Tertiary Education Commission

Te Amorangi Mātauranga Matua

National Office

44 The Terrace

PO Box 27048

Wellington, New Zealand

2

Contents

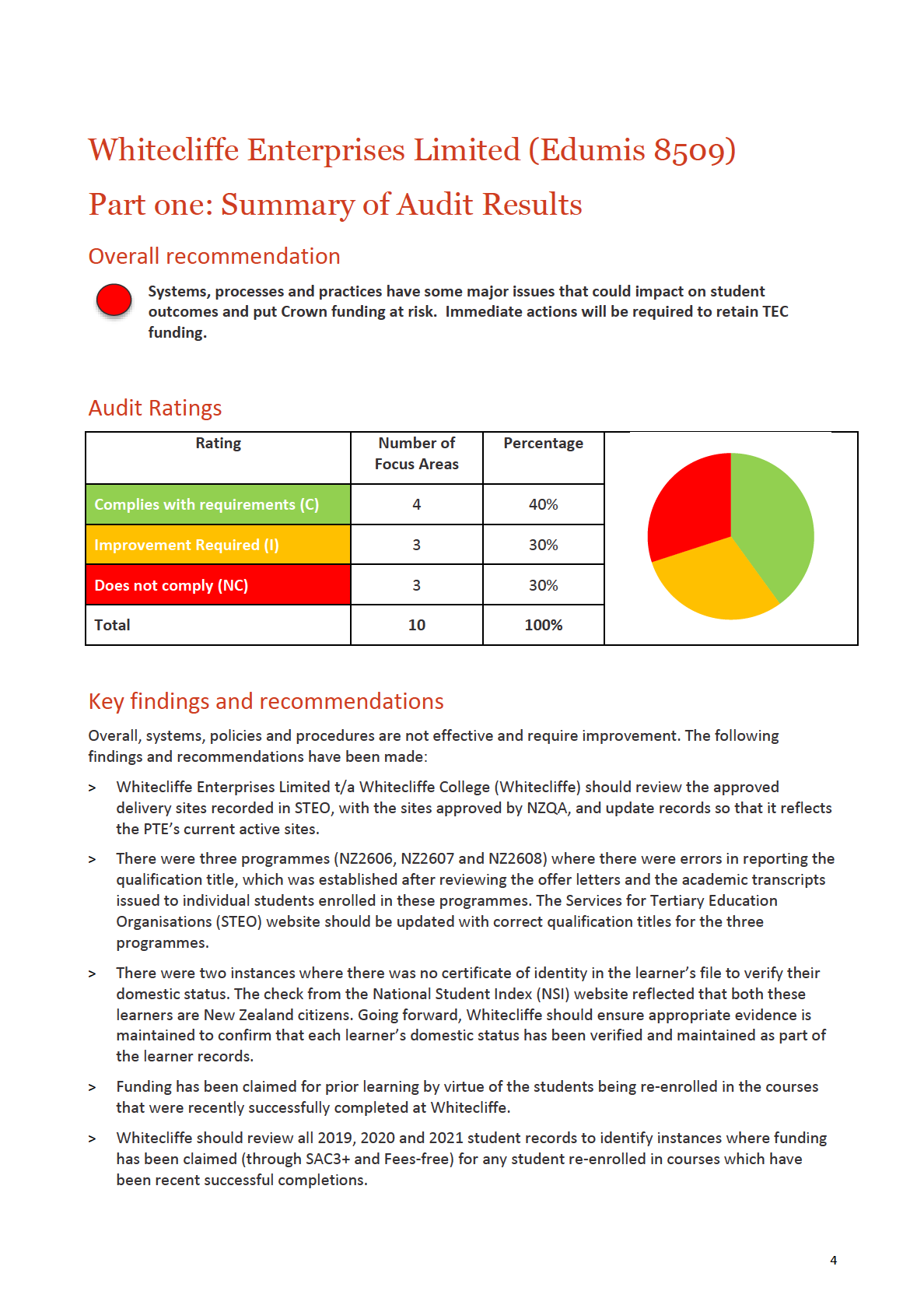

Whitecliffe Enterprises Limited (Edumis 8509)

