Report

MACC - EECA Programme 2A Energy Efficiency Review

(Building Envelope)

Prepared for Wellington City Council

By Beca Ltd

3 June 2016

/

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Revision History

Revision Nº

Prepared By

Description

Date

1

Shaan Cory

Issued for information

7 June 2016

2

3

4

5

Document Acceptance

Action

Name

Signed

Date

Prepared by

Shaan Cory

30 May 2016

Reviewed by

Ben Masters

3 June 2016

Approved by

Ben Masters

7 June 2016

on behalf of

Beca Ltd

© Beca 2016 (unless Beca has expressly agreed otherwise with the Client in writing).

This report has been prepared by Beca on the specific instructions of our Client. It is solely for our Client’s use for the purpose for which

it is intended in accordance with the agreed scope of work. Any use or reliance by any person contrary to the above, to which Beca has

not given its prior written consent, is at that person's own risk.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // i

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Executive Summary

The following is a summary overview of the selected energy efficiency opportunities assessed as part of the EECA Programme 2A energy efficiency advisory service for the proposed Museum and Convention Centre (MACC)

project to assess building envelope opportunities. The energy efficiency review has used computer simulation modelling to benchmark annual energy use savings against a theoretical baseline building model.

Comparison of Building Envelope Energy Efficiency Opportunities

Attribute

Annual

The findings and recommendations are:

Energy Use

Combining the energy efficiency opportunities which offer an energy reduction

Benchmark

(enhanced glazing, roof, and wall insulation) indicates around 12kWh/m2 per year

Comparison

energy savings compared to the NZBC baseline model. The energy savings of the

combined energy efficiency options may reduce GHG emissions by more than 40

tonnes per year.

The combination of implementing the enhanced glazing, wall and roof opportunities

is indicated to provide approximately $11k of energy cost savings per year, which

has an estimated payback period of 11 years, a NPV of $10k, and an IRR of 7.3%

(20 year period). This indicates the assessed options would result in a favourable

return on investment.

Along with offering energy savings, the assessed enhanced glazing (IGU Low-e

Solar Control) option is also recommended for improved occupancy thermal comfort

due to improved summer and winter radiant surface temperatures in the occupied

spaces. Likewise, the increased insulation level will result in improved winter thermal

comfort.

External solar shading and glazing performance criteria may also result in a reduced

peak cooling load and resulting chiller plant capacity and required AHU sizes.

Likewise increased thermal insulation will reduce the required boiler plant capacity.

These potential capital cost savings have not been factored into the assessment

It is indicated that installing additional solar shading increases energy consumption

and GHG emissions, but would also improve summer comfort in the Level 4 FOH

area.

We recommend that WCC considers including the above combined opportunities

subject to meeting their investment criteria and the project budget.

Annual

Savings

Enhanced Energy Efficiency Opportunities

Benchmark

Annual Energy and Emissions Savings

Combined Building Envelope

Summary

Benchmark

External solar shading

Enhanced Glazing

Enhanced Roof Insulation

Enhanced Wall Insulation

Opportunities

kWh/m2 per year

-0.5

4

6

6

12

kWh per year

-7,000

58,000

96,000

96,000

196,000

$ per year

$60

$4,000

$6,000

$6,000

$11,000

Tonnes CO2-e/ year

-2

12

21

21

43

Performance

Financial

Enhanced Energy Efficiency Opportunities

Analysis

Financial Performance Indicator

Enhanced Glazing

Combined Building Envelope

Summary

External Solar Shading

Enhanced Roof Insulation

Enhanced Wall Insulation

(IGU Low-e Solar Control)

Opportunities

Indicative Capital Cost1

$50K

$80K

$25K

$30K

$135K

Payback Period2

NA years

17 years

5 years

6 years

11 years

20 year NPV3

-$49,000

-$25,000

$49,000

$44,000

$10,000

20 year IRR

NA

2.4%

24.0%

20.1%

7.3%

1

Based on indicative increased capital cost over baseline option. Order of capital costs TBC by Cost Consultant. Excluding GST, contractor P+G and margins, contingency allowance, and professional fees. These estimates are for comparison purposes

only, and not to establish construction budget or estimate operating expenses. 2

Based on WCC electricity rate of 10ȼ/kWh and gas rate of 5ȼ/kWh with a 2.5% annual inflation rate assumed

3

Assumes a 6.5% discount rate

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // ii

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Contents

1 Introduction

2

2 Project Description

2

2.1

Museum and Convention Centre

2

3 Energy Efficiency Overview

3

3.1

Efficiency Optimises Lifetime Costs

3

3.2

Energy Efficiency Adds Value

3

4 Computer Simulation Models

3

4.1

Weather File

3

4.2

Baseline Model

3

5 Energy Efficiency Opportunities

5

6 Findings

6

7 Financial Performance Analysis

7

8 Comments & Recommendations

8

9 Next Steps

8

Appendices

Appendix A – Computer Simulation Model Inputs

Appendix B – Financial Performance Analysis

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // i

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

1

Introduction

2

Project Description

This energy efficiency advisory service has been requested by Wellington City Council (WCC) to review selected

2.1

Museum and Convention Centre

energy efficiency opportunities available to the proposed Museum and Convention Centre (MACC). The scope of

services provided aligns with the objectives of the Energy Efficiency & Conservation Authority (EECA)

WCC is planning to construct a new MACC with an approximate useable floor area of 15,751m2. MACC is a 5

Programme 2A Advisory service requirements.

storey building. The lower four floors consist of two 10m high floor to ceiling mezzanine split levels that house the

museum exhibits. The top floor houses the convention centre. MACC is comprised of:

As summarised by EECA:

11 large exhibition pieces

The objective of Programme 2A is to recommend energy efficient design features [building envelope]

when the

1,100 person convention centre,

building design is at the initial concept stage and to "lock in" energy efficiency before a significant amount of time

Kitchen,

and money has been spent on detailed drawings and designs.

Offices, and

Lobby area.

The EECA Programme 2B report has been carried out in parallel with this report and is focussed on energy

efficient systems.

