23 August 2022

Job No: 1089394

River Managers Special Interest Group

C/- Greater Wellington Regional Council

PO Box 11646

Wellington

Attention: Graeme Campbell

Dear Graeme

Letter of Engagement

Business Case - National Flood Protection Funding Model

Following our recent discussions and as you requested, we are pleased to confirm the basis on which

we will support you in the preparation of a Business Case for a National Flood Protection model for

you as our client.

The Business Case will be prepared in accordance with the Better Business Case framework and in

close collaboration with key stakeholders including regional Councils, the Department of Internal

Affairs (DIA) and Treasury. Put simply, the process provides a framework to agree aims and

objectives for a potential national funding model with Treasury and DIA (likely also MBIE). This is the

Strategic Case. The aims and objectives are then used to guide a ‘co-design process’ to confirm the

best value for money approach to achieving the aims and objectives in the

Economic Case.

Implementation Planning is address through the

Management Case (how the model will be

delivered), the

Financial Case (how the model will be funded) and the

Commercial Case (how

activities will be procured).

From our discussions with you, our support will include working with you to:

•

Draft a Strategic Case for a national flood risk infrastructure funding model.

•

Complete an Economic Case set out analysis to identify the best value for money option for

flood protection infrastructure funding at a national level.

•

Drafting Management, Financial and Commercial Cases to support the implementation of the

best value for money option identified in the Economic Case.

We note that Tonkin & Taylor Limited (T+T) is already working with the Rivers Group to update

analysis on flood protection issues and opportunities, i.e.: additional follow on work recommended

in the “Hiding in Plain Sight” report. We anticipate that the update of information (not covered by

this Letter of Engagement) will take place in parallel with the development of the Strategic Case.

Scope of work

Strategic Case

The Strategic Case sets out the reason for planned investment and provides an opportunity to clearly

define the problem(s) to be addressed, measures of success and ‘critical success factors’. For this

Tonkin & Taylor Ltd | Harbour Tower, Level 4, 2 Hunter Street, Wellington 6011, New Zealand

PO Box 2083, Wellington 6140 P +64-4-381 8560 F +64-9-307 0265 E [email address]

2

case developing a clear Strategic Case provides an opportunity to discuss and agree key drivers for,

and objectives of, a national funding model. This is a critical component of the Business Case drafting

and provides a medium to ensure that key central government stakeholders are aligned with

Regional Councils on the need for funding and the way that success will be measured.

Key tasks during the development of the Strategic Case will be:

•

Confirm with Regional Council CEOs key people (5-8) to be involved in framing the Strategic

Case (Investment Logic Mapping (ILM) process)

•

Engage with key decision makers in DIA, Treasury and MBIE (Shovel Ready team) as part of the

preparation for the ILM process. This will include discussion on the framing of the Strategic

Case and the anticipated level of analysis of options developed and evaluated in the Economic

Case. We would also proactively engage with the Treasury IQA team during preparation so

there are no surprises at that later stage of review.

•

Complete an Investment Logic Mapping process.

−

Draft a Briefing Paper for ILM participants

−

Complete an ILM process, anticipated to comprise 2 x 2-hour workshops with key

stakeholder representatives (5-8 people)

•

Draft an Outline Strategic Case – to be ‘socialised’ with DIA, Treasury, MBIE and Regional

Councils

•

Finalise the Strategic Case

Once the Strategic Case is largely complete, we will confirm the scope and timeline for developing

the Economic Case. Our current view on the scope is outlined below.

Economic Case

The economic case will make use of existing information, updates that will be completed in parallel

with developing the Strategic Case and potentially additional information identified through the

Strategic Case development. The purpose of the Economic Case is to use the Investment Objectives

and Critical Success Factors developed agreed with stakeholders and documented in the Strategic

Case to identify the best value for money option.

Key tasks in preparation of the Economic Case will comprise:

•

Identifying information gaps (if any) based on the Strategic Case

•

Developing funding model options (Do Nothing through to ‘protect everything’)

•

Completing a preliminary evaluation of options making use of the Investment Objectives and

Critical Success Factors set out in the Strategic Case

•

Workshop with key project team members to confirm the evaluation

•

Document the option development and evaluation process, and preferred option, in the

Economic Case.

Once the Economic Case is largely complete and the preferred option identified, we will confirm the

scope of the Financial, Management and Commercial Cases that will make up the remainder of the

full Business Case. Our current view on the scope for each case is outlined below.

Financial Case

The Financial Case sets out funding arrangements including providing a forward view on likely costs.

For flood protection infrastructure it is expected that the Financial Case will draw on various

engineering studies and Asset Management Plans to provide a high-level view of annual and total

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

3

spend. In light of current uncertainties regarding cost, related to design, construction and materials

supply challenges, we would expect any funding model to provide significant contingency while

looking to leverage scale and long term funding to deliver the programme outcomes as efficiently as

possible.

