link to page 2 link to page 6 link to page 32 link to page 48 link to page 51 link to page 55 link to page 57 link to page 62 link to page 66 link to page 66 link to page 70

OIA 20210214

Table of Contents

1.

Treasury Circular 2019_12

1

2.

Treasury Circular 2019_12_ Budget 2020 Process and Technical Guide for Agencies

5

3.

Treasury Circular 2019_12_ Guidance March Baseline Update 2020

31

4.

Treasury Circular 2019_10

47

5.

Treasury Circular 2019_10_ Guide to Writing Initiative Titles and Descriptions

50

6.

Treasury Circular 2019_10_ Cost Pressure Template

54

7.

Treasury Circular 2019_10_ New Spending Template

56

8.

Treasury Circular 2019_10_ Letter Templates

61

9.

Treasury Circular 2019_10_ Digital, data and ICT initiatives guidance for Budget

65

2020

10.

Treasury Circular 2019_10 _ Budget 2020 Slides for Agency Information Session

69

Doc 1

Page 1 of 101

IN-CONFIDENCE

BM-2-4-2020-2

18 December 2019

Treasury Circular 2019/12

Restricted Distribution

Chief Executives

Directors of Finance/Chief Financial Officers

Contact for Enquiries:

Budget process queries:

Your Treasury Vote Analyst

CFISnet entry queries:

s9(2)(k)

BUDGET 2020: TIMETABLE AND TECHNICAL REQUIREMENTS FOR

AGENCIES

Introduction

1. This circular outlines the indicative timetable for the Budget 2020 process, and

includes information about key items in the production process.

2. The “Budget 2020 Process and Technical Guide for Agencies” supplements this

circular and outlines technical requirements for Budget 2020. It is now available on

CFISnet. The templates annexed to the Guide are also available on CFISnet in

Word format as related files.

3. Please note that Budget Day for 2020 has not yet been finalised or publicly

communicated.

As such, the production timetable should be considered

indicative and treated in confidence. It is possible that timeframes may need to

be amended following confirmation of Budget Day.

4. The Treasury will release a final timetable soon after Budget Day for 2020 has

been announced. In addition, a circular will be issued in late January covering the

reporting requirements for the five-year fiscal forecasts.

Budget decisions

5. Budget Ministers will make decisions on a Budget package to recommend to Cabinet

from mid-February to March. Vote Analysts will communicate with agencies what

should be included in their significant financial recommendations in order to meet the

Tuesday 17 March financial recommendations deadline. Agencies can contact

Vote Analysts to discuss specific issues or concerns.

Treasury:4217803v1

IN-CONFIDENCE

1

Doc 1

Page 2 of 101

IN-CONFIDENCE

Titles and descriptions for the Summary of Initiatives

6. The Summary of Initiatives for Budget 2020 will be published on Budget Day. This

document provides a reconciliation of all Budget decisions against the operating

and capital allowances.

7. Agencies are required to submit a clear title and description, and the funding details

for each Budget initiative. This information should be entered in CFISnet (CFISnet >

Baselines > Budget Initiatives > Initiatives or Recommendations Entry).

8. Final information must be submitted with the final financial recommendations by

Tuesday 17 March. The Summary of Initiatives will be drawn from CFISnet, making

it important that information is clear and high quality. Specific guidance can be found

in the Budget 2020 Process and Technical Guide for agencies.

9. Agencies are not required to update the Budget initiative templates or supporting

information to match any changes made to titles and descriptions in CFISnet, but

titles and descriptions may need updating to reflect final funding decisions.

10. Agencies should work with their communications teams early on to ensure the titles

and descriptions are clear and can be understood by a member of the public.

11. Agencies should also test the titles and descriptions with their Minister’s Office to

ensure they are comfortable with the wording. Ministerial press secretaries will use

the list of initiative titles and descriptions to write press releases.

Budget Economic and Fiscal Update (BEFU) Forecasts

12. Agencies must provide financial forecasts to the Treasury to inform the

Treasury’s forecasts for the 2020 BEFU. A separate circular will be released early

next year with reporting requirements and key dates. At this stage, it is likely that

the five-year forecast will be required sometime between 27 March and 3 April.

March Baseline Update (MBU)

13. The Baseline

Updates

(which take place twice a year) provide opportunities to

update baselines to take account of any Cabinet decisions made since OBU,

move funds between appropriations or

years in accordance with the delegations

to Joint Ministers in Cabinet Office Circular CO(18)2, make forecast adjustments

to appropriations, and establish new appropriations.

14. The Treasury coordinates the Ministerial letter process, and confirms whether the

requested changes are consistent with CO(18)2 via a response letter and on

CFISnet. Dates for the MBU process are outlined below.

15. The baseline update process can be resource intensive and iterative between

Vote teams and agencies. Often, time and effort is spent determining whether or

not changes proposed in a baseline update are consistent with the rules for

decisions able to be taken by joint Ministers outlined in Cabinet Office Circular

Treasury:4217803v1

IN-CONFIDENCE

2

Doc 1

Page 3 of 101

IN-CONFIDENCE

CO(18)2. For instance, expense and capital transfers can be used only where a

factor outside the department’s control has caused a delay in a specific and

discrete project. To reduce this time and effort, we encourage you to include

information in the Ministerial letter to demonstrate that the proposed changes are

consistent with CO(18)2.

16. If a change is outside the delegation to joint Ministers in CO(18)2, the

technical

Budget package (see below) provides an opportunity to obtain Cabinet

agreement to fiscally-neutral transfers between appropriations

and years.

Technical initiatives

17. Technical Budget initiatives are ones that do not seek new funding and do not

carry significant policy implications.

18. Proposals with financial implications that cannot be agreed by Joint Minister for

MBU consistent with CO(18)2 can be agreed through the technical initiatives

Cabinet paper (where they are technical and non-significant).

19. Technical initiatives are to be submitted in CFISnet by

Tuesday 2 March. Further

guidance on technical initiatives can be found in Annex Two of the Budget 2020

Process and Technical Guide for agencies.

Estimates production

20. All changes to appropriations agreed by Cabinet through the Budget must be

agreed by Parliament in an Appropriation Act. Departments should submit all

Estimates documents as soon as they are finalised to enable prompt processing.

Final deadlines are outlined below.

Budget Moratorium

21. There will be a moratorium on Cabinet, Cabinet Committees and joint Ministers

approving any financial recommendations after Cabinet agrees the Budget package

(expected to be

Monday 30 March) until Budget Day.

22. Departments must not submit any papers to Cabinet with financial implications

during this period. The moratorium exists so that the Budget documents and

legislation accurately reflect the fiscal implications of all Government decisions.

Alex Harrington

Manager, Budget Management

for the Secretary to the Treasury

Treasury:4217803v1

IN-CONFIDENCE

3

Doc 1

Page 4 of 101

IN-CONFIDENCE

Budget 2020 Process

Unless advised otherwise all requirements are due by 1pm. All coloured boxes (noted in the key below) are subject to change following finalisation of

Budget Day.

