GW Corporate Carbon Pathways for the 2021-31 LTP

GW Corporate Carbon Pathways for the 2021-31 LTP

Overview

• Background and scenario building

• Officer’s preferred option - B2-R1-P1.5

• Option two - B2-R2-P2

• Option three - B1-R1-P1

• Comparison

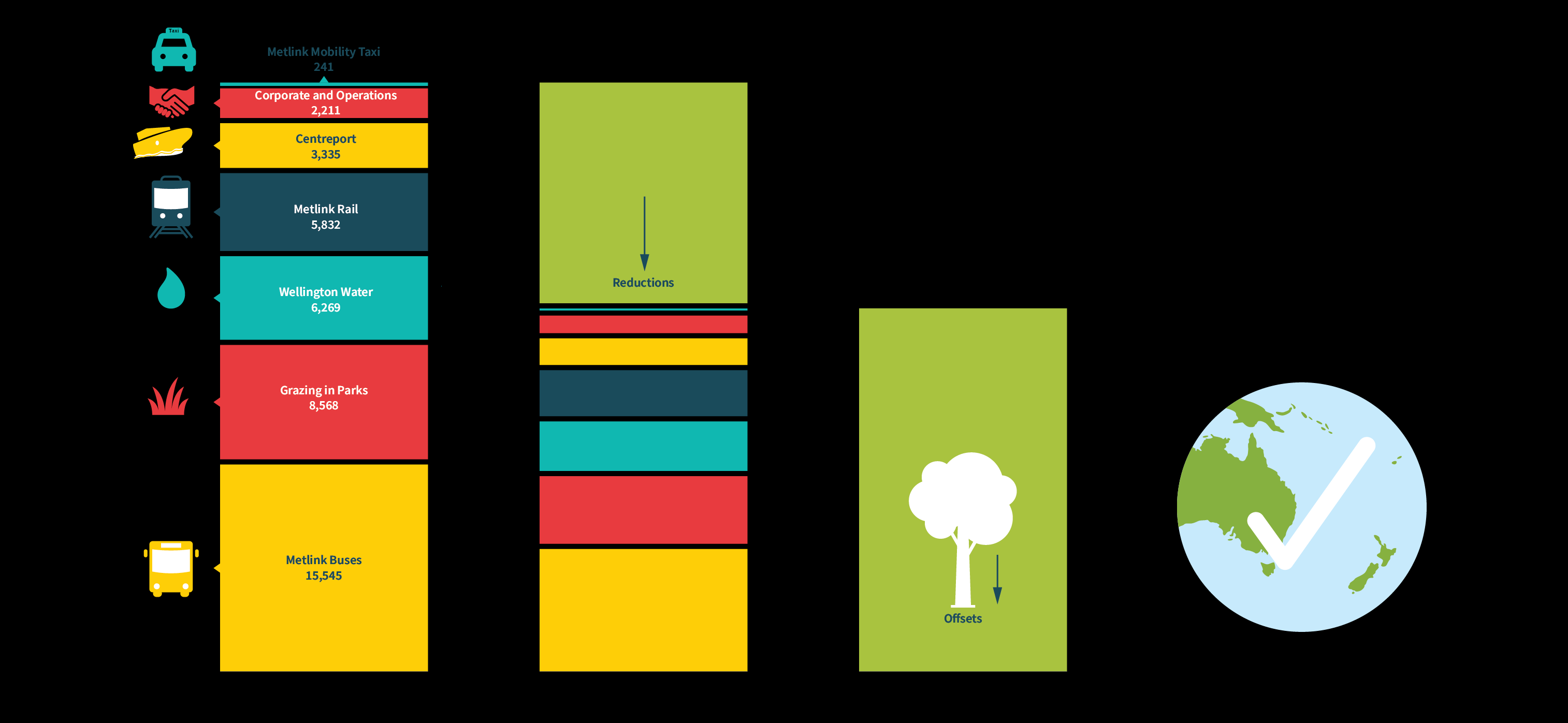

Greater Wellington – the path to carbon neutrality and beyond

Greater Wellington – the path to carbon neutrality and beyond

GW’s corporate targets

GW’s corporate targets

• 40% reduction in net emissions in 2025

• 100% reduction in net emissions in 2030

(carbon neutral or net-zero)

• ‘Carbon positive’ by 2035 (units being

generated by GW exceed gross emissions)

