[IN CONFIDENCE RELEASE EXTERNAL]

29 July 2022

N Ryan

[FYI request #19807 email]

Dear N Ryan

Thank you for your request made under the Official Information Act 1982 (OIA), received

on 2 July 2022. You requested the following:

Copies of all of the compulsory survey documents issued to participants in the High-

Wealth Individuals Research Project.

This request seeks that you include PDF copies of the actual survey forms, and all

related documents that were sent to participants.

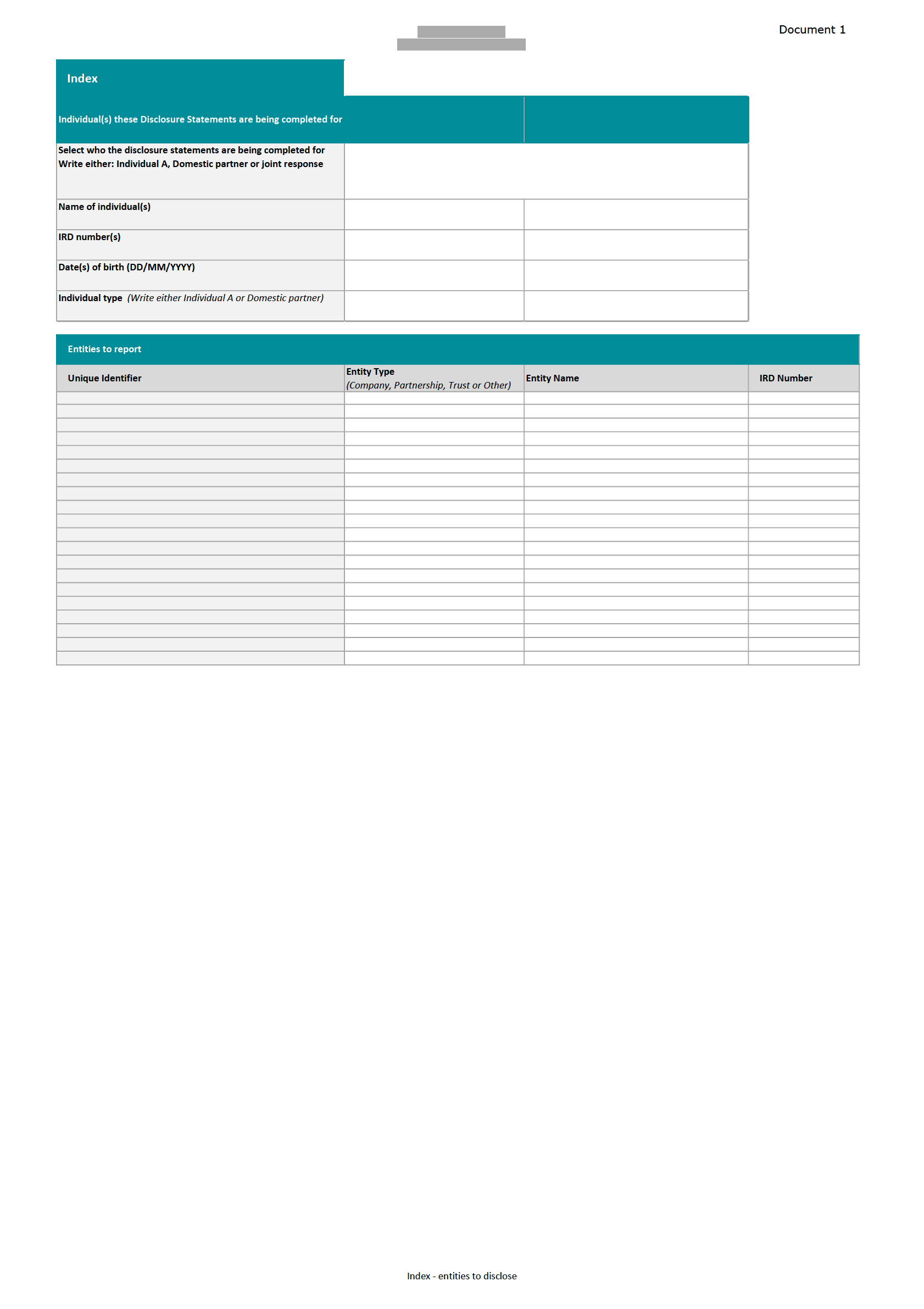

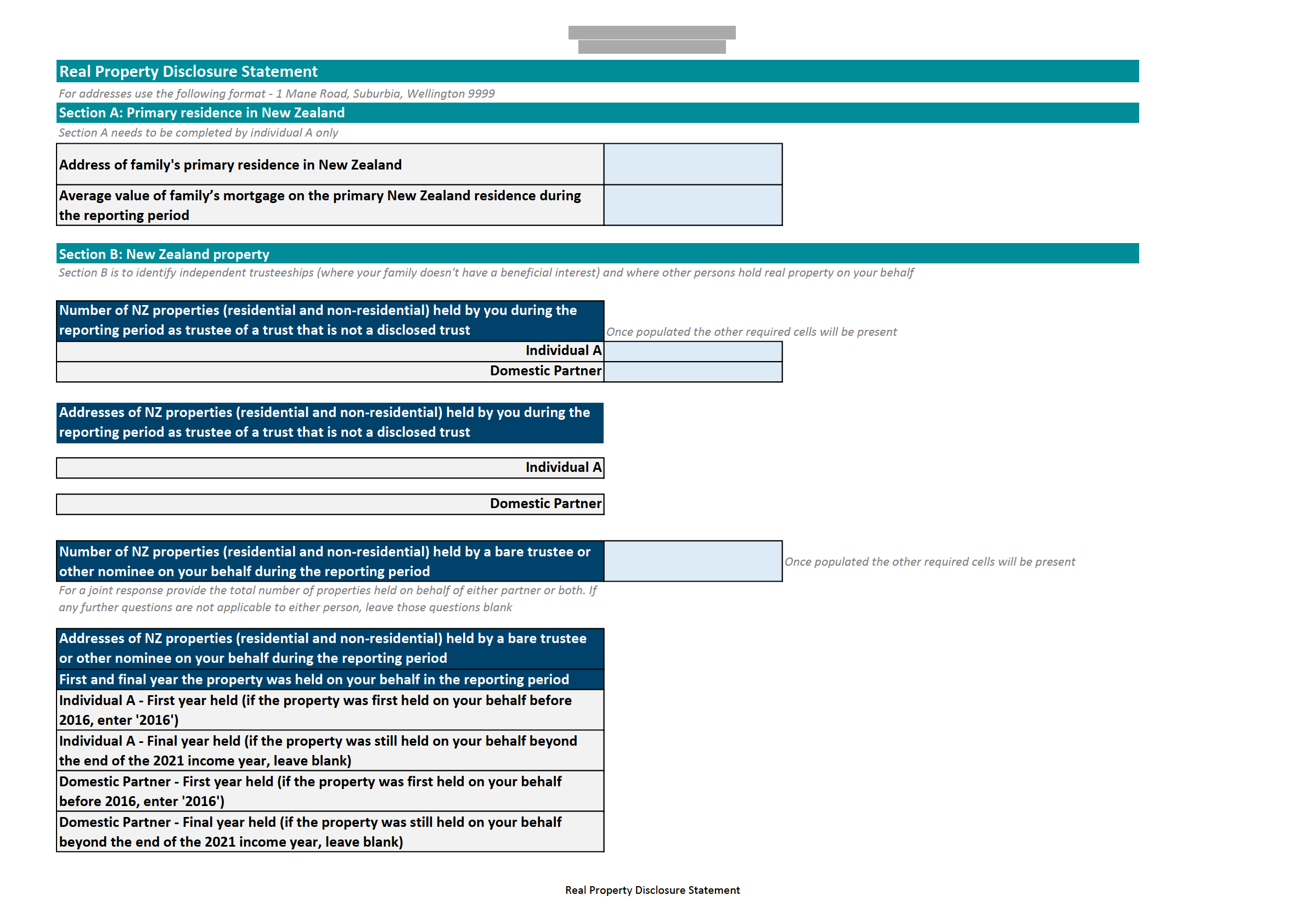

Information being released Please find enclosed the following documents:

Item Date

Document description

Decision

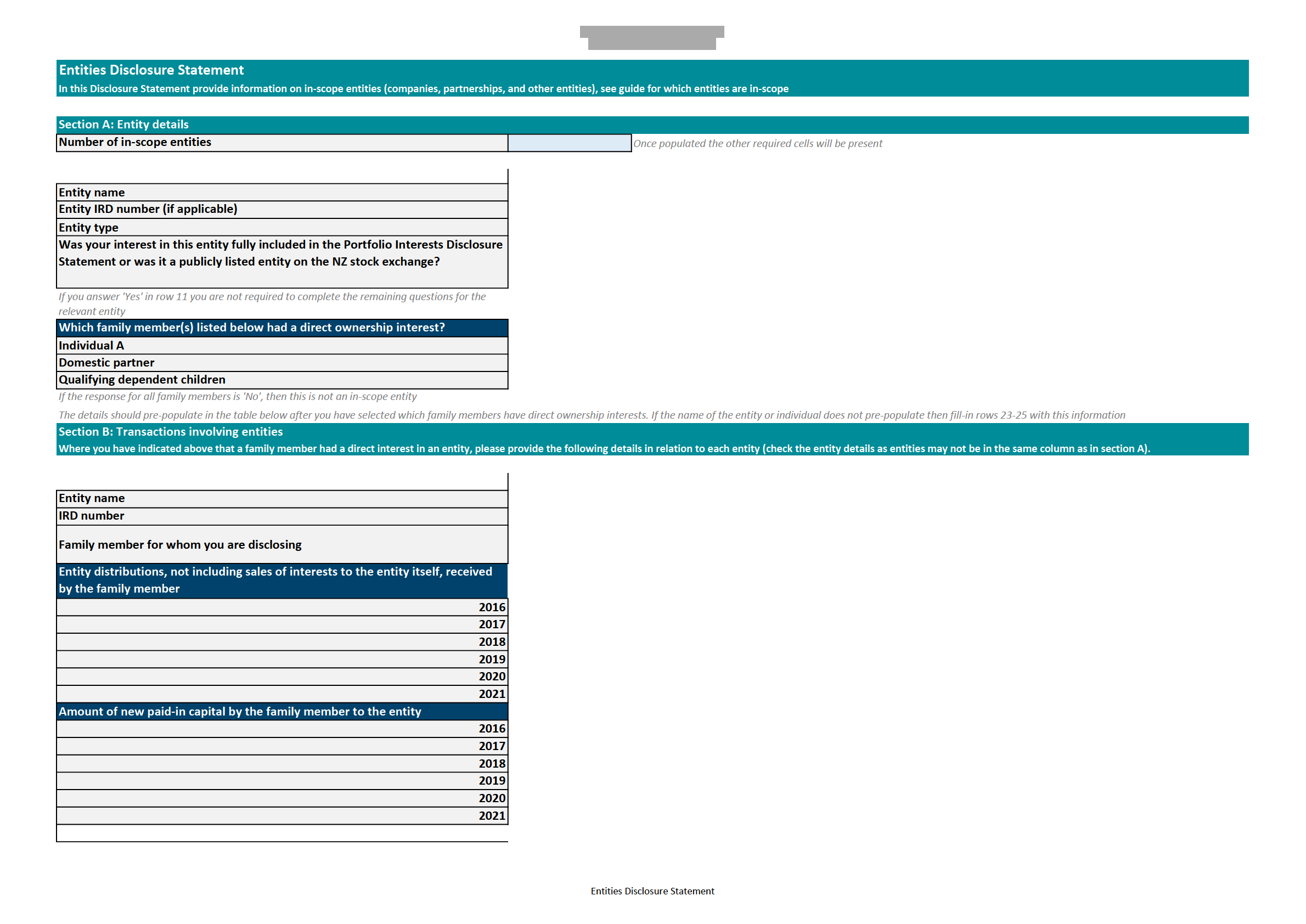

1.

