Tertiary Education Commission

Te Amorangi Mātauranga Matua

National Office

44 The Terrace

PO Box 27048

Wellington, New Zealand

2

Contents

School of Business Limited (Edumis 7826)

4

Part One: Summary of Audit Results

4

Overall recommendation

4

Audit Ratings

4

Key findings and recommendations

4

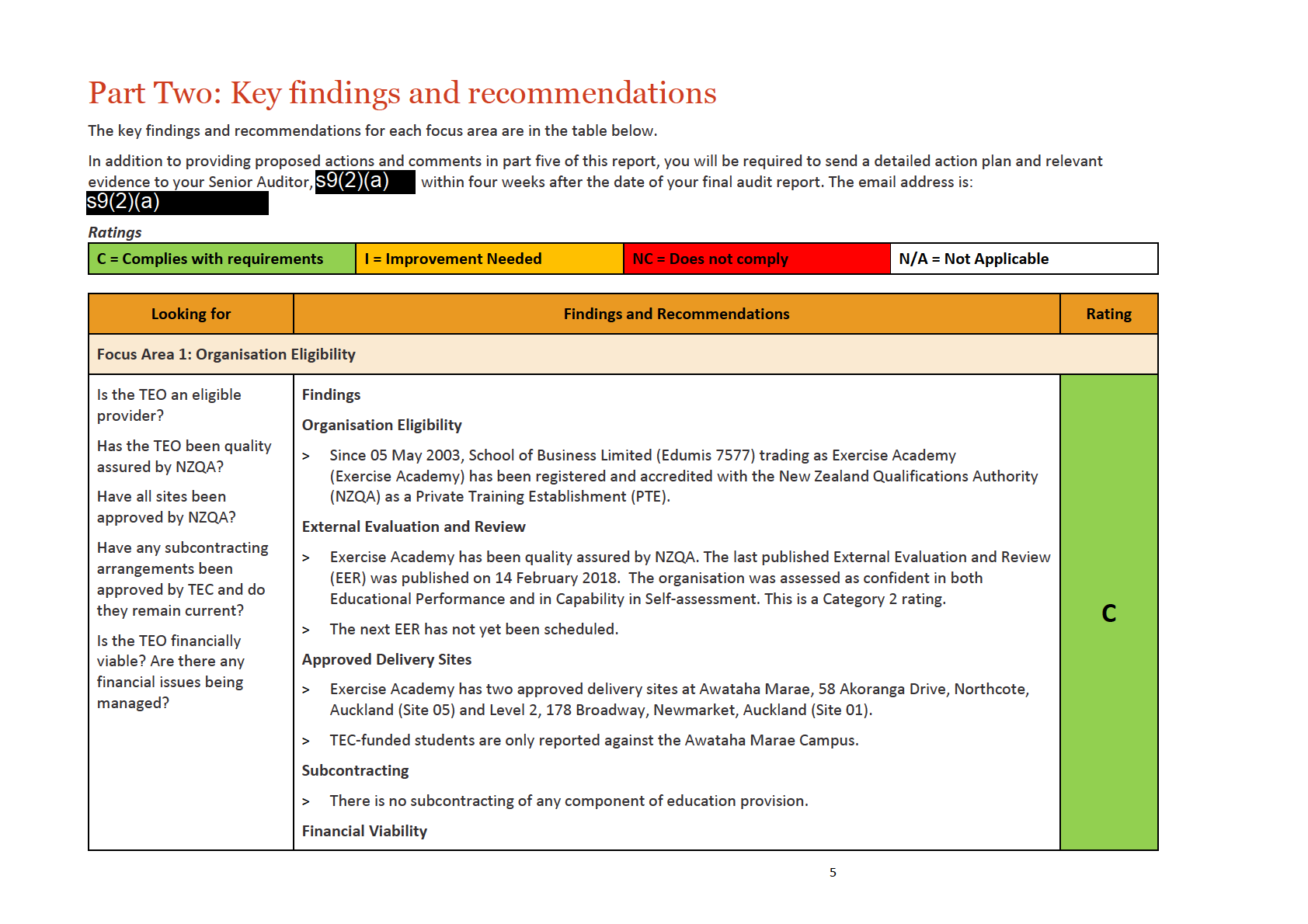

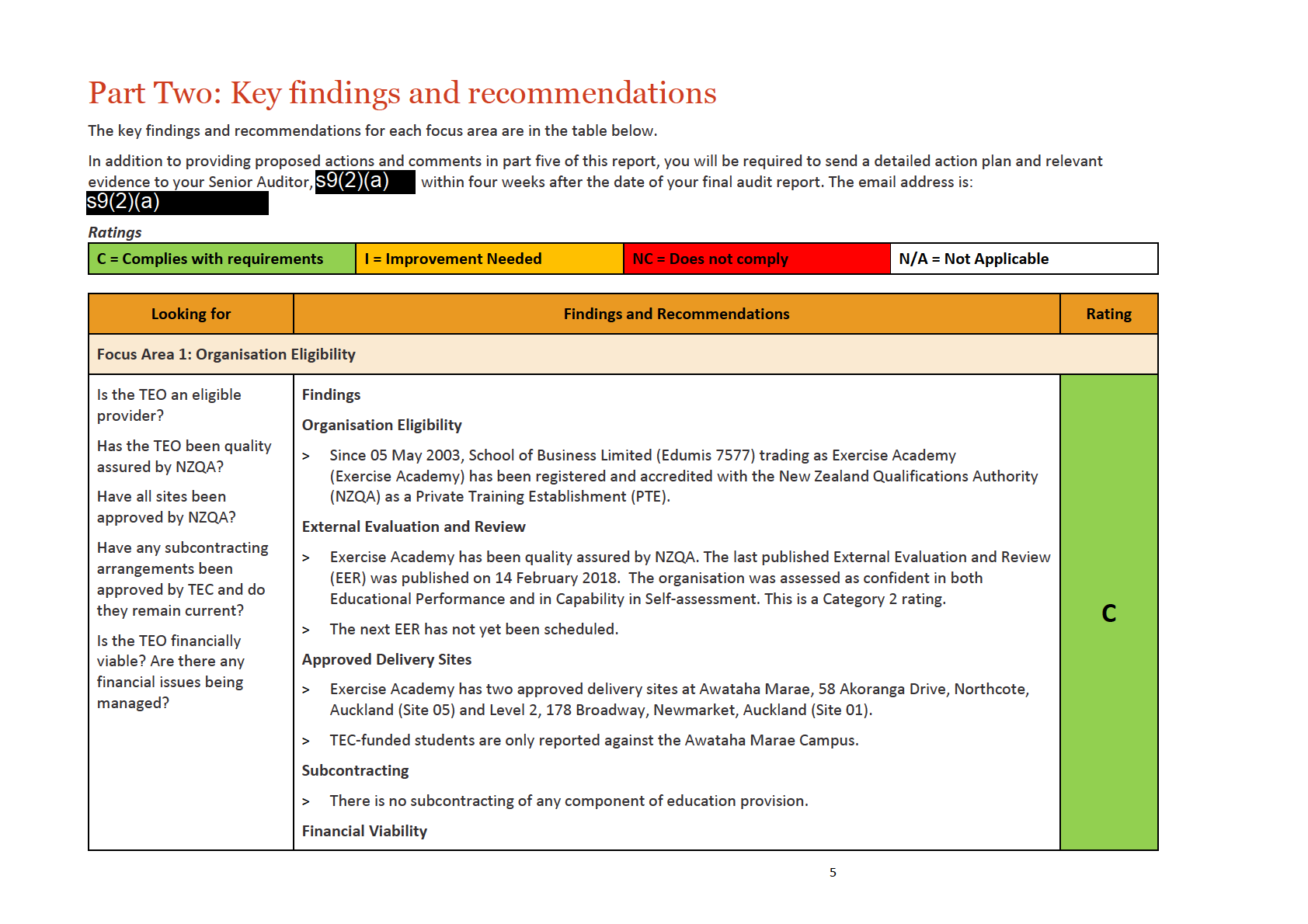