• Set five-yearly carbon budgets

Background

• On 29 October Council agreed that there would be at least two

decarbonisations scenarios in the LTP consultation document and one of

these would be B2-R2-P2

• Since then the various scenarios have been investigated further and costs

refined

• The current scenario included in the draft LTP is B2-R1-P1.5

• Following workshop feedback, offsetting assumed not to begin until 2025

at the earliest

Scenario building

Scenario building

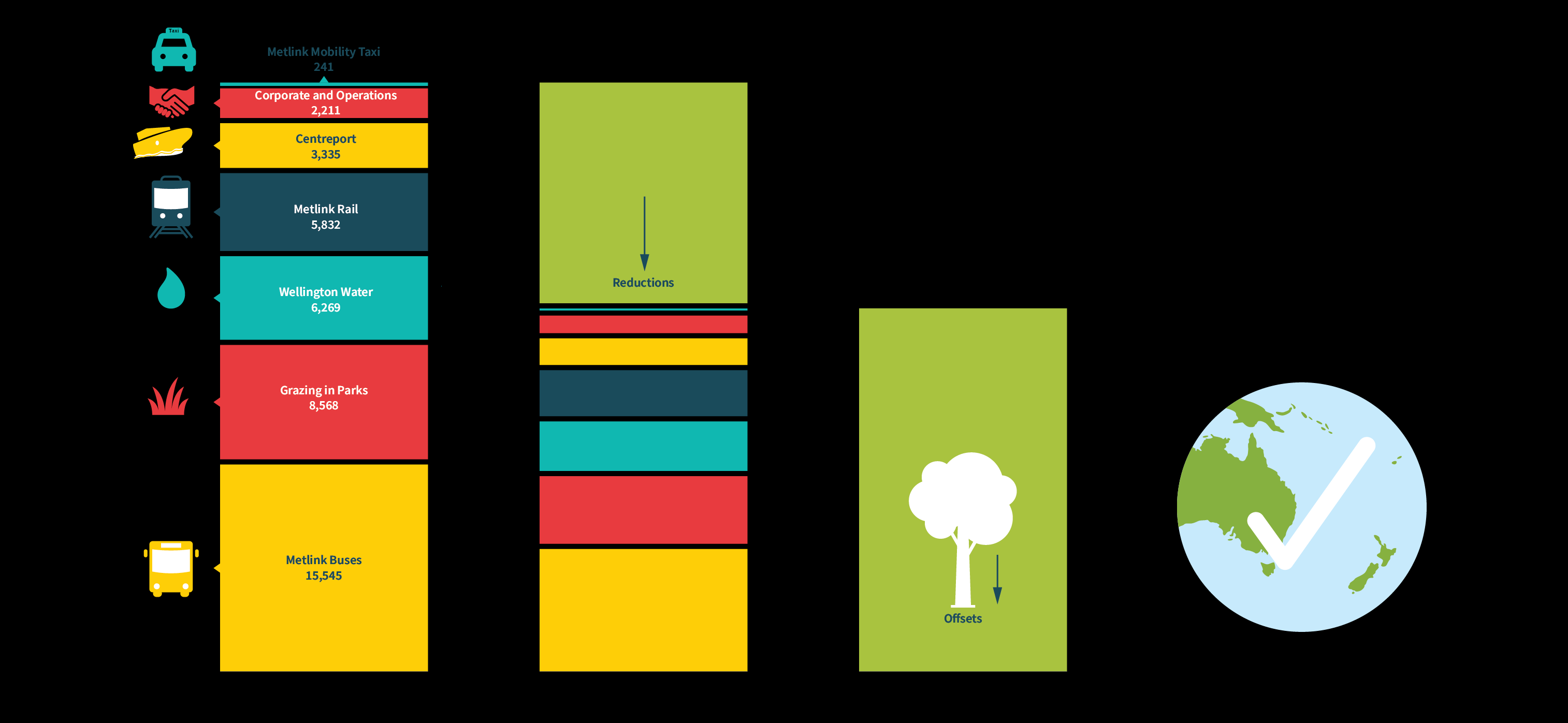

• 100% renewable electricity by 2030 (updated

post election)

• All electric light fleet by 2030

• Cuba Street change included

• CentrePort and CCOs removed from footprint

and modelling (total 10,370 tonnes CO2e/year

in 2018-19)

Scenario building - Bus

Level/

Description

GW share of cost

Total cost

label

(2021-30)

(2021-30)

B1

Existing commitment electric buses, plus

$63M

$128M

new EVs at replacement only (‘Organic

Growth)

B2

All bus peak vehicle commitment EV

$83M

$169M

from contract renewal, spares are diesel

(‘Step Change’)

•

Costings are based on existing contractual arrangements. 51% NZTA subsidy.

•

Costs common to both scenarios excluded.

•

B2 achieves a 75% reduction in emissions in 2030 compared to 2019. Scenarios with spare

buses as EV achieve an 82% reduction.