21 February

Entity collection disclosure

Released in full

2022

statement

2.

9 June 2022

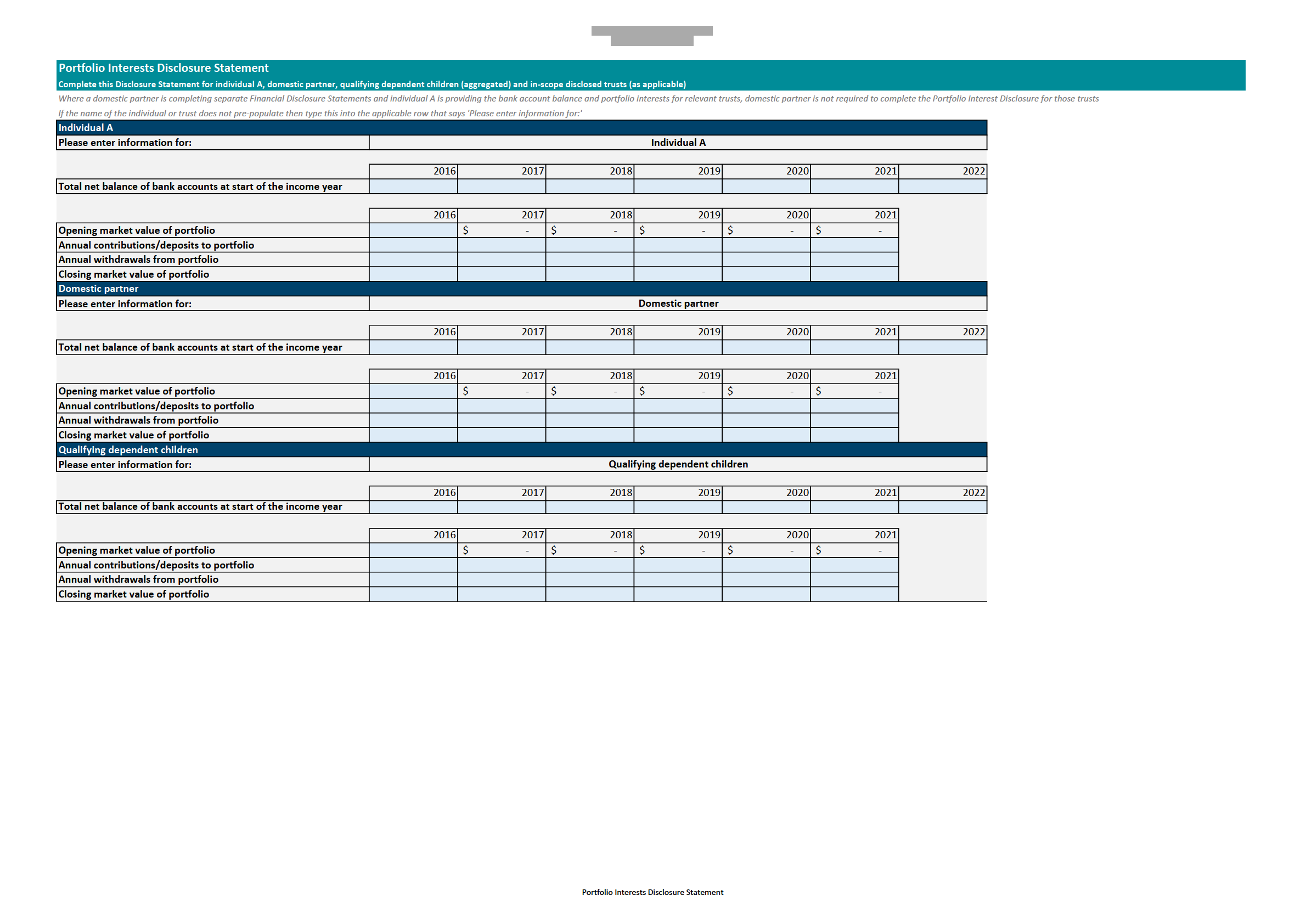

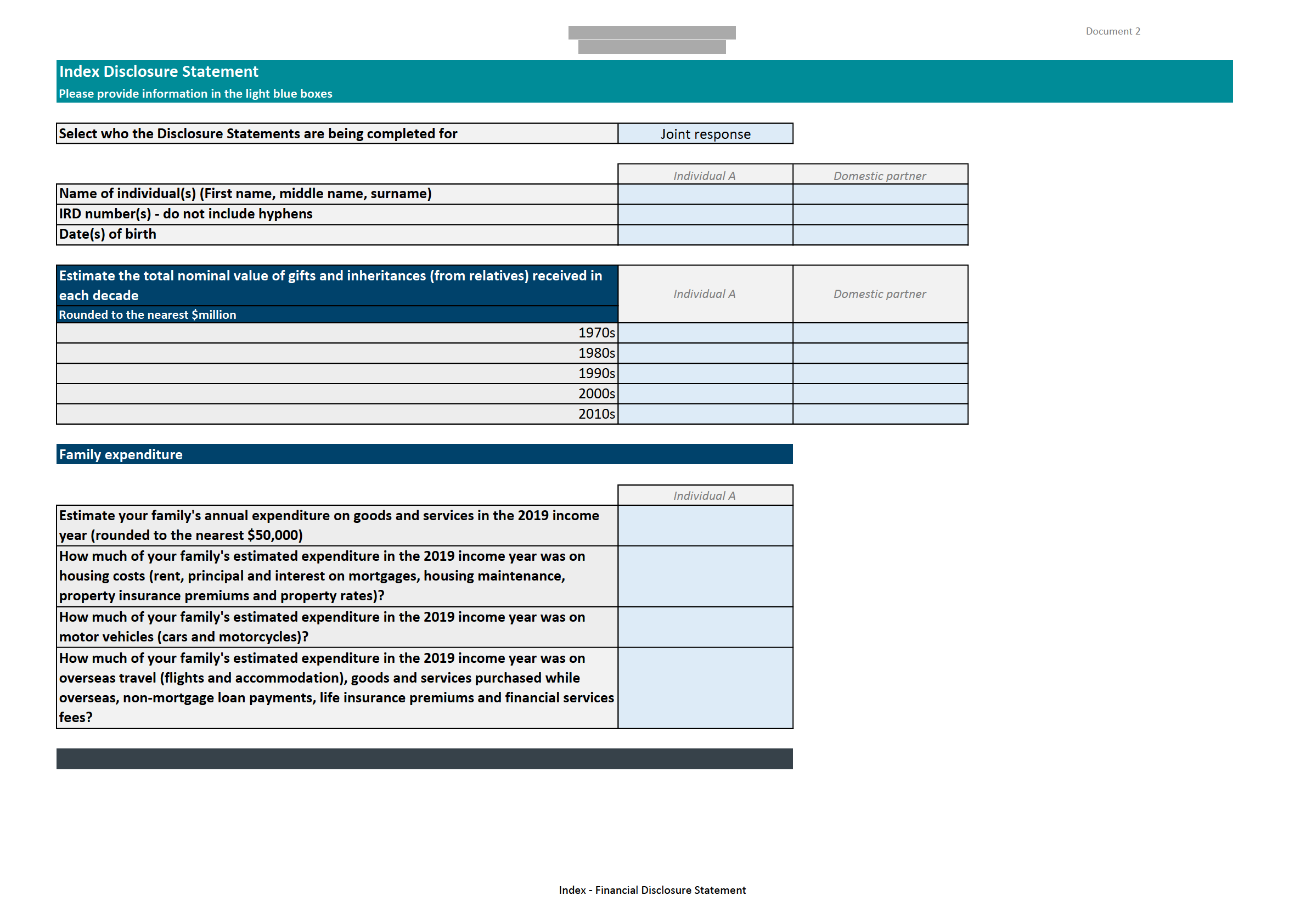

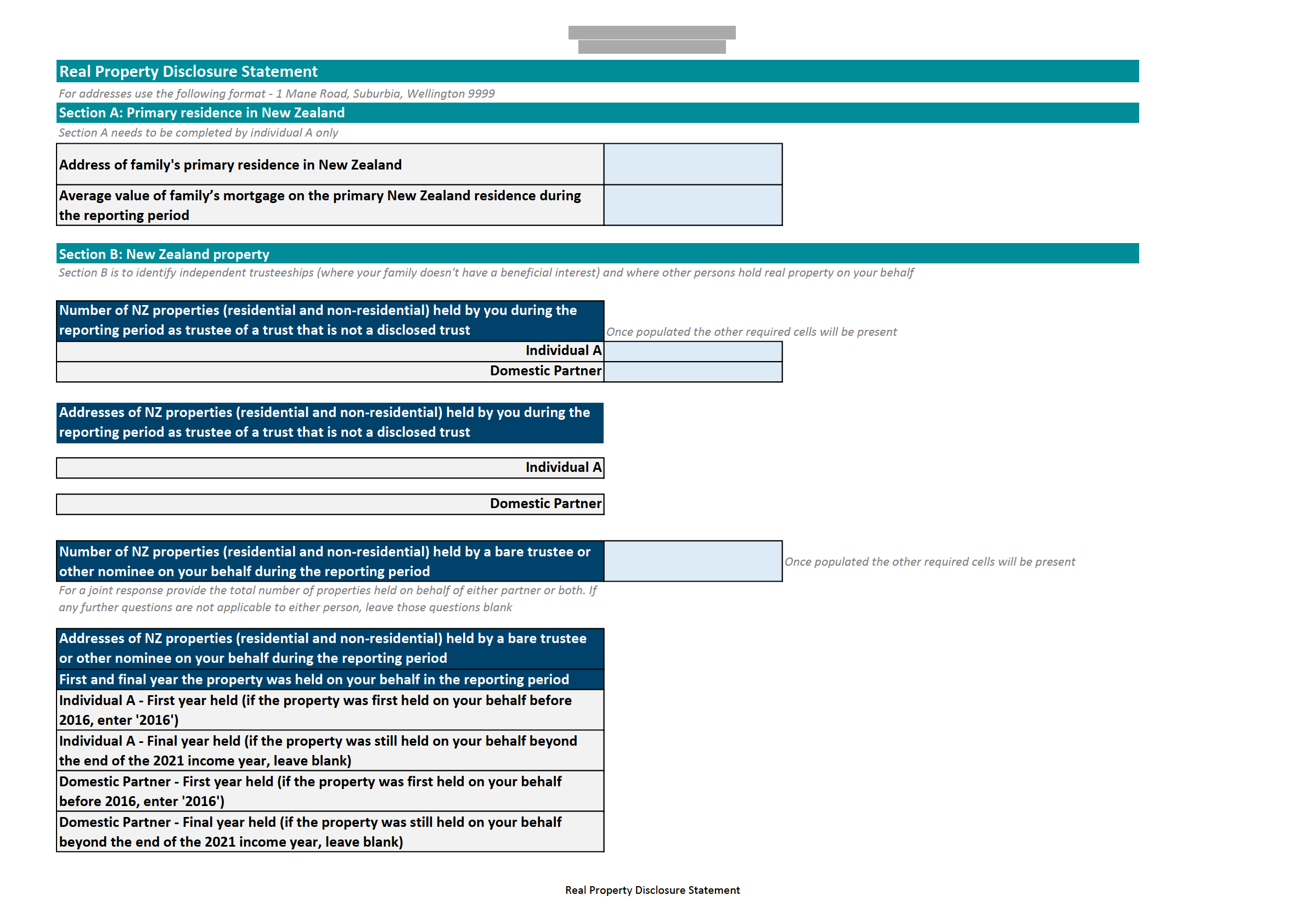

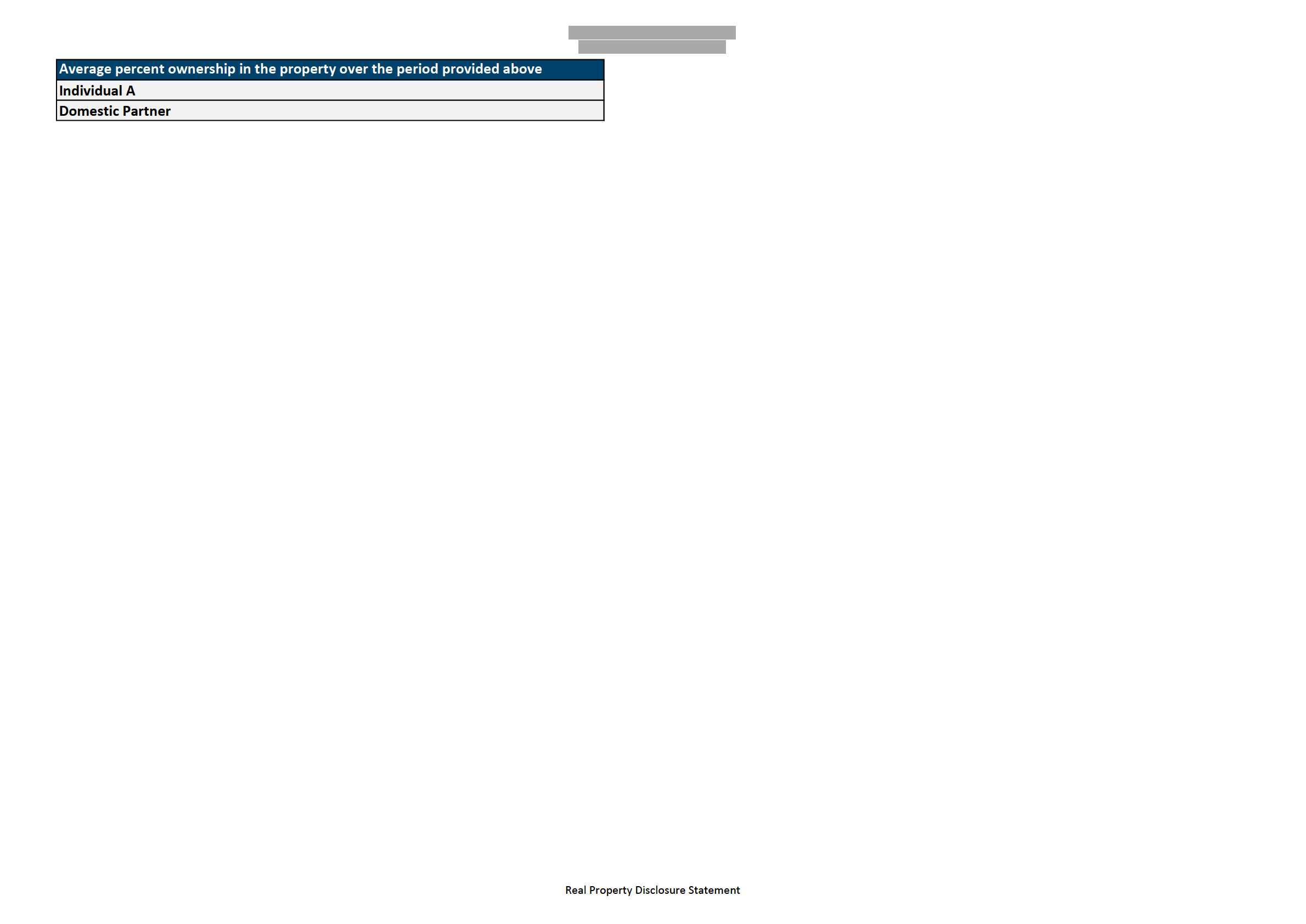

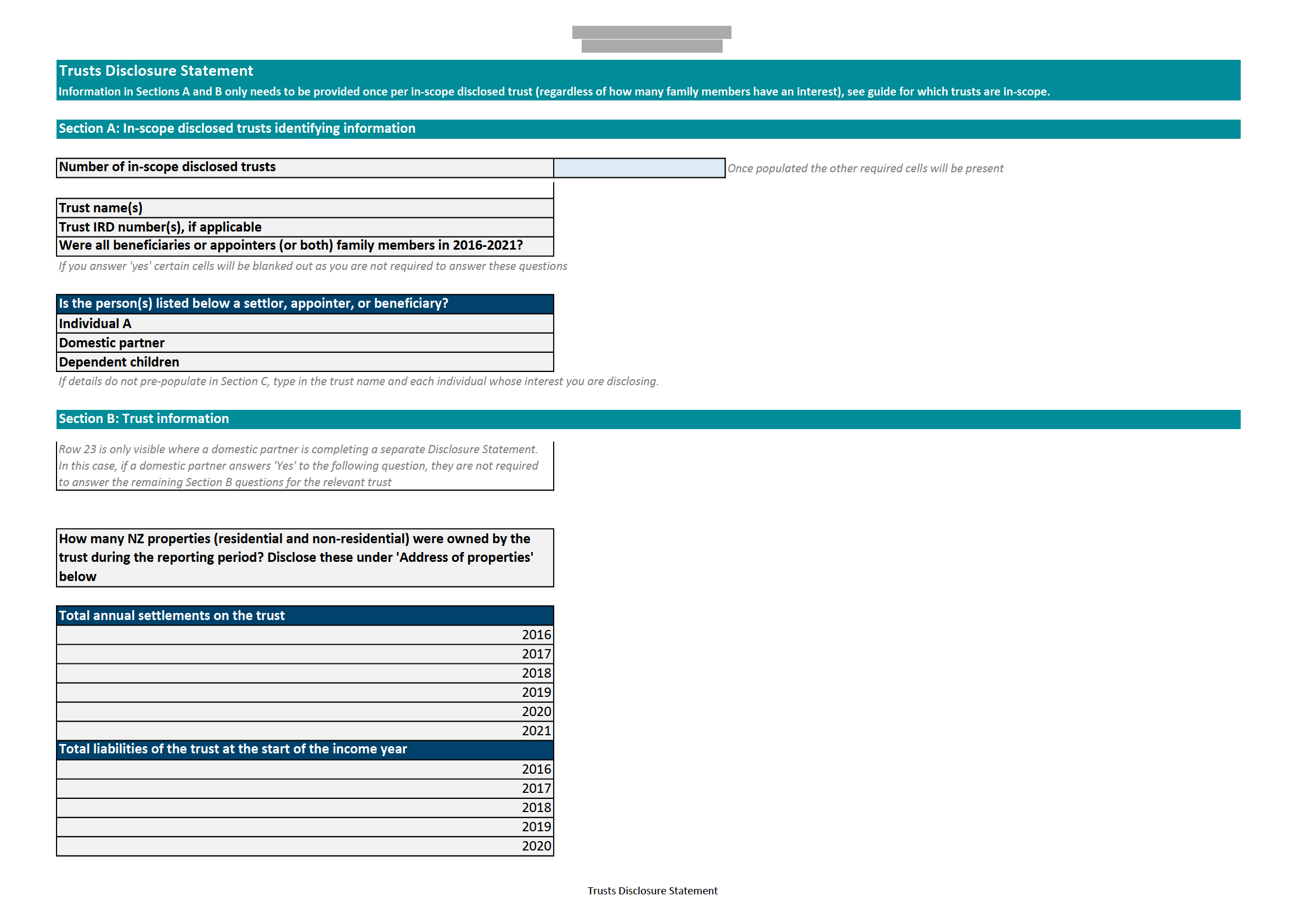

Financial collection disclosure

Released in full

statement

3.

20 October

Template letter to high-wealth

Released with

2021

individuals with authorisation form redactions under

and information sheet

section 9(2)(a)

Authorisation form

withheld in full under

section 18(c)(i)

4.

2 November

Template letter to high-wealth

Released with

2021

individuals for family details

redactions under

collection

sections 9(2)(a) and

18(c)(i)

5.

21 February

Template letter to high-wealth

2022

individuals for entity collection

6.

9 June 2022

Template letter to high-wealth

individuals for financial information

Where information in the documents is withheld, the relevant withholding ground of the

OIA is specified in the document. Some information has been withheld under the following

OIA grounds:

•

Section 9(2)(a) – to protect the privacy of natural persons

•

Section 18(c)(i) – the making available of the requested information would be

contrary to section 18(3) of the Tax Administration Act 1994 (TAA).

No public interest in releasing the withheld information has been identified that would be

sufficient to outweigh the reasons for withholding.

www.ird.govt.nz

Ref: 23OIA1009

Page 1 of 2

[IN CONFIDENCE RELEASE EXTERNAL]

