Hastings place-based approach: progress report to 31 March 2021 (BRF20/21040925)

Hastings place-based approach: progress report to 31 March 2021 (BRF20/21040925)

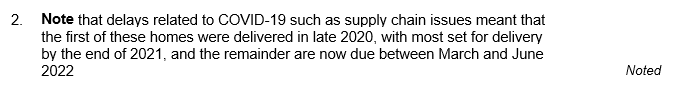

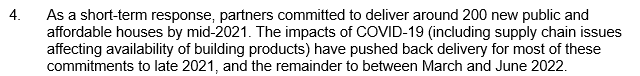

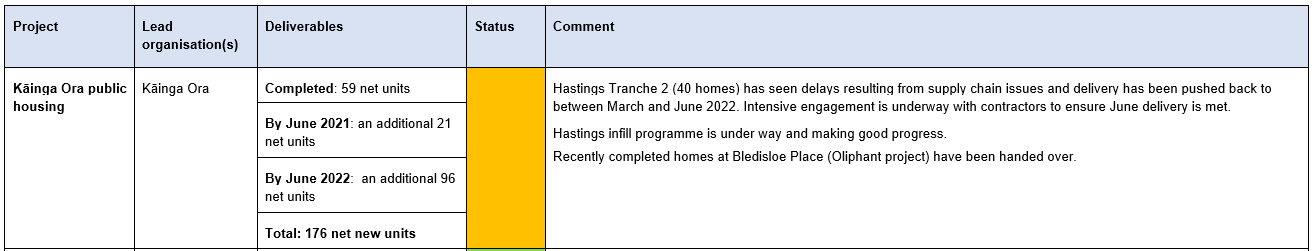

the 1982

Housing Market Update May 2021

Act

under

Housing Market Update – May 2021 (IREQ20/21050939)

Released

Information

Housing Market Dashboard – April 2021

Official

the 1982

Act

under

Released

Information

Official

AH 21 024

31 March 2021

Minister of Housing

Associate Minister of Housing (Public Housing)

cc: Vui Mark Gosche, Board Chair

Construction Materials Supply Chain – Risk and Management

Purpose

This paper provides information on the current situation concerning the supply chain of

construction materials and products in New Zealand

Background

The COVID-19 pandemic has had a serious impact on global manufacturing, supply

chains and logistics. The resulting trade imbalance is impacting imports to New Zealand

for all goods and materials. The current boom in construction activity in New Zealand is

adding an additional constraint to the market, as demand is far exceeding forecasts and

available supply.

Impact of COVID-19 on global supply chains and logistics

Countries across the globe have experienced COVID-19 outbreaks at different times as

the pandemic spread from its epicentre and, consequently, introduced lockdowns, and

halted economic movements and production. The impacts of this have resulted in

constraints in supply due to:

reduced productivity

the flow of imports and exports changing

the impact on the flow of shipping movements.

Interruptions to production caused large numbers of shipping containers to be stranded at

ports leading to carriers reducing the number of vessels out at sea. This situation

continues, with international shipping volumes considerably reduced.

Global Container Shortage

There is currently a global shortage of shipping containers due primarily to a severe trade

contraction in the first half of 2020 that led to the cancellation of sailings. Increased

economic activity in China in the second half of 2020 resulted in a resurgence in trade

demand as well as the peak period demand for goods in western markets due to

Christmas and New Year holidays.

However, demand for American and European goods from Asian markets has been weak,

meaning that most containers worldwide are stranded in European and American ports.

The result of this has been a worldwide logistics backlog and empty containers not being

where they are needed. The limited access to containers is, in turn, driving up the cost of

new containers.

Auckland Port Congestion

The Ports of Auckland is currently operating only three of its eight ship-to-shore cranes

during the day (two at night) due to a labour shortage. It is currently seeking to recruit five

crane operators from overseas but it is unknown when the first candidates wil arrive in

New Zealand. Completion of the Ports of Auckland terminal automation project, due at the

end of March 2021, has also been delayed due to freight processing taking priority.

As a result, container ships are waiting at sea for 10 to 14 days to unload at Auckland;

shipping lines are reducing their calls to Auckland; some are imposing Auckland

congestion charges on import containers; and shipments can be re-directed to other ports,

with little or no notice, if the shipping lines do not want to wait to be unloaded.

Other factors

Other factors affecting supply chains include:

industrial action at Australian ports

shipping cost increases of between 150 – 400 per cent as shipping lines focus

traffic on the most profitable

increased air freight costs due to reduced inbound flights to New Zealand

reduced or non-production due to COVID-19 distancing measures in

manufacturing operations

unprecedented and unexpected demand from the construction sector boom in New

Zealand

supplier decisions prior to COVID-19 – for example, James Hardie manufacturing

moved from Penrose and now all in Australia.

Kāinga Ora – Homes and Communities response to Carter Holt Harvey structural

timber supply changes

Timber is in short supply across New Zealand due to high demand. This has resulted in

significant price increases to timber products and lead times extending.

Kāinga Ora is supporting its build partners to work with their suppliers in order to ensure

continued supply of structural grade timber.

Kāinga Ora spoke to all its major suppliers Monday 29 March 2021 following the Carter

Holt Harvey announcement to cut its supplies of structural grade timber to Mitre 10 and

ITM.

In summary, while Carter Holt Harvey is a major supplier of timber products, suppliers

have other options in terms of mil s that also produce this timber.

It is too early to say what the impact of current shortages wil be on our national build

programme. We are recommending our build partners place orders well in advance in

case of delays. We wil continue to monitor this changing situation and wil offer any

assistance we can to our partners.