December

January

February

March

April

May

Late Jan: Draft priority

2 March: Financial recommendations

Budget Day:

packages due from

due for

technical initiatives, including

Appropriation

Coordinating Ministers

titles and descriptions

Bil s introduced

to the Minister of

in Parliament

Finance

17 March: Financial recommendations

due for

significant initiatives, including

titles and descriptions

Budget

23 March: Cabinet considers

technical

decisions

Budget package

process

30 March: Cabinet considers

significant Budget package

Dec-Late Jan: Treasury Vote teams and secretariat

Mid-Feb – March Budget Ministers and Cabinet Commit ees consider Budget

30 March – Budget Day: Budget Moratorium

groups make assessments and advice is provided to the

2020 packages

Minister of Finance and Coordinating Ministers

MBU

MBU

BEFU

Budget Day:

13 Feb: Departments submit

Week of 16 Mar: Minister of Finance

27 March - 3 Apr:

Budget

Coredata requests

signs MBU letters and notifies Ministers

Departments to

documents

of outcomes

submit changes to

released

20 Feb: Departments finalise

forecasts

Updates

MBU data and five-year

BEFU

and

forecasts into CFISnet

and

27 March: Departments to submit

MBU letters are sent to the

Specific Fiscal Risks

Estimates

Minister of Finance

production

Estimates signed by Appropriation Ministers and sent to Minister of Finance

24 March: Votes which have no Budget 2020 initiatives

31 March: Votes which have Budget 2020 initiatives

6 Apr: Forecast departments and Votes requiring changes following Cabinet’s decisions on

the Budget 2020 package

MBU + BEFU

Budget Cabinet Papers

Estimates Documents

Appropriation bil s

Treasury:4217803v1

IN-CONFIDENCE

4

Doc 2

Page 5 of 101

Budget 2020

Process and Technical Guide for Agencies

18 December 2019

Doc 2

Page 6 of 101

link to page 30 link to page 28 link to page 26 link to page 25 link to page 22 link to page 21 link to page 21 link to page 19 link to page 19 link to page 19 link to page 19 link to page 16 link to page 14 link to page 13 link to page 13 link to page 12 link to page 12 link to page 12 link to page 12 link to page 11 link to page 11 link to page 11 link to page 11 link to page 11 link to page 11 link to page 10 link to page 9 link to page 8

Doc 2

Page 7 of 101

IN-CONFIDENCE

Contents

Contents ....................................................................................................................... 1

About this guidance ...................................................................................................... 2

Budget 2020 Process ................................................................................................... 3

Budget Decisions Technical Process ............................................................................ 4

Budget Ministers and Cabinet Committees .......................................................... 4

Information required from agencies for Budget 2020 products ............................ 4

Financial Recommendations and Titles and Descriptions ............................... 4

Significant or technical Budget initiative submission ....................................... 4

March Baseline Update (MBU) ....................................................................... 4

MBU Timeline ................................................................................................. 5

Budget Economic and Fiscal Update (BEFU) forecasts .................................. 5

Specific Fiscal Risks – Due Friday 27 March .................................................. 5

Estimates production – Due March/April (dates below) ................................... 5

Budget Moratorium – From Monday 30 March to Budget Day ............................. 6

Proactive Release – May to July ......................................................................... 6

Annex One: Summary of Initiatives in Budget ............................................................... 7

Annex Two: Financial Recommendations ..................................................................... 9

Annex Three: Production of Estimates and Supplementary Estimates ....................... 12

Overview for Estimates and Supplementary Estimates ..................................... 12

Review of Estimates Documents by the Treasury ............................................. 12

Sign-off of Estimates Documents by Ministers ................................................... 12

Annex Four: Appropriation Bills (Estimates and Supplementary Estimates) ............... 14

Ministers Reporting Against Appropriations ....................................................... 14

Supplementary Estimates Chief Executive Sign Off .......................................... 15

Estimates Chief Executive Sign Off ................................................................... 18

The Estimates and Supporting Information Documents ..................................... 19

Estimates Ministerial Sign Off ............................................................................ 21

Supplementary Estimates Ministerial Sign Off ................................................... 23

Budget 2020: Process and Technical Guide for Agencies | 1

Doc 2

Page 8 of 101

IN-CONFIDENCE

About this guidance

This guidance provides information for agencies on technical processes related to Budget

2020, including key submission dates and sign-off processes. It is intended to complement

the main guidance on significant Budget initiatives (Circular 2019/10). For additional

information on key changes to the Budget 2020 process, how to submit a Budget initiative,

and the Budget templates please refer to the main guidance and CFISnet entry guidance

(both part of Circular 2019/10).

Please note that, in some cases, specific dates (such as Budget Day) have not been

finalised as they are yet to be confirmed by Ministers. The Minister of Finance will confirm

Budget Day at the Finance and Expenditure Committee in February 2020. This guidance will

be updated following confirmation.

Please get in touch with your Vote Analyst at the Treasury in the first instance if you have

any questions about the content of this guidance.

Budget 2020: Process and Technical Guide for Agencies | 2

Doc 2

Page 9 of 101

IN-CONFIDENCE

Budget 2020 Process

Unless advised otherwise all requirements are due by 1pm. All coloured boxes (noted in the key below) are subject to change following finalisation of Budget Day.

December

January

February

March

April

May

Late Jan: Draft priority

2 March: Financial recommendations

Budget Day:

packages due from

due for

technical initiatives, including

Appropriation Bil s

Coordinating Ministers

titles and descriptions

introduced in Parliament

to the Minister of

Finance

17 March: Financial recommendations

due for

significant initiatives, including

titles and descriptions

Budget

23 March: Cabinet considers

technical

decisions

Budget package

process

30 March: Cabinet considers

significant Budget package

Dec-Late Jan: Treasury Vote teams and secretariat

Mid-Feb – March Budget Ministers and Cabinet Commit ees consider Budget

30 March – Budget Day: Budget Moratorium

groups make assessments and advice is provided to

2020 packages

the Minister of Finance and Coordinating Ministers

MBU

MBU

BEFU

Budget Day: Budget

13 Feb: Departments submit

Week of 16 Mar: Minister of Finance

27 March - 3 Apr:

documents released

Coredata requests

signs MBU letters and notifies Ministers

Departments to

of outcomes

submit changes to

20 Feb: Departments finalise

forecasts

Updates

MBU data and five-year

BEFU

and

forecasts into CFISnet

and

27 March: Departments to submit

MBU letters are sent to the

Specific Fiscal Risks

Estimates

Minister of Finance

production

Estimates signed by Appropriation Ministers and sent to Minister of Finance

24 March: Votes which have no Budget 2020 initiatives

31 March: Votes which have Budget 2020 initiatives

6 Apr: Forecast departments and Votes requiring changes following Cabinet’s decisions on the

Budget 2020 package

MBU + BEFU

Budget Cabinet Papers

Estimates Documents

Appropriation bil s

Budget 2020: Process and Technical Guide for Agencies | 3

Doc 2

Page 10 of 101

IN-CONFIDENCE

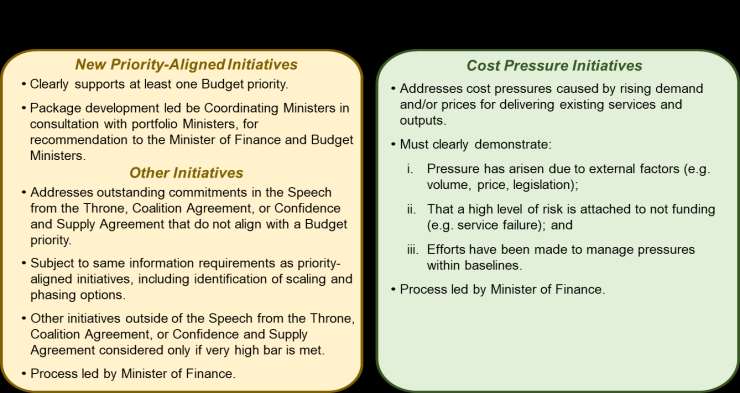

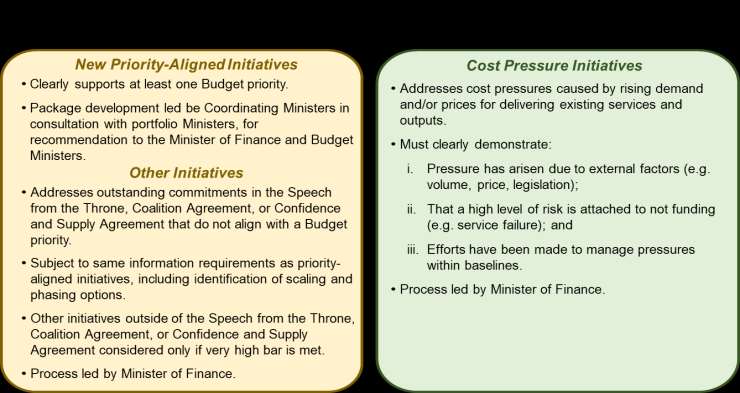

Budget Decisions Technical Process

Budget Ministers and Cabinet Committees

1.