Part Two: Key findings and recommendations

5

Part Three: Other Audit Findings

15

Financial Viability Assessment

15

Minimum Prudential Financial Standards

15

Part Four: Audit Process Overview

17

Purpose of the audit

17

Scope of the audit

17

Overview of School of Business Limited

18

Audit process overview

18

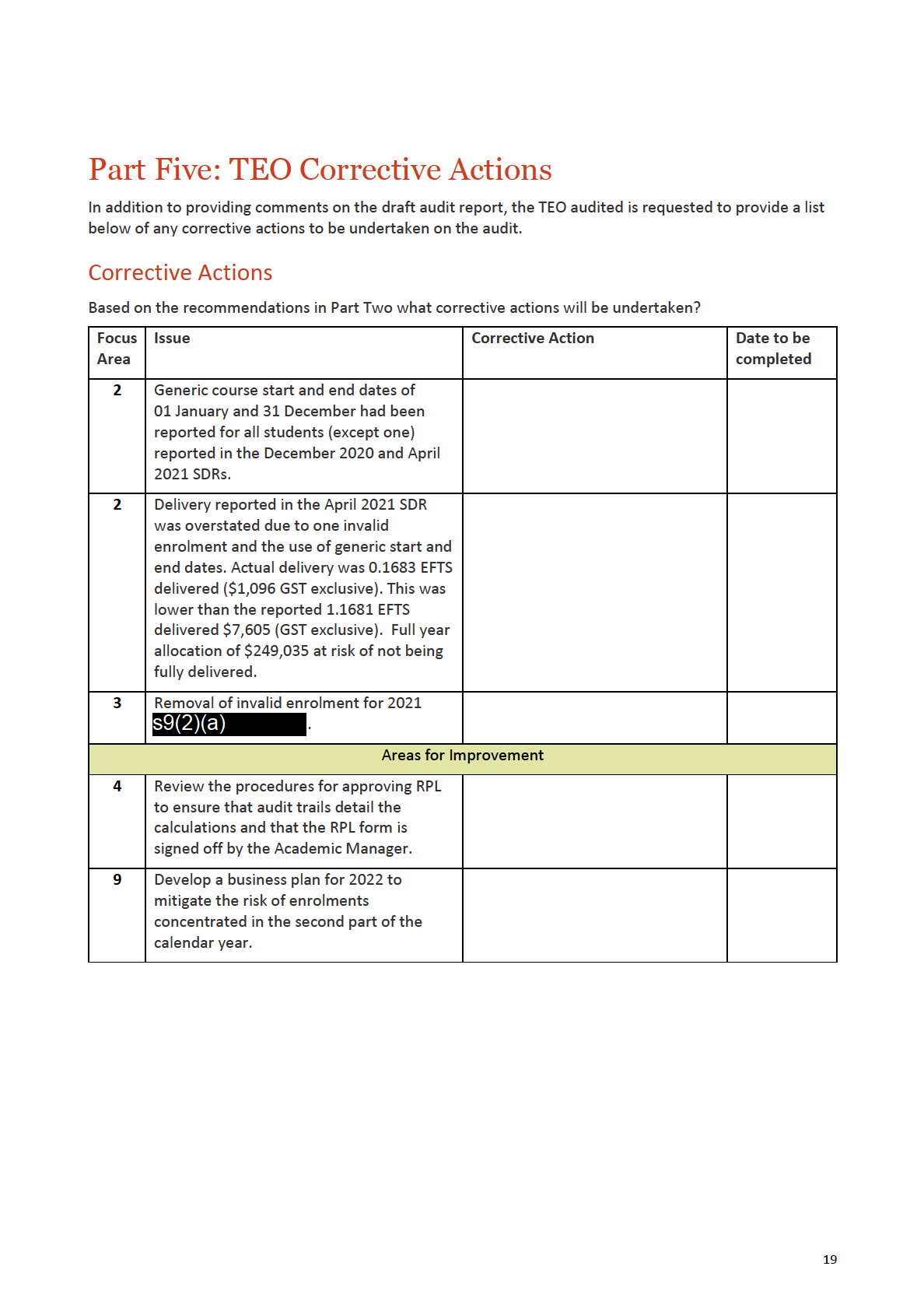