Key tasks in preparation of the Financial Case will comprise:

•

Developing funding options, in close collaboration with River Managers, DIA and Treasury. We

anticipate that this will involve drawing on information in Asset Management Plans and Long

Terms Plans across Regional Councils (currently being collated by T+T) as well as linking to

Central Government Budget cycles and departmental allocations existing and planned.

•

Consideration of how to most effectively link a 10+ year programme with Central Government

(1 year cycle) and Local Government (3-10 year cycle) funding processes.

•

Given the ideal programme of work is likely to significantly exceed available funding, the

Financial Case will need to draw on insights from the Strategic and Economic Cases to reflect

the need for prioritisation of spend across New Zealand.

Management Case

The Management Case sets out arrangements for managing the delivery of the preferred approach

for the flood protection infrastructure maintenance and upgrade programme of work. This links to

the Financial Case including providing a forward view on likely activity with cost set out in the

Financial Case.

For flood protection infrastructure it is expected that the Management Case will draw on insights

from the delivery of projects under the ‘shovel ready’ programme of work as well as individual

Council activities under their Asset Management and Long Term Plan arrangements. In light of

current uncertainties regarding availability of people and resources for design and construction, we

would expect the delivery approach to provide significant flexibility while again looking to leverage

scale and long term funding to secure resources to deliver the programme outcomes as effectively

as possible.

Key tasks in preparation of the Management Case will comprise:

•

Review and compile delivery approaches adopted by Regional Councils and the Shovel Ready

programme.

•

Work with River Managers, DIA and Treasury to set out a national level governance

framework to oversee the long term programme.

•

Preliminary workforce and construction programming, to establish a programme of work that

is achievable in real world conditions, i.e.: strike a balance between aspirations and available

people and materials to complete the proposed programme of work.

Commercial Case

The Commercial Case sets out arrangements for procurement associated with the delivery of the

preferred approach. This links to the Management and Financial Cases with a focus on

understanding the market including potential providers and other activity.

For flood protection infrastructure programme of work it is expected that the Commercial Case will

focus on strategic level procurement considerations. This includes the availability of design and

construction suppliers, the respective benefits of long term contracts for programmes of work vs

procurement discrete packages and any need to grow capability and capacity in the market.

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

4

Similar to Financial and Management Cases, we would expect the procurement approach to provide

significant flexibility while looking to leverage scale and long term funding to secure resources to

deliver the programme outcomes as efficiently and effectively as possible.

Track Record

As previously shared with you, we have extensive experience working on the development of

Business Cases for central and local government. Our focus is on combining robust technical

knowhow with an understanding of business case process (Better Business Case) and a record of

getting things done with central government.

Two examples that illustrate this approach are our current work on addressing Acid Mine Drainage

(AMD) at the Stockton Mine and a completed project developing a National Resilience Programme

Business Case for Waka Kotahi.

The

Stockton Mine project is being completed for Treasury with a view to establishing long term

funding (150+ years) for the ongoing management of AMD produced at the Stockton Mine. T+T is

working with Tregaskis Brown to develop a Strategic Case (90% complete, waiting on final Mana

Whenua input) and complete an evaluation of options i.e.: the Economic Case.

This project provides us with current experience navigating the Treasury assurance process as well

as insights relating to long term programmes of activity and working with multiple stakeholders.