4

Part one: Summary of Audit Results

4

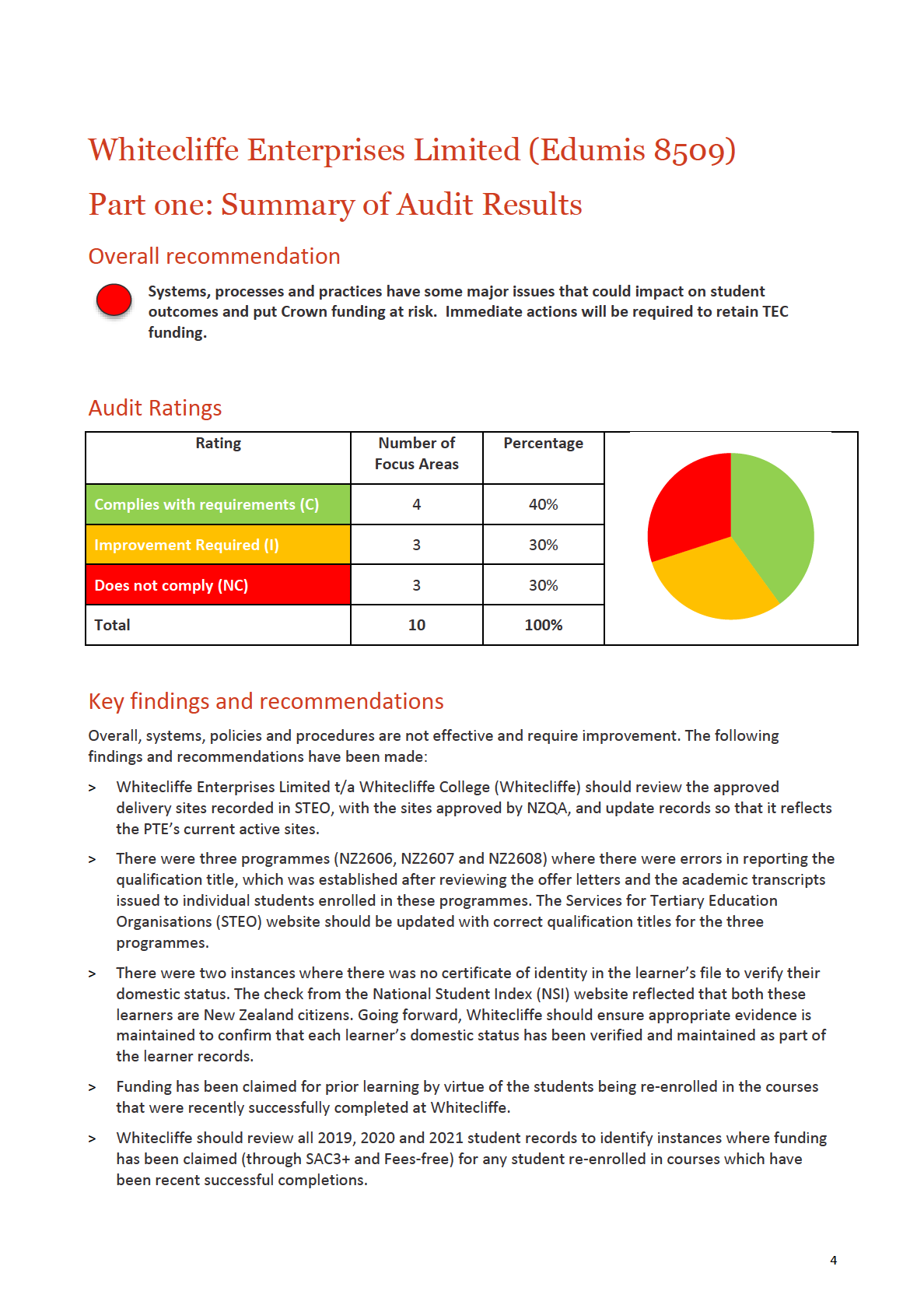

Overall recommendation

4

Audit Ratings

4

Key findings and recommendations

4

Part two: Key findings and recommendations

6

Part three: Other Audit Findings

20

Financial Viability Assessment

20

Part four: Audit Process Overview

21

Purpose of the audit

