Tertiary Education Commission

Te Amorangi Mātauranga Matua

National Office

44 The Terrace

PO Box 27048

Wellington, New Zealand

Contents

Part one: Summary of Audit Results

4

Overall recommendation

4

Audit Ratings

4

Key findings and recommendations

4

Part two: Key findings and recommendations

5

Part three: Other Audit Findings

12

Financial Viability Assessment

12

Minimum Prudential Financial Standards

12

Part four: Audit Process Overview

14

Purpose of the audit

14

Scope of the audit

14

Overview of Taranaki Outdoor Pursuits and Educational Centre

15

Audit process overview

15

Part five: TEO Corrective Actions

16

Corrective Actions

16

Part three: Other Audit Findings

Further findings of the audit are set out below.

Financial Viability Assessment

8091-Taranaki Outdoor Pursuits and Education Centre Trust

Minimum

Prudential

Risk assessment

Financial

(Based on your financial statements for the years shown)

Standards s9(2)(b)(ii)

The PTE was first funded by the TEC in 2020. TOPEC’s financial year end is 31 December. The 2020 financial

reports and 2021 forecast were due on 31 May 2021. The PTE applied for an extension to 30 June 2021

because their auditors had advised they would be unable to complete the audit by the due date. The TEC

received the reports on 30 June 2021.

s9(2)(b)(ii)

The PTE receives Student Achievement Component Level 3 and above funding and Fees-free Payments

from the TEC.

