Updating and strengthening

Draft

the consumer care

guidelines

Decision paper

under the Official Information Act 1982

15 January 2024

Released

Executive summary

Consumers are at the heart of everything The Electricity Authority Te Mana Hiko (Authority)

does. Electricity is a crucial service in our everyday lives and one that is helping us innovate

for future generations.

Consumers can and should benefit from a secure and reliable power system, have more

control over their energy use, receive a standard and consistent level of care from their

electricity provider, and have confidence that regulatory and policy decisions are informed by

accurate and up-to-date data.

Earlier this year we consulted on four options to strengthen and update the Consumer Care

Guidelines (Guidelines). These options ranged from maintaining the status quo to mandating

large parts of the Guidelines. We received over 1,000 submissions during the consultation

period, the large majority of which came from consumers, highlighting the importance of a

standard and consistent level of care to be provided by electricity retailers to their customers.

Subm Draft

itters largely supported our approach to strengthen consumer protections and agreed

that the voluntary nature of the Guidelines is not providing effective protection. On the whole,

submitters agreed that mandatory safeguards are required, but that the options presented

inadequately addressed the complexities of mandating the Guidelines and would not

produce the desired outcomes.

Acknowledging the initial options presented in the consultation were not entirely fit-for-

purpose, we have reevaluated our approach to ensure a robust and more nuanced approach

that prioritises the well-being of consumers.

The Authority has decided to replace the Consumer Care Guidelines and establish

mandatory minimum standards

In response to feedback and our commitment to improve consumer protections in the

electricity market, the Authority has decided to establish mandatory minimum standards to

replace the Consumer Care Guidelines.

However, before making the Guidelines mandatory, respondents have urged us to do a

thorough review and unpack what has worked well, and more importantly to resolve the

challenges that retailers have experienced in their implementation. This review is critical to

ensure the new requirements enhance consumer protections, improve clarity, and reduce

ambiguity and other issues imposing undue costs and inefficiencies in the electricity market.

under the Official Information Act 1982

This approach aligns with our additional objective and function to protect consumer interests.

This significant step forward aims to deliver better outcomes for consumers, especially the

most vulnerable, including those medically dependent on electricity. Establishing minimum

standards ensures an enforceable framework, promoting a consistent and supportive

standard of care for all New Zealanders from their electricity retailer.

Recognising retailers’ pivotal role, the Authority values their work done to ensure alignment

with the Guidelines. Their lessons learned from the implementation of the Guidelines will be

a key input into the development of mandatory minimum standards. Collaboration and an

Released

active engagement with the industry will be essential in developing effective, coherent,

workable, and enforceable obligations.

The Authority would like to thank all those who provided feedback on the Guidelines during

our consultation period.

Next steps

Our immediate focus will be to conduct an in-depth analysis of the Guidelines. This

examination will pinpoint existing challenges and areas for improvement. Subsequently, we

will reengage stakeholders to shape the future of consumer protections standards. We

recognise the importance of involving all stakeholders in this process and will be facilitation

workshop sessions to provide a platform for industry groups consumer advocacy groups and

other interested parties to have their say.

Following the engagement phase, we will begin the process to draft code amendments that

reflect the refined Guidelines and stakeholder views and carry out a cost-benefit analysis to

ensure regulatory framework achieves its objectives efficiently.

We intend to consult on the draft Code amendment and the cost-benefit analysis from end of

September to end of October 2024. We are committed to achieving full implementation by

the end of 2024 and will look to address issues outside of scope to the Guidelines in the

second half of 2024.

Draft

under the Official Information Act 1982

Released

Contents

Executive summary

2

1.

Purpose

5

2.

The Authority has decided to introduce mandatory minimum standards of

consumer care

5

3.

We sought to improve the Guidelines to address concerns about their

effectiveness

5

The Guidelines were introduced to address domestic consumer vulnerabilities

5

The Authority has gained an additional, consumer-focussed statutory objective since the

Guidelines were introduced

6

Our reviews have shown implementation has not been as consistent as expected across

the retail market

6

Draft

The Authority released a consultation paper seeking views on options to improve the

Guidelines

7

4.

Feedback revealed shortcomings with the proposed options

7

The scope of option two is too narrow to effectively address the issues with the existing

Guidelines raised in submissions

8

We consider Option three risks undermining the Guidelines as a whole

8

There are significant shortcomings with progressing Option four

9

5.

The Authority has decided to progress an alternative to Option four

10

The Authority will develop mandatory minimum standards for consumer protection 10

This approach will allow the Authority to address the issues raised in consultation

10

6.

Our desired policy objective of improving the Guidelines

11

Our statutory objectives drive our work and how our decision meets our statutory

objectives

11

Our stated policy intent

12

7.

Responses to matters raised in the submissions

12

under the Official Information Act 1982

Additional issues that are outside of the scope of the Guidelines will be addressed

following the creation of mandatory minimum standards

12

There is a wider consumer-care work programme to address additional issues

12

8.

Respondents also raised several other issues that were outside the scope of this

consultation 13

9.

Next steps in action: our year-ahead plan from policy to implementation

14

Released

10.

Attachments

15

Appendix A Submissions analysis

16

Consultation feedback demonstrated a need for the Guidelines to improve on consumer

protections and resolve workability issues

16

Submissions Analysis

16

Key Themes

17

Appendix B List of issues provided by respondents within scope of the Guidelines 23

Appendix C Consumer Care Guidelines Annual Alignment Statement Report 2022/23

34

1.

Purpose

1.1.

This decision paper seeks to:

(a)

Explain the Authority’s decision as a result of the consultation process from

the consultation paper Options to update and strengthen the Consumer Care

Guidelines.

Draft

(b)

Provide analysis of the stakeholder feedback gathered during the public

consultation, particularly focusing on the refinement of our approach on how

to reinforce consumer protections effectively.

(c)

Map out the way forward, outlining the Authority’s actions for the prompt and

effective implementation of the decision to increase consumer protections as

well as fixing existing issues.

2.

The Authority has decided to introduce mandatory

minimum standards of consumer care

2.1.

The Authority has decided to introduce mandatory minimum standards (Standards)

of consumer care within the Electricity Industry Participation Code 2010 (Code).

The Standards will replace the Consumer Care Guidelines (Guidelines).

2.2.

The Standards will largely be based on the existing Guidelines, and will aim to

provide clearer, more practical, and enforceable measures than currently exist. Our

goal is to offer comprehensive consumer-care protections, improve clarity and

mitigate potential costs or inefficiencies.

2.3.

By including these Standards into the Code, the Authority seeks to establish a

under the Official Information Act 1982

consistent and easily communicable regulatory framework for all electricity industry

participants to provide a consistent and supportive minimum standard of care for

New Zealand’s domestic consumers.

3.

We sought to improve the Guidelines to address

concerns about their effectiveness

Released

The Guidelines were introduced to address domestic consumer vulnerabilities

3.1.

The Authority published the Guidelines in March 2021, to support electricity retailers

to deliver a consistent and supportive minimum standard of care to all New Zealand

domestic consumers. The Guidelines replaced guidelines for assisting vulnerable

and medically dependent consumers, which had been introduced mid-to-late 2000s.

3.2.

The Authority decided that the Guidelines would be voluntary at the time of

publication. We also indicated that if voluntary guidelines did not satisfactorily

deliver their intended outcomes, we would consider mandating them (or aspects of

them) in the future.

The Authority has gained an additional, consumer-focussed statutory

objective since the Guidelines were introduced

1982

3.3.

On 31 December 2022, a new section 15(2) and 15(3) of the Electricity Industry Act

2010 came into force. It introduced a new additional objective, which requires the

Authority to protect the interests of domestic consumers and small business Act

consumers in relation to the supply of electricity to those consumers, specifically in

relation to the dealings of these consumers with industry participants.

3.4.

We were also given a new function, under section 16(1)(ia) of the Act, to undertake

Draft

measures aimed at protecting the interests of domestic and small business

consumers in relation to the supply of electricity by industry participants.

Our reviews have shown implementation has not been as consistent as

expected across the retail market

Information

3.5.

