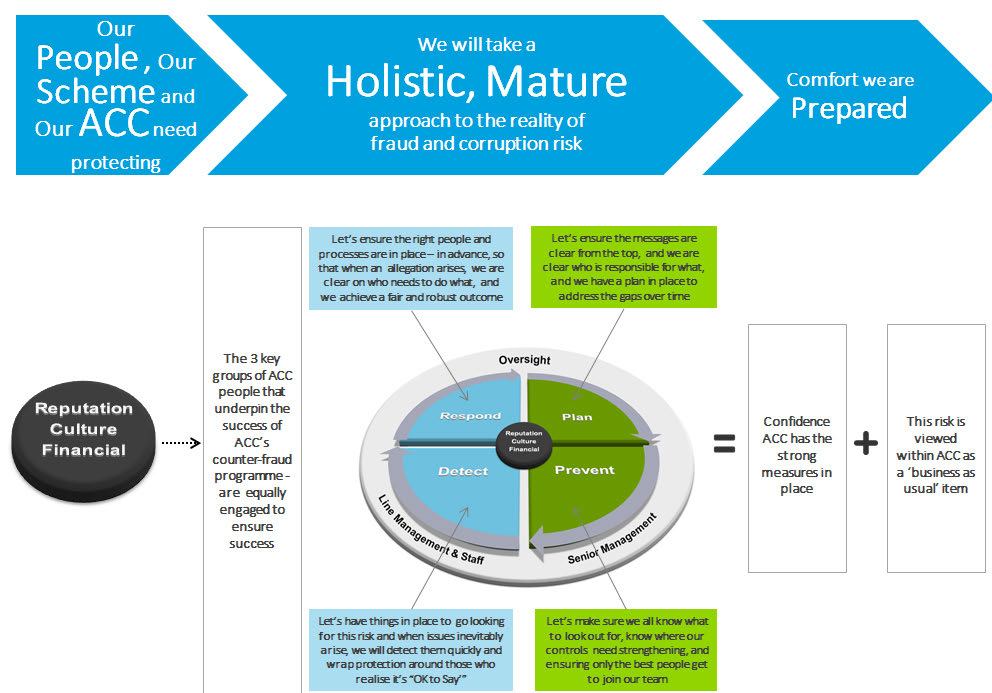

b. Implementing the new Counter-Fraud Outcomes Model

As part of the review, a new Counter-Fraud Outcomes Model was designed. This has been

endorsed by the Executive. The new model will work alongside ACC’s existing risk

management function to provide greater leadership and an effective framework for how we

behave towards fraud moving forward.