21

Scope of the audit

21

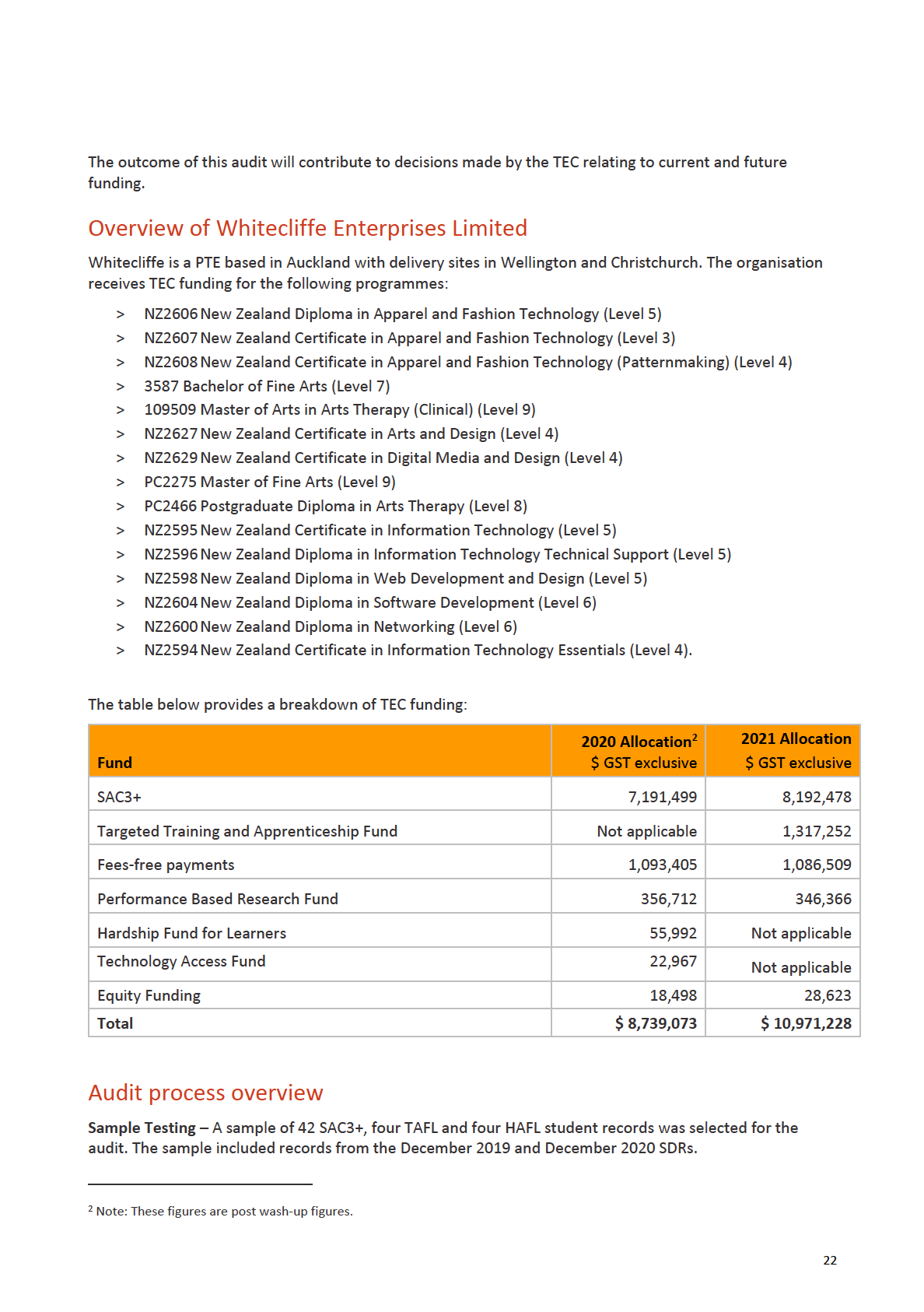

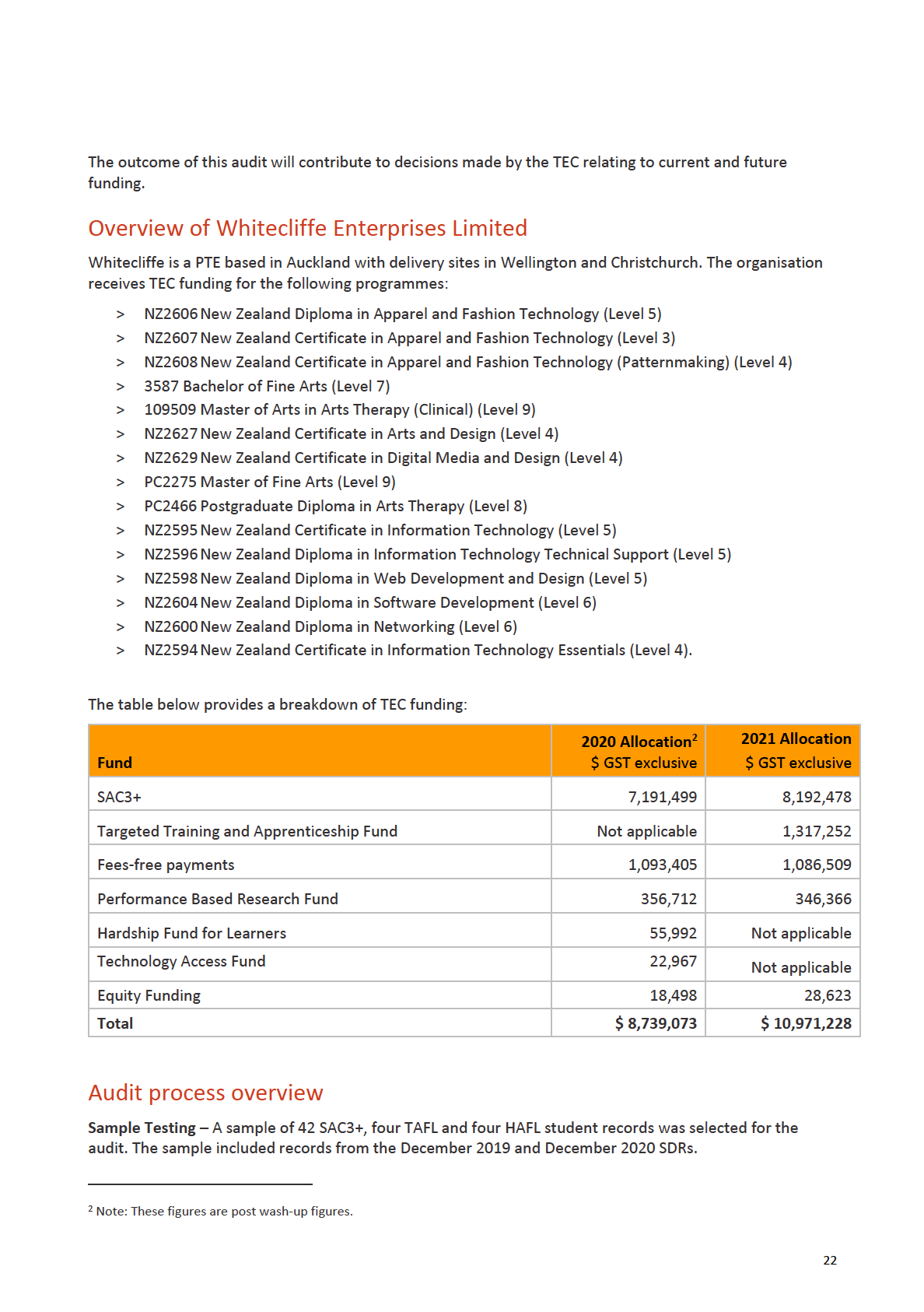

Overview of Whitecliffe Enterprises Limited

22

Audit process overview

22

Part five: TEO Corrective Actions

24

Corrective Actions

24

Appendix 1 – discrepancies between fees invoiced and recorded in STEO

26

3

>

