Cabinet Office

CO (19) 1

Cabinet Office

CO (19) 1

(updated 29 January 2020)

Circular

17 June 2019

Intended for

All Ministers

All Chief Executives

Copies to

All Senior Private Secretaries

All Private Secretaries

Revised Fees Framework for members appointed to bodies in which the

Crown has an interest

This circular has been updated to include minor amendments.

1

Cabinet has recently approved a modified Fees Framework for d termining or reassessing

the fees paid to members of statutory and other bodies in which the Crown has an interest

[APH-18-MIN-0271].

under the

2

This circular and the attached Framework will take ef ect from 1 July 2019, replacing

Cabinet Office Circular CO (12) 6.

3

The modified Framework covers all statutory bodies, non-statutory bodies and committees

in which the Crown has an interest, that are outside the Remuneration Authority’s or other

fee-setting bodies’ jurisdiction. The Framework therefore covers most Crown entities

(including Crown Agen s, Autonomous Crown Entities (ACEs) and tertiary education

institutions), trust boards, advisory bodies and committees, Royal Commissions, Public

Inquiries, Government Inquiries and Ministerial Inquiries, statutory tribunals, individuals

appointed as statutory bodies that are not covered by the Remuneration Authority and

some subsidiary bodies.

Released

4

The Framework provides guidance on the classification and remuneration of statutory and

other Crown bodies. Since the Framework covers a varied array of bodies, it is not

intended to be presc iptive, and judgement will be required to determine best fit.

5

The purpose of the Framework is to provide a basis for judgement in setting fees that will:

ensure a consistent approach to remuneration across all statutory and other Crown

bodies;

Official Information Act 1982

contain expenditure of public funds within reasonable limits;

provide flexibility within clear criteria.

6

The main changes to the previous Framework are:

a new category for Audit and Risk Committees;

a modest increase to the fee ranges for Groups 2, 3 and 4 bodies;

284308v1

1

for chief executive or governance board established bodies, the chief executive or

governance board of the agency may agree to fee increases of up to 3 per cent,

within the applicable fee range and not more frequently than once a year;

the responsible Minister may agree to fee increases of up to 5 per cent, within the

applicable fee range and not more frequently than once a year, without referral to the

Minister of State Services or the Cabinet Appointments and Honours Committee and

Cabinet;

the Minister of State Services may agree to fee increases of up to 10 per cent within

the applicable fee range and not more frequently than once a year, without referral to

the Cabinet Appointments and Honours Committee and Cabinet;

a new section clarifying that Cabinet may agree standing exceptions to the Cabinet

Fees Framework;

expanding the purpose statement to reflect the importance of diversity of board

members;

updating the sections on taxation, allowances and expenses and public servants

serving on Crown bodies;

adding a new glossary of terms and an additional flow chart.

7

Ministers and chief executives should ensure that all staff involved in appointments to

bodies covered by the Framework are familiar with the requirements of this circular.

under the

Further information

8

For advice on the application and interpretati n of the Fees Framework, contact the State

Services Commission, email: [email address] or phone (04) 495 6600.

9

For advice on taxation on fees, contact Mark Murphy, Team Lead, Significant Enterprises,

email: [email address] or phone (04) 890 3079.

Released

Michael Webster

Secretary of the Cabinet

Enquiries:

State Se vices Commission, ph 04 495 6600

Official Information Act 1982

APH Secretary, Cabinet Office, ph 04 830 5020

284308v1

2

Table of Contents

Page

Executive summary

5

Section A: Coverage by the Framework

7

Bodies covered by the Framework ........................................................................................... 7

Exclusions ................................................................................................................................ 8

Consultancies ....................................................................................................................... 8

Other exclusions ................................................................................................................... 8

