IN-CON FIDENCE

16 February 2022

Release

s 9(2)(a) OIA

Team Lead

Crown

Significant Enterprises

Inland Revenue

By email: s 9(2)(a) OIA

Under

Tēnā koe s 9(2)(a)

Orange Tamariki Ministerial Advisory Board tax treatment of Board Member

Official

Fees I am writing to you to provide an update on the tax treatment of board member fees

for the Oranga Tamariki Ministerial Advisory Board (the Board) and to confirm the

steps we have taken to address the historical incorrect treatment of tax.

Information

I understand officials from Oranga Tamariki contacted you in October 2021 to

discuss concerns over GST being invoiced on board members fees. Subsequently

PwC also contacted you in November regarding the treatment of tax for the Board

members on behalf of Oranga Tamariki. As you may recall there were several points

covered around both the charging of GST and the deduction of withholding tax from

the members.

I am advised that PwC met with you on 2 November 2021 where they sought specific

advice regarding how to rectify historical payments to the board members and the

return of withholding tax to Inland Revenue. It was confirmed that withholding tax

Act

would be deducted from future payments to the Board Members.

You agreed that the Board Members needed to provide Oranga Tamariki assurance

1982

that they will return the income in their respective 2021 and 2022 income tax returns.

You also noted Oranga Tamariki needed to:

•

Communicate with each Board Member clearly setting out what is required to

rectify the incorrect tax treatment, both from a historical and prospective basis,

•

Provide confirmation to each Board Member that withholding tax will be

deducted from future payments,

•

Seek assurance from each Board Member that they will/have returned the

income in their 2021 and 2022 income tax returns, and

IN-CON FIDENCE

•

Provide you with detailed information on what has been paid to each Board

Member to date, where withholding tax was not deducted, for you to complete

spot checks of their 2021 and 2022 income tax returns.

I can confirm that we wrote to all Board Members in early December 2021 setting out

that all payments to members are subject to withholding tax and the deduction of

withholding tax will be applicable from 1 September 2021 onwards. The payment of

Release

Board Member fees was temporarily paused while we understood and corrected the

treatment of tax on members fees.

In the letters to the Board Members, we clearly set out each step required to rectify

the historical treatment of payments and requested they provide us assurance they

would return the income direct to Inland Revenue for the applicable tax periods.

Please find attached a copy of the letters sent to the Board Members. I have also

attached a copy of the Board Member’s assurance (email) of their intention to pay

Under

the appropriate amounts directly to Inland Revenue.