Our first review of retailers’ self-assessed alignment with the Guidelines for the

period 1 July 2021–30 June 2022 (published in June 2023) showed that retailers’

stated alignment with the Guidelines was variable, and implementation has not

been as consistent as we expected. This review showed us that retailers were

interpreting clauses of the Guidelines in several different ways. The result of this is

that the outcomes for consumers were likewise variable.

Official

3.6.

The Authority has recently completed the second review of retailers’ alignment with

the Guidelines. This is attached at Appendix C. In summary, the findings of this

report were that, while alignment has improved since the previous review, there

the

remains persistent partial alignment and non-engagement with the Guidelines from

small retailers.

3.7.

Consumer groups have expressed to the Authority on numerous occasions that the

Guidelines should be mandated to protect vulnerable consumers.

under

3.8.

The Energy Hardship Expert Panel Report1 also considered that the Guidelines, as

currently drafted and implemented, are not effective in delivering adequate

protections to consumers and that retailers may not be following them.

3.9.

The limiting nature of voluntary alignment, variable self-alignment responses,

consumer feedback, and retailers raising issues with ambiguity, indicated that the

Guidelines were not satisfactorily delivering their intended outcomes. Furthermore,

the Guidelines were introduced prior to the introduction of a consumer protection

Released

objective and function for the Authority.

1 https://www.mbie.govt.nz/assets/energy-hardship-the-chal enges-and-a-way-forward-energy-hardship-expert-

panel-report-to-minister.pdf, Section 9.2, page 109

3.10.

As a result of the above, the Authority decided to consult on options to update and

strengthen the Guidelines.

The Authority released a consultation paper seeking views on options to

improve the Guidelines

3.11.

The consultation paper was released on 4 September 2023, and sought feedback

on options to update and strengthen the Guidelines. The consultation period closed

Monday 2 October 2023.

3.12. The paper outlined the Authority’s view that the Guidelines could be strengthened

1982

and presented four options the Authority was considering:

(a) Option One: Maintain the status quo.

Act

(b) Option Two: Keep the Guidelines voluntary but clarify interpretation issues in

some areas. This option could be undertaken on its own or alongside options

three and option four.

Draft

(c)

Option Three: Codify (i.e. make mandatory) parts two, six, seven, and eight

of the Guidelines. These parts provide key consumer welfare protections

around financial difficulty, disconnection, and medically dependent

consumers.

(d) Option Four: Codify parts one to nine of the Guidelines.

Information

3.13.

Options three and four also included resolving interpretation issues as described in

Option two.

3.14.

The Authority outlined Option three as its initial preferred option. It was the

Authority’s view that this option would protect the interests of domestic consumers

facing financial difficulty, disconnection, and medically dependent consumers. We

Official

also considered this would minimise any potential negative impacts on innovation,

competition, and efficiency – considerations which align with the Authority’s

statutory objective. the

3.15.

The consultation paper sought feedback from stakeholders on these options and

the Authority’s initial assessment of how best to achieve the Guidelines’ purpose

and intended outcomes. This decision paper is the outcome of that consultation.

4. Feedback revealed shortcomings with the proposed

under

options

4.1.

We received a substantial number of responses to the consultation paper. In total

there were 128 formal submissions and nearly 1000 responses to our online

consumer survey. A summary and analysis of the submissions received is attached

at Appendix A.

4.2.

After carefully considering the feedback received, it has become evident that none

Released

of the presented options – Options two, three and four – stand as a fully suitable

solution to update and strengthen the Guidelines going forward.

The scope of option two is too narrow to effectively address the issues with

the existing Guidelines raised in submissions

4.3.

Option two proposed to keep the Guidelines voluntary but amend their wording to

address issues noted by stakeholders about varying interpretations of parts of the

Guidelines. Examples given in the consultation paper included:

(a) the definition of a ‘severe weather event’

(b) when a disconnection could be interpreted as endangering the wellbeing of

the customer or any customer at the premises (clauses 66(c), and 73(a)(i))

1982

(c)

what ‘reasonable’ means in various parts of the Guidelines

(d) any other wording raised by stakeholders through this consultation that needs

Act

clarification but does not significantly amend or extend the Guidelines.

4.4.

As shown in Appendix B retailers outlined substantial challenges tied to the

Guidelines, including clarity, workability, and even cost/effectiveness concerns. The

Draft

need to eliminate ambiguities, inconsistencies and anomalies emerged as a

common theme.

4.5.

Feedback revealed that Option two would be a significantly more substantial

undertaking than originally anticipated. This is because the number and magnitude

of issues reported with the current Guidelines is a lot more complex than simply

amending the wording in the Guidelines (as was proposed in the consultation

Information

paper).

4.6.

We have concluded that it is important that the concerns raised by retailers are

effectively addressed before minimum standards are introduced. Industry

participants have also stressed the importance of a collaborative approach to

resolve these complexities, emphasising the need for comprehensive resolution to

Official

ensure robust consumer protections.

4.7.

This option would only be feasible if the issues raised by respondents were

primarily minor wording issues regarding interpretation. Given the range and

the

substance of issues raised with the Guidelines by respondents, and the scope of

these being beyond that proposed by Option two, we consider this option would not

achieve the desired outcomes.

We consider Option three risks undermining the Guidelines as a whole

under

4.8.

Option three proposed to codify (make mandatory through the Code) parts two, six,

seven, and eight of the Guidelines.

4.9.

Our initial preference for Option three was grounded in our belief that making these

parts mandatory would effectively mitigate harm to domestic consumers. However,

after reflecting on the submissions received, the Authority’s position on this has

changed. The Authority now considers that having some parts of the Guidelines

mandatory, and others voluntary, will create significant issues that will undermine

Released

the effectiveness of the Guidelines as a whole.

4.10.

While respondents agreed that parts, two, six, seven and eight of the Guidelines are

the parts that prevent greatest harm from occurring to consumers, consumer

advocacy groups commented that this option would create significant shortfalls in

the protections provided. This means that the harms occurring to domestic

consumers could not be prevented if these are the only parts made mandatory.

4.11.

For example, many consumers and consumer advocacy groups mentioned how

part nine (Fees and Bonds) is critical for consumers. Part four (When a customer

signs up or is denied a contract) and part five (Business-as-usual accounts

management) were also highlighted as foundational aspects of the Guidelines that 1982

provide adequate protections for Consumers.

4.12.

Some parts of the Guidelines contain important foundational processes such as

information and records (part three) and the business-as-usual account

Act

management (part five). These parts are essential for realising the desired

outcomes of parts six, seven, and eight and their consistent implementation.

4.13.

After further consideration, we have also concluded that Option 3 could

Draft

inadvertently reverse the progress made by some retailers who have implemented

the entire suite of Guidelines. A segmented approach might create perverse

incentives, leading retailers and new entrants) to prioritise compliance with

mandatory parts while overlooking the voluntary components.

4.14.

In essence, the Authority’s view reflects the need for a more nuanced perspective

Information

than Option three, recognising the interdependence of the Guidelines and a

cohesive, comprehensive regulatory framework.

There are significant shortcomings with progressing Option four

4.15.

Option four proposes to codify parts one to nine of the Guidelines. This option was

favoured by consumers and consumer groups. These groups expressed concerns

Official

that the voluntary nature of the Guidelines leads to consumer harm due to

inconsistent retailer adherence, especially for vulnerable groups.

the

4.16.

Many consumers submitted that the key benefits of mandatory Guidelines will:

(a) reduce variability in outcomes, ensuring a consistent and reliable quality of

service as well as safety for vulnerable consumers (such as those who are

medically dependent on electricity)

(b) allow the Authority to enforce the consumer protection standards as they will

under

be Code obligations.

4.17.

Stakeholders in general supported mandating the Guidelines, however, some

(particularly those from industry) expressed that an adequate option requires

improvements in clarity, coherence, consistency, and enforceability.

4.18.

Retailers opposed Option four, citing the need for significant changes to the current

Guidelines to improve workability. Consumer advocacy groups also stressed the

need for the Guidelines to be better aligned to the Authority’s statutory objectives.

Released

4.19.