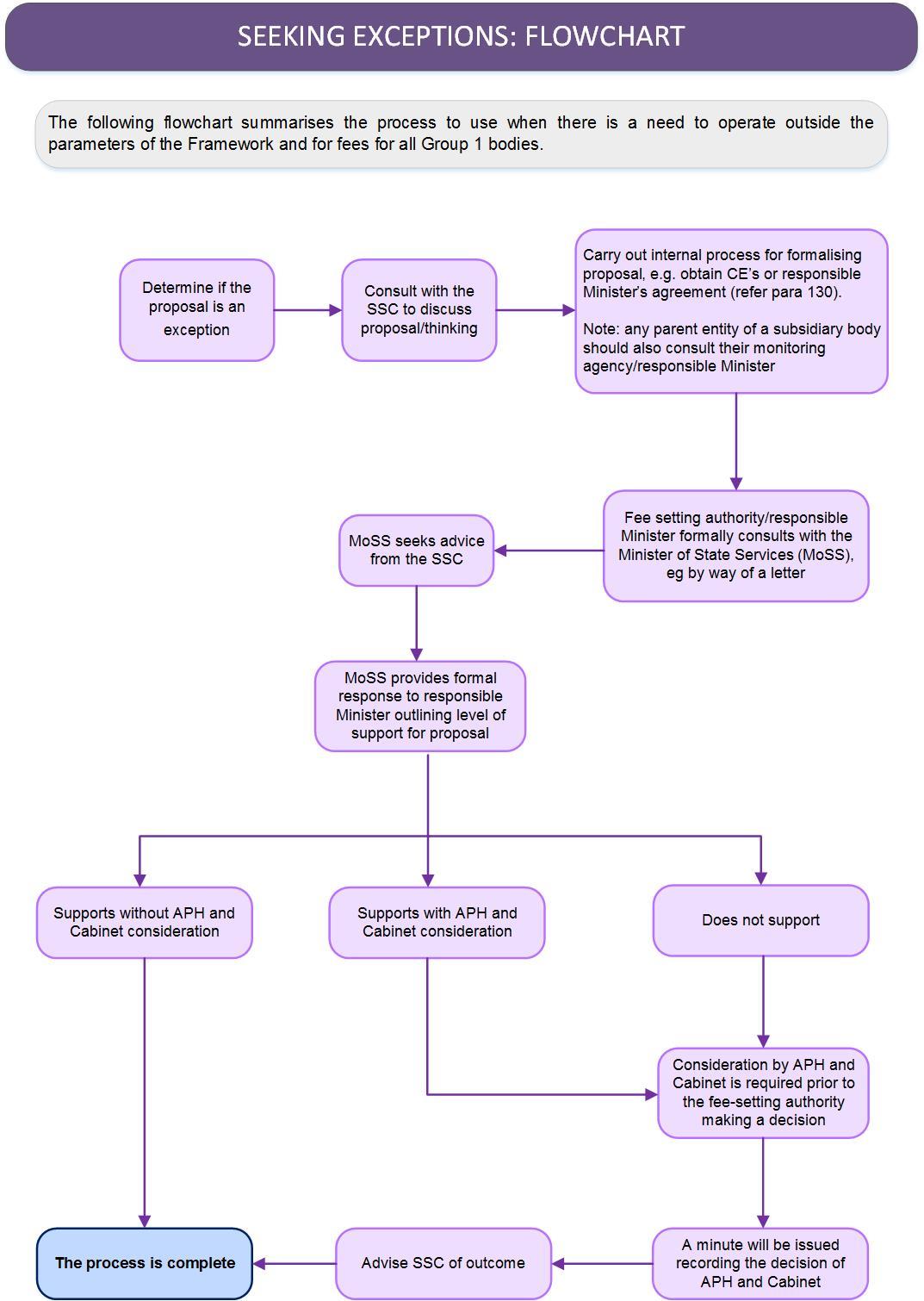

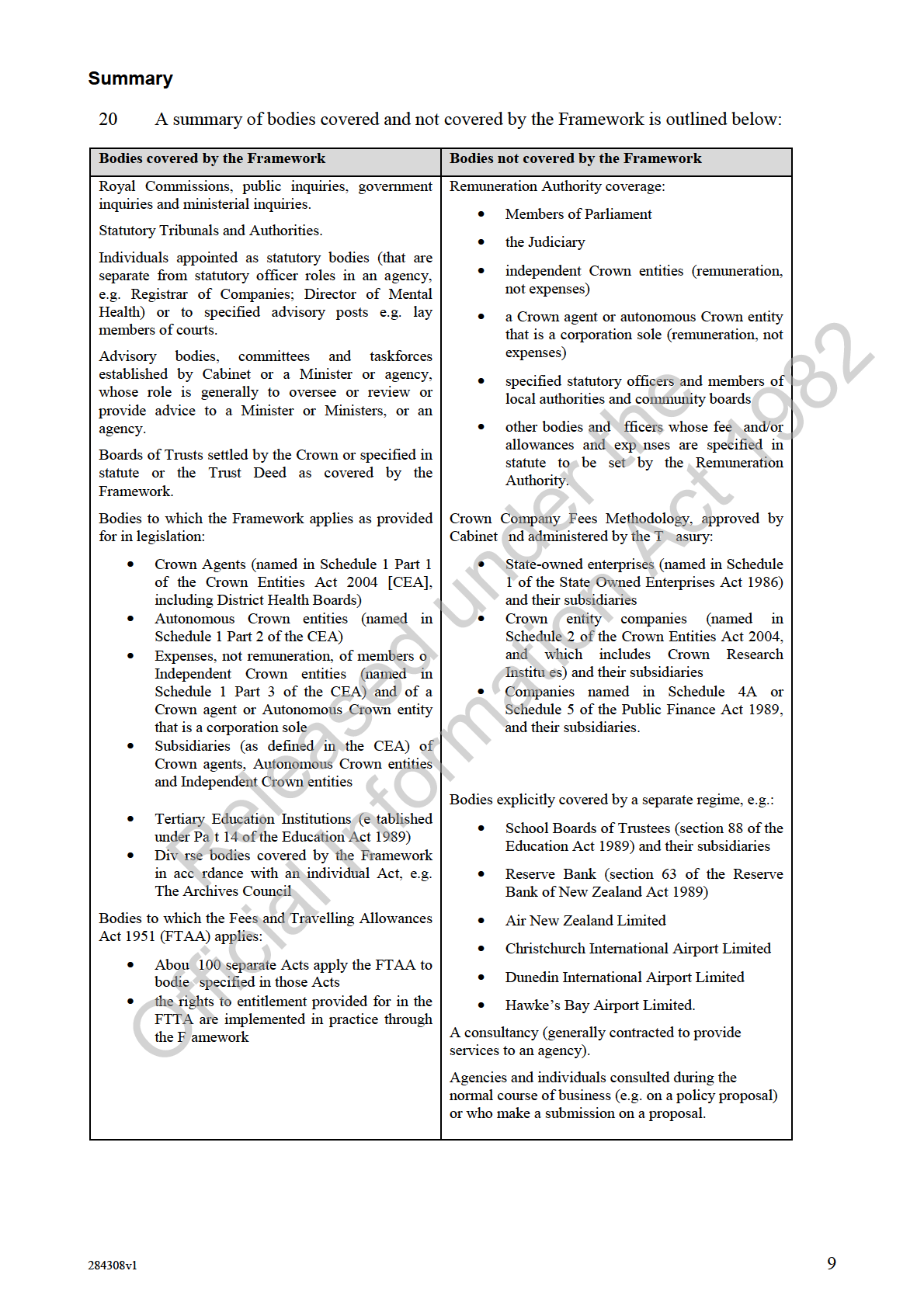

Summary .................................................................................................................................. 9

Section B: Process for setting or reviewing fees

10

Section C: Guidance about fees

12

Who sets the fees........................................................................................ . ... .............. .... 12

Factors to be considered in setting or receiving fees ......................... ...... ............... ........ 12

Payment basis ..................................................................................... .... ......................... .. 13

Annual rate ............................................................................ .......................... ............... 13

Daily rate .................................................................. ....

... .................... ...... .............. 14

Other fee payment methods/other types of payments . ...... ................... ... ... ................... 15

Rates for sub-committees .................................... ..... ............................ .......................... 15

Independent members of sub-committees .... ...... ........................ ...... ............................... 16

under the

Rates for deputy chairs and sub-committee chairs ........... ..... ...... ....................................... 16

One person committees ....................... ..... ................. . .... ............................................. 16

Payments to public sector employ es appointed to bodies covered by the Framework ........ 17

Appointments to bodies covered by the Framework ........................................................... 17

Appointments of public sector employees in their own right ................................................ 17

Payment for time spent in travel to meetings/sittings or on board business (daily fees only) 18

Childcare expenses ... ...................... ....

........................................................................... 18

Payment of a fee for a cancelled meeting/sitting ................................................................... 18

Payment for meetings by teleconference ............................................................................... 19

Released

Absence .......................

... .................................................................................................. 19

Reimbursing expenses. ... ..................................................................................................... 19

Section D: Classification of bodies and fee scales

20

Group 1: Royal Commissions, Public Inquiries, Government Inquiries and Ministerial

Inquiries ... ..... ...................................................................................................................... 20

Group 2: Statutory Tribunals and Authorities ........................................................................ 21

Official Information Act 1982

Group 3: Governance Boards ................................................................................................. 23

Group 3a: General Governance Boards (including TEIs and DHBs) ................................ 24

Group 3b: Subsidiary Bodies of Statutory Entities ............................................................ 27

Group 4: All Other Committees and Other Bodies ................................................................ 28

Audit and Risk Committees ............................................................................................... 30

284308v1

3

Section E: Operating outside the parameters of the Framework/exceptions to the

Framework

31

Standing exceptions ............................................................................................................... 34

Grandparenting of existing fees ............................................................................................. 34

Payment for consulting .......................................................................................................... 34

Section F: Reviewing existing fee levels

36

Section G: Other

37

Indemnity and insurance ........................................................................................................ 37

Employment status ................................................................................................................. 37

Tax on fees ............................................................................................................................. 37

Disclosure............................................................................................................................... 39

Fiscal implications .....................................................................................

.... ............. .... 39

Cabinet committee submissions .................................................... .. . ...... .............. ....... 39

Further information .............................................................................. ............................ . 39

Glossary of Terms

40

under the

Released

Official Information Act 1982

284308v1

4

Executive summary

1

The Cabinet Fees Framework (the Framework) should be used:

before an appointment is submitted to the Cabinet Appointments and Honours

Committee (APH);

when a new body or committee is being established;

if there is a proposed significant change in board duties;

when the classification of the body or the current fees are being reviewed; and

for guidance about the administration of fees and other reimbursement payments for

bodies covered by the Framework.

2

The purpose of the Framework is to provide a basis for judgement in setting fees that will:

ensure a consistent approach to remuneration across all statutory and other Crown

bodies;

support the appointment of appropriately qualified and diverse body members;

contain expenditure of public funds within reasonable limits; and

provide flexibility within clear criteria.

under the

3

The Framework enables fees to be determined by Ministers and other fee-setting

authorities who are most familiar with the work of particular bodies. It provides for:

responsibility for setting fees for statutory and other bodies in which the Crown has

an interest, within clearly defined parameters, to rest with the responsible Ministers

or another fee-set ing authority;

a system for the classif cat on of bodies for fee-setting or reviewing purposes

(section D);

a range of fee levels for each category of body (section D);

Released

a process for setting and reviewing fees, and for proposing fees outside the

Framework (s ctions B, E and F);

an outlin of administrative principles to be followed in applying the Framework

sections C and G);

4

The role of the State Services Commission (SSC) includes:

Official Information Act 1982

administering the Framework;

conducting surveys of fee levels and other information to inform an annual report to

Cabinet;

conducting regular reviews of the Framework and recommending changes for

consideration by Cabinet;

advising the Minister of State Services about exceptions to the Framework;

284308v1

5

advising agencies about any aspects of the Framework; and

assisting in the interpretation and application of the Framework if required.

5

Agencies apply the Framework in making recommendations and/or setting fees for body

members.

6

Agencies are strongly advised to consult the SSC on any fee matter (such as an exception)

that the responsible Minister will need to refer to the Minister of State Services, before

formally submitting this to the responsible Minister. SSC can advise on precedents and the

information required to support the recommendation.

7

Please refer to the summary flow charts in section B for setting or reviewing fees and, if

required, in section E for seeking an exception to the Framework.

8

The Framework should be read in conjunction with the:

Board Appointments and Induction Guidelines

CabGuide: The appointments process, and

relevant Cabinet circulars:

CO (02) 5: Appointments of Public Servants to Statutory Boards

CO (02) 16: Government Appointments: Increasing Diversity of Board

Membership

under the

CO (11) 7: Role of the Remuneration Authority in Setting Remuneration for

Individuals appointed to Statutory Bodies and Other Positions).

Released

Official Information Act 1982

284308v1

6

Section A: Coverage by the Framework

Bodies covered by the Framework

9

The Framework is one of three fee setting mechanisms for statutory and other “bodies in

which the Crown has an interest”. A broad array of agencies and individual officers come

within this scope, as indicated in the table below. The term “bodies in which the Crown

has an interest” is used in several Acts to apply the Framework to a body or bodies named

in the Act, but the term is not defined. It is understood generally to:

be broader than ‘government agency’ if that term is synonymous with agencies that

operate within the executive branch of government, or that operate as instruments

under direct or indirect Ministerial control or direction, or where the body or

individual is appointed by a Minister or an agency;

encompass certain bodies and individuals in the judicial branch of government;

include bodies and individuals that carry out some aspect of the business or

responsibilities of central government, or that scrutinise or investigate or assist the

agencies that do so directly;

An element of judgement is needed in particular cases to determine whether or not a body

fits within the scope of the Framework;

10

The Framework complements the fee-setting role of the Remuneration Authority (under

the Remuneration Authority Act 1977) and the Crown Company Fees Methodology

under the

administered by The Treasury. The Framework is used to set the fees for government-

related bodies and their subsidiaries that are outside the jurisdiction of the Remuneration

Authority, the Treasury, or a separate fee mechanism such as applies to School Boards of

Trustees (where the Minister set the fees under the Education Act 1989) and local

authorities (where the Remuneration Authority sets the fees under the Local Government

Act 2002).

11

Consultation w th the Minister of State Services should take place about fees when

trans-Tasman bodies have been established, as specific provisions may apply to such

bodies that override the general application of the Framework.

12

Establishment by statute is not the only criterion for coverage by the Framework, nor is it a

Released

necessary requirem nt that there be a responsible Minister. It should also be noted that the

Framework covers bodies that are self-funded, where a responsible Minister appoints some

or all of the members. The Minister should apply the Framework in circumstances where

the body has the responsibility for setting fees and the Minister approves them.

Official Information Act 1982

284308v1

7

Exclusions

Consultancies

13

The Framework does not cover individual consultancies that would fall outside any of the

categories listed in section D, paragraph 95. Such individual consultancies involve

contractors appointed by a body in which the Crown has an interest under a contract for

services for a specific project, usually within a specified timeframe.

14

In general, the key distinctions between a consultancy and a body covered by the

Framework are that a consultancy has:

defined deliverables for a finite period of time;

no ownership or governance in relation to the implementation and operation of the

deliverables of the project.

15

It is possible, however, that in some cases there may be a judg ment involved between

using a consultancy on the one hand, or using a body referred to under paragraph 95,

Group 4 (All Other Committees and Bodies), notably an advisory committee.

