IN-CONFIDENCE

ICT Shared Capabilities

Marketplace

Payroll Enterprise Software

Provider Hosted

Security Risk Assessment

Report

IN-CONFIDENCE

ICT Shared Capabilities

Marketplace

Payroll Enterprise Software

Provider Hosted

Security Risk Assessment

Report

under the Official Information Act 1982

Issued by

Digital Public Services Branch

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

IN-CONFIDENCE

Glossary of Terms

Availability

Ensuring that authorised users have timely and reliable access to

information.

API

A set of functions and procedures allowing the creation of

applications that access the features or data of an operating system,

application, or other service.

Confidentiality

Ensuring that only authorised users can access information.

Consequence

The outcome of an event. The outcome can be positive or negative.

However, in the context of information security it is usually negative.

Control

A risk treatment implemented to reduce the likelihood and/or

impact of a risk.

Gross Risk

The risk without any risk treatment applied.

Impact

See Consequence.

Information Security

Ensures that information is protected against unauthorised access

or disclosure users (confidentiality), unauthorised or improper

modification (integrity) and can be accessed when required

(availability).

Integrity

Ensuring the accuracy and completeness of information and

information processing methods.

Likelihood

See Probability.

Probability

The chance of an event occurring.

Recovery Point Objective

The earliest point time that is acceptable to recover data from. The

(RPO)

RPO effectively specifies the amount of data loss that is acceptable

to the business.

Recovery Time Objective

The amount of time allowed for the recovery of an information

(RTO)

system or service after a disaster event has occurred. The RTO

effectively specifies the amount of time that is acceptable to the

business to be without the system.

Residual Risk

The risk remaining after the risk treatment has been applied.

Risk

The effect of uncertainty on the business objectives. The effect can

be positive or negative. However, in the context of information

under the Official Information Act 1982

security it is usually negative.

Risk Appetite

The amount of risk that the organisation is willing to accept in

pursuit of its objectives.

Risk Owner

A person or entity with the accountability and authority to manage

a risk. Usually, the business owner of the information system or

service.

Stakeholder

A person or organisation that can affect, be affected by, or perceive

Released

themselves to be affected by a risk eventuating.

Threat

A potential cause of a risk.

Vulnerability

A weakness in an information system or service that can be

exploited by a threat.