Based on the feedback received, the Authority believes the Guidelines need to be

thoroughly examined to address the various issues raised in submissions before

they can be made mandatory. As noted above, retailers provided the Authority with

a large number of issues with the Guidelines – included as Appendix B.

4.20.

However, as discussed above, the scope of any changes to the Guidelines

proposed by Option two (and thereby included in Option four) is too narrow for the

Authority to include in this process. This is particularly true if the conclusion of any

further analysis is that some clauses of the Guidelines should be removed and/or

significantly altered.

5.

The Authority has decided to progress an alternative

to Option four

1982

5.1.

Considering the feedback received, the Authority believes it is imperative to explore

a fit-for-purpose alternative that better aligns with our policy objective than the

options consulted on in the consultation paper.

Act

5.2.

This alternative will maintain the principle of Option four but will include a greater

examination of the existing Guidelines to address issues greater than purely those

of interpretation and clarity.

5.3. Draft

Pursuing an alternative also allows us to address the various concerns raised by

stakeholders as a part of the process of mandating the Guidelines, offering a

practical and efficient solution that includes the views of both consumers and

retailers.

Information

The Authority will develop mandatory minimum standards for consumer

protection

5.4.

The Authority considers the best approach forward is to develop a set of mandatory

minimum standards for consumer protection (Standards) within the Code, based on

the Guidelines.

Official

5.5.

These Standards will aim to address stakeholders’ concerns and create workable,

practical, and enforceable standards that ensure consistency of outcomes for

consumers without creating unnecessary costs or ambiguity. The Authority believes

the

this approach will ensure clear service standards for retailers are set, while also

facilitating effective monitoring and enforcement.

5.6.

While this is a new approach, it is strongly informed by the options in the

consultation paper and does not entail recreating the Guidelines. The Guidelines

will form a foundation of the new Standards, which will be refined through the

under

experiences of consumers and insights provided by retailers who have implemented

the Guidelines.

This approach will allow the Authority to address the issues raised in

consultation

5.7.

This approach will require the Authority to rigorously analyse the Guidelines in light

of the feedback received in submissions. This will build on our earlier analysis of the

Guidelines and will allow us to engage with industry groups and consumers to

Released

inform the design of the Standards.

5.8.

We believe this approach will best achieve the desired policy objectives and update

the Guidelines in line with the Authority’s statutory objectives – particularly the

additional objective. This option will also ensure the Authority addresses the views

of both consumer facing and industry facing stakeholders, which is likely to have the

effect of creating shared commitment across the board to enhance consumer

protections.

6.

Our desired policy objective of improving the

Guidelines

1982

Our statutory objectives drive our work and how our decision meets our

statutory objectives

6.1.

The consultation paper presented our desired policy objective as ensuring that the

Act

Guidelines’ purpose and intended outcomes are consistently being delivered, in line

with the Authority’s statutory objectives. Our main policy objective is to enhance

consumer protections in alignment with our statutory objectives.

6.2. Draft

In considering whether any changes are required to ensure that the purpose and

intended outcomes of the Guidelines are being consistently delivered, we need to

ensure the Authority acts consistently with its statutory objectives:

(a) to promote competition in, reliable supply by, and efficient operation of, the

electricity industry for the long-term benefit of consumers (the main objective)

Information

(b) to protect the interests of domestic consumers and small business consumers

in relation to the supply of electricity to those consumers (the additional

objective) – the additional objective applies only to the Authority’s activities in

relation to the direct dealings of industry participants with domestic consumers

and small business consumers.

6.3.

As the minimum standards will largely be based on the Guidelines, the Authority’s

Official

view is that they promote the additional objective, and they are not inconsistent with

the main objective. In addition to being consistent with the statutory objectives, the

minimum standards would need to be necessary or desirable to do so in order to

the

promote the protection of the interests of domestic consumers in relation to the

supply of electricity to those consumers. This is because section 32 of the Act

provides that the Code can only contain provisions that are consistent with the

objectives of the Authority, and are necessary or desirable to promote any or all of

the following:

under

(a) Competition in the electricity industry.

(b) Reliable supply of electricity to consumers.

(c)

Efficient operation of the electricity industry.

(d) Protection of the interests of domestic consumers and small business

consumers in relation to the supply of electricity to those consumers.

(e) Performance by the Authority of its functions.

Released

(f)

Any other matter specifically referred to in the Act as a matter for inclusion in

the Code.

Our stated policy intent

6.4.

We received feedback from a submitter that the “guidelines do not adequately meet

the Authority’s new objective. First, there are significant shortfalls in the protections

they provide for consumers. Second, the guidelines’ intended outcomes are aimed

at achieving a “balance” between consumer and retailer interests, which we believe

conflicts with the protection function mandated by the act.” A legal opinion was

obtained to support the submitter’s view that such a “balancing” approach as

outlined in paragraph 4.3 of the consultation paper was inconsistent with the

Authority’s objective in section 15(2) of the Electricity Industry Act 2010. We note

1982

that this argument has been supported by other consumer advocacy groups as well.

6.5.

In response to the first comment, the Authority is of the view that the Authority’s

decision to introduce mandatory minimum standards following a consultation Act

process with stakeholders will help the Authority understand how the protections in

the Guidelines can be refined. In response to the second comment, the Authority’s

intention was to confirm that it has taken into account its main objective of

Draft

promoting a competitive, reliable and efficient electricity industry as well as the

additional objective when considering how the proposal impacts consumers as

consumers are referenced both in the main objective and the additional objective.

7.

Responses to matters raised in the submissions

Information

7.1.

The Authority acknowledges the vast number of issues raised in this consultation,

many of which relate to the content of the Guidelines. These are outlined in

Appendix B and will be addressed in conjunction with developing the Standards.

We acknowledge that addressing these matters is vital to resolving current

ambiguities and impracticalities present in the Guidelines.

Official

Additional issues that are outside of the scope of the Guidelines will be

addressed following the creation of mandatory minimum standards

the

7.2.

The Authority considers progressing the strengthening of consumer protections a

priority, and therefore the creation of mandatory minimum standards for consumer

care within the Code. The Authority will therefore prioritise the process of redrafting

the Guidelines into these mandatory minimum standards in early 2024 and will

consult with stakeholders in due course.

under

7.3.

The issues that lie beyond the scope of this consultation, presented in the section

above, will be considered further with an aim to include them in our work

programme starting the second half of 2024.

There is a wider consumer-care work programme to address additional issues

7.4.

While the Authority will prioritise the process of redrafting the Guidelines into

mandatory minimum standards, issues raised that are outside the scope of this

Released

consultation will be addressed after the conclusion of the creation of mandatory

minimum standards.

7.5.

The Authority notes work is being done on several concurrent work programmes

that may address some of these issues. The outcomes of these workstreams will be

considered ahead of revisiting out-of-scope issues from the Guidelines consultation.

These workstreams include:

(a) Improving the Authority’s collection of retail data – which will provide the

Authority with substantial data on consumer debt, disconnections, complaints,

and other issues. This will allow the Authority to make more informed

decisions and improve monitoring of how retailers are treating their

customers.

(b) Designing an updated registration form and emergency response plan

to assist medically dependent consumers – the Authority is working with

1982

Te Whatu Ora Health New Zealand on a project designing an updated

registration form for medically dependent consumers and an updated

emergency response plan to assist medically dependent consumers in Act

emergency situations – such as planned or unplanned outages. The outcome

of this project will inform the overall review of the Guidelines.

(c)

Options to support consumer plan comparison and switching – the

Draft

Authority is considering a range of options for the best means to support

consumers to compare and switch electricity plans and retailers. This will

canvass several options, including forms of website delivery and supporting

services, including an option regarding requirements for retailers to provide

best plan comparisons of their own products.

Information

8.

Respondents also raised several other issues that

were outside the scope of this consultation

8.1.

A number of other issues were raised, many of which were outside the scope for

the Authority to consider with regards to the objectives of this consultation. The

Official

Authority will consider the issues, discussed below, after resolving the outcome of

this consultation.

the

Processes and fees for disconnection and reconnection

8.2.

