Wellington City

Parking and Retail Spend

Dec 2021 analysis

Terms of Reference

• Thorndon

• Retail spend/parking (night, day, week, W/E)

• CBD

• Retail spend/parking (night, day, week, W/E)

• Clifton car-park

• Occupancy (Week and W/E)

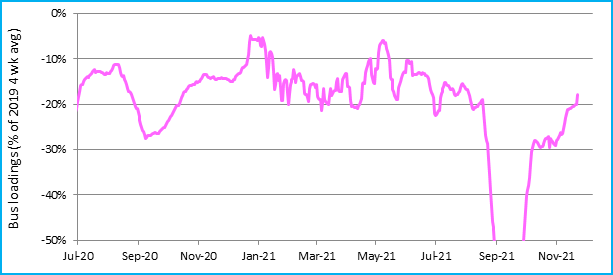

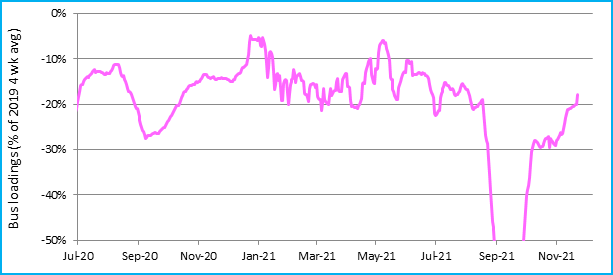

Context

Public transport use

Z

e: GW

urc

So

• COVID-19 Lockdowns and health sensitivity

• High % are persistently working from home

Parking

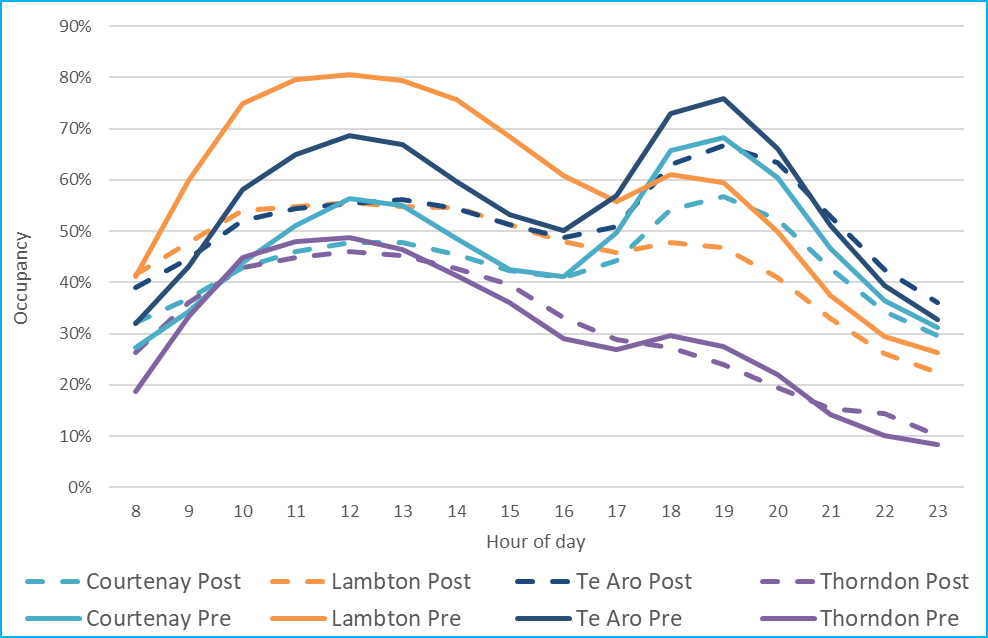

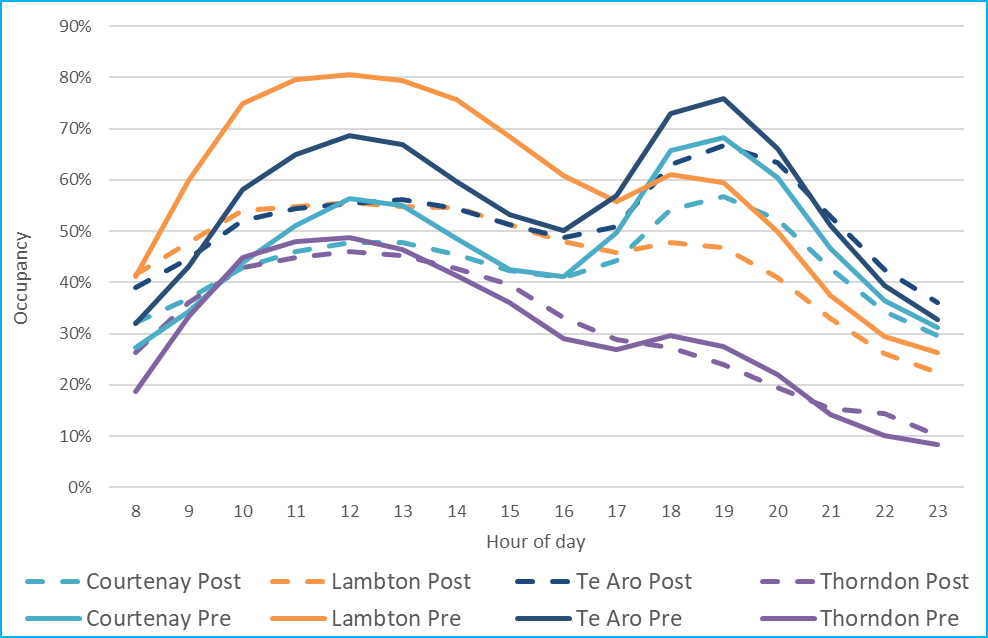

Occupancy: Pre vs Post tariff increase

• Background

• Compares July/Aug 2020(Pre)

with Jul/Aug 2021 (Post)

• Lambton and Thorndon are

mid-morning intensive

• Te Aro and Courtenay are

afternoon intensive

• Change in occupancy

• Thorndon grows!