Please note the security classifications on the documents have been redacted to allow for

release.

Information publicly available

The following information you requested is publicly available on Inland Revenue’s website

under the

High-wealth individuals research project section

(www.ird.govt.nz/about-

us/who-we-are/organisation-structure/significant-enterprises/hwi-research-

project/questionnaire-guides-hwi):

Item

Date

Document description

7.

June 2022

Financial questionnaire guide

8.

May 2022

Information sheets

9.

February 2022

Entity questionnaire guide

10.

November 2021

Family details collection questionnaire guide

The

Section 17GB Tax Administration Act 1994 enclosed in each letter can be found here:

https://www.legislation.govt.nz/act/public/1994/0166/latest/LMS437229.html. Your request for the documents listed in the above table is therefore refused under section

18(d) of the OIA, as the information is publicly available.

Some information has been removed from documents listed above, on the OIA grounds

described in the documents.

Right of Review

If you disagree with my decisions on your OIA request, you can ask an Inland Revenue

review officer to review my decisions. To ask for an internal review, please email the

Commissioner of Inland Revenue at:

[email address]. Alternatively, under section 28(3) of the OIA, you have the right to ask the Ombudsman

to investigate and review my decisions. You can contact the office of the Ombudsman by

email at:

[email address]. If you choose to have an internal review, you can still ask the Ombudsman for a review.