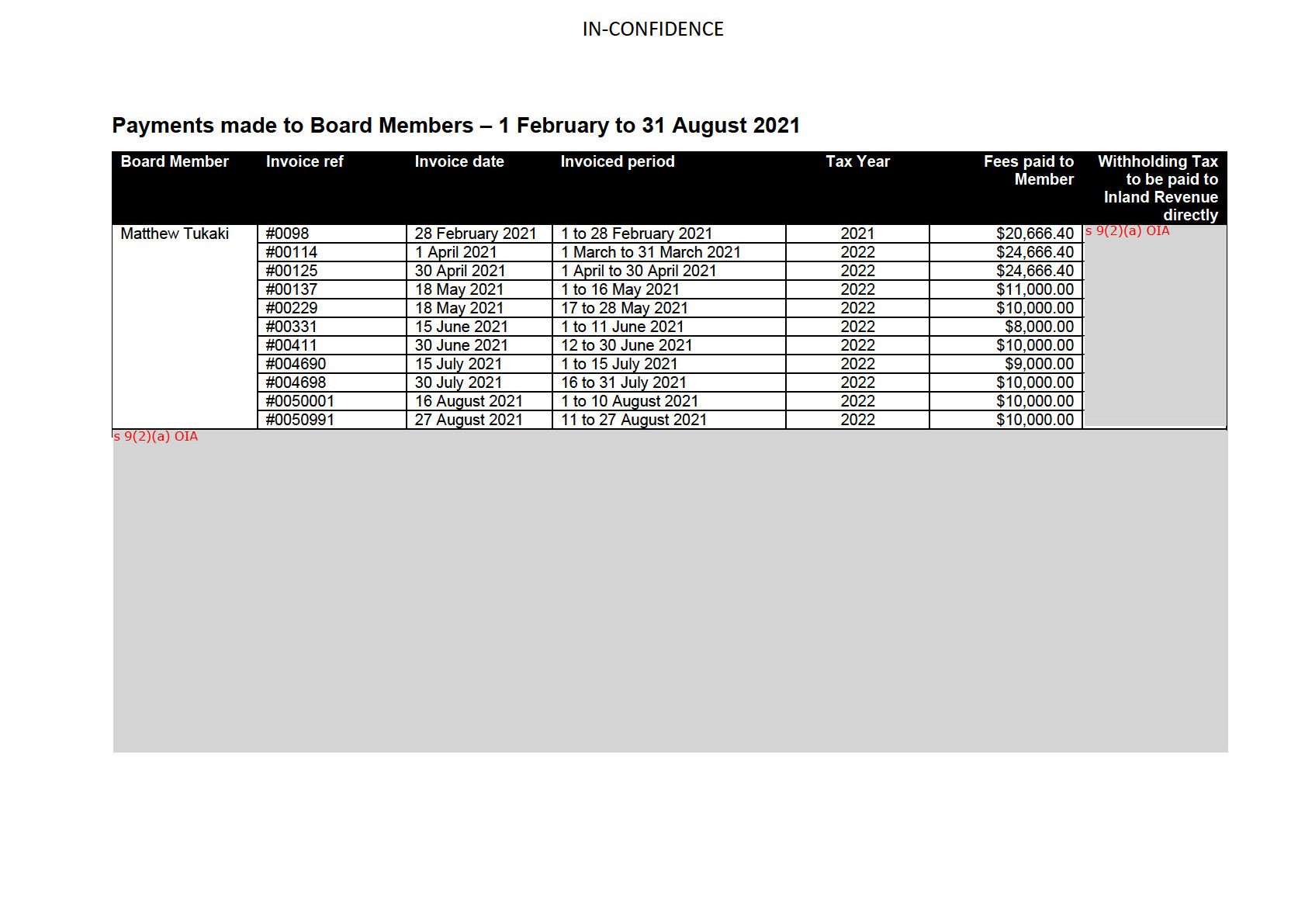

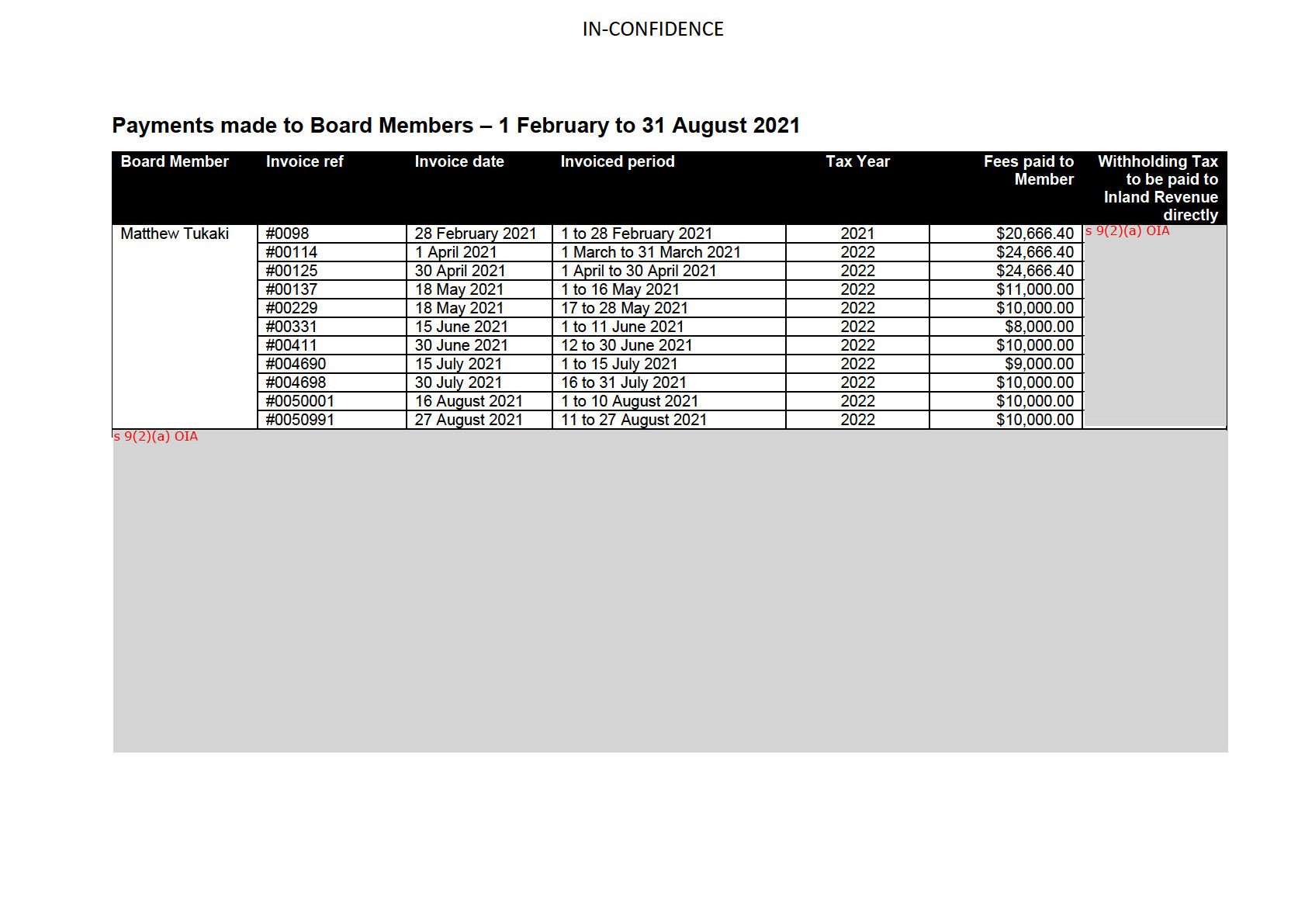

To enable you to carry out assurance on the 2021 and 2022 income tax returns for

the Board Members you requested copies of the payments made to the end of

August 2021. I have attached a table of the payments made to each Board Member

Official

for the period 1 February to 31 August 2021.

I can confirm there were additional payments made to the Chair of the Board during

this period however these were subsequently identified as an overpayment. The

Chair is returning those payments to us; therefore, these are not included in the

attached schedule.

Information

Thank you for your ongoing patience and support in addressing and the tax

treatment of members fees. The approach you have taken to support us in

addressing these issues is appreciated. I am pleased to advise that the necessary

steps have since been taken to improve and strengthen the controls to prevent this

from occurring in the future.

I trust that the information provided above and the assurance we have now provided

resolves the incorrect tax treatment. If you have any questions or would like further

information, please contact me s 9(2)(a) OIA

or Julie Miller, Acting Director

Act

Review Management, s 9(2)(a) OIA

1982

Nāku noa, nā

Jane Fletcher

Acting Deputy Chief Executive

Governance and Engagement

Release

Under

Official

Information

Act 1982