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 4 of 49

IN-CONFIDENCE

Contents

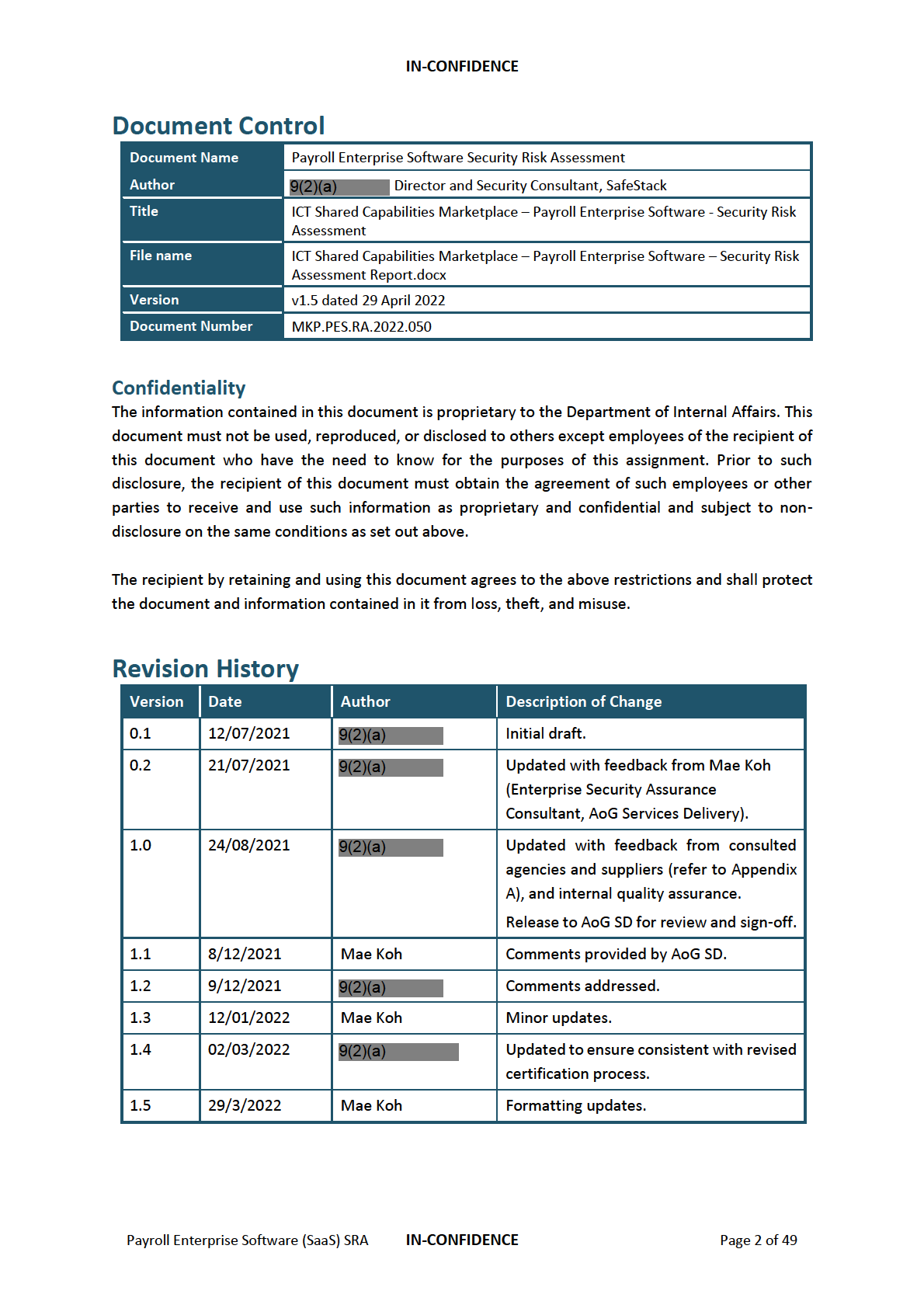

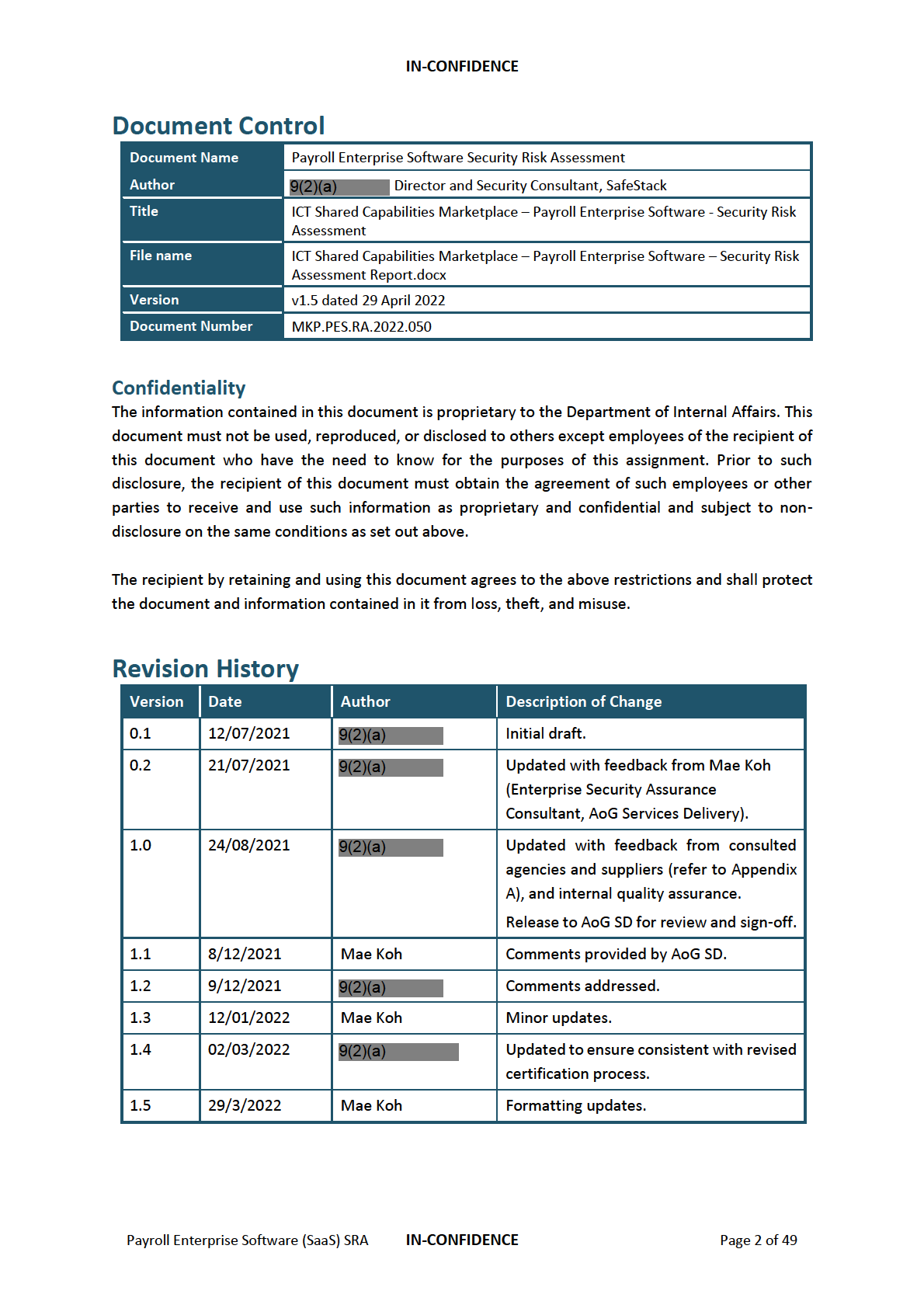

Document control

2

Revision History

2

Glossary of Terms

4

Executive Summary

6

Introduction

6

Key Risks

6

Gross Risk Position

9

Key Recommendations

10

Residual Risk Positions

12

Business Context

14

Business Processes Supported

14

Information Classification

17

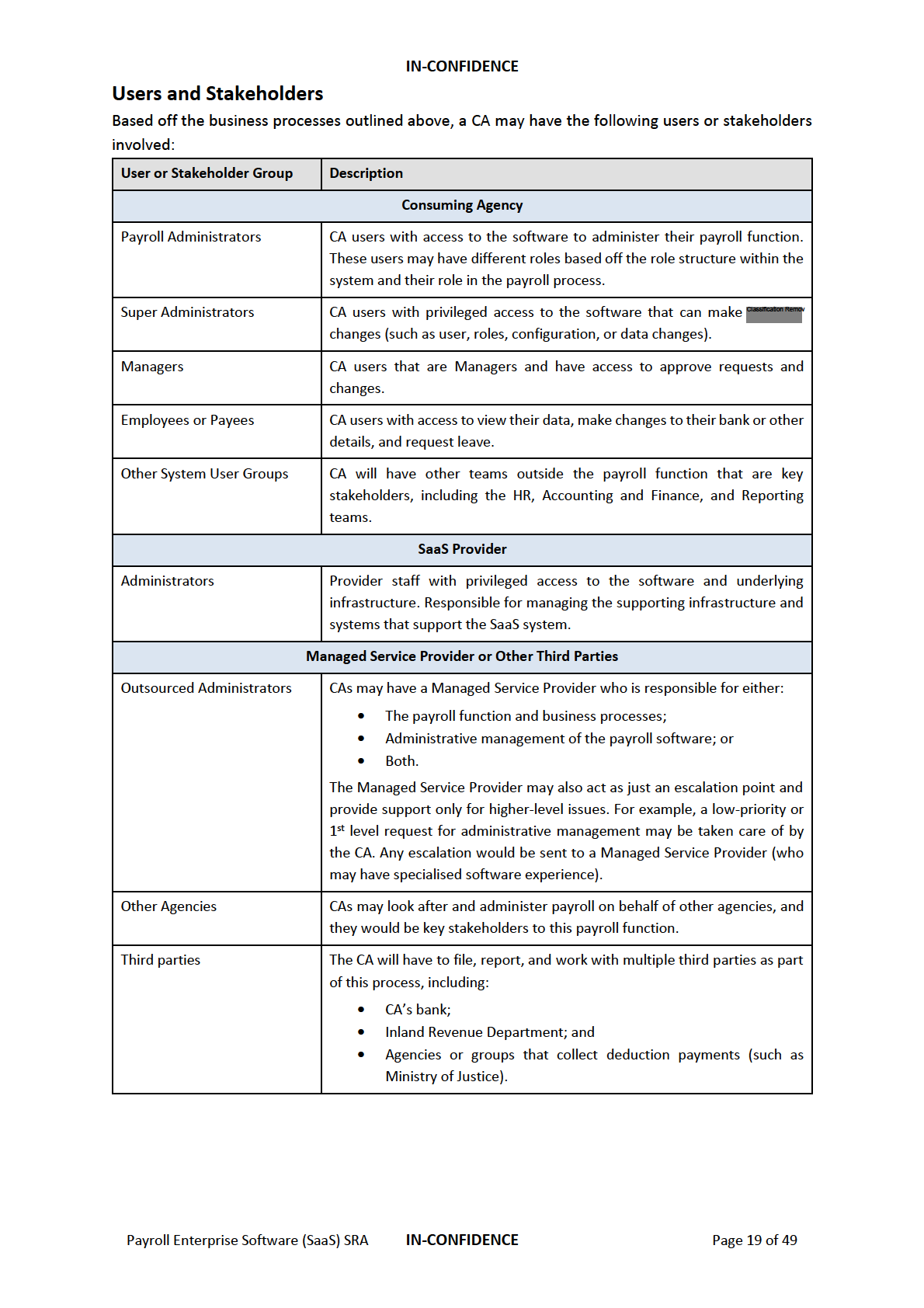

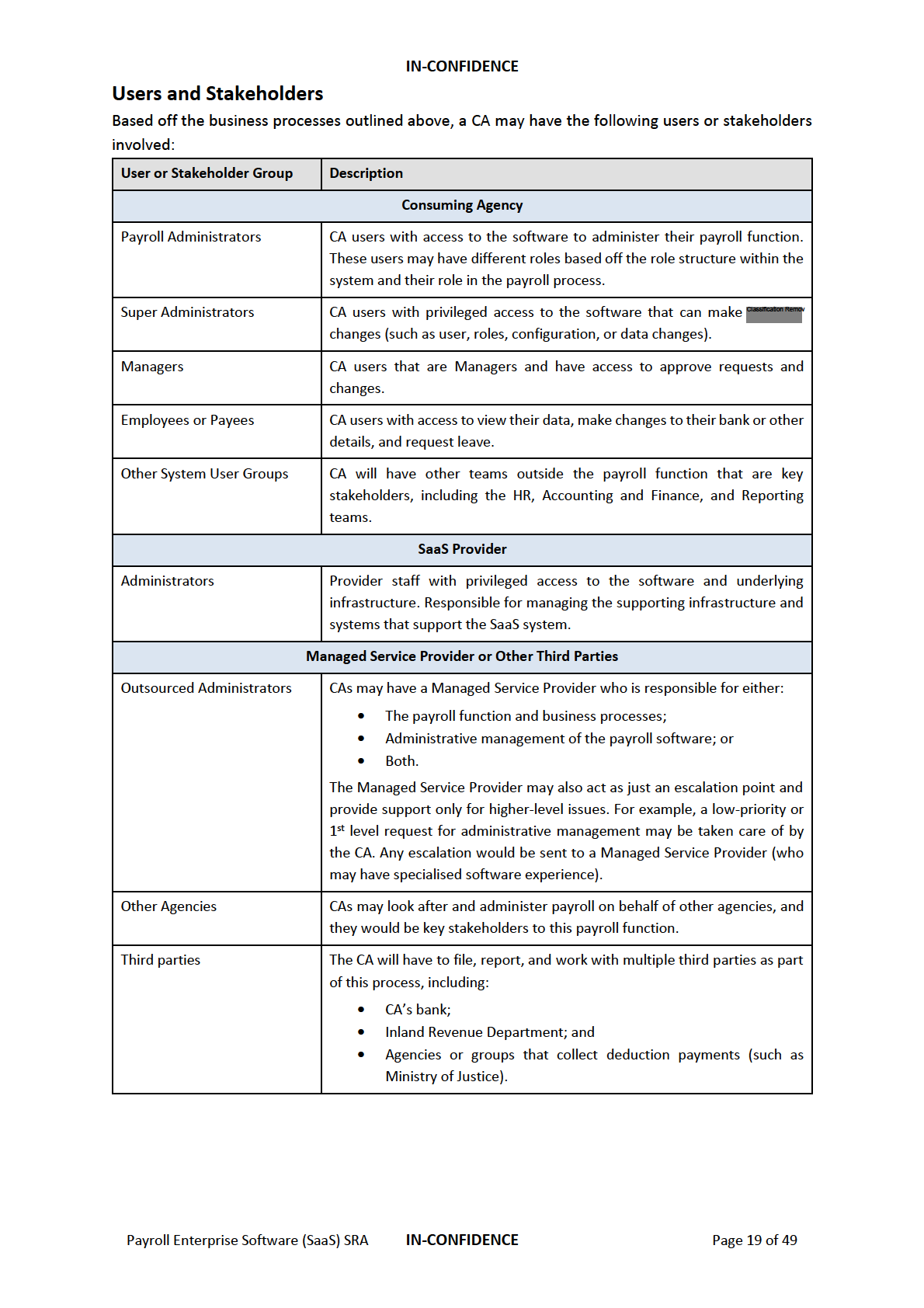

Users and Stakeholders

19

Legislation, Policy, and Guidelines

20

Technical Context

21

Security Requirements