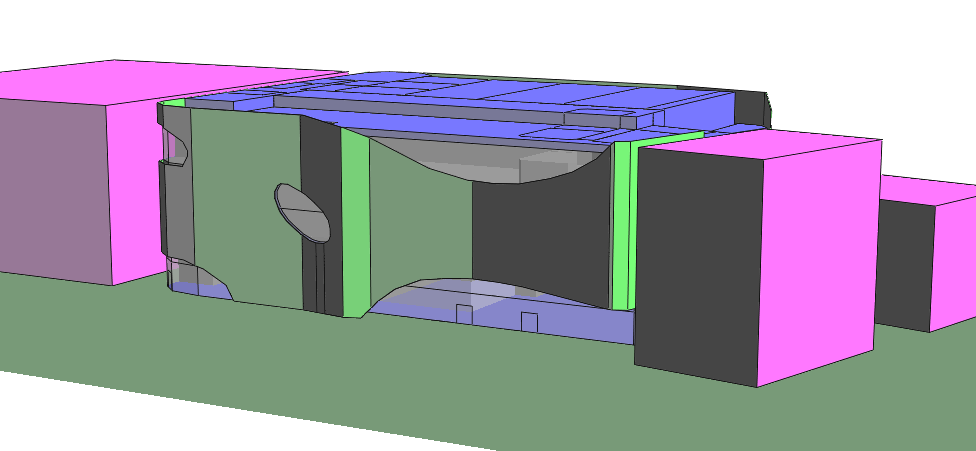

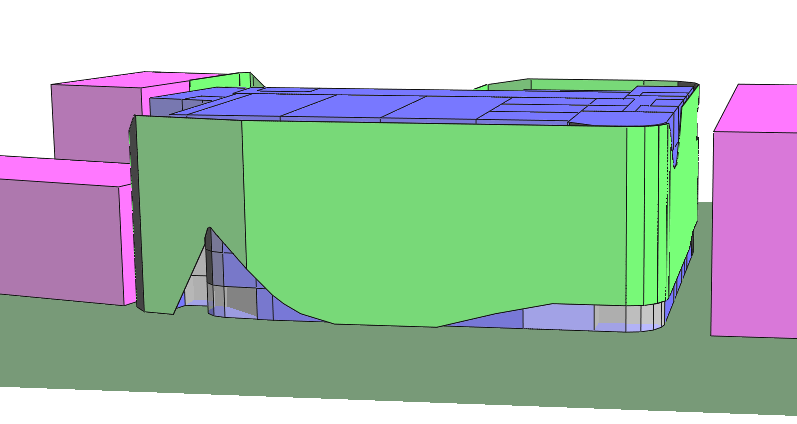

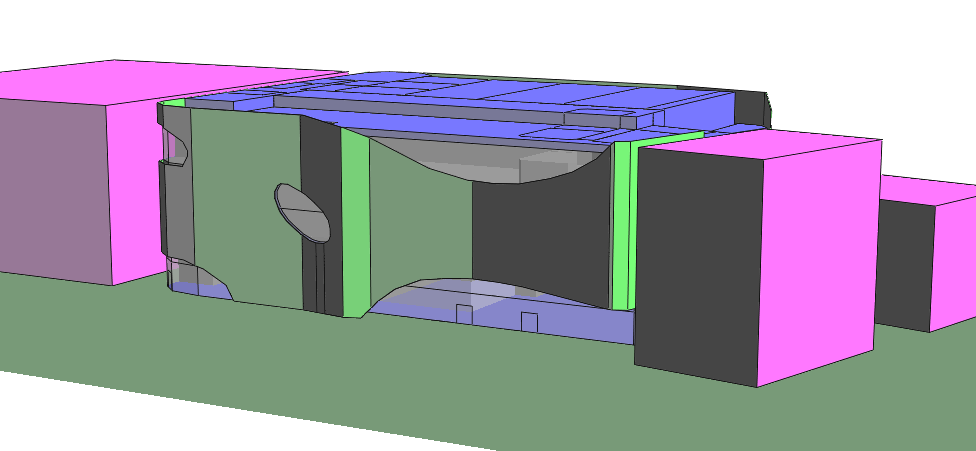

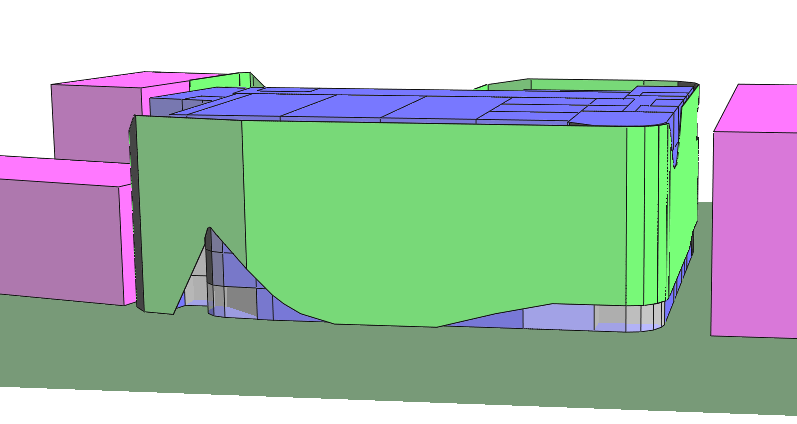

Figure 1 shows that MACC is located across the street from Te Papa and situated between three existing

buildings.

The energy efficiency review uses computer simulation modelling to benchmark the energy performance benefit

of selected building envelope energy efficiency opportunities against a theoretical baseline model and the

Project summary details are as follows:

proposed design.

Location: Cable Street, Wellington

Each opportunity has been considered purely from an energy, Greenhouse Gas (GHG) emissions and energy

Client: Wellington City Council

cost perspective only. Other criteria including internal environmental quality (e.g. occupancy thermal comfort, air

Design Stage: Preliminary Design

quality, daylight availability, access to external views etc), architectural, construction, cost, emissions, cleaning,

safety in design and all other aspects which inform to the performance and aesthetic requirements of the building

design should be considered separately by the project team.

N

Limitations

This study has been prepared for the purposes of helping to inform the development of the building design. The

computer simulation models are only intended to help inform the building design and the predicted values may

Cable Street

overestimate or underestimate the actual building performance in use. Note that the energy benchmark

calculations use standard benchmarking criteria for occupancy, lighting, power and plant usage and benchmark

weather data. Actual operating variables will differ in reality (e.g. weather, fitout and usage patterns, blinds

control etc.). We point out that the weather files used for the computer simulations represent a typical weather

year only and does not account for periods of unseasonably high (or low) temperature or humidity.

The energy benchmarks are not an estimate of predicted energy use and as such cannot be guaranteed that the

actual building energy use will be within the target limits as this will be determined by many variables, including

those listed above.

All costs are high level estimates only based on suppliers quotes and may not reflect the actual costs. These will

need to be confirmed by further design and the project quantity surveyor.

Figure 1 – Proposed site location on the existing Cable Street site

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 2

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

3

Energy Efficiency Overview

4

Computer Simulation Models

Commercial and industrial buildings account for around 8% of New Zealand’s total energy consumption a year,

A 3D computer simulation model was created for the building using IES Virtual Environment software. IES

and 5% of total CO2 emissions.

simulation software is of the dynamic thermal simulation type that is capable of predicting building thermal

performance and estimating annual energy consumption in a building.

Studies have shown there can be as much as a ten-fold difference in actual energy consumption between similar

buildings with design and construction-related issues and operational issues the main contributors to the

The program is based upon finite difference methods as recommended by CIBSE Part A for energy and

differences.

environmental modelling to model the transmission and storage of heat in the building fabric.

3.1

Efficiency Optimises Lifetime Costs

The thermal model was created using IES Virtual Environment Version 2015. This has been independently

verified to meet ANSI/ASHRAE Standard 140-2004 (Building Thermal Envelope and Fabric Test Loads)

Designing energy-efficient buildings makes sense on a number of levels – not the least of which is the overall

performance criteria. The

Apache HVAC module has been used to simulate Heating, Ventilation, and Air-

economics.

Conditioning (HVAC) energy.

Typical costs relative to initial construction costs over the life of a typical building are:

Environmental consultant fees

0.01 to 0.03

4.1

Weather File

Professional fees

0.10 to 0.15

Each model has been simulated using the NIWA Wellington TMY2 weather file (Data Source - TMY2 NIWA

Construction costs

1.00

18234 D14482 WMO Station 934360). This represents a historical average year of Wellington weather data as

Energy, operating and maintenance costs 3.00

recorded at the Kelburn weather station. It must be noted that the weather data does not account for any

Business costs (salaries, rental/space)

200.00

unseasonable weather conditions and does not account for any localised micro climate effects at the site

Even taken together the design fees and costs of construction are a small portion of total lifetime costs of a

location.

building. Focusing on these initial construction costs alone will almost certainly result in a project that does not

optimise its lifetime costs.

4.2

Baseline Model

A theoretical baseline model for the MACC building has been created which generally aligns with the New

The extra initial cost of letting the architects and engineers evaluate the design thoroughly and determine an

Zealand Building Code (NZBC) Clause H1 minimum energy efficiency requirements. The proposed building

energy-efficient outcome is an investment that should repay itself many times over the life of the building.

geometry has been modelled, with proposed areas and location of clear single glazing included on each façade.

External wall, roof and suspended floor areas are all insulated to align with the Clause H1 R-value minimum. The

Business costs are by far the most significant lifetime cost of a project, and to influence them, the potential effect

baseline model includes the external solar shading which wraps around the building.

of a building on the productivity and health of its users must be taken into account.

The baseline model has full air conditioning to all occupied areas with a combination of centralised Variable Air

Energy-efficient design can also play a significant role in providing healthier, more productive environments. For

Volume (VAV) Air Handling Units (AHU) with zone reheat and a 4 pipe fan coil unit system providing heating and

example:

cooling via a water cooled chiller plant and gas boiler plant (condensing type). Mechanical ventilation is provided

as per the current design provision. Internal lighting is assumed to be predominantly provided by LED lighting

Increased levels of thermal insulation results in improved winter thermal comfort

technology. HVAC plant and equipment efficiencies align with the Department of Building and Housing’s

External shading to control summer cooling loads also reduces direct solar gain which may cause discomfort

for building occupants. Well-designed shading also means users do not need to use their blinds as much,

Guidelines for Energy Efficient HVAC plant (MEPS).

allowing more access to daylight and exterior views.

The operating and occupancy profile used in the model has been set to align with the forecast average 10 year

Energy-efficient high frequency lighting may reduce headache producing flicker

projection for movie museum usage from “Wellington City Council - Indicative business case for a new movie

3.2

Energy Efficiency Adds Value

museum” document from November 2015 and projected year 5 convention centre usage from “Wellington City

Council - Indicative business case for a new convention centre” document from December 2015.

All stakeholders in the building stand to gain from more energy-efficient design.

Further details of the baseline computer model inputs are described in Appendix A.

Owners/occupiers and building users enjoy lower operating costs, and potentially greater operational flexibility

and an environment that encourages greater productivity. The benefits also contribute to the long-term value of

Sample images of the 3D computer model can be seen in the following figures:

the asset for owners and portfolio holders.