• Rest decline by 15%-5%

• Lambton has the largest decline

Source: WCC

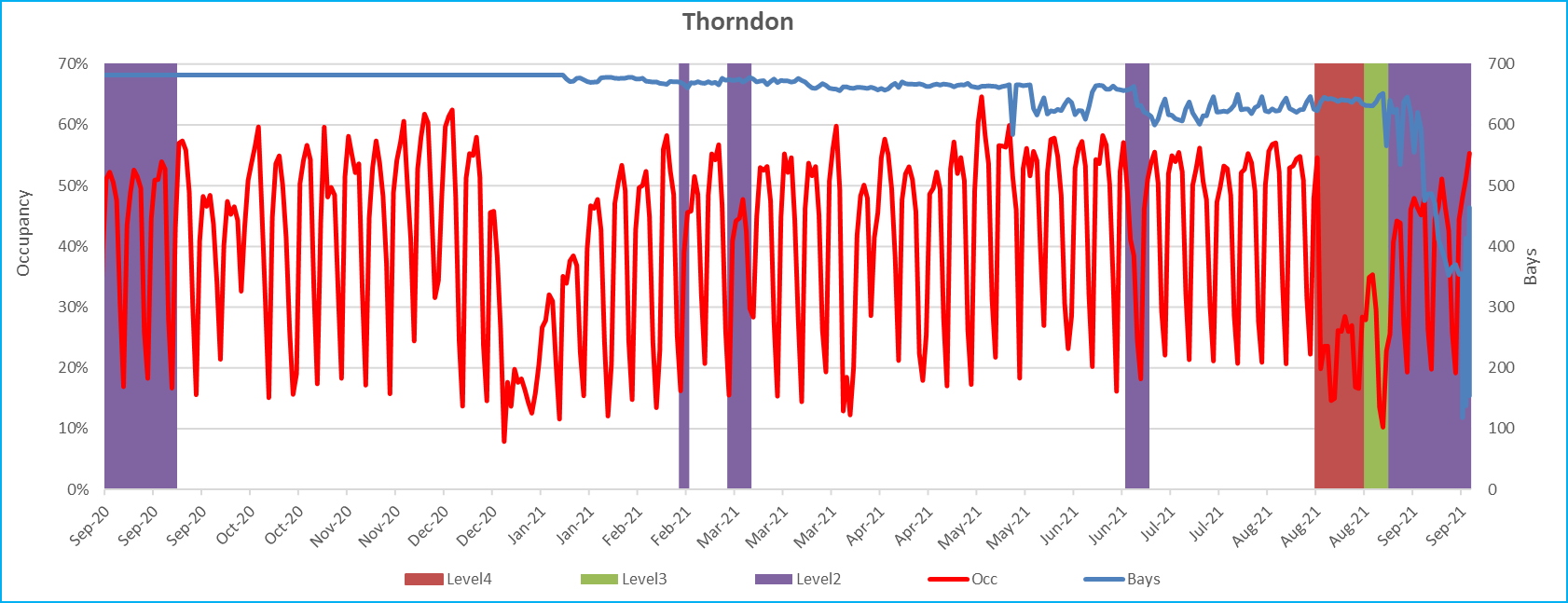

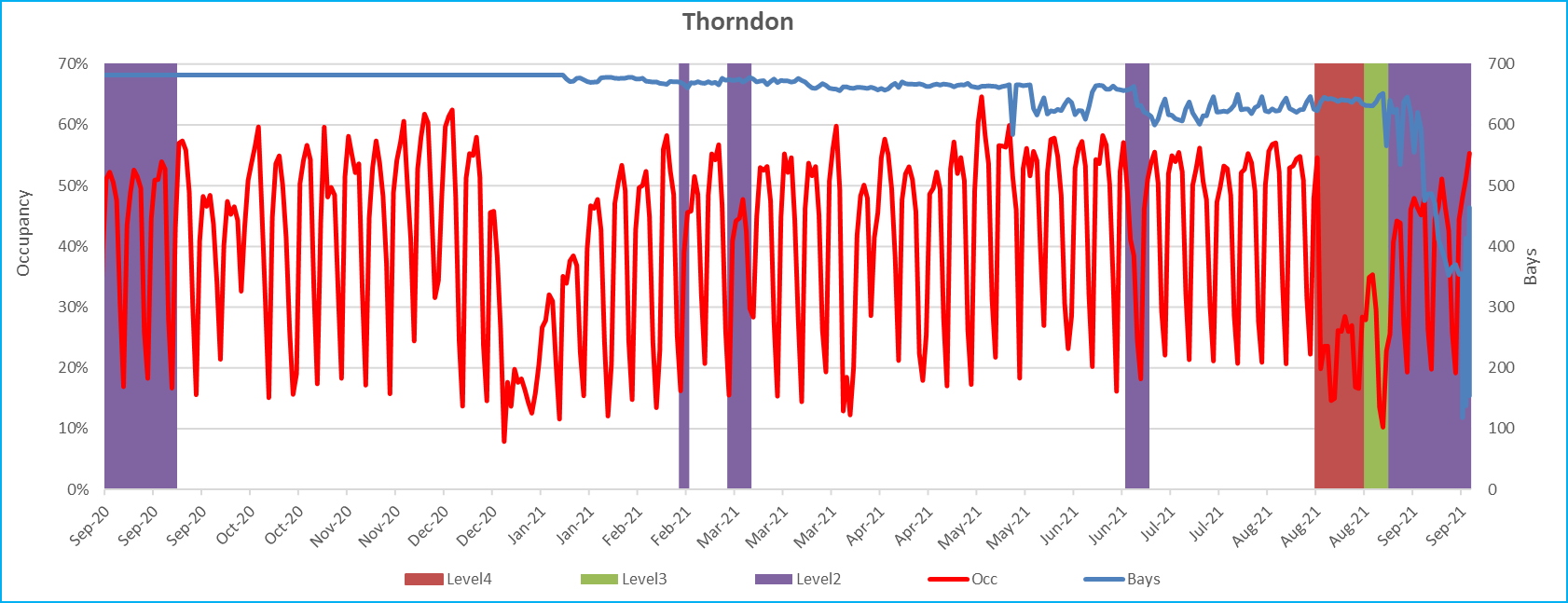

Thorndon

C

C

W

ce:

Sour

• Low occupancy (especially at W/E)

• No decline post July

Thorndon loss of bays

C

C

W

ce:

Sour

• Stable occupancy July to Aug

• NOTE: Loss of bays (-15%) in Sep PLUS increase in occupancy

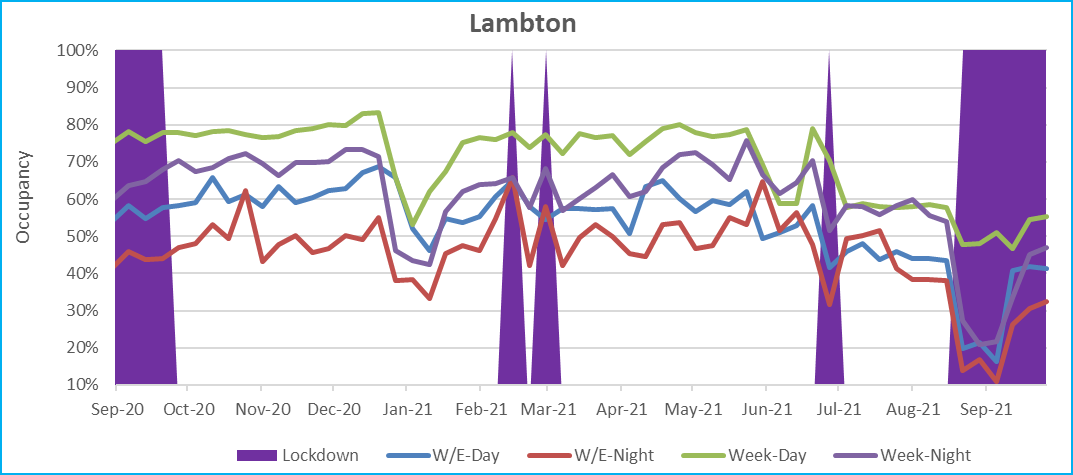

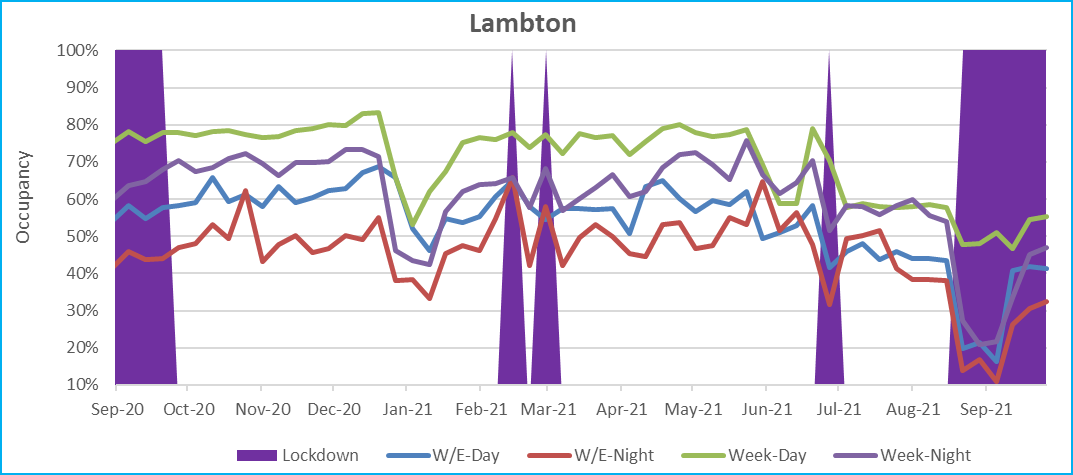

Lambton

C

C

W

ce:

Sour

• High occupancy in day

• Dramatic decline post July

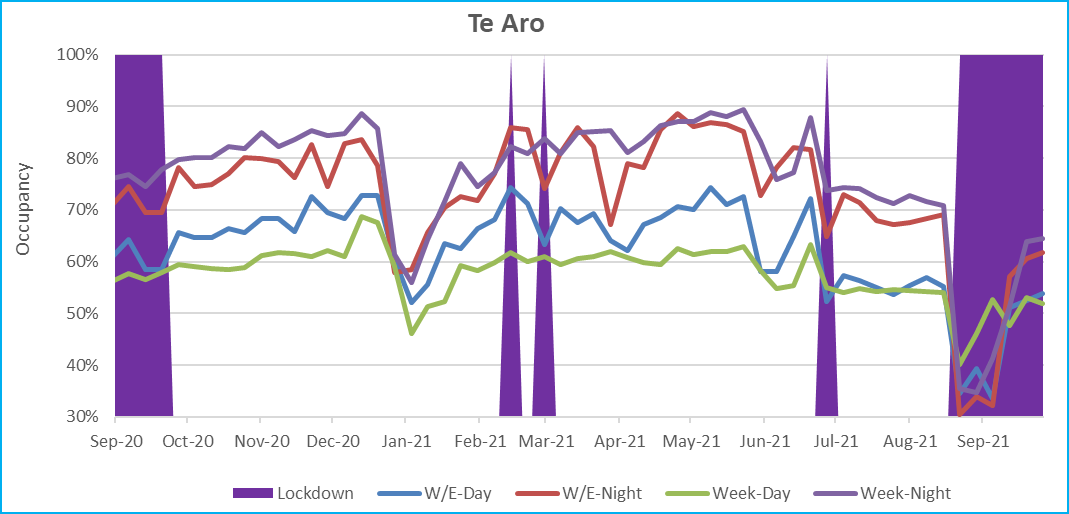

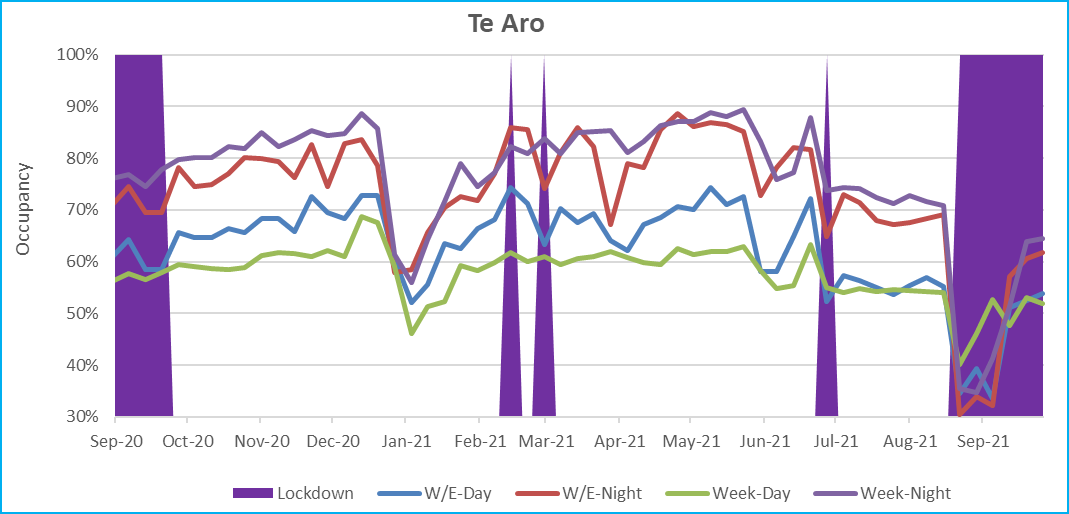

Te Aro

C

C

W

ce:

Sour

• High occupancy in day and night

• Dramatic decline post July

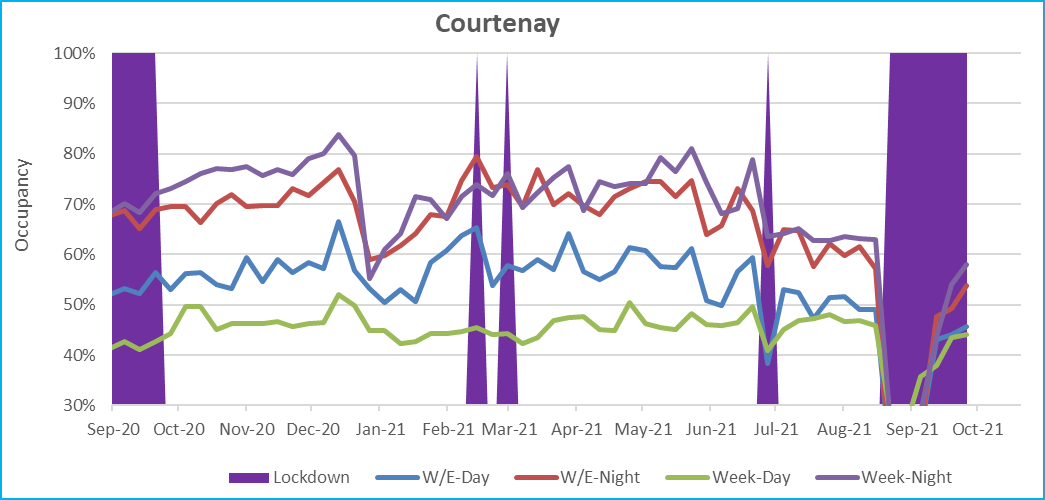

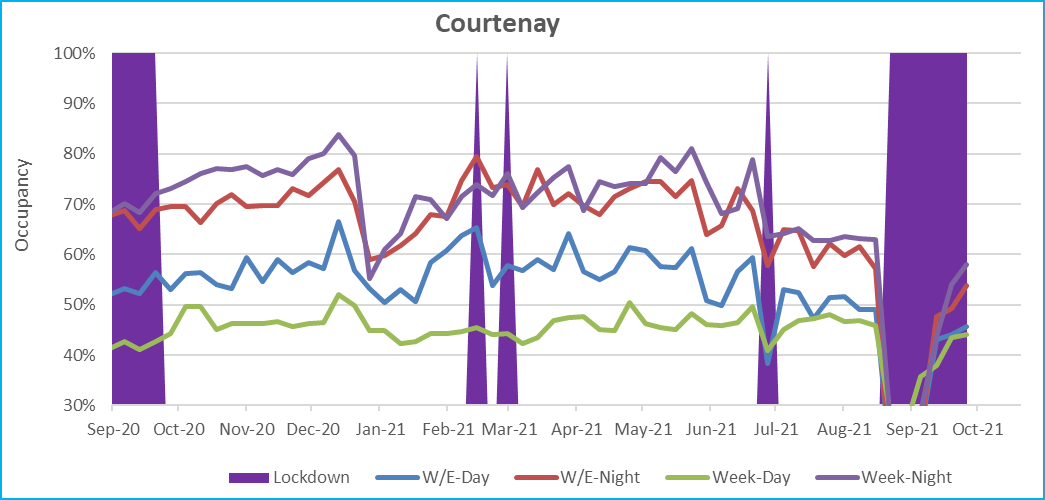

Courtenay

C

C

W

ce:

Sour

• High occupancy at night (week and W/E)