Most consumers and consumer advocacy groups emphasised the importance of

addressing fees and bonds (part nine of the Guidelines, which were proposed to

remain voluntary under Option three). These respondents raised concerns around

the lack of mandatory rules governing bonds and fees, and how this could lead to

under

excessive costs of electricity.

8.3.

Of particular concern was the processes and fees around disconnection and

reconnection, where respondents highlighted that these create significant equity

issues for low-income householders that are the most likely to face disconnection

due to non-payment. Several consumer advocacy groups asked for these fees to be

banned.

8.4.

The Authority will need to conduct further analysis on this issue. The banning of

Released

disconnection and reconnection fees is a complex issue that would require its own

analysis and consultation. Of note, the Guidelines currently indicate that fees should

be reasonable (paragraph 109 of the Guidelines), but there is likely not a common

understanding of what this entails. This issue may be addressed in part through the

creation of mandatory minimum standards for consumers.

The Guidelines’ approach to pre-pay plans

8.5.

Submitters commonly raised matters of equity issues regarding pre-pay electricity

plans. Consumer advocacy respondents suggested that the Authority should

address the disparities in tariffs and fees across prepay plans.

8.6.

Most consumer advocacy groups highlighted the lack of information around prepay

disconnections. These respondents also suggested the Authority should collect and 1982

publish data on pre-pay plans and the varying associated costs.

8.7.

Further information would be required before the Authority could address these

Act

issues. As with the issue of disconnection and reconnection processes and fees

above, this is also a complex issue that is outside the scope of the current

Guidelines and will need further analysis.

Infor Draft

mation and enforcement

8.8.

The vast majority of consumers, consumer advocacy groups, and retailers

suggested that the Authority should invest in collecting and publishing greater

information and insights on the residential electricity sector.

8.9.

Consumer advocacy groups also suggested that greater monitoring of the retail

Information

sector is necessary to enforce the Guidelines – particularly if parts of the Guidelines

remain voluntary.

8.10.

The Authority is currently undertaking a work programme to increase the amount of

retail data available to improve our monitoring functions.

Other matters

Official

8.11.

Other matters raised in individual submissions included:

(a) protections for consumers experiencing family violence

the

(b) expanding protections for consumers using alternative energy sources such

as solar panels

(c)

extending the Guidelines to include protections for small businesses as well

as consumers.

under

9. Next steps in action: our year-ahead plan from policy

to implementation

9.1.

Detailed analysis – our immediate focus involves conducting an in-depth analysis

of the Guidelines. This examination will pinpoint existing challenges and areas for

improvement. Analysis will take place January-February 2024.

Released

9.2.

Stakeholder engagement – we recognise the importance of involving all

stakeholders in shaping the future of consumer protection standards. Active

engagement will involve workshop sessions, providing a platform for industry

groups, consumer advocacy groups and other interested parties to have their say.

Stakeholder engagement will take place March-April 2024.

9.3.

Code drafting process – following the engagement phase, we will begin the

process to draft code amendments that reflect the refined Guidelines and

stakeholder views. This stage involves translating the identified standards into

actionable and enforceable provisions within the Code. We intend to finalise the

drafting of the Code amendments by August 2024.

9.4.

Cost-benefit analysis – to assess the impact of our proposed changes, a

comprehensive cost-benefit analysis will be undertaken. This analysis aims to

1982

estimate the net benefits from implementing the mandated minimum standards for

consumers. By weighing the costs against the anticipated benefits, we can ensure

the regulatory framework achieves its objectives efficiently. We expect to have a

Act

cost-benefit analysis completed by the end of September 2024.

(a) We intend to consult on the draft Code amendment(s) and the cost-benefit

analysis from end of September to end of October 2024.

9.5. Draft

Monitoring and enforcing mechanisms – in order to achieve full implementation

fo the Standards by the end of 2024, we will need to establish effective monitoring

and enforcement mechanisms to implement the Standards.

9.6.

Issues outside of scope to the Guidelines – the Authority intends to begin work

on issues outside of scope of the Guidelines in the second half of 2024, once the

Information

mandated minimum standards work programme is settled from a policy perspective.

10. Attachments

10.1.

The following appendices are attached to this paper:

Official

Appendix A Submissions analysis

Appendix B List of issues provided by participants within scope of the Guidelines

the

Appendix C Alignment Report

under

Released

Appendix A

Submissions analysis

Consultation feedback demonstrated a need for the Guidelines to improve on

consumer protections and resolve workability issues

A.1. Feedback to the consultation was significant and came from a wide range of

stakeholders. Overall, the feedback we received demonstrated the need to

significantly update the Guidelines. The submissions are published on the Authority’s 1982

website.2

Submissions Analysis

Act

A.2. The Authority received 128 written submissions from respondents listed in Table One

below, including:

(a) 100 from consumers

Draft

(b) 12 from consumer advocacy groups

(c)

One social agency

(d) One disputes scheme

(e) One electricity distributor

Information

(f)

11 electricity retailers

(g) One research organisation

(h) One electricity retailer association

A.3. The Authority also received eight submissions from school children, who articulated

the importance of electricity to everyday life and the need for New Zealanders’ access

Official

to electricity to be protected. We noted these submissions, but they were not included

as part of our formal submissions analysis (and do not feature in Table One below).

A.4. The Authority also received nearly 1000 substantive responses to the online

the

questionnaire, primarily from individual consumers.

Table One: List of submitters to the consultation paper by category

Category

Submitters

under

Consumer advocacy groups Anglican Advocacy, Child Poverty Action Group, Citizens

Advice Bureau, Common Grace Aotearoa, Community Law

Centres o Aotearoa, Consumer Advocacy Council,

Consumer NZ, Disabled Persons Assembly NZ,

Presbyterian Support New Zealand, The Salvation Army,

New Zealand Council of Christian Social Services, Electric

United Community Action Network

Released

Social agencies

FinCap

2 Improving the Consumer Care Guidelines | Our consultations | Our projects | Electricity Authority (ea.govt.nz)

Disputes scheme

Utilities Disputes Limited

Electricity distributor

Wellington Electricity

Electricity retailer

Contact Energy, Electric Kiwi, Electricity Networks

Aotearoa, Entrust, Genesis Energy, Independent Retailers,

Mercury, Meridian Energy, Nova Energy, Octopus Energy,

Genesis

1982

Research organization

He Kāinga Oranga

Electricity retailer

Electricity Retailers Association New Zealand (ERANZ)

Act

association

Social Enterprise

Toast / Sustainability Trust

Key Draft

Themes

A.5. Five main themes emerged from submitters responses to the consultation paper.

These themes encapsulate the major feedback we received from respondents and as

such have presented our summary of the feedback through them. These themes

have provided a base to the Authority’s decision to progress creation of a mandated

Information

minimum standards.

A.6. These themes are:

(a) The existing Guidelines fail to adequately protect consumers.

(b) Mandatory minimum standards are necessary to increase consumer

protections.

Official

(c)

The current Guidelines require significant improvement to become

workable. the

(d) Retailers are unable to estimate possible impacts of mandatory Guidelines

without knowing what changes will happen.

(e) Compliance monitoring requires substantial enhancement.