5

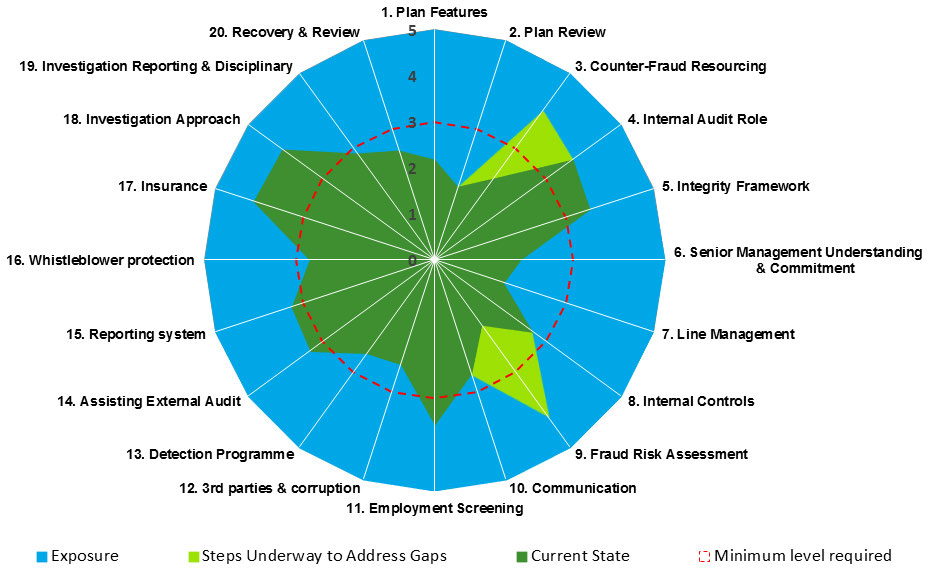

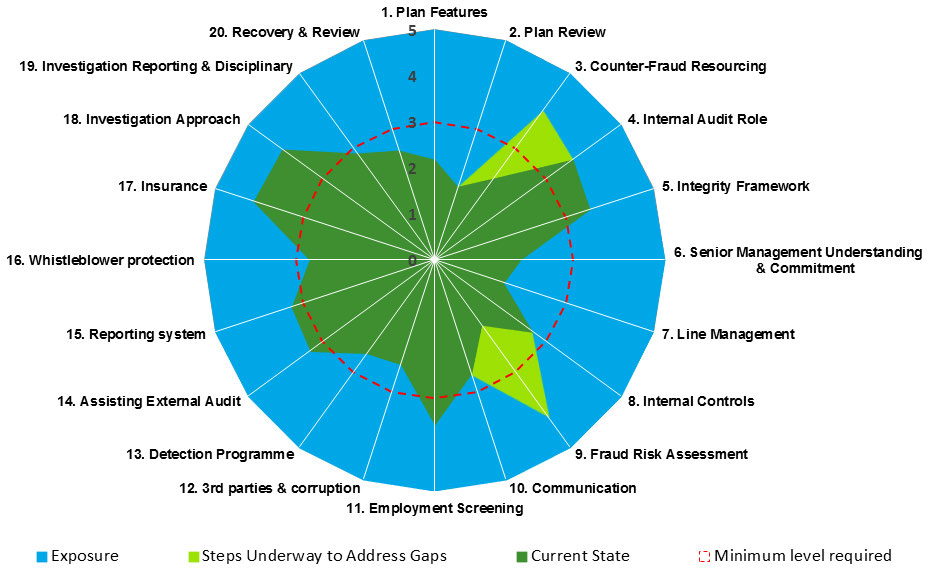

c. Improving fraud and corruption risk management

c. Improving fraud and corruption risk management

The review included a gap analysis of ACC’s management of fraud and corruption risks,

compared to best practice. It assessed ACC’s performance against each of 20 best practice

features of an effective fraud and corruption management system. A score of five

represents best practice, with three the ‘industry minimum acceptable level’ that would be

expected. The results are shown pictorially below.

To address these gaps and achieve at least the ‘industry minimum acceptable level’, the

following changes must be made to the way we manage fraud and corruption risks at ACC:

ACC needs to take a more strategic focus to the management of fraud and corruption

risk, focussing on prevention as well as investigation and detection. This can be

achieved through implementing the Counter-Fraud Outcomes Model;

The NIU needs to be repositioned to be a highly visible part of ACC’s ‘three lines of

defence’;

The focus of the NIU needs to be expanded to include provider fraud, levy payer

fraud, client fraud, and internal fraud;

A clear and balanced strategy for the prevention, investigation and detection of fraud

across all four fraud focus areas needs to be developed; and

A new organisational structure needs to be introduced to drive a more holistic

approach to fraud and corruption management, aligned to Risk and Assurance.

This new holistic approach to fraud will be achieved through the current unit by focusing on a

smaller number of cases, with higher value outcomes.

6

against the model used within other similar prosecuting agencies as specified by the Crown

Law Public Prosecutions Unit.