• Dramatic decline post July

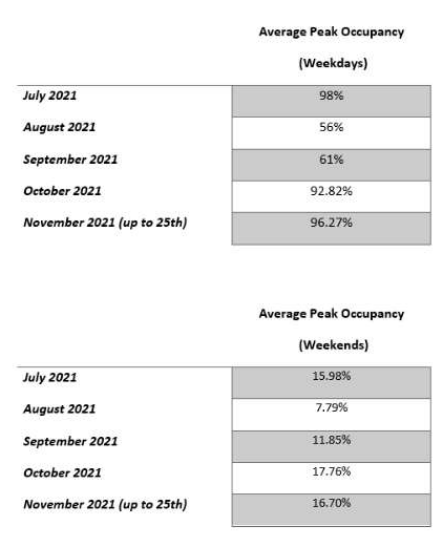

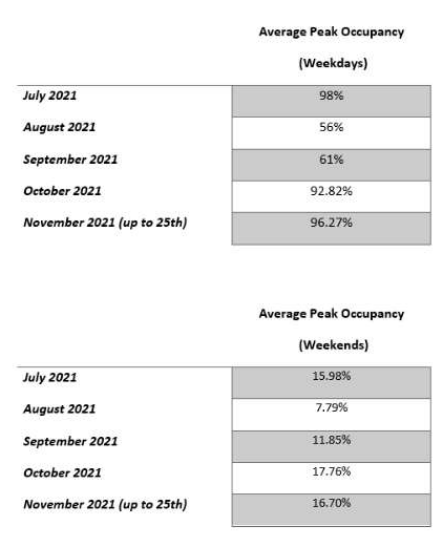

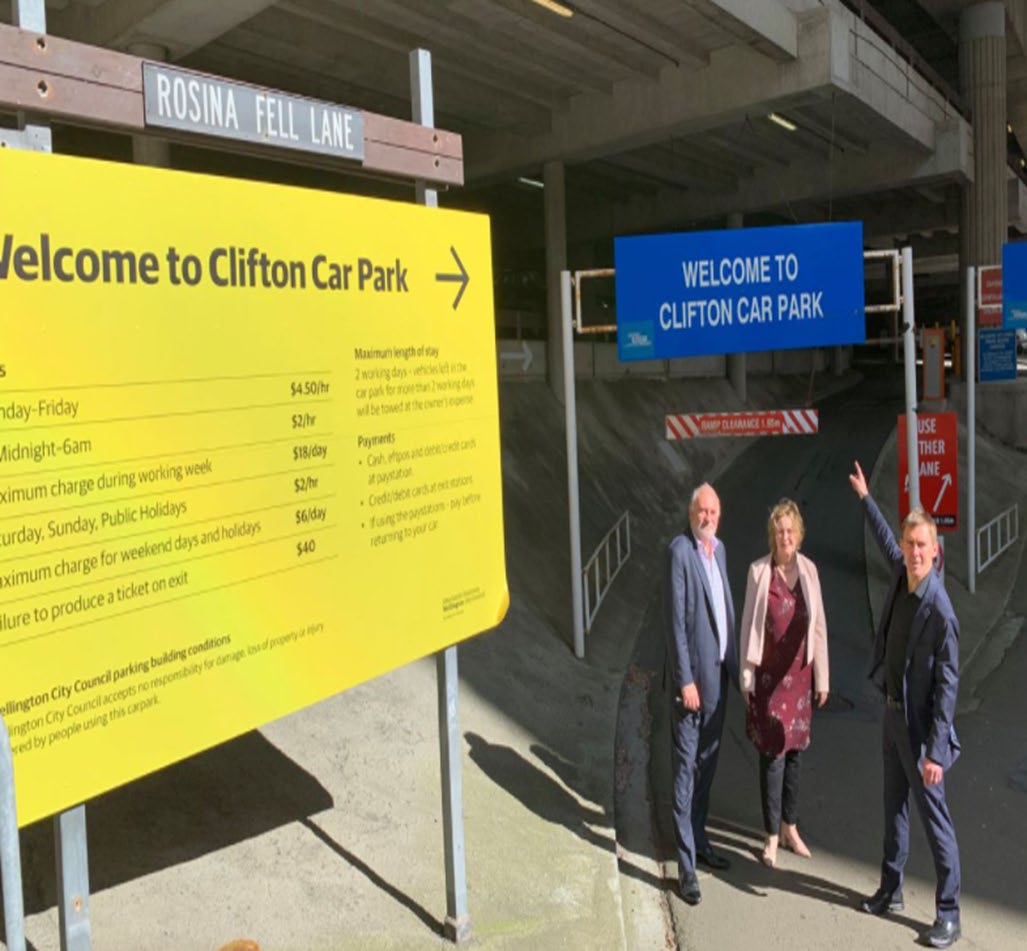

Clifton carpark

C

C

W

ce:

Sour

• Week:

Full (95%+ post-Lockdown)

• W/E:

Underutilised (16%)

Parking summary

• Context

• City wide car-parks:

• 3,200 (approximately) WCC control ed carparks

• 23,000 total car-parks (private + public)

• Public parking charges increased:

• 50c/hour for al tariffs on July 5th 2021 (i.e. 20% increase during W/E)

• Weekend hours went from 8am-6pm to 8am to 8pm

• Observed trends

• CBD occupancy dropped approximately 15% post-tariff change

• Thorndon

• 2% increase in occupancy post-tariff change

• Reduction in bays increases occupancy in Sep+ 2021

• Lockdown delays expected ‘recovery’ after tariff increase

• There is anecdotal evidence that occupancy drops as tariffs are increased, but then return to normal after