•

~21% of the bus fleet are spares (138 of 663 buses in 2030)

Scenario building - Rail

Level/

Description

GW share of cost

Total cost

label

(2021-30)

(2021-30)

R1

Diesel-electric multiple unit (DEMU) trains on

$118M

$240M

Wairarapa and Manawatu lines from 2025

R2

Battery-electric multiple unit (BEMU) trains

$270M

$550M

on Wairarapa and Manawatu lines from 2025

•

51% NZTA subsidy assumed to calculate GW share of cost

•

Costs common to both scenarios excluded (e.g. station improvements)

•

Note carbon reductions from full electrification of these lines (EMU trains) are the same as R2

Scenario building - Parks

Level/

Description

Cost estimate (total to 2035)

label

P1

1,115Ha grazing phased out over 15 years,

$23.5M

planted in new native forest

P1.5

1,350Ha grazing phased out over 10 years,

$26.4M

planted in new native forest

P2

1,713Ha grazing phased out over 10 years,

$36.3M

planted in new native forest

•

Cost estimate excludes value of emissions units earned from new forest

•

Excludes any contribution from Low Carbon Acceleration Fund (LCAF)

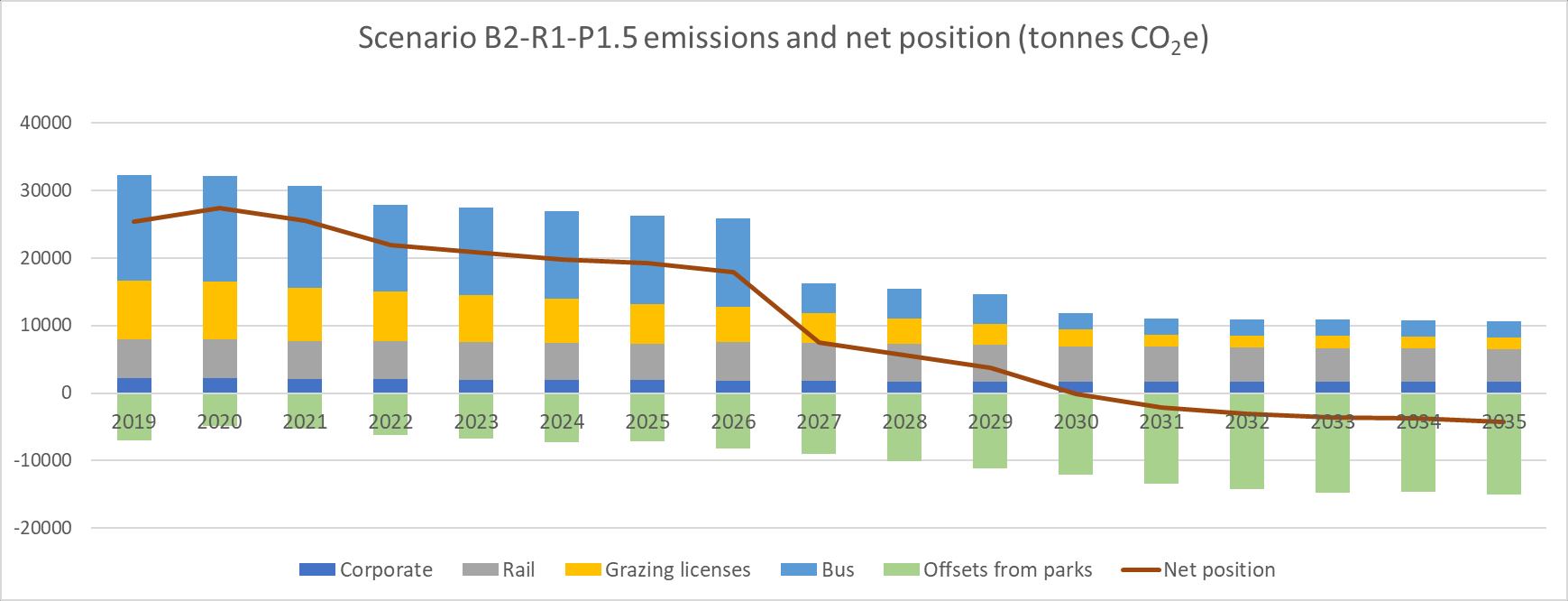

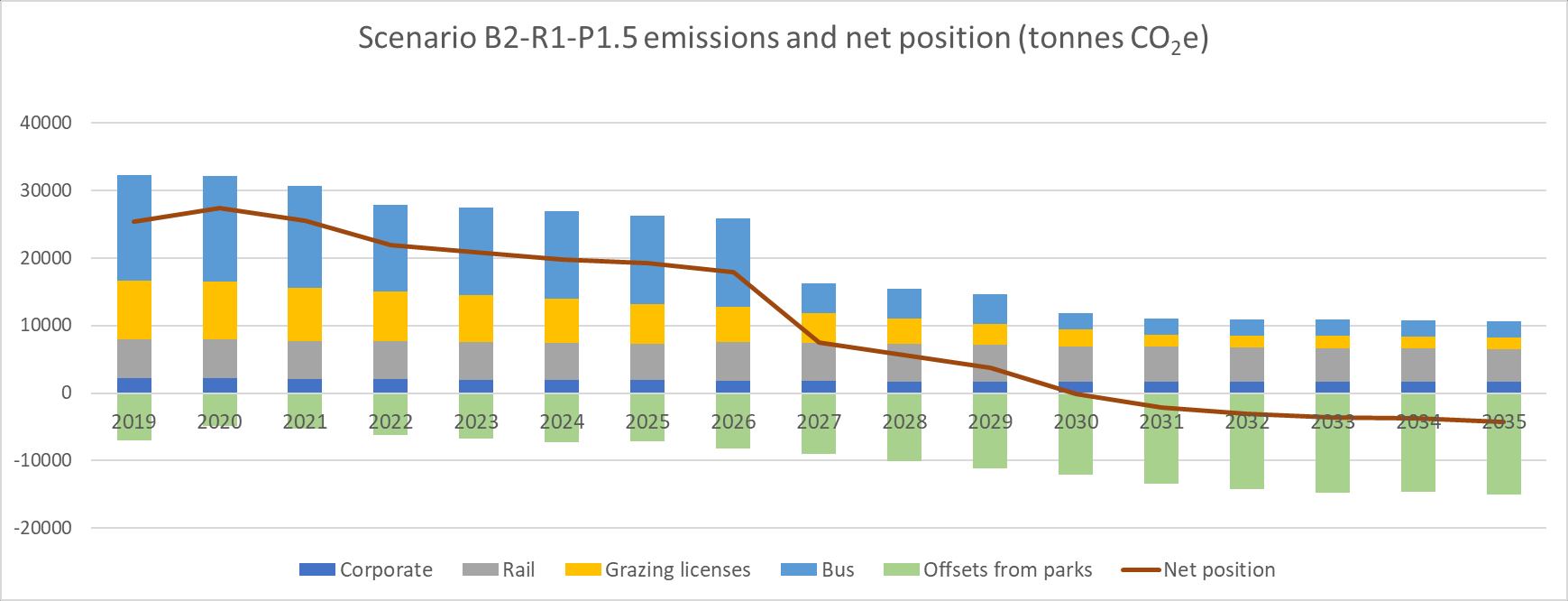

Officer’s preferred scenario - B2-R1-P1.5

Officer’s preferred scenario - B2-R1-P1.5

• Carbon positive goal achieved

Officer’s preferred scenario - B2-R1-P1.5

tCO2e

Budget

Gross emissions Difference Sequestration Shortfall

2021-25

N/A

140103

0

-32612

-32612

2026-30

38877

85070

46192

-50566

-4374

2031-35

0

55230

55230

-72024

-16794

Total

-53780

Pre-2021 emission unit reserve

-86,129

Net emission unit position

-139,909

Value at $150/tCO2e $ 2

0,986,313

• No external emissions unit purchase needed to maintain carbon

neutral status

• Surplus emissions units available – e.g. for Centreport & CCOs

Why is B2-R1-P1.5 officer’s preferred option?

• This option allows us to meet our carbon positive goals by 2035, while also

optimising costs

• This is a more achievable and affordable option, given we are facing

double digit rates increases for the next five or so years

• Staff have deemed P2 unachievable (more on the next slide)

• R2 seems to be unaffordable, and unnecessary to meet our carbon

positive goals

Why is P2 not achievable? (P1.5 versus P2)

•

Large scale restoration needs to be well-planned, and should align with our master

planning process, which will also identify recreational areas within parks

•

Requires large scale plant procurement, this option will put pressure on existing

suppliers, no time for new suppliers to get into business

•

We can only plant at certain times of the year, which means we would be at risk of not