Thank you for your request.

Yours sincerely

Felicity Barker

Project Director, Inland Revenue

Page 2 of 2

Ref: 23OIA1009

[IN CONFIDENCE RELEASE EXTERNAL]

Document 3

Policy and Regulatory Stewardship

Kaupapa me te Tiaki i ngā Ture

PO Box 2198

Wellington 6140

New Zealand

20 October 2021

«legal_name»

«courier_addr1»

«courier_addr2»

«courier_addr3»

«courier_addr4»

«courier_addr5»

Tēnā koe,

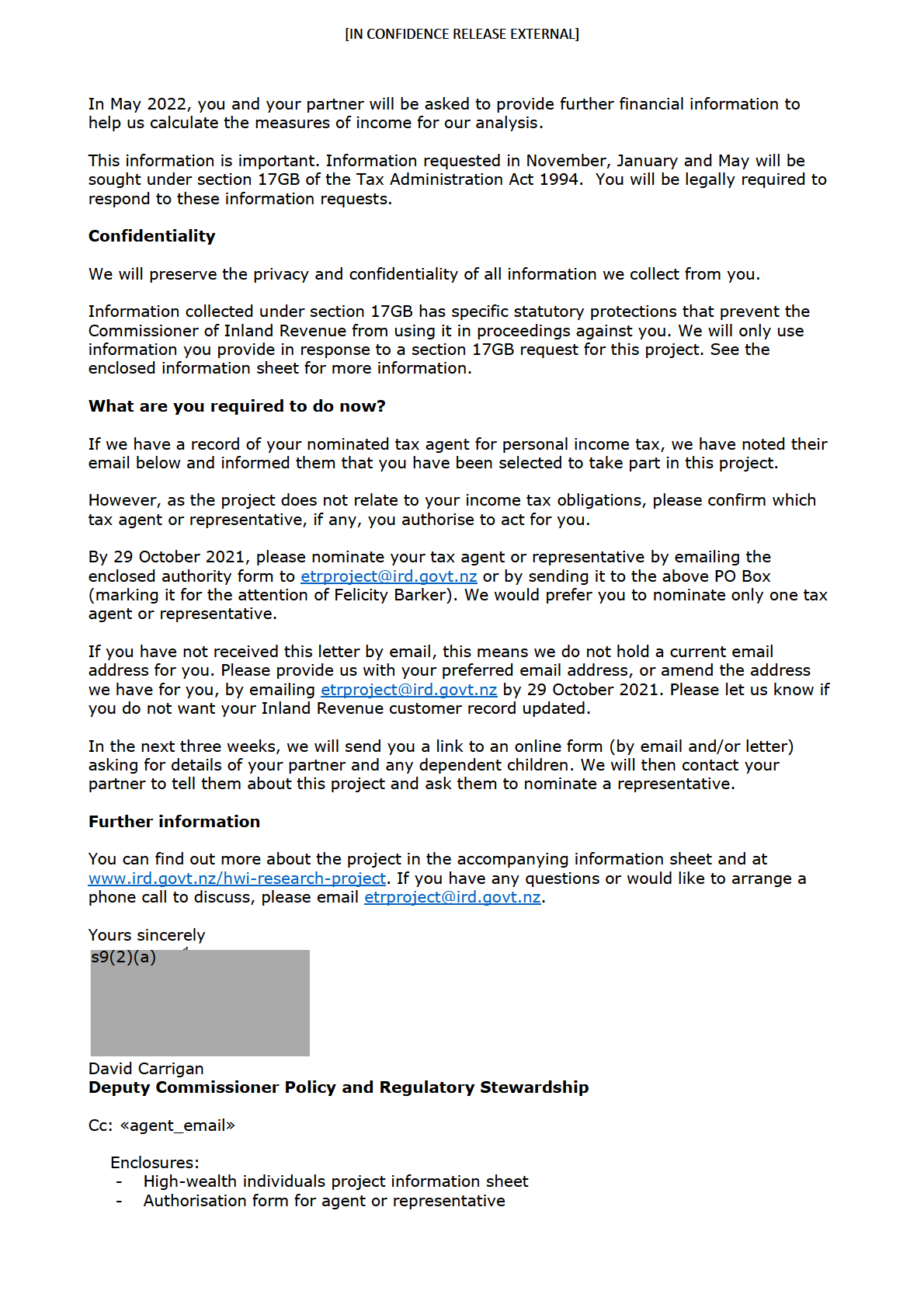

High-Wealth Individuals Research Project

You have been selected to take part in Inland Revenue’s high-wealth individuals research

project.

This is a statistical research project that aims to fill a gap in our knowledge of effective tax

rates relative to economic measures of income, particularly for high-wealth individuals.

In the next three weeks, we will contact you again to ask for details about your household.

All the information you provide will be kept confidential, and will not be used to reassess your

tax liability.

Why are we carrying out this project?

The project seeks to improve the evidence base for making assessments of the fairness of the

tax system. The project is not making any policy recommendations, but the analysis will

inform future tax policy advice.

The research will be published in a report to be made public in mid-2023. This report will not

identify any individual, their financial information or their specific effective tax rate.

How will you be involved in the project?

We have selected about 400 high-wealth individuals to take part in this research project.

The project will use household income as the unit of analysis, so we will ask you for

information about your partner (if you have one) and any dependent children.

You and your partner will separately be asked to provide information to Inland Revenue. If you

have any dependent children, you will be asked to provide information about them.

What information will you and your partner be required to provide?

In November 2021, we will ask you to provide details of your partner and any dependent

children.