23

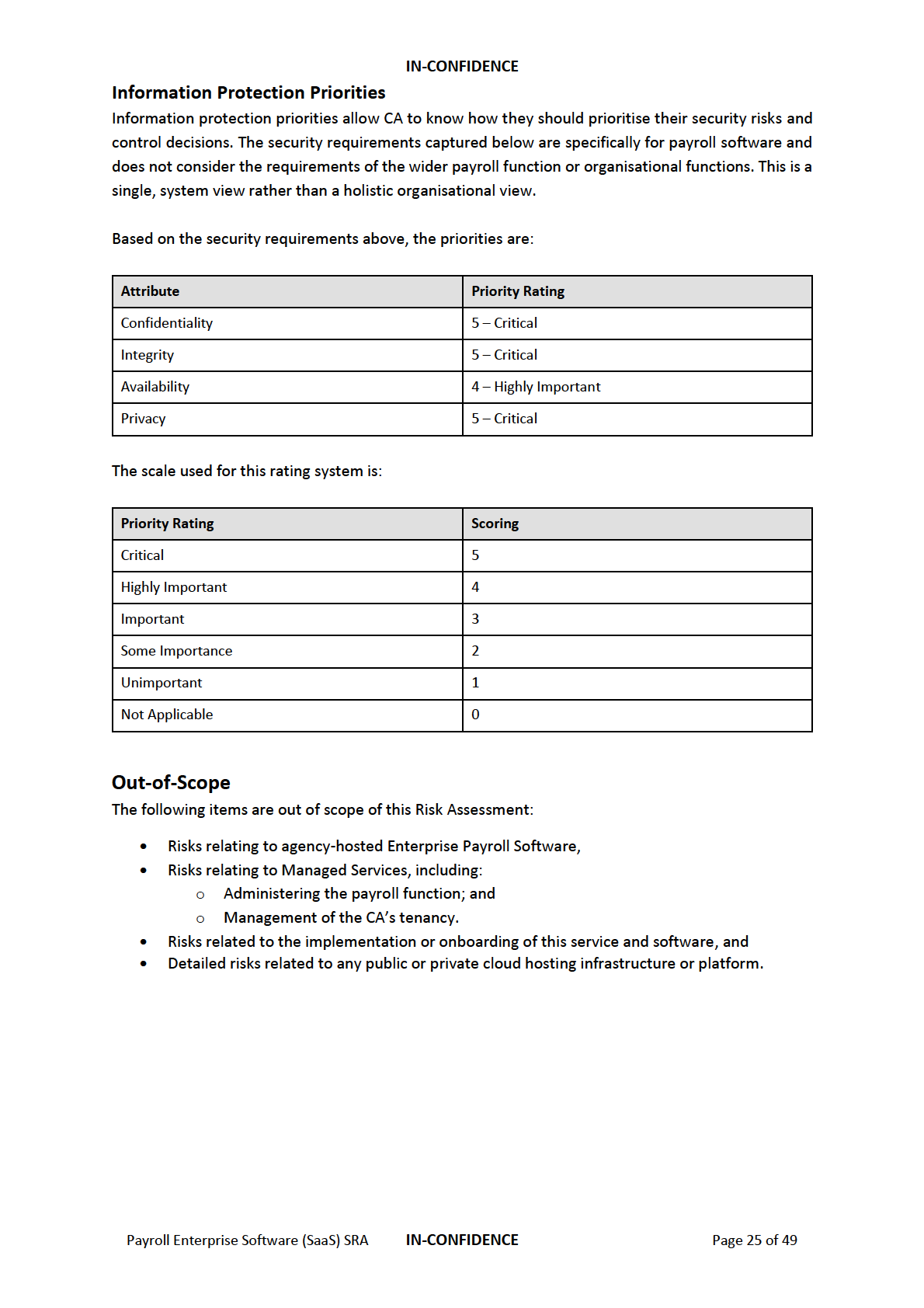

Out-of-Scope

25

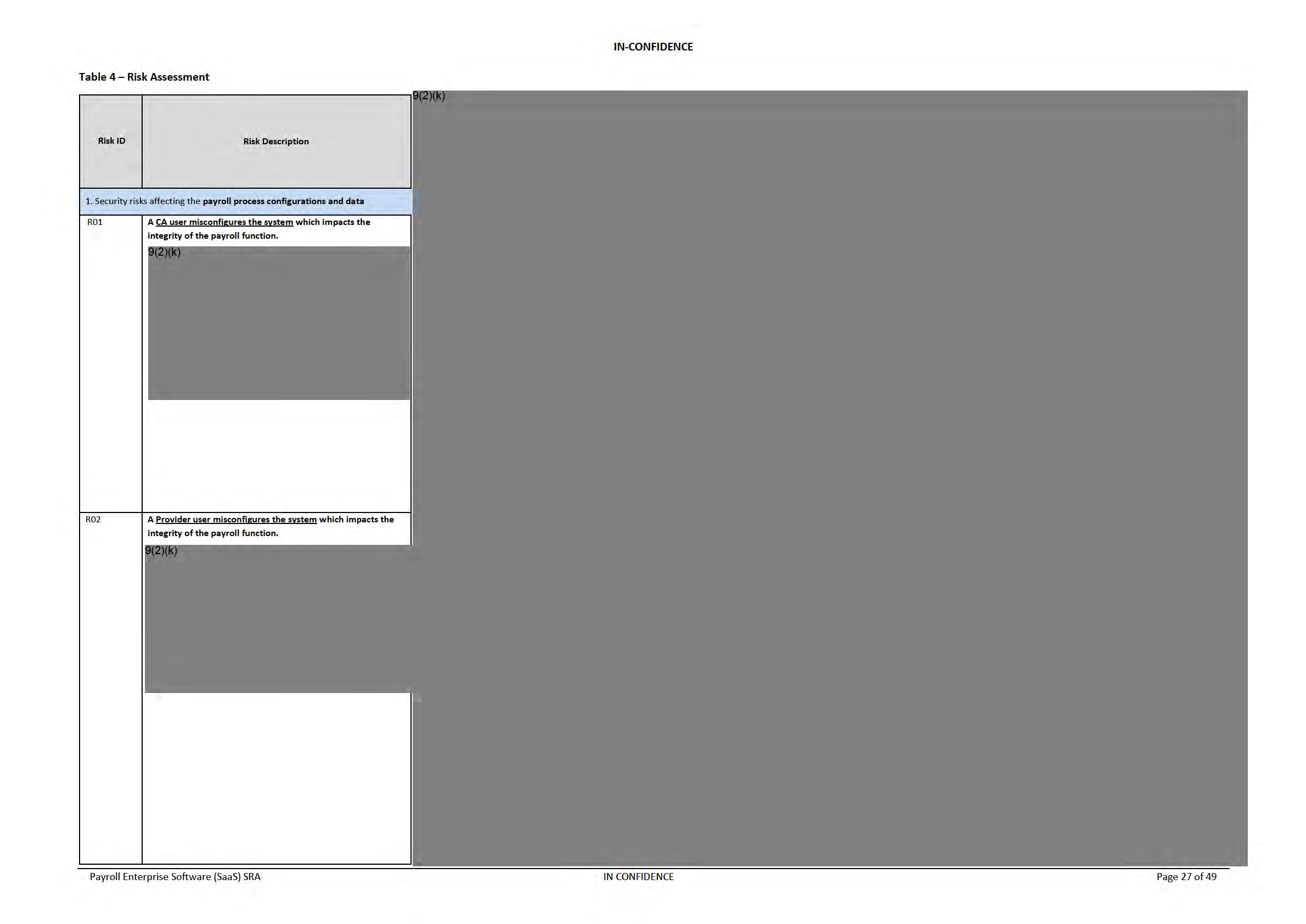

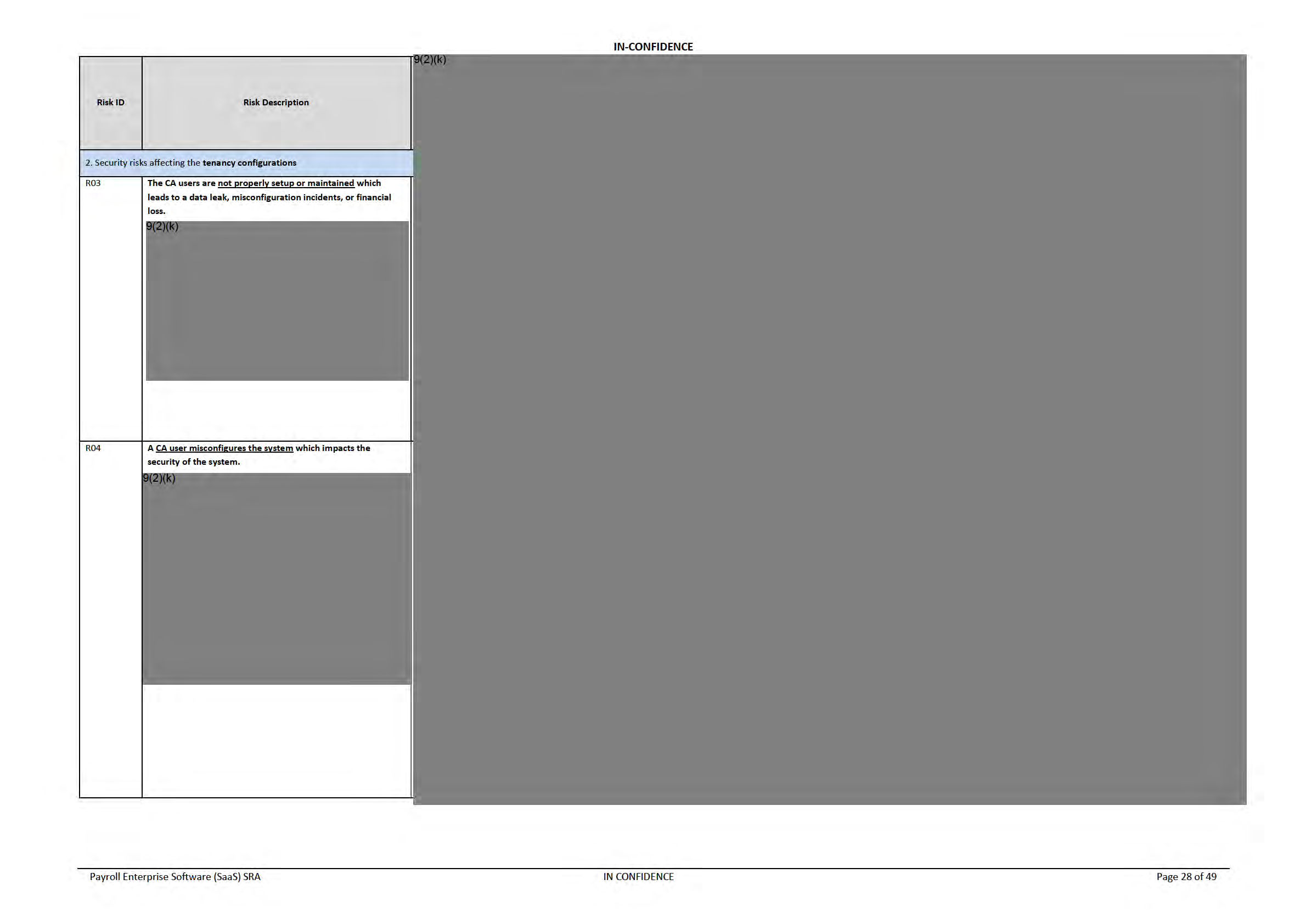

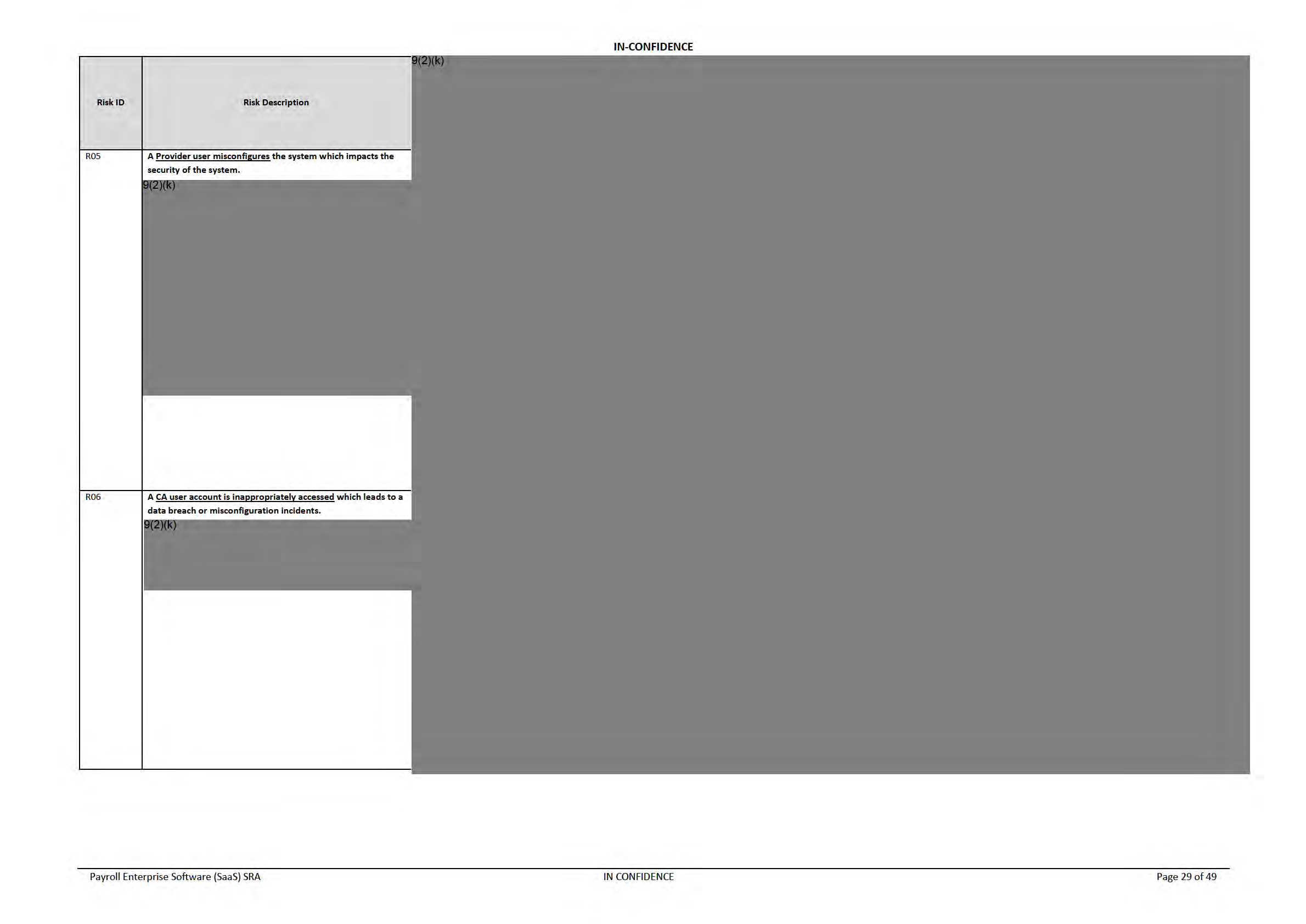

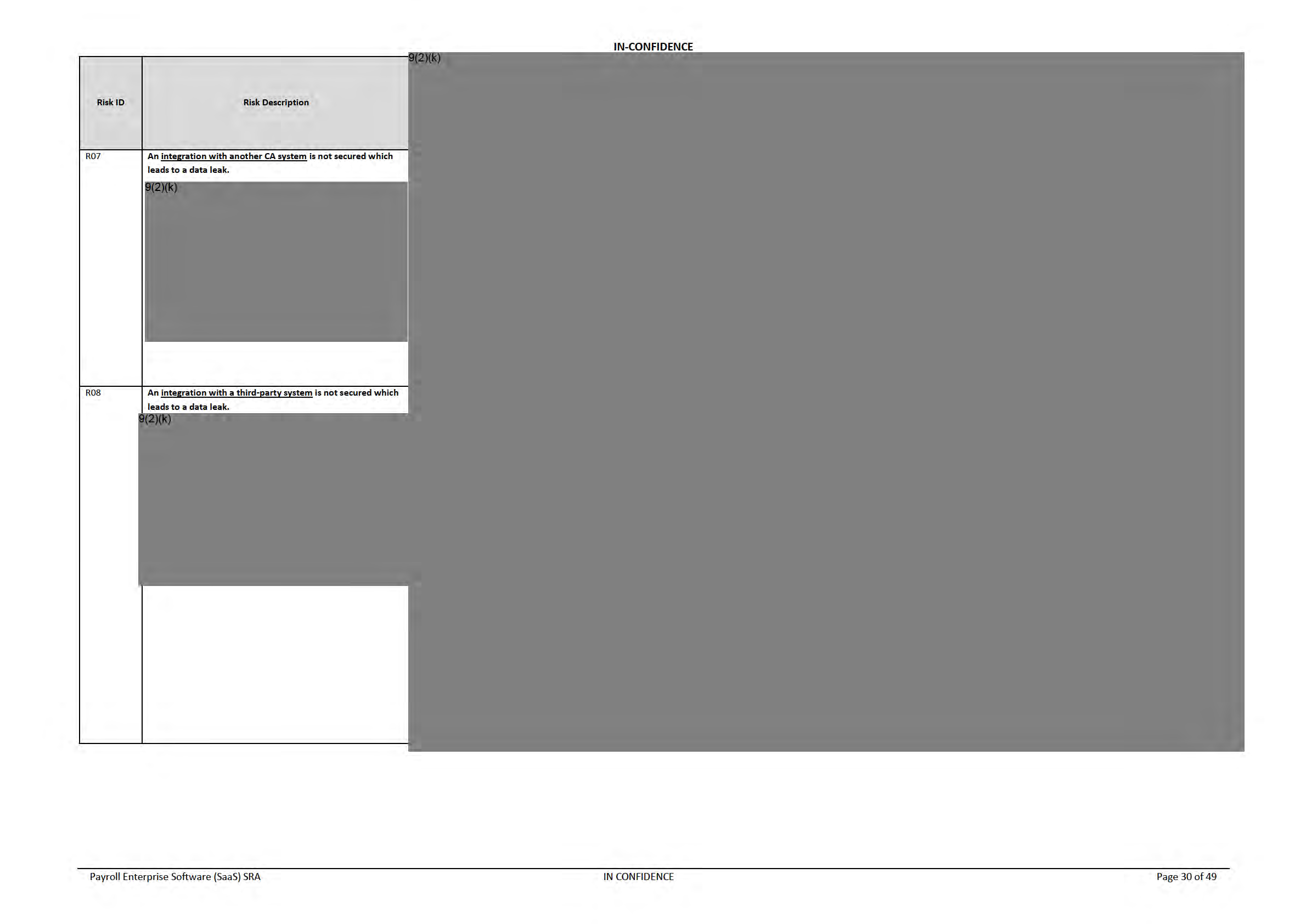

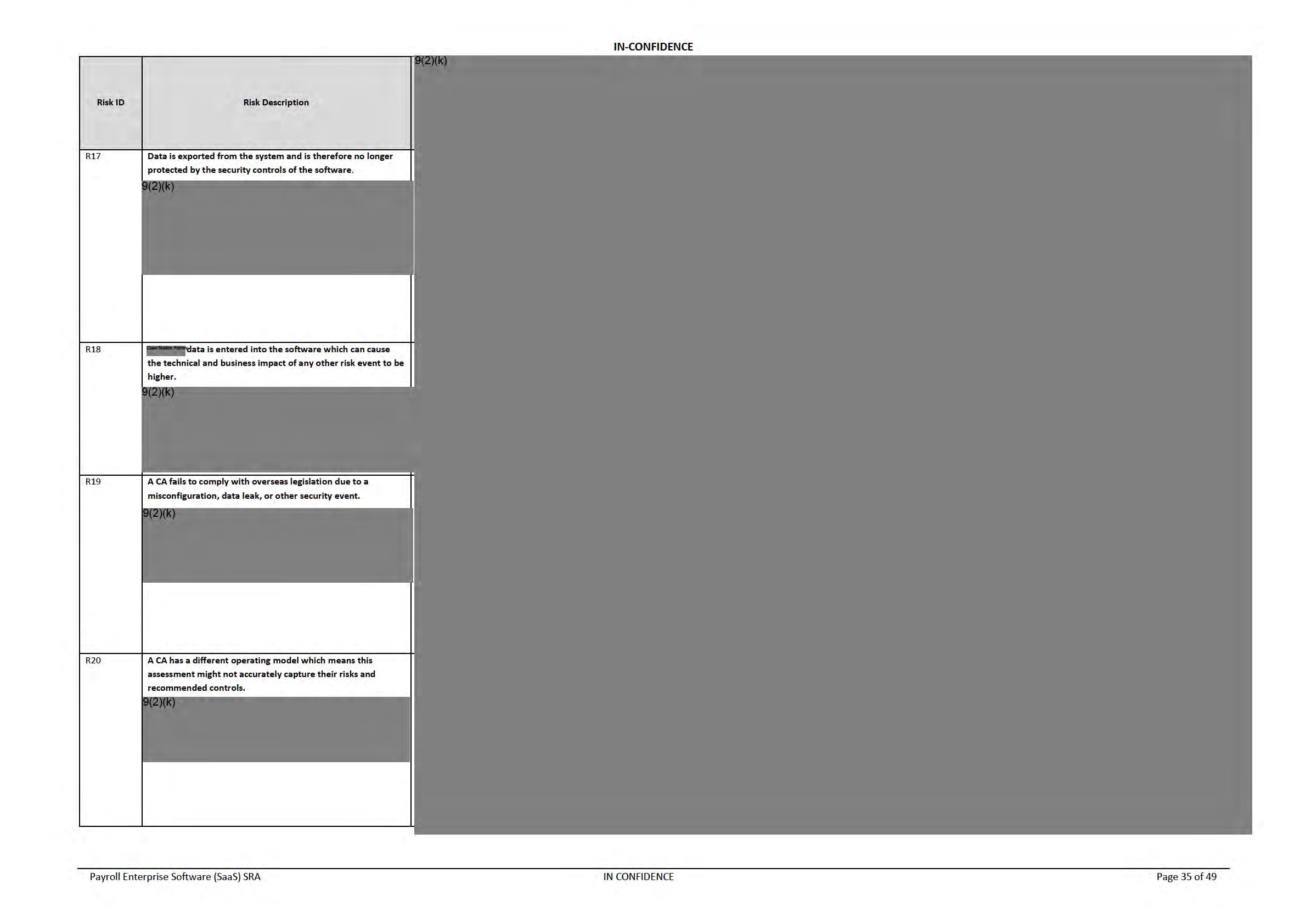

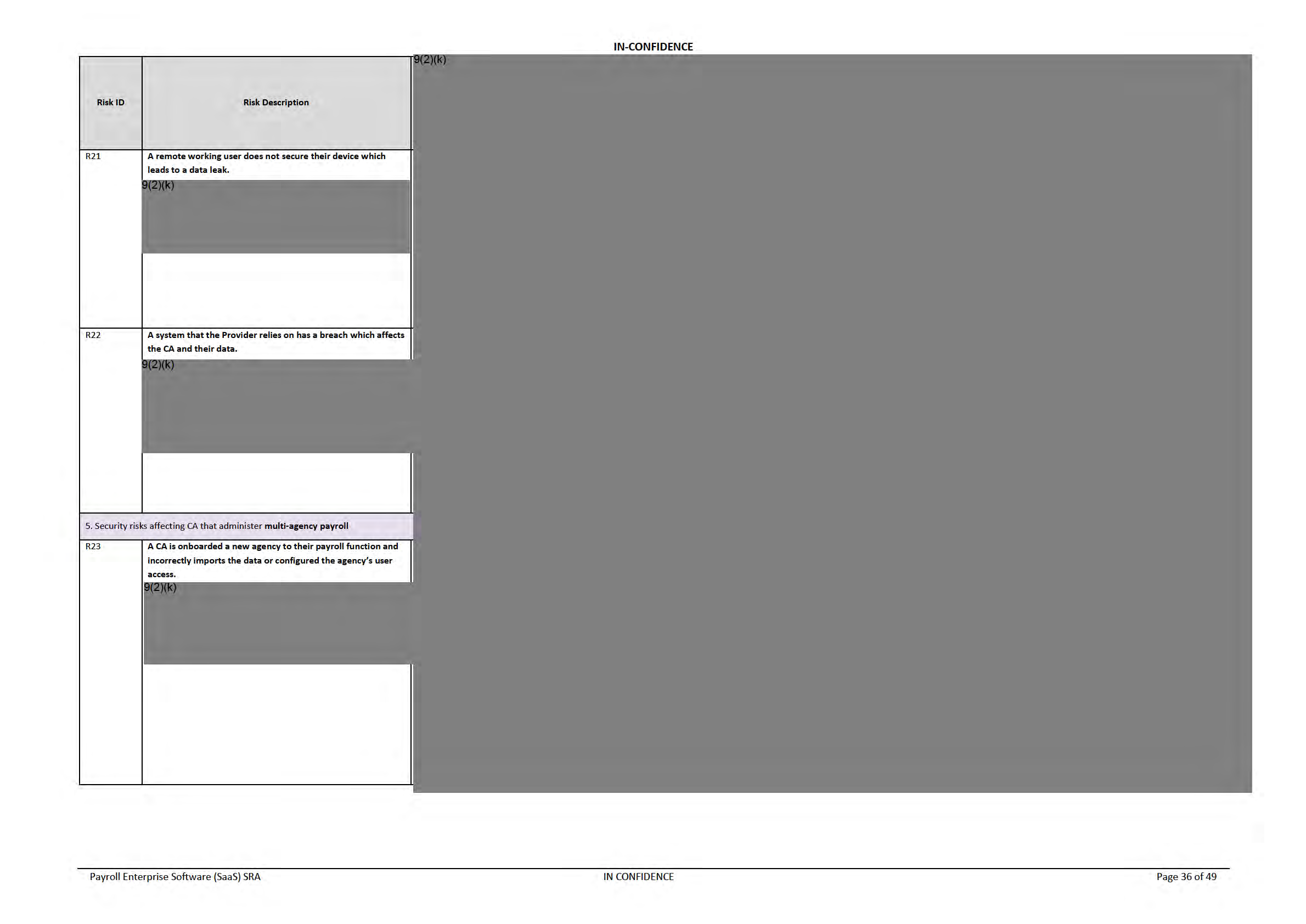

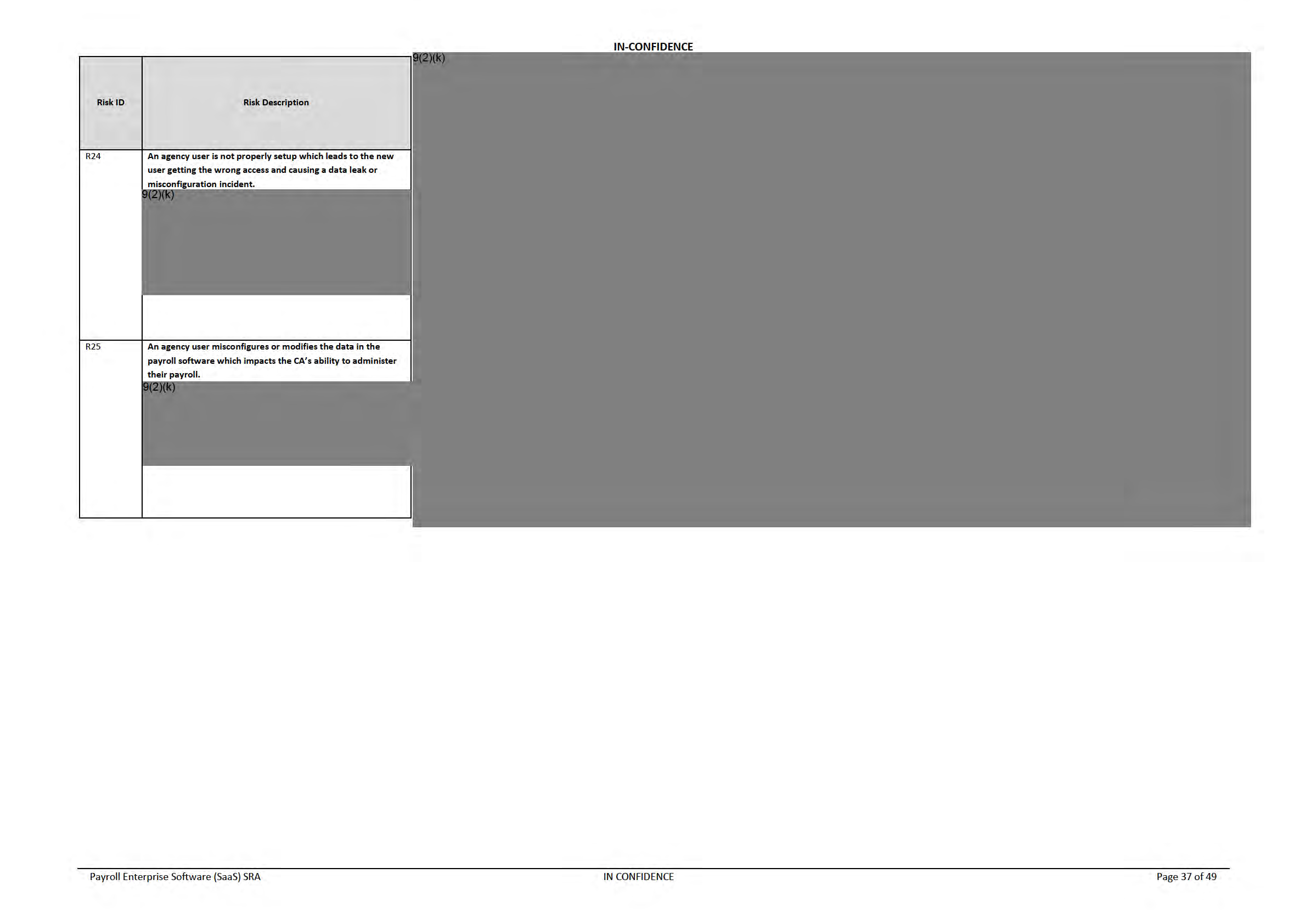

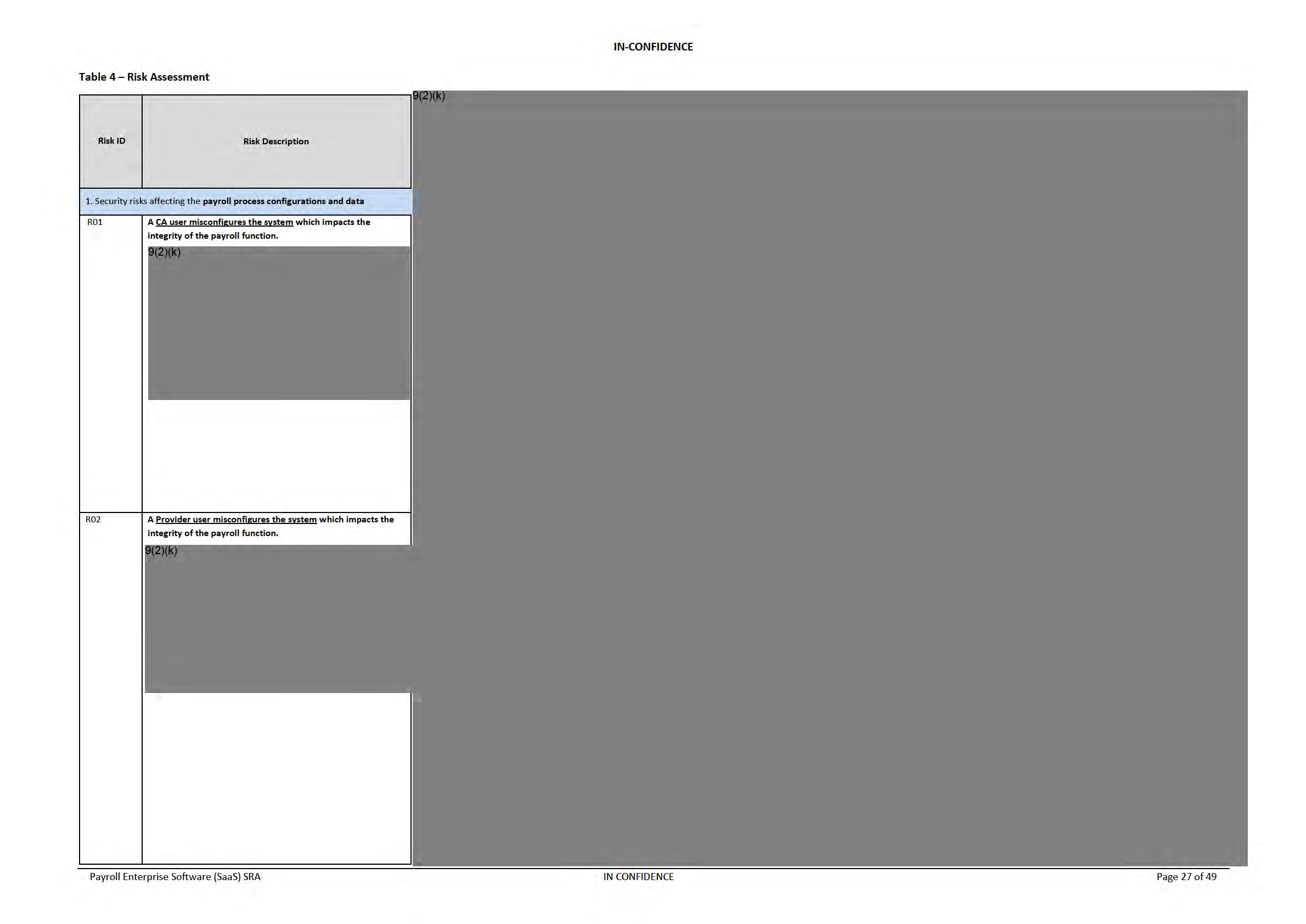

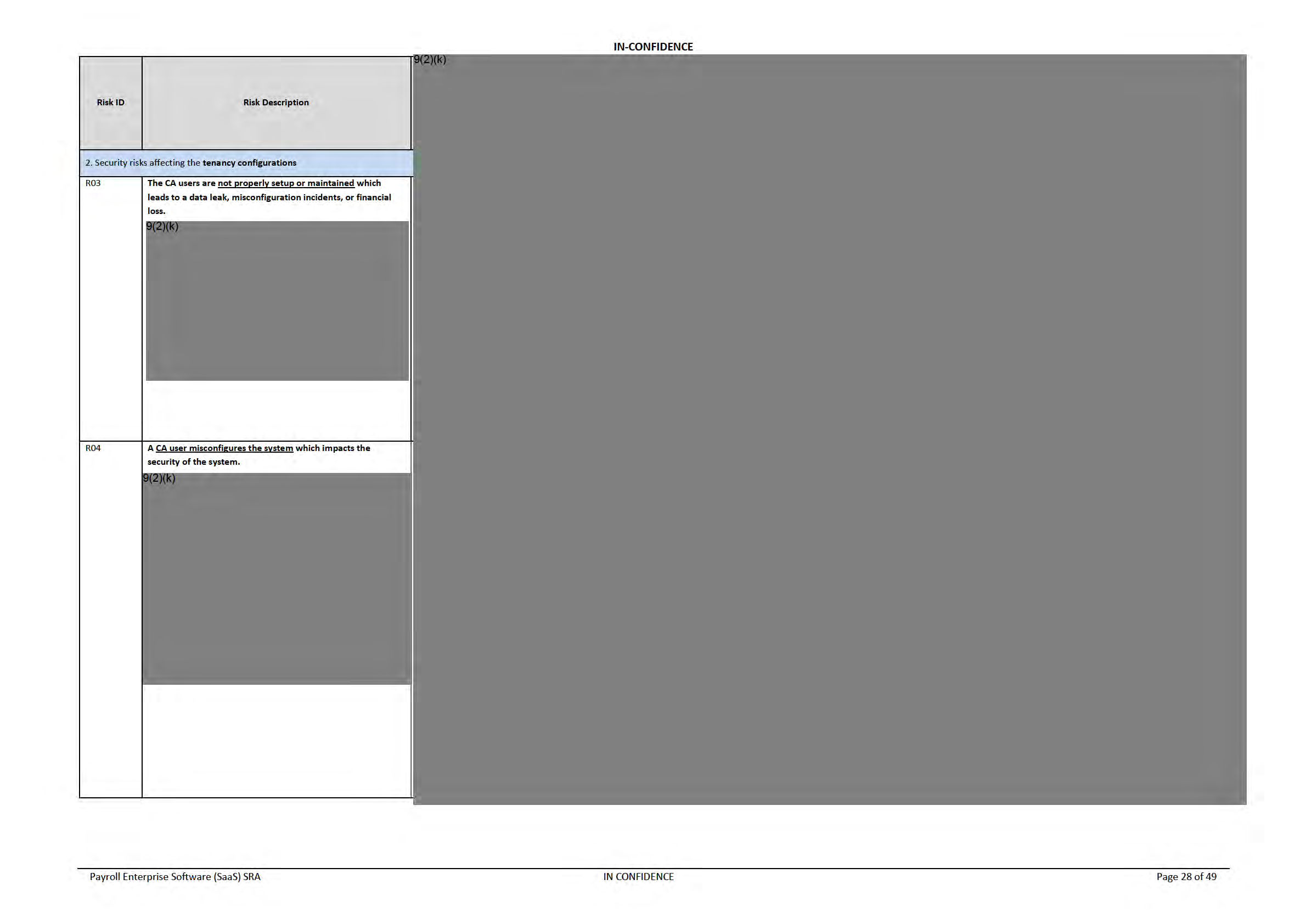

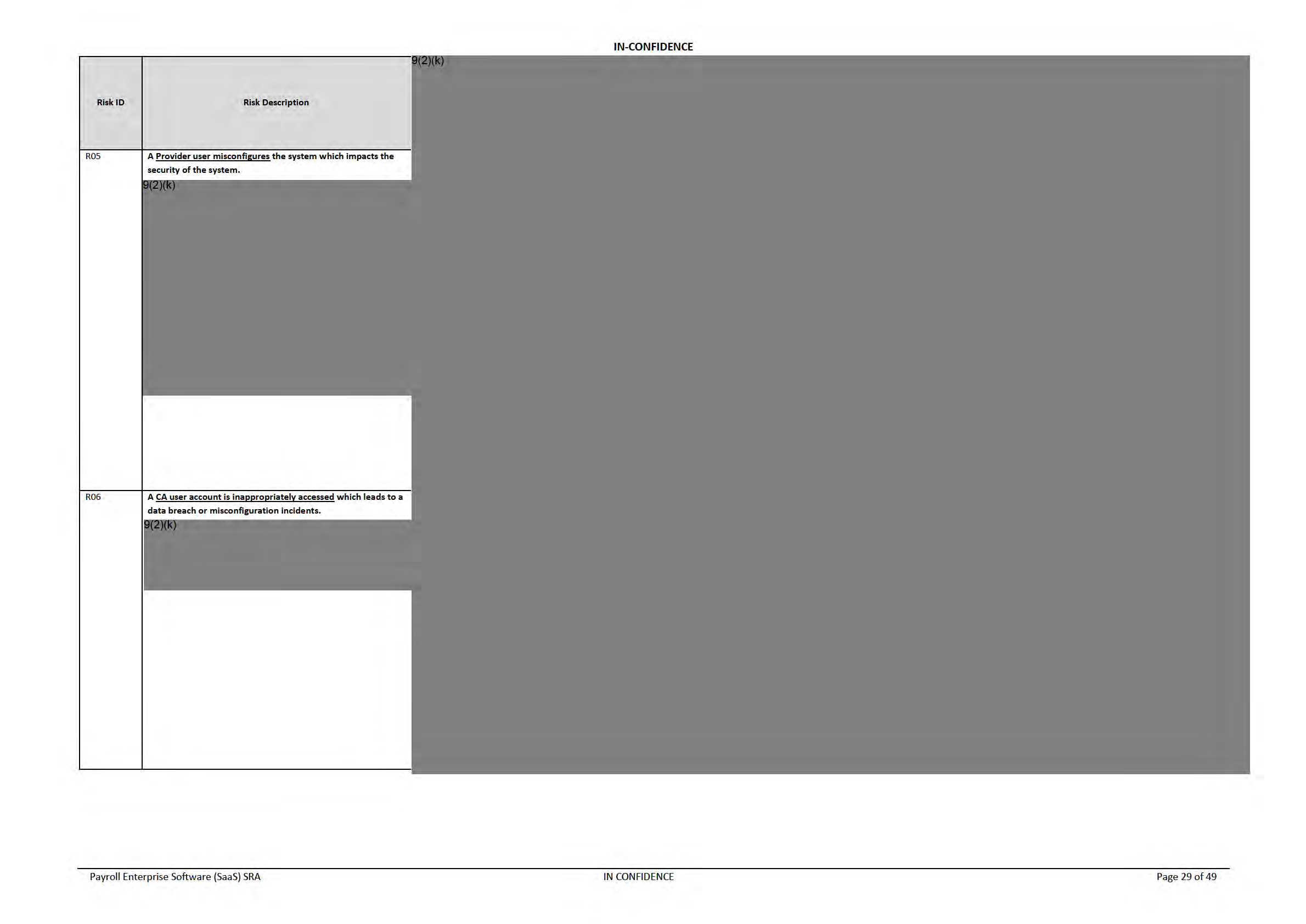

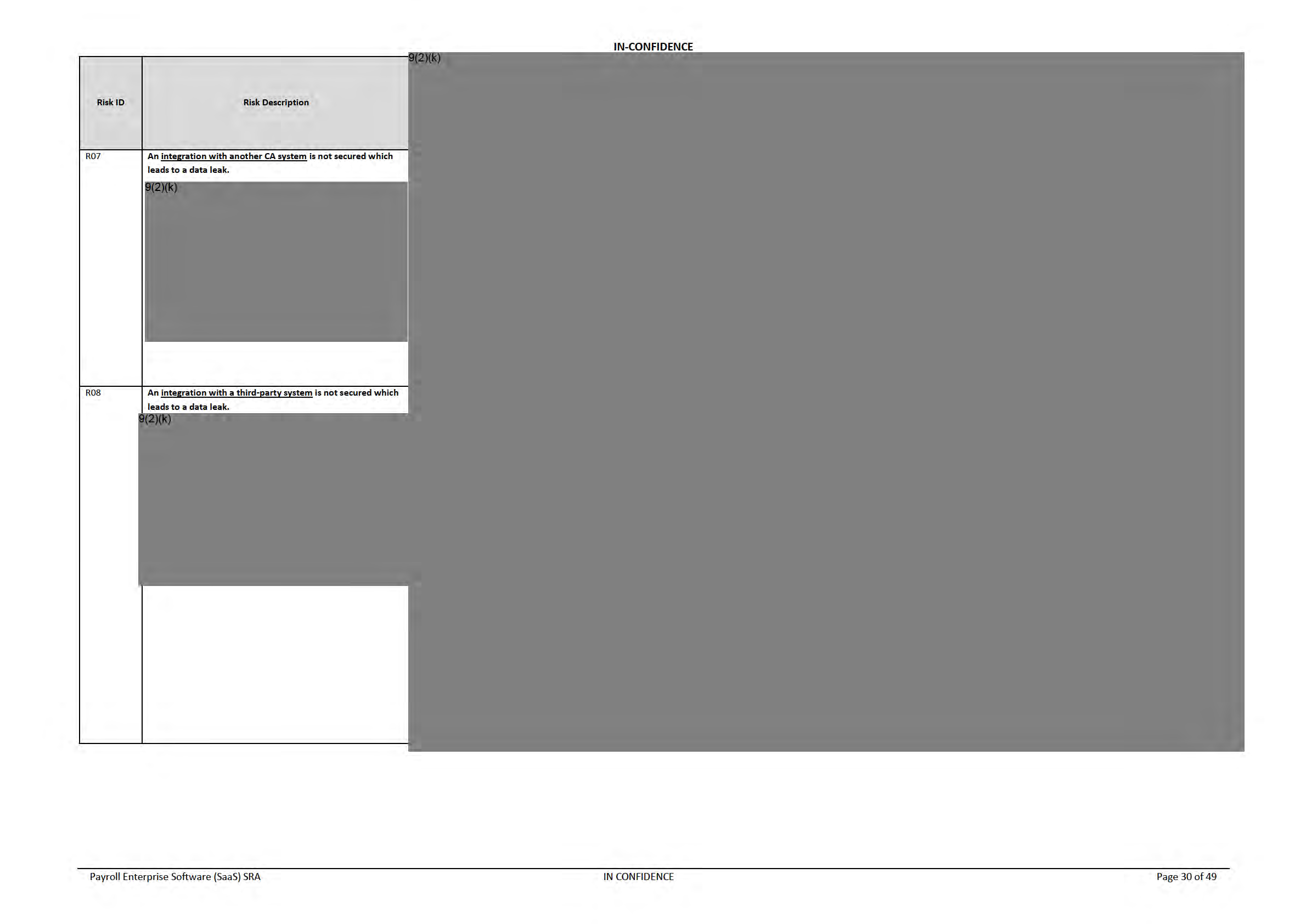

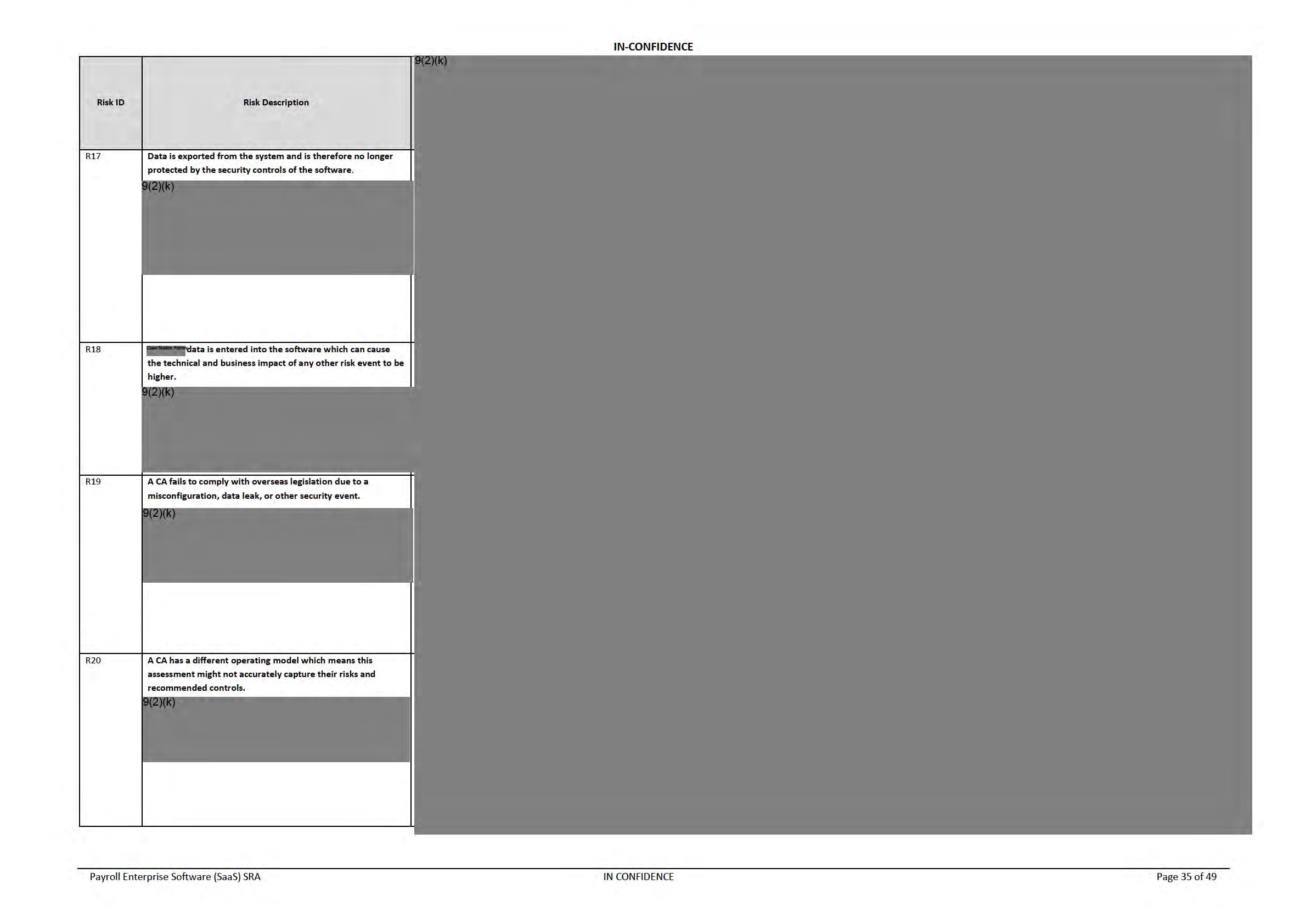

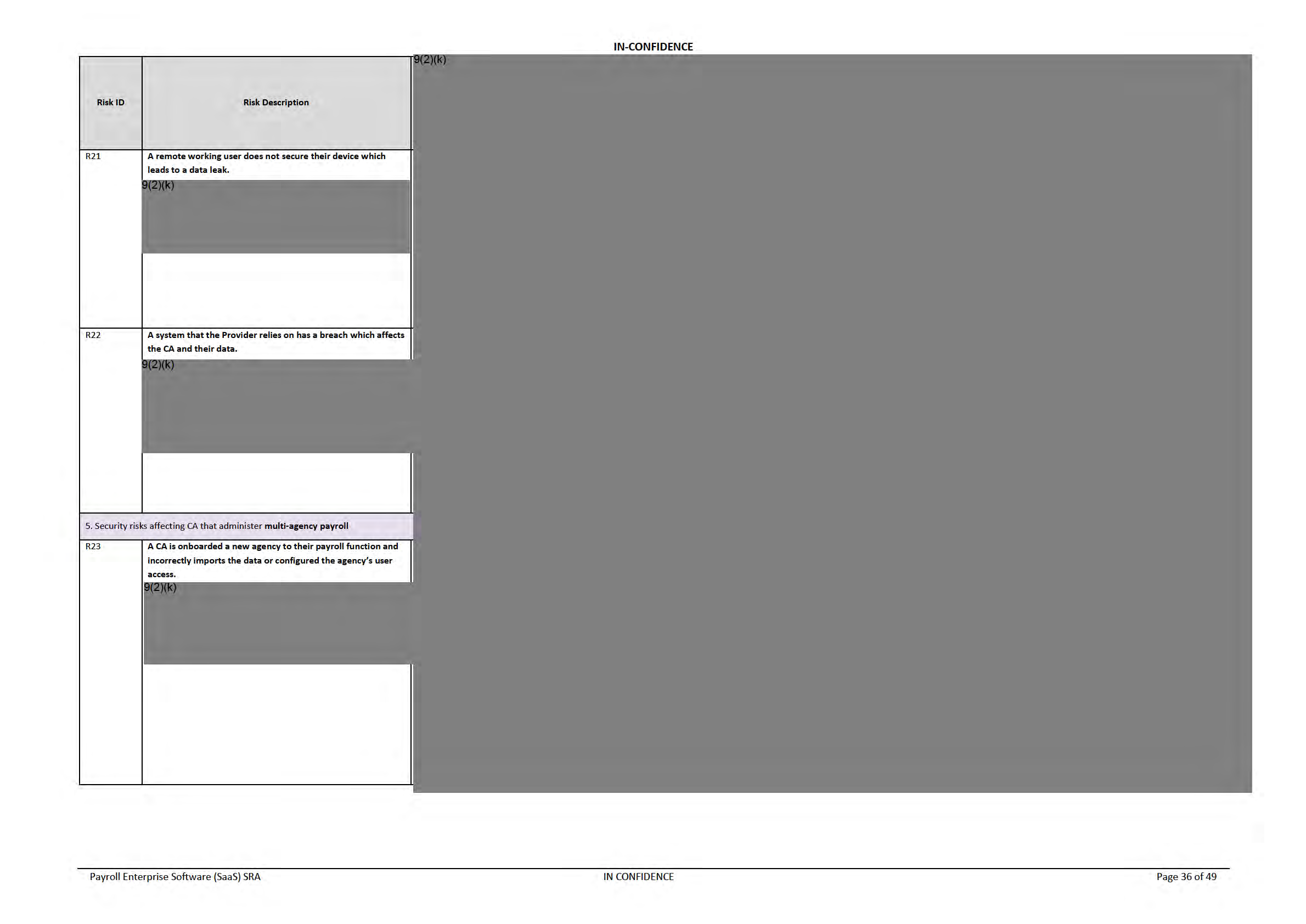

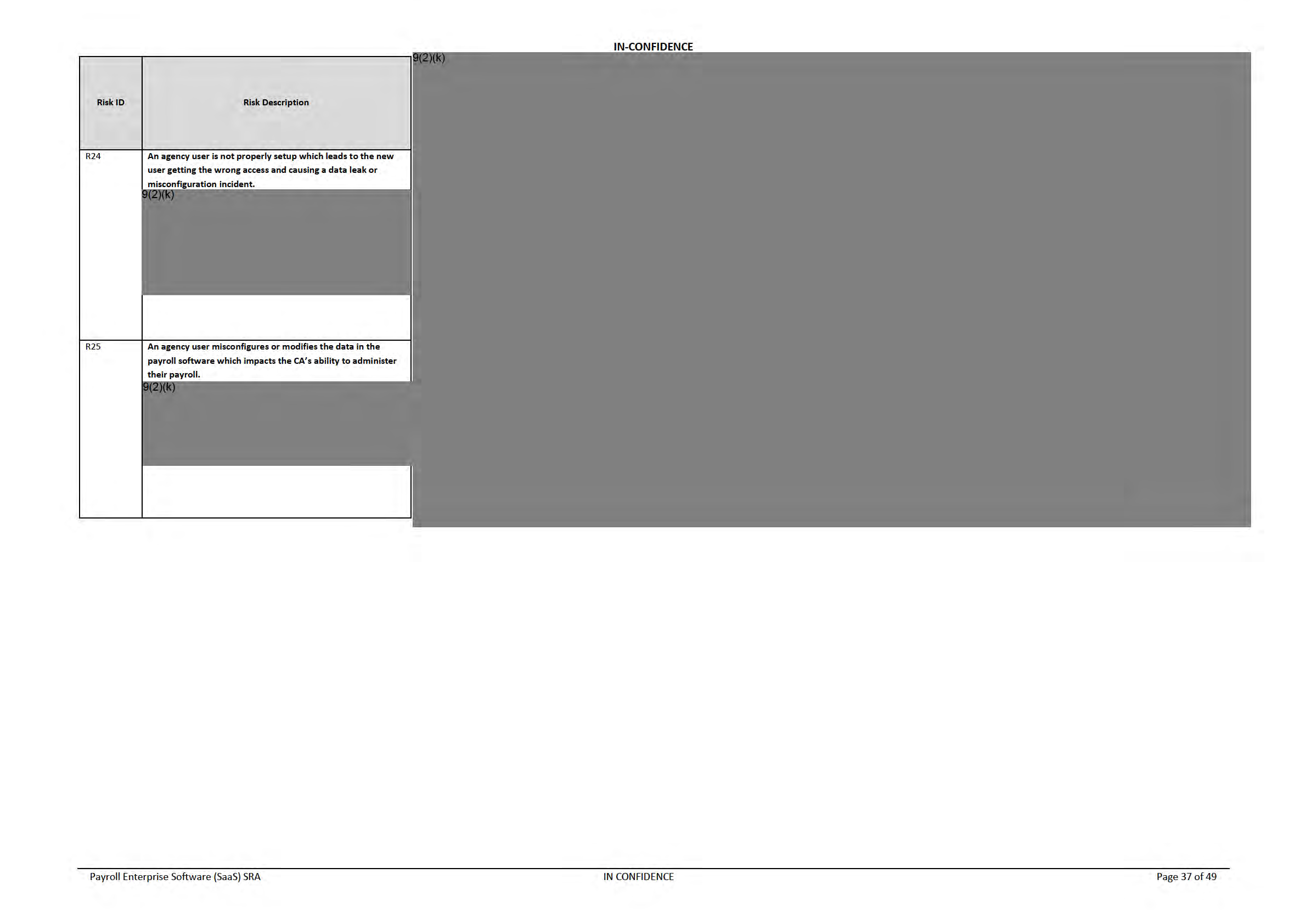