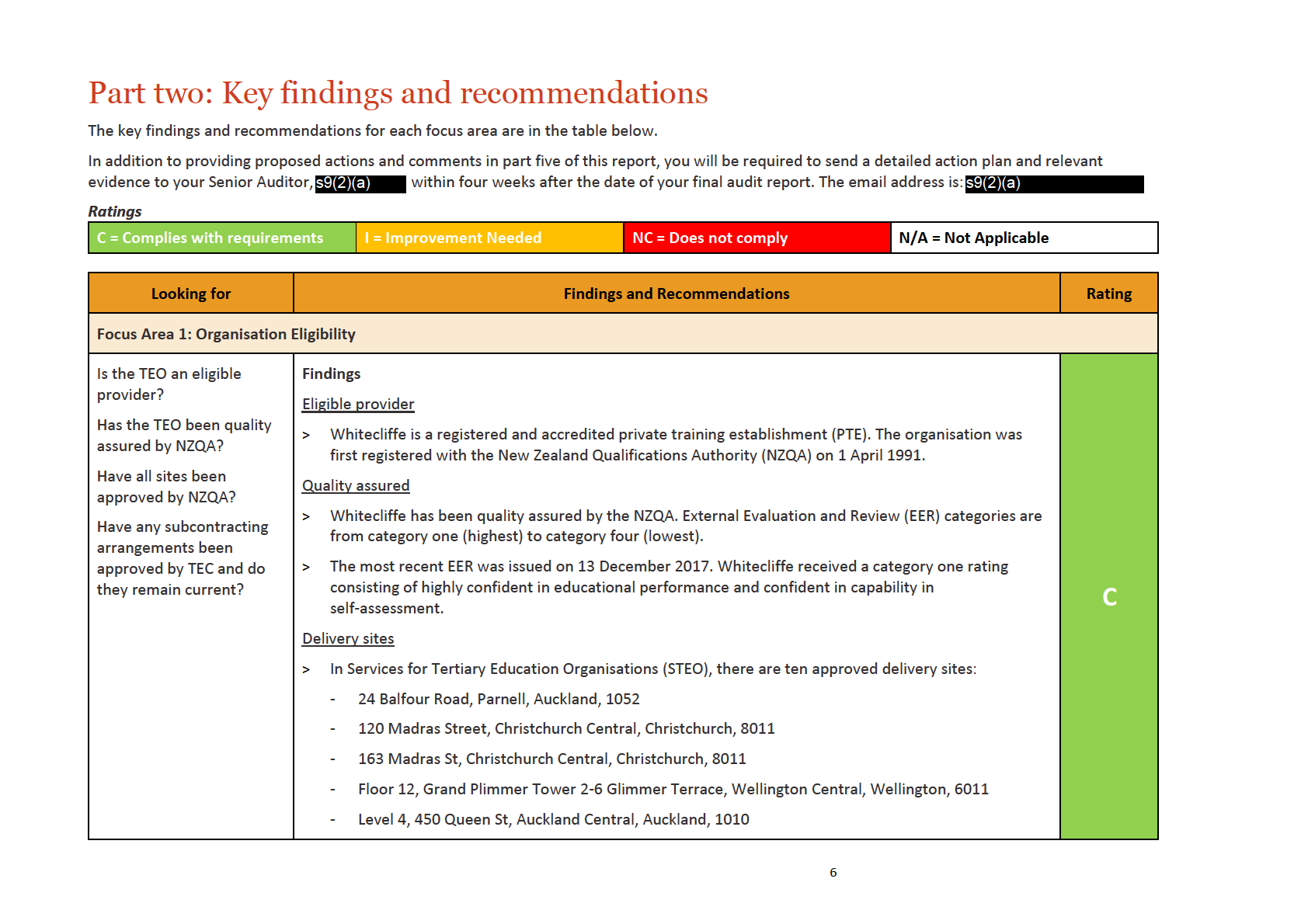

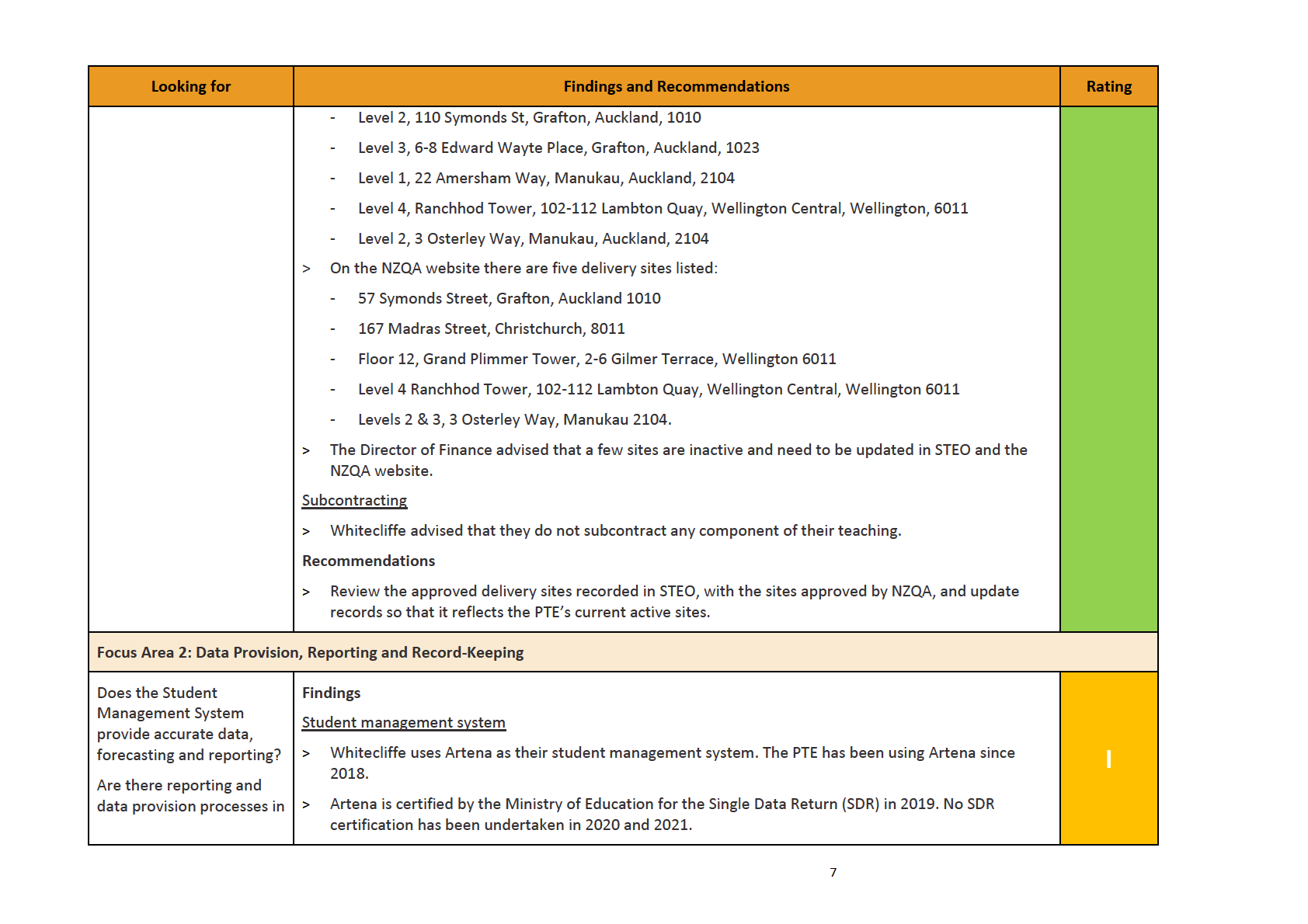

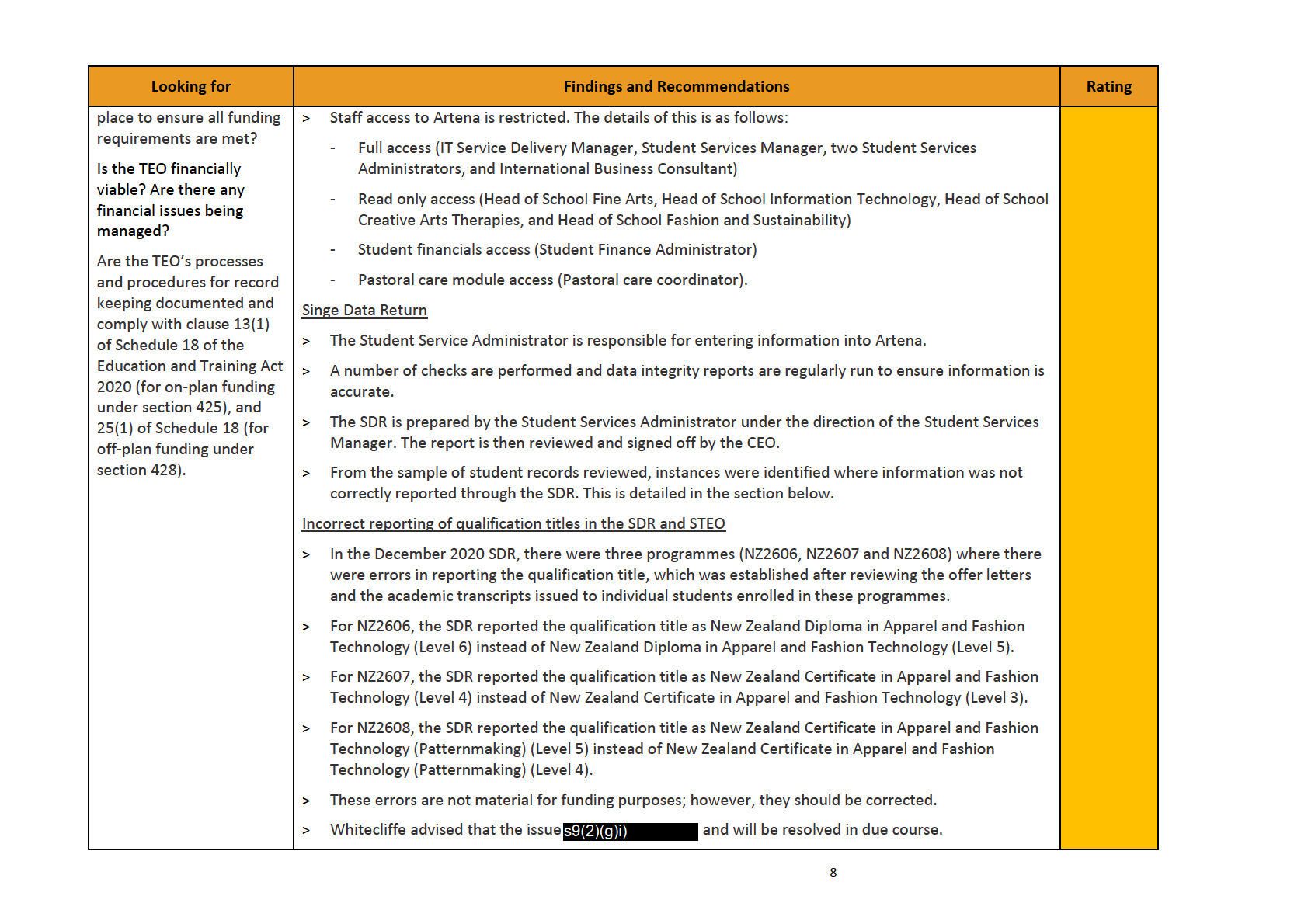

A review of the December 2019 and December 2020 SDR identified that Whitecliffe did not report

correct withdrawal dates. The PTE advised that this is due to some default setting in the SMS, which

has to be resolved.