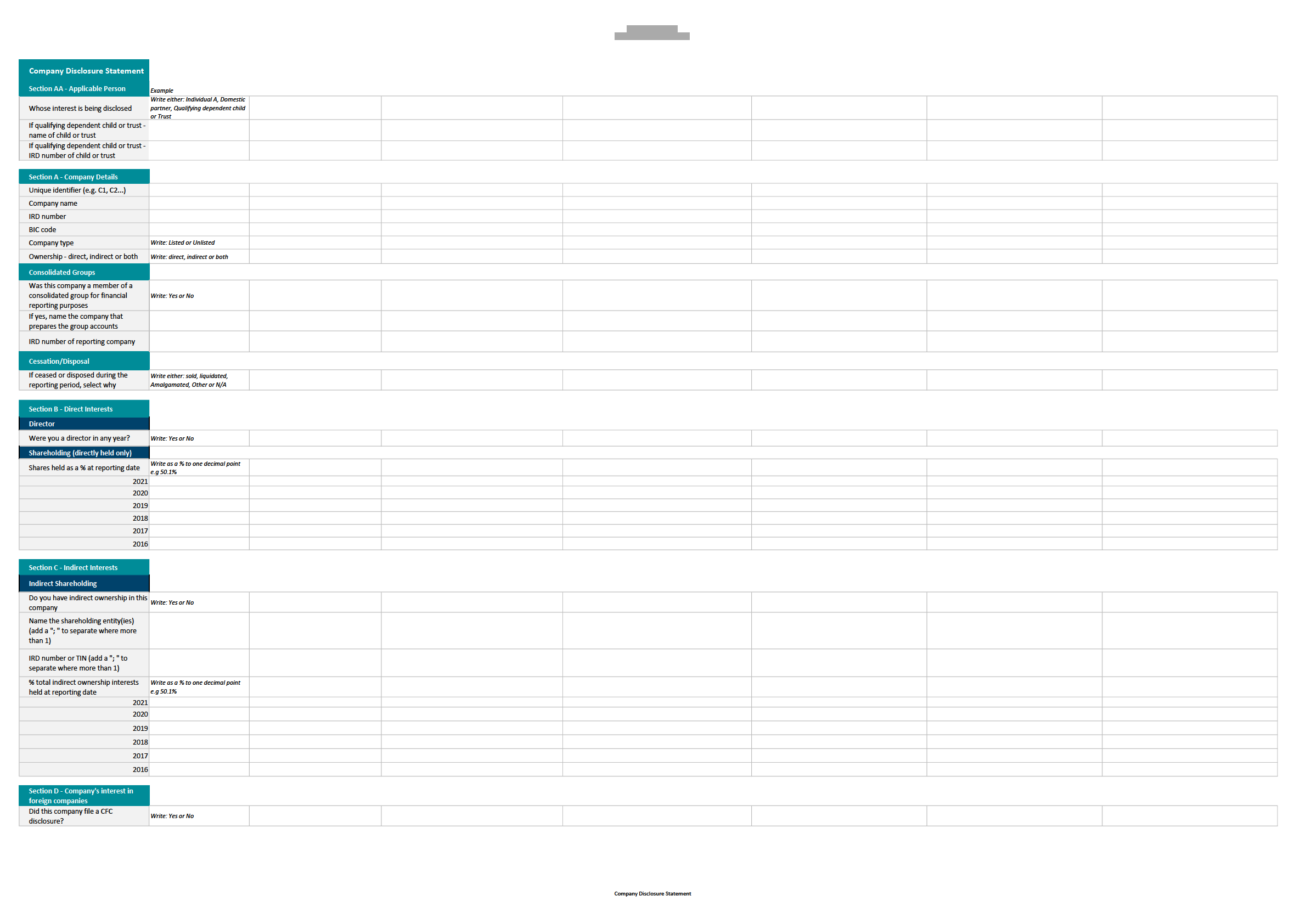

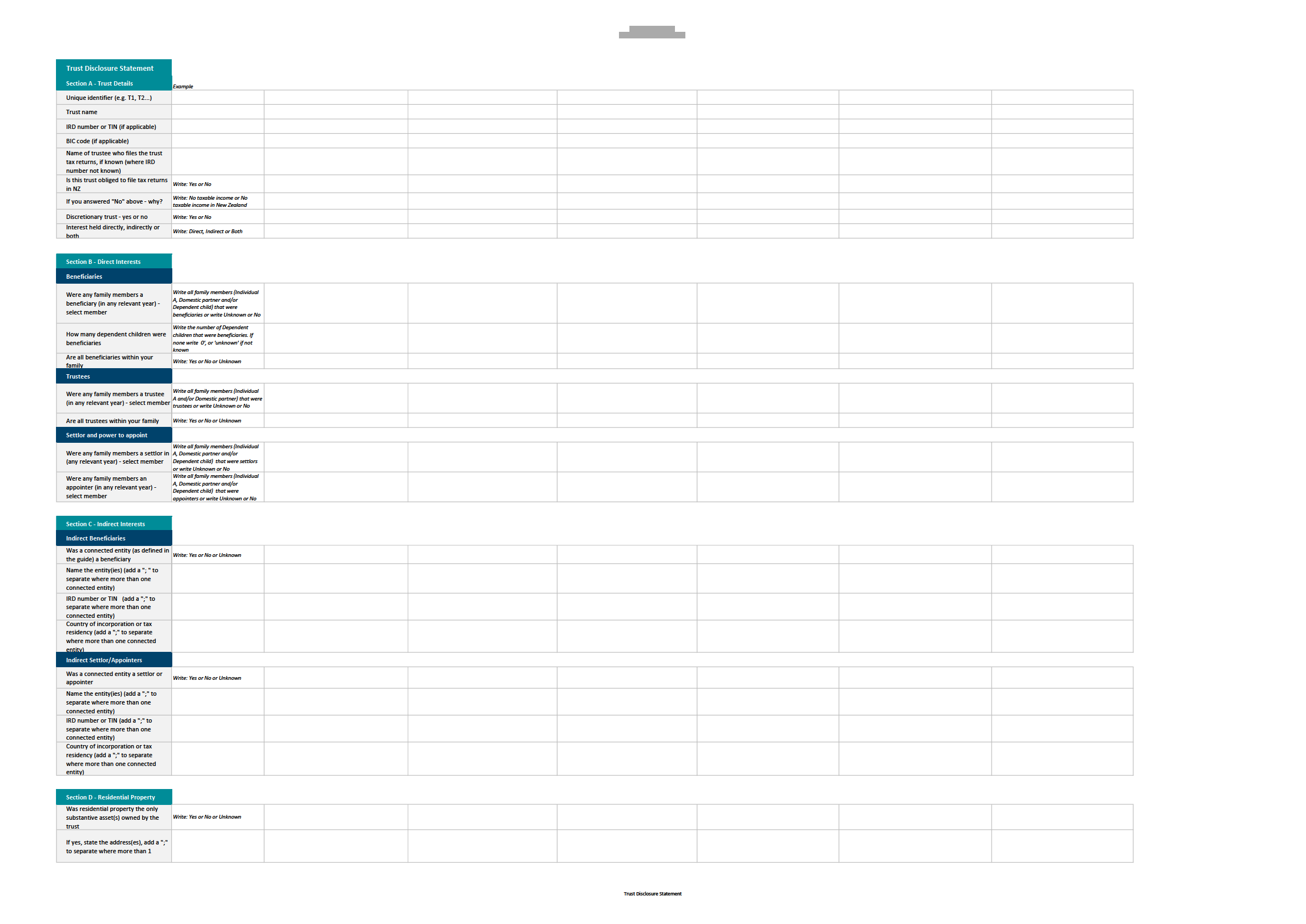

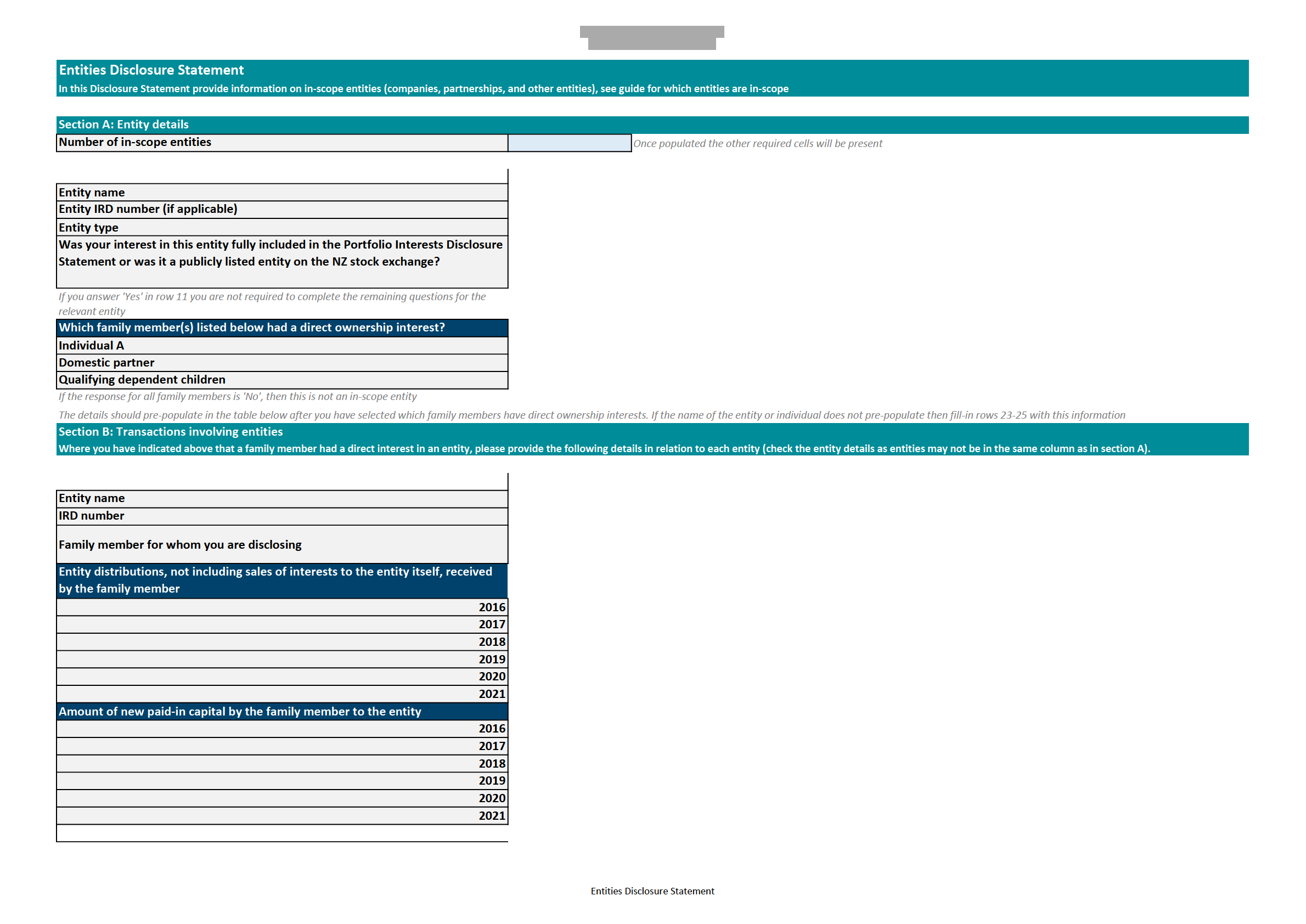

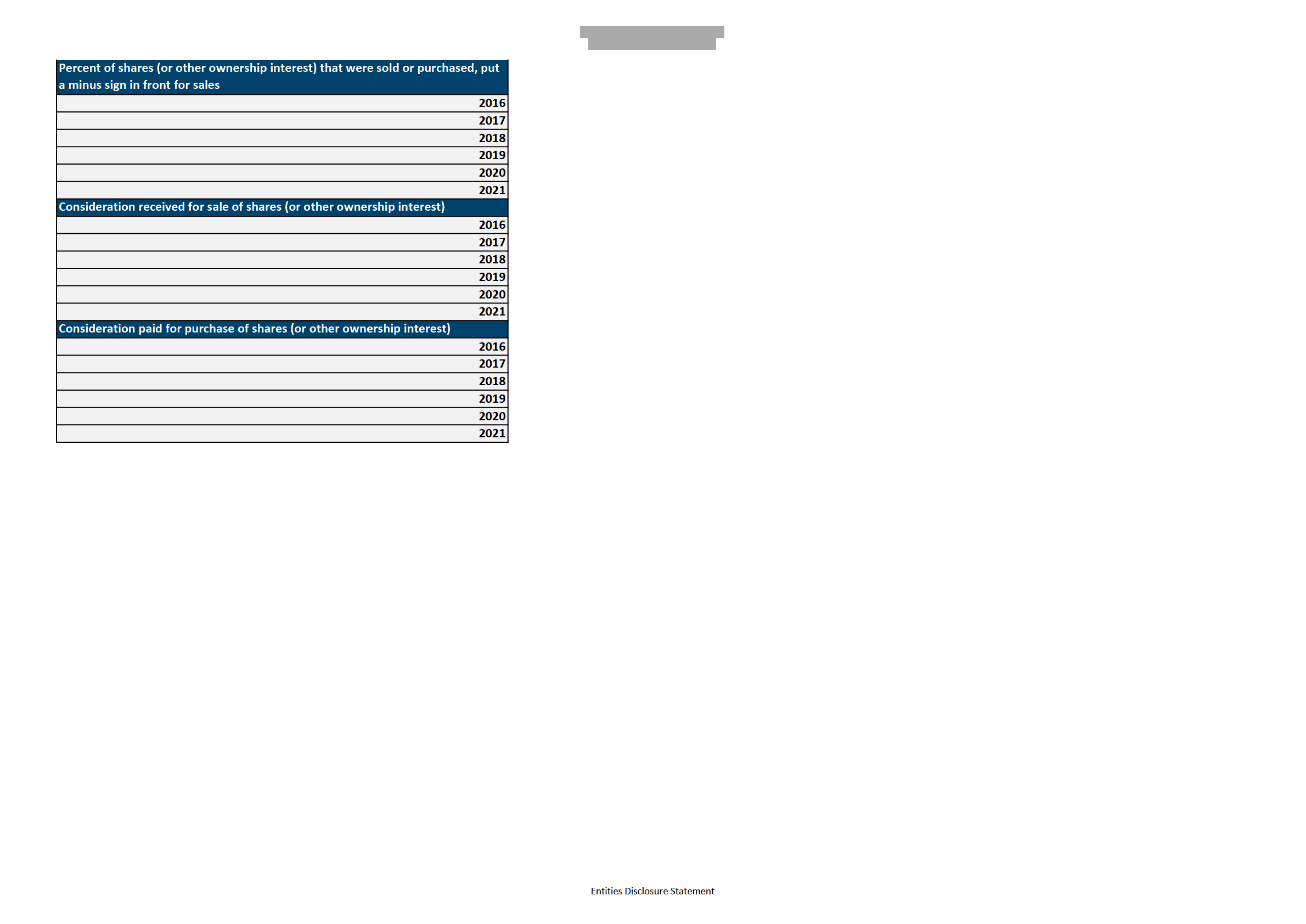

In January 2022, we will ask you for information about the various entities and business

undertakings (that is, companies and trusts) you, or your dependent children, have an interest

in. We will ask your partner for the same information in relation to the entities and business

undertakings they have an interest in.

[IN CONFIDENCE RELEASE EXTERNAL]

7. Please provide the following information about your partner. These details will be used to contact

your partner to ask them for information needed for the high-wealth individuals research project. If

there is insufficient information to contact your partner, we will need to contact you again about

this.

a. Partner's first name

b.

(s)

c.

d. Please provide any other names that your partner has been known by (e.g. maiden name)

e. Partner's date of birth

f. Partner's IRD number

g. Partner's other Tax Identification Number(s) and country of issue

h. Partner's postal address

i. Partner's phone number

j. Partner's email address

8. Do you currently have any dependent children?

A dependent child is a child of you and/or your partner from a biological, adoptive or

fostering relationship who is:

Aged 17 or under, and

Not in full time paid employment (regularly working 30 hours or more per week),

and

Not married, in a civil union or in a de facto relationship themselves, and

You regard as being part of your household due to them, for example:

often living at a shared address with you, or

sharing household activities with you, or

being viewed as your dependent child by others.