The benefits of energy efficiency will become more obvious and more valuable as energy costs rise, employees’

pressure for healthier environments increases, regulation becomes a more distinct possibility and overall

environmental awareness improves.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 3

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

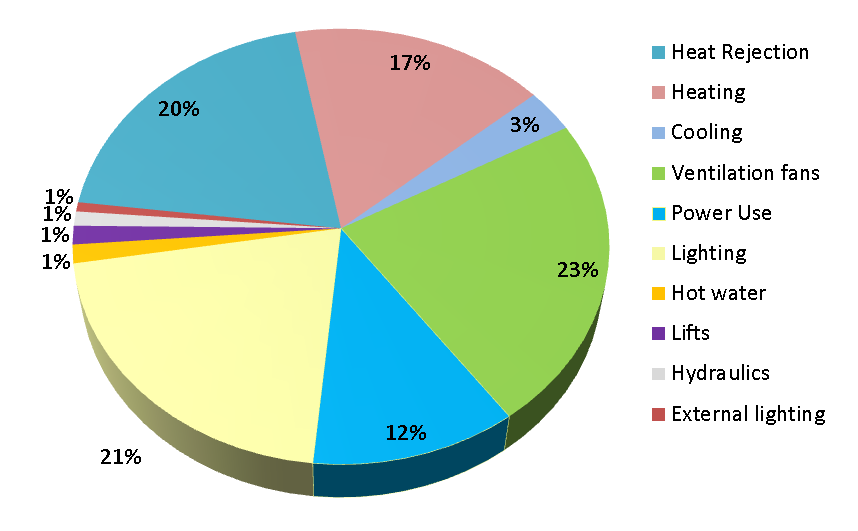

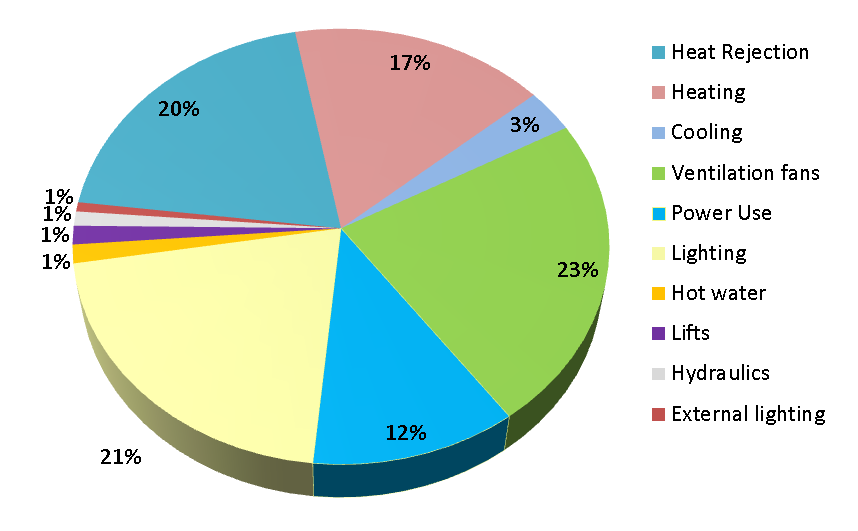

Benchmark Energy End Use Breakdown

Adjacent Buildings

The benchmark annual energy end-use breakdown for the theoretical baseline model can be seen in the

following figure:

Solar Shading

Figure 2 - Computer simulation model showing proposed façade design, view from north.

Figure 4 - Baseline Model, Benchmark Energy End Use Breakdown

It can be seen that heating, cooling, ventilation fans, and heat rejection energy makes up 63% of the annual

energy use for the baseline model. Ventilation fans energy is the highest HVAC end use at 23% and is

comprised of AHUs, supply air fans, fan coil units, and miscellaneous extract fans (e.g. toilets, kitchen exhaust,

back of house etc). Heat rejection energy is the second largest energy user at 20% of overall energy and is

comprised of the cooling tower fans and the condensing circuit’s pumps. In the baseline model, the heat rejection

operates at a constant speed, regardless of the cooling load. Heating energy is 17% and is comprised of outdoor

air heating and space heating. Cooling energy accounts for only 3% due to the efficiency of the base case water

cooled chiller.

The lighting and power (for computers, kitchen equipment and other equipment) makes up a further 33% of the

annual energy usage. The baseline model assumes LED lighting and typical use of lighting and power with a low

level of energy management being employed by building users. The energy use attributed to computers and

other appliances can be a large variable and should be benchmarked as the design and Furniture, Fixtures and

Equipment (FFE) stage progresses. The simulations have assumed equipment efficiency is not overly energy

efficient at this stage but we recommend that an energy efficient equipment specification is targeted.

Figure 3 - Computer simulation model showing proposed façade design, view from south

The remaining 4% of energy usage is for hydraulics, lifts, and external lighting.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 4

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

5

Energy Efficiency Opportunities

The following Programme 2A energy efficiency opportunities were identified by Beca. The theoretical baseline

Additional Solar Shading

model has been modified to represent each of the following energy efficiency opportunities (Refer to Appendix A

for further details of computer model inputs):

External Solar Shading: The addition of a theoretical solar shading element to level 4 north façade (refer to

Figure 5). The shading has been modelled as a 2m overhang at roof level, but may also represent two 1m

fins (one fin at roof level and the other at the midway point of the level 4 façade height). Shading of this

configuration will shade from midday summer sun while allowing passive solar gain in winter.

Enhanced Roof Insulation: The roofing option has an increased level of insulation and was modelled as

follows:

– Total R-value: R 3.0 m2.K/W (including thermal bridging effects)

Enhanced Wall Insulation: The wall option has an increased level of external wall insulation and was

modelled as follows:

– Total R-value: 2.0 m2.K/W (including thermal bridging effects)

Enhanced Glazing: Solar control Low-e Insulated Glazed Units (IGU) have a lower Shading Coefficient and

G-value to reduce the amount of solar heat gain transmitted through the glazing and a higher thermal

resistance to prevent heat loss through the glazed areas. The glazing was modelled as follows:

– Uwindow: 3.0 W/m2.K (including frame effect)

– Shading Coefficient: 0.4

–

G value: 0.34

Combined Opportunities: The following selected opportunities were simulated together:

Figure 5 – Theoretical solar shading

– Enhanced Roof Insulation

– Enhanced Wall Insulation

– Enhanced Glazing.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 5

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

6

Findings

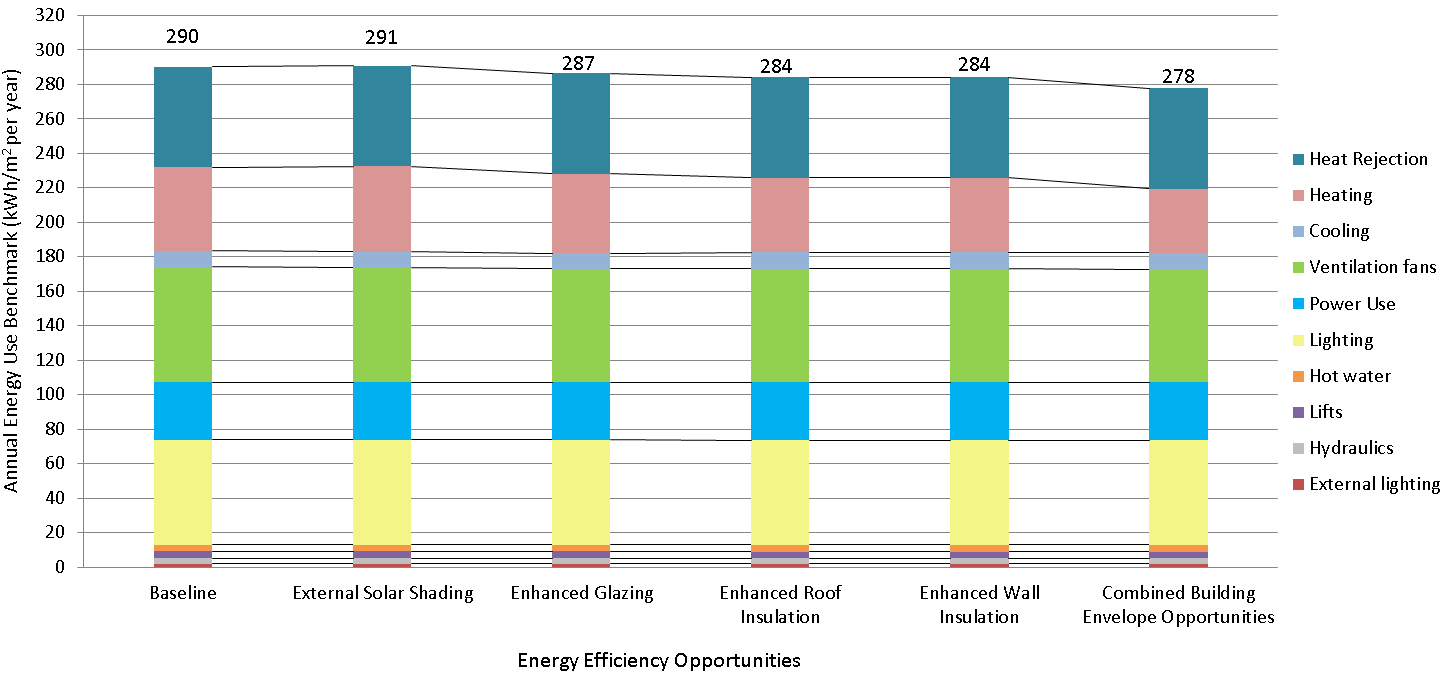

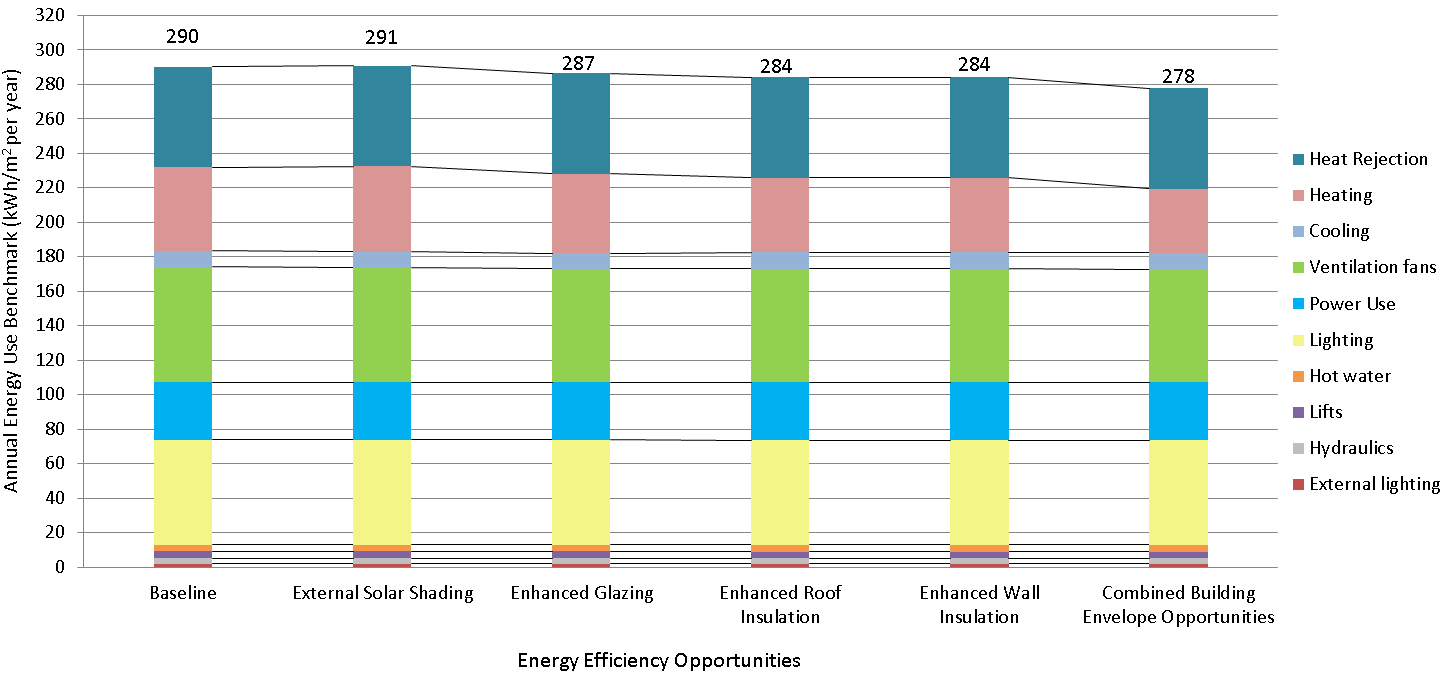

Each computer model has been simulated over a typical Wellington weather year and the annual energy benefit of each energy efficiency opportunity is separately compared to the theoretical baseline model. The findings are as

follows:

Installing solar shading increases energy consumption by 0.5kWh/m2 per

year due to the reduction in cooling energy being outweighed by an

increase in heating energy consumption. However, due to the difference in

the cost of gas and electricity, solar shading does achieve a $60 per year

energy savings.

Installing IGU Low-e Solar Control glazing is indicated to reduce energy

consumption when compared to the baseline glazing. This is due to

increased thermal resistance (increased U-value) and decreased heat loss

through the glazed areas. It is indicated to decrease energy consumption by

4kWh/m2 per year, as well as provide better thermal comfort due to a lower

radiant effect in winter and summer.

Increasing the roof and wall thermal resistance is indicated to reduce

energy consumption by 6kWh/m2 per year for each option.

Combining the energy efficiency opportunities which offer an energy

reduction (enhanced glazing, roof, and wall) is indicated to offer around

12kWh/m2 per year energy savings compared to the NZBC baseline model.

The energy savings of the combined energy efficiency options may reduce

GHG emissions by more than 40 tonnes per year.

Figure 6 – Annual Energy Use Benchmark Comparison

Table 1 – Annual Energy Savings Benchmark Summary

Enhanced Energy Efficiency Opportunities

Annual Energy and Emissions Savings

Benchmark

Combined Building Envelope

External solar shading

Enhanced Glazing

Enhanced Roof Insulation

Enhanced Wall Insulation

Opportunities

kWh/m2 per year

-0.5

4

6

6

12

kWh per year

-7,000

58,000

96,000

96,000

196,000

$ per year

$60

$4,000

$6,000

$6,000

$11,000

Tonnes CO2-e/ year

-2

12

21

21

43

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 6

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

7

Financial Performance Analysis

A summary of the financial analysis can be seen in the following table:

Table 2 – Financial Analysis Summary

This section compares the financial performance of each energy efficiency opportunity. Please refer to Appendix

B for detailed financial analysis of each enhanced energy efficiency opportunity identified over the NZBC

Enhanced Energy Efficiency Opportunities

baseline building.

Financial

Enhanced

Combined

Performance Indicator

The following indicative capital costs over the baseline have been estimated by Beca energy team generally

External Solar

Glazing

Enhanced Roof

Enhanced Wall

Building

Shading

(IGU Low-e

Insulation

Insulation

Envelope

based on previous project experience and supplier costs, however we recommend these are each confirmed by

Solar Control)

Opportunities

the project cost consultant:

Indicative Capital Cost4

$50K

$80K

$25K

$30K

$135K

Payback Period5

NA years

17 years

5 years

6 years

11 years

Solar Shading ($50K): Estimated

based on

a

high level cost of adding a shading element above the glazing

20 year NPV6

-$49,000

-$25,000

$49,000

$44,000

$10,000

at the roof line of level 4.

20 year IRR

NA

2.4%

24.0%

20.1%

7.3%

Solar Control IGU Low-e ($80K): Based on the NZBC minimum of clear single glazing @ $320/m2 (8 mm

clear toughened) compared to solar control low-e double glazing @ $385/m2 (12.4mm clear toughened low-e

+ 8.4mm solar control toughened)

Roof Option ($25K): Estimated

based on

a

high level cost review comparing the lower insulation material

cost @$58K compared to the proposed higher enhanced roof insulation (R 3.0 m2.K/W)system @$83K.

Wall Option ($30K): Estimated

based on

a

high level cost review comparing the lower insulation material

cost @$85.1K compared to the proposed higher enhanced wall insulation R 2.0 m2.K/W)system @$115.1K.

Combined Opportunities ($135K): The combined capital cost increase of the selected opportunities

(enhance glazing, roof and wall).

The current WCC energy charge rates have been used as follows:

Electricity: $0.10 per kWh

Natural gas: $0.05 per kWh

The payback periods have been compared based on the following calculation while taking account of typical

rates of inflation:

Payback Period (in years) = Initial Investment Cost / Annual Operating Savings

Note that the following considerations have been allowed for in these calculations:

Any reduction in heating or cooling plant or equipment costs as a result of each energy efficiency opportunity

has not been considered

An annual 2.5% inflation increase has been used as instructed by WCC

A 6.5% discount rate has been used as instructed by WCC

Maintenance costs have been excluded

4

Based on indicative increased capital cost over baseline option. Order of capital costs TBC by Cost Consultant. Excluding

GST, contractor P+G and margins, contingency allowance, and professional fees. These estimates are for comparison

purposes only, and not to establish construction budget or estimate operating expenses.