Current Guidelines fail to adequately protect consumers

under

A.7. Respondents largely agreed that the Guidelines fall short of their purposes and

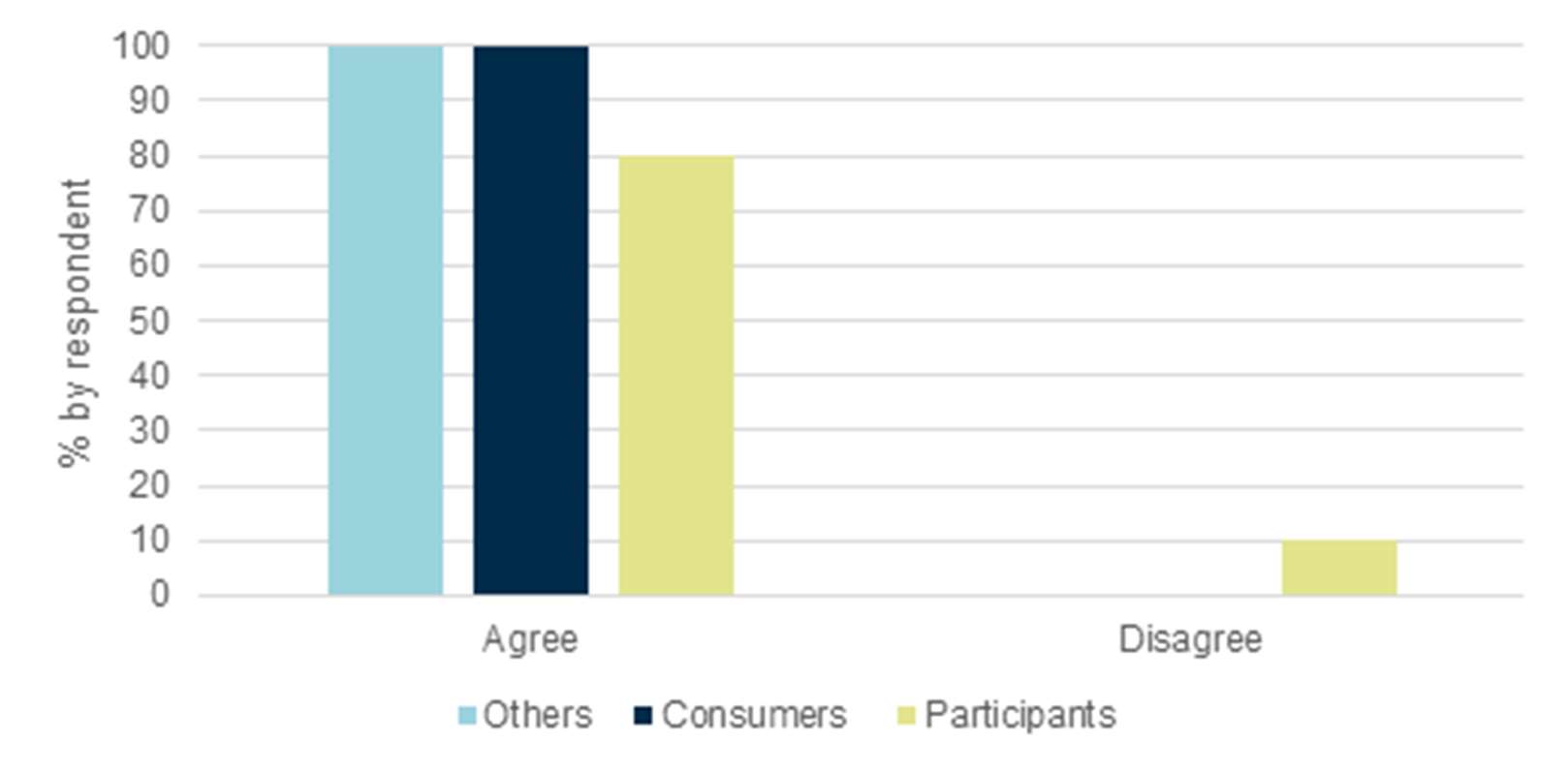

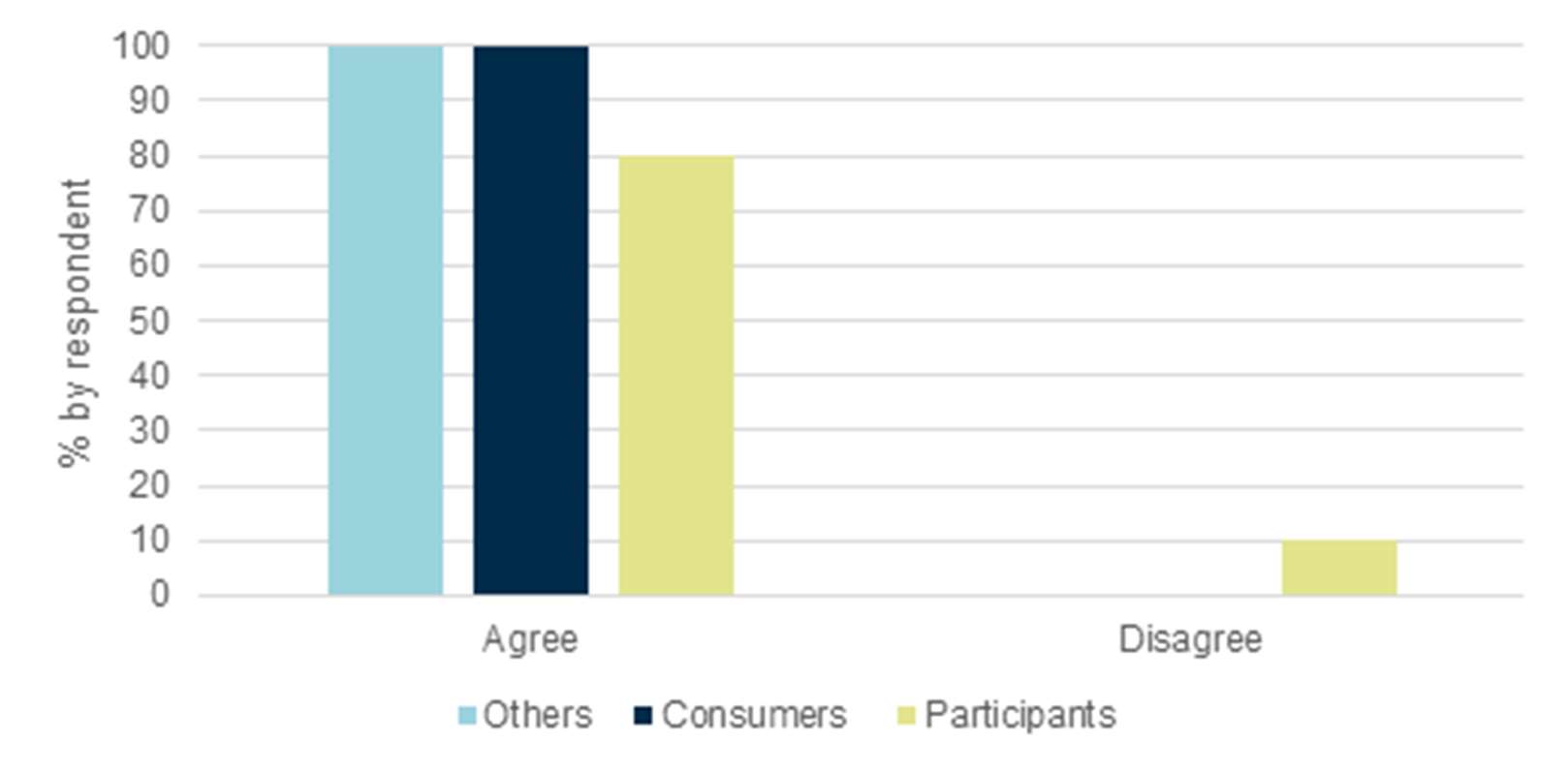

intended outcome. As shown in Figure 2, the vast majority of consumer submissions

agreed with the Authority’s view that the Guidelines are not delivering on their

intended purpose or outcome.

A.8. Many consumers submitted that retailers are not following the Guidelines with several

submitters stating that the voluntary nature of the Guidelines enables this to happen.

Several consumers highlighted retailers being able to not follow the Guidelines

without any repercussion means consumers are not adequately protected and are

Released

being harmed under the status quo.

Figure 2: Q1. Do you agree or disagree with our view that the Guidelines are not

delivering on their purpose or intended outcomes? Please provide any supporting

evidence

1982

Act

Draft

A.9. The online survey showed consistent responses to the written submissions. Table 5

summarises the most common responses on why respondents believe that the

Guidelines are not delivering on their purpose and intended outcome.

Information

Do you think that the Guidelines are currently delivering on their purpose and

intended outcomes? Can you tell us more to support your answer?

“No, the Guidelines are not currently

Official

delivering their intended outcomes”.

“The Electricity Authority’s own review

showed that retailers are not

the

consistently following the Guidelines”.

“That is causing harm to consumers”.

“The Electricity Authority should

commit now to codifying and

under

strengthening all protections in the

Guidelines as fast as possible”.