2

Suez Canal Supply Chain impact

Current advice from Kāinga Ora National Supply Agreement partners is that the Suez

Canal blockage (where the EverGiven became wedged and was re-floated a week later

on Monday 29 March 2021 NZT) is unlikely to have impact on the supply chain in near

future.

The ship was on its way North; however, the knock-on effect of the canal being blocked

for over a week is a significant traffic jam of ships awaiting passage in both directions.

The Kāinga Ora National Supply Agreement Partners have advised that ample stocks are

on hand of materials sourced and products manufactured in the Northern Hemisphere.

The situation is being closely monitored and alternate products wil be sourced, if required.

Risks to Kāinga Ora construction programmes

Collective supply chain continuity risks and impacts are highly likely to result in increases

in the cost of materials to Kāinga Ora and could result in project delays and costs

escalations. The cost of imported products or products that require imported components

are likely to rise.

Products sourced from off-shore, which have previously been viewed as a lower cost

alternative, may become uncompetitive when compared to local y sourced products due to

dramatic logistics costs increases. The main risks for new construction are currently

product availability for exterior timber, timber floor joists, and electrical cable used for

power and lighting; increased lead times for some cladding; and supply of raw materials

for paint products.

Kāinga Ora contracts materials supply for maintenance activities using National Supply

Agreements (NSAs) and these contracts and stock forecasts are actively managed. The

Maintenance and Retrofit programmes make effective use of these contracts and

forecasting of activities for suppliers reduces the risk of supply shortages. In the current

environment, contracted NSA suppliers are holding additional stock. Although this adds

considerable risk to their balance sheets, they are not approaching Kāinga Ora for any

support at this point in time.

Mitigation

Kāinga Ora is working closely with suppliers, manufacturers, and distributors to reduce the

risks as far as possible. This includes ongoing intelligence gathering, supplier liaison, and

mitigation planning.

Our Procurement team is providing regular updates to our Maintenance and Build

Partners, based on information received from shipping companies; product suppliers and

their suppliers; and market intelligence. The information shared is supporting Kāinga Ora

scenario planning for the possibility that the situation dramatical y worsens, and

discussions regarding possible responses to project delays and impacts, and

opportunities to support suppliers, if required.

Next steps

If the current demand for construction products continues at the same or increased level,

there wil be a heightened need for increased levels of forward forecasting both from

Kāinga Ora and our Build Partners to ensure supply wil be available when needed.

3

Kāinga Ora wil continue to monitor the supply market and work through possible solutions

to both shorter and longer term supply constraints, such as alternative products, improving

forecasts and communication, and increasing stock levels.

Andrea Morton

Director Procurement and Supplier Management

Caroline McDowal

General Manager Commercial

4

From:

From:

Fiona Montgomery

To:

EXT Iain Duncan

Subject:

response - Urgent feedback required

Hi Iain

Please see below in response to your earlier request of today.

Kāingā Orā – Homes ānd Communities response to Cārter Holt Hārvey decision

· Timber is in short supply across New Zealand due to high demand. This has resulted in

significant price increases to timber products and lead times extending.

· Kainga Ora is supporting its build partners to work with their suppliers in order to ensure

continued supply of structural grade timber.

1982

·

the

Kainga Ora spoke to all its major suppliers this morning following the Carter Holt Harvey

announcement to cut its supplies of structural grade timber to Mitre 10 and ITM.

· In summary, while Carter Holt Harvey is a major supplier of timber products, suppliers have

other options in terms of mills that also produce this timber.

· It is too early to say what the impact of current shortages will be on our national build

programme. However, we are hopeful that any impact will not be significant. Act

· We are recommending our build partners place orders well in advance in case of delays. We will

continue to monitor this changing situation and will offer any assistance we can to our partners.

· Our Procurement Team has a good relationship with Carter Holt Harvey management. We will

under

also keep in contact with them, as needed.

Regards

Fiona

cid:image001.jpg@01D60678.5EB46090

Fionā Montgomery

Senior Advisor

Mobile: s 9(2)(a)

Information

Government Relations

Email: [email address]

People, Governance and Capability

Released

Freephone: 0800 801 601 | Mainline: (04) 439 3000 | Kainga Ora - Homes and Communities

PO BOX 2628 Wellington 6140 | New Zealand Government |

www.kāingāorā.govt.nz

REQUEST

From: Iain Duncan <[email address]>

Sent: Monday, 29 March 2021 1:19 PM

To: GRU Jobs <[email address]>; Rachel Kelly <[email address]>

Subject: Urgent feedback required

Importānce: High

Official

Hi all

Further to the news over the weekend that Carter Holt Harvey is cutting timber supplies to Mitre 10,

Bunnings and ITM etc will this have any impact on the work being done by Kainga Ora and is KO hearing

anything from partners and stakeholders about this situation and how it is impacting on them?

The Minister would like an urgent update on this situation as soon as possible, as she may be asked by

media around this topic today.

Many thanks.

Iain

Iāin Duncān |

Private Secretary (Housing)

[email address] DDI: 04 817 9782 Cellphone: s 9(2)(a)

Office of Hon Dr Megān Woods

Minister of Housing

| Minister of Energy and Resources

| Minister of Research, Science and Innovation

the 1982

Private Bag 18041 | Parliament Buildings | Wellington 6160 | New Zealand

Office Phone: +64 4 817 8705 Email: [Megan Woods request email]

Act

under

Released

Information

Official

Document Outline