16

Where agencies are unclear about whether an advisory committee or other Group 4 body

would be more appropriate than a consultancy, particularly in cases of high public profile,

they are encouraged to contact the SSC for advice in the first instance and then refer the

issue to the responsible Minister and Minister of State Services. Where a Group 4 body is

appointed, its remuneration would be set und r the Framework

under the

17

Refer to paragraph 148 regarding payments to body members where it is proposed that

they also receive payments as consultants to the same body.

Other exclusions

18

The Framework is not used for bodies where the fees are set by the Remuneration

Authority, for School Boards of Trustees, or for local authorities, where the fees are set

using a separate mechanism.

19

Fees for directors of Crown entity companies and State Owned Enterprises are subject to

separat guidance from th Crown Company Fees Methodology.

Released

Official Information Act 1982

284308v1

8

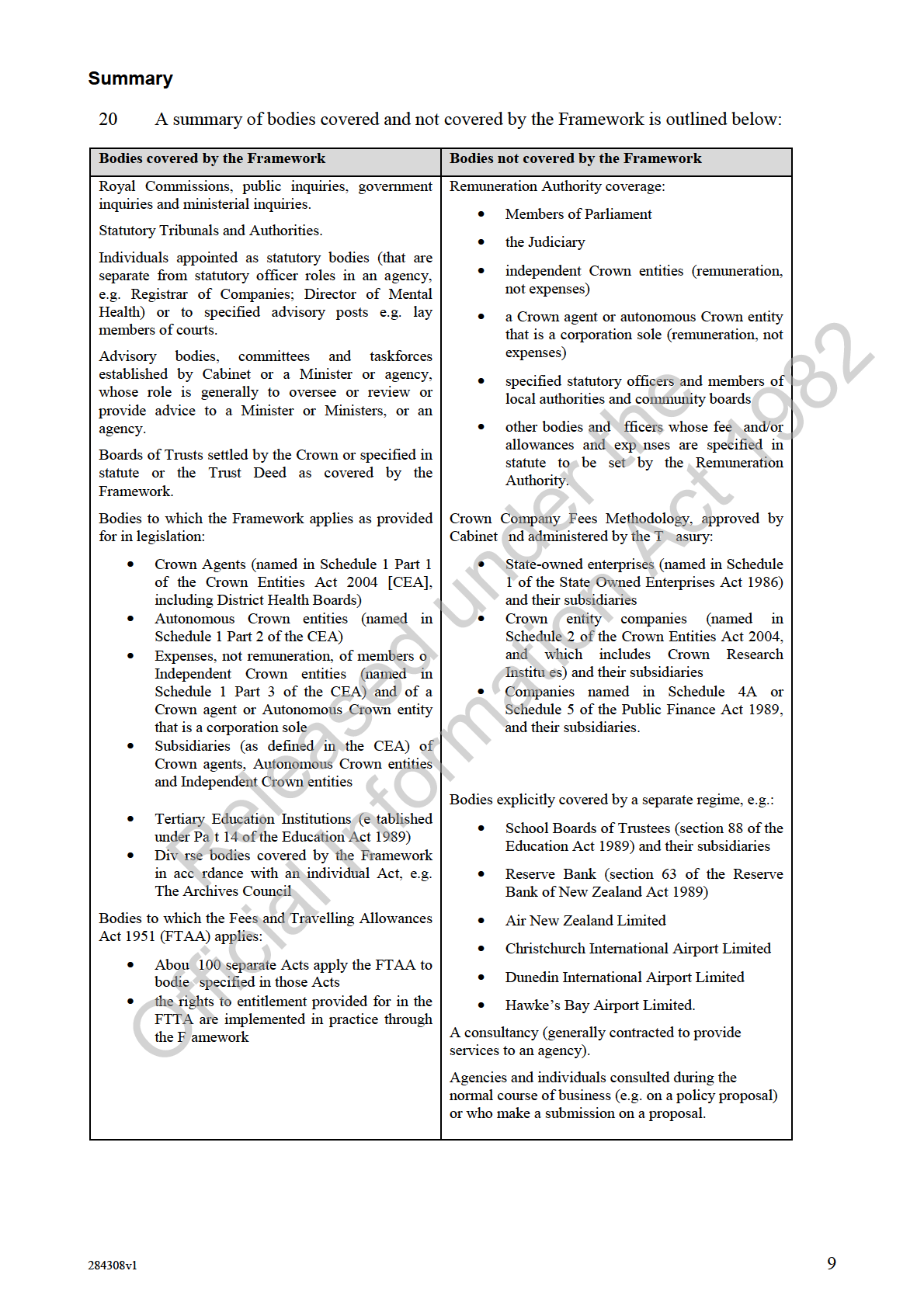

Section B: Process for setting or reviewing fees

21

The steps to be taken in order to set or review fees under the Framework are:

Determine whether the body is covered by the Framework (see section A);

Decide or re-assess which group the body fits into (see section D);

Determine which level within the group is most appropriate by “scoring” the body

according to the factors listed (see section D);

Decide on the appropriate fee (see section D) referring particularly to paragraph 30

regarding factors to be considered in setting fees;

If the fee is being set for the first time, the fee setting authority approves the fee

within the applicable Framework fee range (note section F regarding reviewing fees),

and within other guidance contained in the Framework If the fee-setting authority

wishes to set the fee outside the Framework, an exception must be sought, unless a

standing exception has been approved. Please refer to section E for guidance on

setting fees outside the Framework;

If the fee is being reviewed (note section F regarding reviewing fees), the chief

executive or governance board of the agency, may agree to fee increases of up to 3%

per cent, within the applicable fee range and not more frequently than once a year,

for bodies they have established; under the

For all bodies, the responsible Minister may approve increases of up to 5 percent

within the applicable Framework fee range not more frequently than once a year;

The Minister of State Services must be consulted on any increase above 5 percent

and may approve fee increases up to 10 percent, and minor and technical changes to

fees;

Any increase above 10 percent or that takes the fee above the applicable Framework

fee rang must be refer ed to APH and Cabinet for consideration;

For guidance on sett ng f es outside the Framework, please refer to section E;

Released

22

It is strongly recommended that when existing fees are being reviewed, the above steps be

undertaken to re-assess the classification and level of the body;

23

Note that fees should be increased no more frequently than once a year;

24

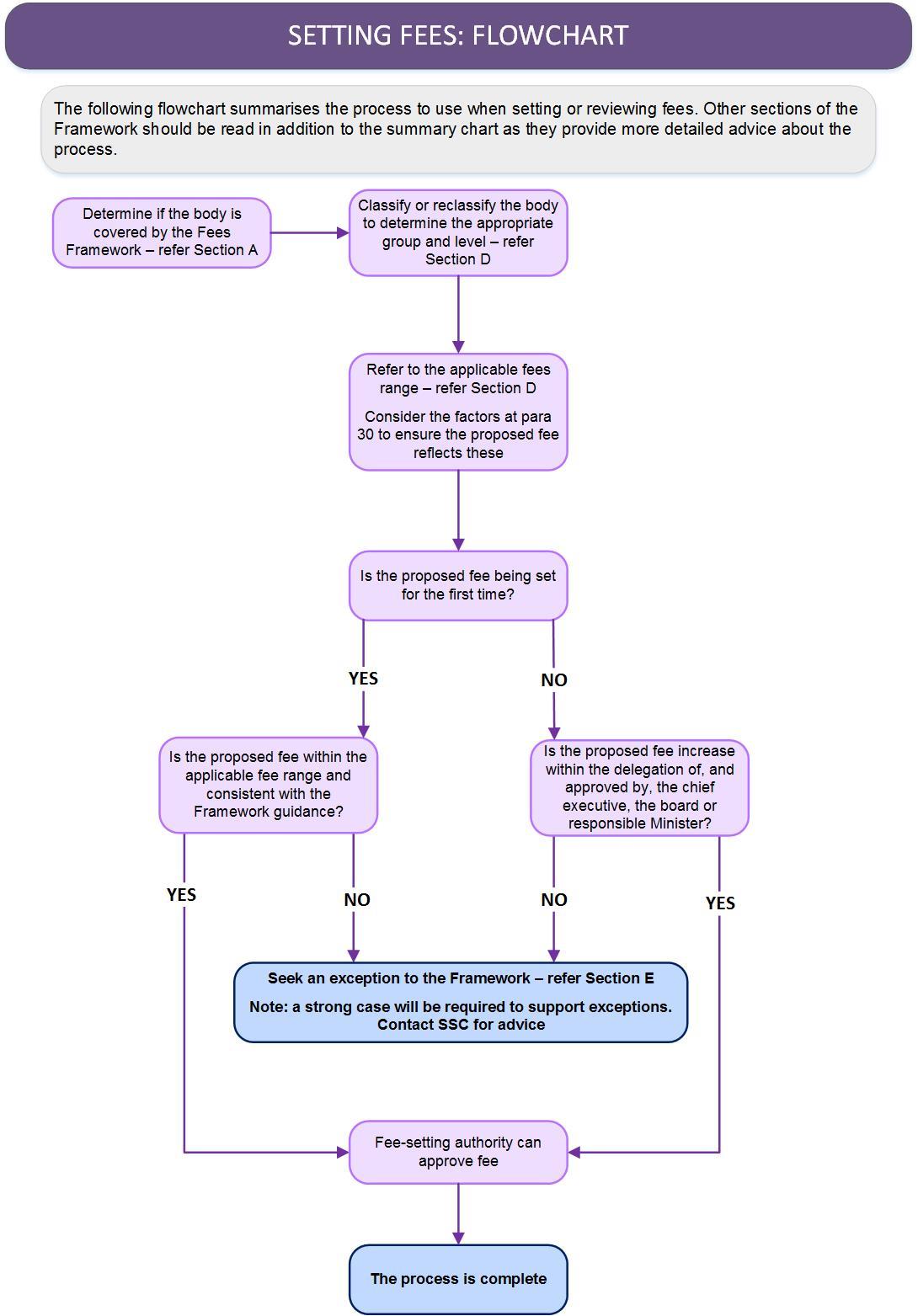

The following flow chart summarises the process to use when setting or reviewing fees.