A.10. Retailers, however, overall support the Guidelines, and emphasise the positive

outcomes that the Guidelines have had for consumers. Some of the retailers’

responses added:

(a) Electricity Retailers' Association of New Zealand stated: “The independent

retailers support the Guidelines. The independent retailers consider the

Released Consumer Care Guidelines have an important role in articulating the

Authority’s expectations about retailer conduct and how to protect the

interests of consumers”

(b) Meridian stated: “Meridian supports codification as we support better

outcomes for consumers. It also seems clear that the Guidelines, as

originally drafted by the Authority, were intended to eventually become

Code at some point.”

(c)

Electricity Networks Aotearoa (ENA) stated: “ENA and its members support

the Consumer Care Guidelines (Guidelines) as they are a vital tool for

ensuring and enshrining welfare protections for domestic consumers.”

(d) Genisis stated: “We would also note that variable retailer alignment, cited

as one of key reasons for considering mandating the Guidelines, can result

from issues or ambiguities in the wording of the Guidelines resulting in

1982

variable interpretation, rather than reflecting genuine lack of alignment that

could drive a suboptimal customer outcome”

A.11. However, many retailers highlighted that there is a strong need to update and Act

strengthen the Guidelines to ensure these are workable and better provide adequate

protections to consumers.

Minimum mandatory standards are necessary to increase consumer protections

A.12. Draft

Respondents largely agreed that the Guidelines fall short of their purpose and

intended outcomes. As shown in Figure 2, the vast majority of consumer submissions

agreed with the Authority’s view that the Guidelines are not delivering on their

intended purpose or outcomes.

A.13. As shown in Figure 4, while consumers agree that parts two, six, seven and eight are

Information

important, they view that making all parts of the Guidelines mandatory is necessary to

deliver adequate protections for consumers (noting that existing shortfalls in the

Guidelines will be addressed).

A.14. While all the consumers and consumer advocacy groups expressed their support for

making all the Guidelines mandatory, industry participants highlighted risks and

possible unintended consequences of this option without first addressing issues with

Official

the Guidelines. Three quarters of industry respondents said that options three and

four might not be likely to add any extra benefits for those consumers who already

have a retailer who is fully compliant. Nearly 25% of industry respondents added that

the

the benefits of mandating some or all parts of the Guidelines can be outweighed by

the potential cost increased caused by the additional obligations.

under

Released

Figure 1: Q7: Do you agree that parts two, six,

seven and eight are the parts of the Guidelines Figure 2: Question 15: What do you think the

preventing the greatest harm from occurring

benefits to domestic consumers will be under

to domestic consumers?

options two to four?

100

100

90

90

80

80

70

70

60

50

60

1982

40

50

30

40

20

30

10

per respondent 20

0

%

Act

10

Option 4 wil

No extra benefit for Benefits to decrease

provide most

consumers with

under option 3 and

0

benefits to

complying

4 due to potential

Agree

Disagree

consumers

Participants

cost increase

Others

Consumers

Participants

Others

Consumers

Participants

A.15. Draft

The online survey showed consistent results to this theme. Most responses to the

online survey answered:

Information

(a) “Yes, but the other parts are also very important”, and

(b) “The Electricity Authority should commit now to making the full set of

Guidelines mandatory as soon as possible”.

A.16. Many consumers who emphasised making all Guidelines mandatory also suggested,

that if a staged approach is adopted, to include part nine (Fees and bonds) in the first

Official

stage of implementation.

The current Guidelines require significant improvement to become workable

the

A.17. Retailers consistently reported that the Guidelines require practical improvements to:

(a) enhance the clarity of the Guidelines and fix ambiguities and other

workability issues for retailers

(b) reduce inefficiency and unnecessary costs (which if made mandatory may

under

pass on additional costs to consumers)

(c)

increase protections to consumers.

A.18. Many industry participants supported having minimum standards of protections for

consumers, but insisted strongly that these must be workable to ensure those

protections can be delivered. Respondents provided detailed submissions outlining

what issues they currently see present in the Guidelines. Appendix B provides a

detailed list of issues raised by submitters on specific Guidelines.

Released

Retailers cannot estimate impacts of mandatory Guidelines without knowing what

changes will happen

A.19. We asked retailers to provide estimated costs to their business if the Guidelines were

made mandatory (either partially or in full). As shown in Figure 6, most retailers

generally responded that they would need to see a draft version of the updated

Guidelines before they could estimate any effects on costs. Retailers emphasised

that such estimations would depend on what option is progressed and are too varied

and uncertain to provide useful input at this stage.

A.20. One submitter expressed that they might expect higher costs should options three or

four be progressed, particularly for potential new entrants into the new market.

A.21. Noted already, but related to this specific question, retailers across all questions

voiced strongly for a collaborative approach between the Authority and stakeholders

when updating the content in the Guidelines to ensure a workable set of Guidelines. 1982

Figure 3: Q14.For retailers, broken down by Guidelines parts, what would the

estimated costs to your business be of codifying parts of the Guidelines under option

three or four (for example implementation and compliance costs)?

Act

100

ts 80

den

n

o

sp

of re

% Draft

60

40

20

0

Information

Need to assess on drafting

Expect to increase costs

Participants

Compliance monitoring requires substantial enhancement

Official

Respondents urge the Authority to publish data on the industry

the

A.22. Most retailers and consumer groups emphasise the Authority’s need to promptly

publish information and insights related to the residential electricity sector. Some

retailers noted that the 2022 – 2023 self-assessment reports have already been

submitted but are not yet published. These respondents also urged the Authority to

publish quarterly data on disconnections due to non-payment consumers.

under

A.23. Most retailers highlight that the currently released data is insufficient for an adequate

assessment of whether the Guidelines are achieving their intended outcomes. Some

think it may be premature to evaluate the Guidelines’ efficacy with only one year of

data.

Compliance monitoring will need to be resourced to ensure any updates to the

Guidelines can be enforced

A.24. Many respondents including retailers, consumers and others, stress the urgent need

Released

for improved and adequately resourced compliance monitoring to ensure the

Guidelines can be enforced if made mandatory.

A.25. A few respondents recommended that if certain parts of the Guidelines become

mandatory, the provision of monitoring information in part ten, should also be

mandated. These submitters viewed part ten as essential to ensuring making the

parts identified under Option 3 workable as a package.

A.26. Overall, consumers supporting the Guidelines becoming mandatory, either in full or

partially, raised that without effective compliance monitoring, the intended purpose

and outcomes of the Guidelines are at risk of never being achieved.

1982

Act

Draft

Information

Official

the

under

Released

1982

Appendix B

List of issues provided by respondents within scope of the Guidelines

Act

B.1. The table below provides an aggregated list from individual examples that some retailers provided as non-comprehensive lists of issues and

limitations t

Submitt

8

Indep

Draft

hat the current version of the Guidelines should address as part of the next steps.

B.2. This list is illustrative of the magnitude of the issues raised by retailers and the extent of the workability issues that need to be resolved.

Clause

er

Feedback

no.

endent In relation to Part 2, retailers should have a Consumer Care Policy and the Guidelines should prescribe what must be

Retailers

included in the Policy but, if mandated, it should be the retailer’s own policies and not drafted by the Authority e.g.,

clauses like clause 8 should not be mandated.

Information

11

Contact

Parts of clause 11 are highly prescriptive in the way retailers communicate with customers. While we achieve the

intent of these clauses there are often more efficient and customer centric ways to achieve the intended outcomes.

14

Contact

Parts of clause 14 are highly prescriptive in the way retailers communicate with customers. While we achieve the

intent of these clauses there are often more efficient and customer centric ways to achieve the intended outcomes.