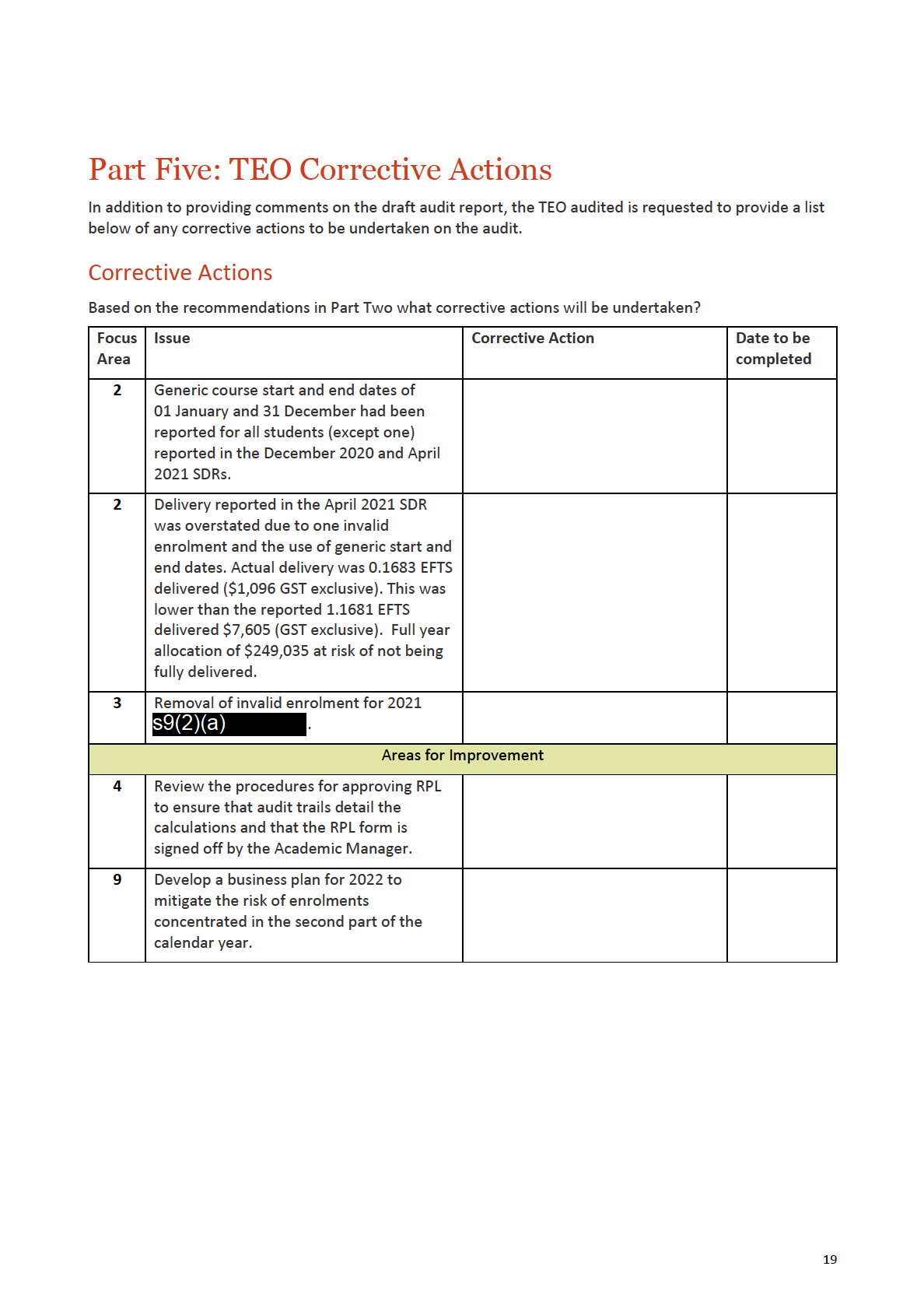

Part Five: TEO Corrective Actions

19

Corrective Actions

19

3

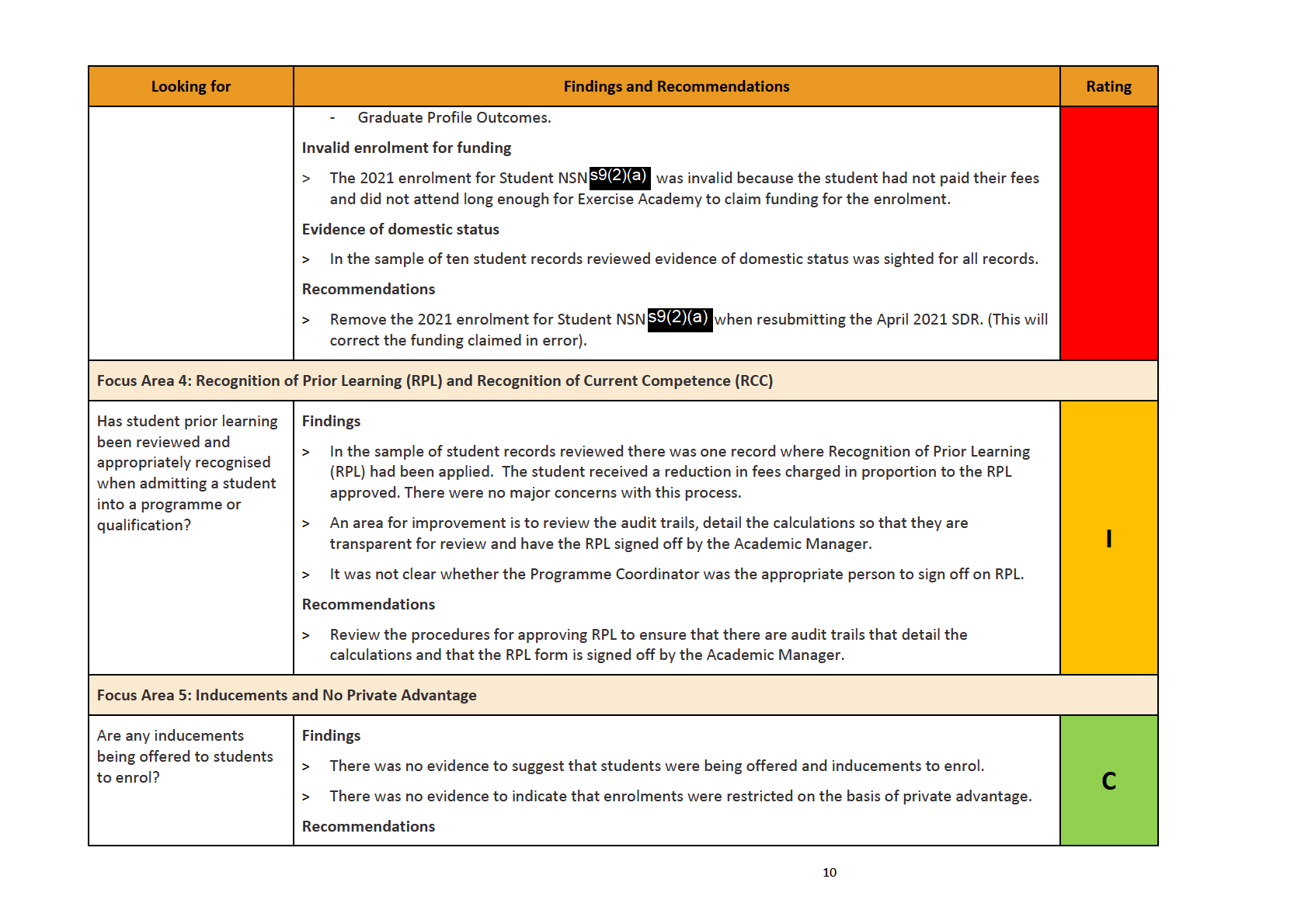

Part Three: Other Audit Findings

Further findings of the audit are set out below.

Financial Viability Assessment

7577-School of Business Limited

Minimum

Prudential

Financial

Standards

Risk assessment

(Based on your financial statements for the years shown)

s9(2)(b)(ii)

The PTE’s financial year end is 31 December. The 2020 financial reports and 2021 forecast were due on

31 May 2021. On 16 June their auditors requested an extension to 15 July 2021 s9(2)(a)

within its

firm. We agreed to this extension. The reports are now outstanding on 21 July 2021.

s9(2)(b)(ii)

s9(2)(b)(ii)