Detailed Risks

26

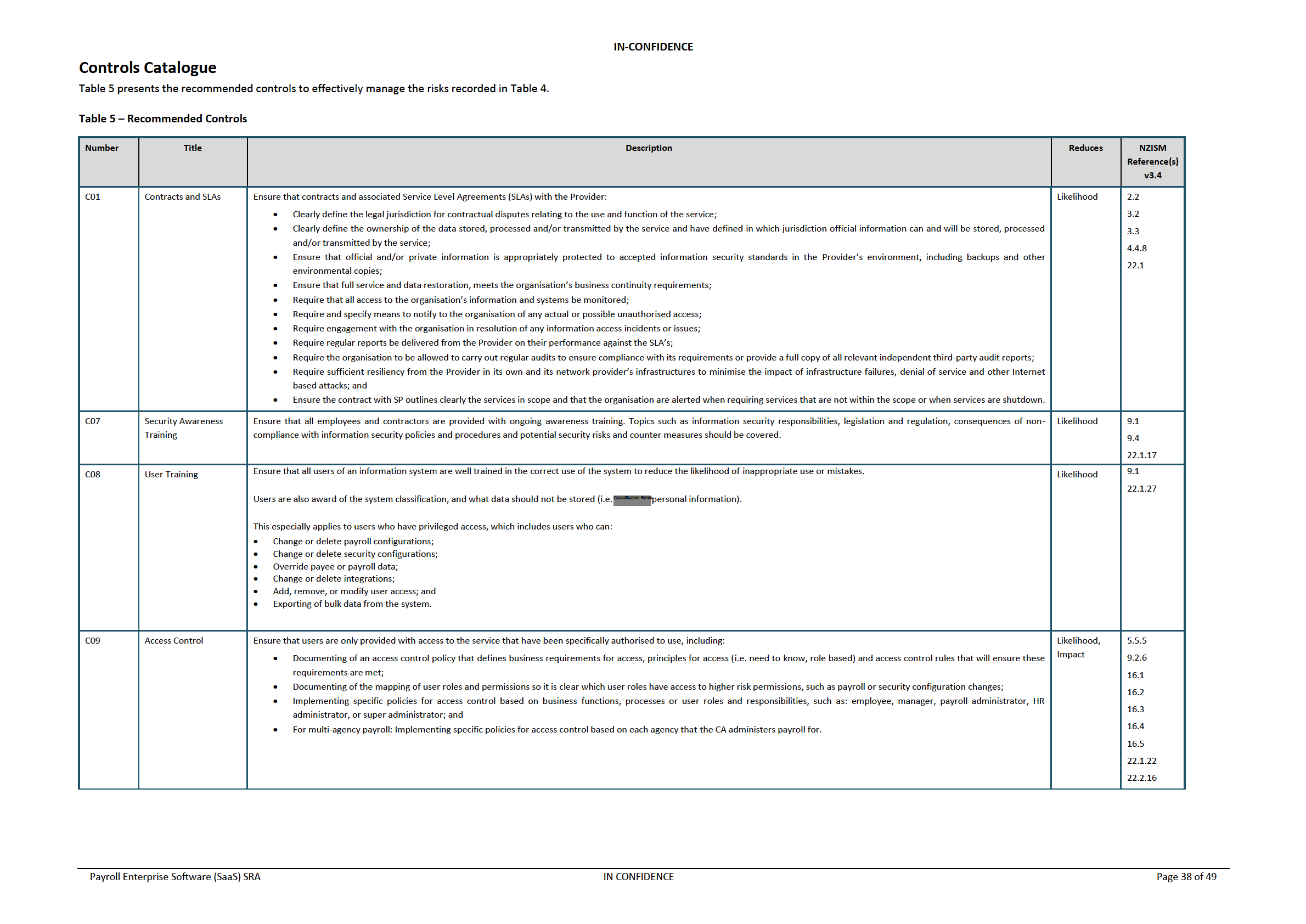

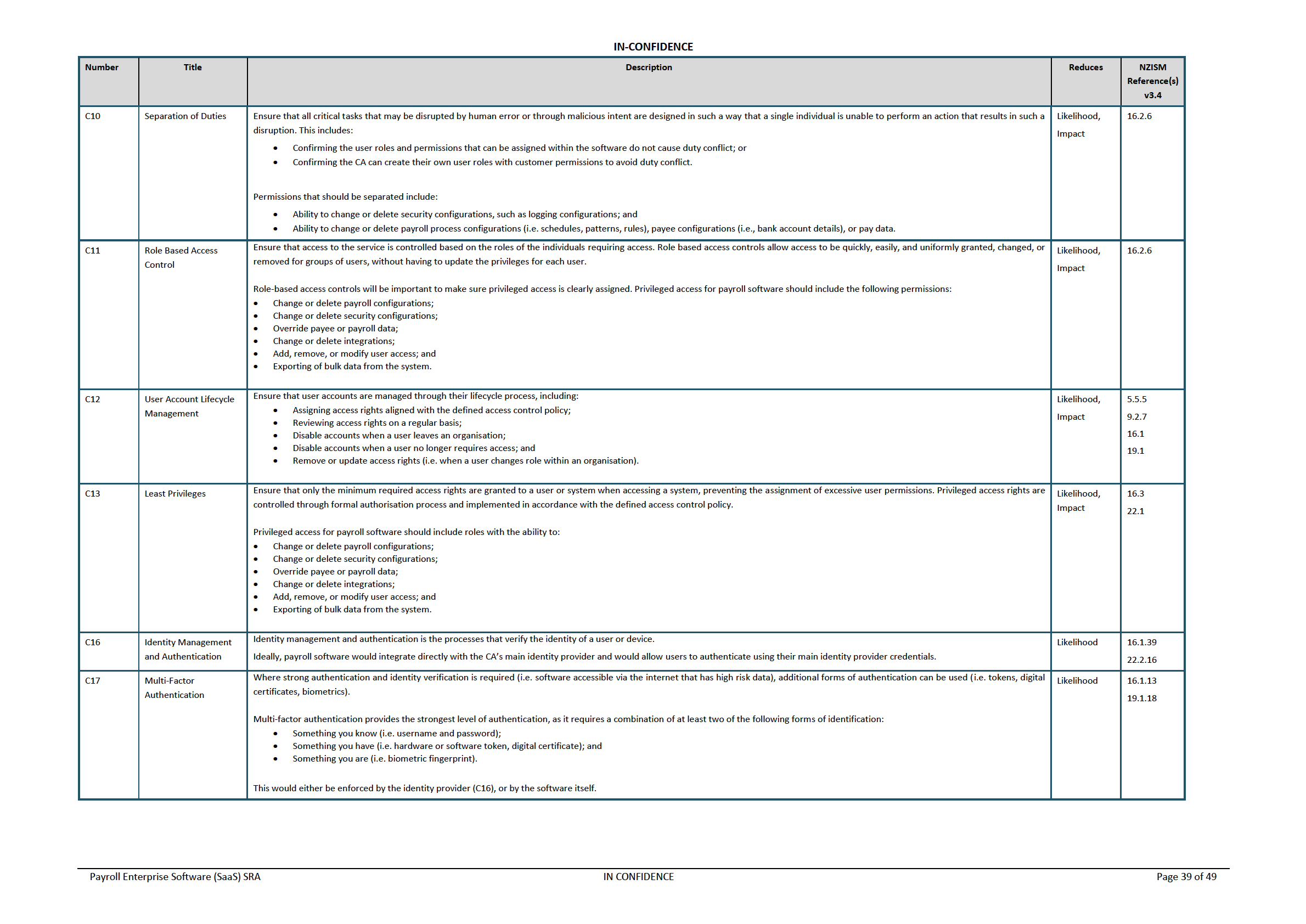

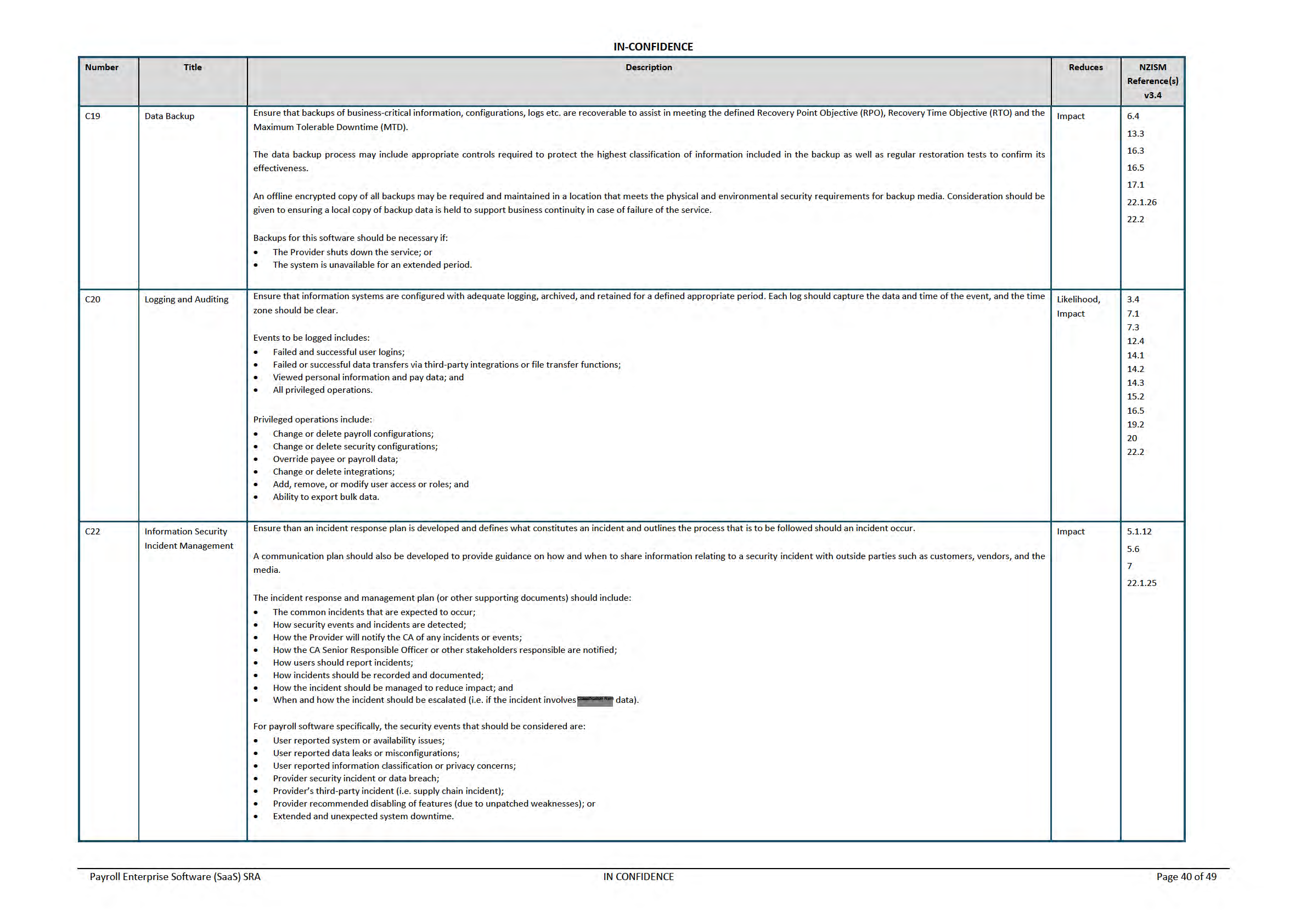

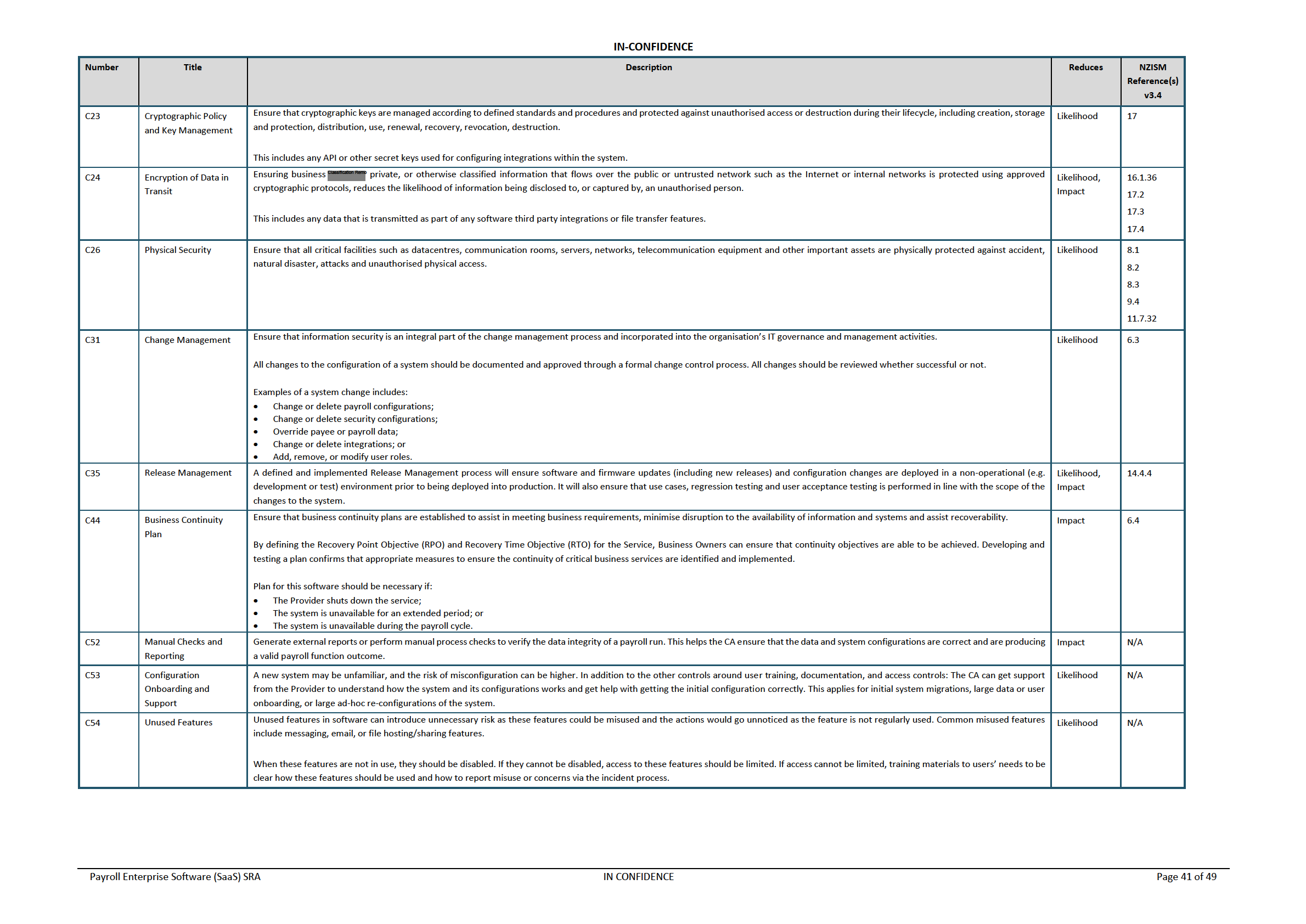

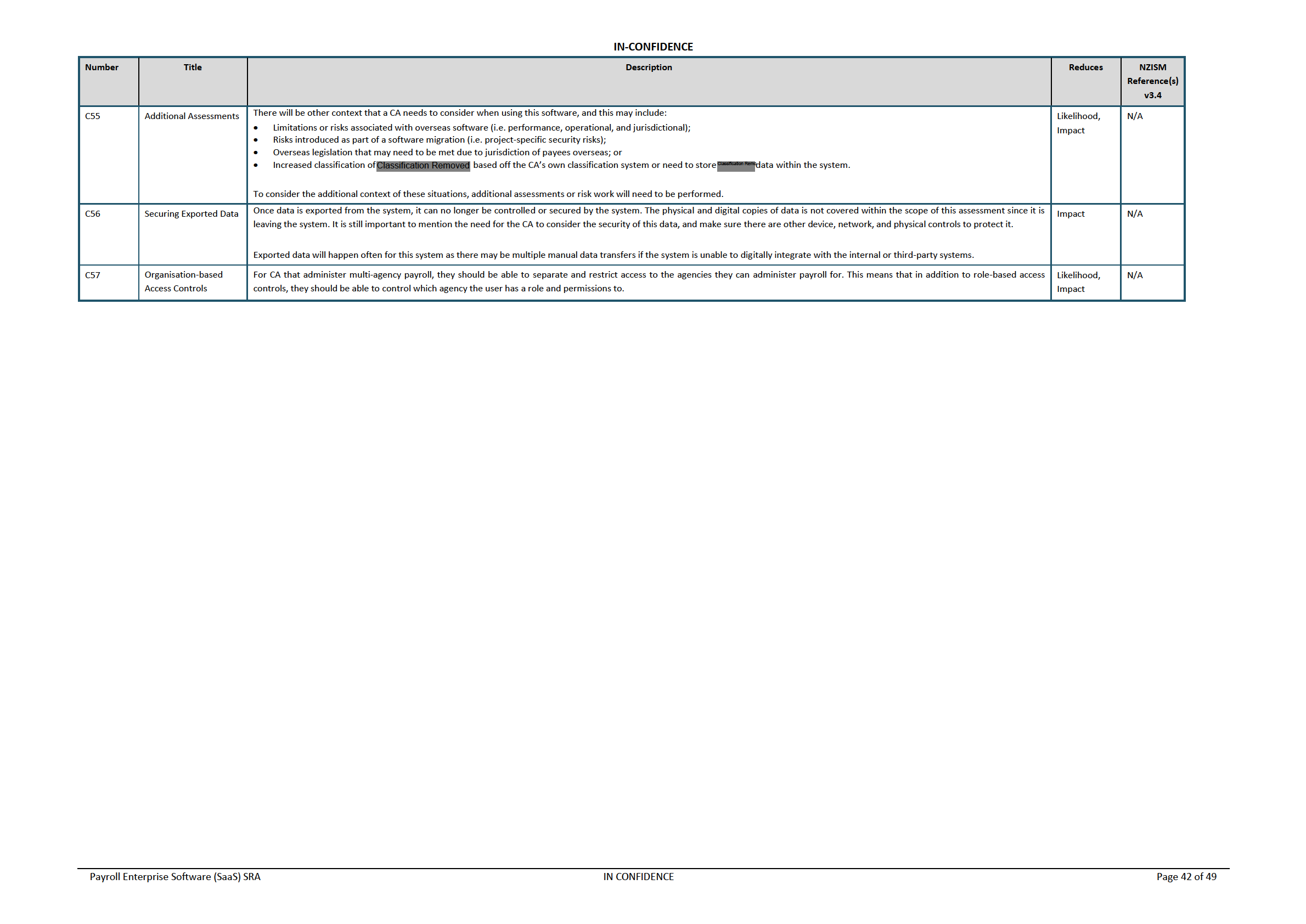

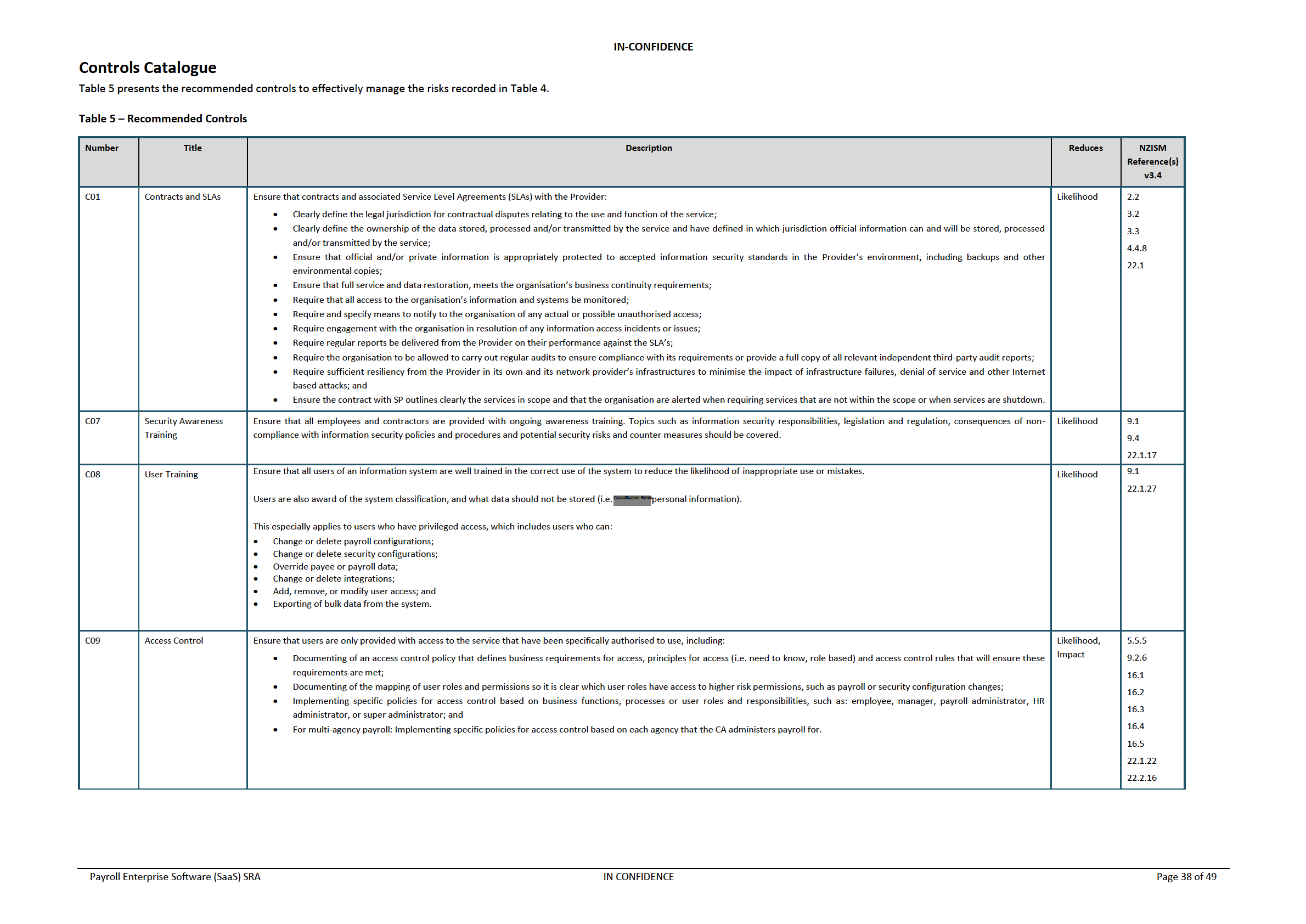

Controls Catalogue

38

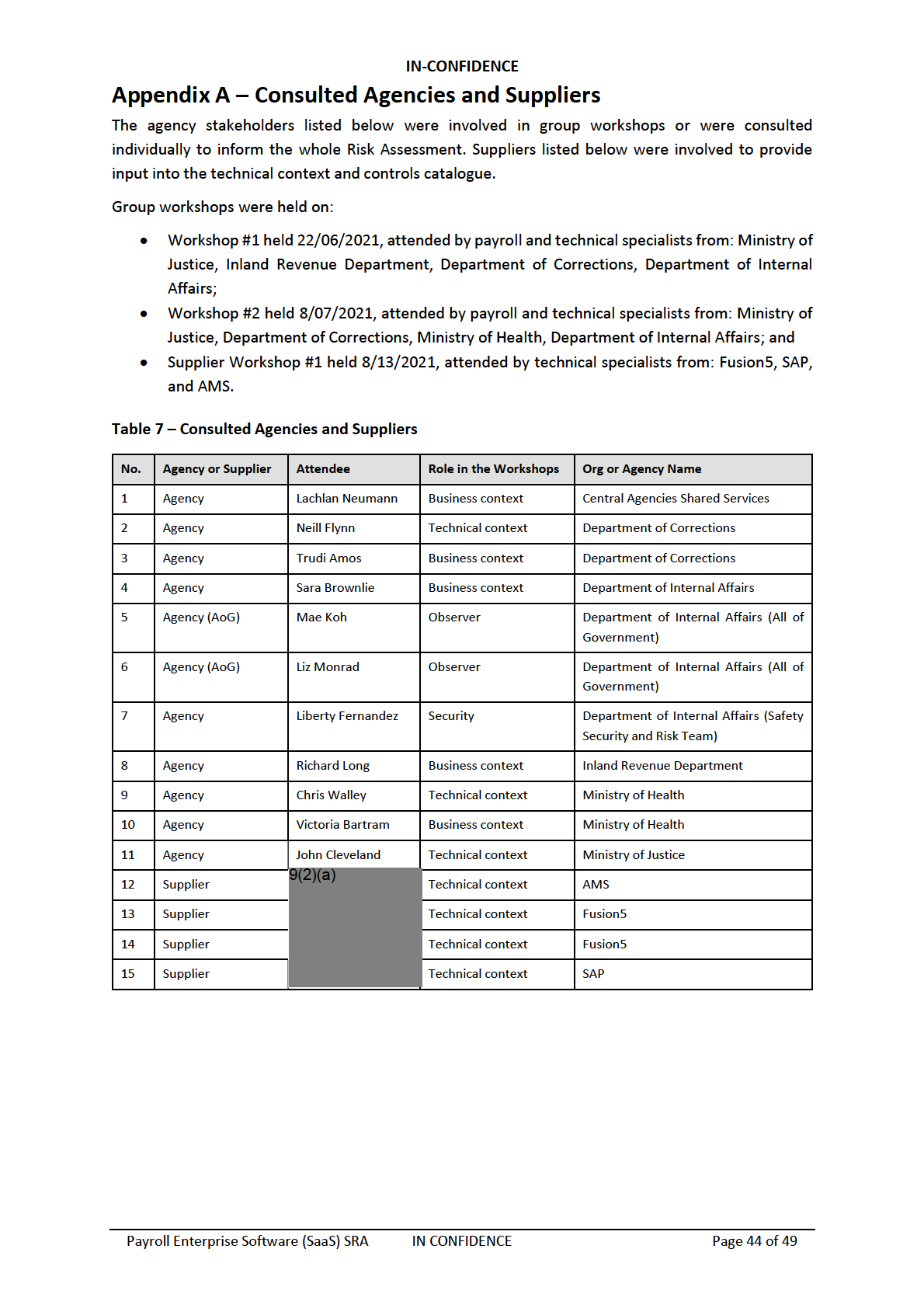

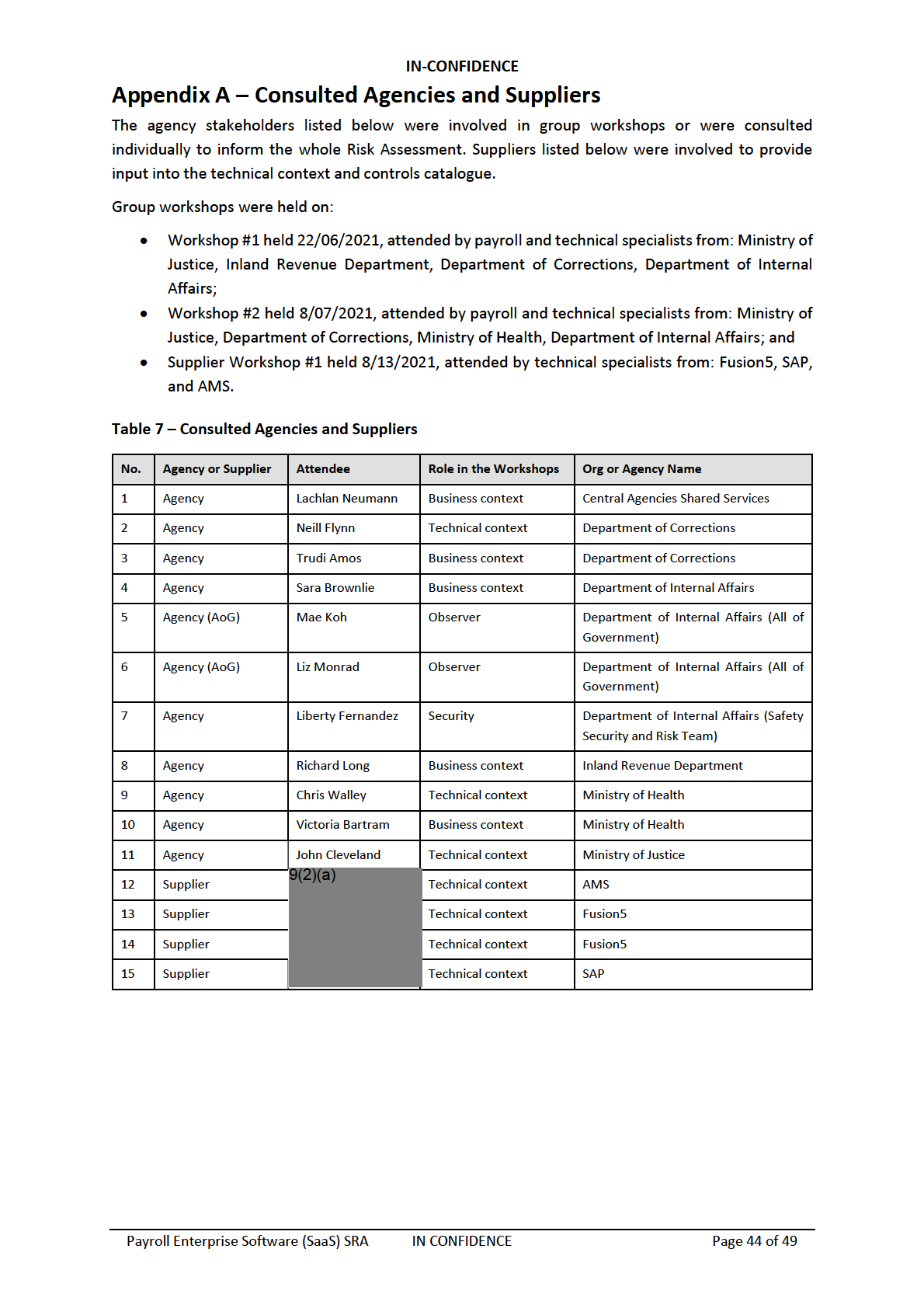

Appendix A – Consulted Agencies and Suppliers

44

Appendix B – Project Overview

45

Appendix C – Risk Assessment Guidelines

47

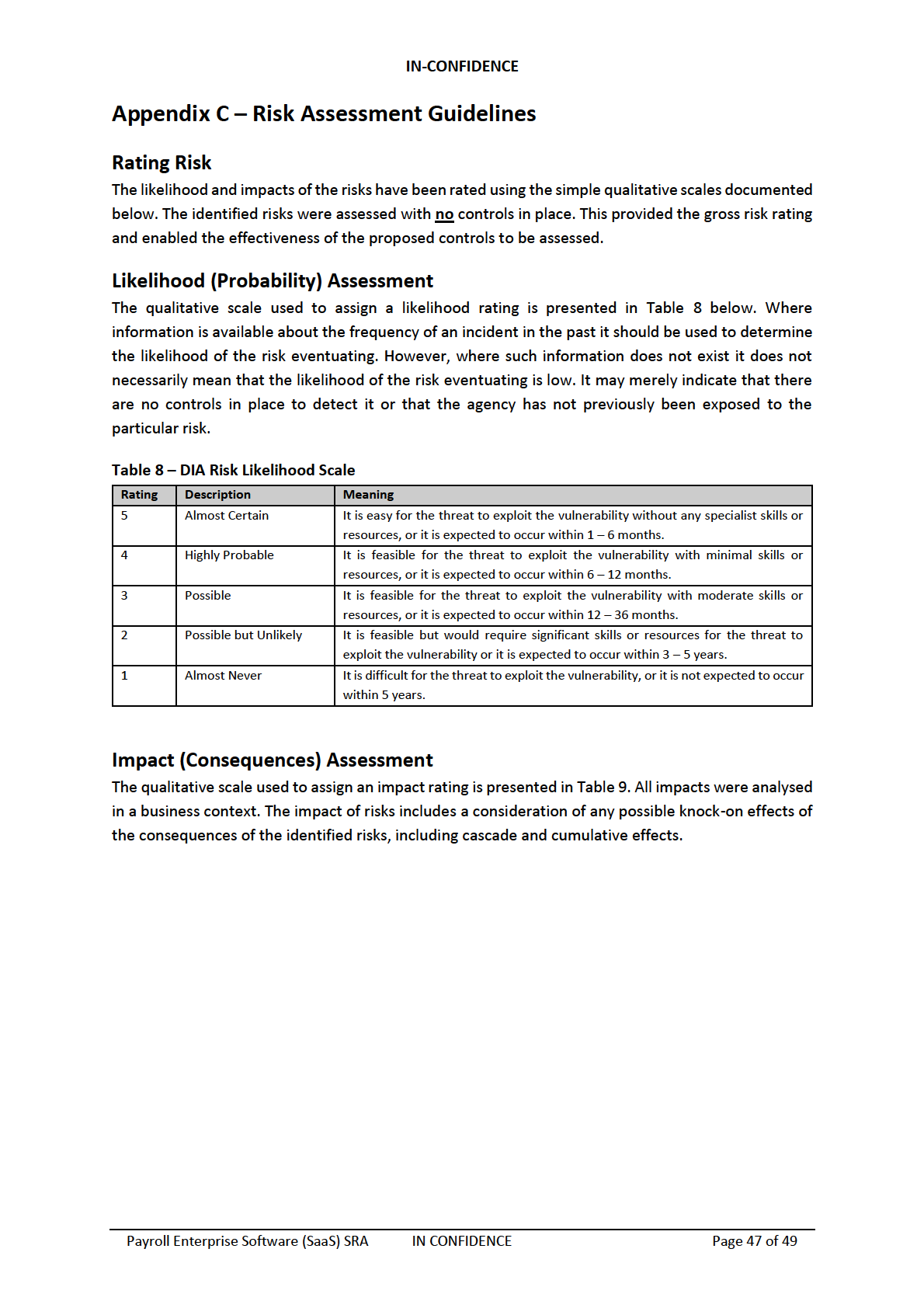

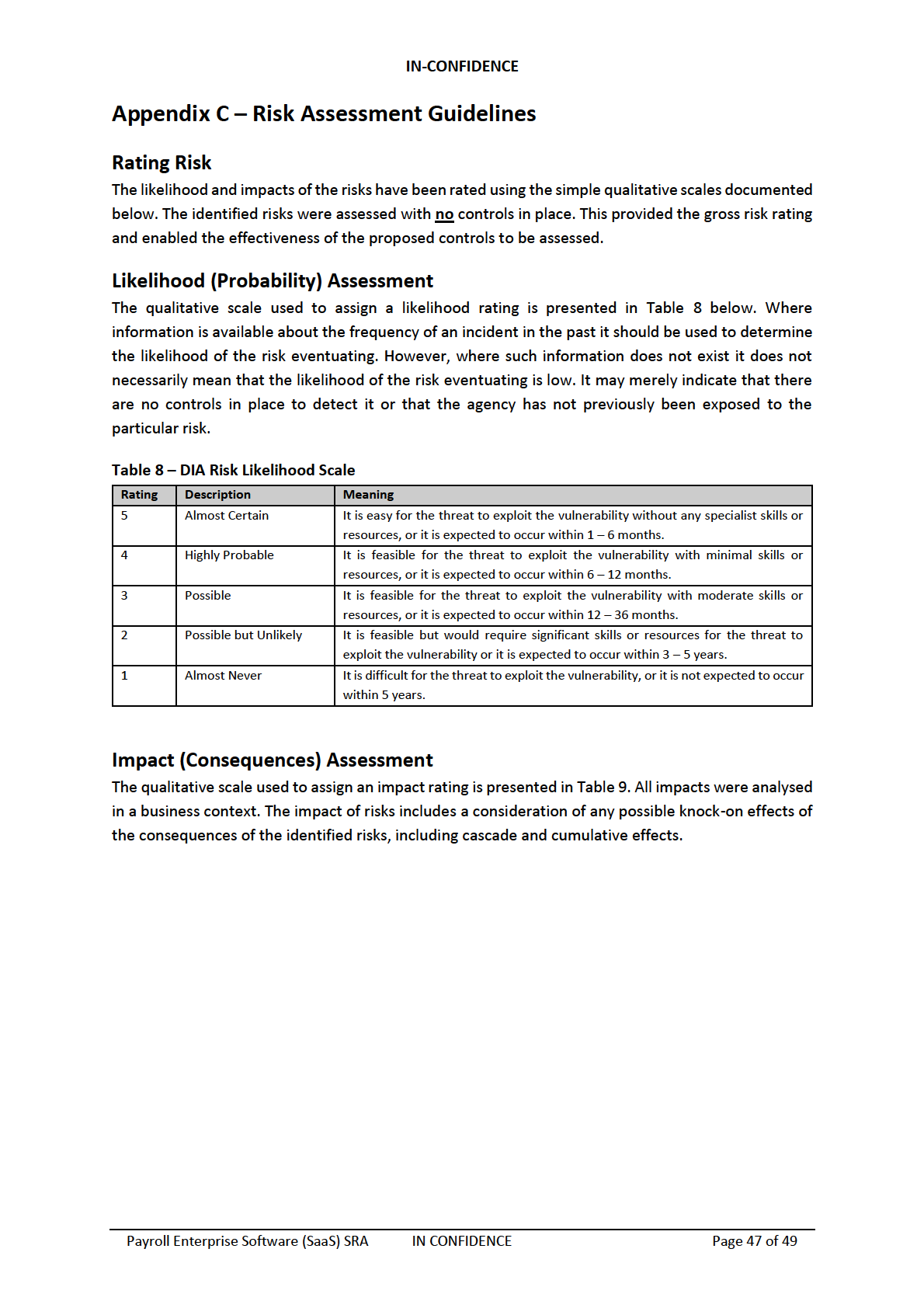

Rating Risk

47

Likelihood (Probability) Assessment