Budget Ministers and Cabinet Committees will consider Budget packages over

February and March before Cabinet agrees to a final Budget package.

This package

is likely to be taken to Cabinet on Monday 30 March for consideration.

Information required from agencies for Budget 2020 products

Financial Recommendations and Titles and Descriptions

2.

Published documents such as the Estimates, the Summary of Initiatives, and the

Wellbeing Budget Document (which will be published on Budget Day), as well as the

Cabinet papers, rely on clear, detailed information in the initiative

title and

description.

This information usually needs to be updated from the information provided at the time of

submission to reflect any scaling or changes in an initiative from the original initiative

submitted.

3.

You will need to

provide your titles and descriptions in CFISnet by Tuesday 17 March.

• See

Annex One for more detailed guidance.

Significant or technical Budget initiative submission

4.

Budget initiatives must be uploaded by departments into CFISnet as either significant

or technical.

5.

Technical initiatives are those initiatives that:

• do not seek new funding from the centre over the forecast period, and,

• do not carry significant policy implications.

6.

The

technical Budget initiative proposal Cabinet paper is prepared by Treasury,

and includes a large number of financial recommendations for every agreed technical

Budget Initiative proposal. Recommendations for

technical initiatives are due in

CFISnet on

Monday 2 March.

7.

Significant initiatives are those initiatives that do seek new funding from the centre over

the forecast period, and/or do carry significant policy implications. This includes

significant policy changes that are fiscally neutral (e.g., funded through reprioritisation).

8.

The

final Budget package Cabinet paper is prepared by Treasury, and includes

financial recommendations for every agreed significant Budget Initiative proposal

(i.e., for cost pressure and new spending initiatives). Recommendations for

significant

initiatives are due in CFISnet on

Tuesday 17 March.

9.

See

Annex Two for more detailed guidance on the technical and significant initiatives.

March Baseline Update (MBU)

10. The March Baseline Update (MBU) is a technical update that allows agencies to

update their baselines to reflect Cabinet and joint Ministerial decisions that have taken

place since the last baseline update in October, and agree changes to baselines

consistent with the delegation to Joint Ministers in CO(18)2. The Treasury coordinates

Budget 2020: Process and Technical Guide for Agencies | 4

Doc 2

Page 11 of 101

IN-CONFIDENCE

the Ministerial letter process, and confirms whether the requested changes are

consistent with CO(18)2 via a response letter and on CFISnet.

11. Proposals with financial implications that cannot be agreed by Joint Ministers

consistent with CO18(2) can be agreed by Cabinet either through the technical

initiatives Cabinet paper (for technical and non-significant changes), or the significant

initiatives Cabinet paper (where the change represents a policy decision). See

Annex

Two for further information.

12.

The Baseline Update Guidance has been uploaded alongside Circular (2019/12) on

CFISnet.

MBU Timeline

13. All requirements are due by

1pm on given dates.

Deadline

Requirement

Now – Thursday 13 February

Departments discuss their specific requirements for MBU with Treasury

Vote teams.

Now – Thursday 13 February

Coredata changes to be submitted to CFISnet for MBU.

Thursday 20 February

Final date for departments to update and lock CFISnet for changes.

Thursday 20 February

Appropriation Minister submission to Minister of Finance. Please provide

2 copies of the appropriation Minister’s letter to the Minister of Finance.

Thursday 27 February

Treasury Vote teams to advise departments of status of updates.

Department to update CFISnet to reflect all changes advised by Treasury.

Week beginning 16 March

Minister of Finance notifies appropriation Ministers of the outcome of MBU.

Budget Economic and Fiscal Update (BEFU) forecasts – Due between Friday 27 March

and Friday 3 April

14. Departments are required to provide financial forecasts to the Treasury to inform the

Treasury’s forecasts for BEFU 2020. A separate circular will be released early next

year with reporting requirements and key dates.

Specific Fiscal Risks – Due Friday 27 March

15. Specific fiscal

risks (SFRs) identify (to the fullest extent possible) all government

decisions and other circumstances known to the Government that may have a material

impact on the fiscal outlook, but are not certain enough in timing or amount to include

in the fiscal forecasts – both potential policy changes, and known cost pressures.

Departments are required to inform the Treasury of all specific fiscal risks by

Friday

27 March, so that they can be included in BEFU 2020. The BEFU circular (to be

released next year) will contain more information. In the interim, please refer to

Treasury Circular 2019/08, which contains some information about the SFRs.

Estimates production – Due March/April (dates below)

16. All changes to appropriations agreed by Cabinet through the Budget must be agreed

by Parliament in an Appropriation Act.

17.

Departments should submit all Estimates documents as soon as they are finalised to enable

prompt processing. The production process will be split into three streams depending on

whether the relevant Vote has Budget initiatives or is a forecasting department.

18.

These dates are outlined below.

Budget 2020: Process and Technical Guide for Agencies | 5

Doc 2

Page 12 of 101

IN-CONFIDENCE

Deadline for submission

Deadline for submission

to Appropriation Minister

to the Minister of Finance

Tranche 1 – Votes which have no

Monday 23 March

Tuesday 24 March

Budget 2020 initiatives

Tranche 2 – Votes which have

Monday 30 March

Tuesday 31 March

Budget 2020 initiatives

Tranche 3 – Forecasting departments

Monday 6 April

Tuesday 7 April

and Votes requiring changes following

Cabinet’s consideration of the Budget package

See

Annex Three and Annex Four for more detailed guidance.

Budget Moratorium – From Monday 30 March to Budget Day

19. There will be a moratorium on Cabinet, Cabinet Committees and joint Ministers

approving any financial recommendations after Cabinet agrees the final Budget

package (expected to be

Monday 30 March) until Budget Day.

20. Departments must not submit any papers to Cabinet, Cabinet Committees or joint

Ministers with financial implications (that change appropriations) during this period. The

moratorium exists so that the Budget documents and legislation accurately reflect the

fiscal implications of all Government decisions at the time of their release.

Proactive Release – May to July

21. The Minister of Finance proactively releases Budget-related documents every year

about two months after Budget day. This release is desirable for government

transparency and public accountability. It also helps to reduce the number of Official

Information Act requests related to the Budget received by the Minister of Finance,

appropriation Ministers, the Treasury and departments.

22. The release includes key documents that have been used in Budget decision-making,

including:

• Budget Ministers’ materials

• Relevant Treasury Reports and Aide Memoires, and

• Cabinet Minutes, including the final Budget paper and financial recommendations

package.

23. The Treasury will release guidance with more information about this process in the New Year.

Budget 2020: Process and Technical Guide for Agencies | 6

Doc 2

Page 13 of 101

IN-CONFIDENCE

Annex One: Summary of Initiatives in Budget

1.

The Summary of Initiatives for Budget 2020 will be published on Budget Day, and

provides the title, description, and agreed funding for every approved initiative (with the

exception of those provided for in contingency that cannot be announced). Additional

information may be required for the Wellbeing Budget, and the Treasury will release

more guidance if required.

2.

The Summary of Initiatives will be drawn from the Recommendations module in

CFISnet. Therefore, it is important that agencies provide high quality titles and

descriptions in the module (CFISnet > Baselines > Recommendations > Department

Entry).

3.

Agencies should check that titles, descriptions and funding are consistent in both

modules – the two modules do not update one another after draft recommendations

are saved. Agencies should ensure that titles and descriptions have been updated to

reflect final funding decisions.

4.