Official

14

Independent Data collection: Clause 14(a)(ii) requiring Retailers to document “a customer’s preferred day(s) or the week to be

Retailers

phoned … and the time(s) within (those) day(s)” is too prescriptive and is information which, if relevant to the

the

customer at all, would likely become quickly out-of-date. The clause also does not appear to have any practical

function. While the Guidelines require this information to be recorded, there are no provisions for when it should be

applied e.g. what happens if the preferred day(s) don’t correspond with a 24 hour disconnection notice? This clause

should be deleted.

under

14(a)

Genesis

We do not agree that certain requirements under Clause 14(a), particularly with regards to how and when retailers

communicate with consumers and customers, result in improved outcomes for consumers, while they also add undue

costs for industry. We would therefore suggest they do not strike the right balance between protecting consumer care

(Principle A) and supporting competition and innovation and avoiding undue costs (Principle C). Specifically, we

Released

1982

would suggest removing the requirement to record a customer’s preferred day of the week to be phoned (14(a)(ii),

language preference (clause 14(a)(i i)), and requirement to record which communication methods are not suitable

(clause 14(a)(iv)).

Act

15

Contact

17

Contact Draft

Parts of clause 15 are highly prescriptive in the way retailers communicate with customers. While we achieve the

intent of these clauses there are often more efficient and customer centric ways to achieve the intended outcomes.

15(d)

Independent What practical function does recorded information on a customers “primary heating sources” serve (clause 15(d))?

retailers

Parts of clauses 17 are highly prescriptive in the way retailers communicate with customers. While we achieve the

intent of these clauses there are often more efficient and customer centric ways to achieve the intended outcomes.

Information

23

Mercury

Requiring retailers to advise every new post-pay customer of the existence of the retailer’s consumer care policy and

the retailer’s commitment to offer support if the customer faces payment difficulties is irrelevant in many

circumstances. Not all customers go into debt and even fewer get to the disconnection stage. It is not appropriate to

presume that a new customer will not pay their account. • We recommend this clause be amended to require retailers

to provide this information as appropriate.

24

ERANZ

Clause 24 – Retailers to consider financial mentoring when examining a credit history: This clause requires retailers

Official

to consider whether a potential new customers’ poor credit rating is countered by their active participation in financial

mentoring or whether it was the result of historic circumstances that have now passed. Satisfying both of these

scenarios involves asking highly personal questions which retailers must then make judgement calls on, well outside

the

their area of expertise. ERANZ recommends maintaining the principle Clause 24, but removing subclauses (a) and

(b).

24

Mercury

Clause 24 – Retailers to consider financial mentoring when examining a credit history. This clause requires retailers

to consider whether a potential new customers’ poor credit rating is countered by their active participation in financial

under

mentoring or whether it was the result of historic circumstances that have now passed. Satisfying these scenarios

involves asking highly personal questions and then asks retailers to make judgement calls which are well outside

their area of expertise. We recommend removing subclauses (a) and (b).

Released

1982

25

Genesis

We do not agree with Clause 25(a). It is unreasonable to expect retailers to have this information, and in any case

this information is freely available to consumers including through channels like Powerswitch (which retailers are

required to direct consumers to in most communications). - Clause 25(a)(i), which requires Retailers to provide

Act

consumers with whom they choose not to contract with information about other options generally available in the

Draft

market; We would argue they do not strike the right balance between protecting consumer care (Principle A) and

supporting competition and innovation and avoiding undue costs (Principle C). Genesis considers we are unlikely to

be alone in being reluctant to encourage our competitors to discuss our offers with their customers.

25

Contact

Clauses 25 and 31 require retailers to represent pricing plans available by competing organisations. This raises

considerable risk of mis-representing other organisations pricing and is better achieved by directing to PowerSwitch.

27

ERANZ

Clause 27 – Advising all new customers of arrears processes: Similarly to clause 23, requiring retailers to advise

every new post-pay customer of the process for unpaid invoices is unnecessary. ERANZ recommends retailers

Information

should have flexibility to only do this on a case-by-case basis, such as there are evident signs of hardship. As an

additional alternative action, retailers can advise of special conditions and support available when onboarding high

credit risk applicants.

27

Mercury

Advising all new customers of arrears processes Similarly to clause 23, requiring retailers to advise every new post-

pay customer of the process for unpaid invoices is unnecessary. Retailers should have flexibility to only do this where

Official

appropriate. • As an alternative action, retailers can advise of special conditions and support available when

onboarding high credit risk applicants.

the

28

Electric Kiwi

We don’t consider the Guidelines requirement (clause 28) that “the retailer should confirm with the customer that the

customer is aware of: … a. any cost differential between post-pay and pre-pay metering arrangements” or “b. that

when credit for the pre-payment service is used up disconnection

will occur” provides consumers, including vulnerable and medically dependent consumers, any meaningful

protection. under

31

Contact

Clauses 25 and 31 require retailers to represent pricing plans available by competing organisations. This raises

considerable risk of mis-representing other organisations pricing and is better achieved by directing to PowerSwitch.

Released

1982

31(b)

ERANZ

Clause 31(b) – Awareness of options generally available in the market: Retailers’ contact centre staff cannot be

realistically expected to have an accurate and up-to-date awareness of competitor options in the market that might be

more suitable. In addition, this requirement potentially introduces competition issues if competitors are expected to

Act

talk about other retailers. ERANZ recommends retailers should, if required, refer to price comparison tools generally

Draft

available in the marketplace such as PowerSwitch.

31(b)

Genesis

We do not agree with clause 31(b) (below). It is unreasonable to expect retailers to have this information, and in any

case this information is freely available to consumers including through channels like Powerswitch (which retailers

are required to direct consumers to in most communications). Clause 31(b), which requires Retailers, if a customer

enquires about changing their pricing plan, to make the customer aware of any other options generally available in

the market that might suit the customer’s circumstances better than the plans offered by the Retailer. We would

argue they do not strike the right balance between protecting consumer care (Principle A) and supporting competition

and innovation and avoiding undue costs (Principle C). Genesis considers we are unlikely to be alone in being

Information

reluctant to encourage our competitors to discuss our offers with their customers.

32

Genesis

Requires Retailers to proactively notify customers if they become aware a customer’s nominated alternate contact

person no longer agrees to act in that capacity. We do not think this requirement is helpful or reasonable, and we

think it fails to strike the right balance between protecting consumer care (Principle A) and supporting competition

and innovation and avoiding undue costs (Principle C). We therefore suggest either removing this clause, or

Official

narrowing the scope of this obligation to only apply to medically dependent customers

41

Independent

In relation to Parts 6 and 7, while we consider electricity retailers should have processes/systems to identify and

the

Retailers

assist customers having difficulty paying their bills, and provide reasonable warning of unpaid bills and potential

disconnection, we would caution against over-prescribing what these requirements should look like e.g., how many

days should be allowed for payment or what happens on day 24 after a bill hasn’t been paid (clause 41).

43

ERANZ

Rigid processes for customers in arrears: Clause 43 sets out a number of very detailed steps to follow when a

under

customer is in payment arrears. The steps are excessive in many cases, sometimes people fall into arrears because

they forgot to update their credit card details. Retailers should be able to tailor their approach to the situation and

what they know of the customer. It is not always appropriate, for example, to refer customers to support agencies

Released

1982

when they have forgotten to pay or just need to update a payment method. ERANZ recommends the Authority

engage with retailers on how to amend this clause so it is more appropriate and useful for customers.

43

Contact

Requires that retailers pause disconnection if majorita customer has contacted a support or social agency. We would

Act

Draft

like it clarified that we can seek confirmation from the support agency that this support has been sought and an

appointment booked. We note that this can only be done where the customer provides a privacy waiver.

46(a)

ERANZ

Monitoring increases and decreases in customer consumption: Many customers find their electricity retailer actively

monitoring their usage and then asking them why their usage has either increased or decreased to be highly

intrusive. As an alternative, retailers enable customers to view their usage data via website and mobile phone apps,

including usage comparison charts on customer bills. ERANZ recommends limiting this requirement to retailers

running high bill exception reporting and attempting to discuss potentially high bills with customers to prevent bill

shock.

Information

46(b)

ERANZ

Monitoring increases and decreases in customer consumption: Many customers find their electricity retailer actively

monitoring their usage and then asking them why their usage has either increased or decreased to be highly

intrusive. As an alternative, retailers enable customers to view their usage data via website and mobile phone apps,

including usage comparison charts on customer bills. ERANZ recommends limiting this requirement to retailers

running high bill exception reporting and attempting to discuss potentially high bills with customers to prevent bill

Official

shock.