9. How many dependent children do you have?

10. Please provide the following information in respect of any dependent child (starting with the eldest)

who, to the best of your knowledge, currently has net assets in their own name in excess of

$1,000,000 or in the 2021 income year had taxable income in excess of $1,000,000. You are not

required to undertake a valuation exercise to answer this question.

a. Child's first name

b. Child's middle name(s)

c. Child's surname

d. Child's date of birth

e. Child's IRD number

Document 5

Policy and Regulatory Stewardship

Kaupapa me te Tiaki i ngā Ture

55 Featherston Street

PO Box 2198

Wellington 6140

New Zealand

21 February 2022

«FirstName» «Middlename» «LastName»

«courier_addr1»

«cou

rier_addr2»

«courier_addr3»

«courier_addr4»

By courier

Tēnā koe,

High-Wealth Individuals Research Project – request for information about entities

You will be aware from our previous correspondence that you have been selected to take part

in Inland Revenue’s high-wealth individuals research project.

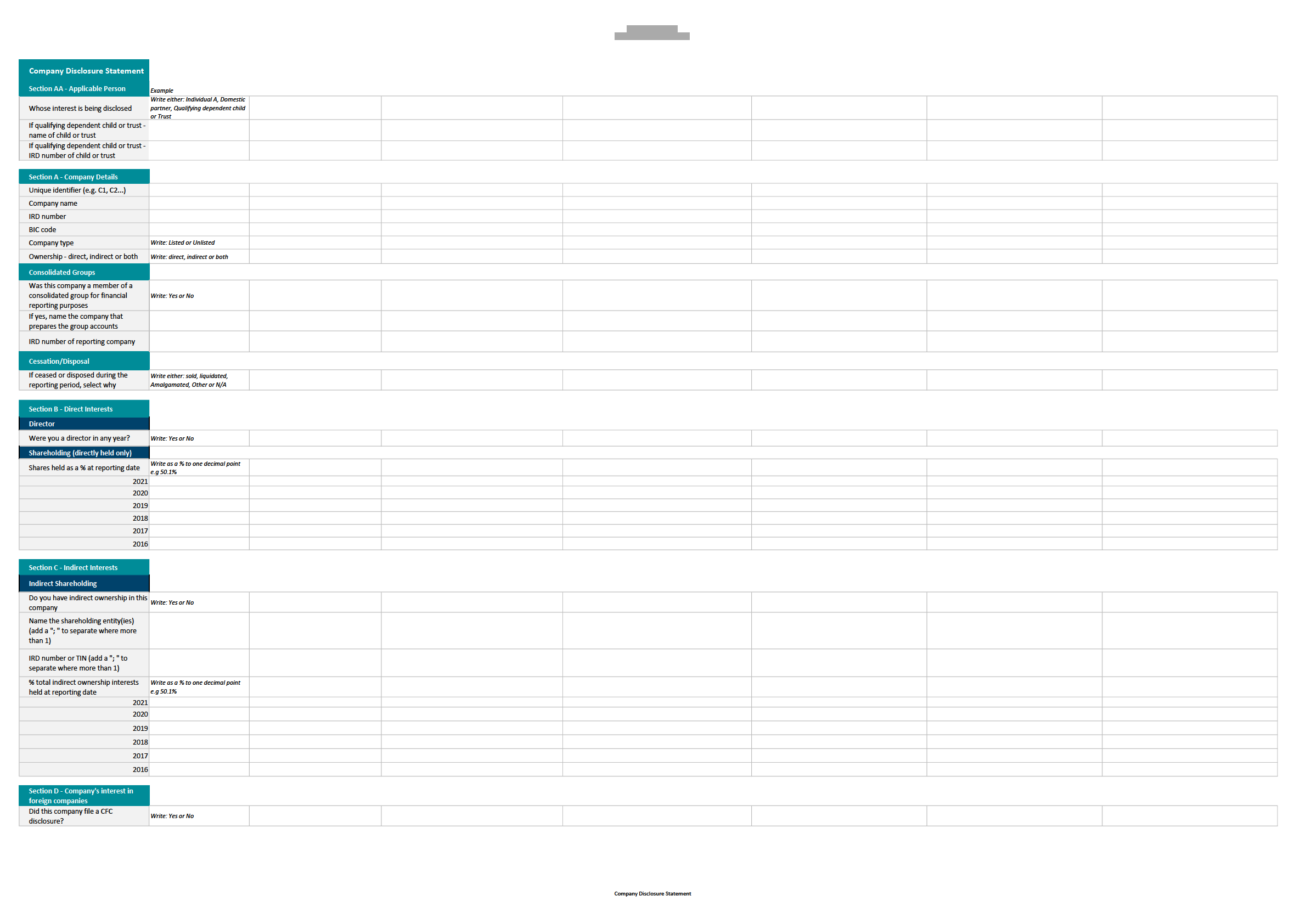

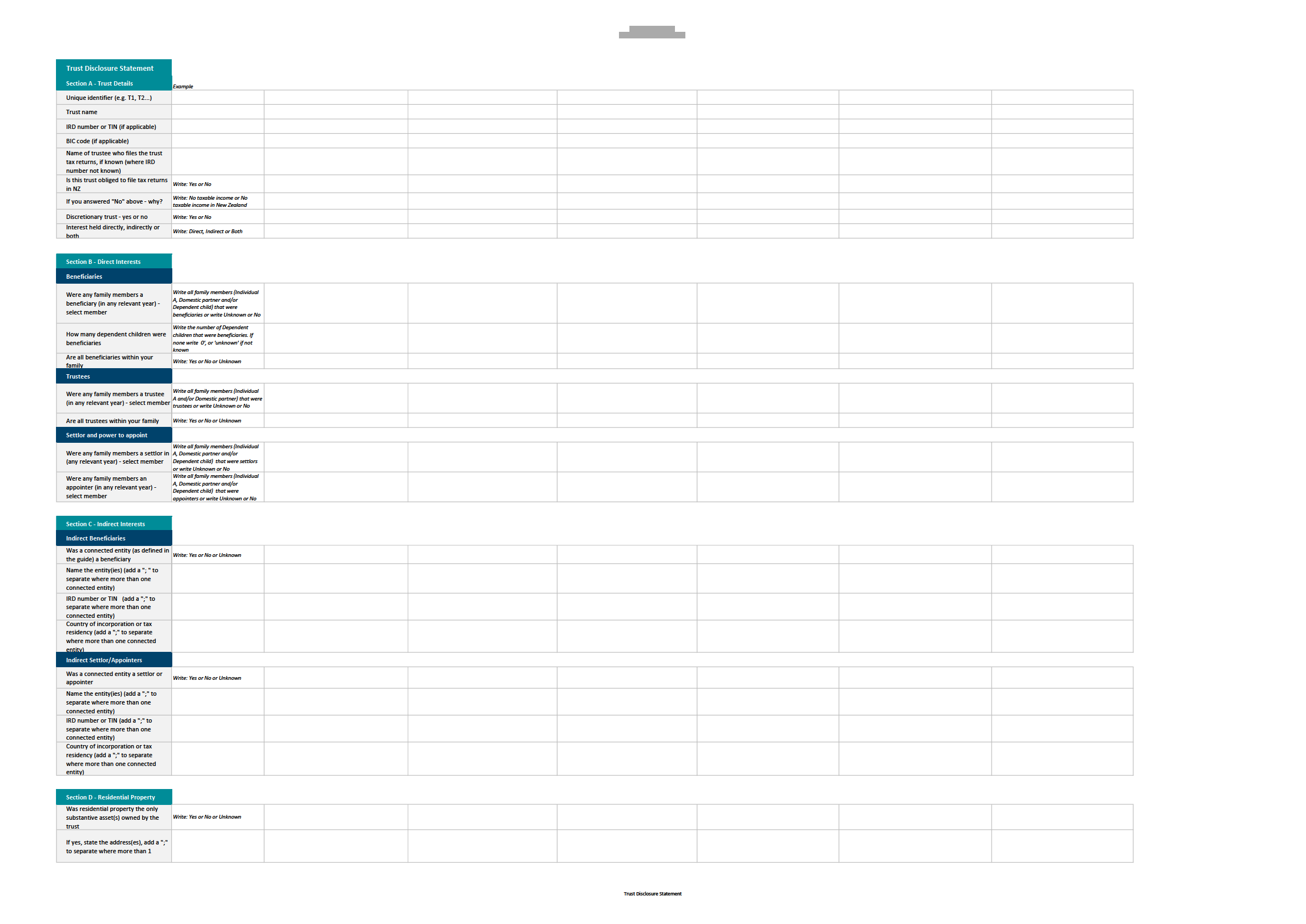

Today we issued a notice pursuant to section 17GB of the Tax Administration Act 1994

requiring you to complete a questionnaire about entities (that is, companies and trusts etc.)

that you have an interest in. In accordance with the legislation, we emailed this notice to the

person you advised is your authorised agent or nominated representative for this project.

You may have already heard from your authorised agent or nominated representative, but if

you have not, please contact them. Your response is due by

5pm on 4 April 2022.

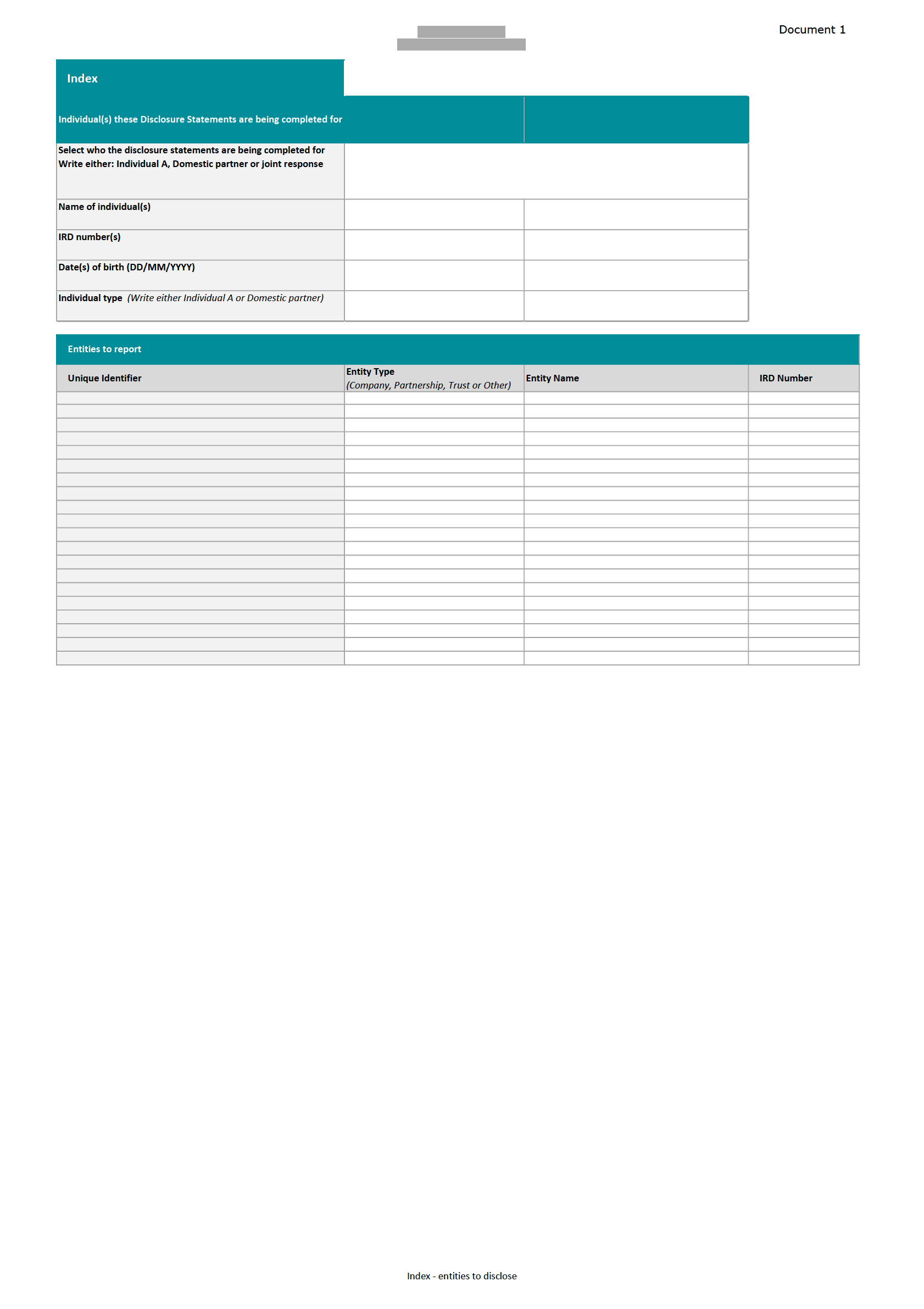

If you require a copy of the Entity Questionnaire – comprising an excel workbook called