Other sections of the Framework should be read in addition to the summary chart as they

provide more detailed advice about the process the fee setting authority should follow

when setting or reviewing fees:

Official Information Act 1982

284308v1

10

under the

Released

Official Information Act 1982

284308v1

11

Section C: Guidance about fees

Who sets the fees

25

The fee setting authority is the position or organisation that has the authority to establish a

body covered by the Framework. This may be set in legislation.

26

In many cases, responsible Ministers set fees within the applicable framework range,

except for subsidiary bodies of statutory entities and bodies established by agencies. (Refer

also to section E regarding Ministers’ roles in setting fees outside the parameters of the

Framework and section F regarding reviewing fees.)

27

For members of subsidiary bodies of statutory entities, (i.e. of Crown Agents, ACEs,

Independent Crown Entities (ICEs)) the board of the parent entity sets the fees within the

applicable framework range. Exceptions to the Framework (see section E) for subsid ary

bodies require

prior consultation with the parent entity’s responsible Minister, and the

Minister of State Services (with advice from the SSC). It is advisable to discuss proposed

exceptional fees with the SSC in the first instance.

28

The default process for some Group 4 bodies where there is no responsible Minister or

relevant legislation (e.g. bodies established by chief executives or governance boards of

agencies) is that the fee-setting authority (e.g. the chief executive or governance board)

should apply the Framework in order to determine he fee. If the proposed fee is outside

the parameters of the Framework, it must be treated as an exception under the Framework

(see section E).

under the

29

For those bodies covered by the Fees and Travelling Allowances Act 1951, the Minister of

State Services has delegated responsibility for setting fees within this Framework to

Ministers responsible for the particular appointments and/or setting the remuneration

levels. If the proposed fee is outside the parameters of the Framework, the agreement of

the Minister of State Se vices is required, and the matter may need to be considered by

APH and Cabinet (see section E).

Factors to be considered in setting or reviewing fees

30

Ministers agencies and other fee setting authorities should refer to section D to classify the

body unde the Framework and then ensure the actual fees reflect an element of public

service and community commitment, the personal contribution and recognition of the

Released

intangible benefits to the member, balanced by:

the complexity of the functions and the expertise required;

recruitment and retention issues;

the extent to which an individual member needs to insure against personal liability;

the potential risk to reputation;

Official Information Act 1982

the degree to which the role is in the public eye;

affordability; and

period since the fees were last reviewed.

284308v1

12

31

Fees will continue to be set on a fair but conservative basis to reflect a discount for the

element of public service involved.

32

Where the fee is paid as an annual rate, it should also reflect the time involved (see

paragraph 38).

33

Members occupying identical positions on the same body should be paid the same fee rate.

The fee rate is varied only to reflect additional responsibility such as that assumed by

chairpersons (and deputies and the chair of a substantial sub-committee where appropriate)

who may receive an extra margin for additional responsibilities that go with the role. The

exception to this is when fees have been grand-parented (refer paragraph 146).

34

In cases where it is necessary to secure people with scarce specialist skills, consideration

may be given to paying a fee higher than the applicable range. Please refer to section E.

35

It is possible to pay fees below the range, provided they reflect the factors noted in

paragraph 30.

Payment basis

36

There are two approaches to expressing fee levels - annu l rates and daily rates. Any other

variations, including annualising daily rates, are regarded as exceptions to the Framework

and require prior consultation at Ministerial level (see section E)

Annual rate

37

For Group 3 bodies, the fee is usually expressed as an annual rate. This is consistent with

under the

the approach taken in the private sector and is most appropriate where the workload is

predictable and/or substantial.

38

The annual fee is set on the following assumptions:

the work is such that the chair and members are required on a part-time basis;

for gener l governance boards, the assumed annual workload for meetings and other

responsibilities associated with the role is that:

a member works around 30 days a year, which is in line with the amount

of time spent by board directors in private sector companies;

Released

chairs have a higher workload than members, with the assumption that a

chair works around 50 days per year. Therefore, the fee for chairs is set at

twice the rate of the members to take account of both the differences in

responsibility and in workload.

39

Where it is anticipated that a chair or members will have a lesser workload than above, it is

expected that this be reflected in the fee level. The workload expectation covers all

authorised work undertaken by members including subcommittee work and preparation

Official Information Act 1982

time. This excludes work for the three District Health Board statutory advisory committees

established under sections 34, 35, and 36 of the New Zealand Public Health and Disability

Act 2000 (see paragraph 116 regarding fees that apply to these three committees).

40

For those situations where a greater workload is expected, please seek advice from the

State Services Commission. Where significant additional work is required, it may be

appropriate to negotiate additional payments.

284308v1

13

41

Payment for additional work should be agreed by the fee-setting authority before the work is undertaken. The key objectives for the additional work must be clearly

specified, and evaluated on completion. A higher annual rate for a fixed period, and based

on defined goals, may also be appropriate where chairs are required to undertake

significant additional work (e.g. where they are required to guide the reorientation or

restructuring of a Crown entity, or where the situation of a Crown entity requires the chair

to act more in the nature of an executive director). However, such additional work should

otherwise relate to the governance role of the board, and should not cover activities that are

more properly within the role of management.

42

The fee-setting authority is required to consult with the Minister of State Services before

committing to payments for additional work and is responsible for monitoring progress

against the negotiated objectives.

43

For members of Group 3b subsidiary bodies of statutory entities (i.e of Crown Agents,

ACEs, and ICEs) who receive an annual fee, there is no assumed annual workload

specified for the members. Time is one of the factors to be consid red by the parent entity

when setting the fees, with reference to paragraph 30.

44

Where it is possible to predict the workload of bodies o her than governance boards, the

annual fee should be calculated by multiplying the dai y rate by the number of days that

will be worked during the year.

45

Proposals for an annual fee for a Group 1, 2 or 4 body should be treated as technical

exceptions, and referred to the responsible Minister and Minister of State Services. In

making submissions to Ministers or reporting to the SSC it will be necessary to specify the

under the

annual fee if this has been agreed, and provide the dai y ra e on which the proposal is

based, and the number of days that will be worked per annum.

Daily rate

46

For Groups 1, 2 and 4 bodies, fee levels are generally expressed as a daily rate, as this

works best for those bodies that have an unpredictable workload. Where a chair or member

of a Group 2 body that is administered by the Ministry of Justice, works full time

consistently, the daily rate will be multiplied by 230. This number will be pro-rated for

those who work substantially full time.

47

For Group 3 governance bo rds that pay a daily rate due to an unpredictable workload, the

maximum annual rate provided in the range that applies to the classification must not be

Released

exceeded unless an exception to the Framework is agreed.

48

It is expected that a working day is about 8 hours, and the daily fee is calculated on this

basis Work for longer than 8 hours in one day must not attract an extra payment, unless

the combination of travel and work is frequently longer than 8 hours. (see para 81).

49

Ho rly pro-rata rates should be calculated by dividing the daily rate by 8 and multiplying

by the number of hours worked.

Official Information Act 1982

50

The daily fee applies to all work, including that performed outside of meetings (e.g.

preparation, representing the board at other forums, or administrative work) that is required

for the body to carry out its role. All work that is required to be performed for the body by

the member should be paid at the approved daily rate.

284308v1

14

51

Where a total of 6 hours is worked in one day, a daily fee

may be paid. It is accepted that it

may not be possible for a member having worked 6 hours in one day on body business to

return to other paid work. Where a member spends time, for example one evening,

preparing for a meeting the next day, if the preparation and meeting time combined were

between 6 and 8 hours, then one daily fee would be paid for the combined preparation and

meeting time.

52

Work other than preparation for meetings/sittings must be approved and minuted by the

body

before it is undertaken. Individual members should not be in a position where they

could be considered to be setting their own work programmes without the endorsement of

the body.

Other fee payment methods/other types of payments

53

Other fee payment methods such as a base honorarium and/or a fee for additional services

or Crown bodies setting their own fees from a total pool, are regarded as exceptions to the

Framework. If such fee payment methods are proposed, refer to s ction E. Early discussion

with SSC is recommended.

54

Where a member is a self-employed professional, locum fees are not to be paid unless an

exception has been approved. The self-employed professional receives payment for body

business only and reimbursement of travel expenses where relevant to body business.

Additional payments are not provided to pay for the use of a locum or the business

overheads since the body is not responsible for funding members own business costs.

Issues such as the potential loss of income and maintenance of a professional practice

(including business overheads) need to be considered by the individual prior to accepting

under the

appointment to a body.

55

Payment of compensation or any benefit for loss of office must not take place.

56

Ex gratia payments and other benefits or rewards, which are in addition to fees, must not

be paid to members of statutory boards, subsidiary bodies of statutory entities, statutory

tribunals, authorities or other Crown bodies or committees.

Rates for sub-committees

57

Depending on its enabling legislation, a body may set up a sub-committee or

sub-committees to carry out part of the body’s business.

Released

58

Members who receiv an annual fee for membership do not receive any additional

payment for membe ship of sub-committees. The only exception is that members of the

three District Health Board statutory advisory committees established under sections 34,

35, and 36 of the New Zealand Public Health and Disability Act 2000 receive an additional

fee as provided for in section D (see paragraph 116).

59

Members who receive a daily fee can receive payment for additional days spent on

sub-committee work. If the sub-committee has been set up to consider an issue and report

Official Information Act 1982

to the main body, then a lesser daily fee may be appropriate. Sub-committees must be

properly constituted under the authorising legislation or terms of reference for the body

before a meeting fee is paid.