5

Based on WCC electricity rate of 10ȼ/kWh and gas rate of 5ȼ/kWh with a 2.5% annual inflation rate assumed

6

Assumes a 6.5% discount rate

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 7

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

8

Comments & Recommendations

9

Next Steps

Each of the identified energy efficiency opportunities are indicated to offer energy cost savings compared to the

We propose the following next steps:

baseline model, however solar shading increased energy consumption. Overall the combined opportunities

(excluding the solar shading) are indicated to offer significant energy savings of approximately $11k per year

1) Client team to review report & discuss with Beca

(12kWh/m2 per year) with a medium term payback period of 11 years. The medium term payback period is

2) Project QS to review energy efficiency opportunities and confirm implementation cost

largely due to the relatively low energy rates WCC are currently paying. The payback period would be more

favourable should energy rates increase in the future.

3) Project team to incorporate energy efficiency opportunities into building design subject to meeting WCC

investment criteria and project budget

The highest level of energy savings is indicated to be offered by an enhanced level of external wall and roof

insulation. The payback period is indicated as short-term at between 5 to 6 years.

4) Beca to carry out Programme 2B Energy Efficiency Review to assess building services related energy

efficiency opportunities (currently in progress)

The specification of an enhanced glazing performance is also indicated to offer a high level of energy savings

with a long-term payback period of 17 years.

Along with offering energy savings the assessed building envelope opportunities are also recommended for

improved occupancy thermal comfort to improve summer and winter radiant temperatures in the occupied

spaces. External solar shading and glazing performance criteria may result in a reduced peak cooling load and

resulting chiller plant capacity and required AHU sizes. Likewise increased thermal insulation will reduce the

required boiler plant capacity. These potential capital cost savings have not been factored into the assessment.

The energy use attributed to computers and other appliances can be a large variable and should be

benchmarked as the design and Furniture, Fixtures and Equipment (FFE) stage progresses. The simulations

have assumed equipment efficiency is not overly energy efficient at this stage but we recommend that an energy

efficient equipment specification is targeted.

We recommend that WCC considers including the above opportunities subject to meeting their investment

criteria and the project budget.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 8

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Appendix A

Computer Simulation Model

Inputs

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 9

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Table 3 - Baseline Model Building Services inputs

Model Item

Baseline Energy Model Input

Model Input

Comment

Model Item

Baseline Energy Model Input

Model Input

Comment

Reference

Reference

Design space

Convention Centre Space Plenary,

Project

Building

Based upon SPA architectural

temperature and

Pre-Function, General Office, Meeting

Documentation

humidity conditions

Mechanical

documents: dated 12 April 2016.

Rooms and Movie Museum Galleries:

engineer

Beca draft building services

23°C Cooling

preliminary design as at 6 May

20°C Heating

2016.

Convention Centre BOH Circulation

18°C Heating

Thermal simulation

IES Virtual Environment version

CIBSE

Movie Museum BOH Circulation

software

2015

18°C Heating

Weather file for

NIWA Wellington TMY2

Assumed

IWEC files have shown to

Kitchen

thermal simulation

contain errors in

16°C Heating

temperature data

Outdoor Design

Summer:

NIWA

2.5% design day criteria

Humidity:

conditions

23.6oC DB

Not controlled

18.9oC WB

#hrs exceeded is 45

Lighting power

Convention Centre:

Project Electrical

LED lighting design

Winter

density

Exhibition: 8 W/m2

Engineer.

lighting power density

5.2oC

Plenary: 12 W/m2

#hrs exceeded is 110

Pre-Function: 12 W/m2

General Office Areas: 6 W/m2

Ground solar

0.20

(CIBSE) Assumed

Meeting Rooms: 12 W/m2

reflectance

Asphalt

Circulation – Area FOH : 8 W/m2

Modelled spaces

All conditioned and unconditioned

Architectural

Circulation – Area BOH : 5 W/m2

spaces in the building

drawings

Movie Museum:

Areas for each space taken from

Project

Galleries: 8 W/m2

architectural drawings – 04/05/2016

mechanical

Circulation – Area BOH : 4 W/m2

engineer

Assessed spaces

Conditioned spaces

Project

Energy consumption of

Lighting schedule

Office and Museum: NABERS

NABERS

Mechanical

the retail areas is not

Convention Centre: Adapted

engineer

considered.

NABERS for 9am to 10pm operation

Thermal zoning

Spaces zoned to align with

Project

Peak equipment

Convention Centre:

CIBSE Guide A

mechanical system design

Mechanical

gains

Exhibition: 5 W/m2

Table 6.2

engineer

Plenary: 15 W/m2

Manually controlled

Assumptions

Not modelled

Project

external shading

Pre-Function: 15 W/m2

NABERS

Mechanical

device e.g. solar

General Office Areas: 11 W/m2

control blinds,

engineer

Meeting Rooms: 11 W/m2

external louvres etc

Circulation – Area FOH : 5 W/m2

Automatically

Circulation – Area BOH : 5 W/m2

Not modelled

Project

controlled shading

Movie Museum:

Mechanical

device e.g. solar

Galleries: 5 W/m2

control blinds,

engineer

Circulation – Area BOH : 5 W/m2

external louvres

Equipment

NABERS schedule for equipment is

NABERS

schedule

adapted similar to the lighting

schedule

Process load

Not modelled

Project

Covered under

density

Mechanical

equipment gains

engineer

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 10

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Model Item

Baseline Energy Model Input

Model Input

Comment

Model Item

Baseline Energy Model Input

Model Input

Comment

Reference

Reference

Occupancy density

Convention Centre

WCC movie

Represent typical

Outside air

Convention Centre:

Beca design

Kitchen/Cafe: 5m2 / person

museum business

diversified density

ventilation rate

Exhibition: 8l/s.person

features report

Circulation – FOH and BOH: 5m2/

case

Plenary: 8l/s.person

person

Meeting Rooms: 10l/s.person

Exhibition: 12m2 / person

General Offices: 10l/s.person

Plenary: 12 m2 / person

Circulation – FOH and BOH:

Meeting Rooms: 12 m2 / person

1l/s.person

Office: 15m2 / person

Kitchen: 8l/s.person

Lobby: 5m2 / person

Cafe: 10l/s.person

Movie Museum:

Movie Museum:

Gallery: 29m2 / person

Museum Gallery spaces:

Lobby: 5m2 / person

8l/s.person

Lobby/Circulation: 10l/s.person

Occupancy gains

Exhibition, BOH, and Lobby : 75W

CIBSE Guide A

sensible, 55W latent

Outside air control

Movie Museum:

Project

No heat recovery or

Kitchen:80W sensible 80W latent

9am to 7pm, 7 days a week

mechanical

Demand Controlled

Plenary, Meeting, and Offices:70W

Convention Centre:

engineer

Ventilation

sensible 35W latent

9am to 10pm, 7 days a week

Boiler SEER

90% (condensing gas fired boiler)

Assumed

Outdoor air preheat and

Occupancy

NABERS schedule for occupancy is

NABERS

NZBC Clause H1

4pipe FCU unit heating

schedule

adapted similar to the lighting

Chiller SEER

Full Load: 5.5 (water source chiller)

New water cooled

Typical water cooled

schedule

Part load: 6.1

chiller plant

chiller efficiency

Infiltration rate

0.15 ACH all of the time ( 24hour

Project

occupancy)

mechanical

Heating Hot Water

HHW design flow temp: 60oC -70oC

Project

engineer

Loop

HHW design delta T: 10oC

Mechanical

Night purge

Not modelled

Project

HHW pump configuration: Constant

Engineer

ventilation

mechanical

Primary, Variable Secondary

engineer

Pressurisation

None

Project

Chilled Water Loop

CHW design flow temp:6oC -12oC

Project

requirements

mechanical

CHW design delta T: 6oC

Mechanical

engineer

CHW pump configuration: Constant

Engineer

HVAC operating

Museum exhibition: 24/7 all year

Project

Primary, Variable Secondary

schedule

round

mechanical

Convention: 8am to 10pm, 7 days

engineer

Condensing Water

CDW design flow temp:29oC -35oC

Project

per week

Loop

CDW design delta T: 6oC

Mechanical

1.5 hour optimum start period

CDW pump configuration: Constant

Engineer

Mechanical

Design room temperatures achieved Project

Flow

services control

during occupancy hours

mechanical

strategy

engineer

Pipe/duct heat

5% allowance

Assumed

loss/gains

Pumps

Based on design flow rates

Assumption

AHU Fans

16°C preheat temperature

Project

Typical fan efficiency

Heating coil via HHW gas boiler

mechanical

circuit

engineer

10 no. AHU Variable Volume Fans:

– Flow rates sized using IES

ApacheHVAC

– 2.5W/l.s

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 11

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Table 4 - Baseline Model Architectural inputs

Model Item

Baseline Energy Model Input

Model Input

Comment

Reference

Model Item

Baseline Energy Model Input

Model Input

Comment

Supply Air Fans

18°C preheat temperature

Project

Typical fan efficiency

Reference

Heating coil via HHW gas boiler

mechanical

Site location

As site location

Assumed

circuit

engineer

Longitude = 174.80 E

2 no. fans:

Latitude = 37.02 S

– SAF-01-01: 2,000l/s

Site Orientation

As site location

Architectural

– SAF-05-01: 6,000l/s

plan drawings

2.5W/l.s

Building

Adjacent buildings modelled

Architectural

Overshadowing

drawings

FCU fans

1 per FCU Zone

Project

Typical AC type FCU fan

Building Geometry

As shown on architectural drawings

Architectural

2.5W/l.s

mechanical

performance

drawings

engineer

Building thermal

External walls: R 1.2 m2.K/W (including

H1 minimum

Clear 4mm single

Exhaust Air fans

7 no. fans:

envelope

Project

Typical fan type

thermal bridging effects)

values

glazing reference

– EAF-01-01: 2,000 l/s

mechanical

performance

Roof: Total R-value: R 1.9 m2.K/W (including

– EAF-05-01: 4,000 l/s

engineer

thermal bridging effects)

– EAF-05-02: 3,500 l/s

R 1.3 ground floor

– EAF-05-03: 2,500 l/s

Glazing:

– EAF-05-04: 2,500 l/s

– Uwindow: U 5.4 W/m2.K (including frame

– EAF-06-01: 2,000 l/s

effect)

– EAF-06-02: 6,000 l/s

Glazing shading

Vision glazing:

NZS4218

4mm single

coefficient

2.5W/l.s

– Shading Coefficient: 0.95

glazing reference

– G value: 0.82

Lifts

4 kWh/m2 per year

GreenStar Office

Internal walls

13mm plasterboard lining, 90mm timber

Architectural

Design & Built

framing, 13mm plasterboard lining

drawings

2009

DHW

4 kWh/m2 per year

GreenStar Office

Intermediate floors

Carpet +underlay, 150mm concrete slab,

Architectural

Design & Built

1000mm ceiling cavity, 13mm plasterboard

drawings

2009

External surface

0.5 (medium coloured) to be assigned to all

Assumed

solar reflectance

external surfaces

External lighting

2 kWh/m2 per year

Assumed

Area of glazing

As per proposed design

Architectural

drawings

Area of frame

10% glazing area

Assumed

Area of skylight/

None

Architectural

clerestory

drawings

Fixed external solar

Fixed Solar Shading modelled as per the

Architectural

Basecase

shading device

proposed design.

drawings

allowance

Manually controlled

Blinds are not operated

Assumed

curtains/blinds

Manually controlled

Not proposed

Assumed

natural ventilation

openings

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 12

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Table 5 – NABERS lighting schedule

Convention Centre areas:

Museum and Office areas:

12am-

7am-

8am-

9am-

10pm-

11pm-

7am

8am

9am

10pm

11pm

12pm

12am-

7am-

8am-

9am-

5pm-

6pm-

8pm-

9pm-

7am

8am

9am

5pm

6pm

8pm

9pm

12am

Week

0%

15%

60%

100%

50%

15%

Saturday

0%

15%

60%

100%

50%

15%

Week

15%

40%

90%

100%

80%

60%

50%

15%

Sunday

0%

15%

60%

100%

50%

15%

Saturday

15%

40%

90%

100%

80%

60%

50%

15%

Sunday

15%

40%

90%

100%

80%

60%

50%

15%

Table 8 – Energy Efficiency Opportunities

Convention Centre areas:

Model Item

Energy Model Input

Model Input Reference

Solar Shading

2m overhang at roof level above Level 4

12am-

7am-

8am-

9am-

10pm-

11pm-

7am

8am

9am

10pm

11pm

12pm

north facade

Week

15%

40%

90%

100%

80%

50%

Enhanced Glazing

IGU Low-e Solar Control

Saturday

15%

40%

90%

100%

80%

50%

–

Sunday

15%

40%

90%

100%

80%

50%

Uwindow: 3.0 W/m2.K (including frame effect)

–

Shading Coefficient: 0.4

– G value: 0.34

Table 6 – NABERS equipment schedule

Enhanced Roof Insulation

Total R-value: R 2.91 m2.K/W (including

Museum and Office areas:

thermal bridging effects)

12am-

7am-

8am-

9am-

5pm-

6pm-

7pm-

9pm-

Enhanced Wall Insulation

Total R-value: 2.0 m2.K/W (including thermal

7am

8am

9am

5pm

6pm

7pm

9pm

12am

bridging effects)

Week

25%

65%

80%

100%

80%

65%

25%

25%

Saturday

25%

65%

80%

100%

80%

65%

25%

25%

Combined Energy

Current Design proposal with the following

As above

Efficiency Opportunities

Sunday

25%

65%

80%

100%

80%

65%

25%

25%

opportunities combined:

– Enhanced Glazing

– Enhanced Roof

Convention Centre areas:

– Enhanced Wall

12am-

7am-

8am-

9am-

10pm-

11pm-

7am

8am

9am

10pm

11pm

12pm

Week

25%

65%

80%

100%

80%

25%

Saturday

25%

65%

80%

100%

80%

25%

Sunday

25%

65%

80%

100%

80%

25%

Table 7 – NABERS occupancy schedule

Museum and Office areas:

12am-

7am-

8am-

9am-

5pm-

6pm-

7pm-

9pm-

7am

8am

9am

5pm

6pm

7pm

9pm

12am

Week

0%

15%

60%

100%

50%

15%

5%

0%

Saturday

0%

15%

60%

100%

50%

15%

5%

0%

Sunday

0%

15%

60%

100%

50%

15%

5%

0%

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 13

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Appendix B

Financial Performance

Analysis

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 14

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Solar Shading

Years

Annual

Cummulative

Payback

Capital

Annual Cash

Present Value of

Net Present Value of

Savings

Savings

Investment

Flow

Saving

Savings

Client Input Values

0

$0

$0

-$50,000

$50,000

-$50,000

-$50,000

-$50,000

Inflation Rate

2.5%

1

$60

$60

-$49,940

$0

$60

$56

-$49,944

Discount Rate

6.5%

2

$62

$122

-$49,879

$0

$62

$54

-$49,889

3

$63

$185

-$49,815

$0

$63

$52

-$49,837

4

$65

$249

-$49,751

$0

$65

$50

-$49,787

Assessment Inputs

5

$66

$315

-$49,685

$0

$66

$48

-$49,739

Capital Cost

$ 5

0,000

6

$68

$383

-$49,617

$0

$68

$47

-$49,692

Secondary Capital Cost

$ -

7

$70

$453

-$49,547

$0

$70

$45

-$49,647

Time of Secondary Capital Cost (Years)

0

8

$71

$524

-$49,476

$0

$71

$43

-$49,604

Annual Savings

$60

9

$73

$597

-$49,403

$0

$73

$41

-$49,563

Assessment Length (Years)

20

10

$75

$672

-$49,328

$0

$75

$40

-$49,523

11

$77

$749

-$49,251

$0

$77

$38

-$49,484

12

$79

$828

-$49,172

$0

$79

$37

-$49,448

Assessment Results

13

$81

$908

-$49,092

$0

$81

$36

-$49,412

Payback Period (years)

NA

14

$83

$991

-$49,009

$0

$83

$34

-$49,378

Total NPV

-$49,198

15

$85

$1,076

-$48,924

$0

$85

$33

-$49,345

IRR

NA

16

$87

$1,163

-$48,837

$0

$87

$32

-$49,313

ROI

-97%

17

$89

$1,252

-$48,748

$0

$89

$31

-$49,282

18

$91

$1,343

-$48,657

$0

$91

$29

-$49,253

25

19

$94

$1,437

-$48,563

$0

$94

$28

-$49,225

20

$96

$1,533

-$48,467

$0

$96

$27

-$49,198

Total

$1,533

-$46,935

-$49,198

Inflation Rate

Glossary of Terms

Discount Rate

The discount rate is the rate at which cash

depreciates with time, hence the value of annual

savings decreases.