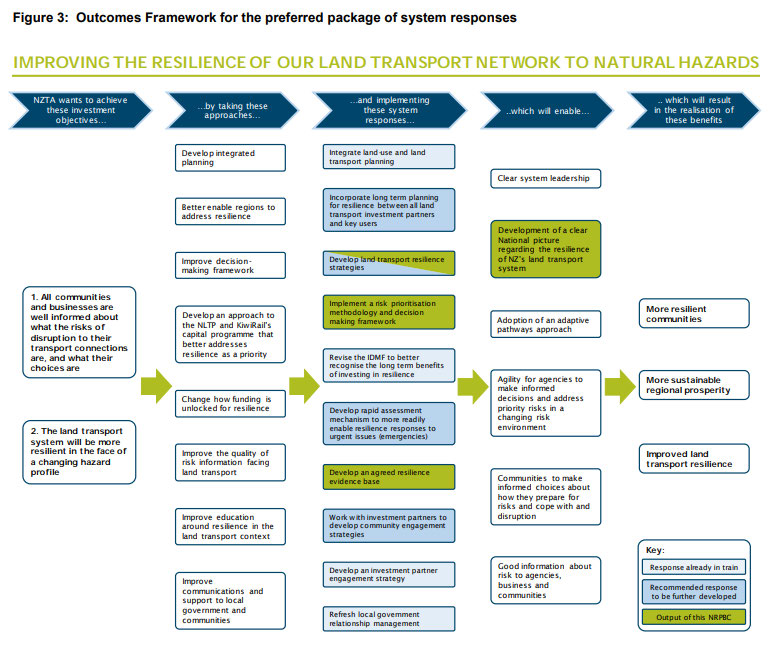

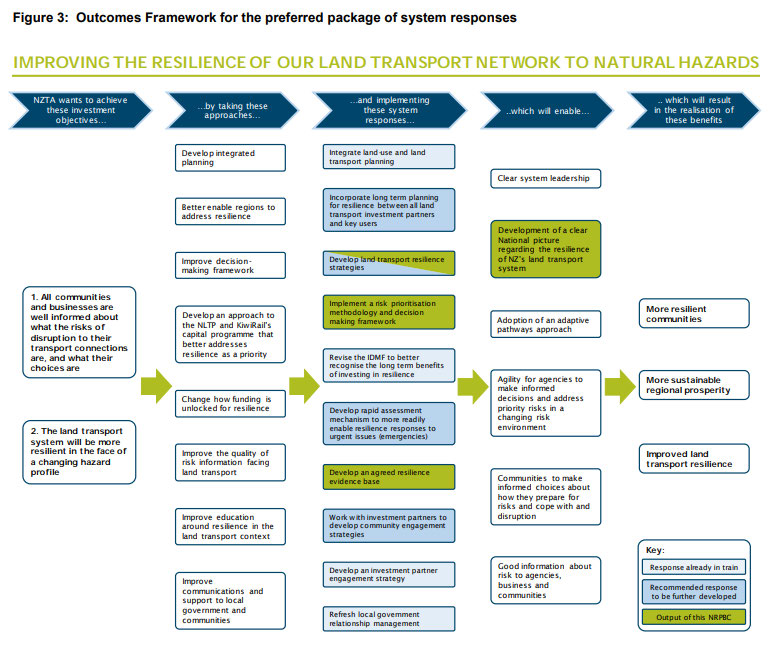

The

Waka Kotahi Resilience Programme Business Case developed a Strategic Case for incorporating

resilience into decision making across the Waka Kotahi spending programme. The project involved

working with multiple stakeholders across New Zealand and identifying and articulating cross

linkages with other programmes of work. It is particularly satisfying for our team to see the

Programme Business Case now guiding decision making on individual Waka Kotahi projects with

resilience becoming a key driver of investment decision making.

This project was the winner of the Excellence in Strategic Planning award in the Institution of Public

Works Engineering Australasia (IPWEA) NZ Excellence Awards 2020. The land page for the

Programme Business Case is at https://www.nzta.govt.nz/roads-and-rail/highways-information-

portal/technical-disciplines/resilience/national-resilience-programme-business-case/.

For this project, identifying links with other ‘interventions’ is an important similarity with DIA’s

current focus on planning (current and strategic/spatial) mechanisms potentially linking very well

with infrastructure investment. The project provides us with directly relevant experience addressing

natural hazards, developing approaches that integrate multiple objectives and working with multiple

stakeholders across central and local government. The figure overleaf is from the Case and illustrates

the links to other aspects of Waka Kotahi’s work relating the resilience of the land transport

network.

Key lessons learnt during preparation of the Waka Kotahi Programme Business Case were:

•

Getting agreement on what the stakeholders want to achieve (in the Strategic Case), is critical

to the success of the Business Case.

•

Working with stakeholders to define options is valuable, but time consuming.

•

Starting discussions with the reviewers early (IQA) adds value to the Business Case

preparation and avoids late changes to the approach or document. This was a significant

factor in the success of the project.

•

Making clear links to complimentary activities or initiatives is critical, no programme or activity

can exist in isolation. Identifying linkages, and avoiding conflicts, will be critical for the flood

protection infrastructure work as it was for the Waka Kotahi work.