15

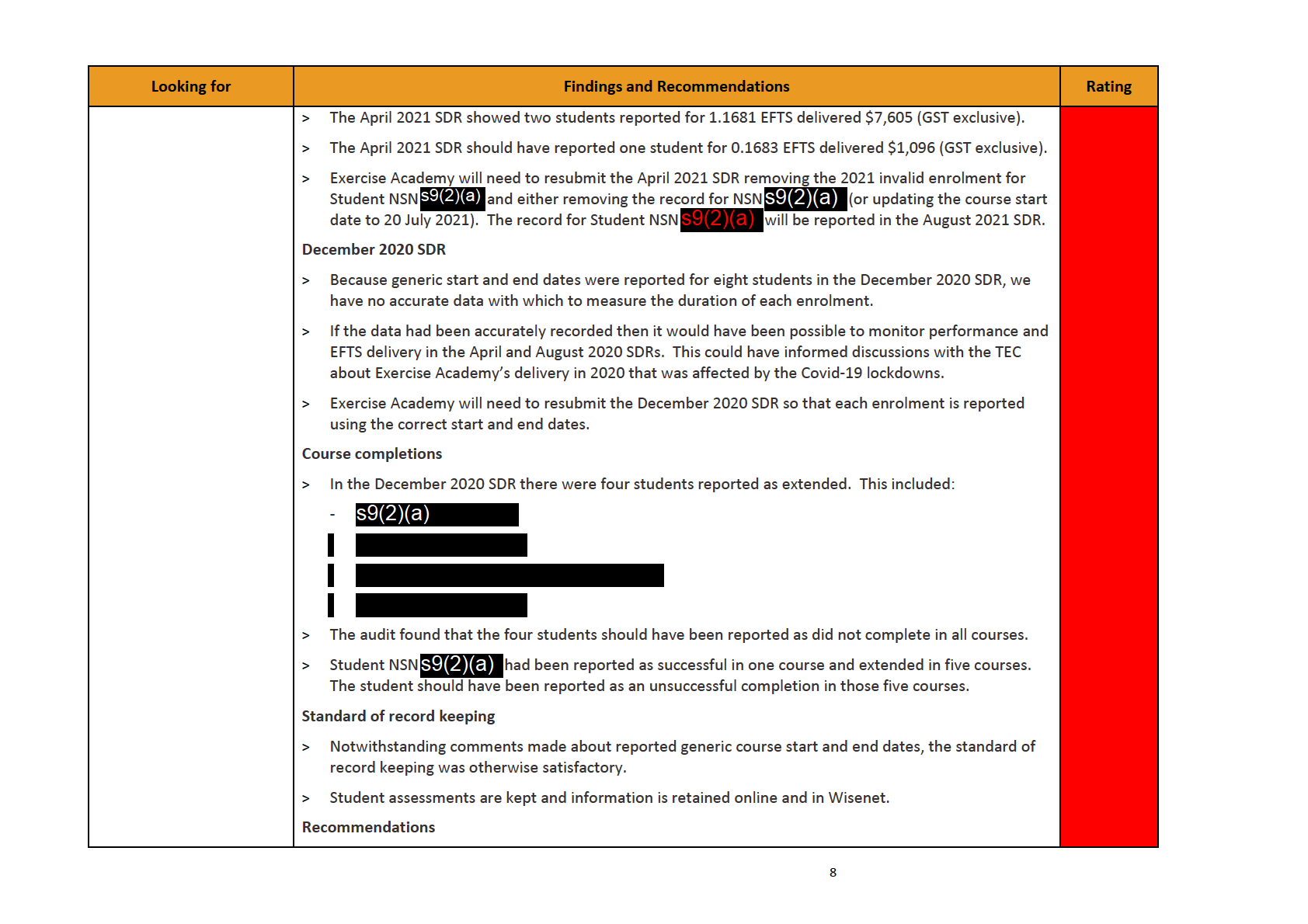

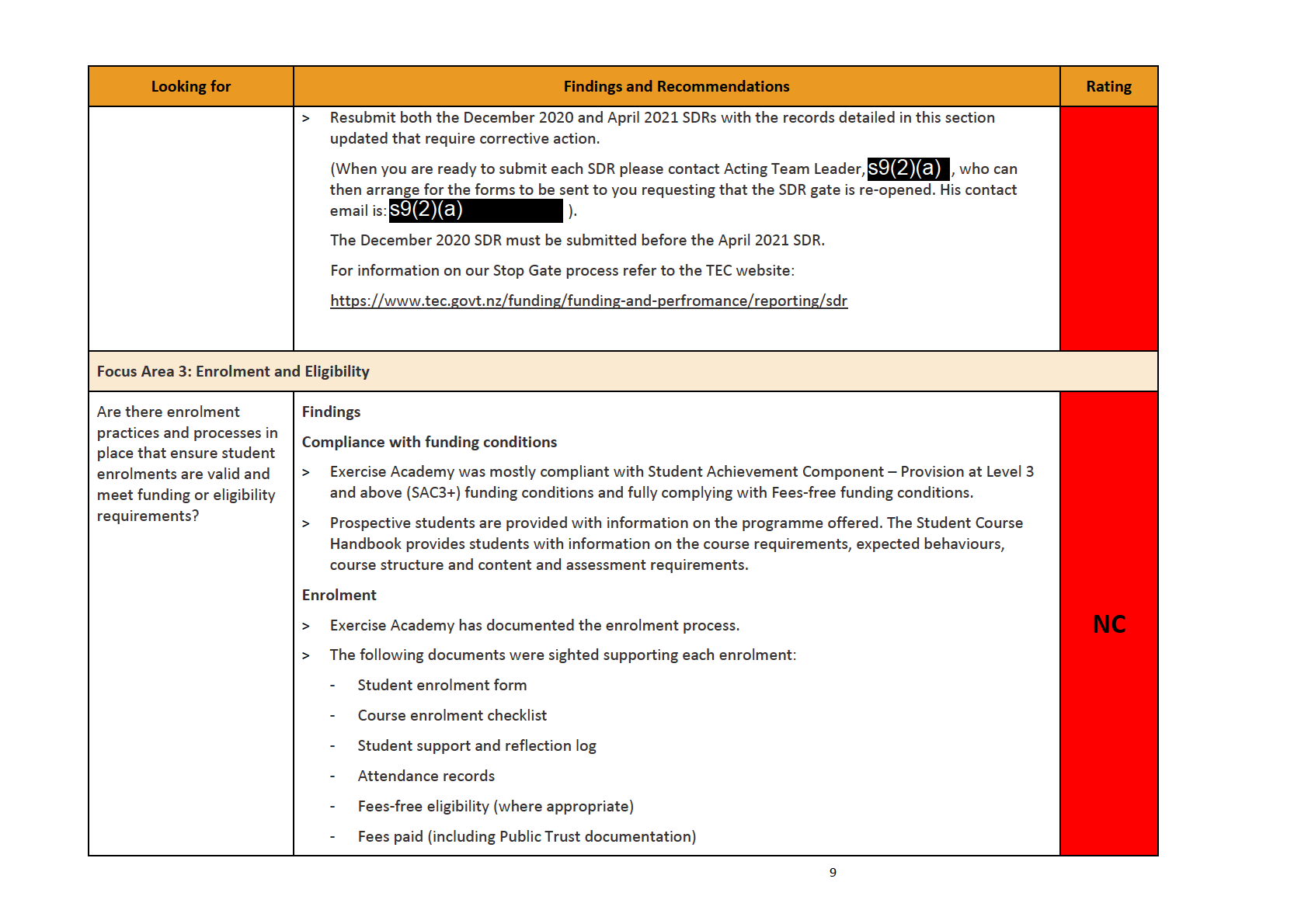

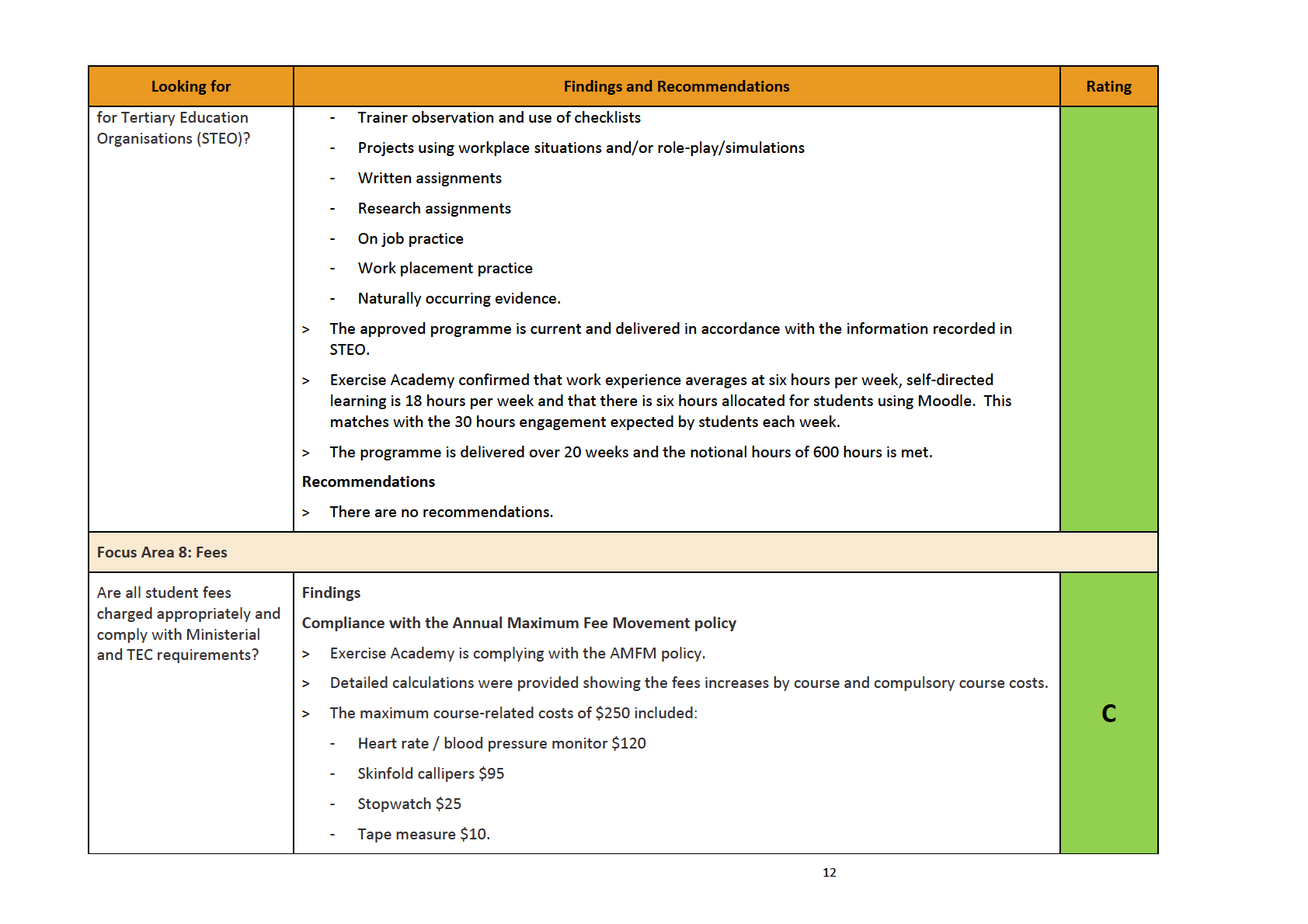

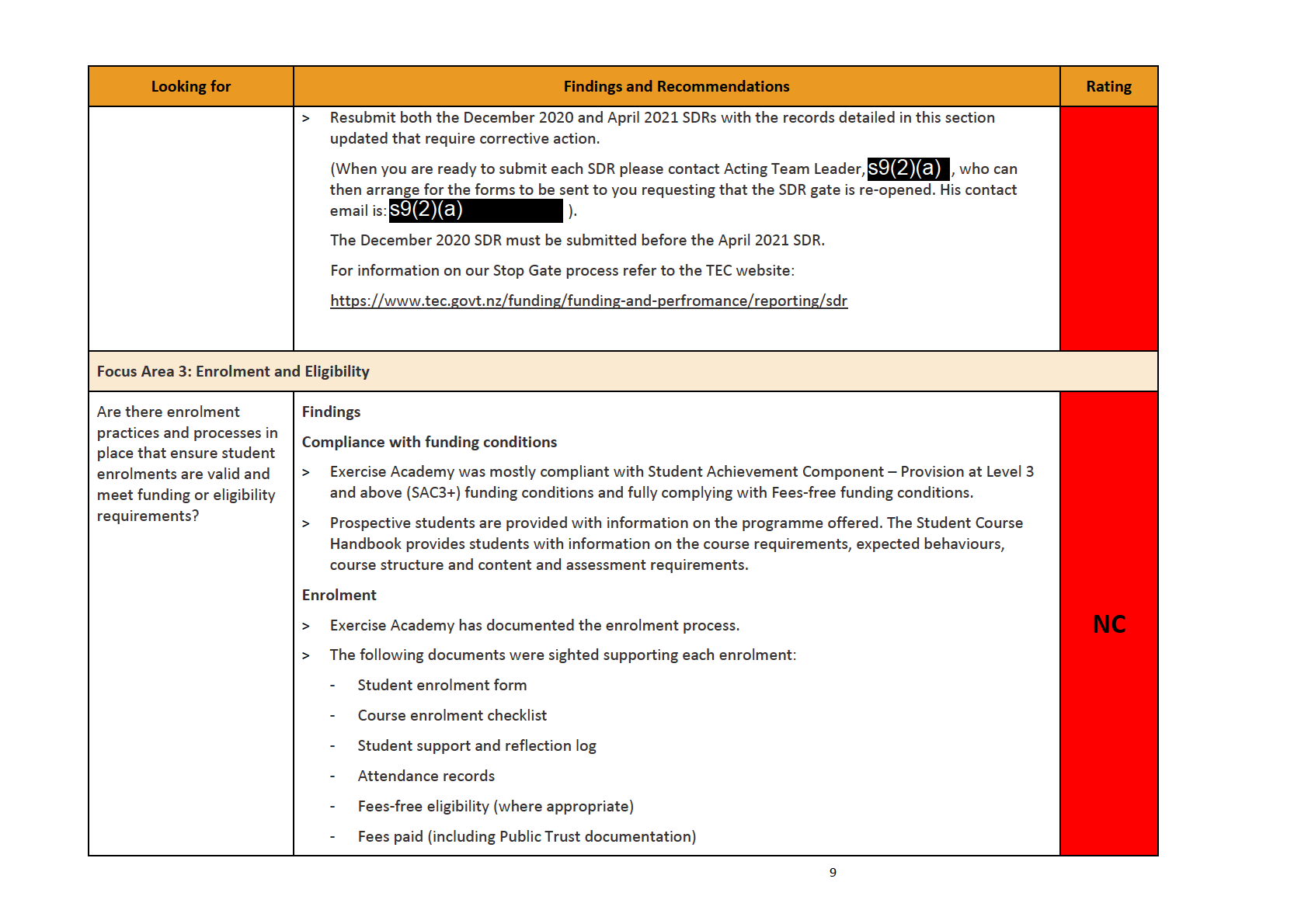