Capital Cost

Capital costs are fixed one time expenses,

typically the purchase of plant.

Present Value (PV)

PV is the present day value of the future returns

from the investment.

Internal Rate Of Return (IRR)

IRR is the discount rate that make the NPV = 0

at the end of the assessment period. i.e. The

Internal Rate of Return is the rate where if you

discount all of the future cash flows, the present

value of the flows is equal to the cost.

Net Present Value (NPV)

NPV is the sum of all previous PV's.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 15

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Enhanced Glazing (IGU Low-e Solar Control)

Years

Annual

Cummulative

Payback

Capital

Annual Cash

Present Value of

Net Present Value of

Savings

Savings

Investment

Flow

Saving

Savings

Client Input Values

0

$ -

$ -

$ ( 80,000) $ 8

0,000

$ ( 80,000) $ ( 80,000) $ ( 80,000)

Inflation Rate

2.5%

1

$ 4

,076

$ 4

,076

$ ( 75,924) $ -

$ 4

,076

$ 3

,827

$ ( 76,173)

Discount Rate

6.5%

2

$ 4

,178

$ 8

,254

$ ( 71,746) $ -

$ 4

,178

$ 3

,683

$ ( 72,489)

3

$ 4

,282

$ 1

2,536

$ ( 67,464) $ -

$ 4

,282

$ 3

,545

$ ( 68,944)

4

$ 4

,389

$ 1

6,926

$ ( 63,074) $ -

$ 4

,389

$ 3

,412

$ ( 65,532)

Assessment Inputs

5

$ 4

,499

$ 2

1,425

$ ( 58,575) $ -

$ 4

,499

$ 3

,284

$ ( 62,248)

Capital Cost

$ 8

0,000

6

$ 4

,612

$ 2

6,036

$ ( 53,964) $ -

$ 4

,612

$ 3

,161

$ ( 59,088)

Secondary Capital Cost

$ -

7

$ 4

,727

$ 3

0,763

$ ( 49,237) $ -

$ 4

,727

$ 3

,042

$ ( 56,046)

Time of Secondary Capital Cost (Years)

0

8

$ 4

,845

$ 3

5,608

$ ( 44,392) $ -

$ 4

,845

$ 2

,928

$ ( 53,118)

Annual Savings

$ 4

,076

9

$ 4

,966

$ 4

0,575

$ ( 39,425) $ -

$ 4

,966

$ 2

,818

$ ( 50,301)

Assessment Length (Years)

20

10

$ 5

,090

$ 4

5,665

$ ( 34,335) $ -

$ 5

,090

$ 2

,712

$ ( 47,589)

11

$ 5

,218

$ 5

0,883

$ ( 29,117) $ -

$ 5

,218

$ 2

,610

$ ( 44,979)

12

$ 5

,348

$ 5

6,231

$ ( 23,769) $ -

$ 5

,348

$ 2

,512

$ ( 42,467)

Assessment Results

13

$ 5

,482

$ 6

1,712

$ ( 18,288) $ -

$ 5

,482

$ 2

,418

$ ( 40,050)

Payback Period (years)

17.0

14

$ 5

,619

$ 6

7,331

$ ( 12,669) $ -

$ 5

,619

$ 2

,327

$ ( 37,723)

Total NPV

$ (

25,487)

15

$ 5

,759

$ 7

3,091

$ ( 6,909) $ -

$ 5

,759

$ 2

,239

$ ( 35,484)

IRR

2.4%

16

$ 5

,903

$ 7

8,994

$ ( 1,006) $ -

$ 5

,903

$ 2

,155

$ ( 33,328)

ROI

30%

17

$ 6

,051

$ 8

5,045

$ 5

,045

$ -

$ 6

,051

$ 2

,074

$ ( 31,254)

18

$ 6

,202

$ 9

1,247

$ -

$ 6

,202

$ 1

,996

$ ( 29,258)

25

19

$ 6

,357

$ 9

7,604

$ -

$ 6

,357

$ 1

,921

$ ( 27,336)

20

$ 6

,516

$ 1

04,120

$ -

$ 6

,516

$ 1

,849

$ ( 25,487)

Total

$ 1

04,120

$ ( 25,487)

Inflation Rate

Glossary of Terms

Discount Rate

The discount rate is the rate at which cash

depreciates with time, hence the value of annual

savings decreases.

Capital Cost

Capital costs are fixed one time expenses,

typically the purchase of plant.

Present Value (PV)

PV is the present day value of the future returns

from the investment.

Internal Rate Of Return (IRR)

IRR is the discount rate that make the NPV = 0

at the end of the assessment period. i.e. The

Internal Rate of Return is the rate where if you

discount all of the future cash flows, the present

value of the flows is equal to the cost.

Net Present Value (NPV)

NPV is the sum of all previous PV's.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 16

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Enhanced Roof Option

Years

Annual

Cummulative

Payback

Capital

Annual Cash

Present Value of

Net Present Value of

Savings

Savings

Investment

Flow

Saving

Savings

Client Input Values

0

$ -

$ -

$ ( 25,000) $ 2

5,000

$ ( 25,000) $ ( 25,000) $ ( 25,000)

Inflation Rate

2.5%

1

$ 5

,501

$ 5

,501

$ ( 19,499) $ -

$ 5

,501

$ 5

,165

$ ( 19,835)

Discount Rate

6.5%

2

$ 5

,639

$ 1

1,140

$ ( 13,860) $ -

$ 5

,639

$ 4

,971

$ ( 14,863)

3

$ 5

,779

$ 1

6,919

$ ( 8,081) $ -

$ 5

,779

$ 4

,785

$ ( 10,079)

4

$ 5

,924

$ 2

2,843

$ ( 2,157) $ -

$ 5

,924

$ 4

,605

$ ( 5,474)

Assessment Inputs

5

$ 6

,072

$ 2

8,915

$ 3

,915

$ -

$ 6

,072

$ 4

,432

$ ( 1,042)

Capital Cost

$ 2

5,000

6

$ 6

,224

$ 3

5,139

$ -

$ 6

,224

$ 4

,265

$ 3

,223

Secondary Capital Cost

$ -

7

$ 6

,379

$ 4

1,518

$ -

$ 6

,379

$ 4

,105

$ 7

,328

Time of Secondary Capital Cost (Years)

0

8

$ 6

,539

$ 4

8,057

$ -

$ 6

,539

$ 3

,951

$ 1

1,280

Annual Savings

$ 5

,501

9

$ 6

,702

$ 5

4,760

$ -

$ 6

,702

$ 3

,803

$ 1

5,082

Assessment Length (Years)

20

10

$ 6

,870

$ 6

1,630

$ -

$ 6

,870

$ 3

,660

$ 1

8,742

11

$ 7

,042

$ 6

8,672

$ -

$ 7

,042

$ 3

,522

$ 2

2,264

12

$ 7

,218

$ 7

5,889

$ -

$ 7

,218

$ 3

,390

$ 2

5,654

Assessment Results

13

$ 7

,398

$ 8

3,288

$ -

$ 7

,398

$ 3

,263

$ 2

8,917

Payback Period (years)

5.0

14

$ 7

,583

$ 9

0,871

$ -

$ 7

,583

$ 3

,140

$ 3

2,057

Total NPV

$ 4

8,571

15

$ 7

,773

$ 9

8,644

$ -

$ 7

,773

$ 3

,022

$ 3

5,080

IRR

24.0%

16

$ 7

,967

$ 1

06,611

$ -

$ 7

,967

$ 2

,909

$ 3

7,988

ROI

462%

17

$ 8

,166

$ 1

14,777

$ -

$ 8

,166

$ 2

,799

$ 4

0,788

18

$ 8

,370

$ 1

23,147

$ -

$ 8

,370

$ 2

,694

$ 4

3,482

25

19

$ 8

,580

$ 1

31,727

$ -

$ 8

,580

$ 2

,593

$ 4

6,075

20

$ 8

,794

$ 1

40,521

$ -

$ 8

,794

$ 2

,496

$ 4

8,571

Total

$ 1

40,521

$ 4

8,571

Inflation Rate

Glossary of Terms

Discount Rate

The discount rate is the rate at which cash

depreciates with time, hence the value of annual

savings decreases.

Capital Cost

Capital costs are fixed one time expenses,

typically the purchase of plant.

Present Value (PV)

PV is the present day value of the future returns

from the investment.