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

5

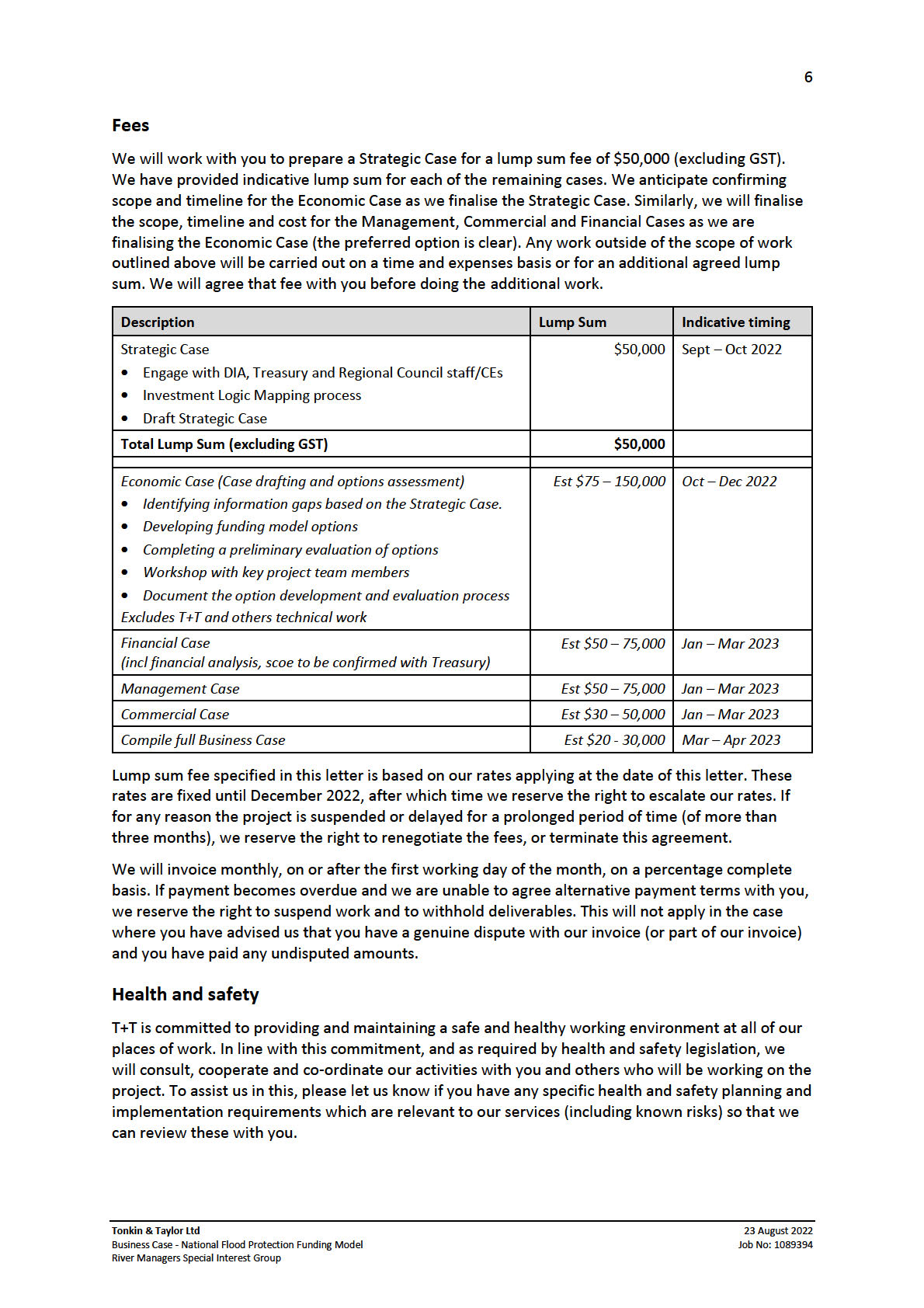

Figure 1: Preferred package – Waka Kotahi National Reslience Programme Business Case

Covid-19

We will use all reasonable endeavours to meet our responsibilities to you, however we cannot be

responsible for any delay, event or circumstance outside our reasonable control due to the impact of

COVID-19 (including travel disruptions, quarantine or self-isolation requirements, ill health or other

delay or inability of our staff or subcontractors to perform or access a site for any reason). If any of

these circumstances do arise, we may seek to negotiate with you a variation to this proposal which

enables us to complete our work for you on mutually acceptable terms, failing which either party

may terminate our engagement.