around 6 weeks

Retail and Hospitality

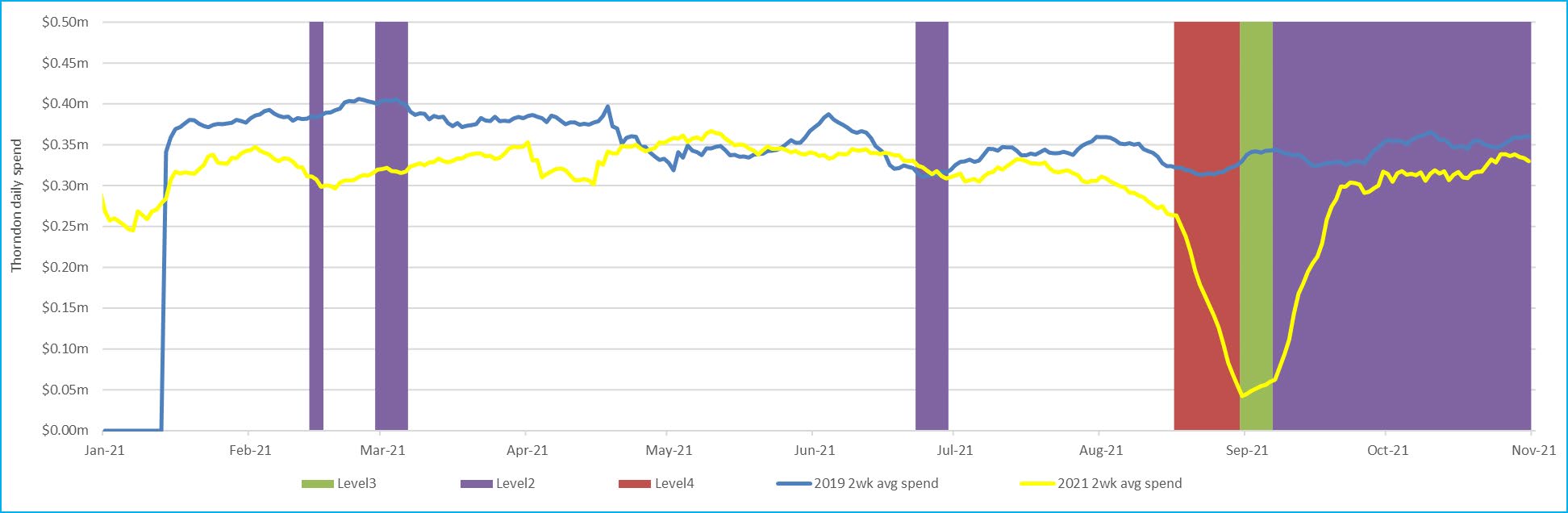

Thorndon: spend by day (8am-6pm)

View

ket

ar

M

ce:

Sour

• Spend is $0.35m average

• Trend: declines Jul/Aug but recovers in Oct (despite changes to parking)