>

The audit identified several instances in the December 2019 and December 2020 SDRs, where the

students were not reported correctly under source of funding code 31 (SoF 31). Whitecliffe needs to

review and resubmit the December 2019 and December 2020 SDRs to ensure that all the relevant

students are correctly reported under SoF 31.

>

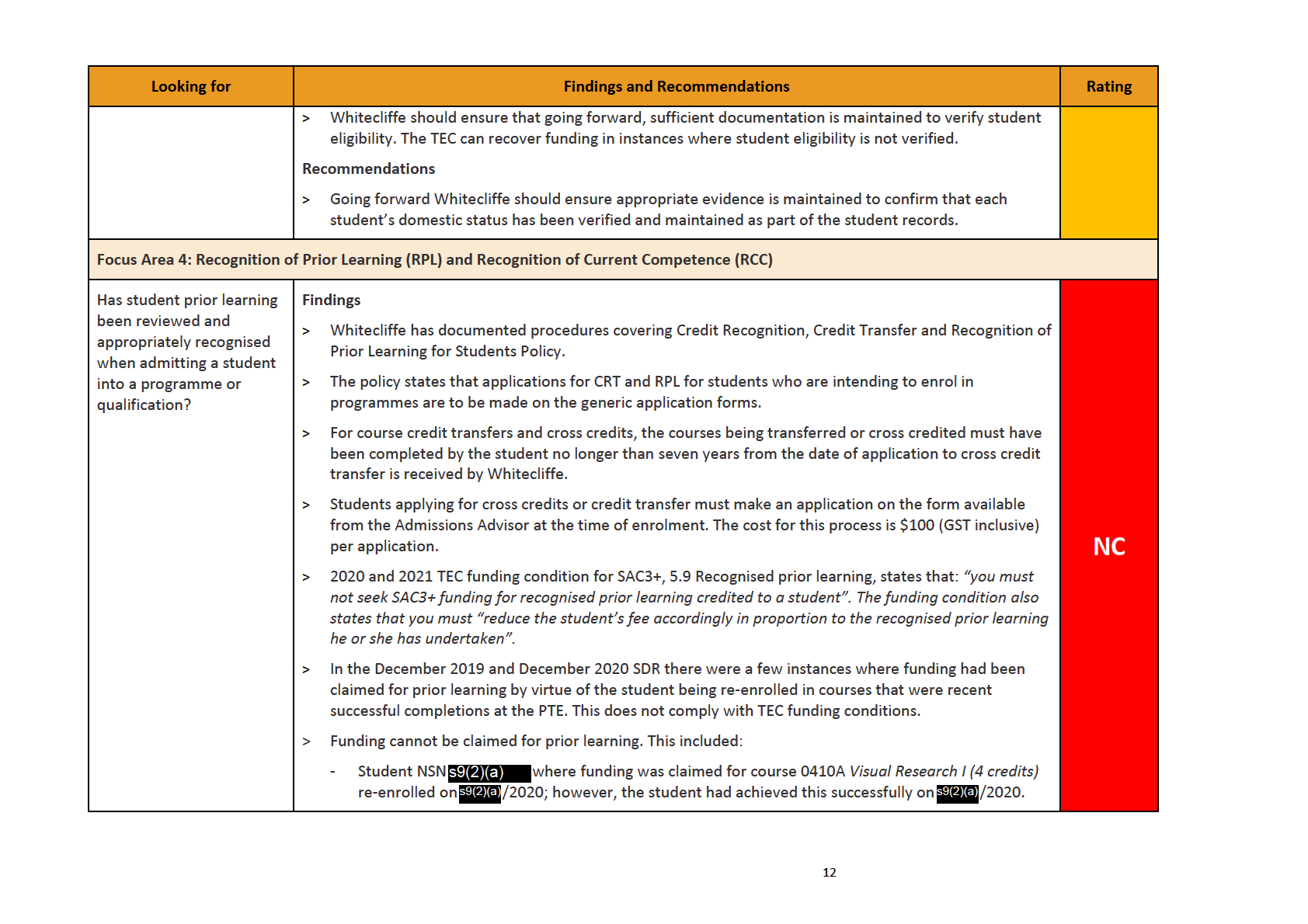