3. Key objectives of proposed change

The key objectives of the proposed changes are to:

Ensure the scope, objectives and structure of the unit are aligned to ACC’s strategic

direction and three lines of defence risk model across ACC;

Implement strategies which achieve ongoing reduction of internal and external fraud

and corruption risk to ACC;

Position ACC to take an increasing involvement in collaboration with other agencies

in tackling the risk of fraud;

Promote and increase the level of fraud and corruption awareness within ACC;

Create a structure which improves speed and accuracy of decision making and

provides clarity around roles and responsibilities for fraud and corruption

management both internally and externally;

Create a more holistic approach to fraud, which balances prevention, deterrence and

detection across all four fraud focus areas (internal, provider, client and levy fraud);

and

Improve alignment with ACC’s ‘three lines of defence’ as part of the risk management

and control framework.

4. Impact on National Investigations Unit

The review outlines a proposed structure, aligned to the new Counter-Fraud Model. This

structure focuses on repositioning the unit from a functional to an enterprise ACC focus by

broadening its scope to introduce the Internal Investigations arm, and adding the discipline

of maintaining ACC’s ongoing fraud and corruption risk assessment as part of the ‘three

lines of defence’ model.

Key proposed changes from the current state are:

The unit would be re-titled Integrity Services and moved from the Claims

Management Group to the Actuarial and Risk Group;

It would be led by a newly established position of Head of Integrity Services,

reporting to the General Manager – Actuarial and Risk;

Integrity Services will support a ‘whole of the business’ approach to fraud and

corruption. This will require the Head of Integrity Services to work closely with the

Chief Risk Officer, People & Communications, and the business groups that Integrity

Services supports across ACC;

The unit would align its structure with the four regions in the Claims Management

Network (Christchurch, Wellington, Hamilton and Auckland). This includes

establishing a fourth Area Investigation Manager to provide greater strategic focus for

both the new region and the already established South Auckland Investigations

Team; and

Group Investigators and Intelligence staff, together with their Area Investigation

Manager, will provide more tailored support across the four regions.

8

c. Proposed new positions to be established

The following new positions are proposed to be established:

Position Rationale

Head of Integrity

This role will be responsible for leading the development and

Services – 1 FTE

implementation of a new counter-fraud model for ACC, with significant

focus on managing an integrated approach to the prevention and

deterrence as well as detection and response across all types of fraud.

This role will require significant engagement with the Executive,

management teams, HR and Risk, aligning ACC strategic direction to

the counter-fraud strategy for ACC.

Integrity Investigation

This role will be responsible for managing an integrated approach to

Manager – 1 FTE

deterrence, prevention and detection of and response to employee-

related fraud, with a greater focus on communication with its customer

stakeholder groups.

Area Investigation

It is proposed that a new position of Area Investigation Manager be

Manager – 1 FTE

established in the Waikato / BOP / Northland region. The establishment

of a fourth Area Investigation Manager will provide greater strategic

focus to the new region and provide greater leadership coverage

across the team.

Senior Intelligence

This role will be responsible for providing best practice subject matter

Analyst – 1 FTE

expertise across the intelligence team. The key function will be to

provide a Business Analyst function by developing and implementing

robust business and reporting processes across the team.

Intelligence Analyst –

The four existing Intelligence Analyst roles will remain the same in

3 FTE

scope; however three non-Wellington based roles will be established in

the regions (Southern, Northern, and Waikato / BOP / Northland) to

align with the Branch Network.

Intelligence Analysts –

An additional (fifth) Intelligence Analyst across the Unit will be

1 FTE

established and located in Wellington. This role will however have a

slightly different focus than the regional Intelligence Analysts towards a

Centre of Excellence approach. It will also provide overflow support to

the regional Intelligence Analysts.

Team Administrator –

This role will be responsible for supporting the Waikato / BOP /

1 FTE

Northland Area Investigations Team.

d. Proposed positions to be disestablished

The following positions are proposed to be disestablished:

Position Rationale

National Manager,

The scope and accountabilities for this position are not sufficiently

Investigations

aligned to the new Counter-Fraud Model, which takes a holistic

approach to the management of fraud and corruption risk. A greater

focus is required at a strategic level to provide direction to the

organisation regarding; prevention and detection, employee fraud, risk

management and be customer facing to ACC Executive team and

11

staff. This significantly increases the breadth of responsibility of this

role as it is not only responsible for the delivery of the fraud function,

but accountable to develop and implement strategy which aligns the

unit’s strategies to ACC’s strategic direction and enterprise Risk

Management.