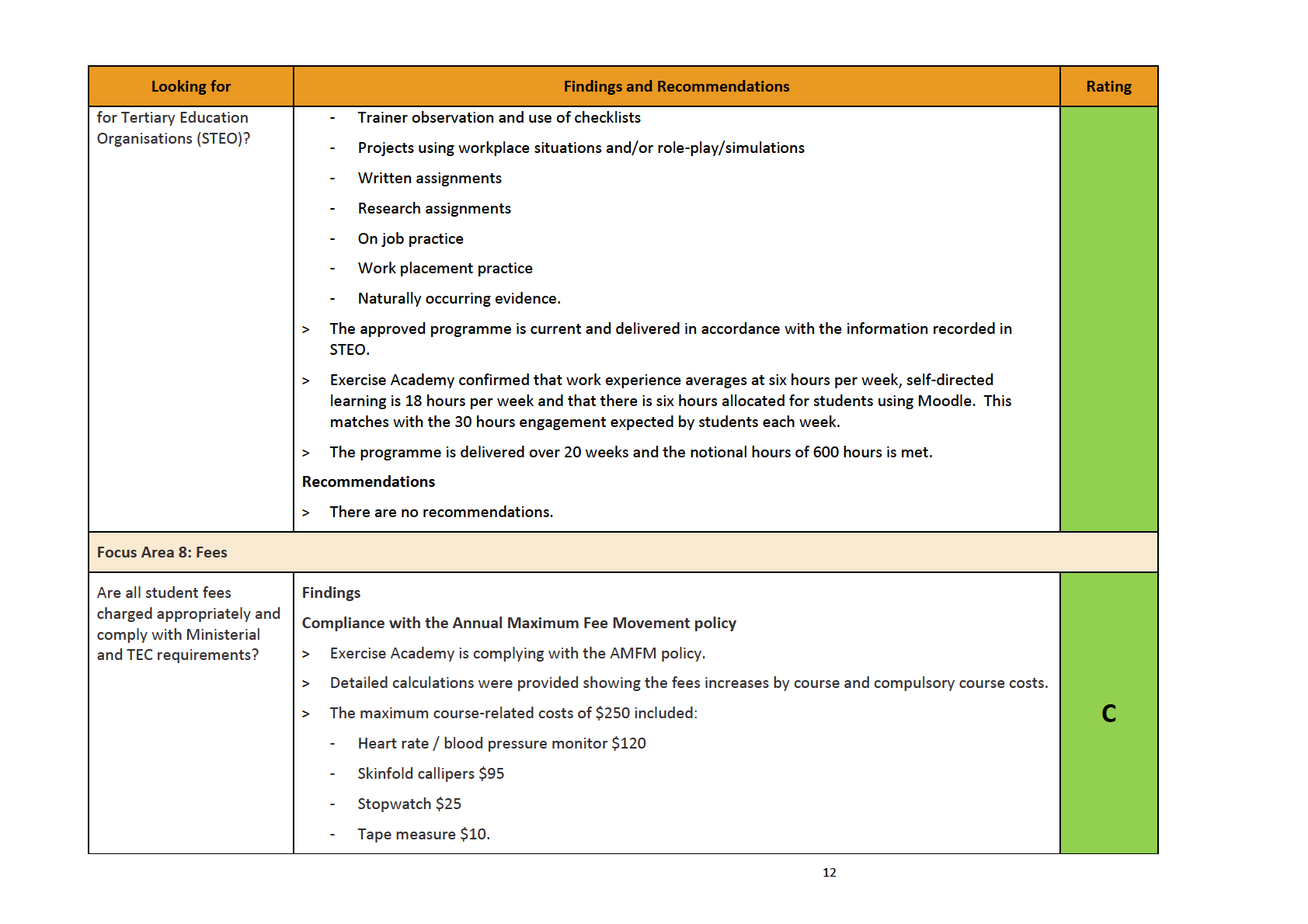

The PTE receives Fees-free Payments and Student Achievement Component – Provision at Level 3 and

above funding.

Excluding Fees-free payments, the TEC funded $238,128 in 2018, $241,260 in 2019, and $245,113 in 2020

(including a Debt Write-off of $216,245). It is funded $249,035 in 2021.