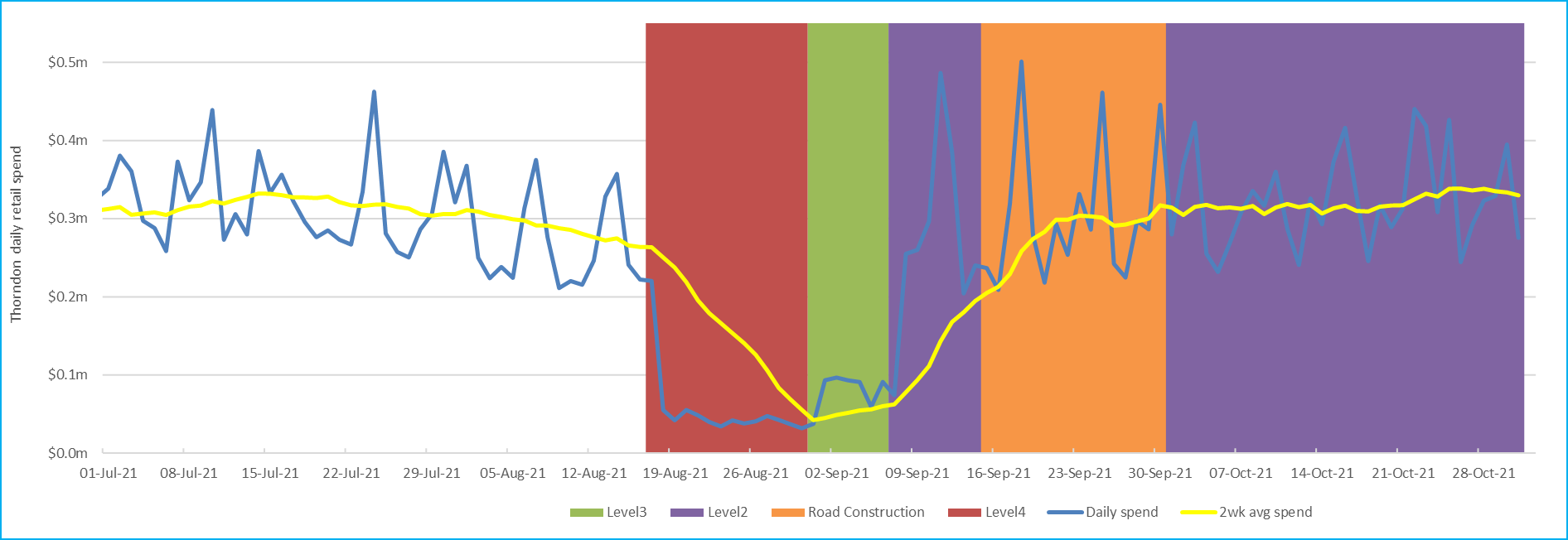

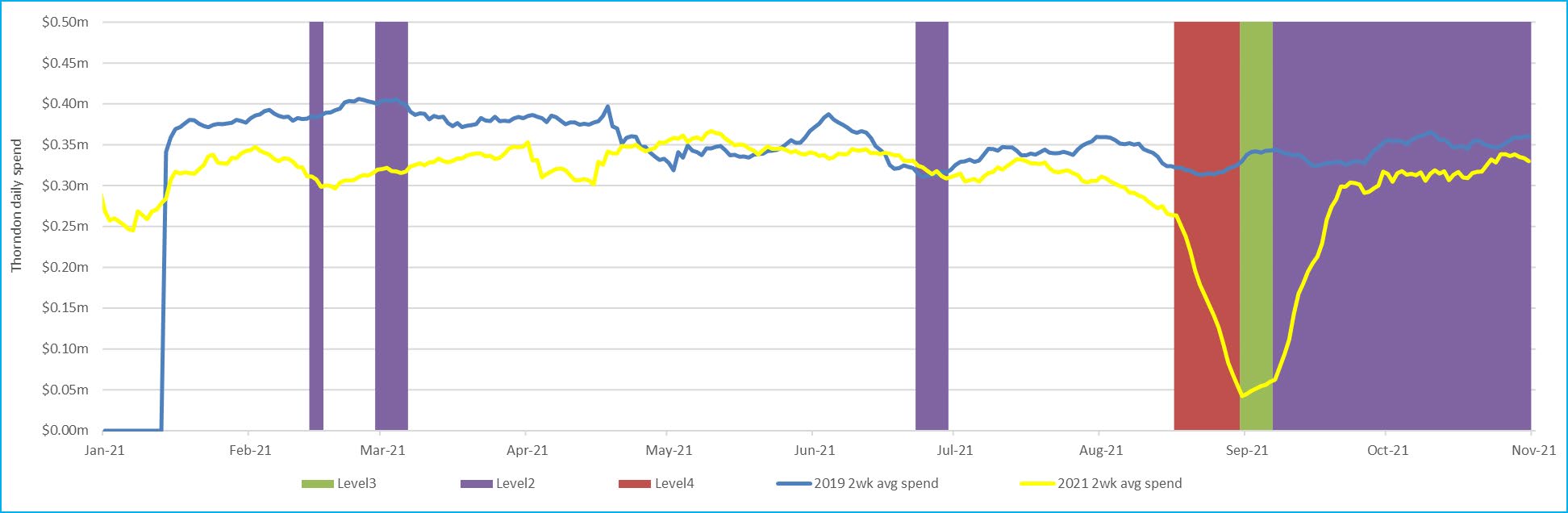

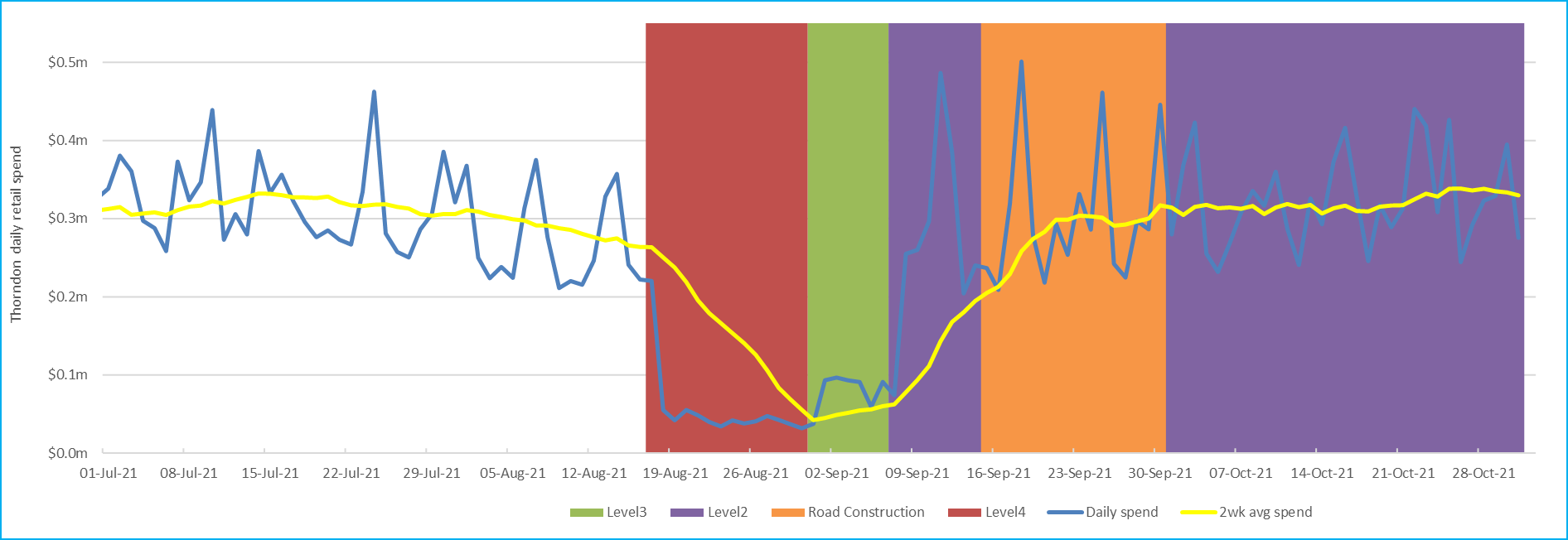

Thorndon: spend by day (8am-6pm) detail

View

ket

ar

M

ce:

Sour

• Road construction to convert angle bays to parallel

• Bounce in spend post-Level4/3 lockdown

• Consistent with home/hardware nature of merchants (consumer travel budget being spent on home improvements)