delivering

•

We need to engage with mana whenua on design, implementation and sites of

significance, this takes time and is reliant on their capacity and capability

•

This option would put staff and contractors under extreme pressure, which is

unnecessary given we can achieve our carbon positive goals with P1.5

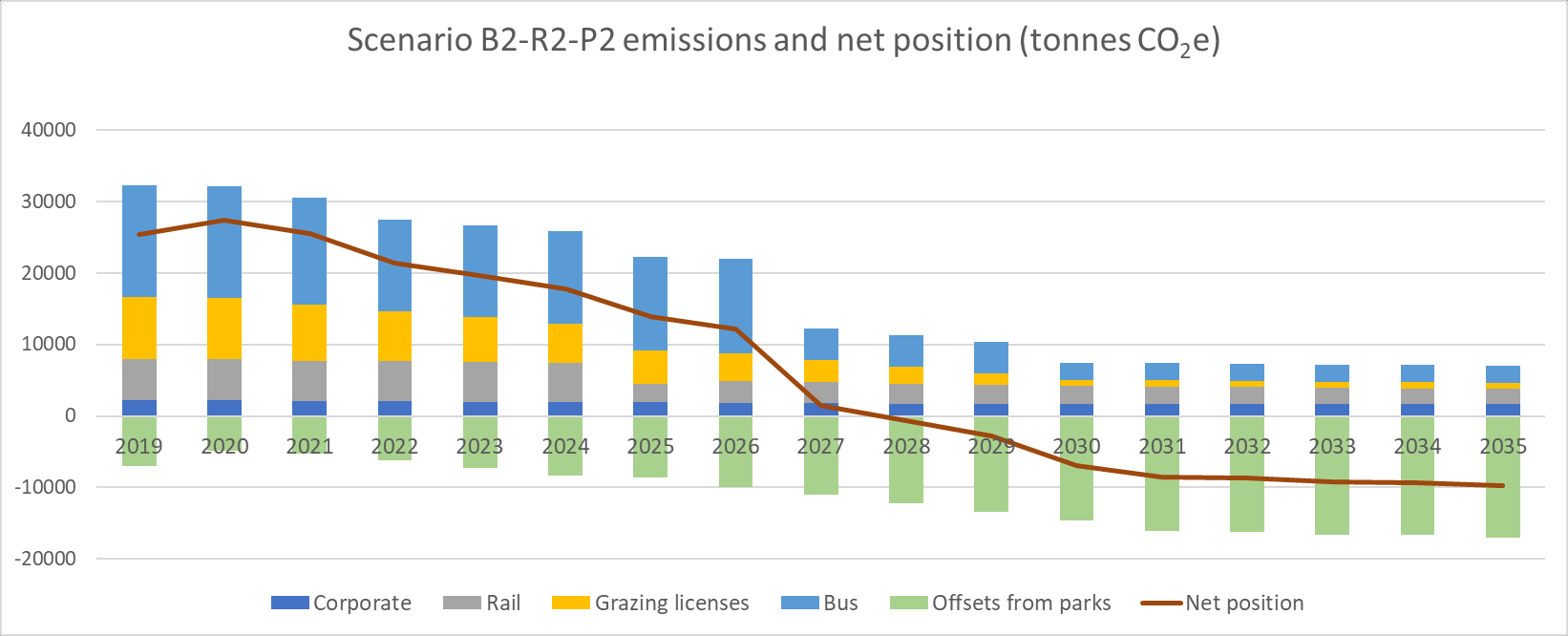

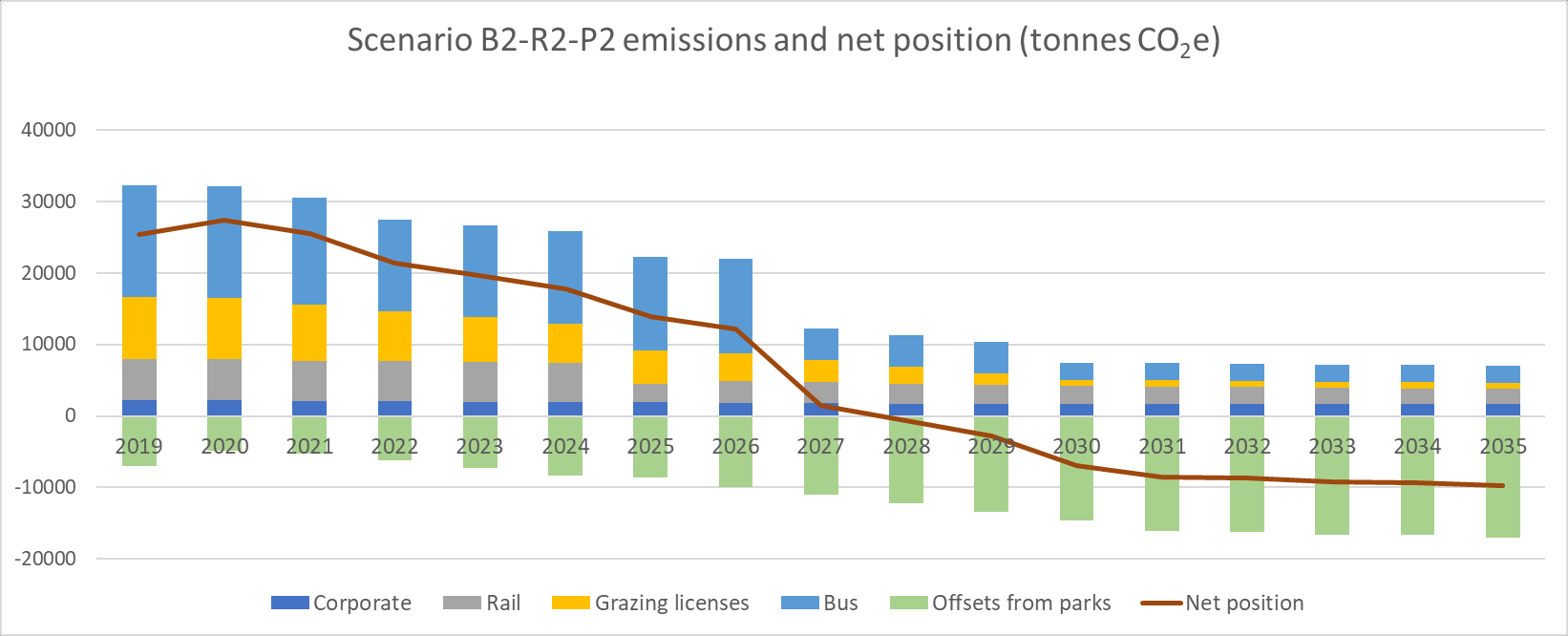

Other scenario - B2-R2-P2

Other scenario - B2-R2-P2

• Carbon positive goal achieved

Other scenario - B2-R2-P2

tCO2e

Budget

Gross emissions Difference Sequestration Shortfall

2021-25

N/A

133870

0

-35777

-35777

2026-30

38877

64339

25462

-61083

-35621

2031-35

0

36913

36913

-82469

-45556

Total

-116954

Pre-2021 emission unit reserve

-86,129

Net emission unit position

-203,083

Value at $150/tCO2e $ 3

0,462,514

• No external emissions unit purchase needed to maintain carbon neutral status, surplus

emissions units

• After further consideration we do not think this scenario is achievable for parks, or