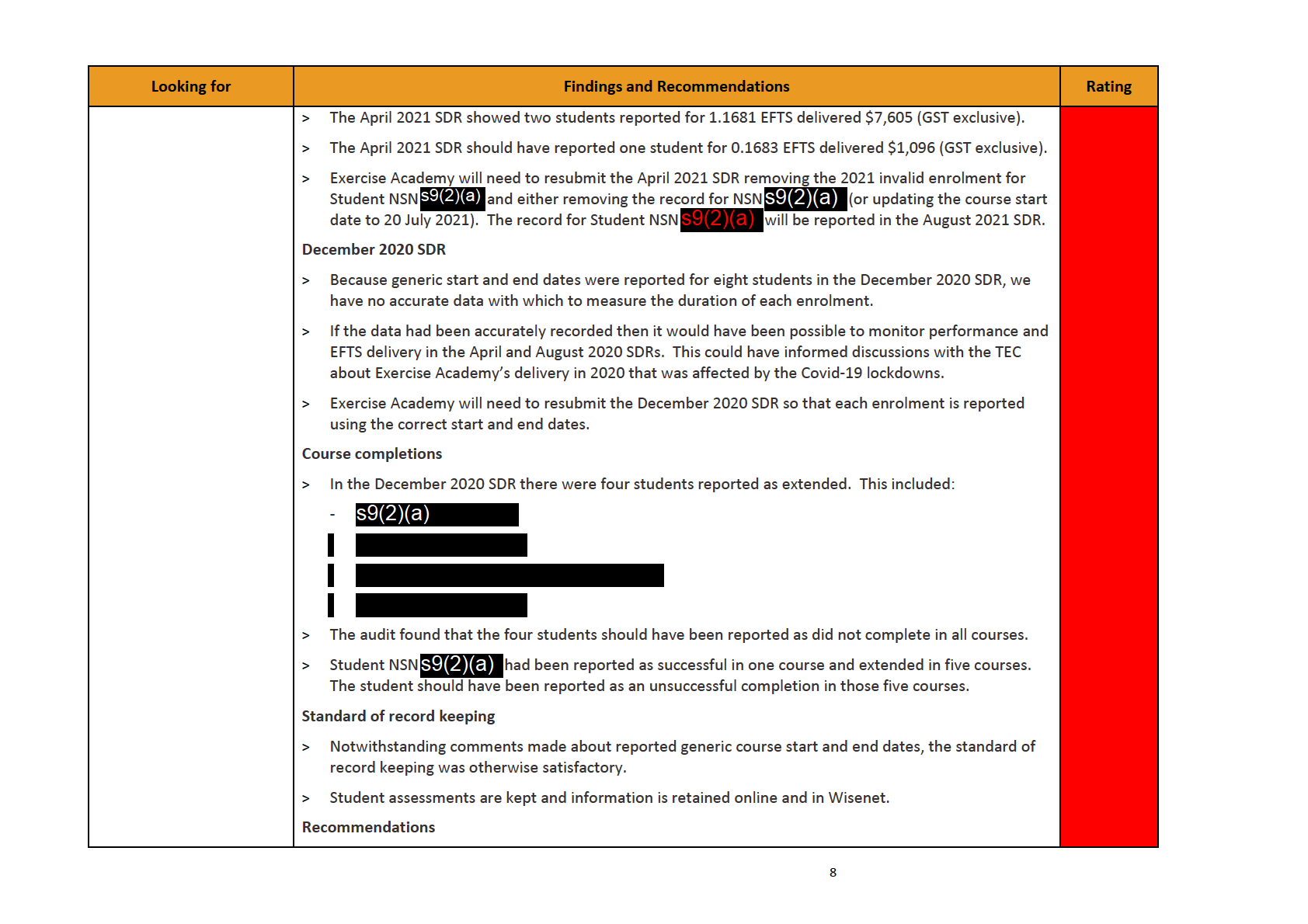

It delivered 38.4 TEC-funded EFTS in 2018 (100.5% delivery), 38.3 EFTS in 2019 (100.2% delivery), and 4.1

EFTS in 2020. It is funded for 40 EFTS in 2021.

The April SDRs show continuously declining delivery. In April 2019 there was 16.5 EFTS, in April 2020 there

was 4.3 EFTS and April 2021 shows 1.2 EFTS (although this is overstated due to one invalid enrolment and a

second enrolment where the commencement date was incorrectly reported).

Actual delivery in the April 2021 SDR was 0.1683 EFTS for $1,096 (GST exclusive). s9(2)(g)i)

16

Part Four: Audit Process Overview

Purpose of the audit

The purpose of the audit was to provide assurance that your organisation is complying with the

Education and Training Act 2020 and conditions imposed on your funding. This audit is part of our ongoing

monitoring of tertiary education organisations (TEOs).

This audit used a sample-based approach and reviewed a limited scope of the applicable funding conditions

and other requirements. As such, despite our best efforts, some non-compliance may remain undetected

and the audit does not provide complete assurance of historical, current or future compliance.

Non-detection of non-compliance does not make that practice compliant, and will not restrict the TEC from

taking action under the Education and Training Act 2020 or from recovering funding in the future if

non-compliance is later detected. Please refer to the audit guidelines for more information on the inherent

limitations of an audit.

Our audit focus wil be on assisting TEOs in achieving their objectives through wel -reasoned audits,

evaluations and analyses of the business viability and education outcomes for students.

Scope of the audit

TEC’s monitoring function is set out in section 409(1)(h) of the Education and Training Act 2020, which

provides that the TEC's functions are to "

monitor the performance of organisations that receive funding

from the Commission including by measuring performance against specified outcomes”.

The scope of the audit was aligned to the performance commitments in the Investment Plan and the

associated funding obligations between the TEC and your organisation. The scope was outlined in the audit

arrangements letter. TEC Audit Guidelines were also provided to help you understand how TEC undertakes

audits and what to expect during the audit.

The scope of the audit was outlined in the audit arrangements letter. This included the fol owing:

> Your current registration and accreditation status for funding eligibility

> Your organisation’s systems and processes for reporting student data through the Single Data Return,

including reporting enrolments, student achievement and withdrawals

> Compliance with your funding conditions for each fund:

- Student Achievement Component – Provision at Level 3 and above

- Fees-free funding

> Compliance with the Annual Maximum Fee Movement policy relating to fees and course costs

> The refund of any fees that have been overcharged (if applicable)

> Compliance with the Compulsory Student Services Fee (if applicable)

> Whether your organisation has offered any inducements or benefits to students

> Responsibility for any subcontracting requirements

> Your programmes and qualifications

> Your organisation’s process for maintaining student records as required by clause 13(1) of Schedule 18

of the Education and Training Act 2020 (for on-plan funding under section 425), and 25(1) of Schedule

18 (for off-plan funding under section 428).

17