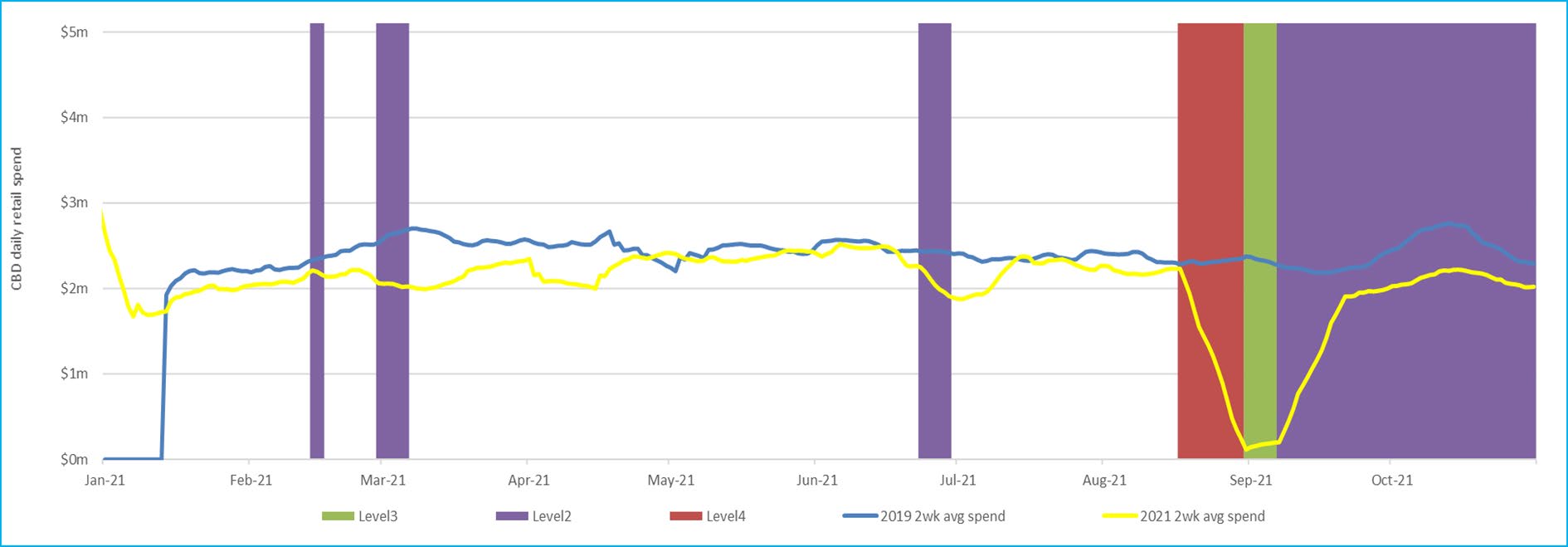

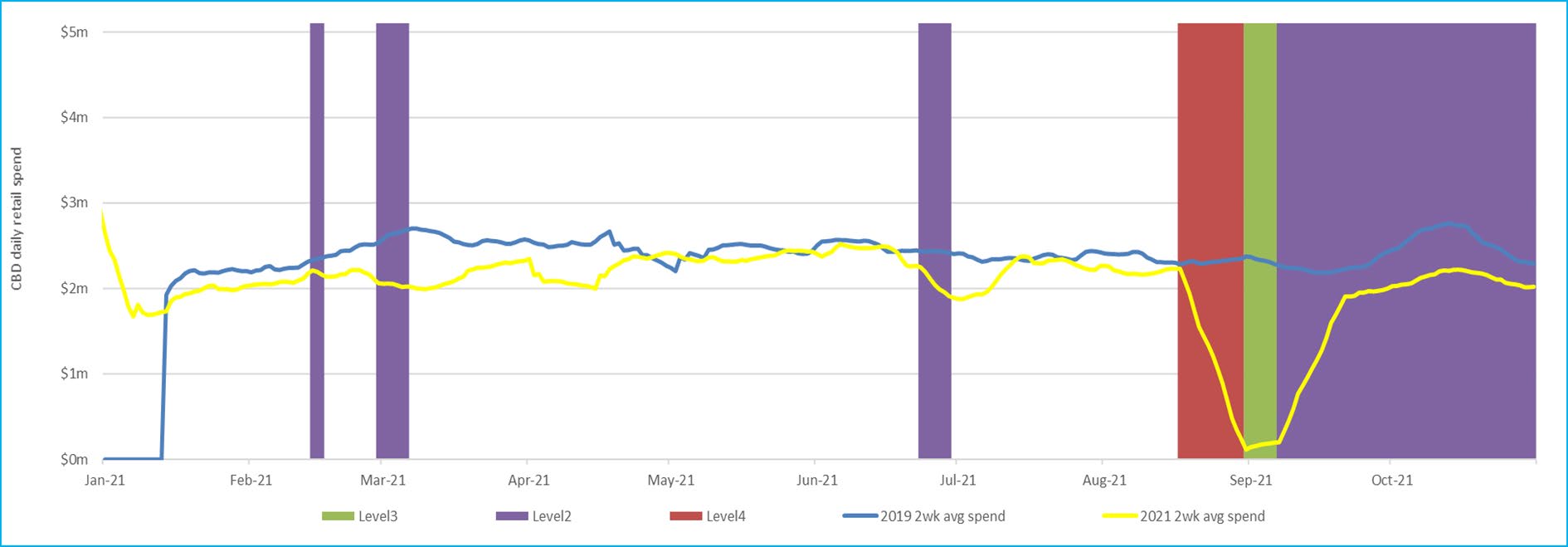

CBD: spend by day (8am-6pm)

View

ket

ar

M

ce:

Sour

• Daily spend of $2.5m

• Trend: post-lockdown not quite recovered (WfH + lockdown anxiety?)

CBD: spend by night (6pm-10pm)

View

ket

ar

M

ce:

Sour

• Daily spend of $0.6m average

• Trend: similar to day spend

Retail summary

• Retail+hospo excludes groceries and fuel

• Recovering to 2019 levels prior to latest lockdown

• Change in spend brought on by

• COVID-19 lockdown

• Working from Home (WfH)

• CBD foot-fal down by 15%+

• But spend is not down by the same factor

• Online spend increase

• Increases in apparel and groceries by approximately 10%

• Parking is a small cost in the overall CBD Experience

• I.e. the average merchant spend is $40 per transaction

• The typical consumer has many transactions in their visit

CBD parking and retail (final thoughts)

• Working from Home

• Likely to be persistent

• Likely to reduce demand for parking and to some extent CBD spend for retail/hospo

• Parking occupancy

• Lockdown: has had a significant impact

• Tariff changes: too early to tell the long-term impact due to COVID-19

Document Outline