284308v1

15

Independent members of sub-committees

60

Independent members of sub-committees are those members who are not members of the

parent body. They may be paid up to a maximum of the daily equivalent of the full

member fee, depending on the assessment by the main body of the skills required for the

independent sub-committee member/s to perform their role.

61

The daily fee for bodies whose members are paid an annual fee should be calculated by

dividing the annual fee by the appropriate number of days worked, e.g. 30 for a general

governance board (refer to paragraph 38 regarding assumption about workload for

members paid an annual fee).

62

The total annual fee paid to an independent member of a sub-committee should not exceed

50 percent of the total annual fee paid to a member of the main body.

63

Any proposal to pay higher daily fees or total annual fees outside this guidance should be

treated as an exception (see section E). This section does not apply to ex-officio members.

Rates for deputy chairs and sub-committee chairs

64

Where the legislation provides for the appointment of a deputy chair and/or where the

work of the body is such that the appointment of a depu y chair is required due to the

complex nature or size of the responsibilities, then a fee additional to the member rate may

be paid to the deputy chair.

65

The fee for the responsibilities of a deputy chair is an addi ional 25 percent of the member

under the

rate. (This is consistent with the rates paid to deputy chairs in Crown companies and in the

private sector.) If this takes the deputy chair fee above the fee range, it is not an exception.

66

Where there is no deputy appointed, and a member is required to chair a meeting, then the

member should be paid a daily rate equivalent to that of the chair.

67

Where an annual fee is paid, it is usual practice for the chair, and the deputy chair, where

one is appointed, to have responsibili y for chairing one or more sub-committees. No

additional fee is payable to the chair nd deputy chair for chairing sub-committees. Where

there are sub-committees that are not chaired by either the chair or deputy chair, then an

additional 10% of the member’s rate may be paid to one other member with responsibility

fo cha ring a sub-committee. This does not apply to the three District Health Board

statu ory advisory committees because additional fees are paid to members of those

Released

committees (refer to paragraphs 39 and 116). Any case for further additional payments for

chairing sub-commi tees must be treated as an exception to the Framework (see section E).

One person committees

68

Where an individual member constitutes a committee and there are decision-making or

rec mmendatory powers, that member should receive the rate applicable to the chair of a

body at that level.

Official Information Act 1982

284308v1

16

Payments to public sector employees appointed to bodies covered by the

Framework

69

Paragraphs 69 to 78 apply in relation to public sector employees including public servants

who may be appointed to a body covered by the Framework. In these paragraphs, the term

“public sector employee” covers employees in all the agencies in the wider state sector as

well as other agencies associated with a Ministerial portfolio and any local authority as

defined under section 5(1) of the Local Government Act 2002. The term “public servant”

applies to all employees of public service departments. Public servants are a sub group of

public sector employees.

70

These paragraphs reflect Cabinet’s agreement in 2012 that the Framework provides that

any employee of a government agency, appointed in their own right to a body covered by

the Framework, must not retain both the fee and his/her ordinary pay, where the duties of

the outside organisation are undertaken during his/her ordinary working hours.

All public sector employees appointed to bodies covered by the Framework

71

Public sector employees may be appointed to a body covered by the Framework either ex

officio (someone who has a right because of an office held), or as a representative of their

department or agency, or, where there are special circumstances, in their own right.

72

All public sector employees appointed to statutory and other public bodies must be able to

do their primary job unhindered and without detriment to the publ c interest. They must

not be double-paid for their job and their membership of a body covered by the

Framework.

under the

73

A public sector employee should not retain both the board fee and their ordinary pay where

the duties of the board are undertaken during their ordinary working hours. Public sector

employees taking annual le ve or leave without pay for board activities may receive a fee.

The arrangements, including the employer’s approval and the justification for any fee

payment i.e. where all board duties are undertaken in the employee’s own time, should be

confirmed in the appointment documentation.

74

Any reimbursement of expenses incurred in relation to participation in a body is the

responsibility of the body and should be paid to the member.

75

Where a public sector employee is appointed to a body covered by the Framework either

ex officio or as a representative of their department or agency, they must not profit

Released

financially from their involvement on a board. The public sector employee will receive

his/her ordinary pay and will not be paid a daily or annualised fee for participating as part

of the board. Where there are out of pocket expenses such as airfares or accommodation,

these should be reimbursed to the employee on the same basis as for other members of the

bo rd.

Special considerations for appointments of public service employees in their own

right

Official Information Act 1982

76

Cabinet has recognised that there may be special circumstances in which employees of

Public Service departments may be appointed to statutory and other public bodies: Cabinet

Office Circular CO(02)5 applies to public servants of statutory bodies1. However, as a

general rule, public servants of a monitoring agency should not serve on a Crown entity

board that their agency monitors, nor should public servants serve on a board that has the

same responsible Minister(s) as their agency.

1 The SSC maintains an up to date list of all of the organisations of the state sector and their categorisation.

284308v1

17

77

Before any public service employee seeks to be appointed to a body in his/her own right,

the employee must first obtain the agreement of his/her agency chief executive. Such

appointments are treated as secondary employment and, in the case of public servants, are

subject to the oversight of the State Services Commissioner.

78

The chief executive must be satisfied that there are no unmanageable conflicts of interest

in relation to a potential appointment to a body and that financial and leave arrangements

will be appropriate. The chief executive must decide whether the public servant will

undertake board activities in their own time (for example, by taking annual leave or leave

without pay) or in the employer’s time.

Payment for time spent in travel to meetings/sittings or on board business (daily

fees only)

79

Members are not paid for time spent in travel to and from meetings or on body business

except in instances where a daily fee is paid and the member has to travel for more than a

total of three hours in the course of a normal business day of approximately 8 hours

80

The purpose of paying for travel time that is greater than three hours is to compensate for

lost income during the business day. For example, a member may spend a few hours at a

meeting but in doing so spends all day away from normal business activity, due to

spending several hours travelling to and from the meeting.

81

In circumstances where considerable time is involved in travel, th s can be recognised by

the chair, with the agreement of the servicing/accountable organisation. In these cases (and

particularly where air travel is involved) the preparation and travelling time need to be

under the

considered together for payment purposes. Where considerable travel is frequently

necessary to meet the requirements of the role, this should be recognised either by reducing

the working time or paying for some or all of the travel time (see para 48).

82

In considering payments for travelling time, the chair and servicing agency need to

consider issues of equity, the government s intention for geographical representation, and

ensure that attendance at meetings does not result in undue personal hardship.

Childcare expenses

83

Under exceptional circumstances a contribution may be made to childcare expenses with

the agreement of the chair (or another member if the chair is claiming expenses) and the

servicing agency. However, it is generally expected that the daily fee paid is adequate to

Released

meet out-of-pocket expenses of individual members as well as reimbursing them for their

time spent. An example where a contribution to childcare expenses may be made is where

an additional m eting is called at short notice (e.g. less than 48 hours). In determining

whether payment is warranted, consideration should be given to issues of equity and

en uring that attendance at meetings does not result in undue personal hardship.

Payment of a fee for a cancelled meeting/sitting

Official Information Act 1982

84

Where a meeting or other activity of a statutory or other body is cancelled or takes fewer

days than planned, in exceptional cases payment of the fee to certain members may be

approved.

284308v1

18

85

Each case would need to be considered on its merits and this should only occur where:

the cancellation was unforeseeable;

the member was unable to reschedule other work to take advantage of the time made

available; and

the member suffered real loss of income as a result of the cancellation.

86

An affected member would need to make a case to the body on each separate occasion.

Payment should not be approved if it is believed the member had not tried to reschedule

other work. Partial payment might be appropriate if rescheduled appointment fees do not

fully compensate a member for the lost fee from the meeting.

87

If appropriate and the body did, on application from a member for a specific instance,

resolve to pay the fee for part or all of the time a meeting was cancelled by, that resolu ion

would need to be noted in the minutes.

Payment for meetings by teleconference

88

Where a meeting is held by teleconference or video conference, the usual fees apply.

89

Where a member is unable to attend a meeting in person but joins the meeting by

teleconference or videoconference, with the agr ement of the chair, the usual fees apply. If

the member receives daily fees and participates in less than half of the meeting, an hourly

pro-rata rate would apply (see paragraph 49).

under the

Absence

90

Where an individual receives an annual fee and is absent from body business for a period

of greater than two months, then the annualised fee should be pro-rated to take account of

this absence (e.g. an absence of 2 months would result in payment of 10/12 of the annual

fee). Where there a e frequent absences over the period of a year, the annual fee should

also be pro-rated to take account of those absences. (This does not apply to members who

work full time or substantially full time).

91

Where a member fails to attend a significant number of meetings, or otherwise perform

th ir duties as a member the chair needs to raise the issue of expectations about

performance with the member and if necessary with the responsible Minister.

Released

Consideration should be given at the time of reappointment of members to the issue of

continued absences from body business.

Reimbursing expenses

92

Members travelling to and from meetings, or on the business of the body in which the

Crown has an interest (where the members are required to be away from their normal

places of residence), are entitled to reimbursement of out of pocket travelling, meal and

Official Information Act 1982

accommodation expenses actually and reasonably incurred. The expectation is that

standards of travel, accommodation, meals and other expenses are modest and appropriate

to reflect public sector norms.

93

Actual and reasonable travel, meals, accommodation and other expenses incurred by the

member in carrying out the business of the body in which the Crown has an interest may

be reimbursed provided they are supported by appropriate documentation.

284308v1

19

94

Where it would not be reasonable to travel by public transport and a member’s private

motor vehicle is used for travel to and from meetings, or on the business of the body in

which the Crown has an interest, reimbursement will be at the mileage rate specified by

Inland Revenue.