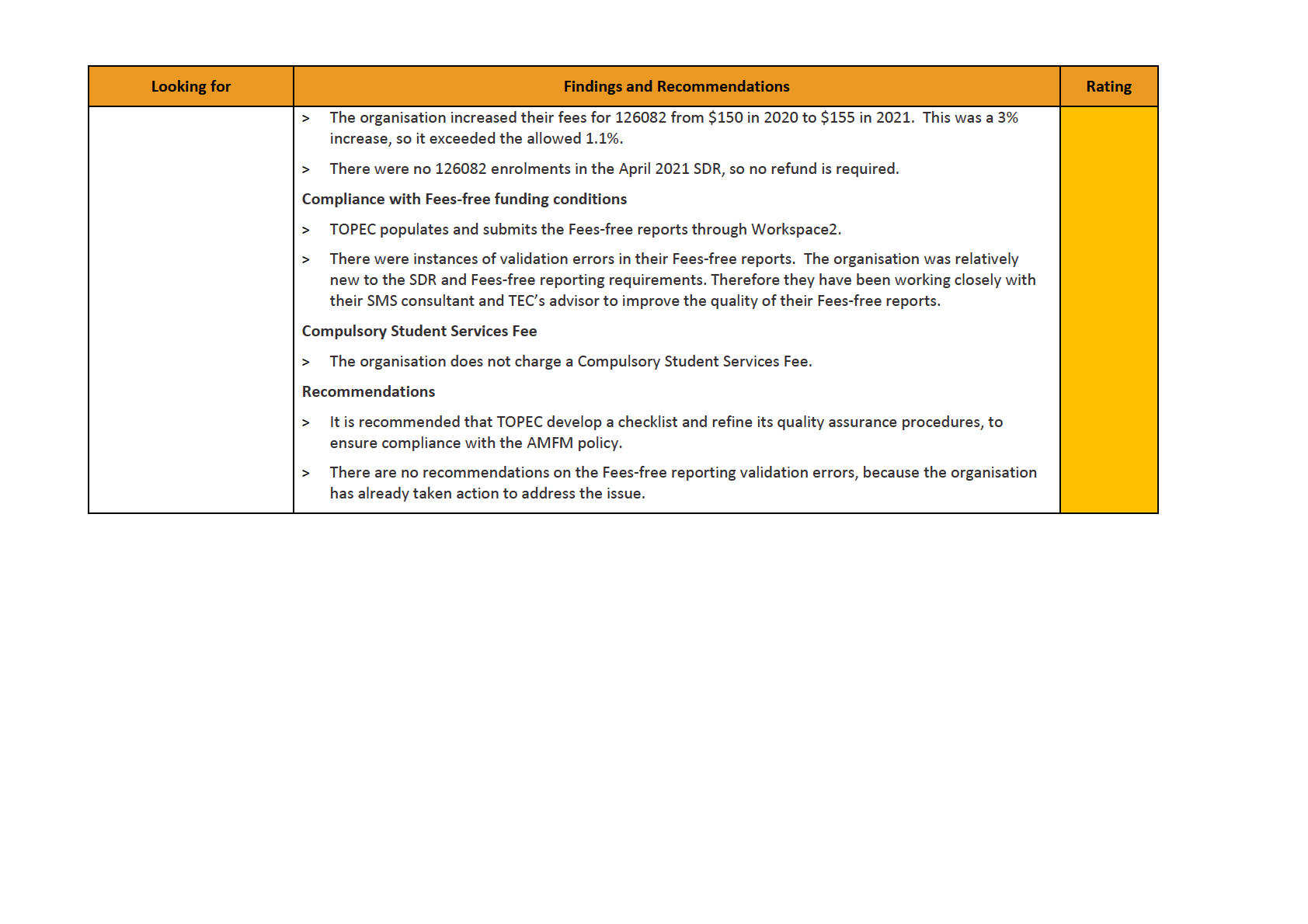

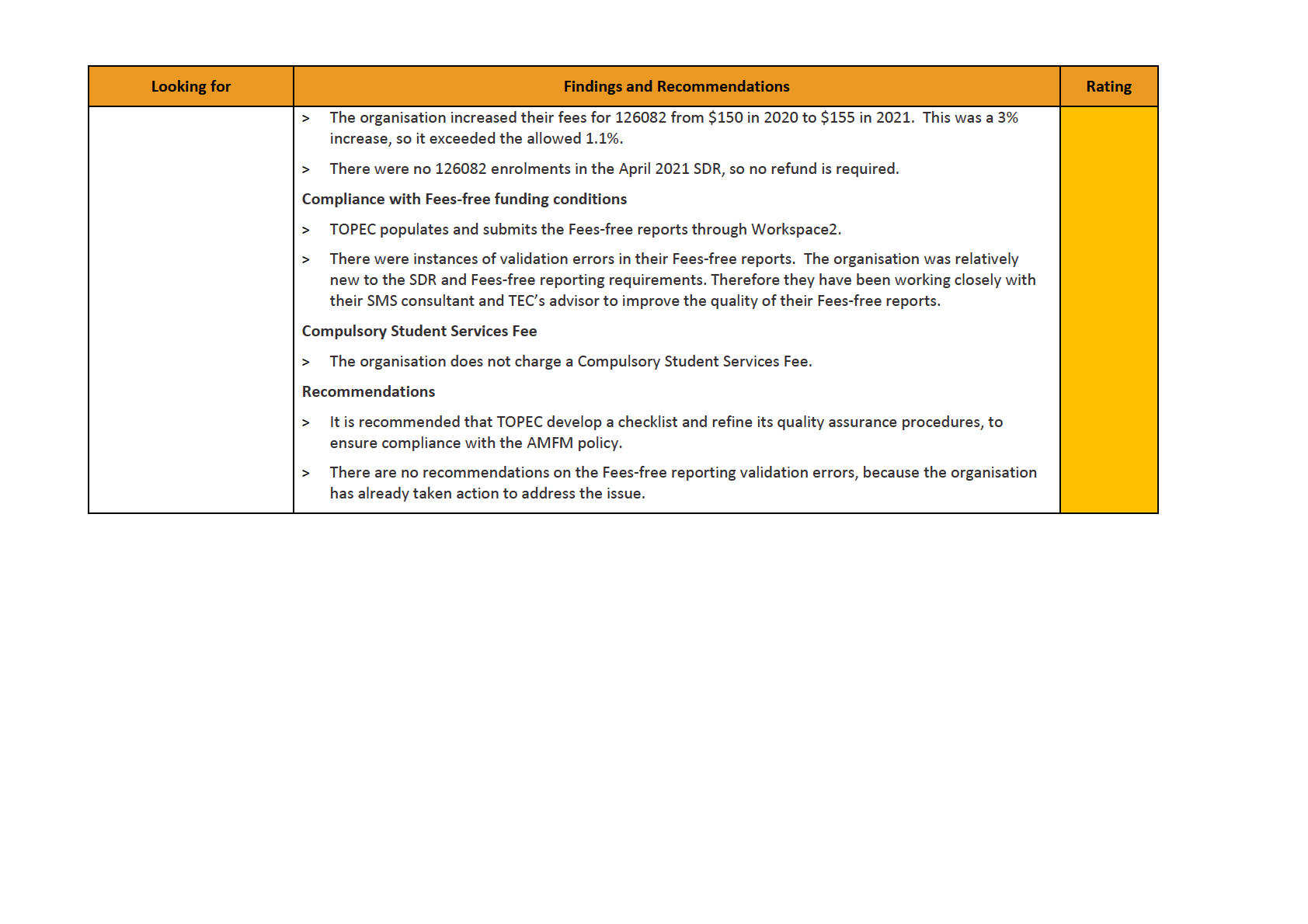

Excluding Fees-free Payments, the TEC funded $128,095 in 2020 (including a debt write-off of $74,758 for