affordable for rail

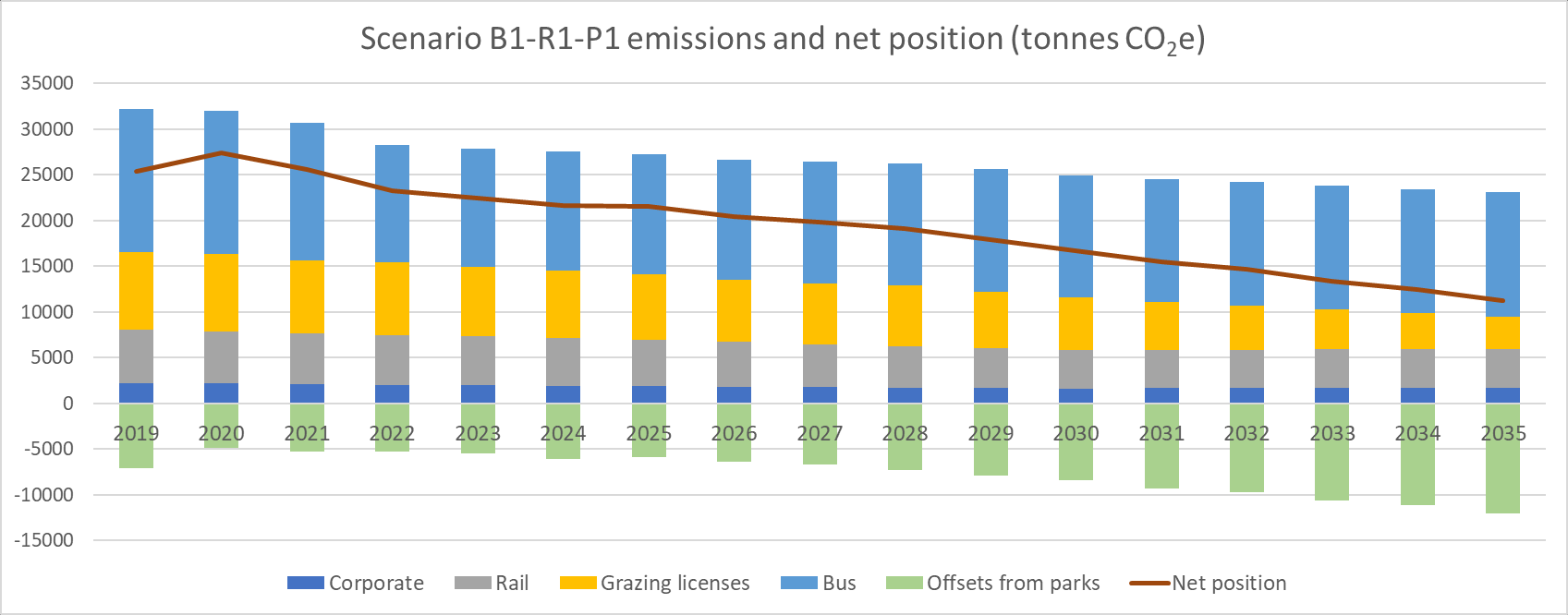

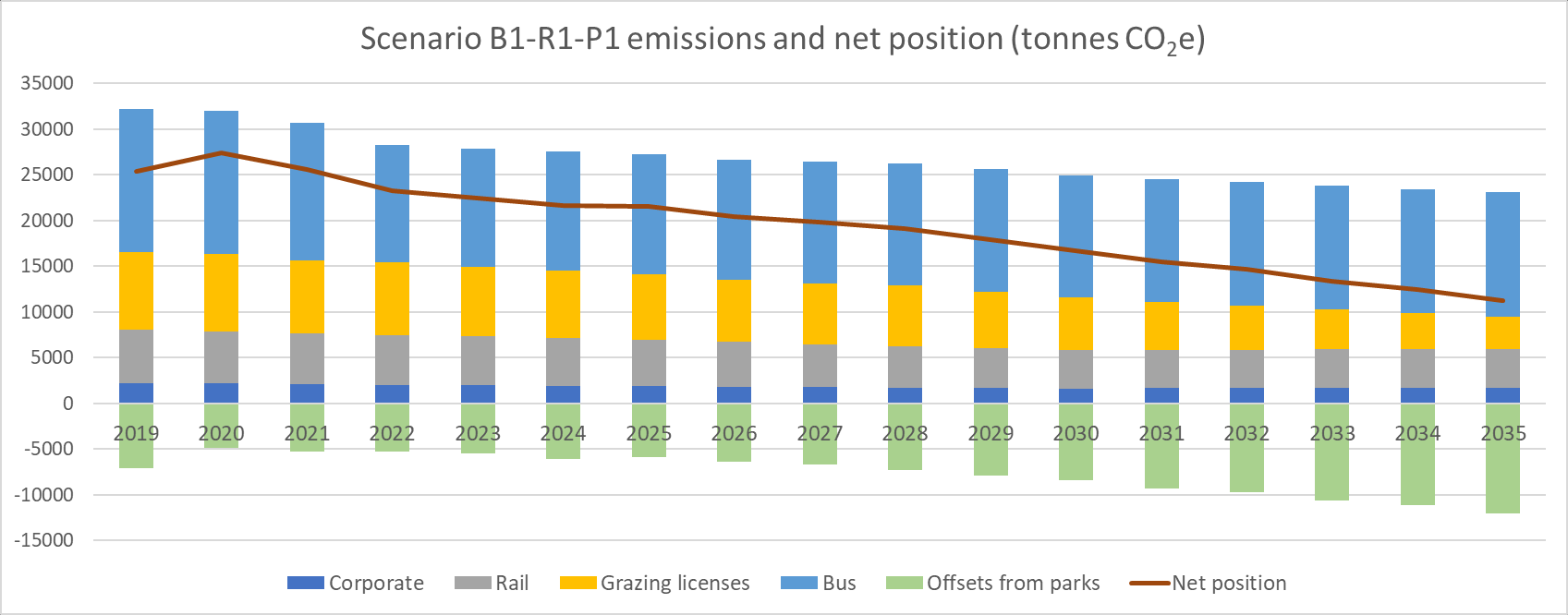

Other scenario - B1-R1-P1

Other scenario - B1-R1-P1

• Carbon positive goal not achieved

Other scenario - B1-R1-P1

tCO2e

Budget

Gross emissions Difference Sequestration Shortfall

2021-25

N/A

142485

0

-27988

-27988

2026-30

38877

130761

91884

-36736

55147

2031-35

0

120026

120026

-52865

67161

Total

94320

Pre-2021 emission unit reserve

-86,129

Net emission unit position

8,191

Value at $150/tCO2 -$ 1

,228,677

• No surplus emissions units

• External emissions unit purchase needed to maintain carbon neutral status

• ~$2.2M/year expense from 2035

• But suggest we include this as a low option in the LTP consultation

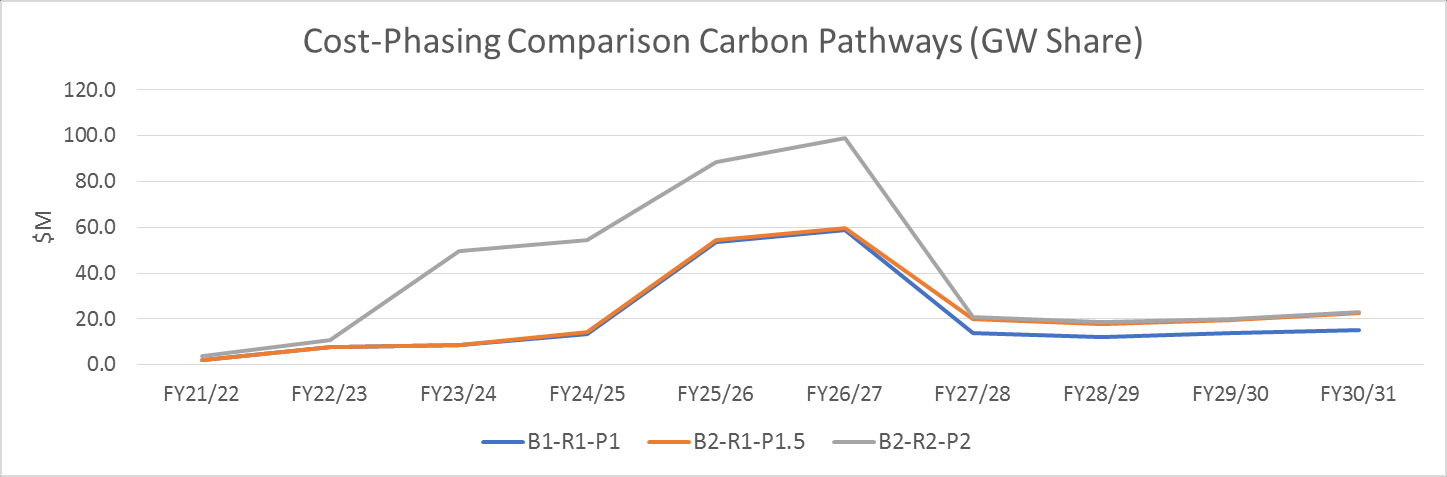