Section D: Classification of bodies and fee scales

95

The Framework provides for the classification of bodies into one of the following groups:

Group 1: Royal Commissions, Public Inquiries, Government Inquiries and

Ministerial Inquiries;

Group 2: Statutory Tribunals and Authorities;

Group 3: Governance Boards:

- Group 3a: General Governance Boards (including TEIs and DHBs);

- Group 3b: Subsidiary Bodies of Statutory Entities (i e of Crown Agents ACEs,

ICEs);

Group 4: All Other Committees and Other Bodies;

- Audit and Risk Committees.

96

Cabinet has agreed to a schedule of fees for all categories that reflects the nature of their

under the

business environment and the role requirements.

97

Once a decision has been made on which group the organisation best fits into, establish the

level within the group (see lassification process below for each group), and then find the

fee range for that level in the appropriate table. A decision is then required on what

amount, within (or below) the ranges provided, is most appropriate. Section C, particularly

paragraph 30, provides guidance on how to make these decisions. Further assistance is

available from the SSC.

98

Refer to section E if the proposed fee is above the ranges provided, or an alternative

method of payment is proposed.

Group 1: Royal Commissions, Public Inquiries, Government Inquiries and

Released

Ministerial Inquiries

99

Royal Commissions, public inquiries, government inquiries and Ministerial inquiries are

time-limit d bodies established to inquire into and report on specific matters. Royal

Commissions and public inquiries are generally chaired by a judge or a retired judge.

100

Th key distinction between a Royal Commission, a public inquiry, government inquiry

and a Ministerial inquiry lies in the form of the instrument of appointment and the nature

Official Information Act 1982

of the authority under which it is established:

Royal Commissions are appointed by the Governor-General, pursuant to the Letters

Patent Constituting the Office of the Governor-General of New Zealand 1983 and

the Inquiries Act 2013. Royal Commissions are, therefore, generally regarded as

having greater prestige and standing than public inquiries appointed under the

Inquiries Act 2013 alone. A Royal Commission is generally appointed when the

subject matter to be investigated is one of particular public importance. The final

report is presented to the Governor-General and the House of Representatives.

284308v1

20

Public inquiries are established by the Governor-General by order in Council

pursuant to the Inquiries Act 2013. The final report is presented to the Governor-

General and the House of Representatives.

Government inquiries are established by a Minister or Ministers by notice in the

Gazette pursuant to the Inquiries Act 2013. The final report is presented to the

appointing Minister.

Ministerial Inquiries are non-statutory inquiries established by a Minister. The Prime

Minister’s agreement must be sought on all matters to do with the establishment of a

Ministerial Inquiry. (Refer DPMC Guidance on inquiries).

101

A Minister must consult the Prime Minister and the Attorney-General when assessing

whether to establish a Royal Commission, public inquiry or government inquiry prior to

submitting any proposal to Cabinet (chapter 4 of the Cabinet Manual)

102

If a Royal Commission, public inquiry, government inquiry or ministerial inquiry is

proposed, the SSC should be contacted for advice about the proposed fee, prior to the

appointment being considered by APH and Cabinet. All fees for Royal Commissions,

public inquiries, government inquiries and ministerial inquiries must be referred to the

Minister of State Services for consideration as an exception.

Group 2: Statutory Tribunals and Authorities

103

Statutory tribunals and authorities are a broad and diverse group of adjudicative bodies that

decide or resolve some form of question or dispute affecting the rights of parties. They

under the

exercise a defined specialist jurisdiction under legisla ive authority and decide cases by

considering facts and evidence and applying settled rules or principles. They are not courts

but equally are independent from the executive (that is, their members are not departmental

officers).

Factors – choose one score from each of the following categories

104

Expertise required

Skills, knowledge and experience may vary between members on a particular tribunal. The

score below should reflect the level of skill

required by the majority of members, and

should not be based on any particular individual. This factor has a higher weighting than

Released

others, to reflect that it is the application of the skills, knowledge and experience in carrying

out their responsibilities that is a major contributor to the successful operation of the tribunal

or authority.

If a member is a sole member, the Chair fee range may be used, but in setting the actual fee

level the factors to be considered in setting or reviewing fees (paragraph 30) should be

taken into account.

Experti e required

Score

Official Information Act 1982

Expert and highly regarded in a particular field or discipline.

9

Senior professional providing expertise in a particular field or discipline.

7

Broad general or professional experience. May include community leadership.

5

284308v1

21

105

Complexity

This dimension measures the problems typically faced by the tribunal and the mental

processes required to arrive at the solution.

Complexity

Score

Very complex issues with no past decisions for guidance. Each situation will be significantly 5

different to others and the solution required is often unique. Decisions may affect the

application of multiple statutes.

Some issues will be very complex with few previous decisions for guidance. Decisions will 4

usually be limited to a single statute but may involve the application of international

conventions and covenants.

Complex issues requiring analysis and consideration of potential alternative solutions. While 3

each case will be treated on its merits there will often be previous decisions for guidance.

Some issues will be complex requiring analysis and careful judgement but other issues will 2

be straightforward and may be resolved quickly through consistent appli ation of

established decisions.

Situations require consideration and judgement, but usually under one statute and 1

established guidelines.

106

Decision-making

Decision-making

Score

Prime function is as an appellate body. Decisions will usually be published. May have the 5

power to fine, award costs etc.

under the

Prime function is as a determining body. De isions will be usually be published. No penalty 4

provisions. Judicial review of decisions m y exist.

Power to make decisions – appeal proce ses available. Has power to fine, award costs etc.

3

Power to make decisions – appeal pr cesses available No penalty or fining authority.

2

Recommendatory powers only

1

107

Impact of decisions

Impact of d cis ons

Score

An imm diate impact on groups of people or sector/s of society.

5

Released

An immediate, critical impac on an individual or small number of people.

4

Decisions have an immediate, but not critical effect on a small number of individuals or a

3

single Corporate entity

Decisions have a longer term impact on groups of people or sector/s of society.

2

Decisions affect internal policies within a Department/Ministry.

1

Official Information Act 1982

284308v1

22

108

Public profile

Public profile

Score

High profile; broad public interest and scrutiny likely. May involve challenging status of 5

legislation. Potential impact on New Zealand’s international reputation.

Moderate profile; strong interest likely from large sectors of the public. Decisions of the

4

Tribunal may have a major effect on the supervising Government Department.

Medium profile; public interest likely to be localised to area, sector or discipline.

3

Limited profile; usually non- controversial determinations but of interest to small pressure

2

groups.

Low profile; generally non-controversial findings or recommendations.

1

Add the scores for each factor together to give a total score. Then refer to the table

below for the ranges of fees payable for Group 2 bodies.

109

Group 2 - daily fees

Total score

Level

Fees range – chair

Fees range – members

26-29

1

$695 - $1,085

$445 - $690

22-25

2

$630 - $925

$410 - $570

17-21

3

$575 - $780

$365 - $510

13-16

4

$485 - $605

$315 - $390

under the

12 or less

5

$365 - $540

$290 - $350

Group 3: Governance Boards

110

These are boards that are primarily responsible for the governance of a Crown body or

organisation (most C own entities fall into this category). In many cases the body will be

established by or under an Act that sets out its statutory purpose or objectives and principal

functions.

111

Governance boards have responsibility for the strategic direction of the organisation, the

determination of business objectives and formulation of policies to achieve these, and

Released

funding policy. A large number will also have the task to recruit, appoint and monitor the

chief executive Where the board is overseeing an interest owned by the Crown, the board

is usually the link between the shareholder/owner (the Crown) and management, and its

members are appointed either by a Minister /the government or the Governor-General. In

some cas s, boards have elected members, or members appointed by stakeholders other

than the Minister. The organisation the board is overseeing may or may not be a company.

112

A number of Trust Boards also fit into this category.

Official Information Act 1982

284308v1

23

Group 3a: General Governance Boards (including TEIs and DHBs)

Factors - choose one score from each of the following categories (noting paragraph 111).

113

Size

Select

either the appropriate budget/turnover

or asset magnitude figure that best represents

the size of the organisation. Lower weighting is given for asset management than budget

controlled as assets have been accumulated over time, are retained by the organisation and

the Board’s responsibility is the safe guardianship and the most effective and sustainable

deployment of assets. Budgets on the other hand are expended over a twelve-month period

and the Board’s accountability for this spend, or revenue earned is more direct.

Please note that funding disbursements and purchases on behalf of the Crown are treated in

the same manner as operating budgets.

Budget/turnover

Assets

Score

$0-$10m

$0-$100m

2

$10m-$50m

$100m-$500m

4

$50m-$100m

$500m-$1.0b

6

$100m-$300m

$1.0b-$3b

8

$300m-$600m

$3b-$6b

10

$600m-$1.2b

$6b-$12b

12

$1.2b+

$12b+

14

under the

114

Business

complexity/functionality

Select the prime function and then consider and assess the complexity of the prime function

in accordance with the following tables. Where the organisation clearly has

more than one

prime function and the board is actively involved in decisions relating to both functions,

the scores of the two functions may be added, but consultation with the SSC is required.

Option

Prime function

Developed

An entity that specialises in making purchase decisions on behalf of the Crown. There

Purchaser

will almost certainly be a contractual relationship between the entity and the provider

of services

Released

Funding

An en ity established to distribute grants or funding.

Disbursement

Investment

and An entity involved in the investment and management of funds on behalf of the Crown

Management

of or for beneficiaries.

Funds

Advisory to Crown

An entity advisory to the Crown at a significant level.

Regulato y

An entity exercising regulatory and/or quasi-judicial power in an independent and

objective manner

Official Information Act 1982

Provider of Services

An entity established to provide services. The level of competition for the services will

and Environment

vary, and there may be limits on competition prescribed by statute or otherwise.