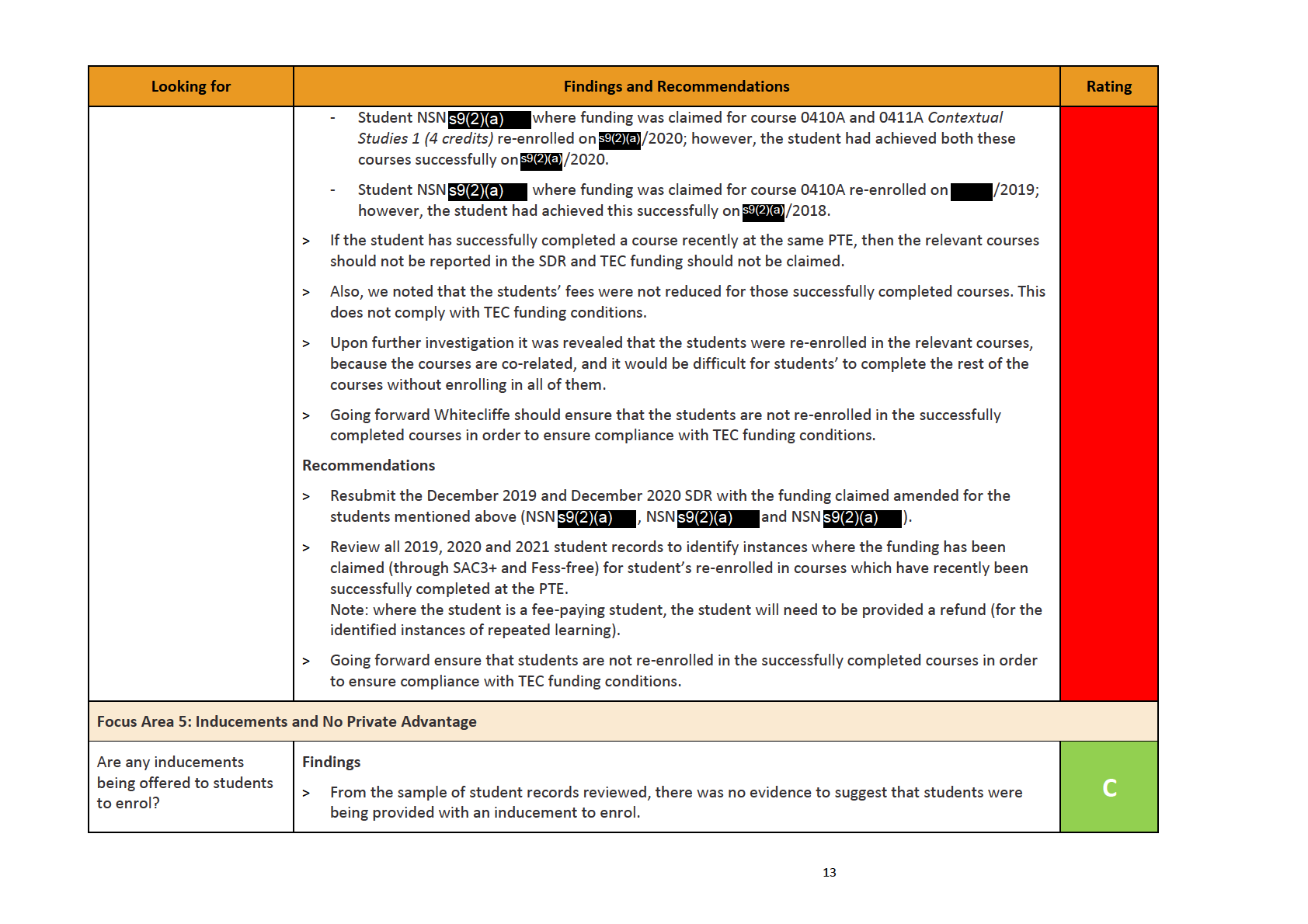

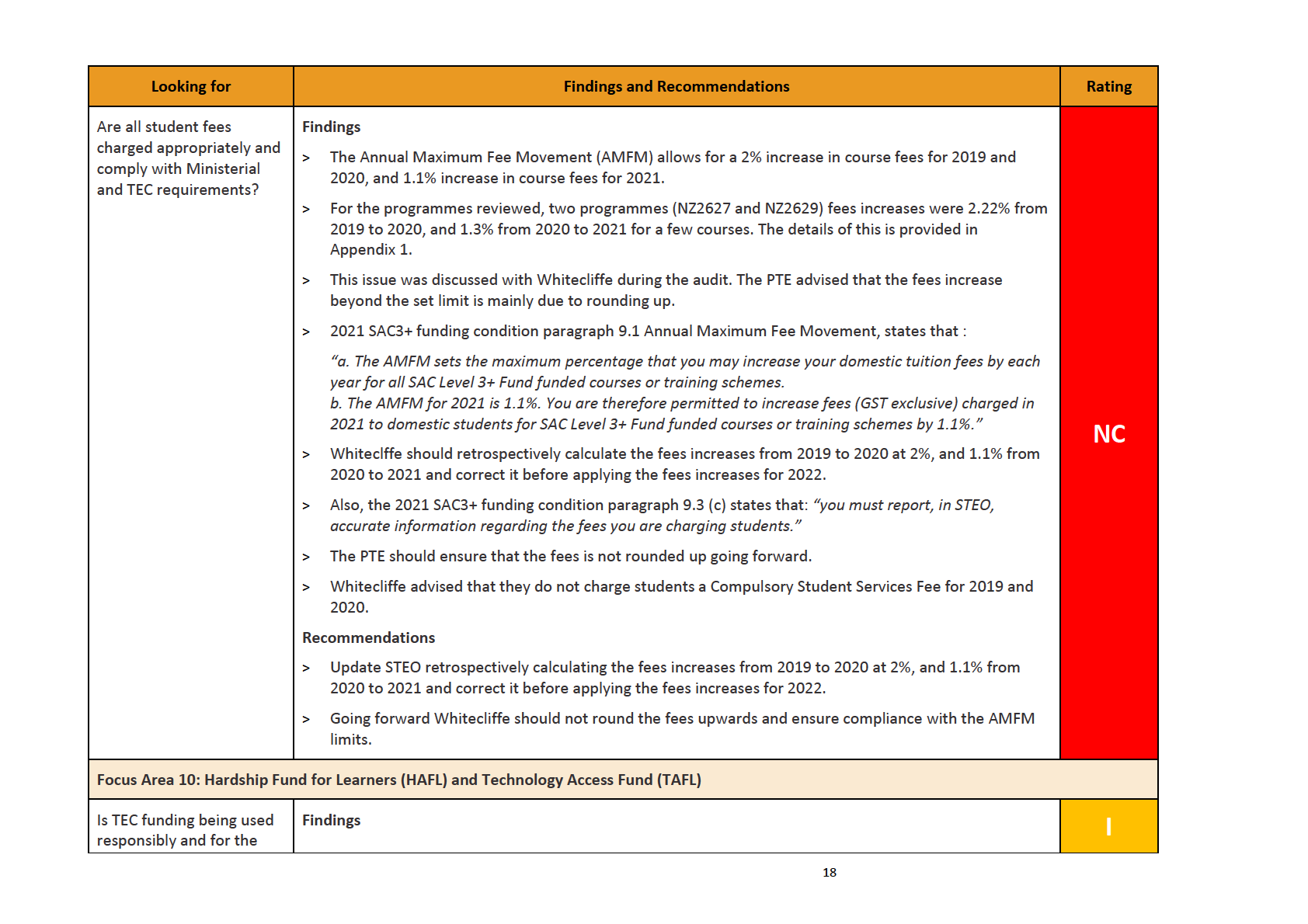

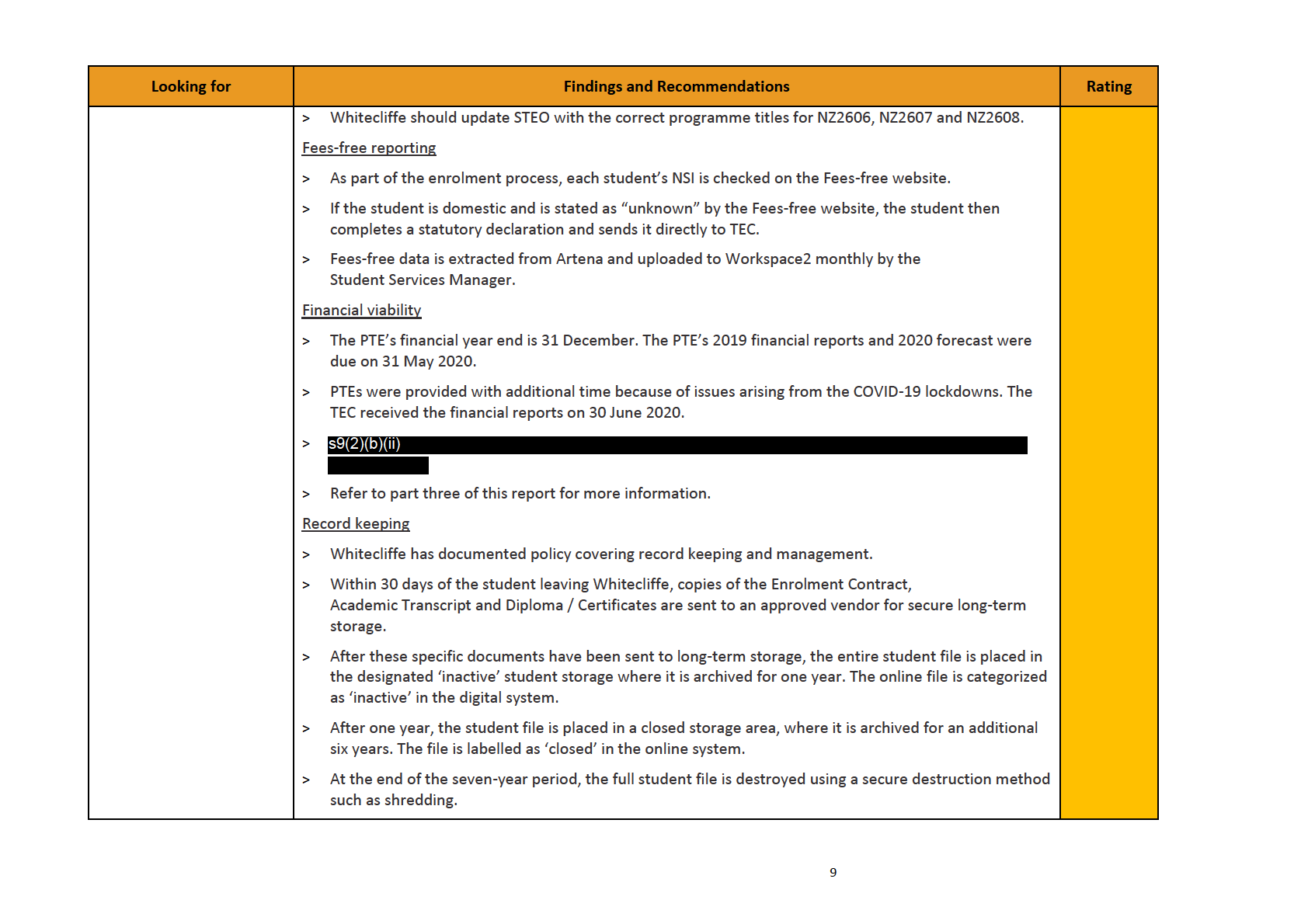

For NZ2627 and NZ2629, fees increases for a few courses were more than the AMFM permissible limit

for 2019 and 2020. Whitecliffe advised that the fees increase beyond the set limit was mainly due to

rounding up. STEO should be updated retrospectively calculating the fees increases from 2019 to 2020