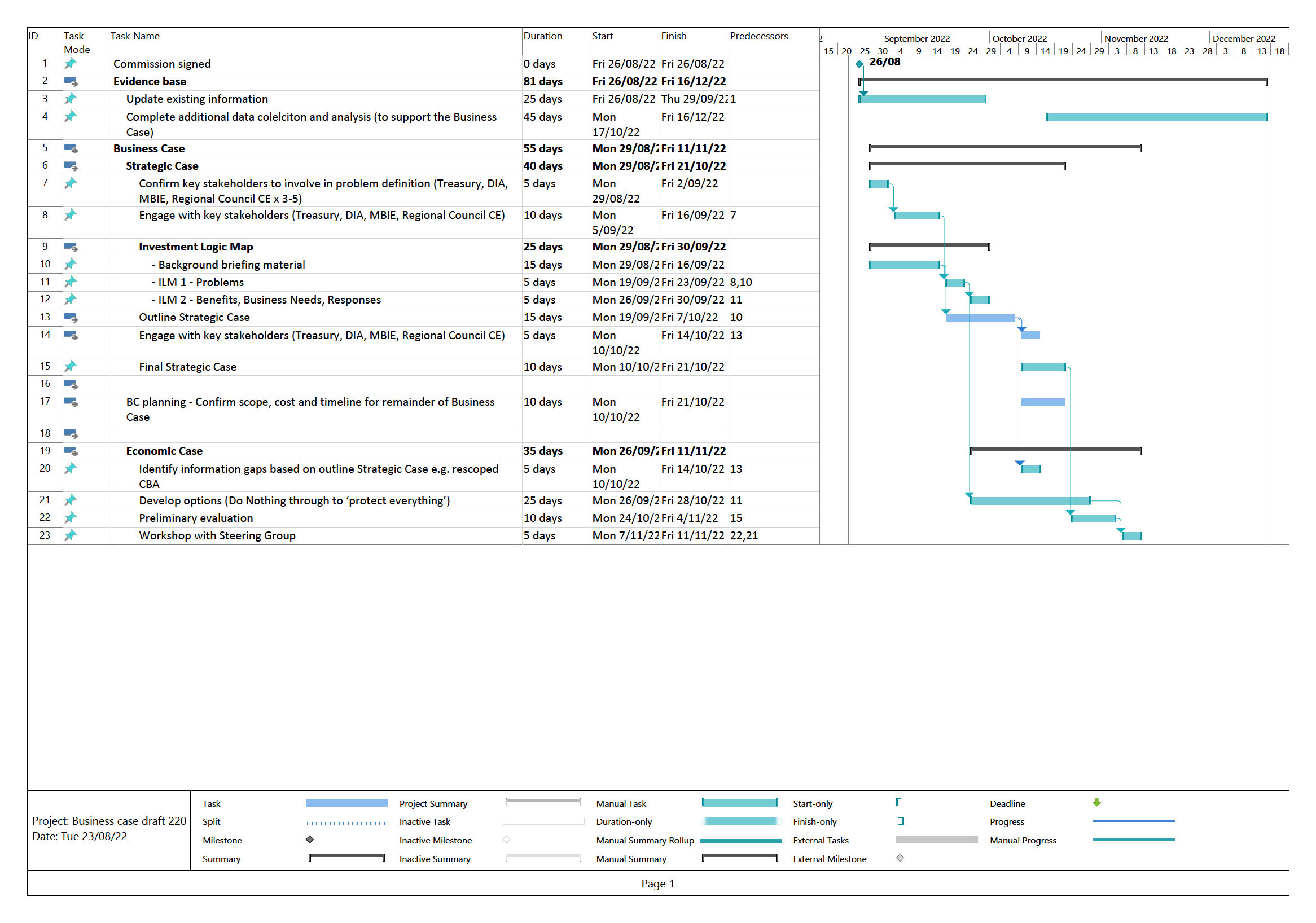

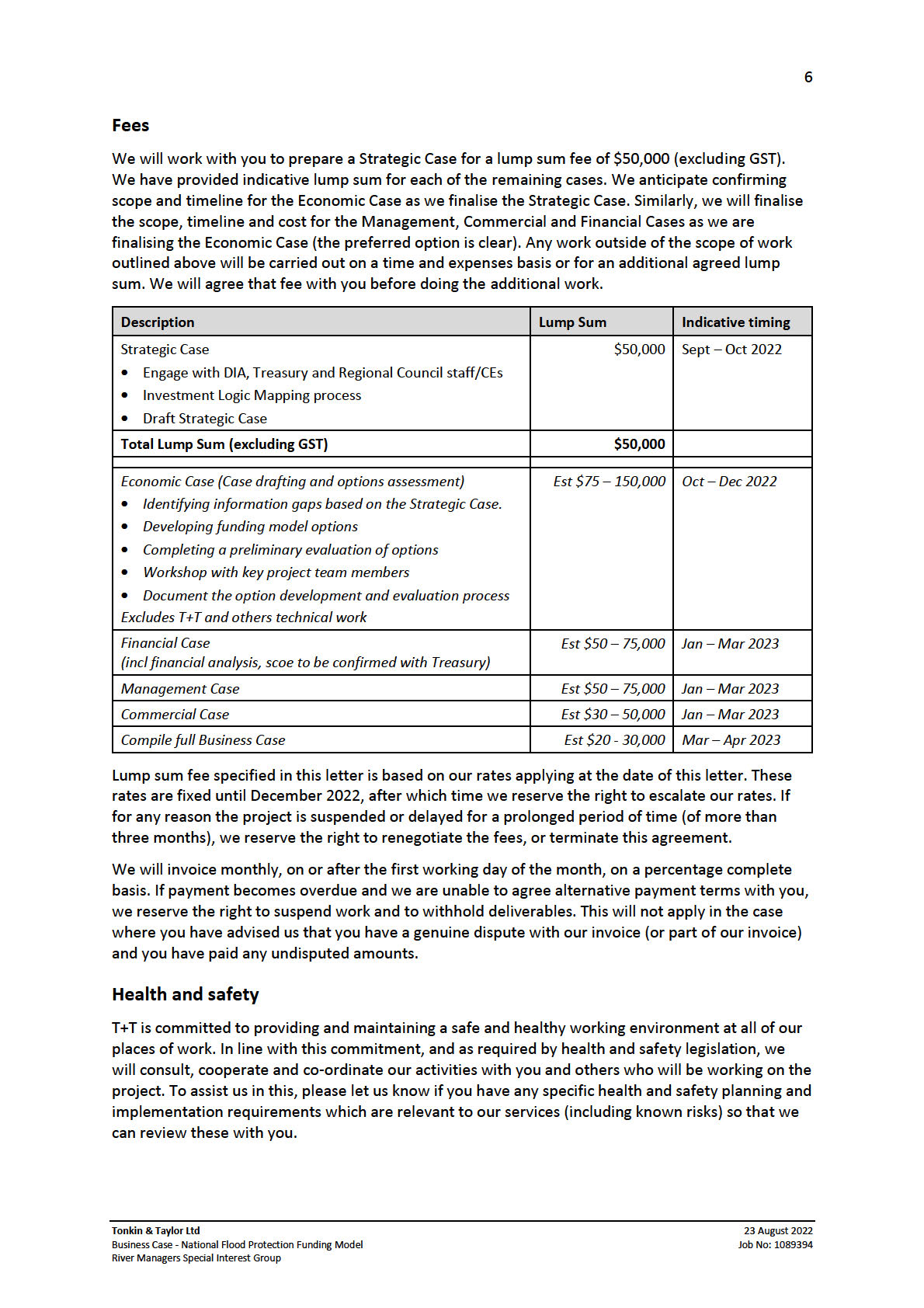

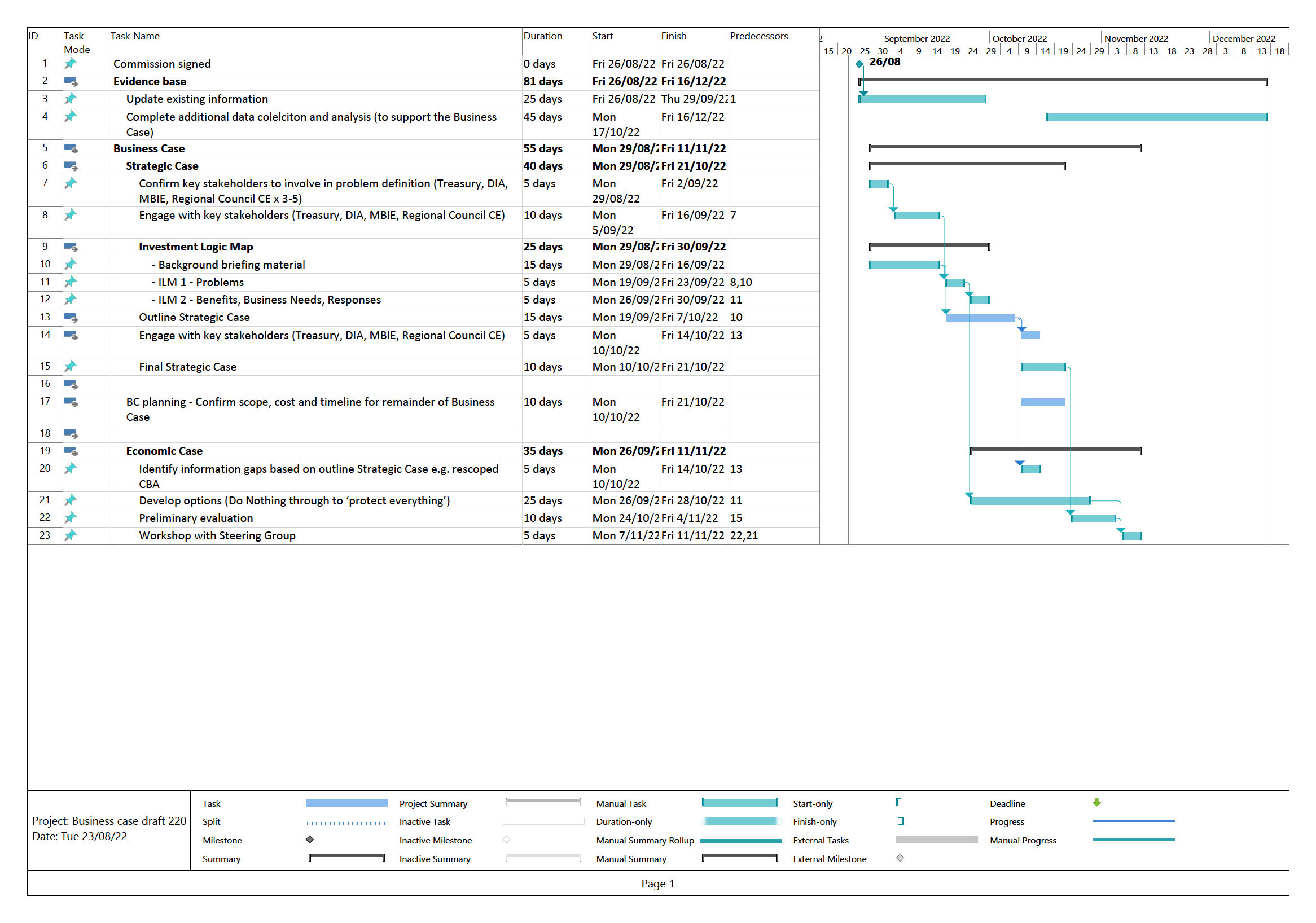

Programme

We have attached an indicative programme. We anticipate discussion specific items and timeline

with you prior to commencement, and as the project progresses.