Holder of

The holder of the Crown’s ownership interest.

Ownership Interest

Social Influence

An entity established to improve a social outcome or outcomes through encouraging

behaviour change (e.g. healthy lifestyle choices) by promotion of activities and

increasing public awareness.

284308v1

24

Devolved purchaser

Prime function

Score

Devolved purchaser of goods and services ($10b+)

5

Devolved purchaser ($1b-$10b)

4

Devolved purchaser ($100m-$1b)

3

Devolved purchaser ($20m-$100m)

2

Devolved purchaser (under $20m)

1

OR

Funding disbursement

Prime function

Score

Funding disbursement ($10b+)

5

Funding disbursement ($1b-$10b)

4

Funding disbursement ($100m-$1b)

3

Funding disbursement ($20m-$100m)

2

Funding disbursement (under $20m)

1

OR

Investment and management of funds

Prime function

Score

Investment management of funds (over $5b)

5

under the

Investment management of funds (over $1b)

4

Investment management of funds (over $500m)

3

Investment management of funds (over $100m)

2

Investment management of funds (under $100m)

1

OR

Advisory to Crown

Prime fun tion

Score

Critical level with a comprehensive effect on most/all aspects of government activity,

5

strategy and New Zealand society

Released

Significant level with a widespread impact across many aspects of government activity,

4

planning and strat gy

Important level with generalised impact across major sectors

3

Generalised impact across several sectors

2

Local or single s ctor impact

1

OR Official Information Act 1982

Regulatory

Prime function

Score

National safety regulatory function for a commercial trading environment where

5

significant international dimensions can impact on operating capability

National safety regulatory function for a commercial trading environment

4

National safety regulatory function for a non-commercial trading environment

3

Regulatory

2

Minor regulations required

1

284308v1

25

OR

Provider of services and environment

Prime function

Score

The lead provider of services in a commercial trading environment, where market

5

leadership is important

A provider of services in a commercial trading environment

4

The major provider of services where there is limited competition

3

A provider of services where there is limited competition

2

Provider of services (not in a competitive environment or protected by statute)

1

OR

Holder of ownership interest

Prime function

Score

The holder of the Crown’s ownership interest

1

OR

Social influence

Prime function

Score

Promote behaviour change and increase public awarene s for ll or most of the

5

population,

and have a measurable, beneficial, influen e on a substantial segment of the

population

Promote behaviour change and increase public aw reness for all or most of he

4

under the

population,

or have a significant influence on a more limited but stil substantial segment

of the population

Promote behaviour change and increas public awareness in a substantial segment of the

3

population,

and have a significant in luence on a limited s gment of the population

Promote behaviour change and increase public awareness in a substantial segment of the

2

population

Promote behaviour change and increase public awa eness in a limited segment of the

1

population

A

dd the scores for “size” and o e “business complexity/ functionality” together to give a total

score. (Consult with SSC about having more than one prime function.) Refer to the guidance

in section C and the table below for the ranges of fees payable for Group 3a bodies.

Released

115

Group 3a – annual fees

Total score

Level

Fees range – chair

Fees range – board

21-24

1

$36,905 - $81,930

$18,450 - $40,595

15-20

2

$31,475 - $66,865

$15,735 - $33,430

11-14

3

$28,220 - $48,845

$14,110 - $24,390

7-10

4

$26,050 - $36,470

$13,025 - $18,410

Official Information Act 1982

6 or less

5

$13,025 - $27,350

$6,510 - $14,195

284308v1

26

District Health Boards Statutory Committees

116

Under sections 34 to 36 of the NZ Public Health and Disability Act 2000, each DHB is

required to establish permanent advisory committees on community and public health,

disability support, and hospitals. An additional $2,500 a year is paid to each DHB member

who is a member of an advisory committee. If a member attends less than 10 meetings per

annum, the fee is pro-rated. The fee for the chair of each of these committees is $3,125 per

annum. These fees are paid to DHB members who are also on DHB audit, risk and finance

committees.

Group 3b: Subsidiary Bodies of Statutory Entities

117

The boards of statutory entities (i.e. the parent boards) set the fees for their subsidiary

board members. The statutory entities are Crown Agents, ACEs and ICEs listed in

Schedule 1 of the Crown Entities Act 2004.

118

Size

The following two size criteria are consistent with the protocol for General Governance

Boards (Group 3a) above (see paragraph 113).

Select

either the appropriate budget/turnover

or asset magnitude figure that best represents

the size of the organisation. Lower weighting is given for asset management than budget

controlled as assets have been accumulated over time, are retained by the organisation and

the body’s responsibility is the safe guardianship and the most effective and sustainable

deployment of assets. Budgets on the other hand are expended over a twelve month period

and the body’s accountability for this spend, or revenue earned is more direct.

under the

Please note that funding disbursements and purchases on b half of the Crown are treated in

the same manner as operating budgets

Budget/turnover

Ass ts

Score

$0-$10m

$0-$100m

2

$10m-$50m

$100m-$500m

4

$50m-$100m

$500m-$1.0b

6

$100m-$300m

$1.0b-$3b

8

$300m-$600m

$3b $6b

10

$600m-$1.2b

$6b-$12b

12

$1.2b+

$12b+

14

Released

Refer to the guidelines in section C and the table below for the ranges of fees payable for

Group 3b bodies.

119

Group 3b – annual fees

Total Score

Level

Fees range – Chair

Fees range - Members

10 – 1

1

$24,965 - $39,855

$12,480 - $19,925

6 – 9

2

$23,335 - $37,365

$11,665 - $18,680

Official Information Act 1982

5 or less

3

$20,080 - $33,490

$10,040 - $16,745

284308v1

27

Group 4: All Other Committees and Other Bodies

120

This category covers a vast array of bodies from advisory committees, to technical review

committees to professional regulatory bodies. These bodies may have their functions

described in statute, or alternatively have been established by a Minister under a general

statutory power to establish advisory committees or by the Cabinet. In other cases, the

bodies will have been established by chief executives or governance boards of agencies to

provide advice on the agency’s functions and responsibilities on a general basis or on

specific areas or issues.

121

The level within this category are determined by:

skills, knowledge and experience required for members;

function, level and scope of authority;

complexity of issues;

public interest and profile.

Factors – choose one score from each of the following categories

122

Skills, knowledge and experience

Skills, knowledge and experience will vary b tween members on a particular body. The

score below should reflect the level of skill required by the majority of members, and should

not be based on any particular individual. This factor has a higher weighting than others, to

under the

reflect that it is the application of the skills, knowledg and experience in carrying out their

responsibilities that is a major contributor to the successful operation of the committee or

body.

Skills, knowledge and Definition

Score

experience

Pre–eminent

Outstanding and authorita ive knowledge, recognised nationally and 12

internationally for expertise in a particular field.

Distinguished

Deep and broad knowledge in a specific area or as a leader. Widely 10

respected as a subject matter expert or authority in their field.

Substantive

Subst ntial range of knowledge and experience in a field or 8

professi nal discipline sometimes associated with senior level

Released

functional or technical leadership, executive management or

governance roles. May include widely respected people with broad

community support.

Technical

A number of years’ experience in a technical, professional field or in a 6

leadership role is a pre-requisite.

Speciali ed experience

No specific experience is required but members would have broad 4

general knowledge and may represent a body of opinion.

Official Information Act 1982

284308v1

28

123

Function, level and scope of authority

Function, level and scope of authority

Score

Sets policy or work programme for a major area of economic activity or policy area of 6

importance to the Government’s strategic priorities.

Sets policy or work programme and/or exercises regulatory/disciplinary powers at an industry 5

level.

Provides expert counsel and advice direct to Ministers, agency governance boards or CEOs 4

and/or multi-agency task forces on technical or major policy issues, where issues are of

strategic importance. At this level the body would be expected to be proactive in identifying

emerging issues and contributing to policy direction and to inform the Government’s agenda

Exercises regulatory/disciplinary powers at the individual/professional level. This will include 3

the power to impose fines and suspend or prohibit professional practice by the individual.

(NB: This would include an individual corporate member.)

Provides a broad range of advice on technical and/or policy issues (multi outputs) to an 2

agency governance board/CEO or Minister where issues affect Government policy.

Provides ad hoc advice to an agency governance board/CEO or Minister on minor matters. 1

Generally a limited focus at a single output level.

124

Complexity of issues

Complexity of issues

Definition

Score

Innovative

The developmen of new concepts is r quired to find 5

innovative and pathfinding solutions. There will be little

under the

or no external guidance (NZ or in ernationally) to aid

resolu ion of these issues.

Constructive

The development of new policy or advice is required 4

where the issues are complex, multi- dimensional and

involve substantial research, consideration of possible

alternatives and heir consequences. The body may

commission research or utilise the findings to inform their

policy devel pment or advice.

Evaluative

Issues will include circumstances, facts and concepts 3

differ nt to those that have been experienced in the past.

Analytical thinking and evaluative judgement will be

required

to

identify

realistic

alternatives

and

apply/recommend a solution.

Released

Judgement

Solutions will be found from application of professional 2

or personal judgement and generally guided by previous

decisions. Circumstances may be different from those

previously experienced but there will be a sufficient frame

of

reference

to

make

a

considered

decision/recommendation.

Operational

Issues to be resolved are generally within existing policy 1

and prior decisions. Decisions can generally be made

quickly and with reasonable certainty.

Official Information Act 1982

284308v1

29

125

Public interest and profile

Public interest and profile

Score

Widespread public interest in outcomes would be expected. Member/s will attract strong 5

media interest. Potential risk to personal and/or the body’s reputation is high.

Strong public and stakeholder interest and importance would be associated with these issues. 4

Media interest would also be expected, but potential risk to personal or the body’s reputation

is unlikely.