High quality refers to:

•

Meaningful titles in plain English. (Good examples from previous Budgets include:

“

Managing our borders: Screening departing passengers”, “

Implementation of the

Social Housing Reform Programme” and “

Completion of the Twin Coasts Cycle

Trail”.)

•

Meaningful first word/beginning for titles. Initiatives are listed alphabetically and it

is important that the first word in the title distinguishes it from other initiatives. (For

example, the use of words such as “

increasing”, “

additional” and “

establishing” should

be avoided).

In previous Budgets, this was overcome in some instances by reordering the title to

lead with the service/programme e.g. “

Intensive Wraparound Service – Increasing

Access”.

•

No jargon, abbreviations or acronyms. (Commonly used acronyms understood by

the general public, e.g. GST, are acceptable; public sector specific abbreviations, e.g.

MBIE, CYF, DHB, TEC, EPA, MFAT etc., are not.)

•

Descriptions explain the purpose of the funding and the intended outcome. The

character limit for descriptions in CFISnet has been extended to ensure agencies

have enough space to adequately describe initiatives.

Descriptions should include information on the expected outcome of the initiative, and

any key wellbeing outcomes.

•

Descriptions beginning with the stem statement “This funding will…” or “

This

initiative will…”. Where the initiative is a business-as-usual pressure, the stem

statement is to begin with “

This additional funding will…”.

•

Descriptions provide contextual information, where relevant, eg, ‘

this funding

contributes to an existing programme that currently receives $x million per annum’.

•

The titles and descriptions of cost-pressure initiatives provide context to the

agency and service that it is relevant to. Initiatives are listed alphabetically and it is

important that descriptors are adequately informative. (For example,

Crown

Prosecution Services – Sustainable Funding).

Budget 2020: Process and Technical Guide for Agencies | 7

Doc 2

Page 14 of 101

IN-CONFIDENCE

5.

Refer to Circular (2019/10) for further guidance on writing titles and descriptions for

Budget 2020.

6.

Agencies should work with its communications teams to ensure the titles and

descriptions are appropriate and can be understood by a member of the public.

7.

Agencies should also test the titles and descriptions with the relevant Minister’s Office

ahead of time to ensure they are comfortable with the wording. If there are any

disputes about wording, the Treasury, in conjunction with the Minister of Finance’s

Office, will make final decisions.

Budget 2020: Process and Technical Guide for Agencies | 8

Doc 2

Page 15 of 101

IN-CONFIDENCE

Annex Two: Financial Recommendations

1. Financial recommendations sign off sheets for Chief Financial Officers can be found below.

Significant or Technical Budget Initiatives

2.

Budget initiatives are categorised as either significant or technical.

3.

Technical initiatives are those initiatives that:

• do not seek new funding from the centre over the five year forecast period, and,

• do not carry significant policy implications.

4.

Significant initiatives are those initiatives that do seek new funding from the centre

over the five year forecast period, and/or do carry significant policy implications. This

includes significant policy changes that are fiscally neutral (eg, funded through

reprioritisation).

5.

When entering Budget initiatives into CFISnet, all Budget initiatives will be classified as

“significant” by default except where “technical” has been selected in the Priority Area

dropdown (ie, not a cost pressure or a new spending initiative).

Technical Budget Initiatives

6.

Your agency must complete the financial recommendations and submit them in CFISnet.

7.

The technical Budget initiative proposal Cabinet paper is prepared by the Treasury,

and includes a large number of financial recommendations for every agreed technical

Budget initiative proposal.

8.

Recommendations can be drafted as soon as an initiative has been entered into

CFISnet. However, recommendations can only be output from CFISnet when the

initiative has been “agreed” following decisions by Ministers. These financial

recommendations are generated automatically from the recommendations that agencies

complete in CFISnet. Therefore financial recommendations must be correctly drafted.

9.

Any specific questions about technical issues or the wording of financial

recommendations should be directed to your Vote Analyst. Further guidance on how to

enter financial recommendations into CFISnet is available on the CFISnet Help page

under ‘Baselines’ > ‘Recommendations’.

Significant Budget Initiatives

10. The process for agencies completing financial recommendations for significant Budget

initiatives is similar to that described above.

11. One distinction is where Budget Ministers agree to scale an agency’s Budget initiative.

In these cases, the Treasury will enter the recommended funding into CFISnet. This

will then allow agencies to generate financial recommendations that reconcile against

the agreed funding. This may include updating titles and descriptions to reflect final

funding decisions.

Budget 2020: Process and Technical Guide for Agencies | 9

Doc 2

Page 16 of 101

IN-CONFIDENCE

BUDGET 2020 SIGNIFICANT INITIATIVES FINANCIAL RECOMMENDATIONS

CHIEF FINANCIAL OFFICER SIGN OFF

--------------------------------------------------------------

Vote

The Significant Financial Recommendations for the above Vote in CFISnet contain all decisions for

Cabinet consideration as part of the 2020 Budget package.

These have been completed in accordance with Financial Recommendations requirements as set out

in Treasury Circulars and guides.

Aspect

Check

(

/

)

All applicable recommendations have been included and reflect decisions taken by

Budget Ministers.

For Votes that are receiving new funding, the title and description clearly specifies

what the money is allowed to be spent on.

The title is spelt correctly and has the appropriate capitals (use capitals for all words

except for words such as ‘of’, ‘it’, ‘to’, etc).

The scope statement for any

new appropriation/category begins with “This

appropriation/category is limited to ….”, and provides a clear legal boundary for the

appropriation/category.

Funding is going into the correct appropriations.

Any implications for baselines outside the forecast period (ie, in outyears) are clearly

documented in the recommendations.

Where initiatives relate to more than one Vote, departments have coordinated their

recommendations so that no information is missing or duplicated.

Additional “non-standard” tables required by departments have been provided to the

Treasury Vote Analyst.

Revenue type is correct (‘Revenue Other’ for third parties; ‘Revenue Department’

where another department purchases the good/service; or ‘Revenue Crown’, and the

GST implications are correct (ie, all financial recommendations should be GST

exclusive).

The impact statement is correct (“with a corresponding / no impact on the operating

balance / debt”).

-----------------------------------

---------------------------------

Name

Signature

Chief Financial Officer

-------------------------------------

Date

Please forward this document to your Vote team no later than

1pm on Tuesday 17 March.

Budget 2020: Process and Technical Guide for Agencies | 10

Doc 2

Page 17 of 101

IN-CONFIDENCE

BUDGET 2020 TECHNICAL INITIATIVES FINANCIAL RECOMMENDATIONS

CHIEF FINANCIAL OFFICER SIGN OFF

--------------------------------------------------------------

Vote

The Technical financial recommendations for the above Vote in CFISnet contain all such

recommendations that need Cabinet consideration as part of the 2020 Budget package.

These have been completed in accordance with financial recommendations requirements as set out in

Treasury Circulars and guides.

Aspect

Check

(

/

)

All applicable recommendations have been included and reflect decisions taken by

Budget Ministers.

For Votes that are receiving new funding, the initiative title and description clearly

specifies what the money is allowed to be spent on.

The title is spelt correctly and has the appropriate capitals (use capitals for all words

except for words such as ‘of’, ‘it’, ‘to’, etc).

The scope statement for any

new appropriation/category begins with “This

appropriation/category is limited to ….”, and provides a clear legal boundary for the

appropriation/category.

Funding is going into the correct appropriations.

Any implications for baselines outside the forecast period (ie, in outyears) are clearly

documented in the recommendations.

Where initiatives relate to more than one Vote, departments have coordinated their

recommendations so that no information is missing or duplicated.

Additional “non-standard” tables required by departments have been provided to the

Treasury Vote Analyst.

Revenue type is correct (‘Revenue Other’ for third parties; ‘Revenue Department’

where another department purchases the good/service; or ‘Revenue Crown’, and the

GST implications are correct (ie, all financial recommendations should be GST

exclusive).

