20 February 2024

Gus M

[FYI request #25216 email]

Dear Gus

Thank you for your Official Information Act (OIA) request, received on 18 December

2023. You requested the fol owing:

Al correspondence between Air New Zealand and their senior management

directly with yourself directly and with your office from 27 November 2023

Information being released

Please find enclosed the fol owing documents:

Item Date

Document Description

Decision

1.

11 December

Message

Release in ful

2023

2.

13 December

FW_Air NZ market release this

Release in ful

2023

morning updating on 1H FY24

(except for contact details)

guidance

3.

13 December

Air NZ updates progress 1H

Release in ful

2023

earnings FY24

(except for contact details)

I have decided to release the documents listed above, subject to information being

withheld under section 9(2)(a) of the OIA, to protect the privacy of natural persons.

Some information has been redacted because it is not covered by the scope of your

request. This is because the document includes matters outside your specific request.

This reply addresses the information you requested. You have the right to ask the

Ombudsman to investigate and review my decision.

Yours sincerely

Hon Nicola Wil is

Minister of Finance

Table of Contents

1.

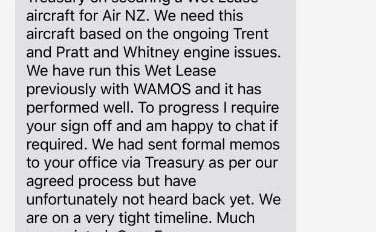

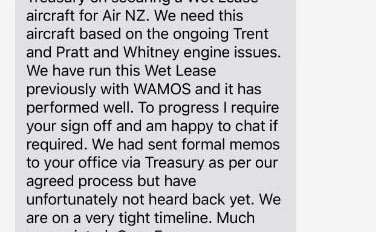

Message

1

2.

Email: FW: Air NZ market release this morning updating on 1H FY24 guidance

2

3.

Air NZ updates progress on 1H earnings FY24

3

From: Leila Peters <[email address]>

Sent: Wednesday, 13 December 2023 8:06 AM

To: Daniel Madley [TSY] <[email address]>; Juston Anderson [TSY] <[email address]>; Amanda Wilson

<[email address]>

Cc: Kim Cootes <[email address]>

Subject: Air NZ market release this morning updating on 1H FY24 guidance

Good morning Juston, Daniel and Amanda,

Please find attached a market release which wil go out to the NZX this morning at 8:30 providing an update on our progress in 1H earnings guidance. It should

be noted that we are cal ing out increased signs of demand softness in the release and expectations for an increasingly chal enging second half.

Please reach out with any questions.

Best,

Leila

Leila Peters

GM Corporate Finance | Corporate Services

FB. facebook.com/airnewzealand

LI. linkedin.com/company/air-new-zealand

185 Fanshawe Street, Auckland

1010, New Zealand

E. [email address]

TW. twitter.com/FlyAirNZ

W. www.airnewzealand.co.nz

YT. youtube.com/airnewzealand

Good planets are hard to find - please think of the environment before you print this email.

____________________________________________________________________

CAUTION - This message may contain privileged and confidential

information intended only for the use of the addressee named above.

If you are not the intended recipient of this message you are hereby

notified that any use, dissemination, distribution or reproduction

of this message is prohibited. If you have received this message in

error please notify Air New Zealand immediately. Any views expressed

in this message are those of the individual sender and may not

necessarily reflect the views of Air New Zealand.

_____________________________________________________________________

For more information on the Air New Zealand Group, visit us online

at http://www.airnewzealand.com

_____________________________________________________________________

Stock exchange listings: New Zealand (NZX: AIR) / Australia (ASX: AIZ) / ADR (OTC: ANZLY)

MARKET ANNOUNCEMENT

13 December 2023

Air New Zealand updates progress on first half FY24 earnings guidance

Fol owing a further two months of operating performance since guidance was given, Air New

Zealand now expects first half earnings for FY24 to be around the bottom end of its $180 million to

$230 mil ion range initial y provided on 12 October.

Early signs of softness in domestic travel, particularly corporate and government travel, which were

noted in the 12 October update have continued, with late booking activity remaining weaker

compared to the prior year. More recently, the airline has noted softer leisure demand in both the

Domestic and Trans-Tasman markets.

Demand for travel to North America continues to be solid, albeit the airline is observing additional

pricing pressure due to increased competition from US carriers. Asia and Pacific Islands demand

remains unchanged. Air New Zealand wil continue to monitor booking patterns closely.

As previously announced, $45 mil ion of Covid related credits that are highly unlikely to be

redeemed by the extended expiry date are included within the above guidance range.

The airline continues to address the ongoing impacts of the global Pratt & Whitney engine issues

on the business. In addition, economic and inflation risks remain and as a result, Air New Zealand

is not providing full year guidance at this time. The airline cautions against extrapolating first half

guidance and currently expects the second half of the financial year to be increasingly chal enging.

Ends

This announcement has been authorised for release to NZX and ASX by Jennifer Page, General Counsel

& Company Secretary ([email address]).

For investor relations queries, please contact:

Kim Cootes

Head of Investor Relations

Email: [email address]

Phone:

Air New Zealand postal address: Private Bag 92007, Auckland, 1142, New Zealand

Investor Relations email: [email address]

Investor website: www.airnewzealand.co.nz/investor