at 2%, and 1.1% from 2020 to 2021. This should be corrected before applying the fees increases for

2022.

>

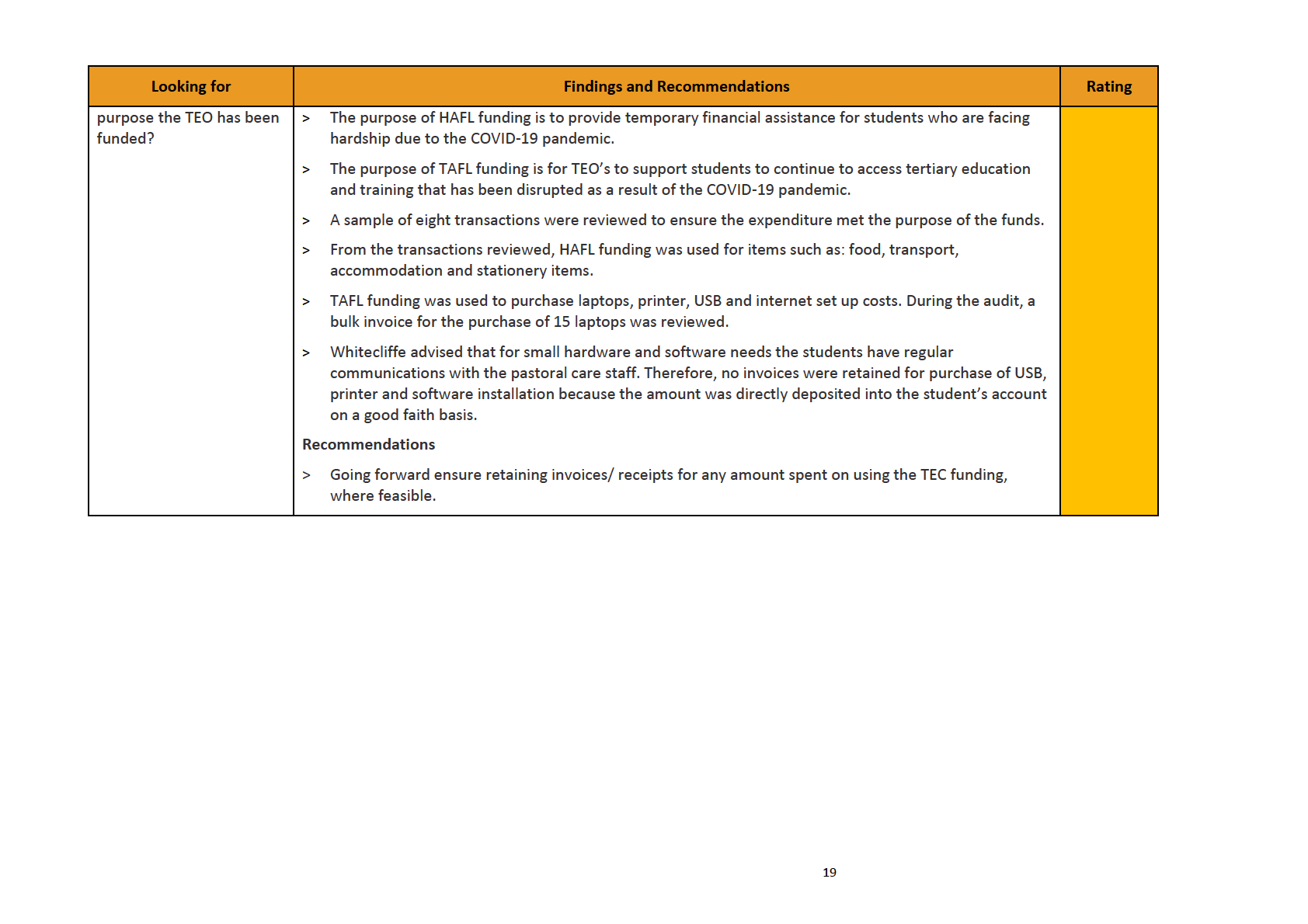

For TAFL funding, no invoices were held for the purchase of USB, printers and software installation

because the amount was directly deposited into the student’s account on a good faith basis.