47

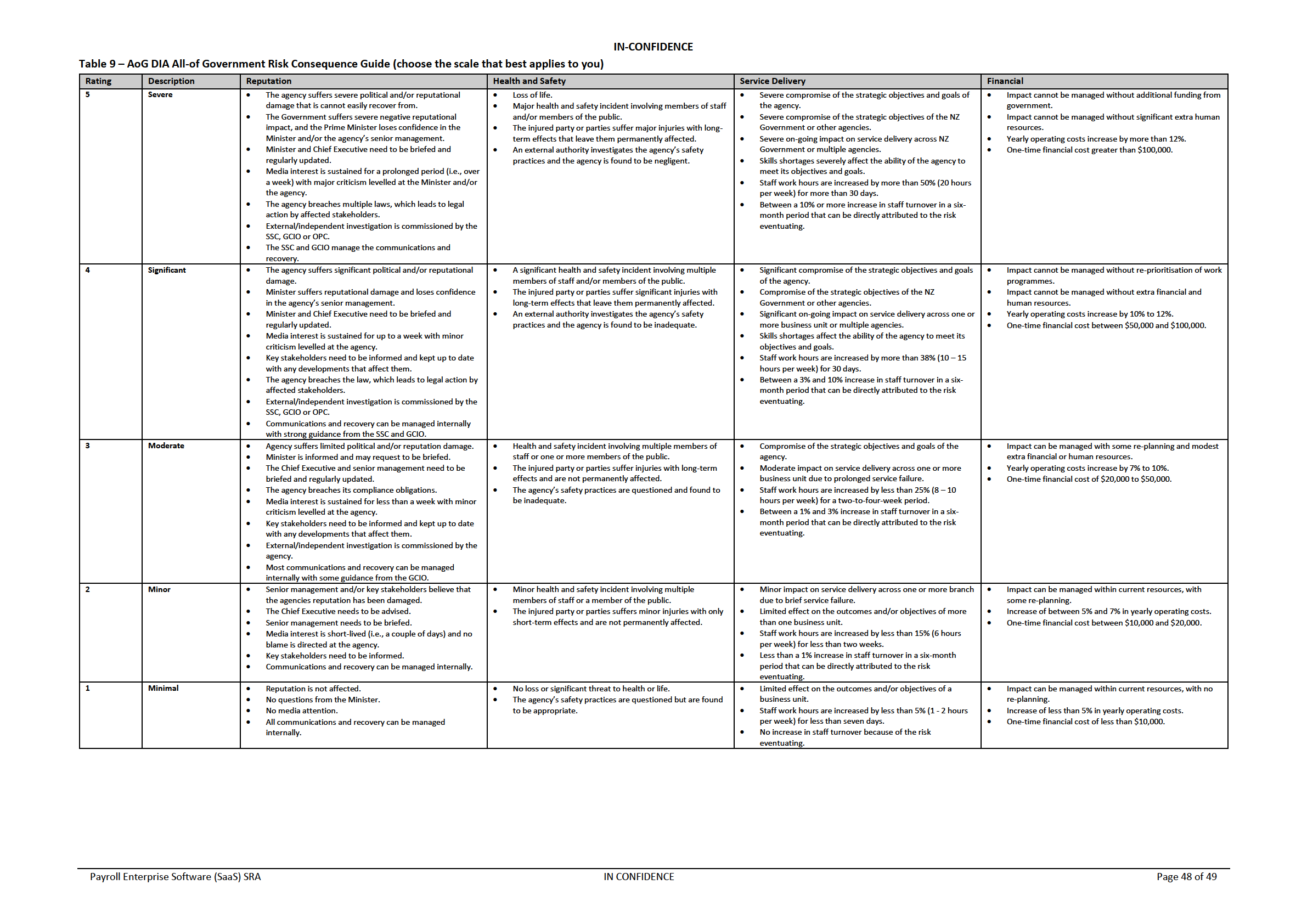

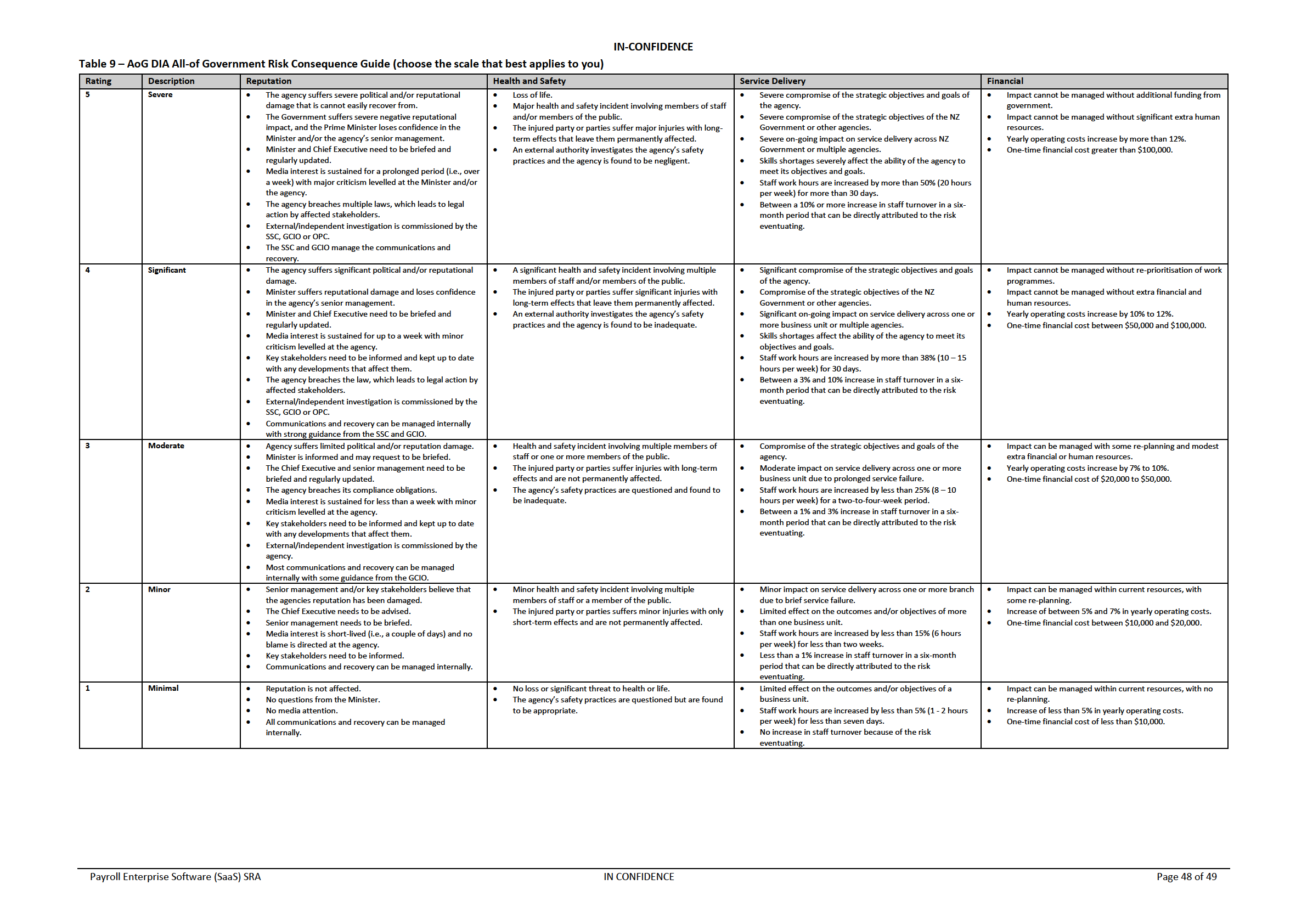

Impact (Consequences) Assessment

47

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 5 of 49

IN-CONFIDENCE

Executive Summary

Introduction

Payroll is a large, important, and complex part of an agency. To effectively run payroll services, the

software used must integrate with many different systems. All these systems combined perform key

business functions ranging from payroll, time and attendance, award interpretation, rostering, human

resources, workforce management, self-service, and data management.

In the Marketplace, Payroll itself is made up of two channels:

• Managed Services, which includes both software and a range of associated business and

supporting services; and

• Enterprise Software, which includes the software.

The Marketplace Payroll Enterprise Software catalogue includes both provider-hosted (or Software-

as-a-Service, SaaS) and agency-hosted products.

This report includes the findings for the information security Risk Assessment for a provider-hosted

Payroll Enterprise Software product used by Consuming Agencies (CAs). There will be multiple

suppliers (or Providers) that will provide this product, and each CA will have their own unique context

and risk appetite. Therefore, this report contains generic findings and the intent is that each CA will

review them using their own risk management framework. This Risk Assessment also only considers

the context that the data stored, transmitted, or processed by these products is classified as IN-

CONFIDENCE or lower. If a CA stores, transmits, or processes data with a higher classification, they will

need to re-assess these risks using their own information classification policy and risk management

framework.

The details of the Marketplace structure and security risk assurance framework can be found in

Appendix B.