‘Disclosure Statements’ and a guide explaining how to complete the Disclosure Statements,

please contact us at [email address] or the above PO Box (attention: Felicity Barker) or

request a copy from your authorised agent or nominated representative. The Entity

Questionnaire and guide can also be accessed through the URL below:

s18(c)(i)

Important: Please ensure you keep this invitation or a note of the URL above. You will need it

later to upload your Disclosure Statements.

Your obligations

You are legally required to provide this information. You are not required to provide

information that would be covered by legal professional privilege or where there is a right of

non-disclosure for documents containing tax advice. For further information, please refer to

OS

13/02 – section 17 notices and

OS 18/02 – non-disclosure right for tax advice documents.

You may ask someone else to respond on your behalf, for example, your agent, but it is

important to understand that the legal obligation to comply remains your own. A copy of

section 17GB is enclosed with this letter. The consequences for non-compliance with section

17GB are the same as for the Commissioner’s other information-gathering powers. For further

information, please refer to

OS 13/02 – section 17 notices.

All information collected as part of this project will be kept confidential and secure. You can

find more information on the protection of your information in the Privacy Impact Assessment

published on the Inland Revenue website:

www.ird.govt.nz/hwi-research-project

Document 6

Policy and Regulatory Stewardship

Kaupapa me te Tiaki i ngā Ture

PO Box 2198

20 Aitken Street

Wellington 6140

New Zealand

9 June 2022

«FirstName» «Middlename» «LastName»

«courier_addr1»

«courier_addr2»

«courier_addr3»

«courier_addr4»

By courier

Tēnā koe,

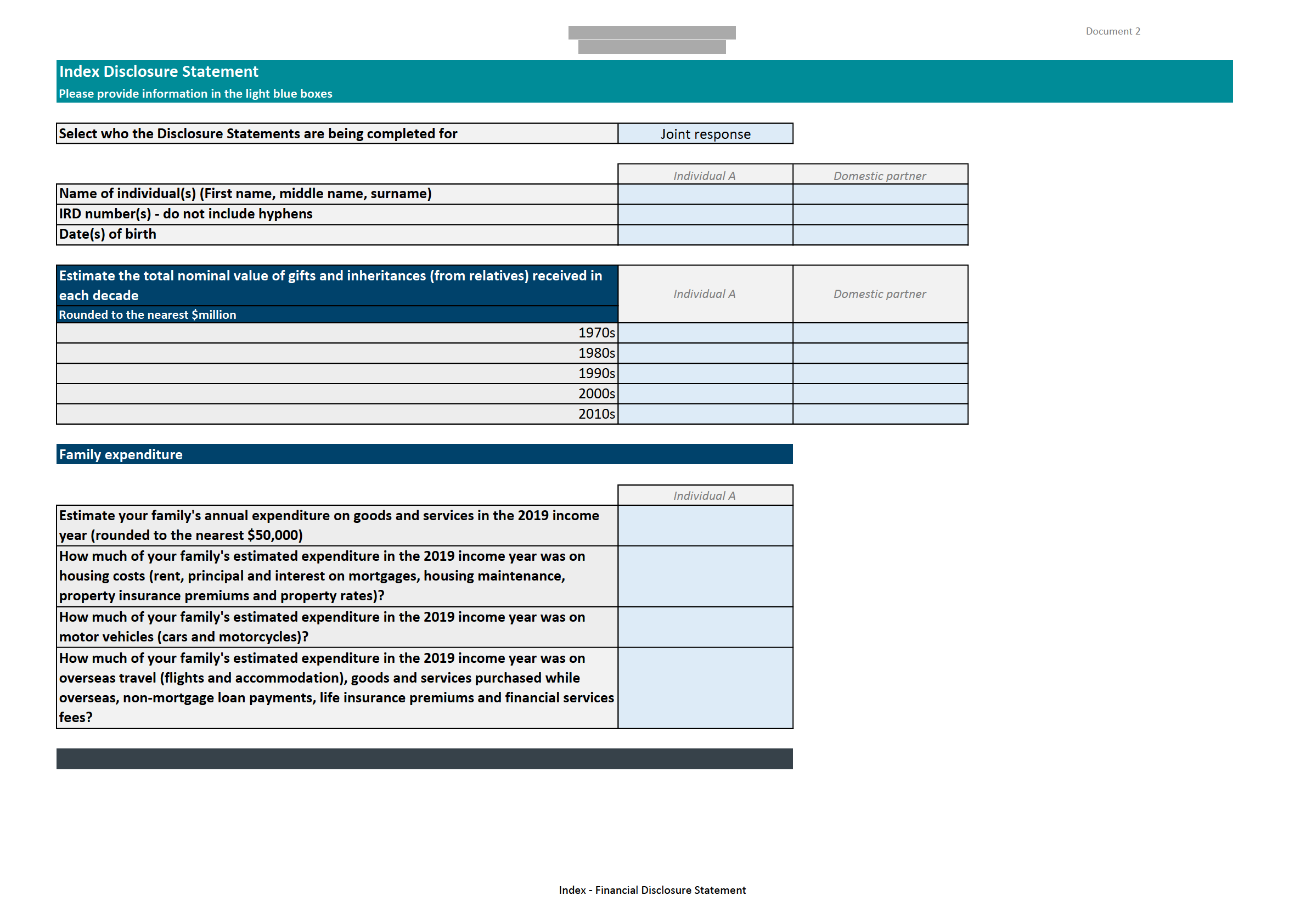

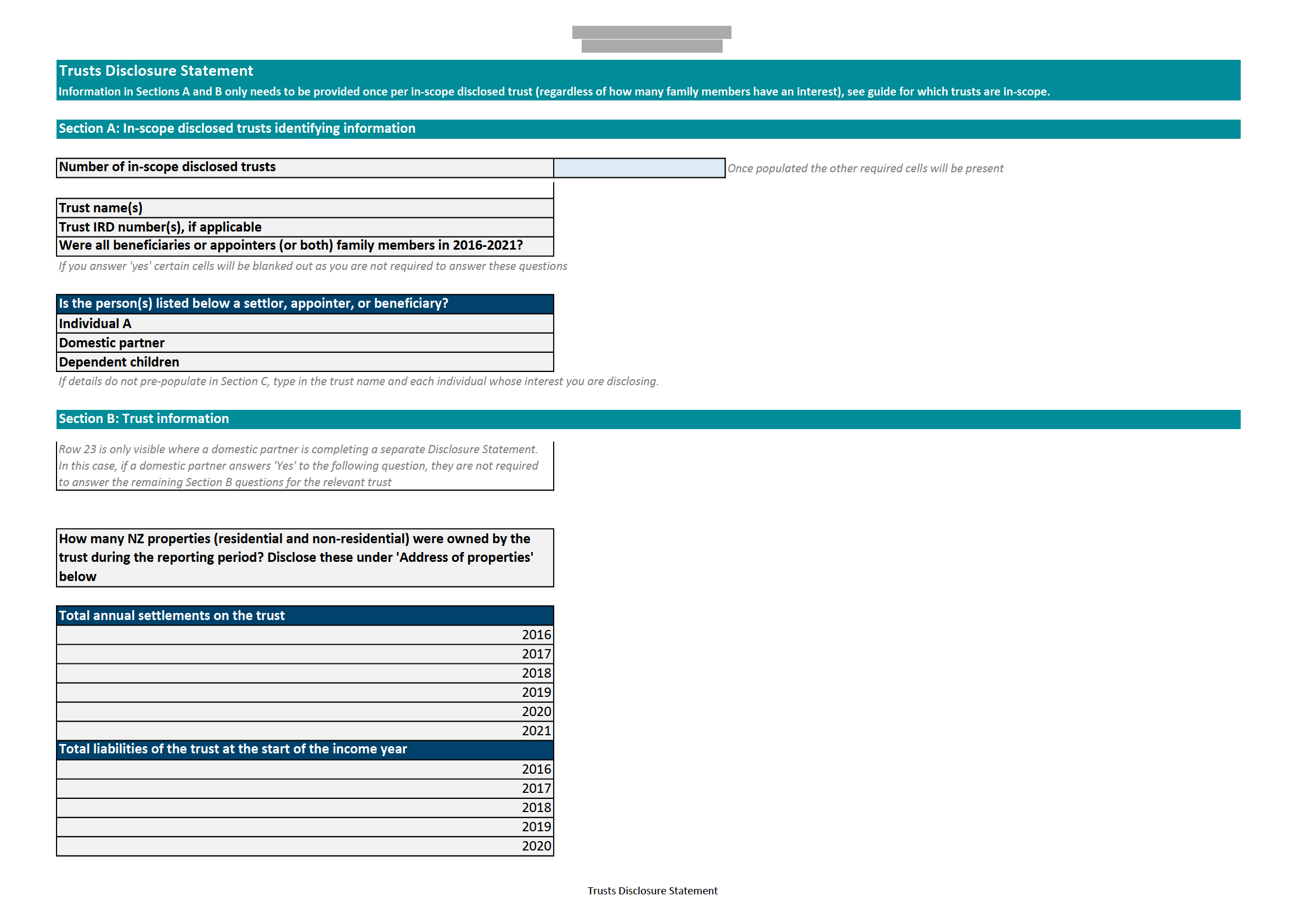

High-wealth individuals research project –financial information required

You will be aware from our previous correspondence that you have been selected to take part

in Inland Revenue’s high-wealth individuals research project.

Today we issued a notice pursuant to section 17GB(1) of the Tax Administration Act 1994

requiring you to provide certain financial information about both yourself and some of the

entities that you have an interest in. In accordance with the legislation, we emailed this notice

to the person you advised is your authorised agent or nominated representative for this

project.

You may have already heard from your authorised agent or nominated representative, but if

you have not, please contact them. Your response is due by

5pm on 24 August 2022.