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

7

Terms and conditions

We will carry out the work in accordance with our attached Conditions of Engagement. These terms

place certain limitations on our liability and, unless agreed otherwise, they will apply instead of any

terms and conditions in any purchase order or other confirming document that you may issue to us.

We provide our reports and other deliverables for your benefit only and they cannot be relied upon

by any third parties. However, if you want us to, we may allow a third party to rely on them after

signing an appropriate reliance statement with us (so that they acknowledge and accept the

limitations of our work and the terms and conditions of our engagement with you).

We understand and agree that you will submit the Business Case to support a Budget Bid and that

government as the responsible agency will use the Business Case for the purpose of compiling that

Budget Bid.

This offer is valid for three months from the date of this letter.

Closing remarks

We trust that this satisfactorily meets your needs. We look forward to receiving your instruction to

proceed and to working with you on this project. You can confirm your acceptance by returning the

attached signatory form. Alternatively, we will take your instruction to proceed as confirmation that

you accept this proposal.

Please contact

at

or +64 27 536 0951 if you would like to

discuss anything about this project.

Yours sincerely

Project Director

Attached:

1

Signatory page

2

ACENZ Short Form Agreement Feb 2019

3

Indicative Programme

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

8

Signatory form

T+T Ref:

1089394

Date:

23 August 2022

Contract:

Business Case - National Flood Protection Funding Model

Confirmation by Client: I/we acknowledge that I/we have read the proposal for the above contract

and the attached Conditions of Engagement, (including the Limitations of Liability), and I/we accept

those terms and authorise the above.

Client name: River Managers Special Interest Group

Client

C/- Greater Wellington Regional Council

address:

PO Box 11646

Wellington

Attention:

Graeme Campbell

Signature:

Name:

Date:

Please provide the following information if different:

Client Name and Address

Invoicing Entity Name* and Address (if different to Client)

______________________________

______________________________

______________________________

______________________________

______________________________

______________________________

______________________________

______________________________

* Invoicing entity to also give the “Confirmation by Client” above by signing below

Signature:

______________________________________________

Name:

______________________________________________

Date:

______________________________________________

Please return one signed copy to

of T+T at email

z or +64

27 536 0951 or to the address on the letterhead.

Privacy Notice

In your dealings with us, we will collect, use, disclose and hold personal information in accordance with our Privacy

Statement (https://www.tonkintaylor.co.nz/about-us/tonkin-plus-taylor-privacy-statement/). Unless you advise us

otherwise, we will assume that you consent for your information to be used for the purposes outlined in our Privacy

Statement. If at any time you wish us to stop using your information for any of the purposes outlined in our Privacy

Statement, please email us at [email address] or use the “unsubscribe” facility in the relevant email message.

23-Aug-22

t:\wellington\tt projects\1089394\contractual\20220823.gwrc-rivers group flood protection funding bc loe.1089394.docx

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group

9

SHORT FORM MODEL CONDITIONS OF ENGAGEMENT

1.

The Consultant shall perform the Services as described in the attached documents.

2.

The Client and the Consultant agree that where all or any of, the Services are acquired for the purposes of a business the pr ovisions

of the Consumer Guarantees Act 1993 are excluded in relation to those Services. However, nothing in this Agreement shall restrict,

negate, modify or limit any of the Client’s rights under the Consumer Guarantees Act 1993 where the Services acquired are of a kind

ordinarily acquired for personal, domestic or household use or consumption and the Client is not acquiring the Services for the

purpose of a business.

3.

In providing the Services, the Consultant must use the degree of skill, care and diligence reasonably expected of a professional

consultant providing services similar to the Services.

4.

The Client shall provide to the Consultant, free of cost, as soon as practicable following any request for information, all i nformation in

the Client’s power to obtain which may relate to the Services. The Consultant shall not, without the Client’s prior consent, use

information provided by the Client for purposes unrelated to the Services. In providing the information to the Consultant, t he Client

shall ensure compliance with the Copyright Act 1994 and shall identify any proprietary rights that any other person may have in any

information provided.

5.

As soon as either Party becomes aware of anything that will materially affect the scope or timing of the Services, the Party must

notify the other Party in writing and where the Consultant considers a direction from the Client or any other circumstance is a

variation the Consultant shall notify the Client accordingly.

6.

The Client may order variations to the Services in writing or may request the Consultant to submit proposals for variations to the

Services.

7.