46(d)

Genesis

Requires retailers to actively monitor increases and decreases in customer consumption, can be intrusive for

the

customers. We recommend changing this requirement so that it only applies for retailers running high bill exception

reporting and attempting to discuss potentially high bills with customers to prevent bill shock

57

ERANZ

High-cost communication methods: These clauses are the highest compliance cost clauses of the Guidelines, yet the

evidence of effectiveness is mixed. For example, the requirement to use in-person visits and signed courier letters to

warn of disconnections is costly, impractical, and ineffective – especially when customers are already unresponsive.

under

Signed courier letters are not a guarantee that the account holder has received the letter. In retailers’ experience,

letters are left in mailboxes, returned to sender, or refused to be signed for. ERANZ recommends the Guidelines do

not specify high-cost yet ineffective types of communications channels; instead retailers should be required to use

Released

1982

communications channels that either the customer prefers, has used successfully in the past, or can be proven to

have been received such as in-app messages with read receipts.

57

Contact

Clauses 57 require retailers to use a traceable form of contact. In our experience this is an expensive and ineffective

Act

Draft

way to engage with customers.

60(d)

ERANZ

Clause 60(d) – Advice on reconnection fees: This subclause requires retailers to detail all the charges a customer

would need to pay for reconnection if they are disconnected. There is little evidence providing this information early in

the process prompts action from customers. Retailers already include all such charges payable in later

communication attempts, but whether doing this early has an impact on payments is not clear because most

customers who are disconnected do not engage with their retailer. ERANZ recommends compulsory advice on

reconnection fees is to accompany the final disconnection warning only. Retailers can still include reconnection fees

elsewhere voluntarily.

Information

61(c)

ERANZ

Requiring on-site contractors to provide advice on budgeting support agencies: Many retailers instruct on-site

contractors not to provide advice to consumers on social support and budgeting services directly. This is because

retailers want to ensure this advice is of a high standard and therefore prefer to provide it through trained contact

centre staff instead. ERANZ recommends on-site contractors are instructed to advise customers to contact the

retailer and advise them on how to do so, so trained staff can provide high quality advice taking into account the

Official

customer's circumstances.

61(c)

Mercury

Requiring on-site contractors to provide advice on budgeting support agencies. Service providers are trained to

the

check the household for medically dependent customers prior to disconnection however they are not trained nor

qualified to give out budgeting advise. Service Providers work with several electricity retailers and to memorise the

specific offerings for each one is unrealistic. There would also be a risk factor attached to service provider

interactions with customers especially when it's not good news. • Instead, service providers are instructed to advise

customers to contact the retailer and advise them on how to do so, so trained staff can provide high quality advice

under

with consideration of each customer's circumstances.

61(c)

Genesis

Clause 61(c), which requires retailers to arrange for their on-site contractors to provide advice to consumers on social

support and budgeting services directly. We do not believe it is appropriate for third-party contractors to provide this

Released

1982

type of advice, particularly as it does not align with their capabilities or contractual role. We therefore recommend

changing this clause to require contractors to provide customers with retailer contact information if requested by the

customer so customers can be directed to customer service representatives with appropriate training

Act

64

Contact Draft

Clauses 57 and 64 require retailers to use a traceable form of contact. In our experience this is an expensive and

ineffective way to engage with customers.

64

ERANZ

High-cost communication methods: These clauses are the highest compliance cost clauses of the Guidelines, yet the

evidence of effectiveness is mixed. For example, the requirement to use in-person visits and signed courier letters to

warn of disconnections is costly, impractical, and ineffective - especially when customers are already unresponsive.

Signed courier letters are not a guarantee that the account holder has received the letter. In retailers’ experience,

letters are left in mailboxes, returned to sender, or refused to be signed for. ERANZ recommends the Guidelines do

not specify high-cost yet ineffective types of communications channels; instead retailers should be required to use

Information

communications channels that either the customer prefers, has used successfully in the past, or can be proven to

have been received such as in-app messages with read receipts.

66(c)

Child Poverty

The Guidelines have touched on aspects of energy hardship as examined by other institutes. However, the

Action Group

Guidelines tend to overlook the demographic disparity in energy hardship. Furthermore, the framing of customer’s

wellbeing should include their dependent children. Therefore, clause 66(c) concerning disconnections that may

Official

endanger the wellbeing of the customer should extend to the customer’s children. Currently, retailers measure their

own compliance of the Guidelines. Genesis Energy’s non-compliance was reported within the media . Other retailers

have taken an unacceptable position of refusing to engage with the Authority’s request for compliance reports. The

the

Authority needs to enforce compliance by making the Guidelines mandatory and track retailers’ compliance through

means outside of self-assessments such as independent audits.

66(d)

ERANZ

Ensuring a customer has “understood” notifications: Requiring a retailer to ascertain whether a customer

“understood” a notification re non-payment and disconnection is an impossible standard to meet. Practically, this is

under

only viable during a phone call by asking the customer whether they have understood. However, getting hold of

customers on the phone is often extremely difficult. Many customers prefer communication through apps, email, text

messages, postal mail, or courier letters – all of which cannot provide evidence of whether the customer has

“understood”. ERANZ recommends the wording “understood” is removed.

Released

1982

66(d)

Mercury

Clause 66(d) – Ensuring a customer has “understood” notifications • Requiring a retailer to ascertain whether the

customer “understood” the notifications re non-payment and disconnection notices is an impossible standard to meet.

Practically, this is only viable during a phone call by asking the customer whether they have understood. However,

Act

getting hold of customers on the phone is difficult at the best of times. Often, customers require communication

Draft

through apps, email, text messages, postal mail, or courier letters – all of which cannot provide evidence of whether

the customer has “understood”. • We recommend the words “and understood” be removed from this clause

72

Electric Kiwi

We also do not consider clause 72 of the Guidelines is in any way appropriate or consistent with the Authority’s

statutory objectives. Regardless of whether Part 7 is mandated this needs to be deleted.

73(a)(i) Child Poverty

The Guidelines have touched on aspects of energy hardship as examined by other institutes. However, the

Action Group

Guidelines tend to overlook the demographic disparity in energy hardship. Furthermore, the framing of customer’s

wellbeing should include their dependent children. Therefore, clause 66(c) and 73 (a)(i) concerning disconnections

Information

that may endanger the wellbeing of the customer should extend to the customer’s children. Currently, retailers

measure their own compliance of the Guidelines. Genesis Energy’s non-compliance was reported within the media.

Other retailers have taken an unacceptable position of refusing to engage with the Authority’s request for compliance

reports. The Authority needs to enforce compliance by making the Guidelines mandatory and track retailers’

compliance through means outside of self-assessments such as independent audits.

Official

75

Contact

Clause 75 states that pre-pay customers must be reconnected within 30 minutes after they purchase a credit. It

should be clarified whether this is 30 minutes after payment is confirmed by our bank, or if there is some other event

that starts the timer.

the

78

ERANZ

MDCs involved in deception - There is no method in the Guidelines for a retailer to deal with a customer who has

attained medically dependent status through fraudulent means, for example, forging a health practitioner’s signature,

or alleging that an MDC resides at the property when they do not. Additionally, the Guidelines are silent on a situation

where a retailer is onboarding a new medically dependent customer and performs a credit check only for the credit

under

check to return flags for fraud and deception.

ERANZ recommends the Guidelines more clearly state that medically dependent consumer protections are for

legitimate MDCs only who have a signed MDC authority from a medical practitioner.

Released

1982

78

Mercury

MDCs involved in deception • There is no method in the Guidelines for a retailer to deal with a customer who has

attained medically dependent status through lies or tricks such as forging a health practitioner’s signature, or alleging

that an MDC resides at the property when they don’t, etc. • We recommend the Guidelines more clearly state that

Act

medically dependent consumer protections are for legitimate MDC’s only.

79

Consu Draft

mer

In addition to the matters raised in our response to question 5, we consider the guideline’s wording relating to the

Advocacy

disconnection of MDCs needs to be strengthened. Clause 79 of the guideline states (emphasis added): Retailers