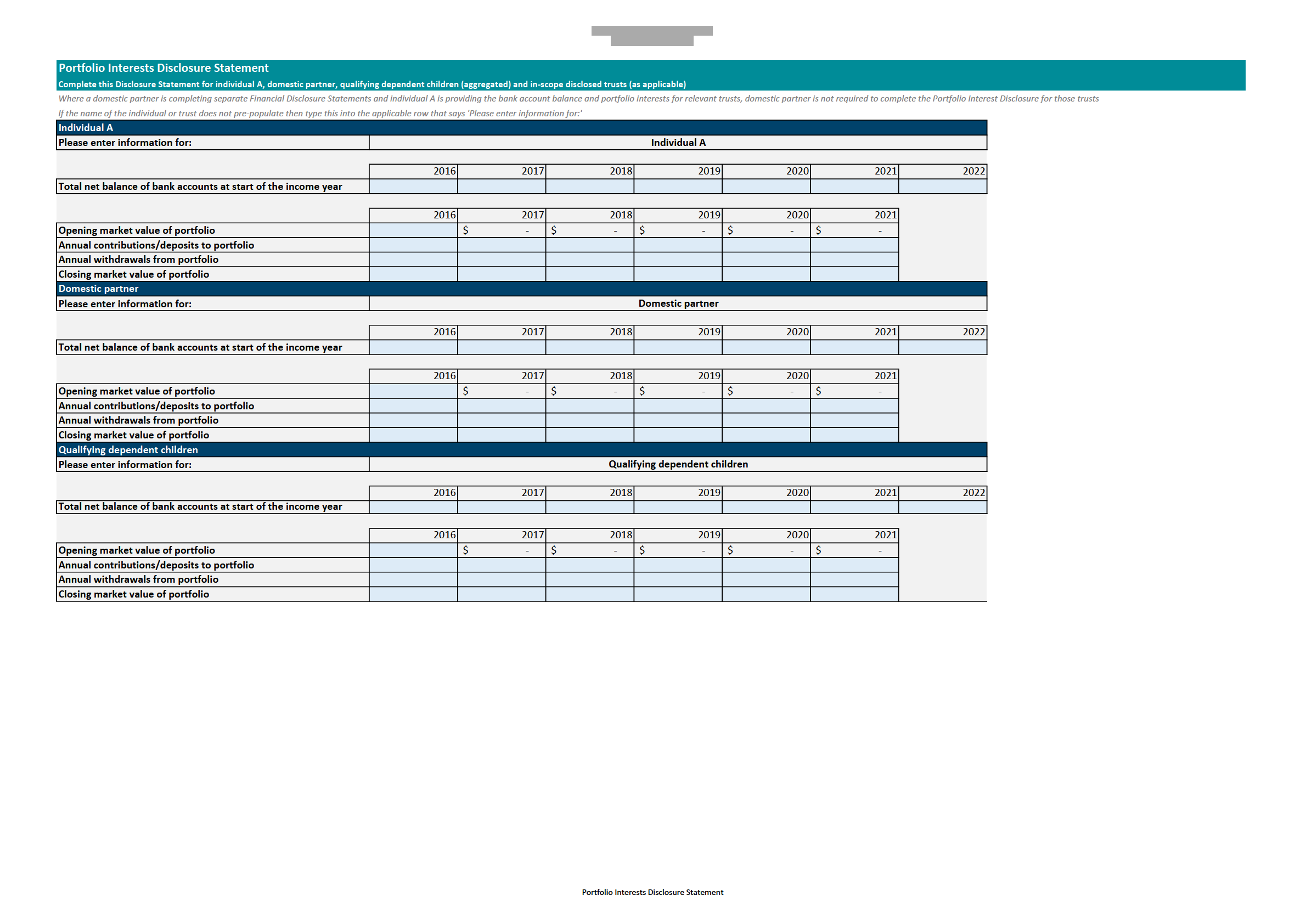

If you require a copy of the Financial Questionnaire – comprising an excel workbook called

‘Financial Disclosure Statements’ and a guide explaining how to complete the Financial

Disclosure Statements, please contact us at [email address] or the above PO Box

(attention: Felicity Barker) or request a copy from your authorised agent or nominated

representative. The Financial Disclosure Statements and guide can also be accessed through

the URL below:

s18(c)(i)

Important: Please ensure you keep this letter or a note of the URL above. You will need it

later to upload your Financial Disclosure Statements.

Your obligations

You are legally required to provide this information as we are requesting it under one of

the Commissioner’s information-gathering powers – section 17GB(1) of the Tax

Administration Act 1994. A person who is notified by the Commissioner that they are

required to provide information under section 17GB(1) must provide any information that

the Commissioner considers relevant for a purpose relating to the development of policy

for the improvement or reform of the tax system. The wording of section 17GB is enclosed

with this letter.

You are not required to provide information that would be covered by legal professional

privilege or where there is a right of non-disclosure for documents containing tax advice.

For further information, please refer to

OS 13/02 – section 17 notices and

OS 18/02 –

non-disclosure right for tax advice documents.

non-disclosure right for tax advice documents. You may ask someone else to respond on your behalf, for example, your agent, but it is

important to understand that the legal obligation to comply remains your own. The

consequences for non-compliance with section 17GB are the same as for the

Commissioner’s other information-gathering powers. For further information, please refer

to

OS 13/02 – section 17 notices. How to respond

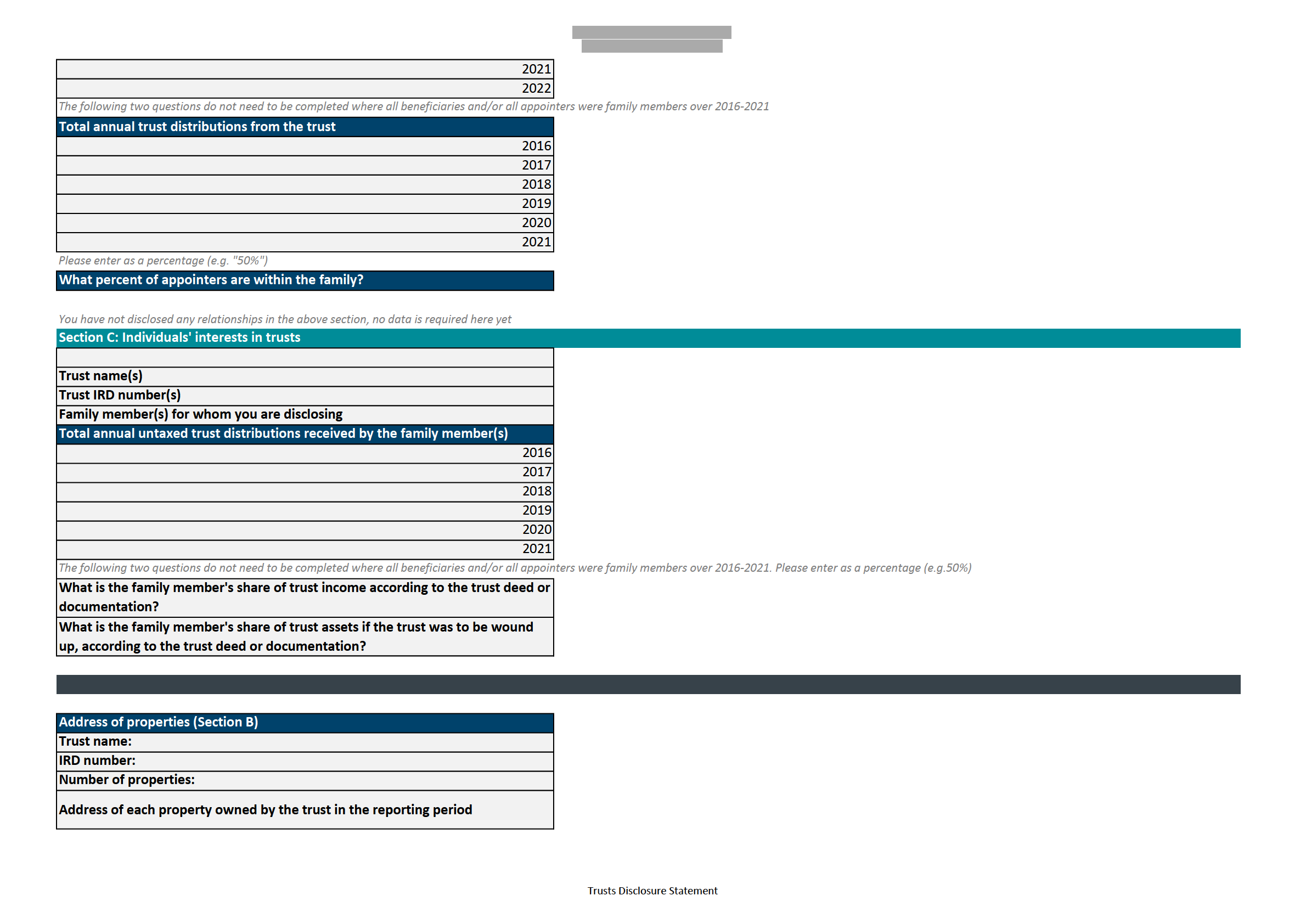

You and your partner (if you have one) have both been asked to provide information to

Inland Revenue on your respective financial affairs. This information has been requested

from each of you separately to protect your privacy. However, as explained in the guide,

you may choose to provide a single joint response or separate responses.

Instructions on how to submit the Financial Disclosure Statements via the URL are in the

guide. We prefer that you submit the Financial Disclosure Statements in this way as it is

the mo

st secure.

If you are unable to submit the Financial Disclosure Statements by uploading them via the

URL, you may submit them by email to s18(c)(i)

. If you reply by

emai

l, we request that you use encryption to protect this information.

Your response is due by

5pm on 24 August 2022.

When information about in-scope disclosed trusts is unavailable

If you are unable to answer any of the questions about in-scope disclosed trusts because

the information is not within your knowledge, possession or control, then by

4 July 2022 you are required to tell us the name and contact details of the person(s) with access to

this information.

To provide these contact details, please download the form called ‘Contact Details for In-

Scope Disclosed Trusts’ (which can be accessed by clicking on the URL above) and email

the completed form to [email address]. Further instructions are given in the guide.

If we do not hear from you by

5pm on 4 July 2022 then we will assume that you will be

able to provide the required information by

24 August 2022.

Further information All information collected as part of this project will be kept confidential and secure. The

Financial Disclosure Statements will be classified as ‘In Confidence – Policy Research Only’

when they are populated. You can find more information on the protection of your

information in the Privacy Impact Assessment published on the Inland Revenue website:

www.ird.govt.nz/hwi-research-project

You have rights of access and correction in accordance with Inland Revenue’s privacy policy.

Enclosed with this letter is an updated Information Sheet on the project. Please note that we

were unable to provide the updated Information Sheet to you prior to sending this letter as we

do not hold a current email address for you. Please provide us with your preferred email

address by emailing [email address].

If you have any questions about completing the Financial Disclosure Statements or require

assistance in completing them, please email s18(c)(i)

Please indicate if

you would like a call back.

If you have any questions about the project generally or require assistance in uploading the

Document Outline