The Client shall pay the Consultant for the Services the fees and expenses at the times and in the manner set out in the attached

documents. Where this Agreement has been entered by an agent (or a person purporting to act as agent) on behalf of the Clien t, the

agent and Client shall be jointly and severally liable for payment of all fees and expenses due to the Consultant under this

Agreement.

8.

All amounts payable by the Client shall be due on the 20th of the month following the month of issue of each GST Invoice or a t such

other timing as stated elsewhere in this Agreement. If the Client fails to make the payment that is due and payable and that default

continues for 14 days, the Consultant may provide written notice to the Client specifying the default and requiring payment w ithin 7

days from the date of the notice. Unless payment has been made by the Client in full, the Consultant may suspend performance of

the Services any time after expiration of the notice period. The Consultant must promptly lift the suspension after the Client has

made the payment. Regardless of whether or not the Consultant suspends the performance of the Services in accordance with this

clause, the Consultant may charge interest on overdue amounts from the date payment falls due to the date of payment at the rate

of the Consultant’s overdraft rate plus 2% and in addition the costs of any actions taken by the Consultant to recover the debt.

9.

Where the nature of the Services is such that it is covered by the Construction Contracts Act 2002 (CCA) and the Consultant has

issued a payment claim in accordance with the CCA, the provisions of the CCA shall apply. In all other cases, if the Client, acting

reasonably, disputes an invoice, or part of an invoice, the Client must promptly give the reasons for withholding the disputed amount

and pay any undisputed amount in accordance with clause 8.

10. Where Services are carried out on a time charge basis, the Consultant may purchase such incidental goods and/or Services as are

reasonably required for the Consultant to perform the Services. The cost of obtaining such incidental goods and/or Services shall be

payable by the Client. The Consultant shall maintain records which clearly identify time and expenses incurred.

11. Where the Consultant breaches this Agreement, the Consultant is liable to the Client for reasonably foreseeable claims, damages,

liabilities, losses or expenses caused directly by the breach. The Consultant shall not be liable to the Client under this Agreement for

the Client’s indirect, consequential or special loss, or loss of profit, however arising, whether under contract, in tort or otherwise.

12. The maximum aggregate amount payable, whether in contract, tort or otherwise, in relation to claims, damages, liabilities, losses or

expenses, shall be five times the fee (exclusive of GST and disbursements) with a minimum of $100,000 and a maximum limit of

$NZ500,000.

13. Without limiting any defences a Party may have under the Limitation Act 2010, neither Party shall be considered liable for any loss or

damage resulting from any occurrence unless a claim is formally made on a Party within 6 years from completion of the Services.

14. The Consultant shall take out and maintain for the duration of the Services a policy of Professional Indemnity insurance for the

amount of liability under clause 12. The Consultant undertakes to use all reasonable endeavours to maintain a similar policy of

insurance for six years after the completion of the Services.

15. If either Party is found liable to the other (whether in contract, tort or otherwise), and the claiming Party and/or a Third Party has

contributed to the loss or damage, the liable Party shall only be liable to the proportional extent of its own contribution.

16. Intellectual property prepared or created by the Consultant in carrying out the Services, and provided to the Client as a del iverable,

(“New Intellectual Property”) shall be jointly owned by the Client and the Consultant. The Client and Consultant hereby grant to the

other an unrestricted royalty-free license in perpetuity to copy or use New Intellectual Property. The Clients’ rights in relation to this

New Intellectual Property are conditional upon the Client having paid all amounts due and owing to the Consultant in accordance

with clauses 7 and 8. Intellectual property owned by a Party prior to the commencement of this Agreement (Pre-existing Intellectual

Property) and intellectual property created by a Party independently of this Agreement remains the property of that Party. The

Consultant accepts no liability for the use of New Intellectual Property or Pre-existing Intellectual Property other than to the extent

reasonably required for the intended purposes.

17. The Consultant has not and will not assume any duty imposed on the Client pursuant to the Health and Safety at Work Act 2015

(“the Act”) in connection with the Agreement.

18. The Client may suspend all or part of the Services by notice to the Consultant who shall immediately make arrangements to stop the

Services and minimise further expenditure. The Client and the Consultant may (in the event the other Party is in material default that

has not been remedied within 14 days of receiving the other Party’s notice of breach) either suspend or terminate the Agreement by

notice to the other Party. If the suspension has not been lifted after 2 months the Consultant has the right to terminate the

Agreement and claim reasonable costs as a result of the suspension. Suspension or termination shall not prejudice or affect the

accrued rights or claims and liabilities of the Parties.

19. The Parties shall attempt in good faith to settle any dispute by mediation.

20. This Agreement is governed by the New Zealand law, the New Zealand courts have jurisdiction in respect of this Agreement, and all

amounts are payable in New Zealand dollars.

February 2019

Tonkin & Taylor Ltd

23 August 2022

Business Case - National Flood Protection Funding Model

Job No: 1089394

River Managers Special Interest Group