under-delivery funded under the Government Funding Guarantee) for 8.1 TEC-funded EFTS. The

organisation is funded $130,145 for 20 EFTS in 2021.

The April SDR shows 2021 delivery is tracking at 10.5 SAC3+ EFTS. This is up on the 7.3 EFTS in the April

2020 SDR (and the 8.1 EFTS delivered in 2020).

Part four: Audit Process Overview

Purpose of the audit

The purpose of the audit was to provide assurance that your organisation is complying with the

Education and Training Act 2020 and conditions imposed on your funding. This audit is part of our ongoing

monitoring of tertiary education organisations (TEOs).

This audit used a sample-based approach and reviewed a limited scope of the applicable funding conditions

and other requirements. As such, despite our best efforts, some non-compliance may remain undetected

and the audit does not provide complete assurance of historical, current or future compliance.

Non-detection of non-compliance does not make that practice compliant, and will not restrict the TEC from

taking action under the Education and Training Act 2020 or from recovering funding in the future if

non-compliance is later detected. Please refer to the audit guidelines for more information on the inherent

limitations of an audit.

Our audit focus wil be on assisting TEOs in achieving their objectives through wel -reasoned audits,

evaluations and analyses of the business viability and education outcomes for students.

Scope of the audit

TEC’s monitoring function is set out in section 409(1)(h) of the Education and Training Act 2020, which

provides that the TEC's functions are to "

monitor the performance of organisations that receive funding

from the Commission including by measuring performance against specified outcomes”.

The scope of the audit was aligned to the performance commitments in the Investment Plan and the

associated funding obligations between the TEC and your organisation. The scope was outlined in the audit

arrangements letter. TEC Audit Guidelines were also provided to help you understand how TEC undertakes

audits and what to expect during the audit.

The scope of the audit was outlined in the audit arrangements letter. This included the following:

> Your current registration and accreditation status for funding eligibility

> Your organisation’s systems and processes for reporting student data through the Single Data Return,

including reporting enrolments, student achievement and withdrawals

> Compliance with your funding conditions for each fund:

- Student Achievement Component – Provision at Level 3 and above

- Fees-free funding

> Compliance with the Annual Maximum Fee Movement policy, relating to fees and course costs

> The refund of any fees that have been overcharged (if applicable)

> Compliance with the Compulsory Student Services Fee (if applicable)

> Whether your organisation has offered any inducements or benefits to students

> Responsibility for any subcontracting requirements

> Your programmes and qualifications

> Your organisation’s process for maintaining student records as required by clause 13(1) of Schedule 18

of the Education and Training Act 2020 (for on-plan funding under section 425), and 25(1) of Schedule

18 (for off-plan funding under section 428)

Part five: TEO Corrective Actions

In addition to providing comments on the draft audit report, the TEO audited is requested to provide a list

below of any corrective actions to be undertaken on the audit.

Corrective Actions

Based on the recommendations in Part Two what corrective actions wil be undertaken?

Focus Issue

Corrective Action

Date to be

Area

completed

2

Inconsistent dates

• Set up electronic Attendance Register per

October

were recorded in

programme for 2022

2021

the attendance

• Set up templated Acceptance Letter per

schedule and the

programme for 2022

communication

letters to

students.

3

No enrolment /

• Study Policy is covered under the Professional

Completed

study policy

Continuous Development cycle as part of Staff

developed for

Appraisal system. Instructor staff qualifications

TOPEC staff in the

must be kept up to date and relevant as part of

QMS.

Safety Management System and Adventure Mark

certification.

8

The fees of one

• Put in EOY process for the new year

October

course was not

2021

compliant with

the AMFM policy.

9

Withdrawal and

• Add Course Withdrawal section to 2022 Student

October

refund

Handbooks and include Withdrawal Form to be

2021

information is not

filled out

recorded in the

• Add Course Refund section to 2022 Students

Student

Handbooks

Handbooks.