The impact statement is correct (“with a corresponding / no impact on the operating

balance / debt”).

-----------------------------------

---------------------------------

Name

Signature

Chief Financial Officer

-------------------------------------

Date

Please forward this document to your Vote team no later than

1pm on Monday 2 March.

Budget 2020: Process and Technical Guide for Agencies | 11

Doc 2

Page 18 of 101

IN-CONFIDENCE

Annex Three: Production of Estimates and

Supplementary Estimates

Overview for Estimates and Supplementary Estimates

1.

The

Estimates and supporting information provide information to Parliament on the

appropriations the Government is seeking for the financial year through to the next

Budget and what those appropriations will be used for.

2.

The Supplementary Estimates and supporting information reflect changes to

appropriations since the Estimates were tabled in Parliament.

3.

Departments should read and be familiar with the detailed information and instructions

on the format and content changes to both the

Estimates and Supplementary

Estimates which are available in the following documents:

Document

Content

Link

Estimates, Supplementary

Sets out the purpose and content

https://treasury.govt.nz/publicati

Estimates and their Supporting

requirements for the Estimates,

ons/guide/estimates-

Information: Technical Guide

Supplementary Estimates and their

supplementary-estimates-

for Departments

supporting information for Budget 2020

technical-guide-departments

Style Guide for Estimates and

Guidance on how to prepare accurate

https://treasury.govt.nz/publicati

Supplementary Estimates of

and consistent Estimates documents.

ons/guide/budget-style-guide-

Appropriations and Supporting

This includes the mock ups which were

estimates-supplementary-

Information

previously separate documents

estimates

Review of Estimates Documents by the Treasury

4.

Agencies are expected to be engaging with their Vote teams and their Ministers’ Office

throughout the process to ensure all feedback is taken on board and issues resolved

promptly.

5.

The Treasury will do an initial review of the Estimates and Supplementary Estimates

documents based on what is in CFISnet. These documents should be as ‘near final’ as

possible, as this review provides opportunity for agencies to receive early feedback for

improvement (or omissions) before their Minister formally signs-off the documents. The

focus of this initial feedback is primarily on the statements, explanations and structure

of these drafts and common problems; at this stage it is not a comprehensive proof-

read or review of the numbers.

Sign-off of Estimates Documents by Ministers

6.

Agency Chief Executives are responsible to the Minister(s) for the quality and accuracy

of the Budget documents prepared by their departments (ie, Estimates and

Supplementary Estimates). This includes factual accuracy (eg, output classes are

correctly specified) and technical accuracy (eg, the numbers include all the decisions

made to date, and they reconcile).

7.

Ministers responsible for appropriations in a Vote must provide a sign off to the Minister

of Finance that the Estimates and Supplementary Estimates documents are accurate

and ready for publishing. The Treasury can then compile them directly from CFISnet for

printing, after Cabinet has taken decisions on the Budget. The relevant sign-off sheets

are below.

Budget 2020: Process and Technical Guide for Agencies | 12

Doc 2

Page 19 of 101

IN-CONFIDENCE

8.

Each Estimates and Supplementary Estimates sign-off sheet should be for one Vote.

Where a Vote has more than one portfolio Minister responsible for different

appropriations, the sign-off should be from one of those appropriation Ministers on

behalf of all the Ministers responsible for these appropriations.

9.

It is the agency’s responsibility to ensure that their Minister, or another Minister with

authority to approve the documents, is available to sign off all of the Estimates and

Supplementary Estimates documents on or before the relevant deadlines. Please

confirm with your Treasury Vote team when the Vote Minister has signed-off on the

documents.

10. Please note that the version number of the Estimates and Supplementary Estimates

that your Vote Minister signs off must be the same as the final version number of the

Estimates and Supplementary Estimates submitted through CFISnet.

11. Ministers should also be seeking assurance from Chief Executives that the material

being submitted is accurate and ready for forwarding to the Minister of Finance.

Similarly, Chief Executives will be seeking similar assurances from the person within

their agency responsible for preparing the agency’s Estimates documents.

Budget 2020: Process and Technical Guide for Agencies | 13

Doc 2

Page 20 of 101

IN-CONFIDENCE

Annex Four: Appropriation Bills (Estimates and

Supplementary Estimates)

1.

All changes to appropriations agreed by Cabinet through the Budget must, by law, be

agreed by Parliament in an Appropriation Act.

2.

The Treasury, in conjunction with the Parliamentary Counsel Office, will compile the

2020/21 Estimates Appropriation Bill and the 2019/20 Supplementary Estimates

Appropriation Bill after Cabinet has agreed to a final Budget package and after all

agencies have loaded their Estimates documents into CFISnet.

3.

It is very important that all Estimates numbers loaded into CFISnet are correct as these

are the numbers that will be used to compile the legislation that will be introduced into

Parliament. Once the legislation is finalised and introduced, changes are virtually

impossible. It is important that the numbers receive adequate QA from departments,

including checking actual outturns for the current financial year with the numbers for

the current financial year in the Supplementary Estimates.

Ministers Reporting Against Appropriations

4.

Section 15C of the PFA requires performance reporting for all departmental and non-

departmental appropriations (excluding those for borrowing expenses and security and

intelligence agencies) at year-end unless specifically exempted by the Minister of Finance.

5.

The Estimates documents identify who reports against each appropriation and in which

document.

Budget 2020: Process and Technical Guide for Agencies | 14

Doc 2

Page 21 of 101

IN-CONFIDENCE

Supplementary Estimates Chief Executive Sign Off

Template– Departmental certification letter to an appropriation Minister(s) for a Vote

[Date]

Hon Grant Robertson

Minister of Finance

Parliament Buildings

WELLINGTON

Dear Minister

2019/20 Supplementary Estimates Documents for Vote: [Vote name]

Action Required

Attached, for your approval are:

• the documentation for the 2019/20 Supplementary Estimates and Supporting

Information for [where there is more than one appropriation Minister, insert:

“the

appropriations that you are responsible for in”] [Vote name], and

• a draft letter to the Minister of Finance.

Background

The Budget 2020 process requires that:

• the Supplementary Estimates documentation for [Vote] is completed by [date], and

Either – when only one appropriation Minister is responsible for all of the

appropriations in the Vote, the following bullet should then be included:

•

“as the appropriation Minister for all of the appropriations in the Vote, you

confirm to the Minister of Finance that this material is correct and in a form

suitable for publication.”

Or – when there is more than one appropriation Minister responsible for

appropriations in the Vote, the following bullet should then be included:

•

“one of the appropriation Ministers responsible for appropriations in the Vote,

on behalf of all appropriation Ministers with appropriations in the Vote, confirm

to the Minister of Finance that this material is correct and in a form suitable

for publication.”

The Supplementary Estimates and Supporting Information Documents

I confirm that the information provided for your approval:

• is consistent with the policies and performance expectations of the Government, and

has been prepared in accordance with the Public Finance Act 1989

Budget 2020: Process and Technical Guide for Agencies | 15

Doc 2

Page 22 of 101

IN-CONFIDENCE

• is consistent with the proposed appropriations to be set out in the Appropriation

(2020/21 Estimates) Bill, as entered by [department] into the Treasury’s CFISnet

system

• is consistent with existing appropriations, financial authorities, and Cabinet decisions

up to [date]

• has been prepared in the required format, and in accordance with the guidance that

has been issued by the Treasury

• has been appropriately reviewed by [department’s] senior management team – with a

particular focus on areas where new strategic information, such as statements about

what an appropriation is intended to achieve, is now required, and

• has been through an appropriate quality assurance process and is free of material

errors and omissions.

Either –

when only one appropriation Minister is responsible for all of the appropriations

in the Vote, the following bullet should then be included:

“The Budget process requires that you review the Estimates documentation, and then

confirm to the Minister of Finance that it is fit for publication.”