Internal Rate Of Return (IRR)

IRR is the discount rate that make the NPV = 0

at the end of the assessment period. i.e. The

Internal Rate of Return is the rate where if you

discount all of the future cash flows, the present

value of the flows is equal to the cost.

Net Present Value (NPV)

NPV is the sum of all previous PV's.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 17

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Enhanced Wall Option

Years

Annual

Cummulative

Payback

Capital

Annual Cash

Present Value of

Net Present Value of

Savings

Savings

Investment

Flow

Saving

Savings

Client Input Values

0

$ -

$ -

$ ( 30,000) $ 3

0,000

$ ( 30,000) $ ( 30,000) $ ( 30,000)

Inflation Rate

2.5%

1

$ 5

,501

$ 5

,501

$ ( 24,499) $ -

$ 5

,501

$ 5

,165

$ ( 24,835)

Discount Rate

6.5%

2

$ 5

,639

$ 1

1,140

$ ( 18,860) $ -

$ 5

,639

$ 4

,971

$ ( 19,863)

3

$ 5

,779

$ 1

6,919

$ ( 13,081) $ -

$ 5

,779

$ 4

,785

$ ( 15,079)

4

$ 5

,924

$ 2

2,843

$ ( 7,157) $ -

$ 5

,924

$ 4

,605

$ ( 10,474)

Assessment Inputs

5

$ 6

,072

$ 2

8,915

$ ( 1,085) $ -

$ 6

,072

$ 4

,432

$ ( 6,042)

Capital Cost

$ 3

0,000

6

$ 6

,224

$ 3

5,139

$ 5

,139

$ -

$ 6

,224

$ 4

,265

$ ( 1,777)

Secondary Capital Cost

$ -

7

$ 6

,379

$ 4

1,518

$ -

$ 6

,379

$ 4

,105

$ 2

,328

Time of Secondary Capital Cost (Years)

0

8

$ 6

,539

$ 4

8,057

$ -

$ 6

,539

$ 3

,951

$ 6

,280

Annual Savings

$ 5

,501

9

$ 6

,702

$ 5

4,760

$ -

$ 6

,702

$ 3

,803

$ 1

0,082

Assessment Length (Years)

20

10

$ 6

,870

$ 6

1,630

$ -

$ 6

,870

$ 3

,660

$ 1

3,742

11

$ 7

,042

$ 6

8,672

$ -

$ 7

,042

$ 3

,522

$ 1

7,264

12

$ 7

,218

$ 7

5,889

$ -

$ 7

,218

$ 3

,390

$ 2

0,654

Assessment Results

13

$ 7

,398

$ 8

3,288

$ -

$ 7

,398

$ 3

,263

$ 2

3,917

Payback Period (years)

6.0

14

$ 7

,583

$ 9

0,871

$ -

$ 7

,583

$ 3

,140

$ 2

7,057

Total NPV

$ 4

3,571

15

$ 7

,773

$ 9

8,644

$ -

$ 7

,773

$ 3

,022

$ 3

0,080

IRR

20.1%

16

$ 7

,967

$ 1

06,611

$ -

$ 7

,967

$ 2

,909

$ 3

2,988

ROI

368%

17

$ 8

,166

$ 1

14,777

$ -

$ 8

,166

$ 2

,799

$ 3

5,788

18

$ 8

,370

$ 1

23,147

$ -

$ 8

,370

$ 2

,694

$ 3

8,482

25

19

$ 8

,580

$ 1

31,727

$ -

$ 8

,580

$ 2

,593

$ 4

1,075

20

$ 8

,794

$ 1

40,521

$ -

$ 8

,794

$ 2

,496

$ 4

3,571

Total

$ 1

40,521

$ 4

3,571

Inflation Rate

Glossary of Terms

Discount Rate

The discount rate is the rate at which cash

depreciates with time, hence the value of annual

savings decreases.

Capital Cost

Capital costs are fixed one time expenses,

typically the purchase of plant.

Present Value (PV)

PV is the present day value of the future returns

from the investment.

Internal Rate Of Return (IRR)

IRR is the discount rate that make the NPV = 0

at the end of the assessment period. i.e. The

Internal Rate of Return is the rate where if you

discount all of the future cash flows, the present

value of the flows is equal to the cost.

Net Present Value (NPV)

NPV is the sum of all previous PV's.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 18

MACC - EECA Programme 2A Energy Efficiency Review (Building Envelope)

Combined Enhanced Envelope Options

Years

Annual

Cummulative

Payback

Capital

Annual Cash

Present Value of

Net Present Value of

Savings

Savings

Investment

Flow

Saving

Savings

Client Input Values

0

$ -

$ -

$ ( 135,000) $ 1

35,000

$ ( 135,000) $ ( 135,000) $ ( 135,000)

Inflation Rate

2.5%

1

$ 1

0,829

$ 1

0,829

$ ( 124,171) $ -

$ 1

0,829

$ 1

0,168

$ ( 124,832)

Discount Rate

6.5%

2

$ 1

1,100

$ 2

1,929

$ ( 113,071) $ -

$ 1

1,100

$ 9

,786

$ ( 115,046)

3

$ 1

1,377

$ 3

3,306

$ ( 101,694) $ -

$ 1

1,377

$ 9

,419

$ ( 105,627)

4

$ 1

1,662

$ 4

4,968

$ ( 90,032) $ -

$ 1

1,662

$ 9

,065

$ ( 96,562)

Assessment Inputs

5

$ 1

1,953

$ 5

6,921

$ ( 78,079) $ -

$ 1

1,953

$ 8

,724

$ ( 87,838)

Capital Cost

$ 1

35,000

6

$ 1

2,252

$ 6

9,173

$ ( 65,827) $ -

$ 1

2,252

$ 8

,397

$ ( 79,441)

Secondary Capital Cost

$ -

7

$ 1

2,558

$ 8

1,731

$ ( 53,269) $ -

$ 1

2,558

$ 8

,081

$ ( 71,360)

Time of Secondary Capital Cost (Years)

0

8

$ 1

2,872

$ 9

4,603

$ ( 40,397) $ -

$ 1

2,872

$ 7

,778

$ ( 63,582)

Annual Savings

$ 1

0,829

9

$ 1

3,194

$ 1

07,797

$ ( 27,203) $ -

$ 1

3,194

$ 7

,486

$ ( 56,096)

Assessment Length (Years)

20

10

$ 1

3,524

$ 1

21,321

$ ( 13,679) $ -

$ 1

3,524

$ 7

,205

$ ( 48,892)

11

$ 1

3,862

$ 1

35,183

$ 183

$ -

$ 1

3,862

$ 6

,934

$ ( 41,958)

12

$ 1

4,209

$ 1

49,392

$ -

$ 1

4,209

$ 6

,674

$ ( 35,284)

Assessment Results

13

$ 1

4,564

$ 1

63,956

$ -

$ 1

4,564

$ 6

,423

$ ( 28,861)

Payback Period (years)

11.0

14

$ 1

4,928

$ 1

78,884

$ -

$ 1

4,928

$ 6

,182

$ ( 22,680)

Total NPV

$ 9

,829

15

$ 1

5,301

$ 1

94,185

$ -

$ 1

5,301

$ 5

,949

$ ( 16,730)

IRR

7.3%

16

$ 1

5,684

$ 2

09,868

$ -

$ 1

5,684

$ 5

,726

$ ( 11,004)

ROI

105%

17

$ 1

6,076

$ 2

25,944

$ -

$ 1

6,076

$ 5

,511

$ ( 5,493)

18

$ 1

6,478

$ 2

42,422

$ -

$ 1

6,478

$ 5

,304

$ ( 189)

25

19

$ 1

6,890

$ 2

59,311

$ -

$ 1

6,890

$ 5

,105

$ 4

,916

20

$ 1

7,312

$ 2

76,623

$ -

$ 1

7,312

$ 4

,913

$ 9

,829

Total

$ 2

76,623

$ 9

,829

Inflation Rate

Glossary of Terms

Discount Rate

The discount rate is the rate at which cash

depreciates with time, hence the value of annual

savings decreases.

Capital Cost

Capital costs are fixed one time expenses,

typically the purchase of plant.

Present Value (PV)

PV is the present day value of the future returns

from the investment.

Internal Rate Of Return (IRR)

IRR is the discount rate that make the NPV = 0

at the end of the assessment period. i.e. The

Internal Rate of Return is the rate where if you

discount all of the future cash flows, the present

value of the flows is equal to the cost.

Net Present Value (NPV)

NPV is the sum of all previous PV's.

Beca // 3 June 2016

5138221 // NZ1-12560810-12 0.12 // page 19