Moderate but widespread public interest is likely. Reputational risk is minimal.

3

Public interest is likely to be limited, but the issues would be of interest to other members of 2

the particular profession or sector.

There is likely to be little or no wider public interest in the decisions.

1

Add the scores for each factor together to give a total score. Then refer to the guidance in

section C and the table below for the ranges of fees payable for Group 4 bodies.

126

Group 4 – daily fees

Total Score

Level

Fees range – chair

Fees range - members

24-28

1

$540 - $1,150

$ 05 - $865

under the

20-23

2

$390 - $885

$290 - $560

15-19

3

$280 - $575

$205 - $395

10-14

4

$250 - $365

$190 - $270

9 or less

5

$205 - $265

$150 - $205

Audit and Risk Committees - Government Departments

127

Most agencies have established audit and risk committees (or their equivalent). All or

almost all of the chairs and members of these committees are external to the agency and

they are generally not public sector employees. Due to the skill and expertise required of

external chairs and memb rs of these committees and the complexity of the matters on

which they advise, higher fees for agency audit and risk committees have been approved.

Released

(The Office of the Auditor-General provides advice on audit committees.)

128

Fees for chairs of audit and risk committees can be up to $1,300 per day and fees for

members can be up to $1,085 per day (up to a maximum of 30 days per annum in both

cases).

Official Information Act 1982

284308v1

30

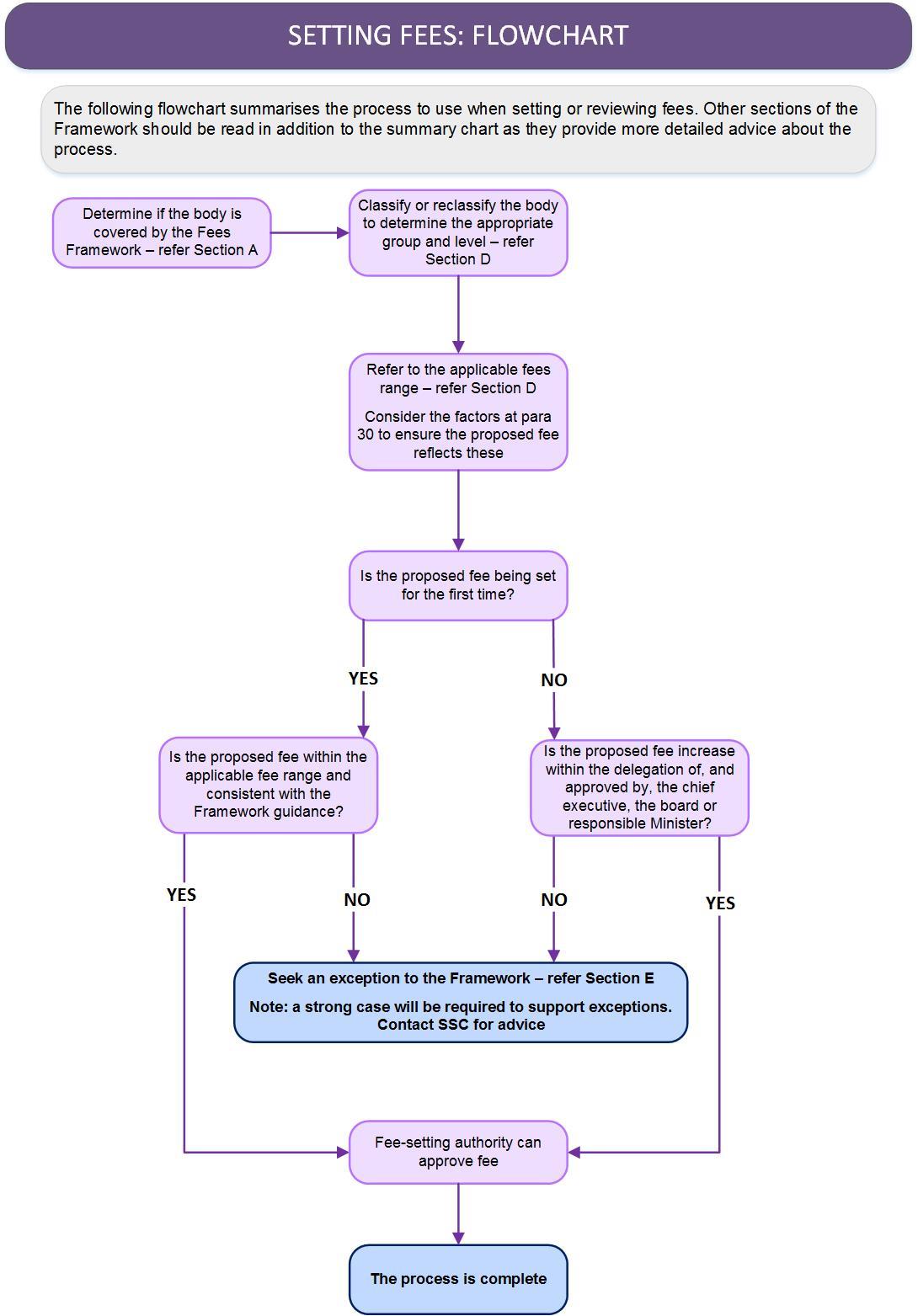

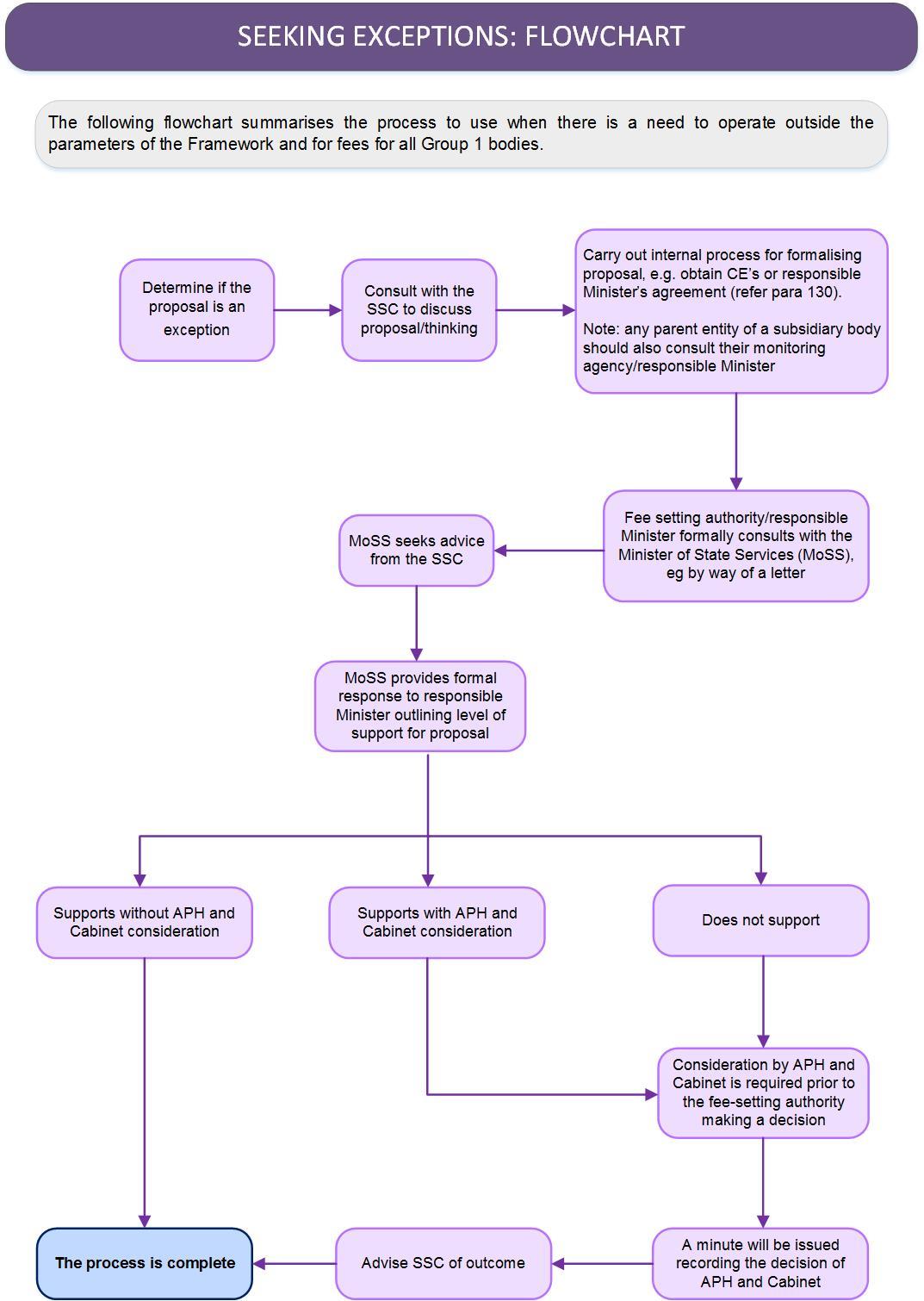

Section E: Operating outside the parameters of the Framework/

exceptions to the Framework

129

Operating outside the parameters of the Framework includes situations where it is

proposed to:

pay fees above the levels set in the fee scales;

increase existing fees by more than 5% (even within the applicable fee range);

use alternative methods for paying or setting fees (for example, payment of a base

honorarium plus a fee for additional services, Crown bodies setting their own fees

from a total pool, a full time fee);

make additional payments for work in excess of the ordinary demands on

body members;

make additional payments to chairs of sub-committees (see paragraphs 64 to 67).

130

Where Ministers, agencies or other fee-setting authoriti s believe there is a case to operate

outside the parameters of the Framework (except where proposed fees are below the