Or – when there is more than one appropriation Minister responsible for appropriations

in the Vote, the following bullet should then be included:

“As detailed below there are several appropriation Ministers associated with [Vote]:

•

Minister –list of appropriations

•

Minister –list of appropriations

•

Minister –list of appropriations

[...]

The Budget process requires that all appropriation Ministers review the Estimates

documentation. One appropriation Minister, on behalf of all appropriation Ministers

associated with the Vote, should then confirm to the Minister of Finance that the

Estimates documentation for the Vote is fit for publication.”

“I understand the Ministers responsible for appropriations in [Vote name] have agreed

that the Minister of/for [portfolio] will sign the attached letter to the Minister of Finance,

on behalf of all appropriation Ministers. Accordingly, I recommend that once

appropriation Ministers are comfortable with the material for the appropriations that

they are responsible for, the Minister of/for [portfolio] sign the attached letter to the

Minister of Finance.”

Budget 2020: Process and Technical Guide for Agencies | 16

Doc 2

Page 23 of 101

IN-CONFIDENCE

Recommendation

Either – when only one appropriation Minister is responsible for all of the appropriations

in the Vote, the following recommendation should then be included:

“I recommend that you sign the attached letter to the Minister of Finance”

Or – when there is more than one appropriation Minister responsible for appropriations

in the Vote, the following recommendation should instead be included:

“I recommend that you agree with the other appropriation Ministers associated with

the Vote which Minister will sign the attached letter to the Minister of Finance.”

Yours sincerely

[Chief Executive Signature]

[Chief Executive Title]

Budget 2020: Process and Technical Guide for Agencies | 17

Doc 2

Page 24 of 101

IN-CONFIDENCE

Estimates Chief Executive Sign Off

Template– Departmental certification letter to an appropriation Minister(s) for a Vote

[Date]

Hon Grant Robertson

Minister of Finance

Parliament Buildings

WELLINGTON

Dear Minister

2020/21 Estimates Documents for Vote: [Vote name]

Action Required

Attached, for your approval are:

• the documentation for the 2020/21 Estimates and Supporting Information for [where

there is more than one appropriation Minister, insert: “the appropriations that you are

responsible for in”] [Vote name], and

• a draft letter to the Minister of Finance.

Background

The Budget 2020 process requires that:

• the Estimates documentation for [Vote] is completed by [insert appropriate date

outlined on page 8], and

Either – when only one appropriation Minister is responsible for all of the

appropriations in the vote, the following bullet should then be included:

•

“as the appropriation Minister for all of the appropriations in the Vote, you

confirm to the Minister of Finance that this material is correct and in a form

suitable for publication.”

Or – when there is more than one appropriation Minister responsible for

appropriations in the Vote, the following bullet should then be included:

•

“one of the appropriation Ministers responsible for appropriations in the Vote, on

behalf of all appropriation Ministers with appropriations in the Vote, confirm to

the Minister of Finance that this material is correct and in a form suitable for

publication.”

Budget 2020: Process and Technical Guide for Agencies | 18

Doc 2

Page 25 of 101

IN-CONFIDENCE

The Estimates and Supporting Information Documents

I confirm that the information provided for your approval:

• is consistent with the policies and performance expectations of the government, and

has been prepared in accordance with the Public Finance Act 1989

• is consistent with the proposed appropriations to be set out in the Appropriation

(2020/21 Estimates) Bill, as entered by [department] into the Treasury’s CFISnet

system

• is consistent with existing appropriations, financial authorities, and Cabinet decisions

up to [date]

• has been prepared in the required format, and in accordance with the guidance that

has been issued by the Treasury

• has been appropriately reviewed by [department’s] senior management team – with a

particular focus on areas where new strategic information, such as statements about

what an appropriation is intended to achieve, is now required, and

• has been through an appropriate quality assurance process and is free of material

errors and omissions.

Either –

when only one appropriation Minister is responsible for all of the appropriations

in the Vote, the following bullet should then be included:

“The Budget process requires that you review the Estimates documentation, and then

confirm to the Minister of Finance that it is fit for publication.”

Or – when there is more than one appropriation Minister responsible for appropriations

in the Vote, the following bullet should then be included:

“As detailed below there are several appropriation Ministers associated with [vote]:

•

Minister –list of appropriations

•

Minister –list of appropriations

•

Minister –list of appropriations

[...]

The Budget process requires that all appropriation Ministers review the Estimates

documentation. One appropriation Minister, on behalf of all appropriation Ministers

associated with the Vote, should then confirm to the Minister of Finance that the

Estimates documentation for the Vote is fit for publication.”

Budget 2020: Process and Technical Guide for Agencies | 19

Doc 2

Page 26 of 101

IN-CONFIDENCE

“I understand the Ministers responsible for appropriations in [Vote name] have agreed

that the Minister of/for [portfolio] will sign the attached letter to the Minister of Finance,

on behalf of all appropriation Ministers. Accordingly, I recommend that once

appropriation Ministers are comfortable with the material for the appropriations that

they are responsible for, the Minister of/for [portfolio] sign the attached letter to the

Minister of Finance.”

Recommendation

Either – when only one appropriation Minister is responsible for all of the appropriations

in the Vote, the following recommendation should then be included:

“I recommend that you sign the attached letter to the Minister of Finance”

Or – when there is more than one appropriation Minister responsible for appropriations

in the Vote, the following recommendation should instead be included:

“I recommend that you agree with the other appropriation Ministers associated with

the Vote which Minister will sign the attached letter to the Minister of Finance.”

Yours sincerely

[Chief Executive Signature]

[Chief Executive Title]

Budget 2020: Process and Technical Guide for Agencies | 20

Doc 2

Page 27 of 101

IN-CONFIDENCE

Estimates Ministerial Sign Off

Template – Ministerial certification to the Minister of Finance for a vote

[DATE]

Hon Grant Robertson

Minister of Finance

Parliament Buildings

WELLINGTON

Dear Minister

2020/21 Estimates: Ministerial Sign-off for Vote [Vote]

I advise that the

Estimates of Appropriation 2020/21 and Supporting Information documents

for [Vote], for which [name of department] is the administering department, have been

completed – and that it is accurate and suitable for publication. I confirm that the information

provided:

• is consistent with the policies and performance expectations of the government, and

has been prepared in accordance with the Public Finance Act 1989

• is consistent with the proposed appropriations to be set out in the Appropriation

(2020/21 Estimates) Bill, existing appropriations and financial authorities, and with

Cabinet decisions up to [date]

• is provided in the required format, and has been prepared in accordance with the

guidance that has been issued by the Treasury, and

• has been through an appropriate quality assurance process and is free of material

errors and omissions.

[Where more than one portfolio Minister is responsible for different appropriations in the Vote

the following bullet should also be added:

“has, where it relates to an appropriation that is the

responsibility of another Minister, been approved by the Minister responsible for that

appropriation”]

In signing this statement, I acknowledge that I [and the other Ministers responsible for

appropriations in this Vote] [am/are] responsible for the information for Vote [name]

administered by [department’s name] included in the

Estimates of Appropriations 2020/21 and

Supporting Information.

Yours sincerely

[Signature]

Budget 2020: Process and Technical Guide for Agencies | 21

Doc 2

Page 28 of 101

IN-CONFIDENCE

Signature

The signature should be either:

(i)

Where the signing Minister is solely responsible for all of the appropriations

contained in the Vote

“Hon [Name]

Minister of/for [portfolio]”

(ii)

Or, where more than one portfolio Minister is responsible for different

appropriations in the Vote

“Hon [Name]

Minister of/for [portfolio]

On behalf of all Ministers responsible for appropriations in Vote [Vote name]”.