Comparison table

Scenario

Carbon positive Spare

Combined cost estimate Total combined cost

goal reached?

emissions units (GW share)

estimate

Comparison table

Scenario

Carbon positive Spare

Combined cost estimate Total combined cost

goal reached?

emissions units (GW share)

estimate

B1-R1-P1

No

-8,200

$204M

$391M

B2-R1-P1.5

Yes

140,000

$227M

$435M

B2-R2-P2

Yes

203,000

$389M

$755M

Note:

Impact of any potential

LCAF funding not shown

(~$7M left in the fund )

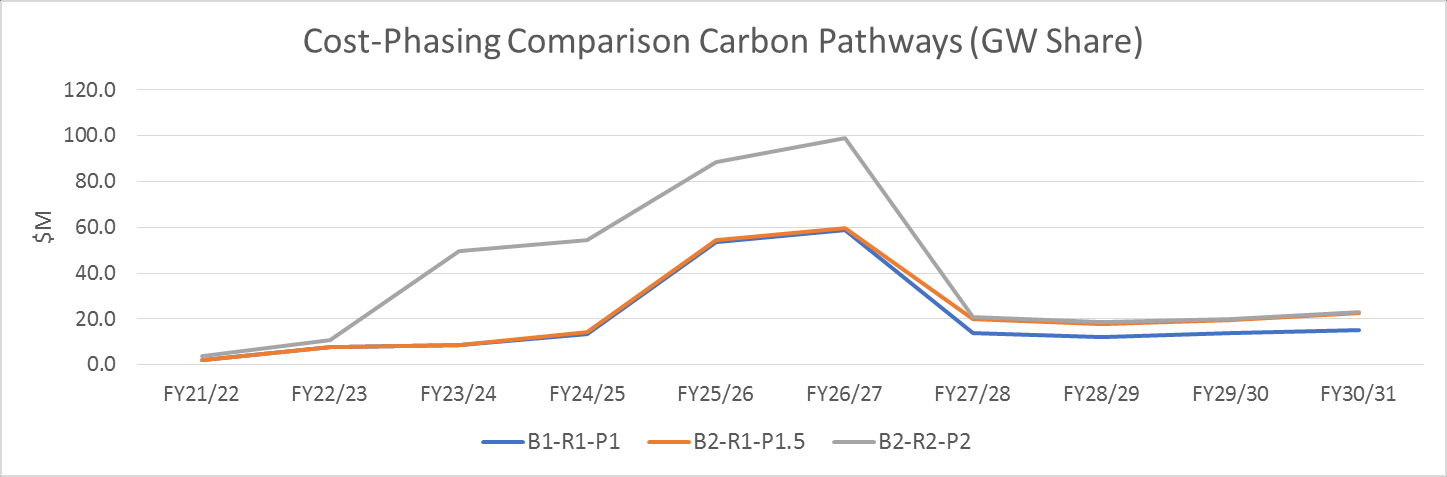

Rates % increase – comparison against LTP budget

18.0%

16.0%

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

2021/22

2022/23

2023/24

2024/25

2025/26

2026/27

2027/28

2028/29

2029/30

2030/31

-2.0%

-4.0%

P1.5 B2 R1 Current package

P1 B1 R1

R2 B2 P2

Impact on rates over 10 years

50

s noilliM 45

40

35

30

25

20

15

10

5

-

2021/22

2022/23

2023/24

2024/25

2025/26

2026/27

2027/28

2028/29

2029/30

2030/31

P1.5 B2 R1 Current package

P1 B1 R1

R2 B2 P2

Summary

• B2-R1-P1.5 is an achievable option which optimises cost and achieves our

carbon positive goal

• B2-R2-P2 maximises carbon reduction, but is unachievable for parks and

unaffordable for rail

• B1-R1-P1 minimises costs but is inconsistent with the carbon positive goal,

and creates an ongoing liability for procuring carbon offsets after 2034 to

maintain carbon neutral status

• All three are valid options for the LTP consultation document, officers’

recommend the option currently budgeted, B2-R1-P1.5

Questions?

Questions?