5

Part three: Other Audit Findings

Further findings of the audit are set out below.

Financial Viability Assessment

8509-Whitecliffe Enterprises Limited

Risk assessment

(Based on your financial statements for the years shown)

s9(2)(b)(ii)

20

Part four: Audit Process Overview

Purpose of the audit

The purpose of the audit was to provide assurance that your organisation is complying with the

Education and Training Act 2020 and conditions imposed on your funding. This audit is part of our ongoing

monitoring of tertiary education organisations (TEOs).

This audit used a sample-based approach and reviewed a limited scope of the applicable funding conditions

and other requirements. As such, despite our best efforts, some non-compliance may remain undetected

and the audit does not provide complete assurance of historical, current or future compliance.

Non-detection of non-compliance does not make that practice compliant, and will not restrict the TEC from

taking action under the Education and Training Act 2020 or from recovering funding in the future if non-

compliance is later detected. Please refer to the audit guidelines for more information on the inherent

limitations of an audit.

Our audit focus will be on assisting TEOs in achieving their objectives through well-reasoned audits,

evaluations and analyses of the business viability and education outcomes for students.

Scope of the audit

TEC’s monitoring function is set out in section 409(1)(h) of the Education and Training Act 2020, which

provides that the TEC's functions are to "

monitor the performance of organisations that receive funding

from the Commission including by measuring performance against specified outcomes”.

The scope of the audit was aligned to the performance commitments in the Investment Plan and the

associated funding obligations between the TEC and your organisation. The scope was outlined in the audit

arrangements letter. TEC Audit Guidelines were also provided to help you understand how TEC undertakes

audits and what to expect during the audit.

The scope of the audit was outlined in the audit arrangements letter. This included the following:

> Your current registration and accreditation status for funding eligibility

> Your organisation’s systems and processes for reporting student data through the Single Data Return,

including reporting enrolments, student achievement and withdrawals

> Compliance with your funding conditions for each fund:

-

Fees-free funding

-

Student Achievement Component – Provision at Level 3 and above

-

Hardship Fund for Learners

-

Technology Access Fund

> Compliance with the Annual Maximum Fee Movement policy relating to fees and course costs

> The refund of any fees that have been overcharged (if applicable)

> Compliance with the Compulsory Student Services Fee (if applicable)

> Whether your organisation has offered any inducements or benefits to students

> Responsibility for any subcontracting arrangements

> Your programmes and qualifications

> Your organisation’s process for maintaining student records as required by clause 13(1) of Schedule 18

of the Education and Training Act 2020 (for on-plan funding under section 425), and 25(1) of Schedule

18 (for off-plan funding under section 428).

>

Any other matters relating to funding provided by the TEC.

21

There were 1092 students reported in the December 2019 SDR. This includes international fee-paying

students who are not funded by the TEC.

The December 2020 SDR reported 1045 students, again this included international fee-paying students.

Interviews – Interviews were held at Whitecliffe’s Auckland office with the following:

> s9(2)(a)

23

Part five: TEO Corrective Actions

In addition to providing comments on the draft audit report, the TEO audited is requested to provide a list

below of any corrective actions to be undertaken on the audit.

Corrective Actions

Based on the recommendations in Part Two what corrective actions will be undertaken?

Focus Issue

Corrective Action

Date to be

Area

completed

1

STEO currently records delivery sites which This has been updated on STEO already Completed

are no longer active.

2

Update STEO with correct qualification

The error was on NZQA’s part, and we 31 December

titles for NZ2606, NZ2607 and NZ2608.

are working with NZQA to rectify this.

2021

(tentative)

3

The audit identified two instances (NSN

We have improved our processes to Completed

s9(2)(a)

and NSN s9(2)(a)

where

ensure

appropriate

evidence

is

there was no certificate of identity in the

obtained to verify learner’s domestic

learner’s file to verify their domestic

status.

status.

4

Funding has been claimed for prior

We have updated our processes to Completed

learning by virtue of the students being re-

ensure funding is not claimed for

enrolled in the courses that were recently

courses previously completed.

successfully completed at Whitecliffe.

4

Review all 2019, 2020 and 2021 student

We have identified students where 31 December

records to identify instances where the

funding has been claimed twice, 2021

funding has been claimed (through SAC3+

amounting to 0.3834 EFTS for 2019 and

and Fees-free) for students re-enrolled in

2020. We will correct this in the SDR

courses which have recently been

resubmission

successfully completed at Whitecliffe.

6

Ensure withdrawal dates are correctly

We have updated our processes to Completed

reported in the SDR going forward.

ensure

withdrawals/dates

are

correctly reported in the SDR.

6

The audit identified several instances in

We will work with TEC to resubmit our 31 December

the December 2019 and December 2020

2019 and 2020 SDR, with correct 2021

SDRs, where the students were not

reporting of SoF 31 funding. We have

reported correctly under SoF 31.

identified 5.2040 EFTS for 2019 and

2.5422 ETS for 2020 that will be re-

Whitecliffe should review and resubmit

coded from 01 to 31, despite there

the December 2019 and December 2020

being no funding recovery for 2020.

SDRs to ensure that all the relevant

students are correctly reported under SoF

31.

9

For NZ2627 and NZ2629, fees increases for Noted, we will correct the fee increases 31

January

a few courses were more than AMFM

when applying for 2022 AMFM 2022

permissible limit for 2019 and 2020

increase.

(details in Appendix 1). The fees increase

24

beyond the set limit was mainly due to

rounding up. STEO should be updated

retrospectively calculating the fees

increases from 2019 to 2020 at 2%, and

1.1% from 2020 to 2021. This should be

corrected before applying the fees

increases for 2022.

10

For TAFL funding, no invoices were held for Noted

n/a

the purchase of USB, printers and software

installation because the amount was

directly deposited into the student’s

account on a good faith basis.

25

Appendix 1 – AMFM fees increases

s9(2)(b)(ii)

26