Budget 2020: Process and Technical Guide for Agencies | 22

Doc 2

Page 29 of 101

IN-CONFIDENCE

Supplementary Estimates Ministerial Sign Off

Template – Ministerial certification to the Minister of Finance for a vote

[DATE]

Hon Grant Robertson

Minister of Finance

Parliament Buildings

WELLINGTON

Dear Minister

2019/20 Supplementary Estimates: Ministerial Sign-off for Vote [Vote]

I advise that the

Supplementary Estimates of Appropriation 2019/20 and Supporting

Information documents for [Vote], for which [name of department] is the administering

department, have been completed – and that it is accurate and suitable for publication. I

confirm that the information provided:

• is consistent with the policies and performance expectations of the government, and

has been prepared in accordance with the Public Finance Act 1989

• is consistent with the proposed appropriations to be set out in the Appropriation

(2019/20 Supplementary Estimates) Bill, existing appropriations and financial

authorities, and with Cabinet decisions up to [date]

• is provided in the required format, and has been prepared in accordance with the

guidance that has been issued by the Treasury, and

• has been through an appropriate quality assurance process and is free of material

errors and omissions.

[Where more than one portfolio Minister is responsible for different appropriations in the Vote

the following bullet should also be added:

“has, where it relates to an appropriation that is the

responsibility of another Minister, been approved by the Minister responsible for that

appropriation”]

In signing this statement, I acknowledge that I [and the other Ministers responsible for

appropriations in this Vote] [am/are] responsible for the information for Vote [name]

administered by [department’s name] included in the

Supplementary Estimates of

Appropriations 2019/20 and Supporting Information.

Yours sincerely

[Signature]

Budget 2020: Process and Technical Guide for Agencies | 23

Doc 2

Page 30 of 101

IN-CONFIDENCE

Signature

The signature should be either:

(i)

Where the signing Minister is solely responsible for all of the appropriations

contained in the Vote

“Hon [Name]

Minister of/for [portfolio]”

(ii)

Or, where more than one portfolio Minister is responsible for different

appropriations in the Vote

“Hon [Name]

Minister of/for [portfolio]

On behalf of all Ministers responsible for appropriations in Vote [Vote name]””.

Budget 2020: Process and Technical Guide for Agencies | 24

Doc 3

Page 31 of 101

UNCLASSIFIED

Baseline Updates: Guidance for

departments

This Guidance covers the following:

Overview of the Baseline Updates ................................................................................ 2

Baseline Update process overview ............................................................................... 3

Updating CFISnet to reflect Cabinet decisions .............................................................. 4

Financial changes to baselines that can be agreed under CO(18)2 .............................. 5

ANNEX 1: Baseline Update Template ......................................................................... 10

Treasury:4167605v1

UNCLASSIFIED 1

Doc 3

Page 32 of 101

UNCLASSIFIED

Overview of the Baseline Updates (BU)

1.

There are two baseline updates during the fiscal year:

a.

The October Baseline Update (OBU), and

b.

The March Baseline Update (MBU).

2.

Baseline updates provide an opportunity for departments to:

a. Seek

Joint

Ministers1 agreement to:

i.

changes to baselines that Joint Ministers are able to approve under

CO(18)2 and update CFISnet to reflect the agreed changes

ii.

Confirm in-principle expense and capital transfers agreed at MBU or

agreed before the end of the previous financial year and

iii.

At OBU, adjust the future spending profile of multi-year appropriations

to ensure the remaining profile of each MYA reflects the difference

between the total amount of the MYA and the total actual expenditure

to the end of the previous year.

b.

Update CFISnet to reflect Cabinet decisions and other Joint Ministers’

decisions affecting baselines that have been made since the Budget

c.

Request their appropriation Minister seek the Minister of Finance’s

agreement to:

i.

Performance reporting exemptions, and

ii.

The establishment of Multi-Category Appropriations (MCAs).

3.

Ahead of each baseline update, timelines are uploaded to CFISnet and released

to departments.

4.

Baseline updates are technical updates, with their contents designed to require

no review by Cabinet. Any changes that require Cabinet approval should be

considered separately. Departments should discuss the appropriate approach

with their Treasury Vote Analyst.

5.

Departments should also discuss any potentially contentious changes with their

Treasury Vote team as early as possible, so these can be resolved in advance of

the appropriation Minister’s submission for the baseline update.

1 The Minister of Finance and the appropriation Minister

Treasury:4167605v1

UNCLASSIFIED 2

Doc 3

Page 33 of 101

UNCLASSIFIED

6.

Any disagreements regarding changes should be resolved, if possible, between

the department and the Treasury Vote Team before Joint Ministers agreement is

sought. Where disputes can be resolved, CFISnet should be updated to reflect

the agreed position. Where disputes cannot be resolved, the disputed items are

to be removed from CFISnet and deferred to the next Budget process.

Baseline Update Process overview

Coredata Changes

7.

Coredata changes are required for all new appropriations agreed to by Cabinet

and to amend existing details such as title, scope and the Minister responsible for

the appropriation. Normally, titles and scopes should not be amended during a

financial year. To allow departments to enter information against the new

appropriations in CFISnet a line is created by Treasury to accept the data. Until a

new line is created, no data can be stored against the appropriations.

Appropriation Minister Submission

8.

Appropriation Ministers are to submit two hard copies of their Baseline Update

requests to the Minister of Finance.

9.

The format for appropriation Ministers’ submissions is attached as Annex 1 to this

Guidance. A word version of the template is available on CFISnet in the Treasury

Circulars section. The submission to the Minister of Finance should be

accompanied by the following Tables from CFISnet (CFISnet menu: Baselines

Vote Changes):

•

Table 1: Summary Table of Baseline Numbers

•

Table 2: Baseline Changes Report

10. Proposed changes should be explained in the appropriation Minister’s

submission as follows:

Change type

Explanation to be contained in

appropriation Minister Submission

Fiscally neutral adjustments (FNAs) between

One short paragraph for each change that

appropriations

shows why an FNA is proposed.

Expense or Capital transfers between

One short paragraph for each change that

financial years

explains the factors outside of the agency’s

control that require project or programme

funds to be moved into a subsequent year.

Retention of underspends (RoUs) from one

One short paragraph for each change that

financial year to the next (MBU only)

proves that underspends are a result of

savings made through gains in efficiency or

other savings initiatives.

Front-loading of spending

One short paragraph for each change that

explains why funding will be required in an

earlier financial year.

Technical adjustments to appropriation titles

One short paragraph explaining each

and descriptions

change.

Forecast changes

One short paragraph outlining the key

factors/drivers in the forecast change.

Treasury:4167605v1

UNCLASSIFIED 3

Doc 3

Page 34 of 101

UNCLASSIFIED

11. To assist in subsequent analysis of changes, the explanations should include a

clear description of the drivers of change and, where there are multiple changes

affecting an appropriation, present each individual change rather than

aggregating multiple changes.

12. Updates to CFISnet to reflect Cabinet decisions or Joint Ministers’ decisions do

not require an explanation, but the relevant Cabinet Minute or Joint Ministers’

decision reference must be recorded in the “authority for change” field of the

Table 2 attachment.

13. Appropriation Ministers will also be asked to certify that none of the proposed

changes requires a Cabinet decision.

Treasury Assessment

14. As the focus of the Baseline Update is to action a variety of technical changes, it

is not expected that substantive policy discussions will be required. However,

Treasury Vote teams will still check submissions for such implications. The other

area of focus in the Treasury assessment will be whether the submission meets

the guidelines for changes to baselines as set out in Cabinet Office Circular CO

(18) 2, including whether Joint Ministers have delegated authority to approve the

proposed change.

Notification of Outcome

15. Updated baselines will be confirmed via a letter from the Minister of Finance to

the appropriation Minister. The letter will confirm all agreed changes, any

disputed items that have been resolved following submission, and list any

disputed changes to be addressed in Budget or through other Cabinet processes.