These amendments constitute a significant change to the current

position description.

Intelligence Analysts

It is proposed to disperse the Intelligence Analyst positions to the

(3)

regions to ensure the provision of intelligence analysis is aligned to

regional needs, reporting to the Area Manager. This will enable the

Intelligence Analysts and Investigators to work more collaboratively

and understand one another’s needs in one location/area.

One of the four Intelligence Analyst roles will not be disestablished as

the Central Area role is still based in Wellington, so will be a reporting

line change only.

Roles will be offered to existing staff in the first instance and where

there is more than one person wanting to work in the same region,

interviews will determine the final decision.

The change in location for three of the Intelligence Analyst roles

constitutes significant change.

Manager, Intelligence

This role’s management responsibility for the Intelligence function

would be dispersed with the Intelligence Analyst function largely

decentralised to the regions. Two centralised Intelligence Analysts will

now provide strategic intelligence analysis, a centre of excellence

approach, and overflow support to the regional Intelligence Analysts.

These amendments constitute a significant change to the current

position description.

Investigation Manager

It is important in the new structure to have consistency across the

(x2)

management team and currently there is fifth tier level of management

only in the Auckland region. There is a need for additional head count

at the Area Management level to provide greater strategic support

across the Branch Network. Investigators in the northern region will

now report directly to the two Area Investigation Managers. This will

enable improved speed, accuracy and communication of decision

making.

The change in reporting line for all Investigators in the northern region

to Area Investigation Manager constitutes significant change to the

current position description.

12

e. Proposed changes in reporting line

The following changes are proposed to reporting lines:

Position Currently

Proposed

Rationale

reports to

reporting line

Collection Manager

Intelligence

Manager,

Aligns resources to integrated

Manager

Intelligence &

integrity approach

Support

Services

Senior Investigator,

Manager,

Southern Area

Aligns resources to regional

Christchurch

Intelligence and

Investigation

area

Support

Manager

Services

Intelligence Analyst

Intelligence

Central Area

Aligns resources to the regions

Manager

Investigation

– Central Area (based in

Manager

Wellington)

Investigators (Northern

Investigation

Northern Area

With Investigation Manager

Area only)

Manager (both

Investigation

roles proposed to be

Auckland City

Manager; and

disestablished, the Investigators

and Auckland

Waikato / BOP /

in the current Northern Area will

South)

Northland Area

now role to their respective

Investigation

Area Investigation Manager

Manager

directly.

f. Proposed minor change to position

The following minor changes are proposed to existing positions to better align with the new

strategic direction of the unit. These are only minor changes and do not constitute

significant change:

Position Proposed

changes

Rationale

Operations Support

The position description would

A greater focus on ACC-wide risk

Manager

include accountabilities for risk

assessment and risk profiling is

assessment. The position would needed for effective deterrence,

be re-titled Operations Support

prevention and detections of fraud.

and Risk Assessment Manager.

Area Investigation

Updated position descriptions

This will ensure the new strategic

Managers

would reference the leadership

direction is implemented

elements of the new strategic

consistently across unit, and

Manager, Intelligence

direction e.g. ‘three lines of

integrated across the wider

& Support Services

defence’; holistic approach;

business.

enterprise wide; and the four

fraud focus areas.

Investigators

Updated position descriptions

This will ensure the new strategic

would reference elements of the direction is implemented

new strategic direction relevant

consistently across unit, and

to investigators e.g. holistic

integrated across the wider

approach and four fraud focus

business.

areas.

13

Appendix A: Deloitte Review – ACC Investigation Capability Review (enclosed)

15