Updating CFISnet to reflect Cabinet decisions

16. The Baseline Update process also allows for the updating of CFISnet to reflect

the outcomes of Cabinet decisions that affect baselines, made since the previous

Baseline Update or Budget update. This includes decisions by Joint Ministers

made under delegation from Cabinet.

Cabinet policy decisions

17. All updates entered into CFISnet to reflect the outcome of a Cabinet decision

(including decisions made by Joint Ministers under delegation from Cabinet) must

include the classification “Cabinet Policy Decision” and include the Cabinet

Minute reference as an authority. Where applicable, the joint Ministerial letter

reference should also be included, if Joint Ministers have made the decision

under delegation from Cabinet.

18. When using the classification “Cabinet Policy Decision” to update CFISnet to

reflect the outcome of a Cabinet decision, a “contingency category” must also be

selected to identify the source of funding that the Cabinet policy decision impacts.

Treasury:4167605v1

UNCLASSIFIED 4

Doc 3

Page 35 of 101

UNCLASSIFIED

Financial changes to baselines that can be agreed under CO(18)2

19. The Baseline Update process allows for timely updating of baselines prior to the

production of the Budget (in the case of MBU) and ahead of the Half-Year

Economic and Fiscal Updates (in the case of OBU). The criteria under which

Joint Ministers can approve changes with financial implications are set out in the

Cabinet Office Circular CO (18) 2, ‘

Proposals with Financial Implications and

Financial Authorities’ and can be accessed at:

https://www.dpmc.govt.nz/publications/co-18-2-proposals-financial-implications-

and-financial-authorities

20. Baseline updates or forecasting adjustments unable to be agreed by Joint

Ministers during the Baseline Update because they fall outside the criteria set in

CO (18) 2 may be considered as part of the Budget or through a separate

Cabinet process, if they are consistent with Government priorities.

21. Departments can discuss these particular cases with their Vote Analyst. Changes

that cannot be agreed under CO (18) 2, including those that require additional

funding, should be considered as part of the Budget process. They may be able

to be considered alongside the financial recommendations in the Budget Cabinet

paper. Any changes that cannot be agreed under CO (18) 2 will be recorded in

the Minister of Finance’s response letter to appropriation Ministers.

22. When preparing Baseline Update submissions, it is important that departments:

a.

Pay close attention to the correct classification of any Vote changes sought

as part of the baseline update, as this information is directly used in the

production of the Crown’s fiscal forecasts.

b.

If seeking FNAs between Votes, specify all other Votes affected by the FNA

in the description of the FNA to enable cross-checking by Treasury Vote

teams.

c.

Note that Expense Transfers will be approved only where agencies prove

that a factor outside of their control is the primary cause of delay.

d.

Note that Retention of Underspends will be approved only where agencies

prove that underspends remain as a result of savings made through gains

in efficiency or other savings initiatives.

e.

Note that forecast adjustments should reflect a best estimate prepared on

the basis of best professional judgement reflecting information and

circumstances at the date they are prepared.

Treasury:4167605v1

UNCLASSIFIED 5

Doc 3

Page 36 of 101

UNCLASSIFIED

Expense and Capital Transfers - Approval in principle and confirmation of approvals in

principle

23. In-principle Expense and Capital Transfers (IPECTs) may be sought where the

final amount to be transferred cannot be finalised until after the due date for MBU

submissions (i.e. amounts will only be known when accounts are audited).

IPECTs should be included in your Minister’s letter, but not as a vote change in

CFISnet.

24. In order for the fiscal forecasts to be as accurate as possible, and as noted in CO

(18) 2, Ministers should limit the scope of IPECTs as much as possible. This

means that they should transfer the proportion of funding they are sure of and

only use an in-principle transfer for the remainder. When updating forecast

information (common schedules beginning with a “1”), departments should use

their best estimate of the actual spending patterns. Appropriations and funding

limits should be separated from Revenue and Expense forecasts using the

reconciliation schedules (1:53:0, 1:53:1 and 1:73:0).

25. Departments are encouraged to seek Expense and Capital Transfers at the MBU

if required. There is also an opportunity to seek transfers between Budget Day

and before the end of the financial year, in June. Further information can be

provided as necessary by Vote Analysts.

26. IPECTs do not constitute sufficient authority to incur expenses until the actual

quantum is confirmed and agreed by Joint Ministers, normally in the following

OBU. The level of parliamentary financial authority is monitored on a monthly

basis by the Controller and Auditor General. Any expenditure incurred without

authority (in this case, any expenditure incurred in relation to these transfers prior

to obtaining confirmation of the quantum of transfer, up to the level earlier

approved in principle) will be reported as unappropriated and will require

validation by Parliament. For more information see

Treasury Circular 2012/03

Unappropriated Expenditure - Avoiding Unintended Breaches.

27. Please note, confirmations of in-principle transfers are limited by the amount of

the previous year’s appropriation that remained unspent, as well as the revenue

associated with any output.

Departmental Capital Injection Transfers and Cabinet Approved Departmental Capital

Injections

28. Departmental capital injections require Parliamentary authorisation. Departments

still need to apply the criteria and process stipulated in CO (18) 2 for transferring

departmental capital injections between financial years, as such changes alter

the year for which Parliamentary authorisation of the capital injection is required.

29. Specific lines for Departmental Net Assets are contained in CFISnet schedule

0:9:0, and explanations of movements to these lines are reported in Table 2.

CFISnet validation rules ensure consistency between the 0:9:0 schedule and

Taxpayers’ Funds reported in the Statement of Financial Position.

Treasury:4167605v1

UNCLASSIFIED 6

Doc 3

Page 37 of 101

UNCLASSIFIED

30. Other changes that affect departmental net assets but do not require Joint

Ministerial or Cabinet approval at this stage can be reflected in departments’

updated financial statements submitted via CFISnet. Such changes may

encompass capital withdrawals, revaluations and revisions of surpluses or

deficits. They do not need to be identified in the appropriation Minister’s

submission.

Retention of Underspends (RoUs)

31. Underspends are defined as funding remaining at the end of the financial year as

a result of:

•

savings made through gains in efficiency; and/or

•

other savings initiatives, where the output or service has been delivered in

full. In contrast, an expense and capital transfer can be used when the

output or service has not been fully delivered due to circumstances outside

the department's control.

32. Underspends do not include, for example, funding left over as a result of lower-

than-expected demand for a service, or because the amount required was

originally over-estimated.

33. Joint Ministers can approve the retention of underspends within departmental

expense appropriations. This funding can then be transferred to the next financial

year, and also transferred to any other departmental appropriations.

34. Where approval to retain underspends is sought before or in the MBU, the full

amount can be retained. Underspends must be confirmed during the MBU by

showing a decrease in the current year’s Supplementary Estimates and a

corresponding increase in the following year's Estimates.

35. Where approval to retain underspends is sought after the MBU but before 30

June, half of the amount can be retained. Underspends must be confirmed on the

basis of the audited financial results for the financial year in which underspends

occurred, and the increase reflected in the following year's Supplementary

Estimates. Note that this has similar reporting treatment in the Estimates and

Supplementary Estimates as in-principle expense and capital transfers.

36. Any proposal to retain underspends made after 30 June will be declined.

37. Proposals to retain underspends must:

•

explain how underspends arose (as per paragraph 54 in CO (18) 2)

•

explain what the transferred funding will be used for, and why it should be

retained rather than returned to the centre, and

•

prove that underspends remain as a result of savings made through gains

in efficiency or other savings initiatives.

Treasury:4167605v1

UNCLASSIFIED 7

Doc 3

Page 38 of 101

UNCLASSIFIED

Front-loading of spending (FLoS)

38. Front-loading of spending can be used to bring forward funding in any

departmental expense appropriation within the forecast period for specific

investments or projects that will permanently and sustainably reduce spending in

outyears.

39. Proposals to front-load spending must explain:

•

how the investment or project will permanently and sustainably reduce

expenditure in out-years

•