The Risk Assessment performed followed the Government Chief Information Officer’s (GCIO) Risk

Assessment process, which is based on the AS/NZS ISO 31000:2009 and ISO/IEC 27005:2011 risk

management standards.

under the Official Information Act 1982

9(2)(k)

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 6 of 49

IN-CONFIDENCE

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 7 of 49

IN-CONFIDENCE

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 8 of 49

IN-CONFIDENCE

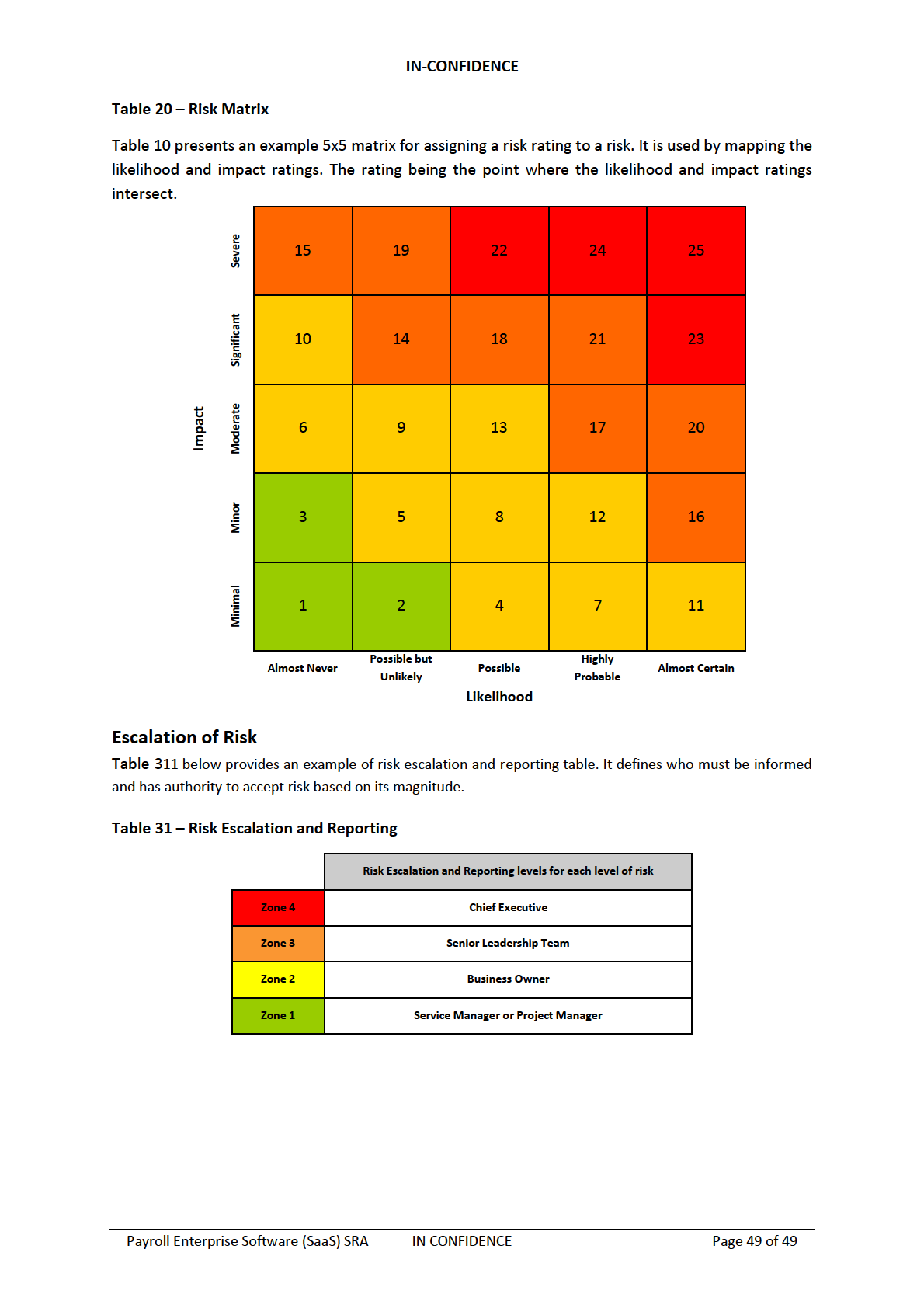

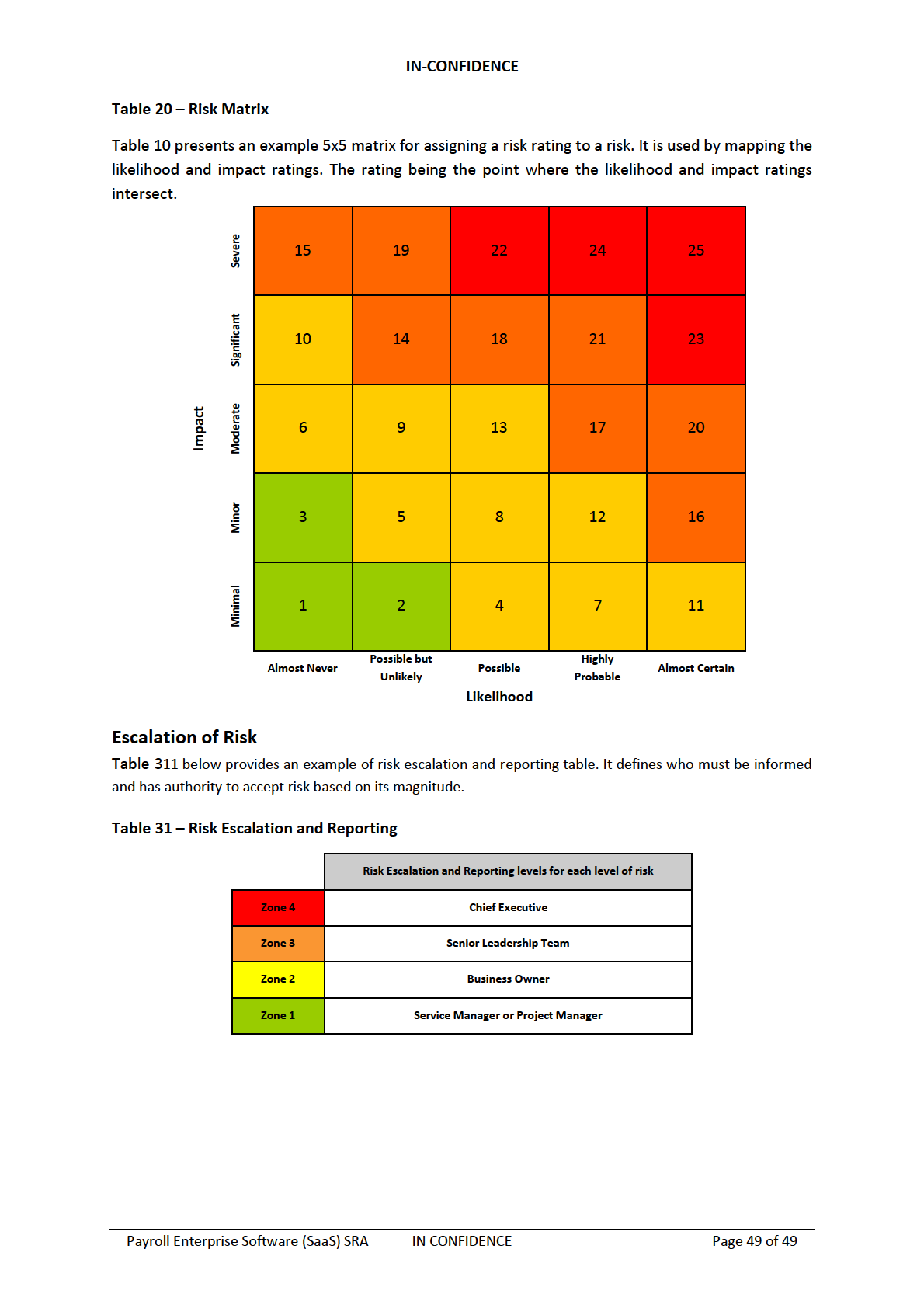

Gross Risk Position

Table 1 illustrates the rating of each risk without any controls in place.

Table 1 – Gross Risk Ratings

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 9 of 49

IN-CONFIDENCE

Key Recommendations

The Risk Assessment included key controls that if implemented, helps to address the identified risks.

A Controls Validation Plan (CVP) was also developed to specify the recommended controls outlined in

the Risk Assessment.

9(2)(k)

To mitigate and manage the identified gross risks rated as

the following key recommendations should be undertaken:

1. Provider and Vendor Due Diligence

The CA will be unable to control how the Provider manages the components of the software that

are outside of the CA’s control. The Provider is also unlikely to share any details about how they

secure or manage those components as this is confidential information for a likely multi-tenancy

environment. If the information were used against the Provider, it could result in risk events that

affect more of their customers than just the CA.

Although the CA will not be able to perform a full audit of the software, they can obtain

information on what controls the software does provide and if the CA can use those controls to

manage their own risks. For example, an important control for the CA to configure is role-based

(and organisation-based for multi-agency payroll) access controls. If the Provider and software

does not provide enough granular levels of configurations, it will not be possible for the CA to

implement this control which would lead to higher risks.

For the controls listed in this report and the CVP, the CA should verify which controls are available

to be configured (which can be verified by the Provider) before attempting to implement the

controls themselves. This includes controls such as: role-based access controls, organisation-

based access controls, separation of duties, least privilege, logging and auditing, information and

security incident management, data backups, encryption in-transit, identity management, and

unused features.

2. Access Management and Controls

There are high risks related to the misconfiguration by CA users or unauthorised access to CA user

accounts. These risk events can lead to various impacts due to the value of data in the system.

One of the most important set of controls for the CA to implement will be strong access

management and controls.

under the Official Information Act 1982

This includes controlling how users authenticate to reduce the likelihood of someone gaining

unauthorised access to an account. It also includes making sure there are granular enough roles

and permissions so the CA can properly separate responsibilities and follow the principle of least

privilege.

3. Logging and Incident Response

Since the higher risks faced by a CA are related to misconfiguration or unauthorised access, it will

Released

be important to have detective controls in place in the event the access controls (preventative

controls) fail.

Logging and auditing will depend on what is available from the Provider and the software, and will

be a critical detection point for CA. These detection points will need to then feed into a security

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 10 of 49

IN-CONFIDENCE

incident management process. That way if risk events do occur, the CA can respond quickly and

effectively to minimise the impact.

4. Additional Assessments

This Risk Assessment is expected to cover most of the use cases for a CA that wishes to use

Provider-hosted payroll software. However, there will be a few edge cases that might apply that

can have large impacts to security risk. This includes edge cases related to:

• Initial migration from the previous payroll system;

• Overseas legislation;

• Use or storage of Classification Removed data; and

• Limitations of software hosted overseas (i.e., jurisdictional, performance, operational risks).

A CA should consider if these edge cases apply to their context and perform additional risk or

assessment work to fully understand how this context affects these risks.

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 11 of 49

IN-CONFIDENCE

Residual Risk Positions

Table 2 below illustrates the expected residual rating of each of the risks if all the recommended

Provider controls are implemented and appropriately configured and managed.

Table 2 – Provider Residual Risk Ratings

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 12 of 49

IN-CONFIDENCE

Table 3 below illustrates the expected residual rating of each of the risks if all the recommended

Consuming Agency controls are implemented and appropriately configured and managed.

Table 3 – Consuming Agency Residual Risk Ratings

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 13 of 49

IN-CONFIDENCE

Business Context

This section provides an overview of the generic business context for the Payroll Enterprise Software

(Provider-hosted) products that are in scope of this generic information security Risk Assessment.

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 14 of 49

9(2)(k)

Pre-payroll Services Processes

Recording of pay data involves many factors:

•

Salary or rostered wages;

•

Schedules or work patterns (default, or custom); and

•

Pay rules (award interpretation, or deductions and allowances).

Salary

under the Official Information Act 1982

Salaried employees have a pattern set in their work profiles that determines how pay is calculated,

and this would be configured and set in the payroll system. There is a default pattern that represents

a common, standard salaried employee (such as Monday to Friday, 8AM to 4PM).

This pattern can be changed and is often happens due to different pattern terms in the salaried

employee’s individual agreement or collective agreement, change in part-time or full-time status.

Released

Rostering / Time and Attendance

Payees paid according to a roster can be full-time, part-time, or casual employees. If a payee is on

rostered wages, the time that they are paid for is based on either rostering (hours recorded in

advance) or a time and attendance (hours recorded

already worked). Either could be performed:

•

Manually, such as using spreadsheets and entering data into a system; or

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 15 of 49

IN-CONFIDENCE

•

Using a system, either within a separate rostering system or within the payroll software (as an

add-on feature).

There are common controls and processes followed to confirm the integrity of the hours before the

payroll process kicks off:

•

Default schedules and configurations – These are set in the rostering or time and attendance

systems, and make sure the pay is correct and complies with the Holidays Act;

•

Approval flows – Hours recorded would go through an approval flow and the approvers

required would depend on either: delegation matrix, collective agreement, individual

agreements, or multi-employer agreements; and

•

Data integrity reports – These can be run in the payroll systems to confirm the pay calculated

is accurate, complete, and reliable.

Pay Rules

Last part of recording pay correctly involves pay rules and this involves considering any award

interpretation, allowances, and deductions that might apply to a specific payee.

Award interpretation involves the translation of worked hours into a paid value based off rules and

regulatory requirements set in the system. This can include allowances, overtime, and penalties. The

rules and requirements are configured in either:

•

The separate rostering systems; or

•

Within the payroll software (as an add-on feature)

Common deductions that need to be configured before payroll is run includes:

•

Employment or contract status;

•

Salary sacrifice (or a donation of part of their salary to a charity);

•

Kiwisaver or superannuation contributions;

•

Inland Revenue Department or Ministry of Justice fines;

•

Student loan payments;

•

Any other changes agreed (such as overpayments, payment of leave up-front); and

•

Payroll tax.

Payroll Processes

The payroll process for each CA will vary, but there are some common steps taken including:

under the Official Information Act 1982

•

Data integrity reporting and validation;

•

Trial pay runs;

•

Calculation of pay;

•

Final pay run and generation of pay, bank, and other third-party files; and

•

Repeat of process for multiple pay runs (i.e. multi-agency payroll).

Pay Calculations

Pay calculation m

Released ay start off with the data that is imported in from other systems (9(2)(k)

9(2)(k)

r it will start off with data based off the profile and rules that the

payee is set up with in the payroll system.

These calculations are consistent across agencies due to required compliance with the Holidays Act,

however they still need to be configured within the system. The CA can alternatively follow the

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 16 of 49

IN-CONFIDENCE

common process model, which helps the CA make sure the payroll rules configured meet good

practice and legislative requirements.

Pay Runs

A CA may administer multiple pay runs before pay is finalised. It may involve a trial run, which checks

if the CA is under or overpaying. Multiple checks take place including checking number of payees

compared to number of employees, comparing of pay data to previous pay runs. These results are

also needed for audit evidence.

When the final run is administered, multiple files will be generated and may include (but is not limited

to):

•

Bank files – which are transferred to the CA’s bank for payment to payees;

•

IRD files – which are transferred to IRD for tax and other compliance;

•

Payees pay information – which includes a summary of their pay, allowances, and deductions;

•

3rd party files – for uploading of pay data into other systems the CA may use (such as financial

management or accounting systems), or to other 3rd parties that deductions were made for

(such as Ministry of Justice); and

•

Union files – which includes a summary of union fees that have been paid.

These files may be manually transferred (by manually uploading the files to the other system) or there

may be an integration or file transfer system used by the CA.

For CA that look after multiple agencies’ payroll, this process would repeat for each agency they look

after.

Post-payroll and Ongoing Processes

After the payroll run is complete, a CA will perform:

•

Accounting and recording of the pay run; and

•

Reporting and sharing of reports with groups within the CA or agencies they administer payroll

for.

There will also be ongoing services that take place outside of the payroll run, such as:

•

Software data management (such as configuration management of profiles, pay rules, and

under the Official Information Act 1982

other payroll-related configurations, access management, and data management);

•

Integration management (such as Rostering, Time and Attendance, HR, and bank system

integration);

•

Identity Provider integration (for authentication to the system);

•

Software, infrastructure, and hardware management (which in the scope of this report is

managed by the SaaS Provider); or

•

Supporting procedural controls (such as incident response, disaster recovery, and business

Released

continuity).

Information Classification

The security classification of the information that will be stored, processed, or transmitted by the

payroll software has been evaluated as IN-CONFIDENCE and below. This is because while the payroll

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 17 of 49

IN-CONFIDENCE

software and business processes contain personal information, this data would not cause an impact

to diplomatic, economic wellbeing, safety, or operational effectiveness of New Zealand.

There is a risk that the payroll software may store Classification Remove information. The most common situations

include:

• Data or documents uploaded related to leave taken that involves domestic violence,

vulnerable children, or health information.

If CAs wish to consume the software for information classified to Classification Removed CAs will need

to comply and confirm with controls detailed in the Protective Security Requirements (PSR).

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 18 of 49

under the Official Information Act 1982

Released

IN-CONFIDENCE

Legislation, Policy, and Guidelines

CA must ensure that they can demonstrate compliance with applicable legislation, policies, guidelines,

and any other external requirements when using payroll software.

The following legislation, policy, and guidelines relate specifically to security requirements are

considered relevant to most CAs:

• Protective Security Requirements (PSR); and

• New Zealand Information Security Manual (NZISM v3.4).

The following legislation, policy, and guidelines relate different aspects to the payroll function or the

business processes they support:

• Holidays Act 2003;

• Human Rights Act 1993;

• Privacy Act 2020;

• Income Tax Act 2007;

• Employment Protection Act 1987;

• Live Organ Donors Act 2016;

• Public Records Act 2005;

• Minimum Wage Act 1983;

• Official Information Act 1982;

• Parental Leave and Employment

• KiwiSaver Act 2006;

Protection Act 1987;

• Accident Compensation Act 2001;

• Public Finance Act 1989;

• Child Support Act 1991;

• Student Loan Scheme Act 2011;

• Datacom GSF Specifications;

• Support Workers (Pay Equity)

• Domestic Violence Amendment;

Settlements Act 2017;

• Employment Relations Act 2000;

• Tax Administration (Correction of

• Equal Pay Act 1972;

Errors in Employment Income

• General Disposals Authority 6;

Information) Regulations 2019;

• Health and Safety at Work;

• Tax Administration Act 1994;

• Home and Community Support

• Volunteers Employment Protection

(Payment for Travel Between Clients)

Act 1973; and

Settlement Act 2016;

• Wages Protection Act 1983.

Some CA may provide payroll services to payees who must comply with overseas legislation. There

will be different requirements and impacts if these are not followed and were not considered in the

context of this work. The CA should perform their own assessment when understanding their specific

requirements under any legislation.

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 20 of 49

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 21 of 49

IN-CONFIDENCE

9(2)(k)

under the Official Information Act 1982

Service Owner and Experts

Each CA will have to use this Risk Assessment and apply it to the specific Provider and payroll software

solution they selected from the Marketplace, and to their own internal risk framework and context.

As part of that, the CA can get support from the following stakeholders:

•

Senior Responsible Officer – or the officer responsible for the use and risk of the software in

Released

their agency;

•

IT Security Manager – or the manager responsible for performing security assurance for the

system;

•

Solution Architect – or the architect responsible for identifying the technical components and

features in the Provider and software chosen; and

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 22 of 49

IN-CONFIDENCE

•

Payroll and other subject matter experts – or others in the CA who can assist with adjusting

this Risk Assessment in the context of how the system will be used within the CA.

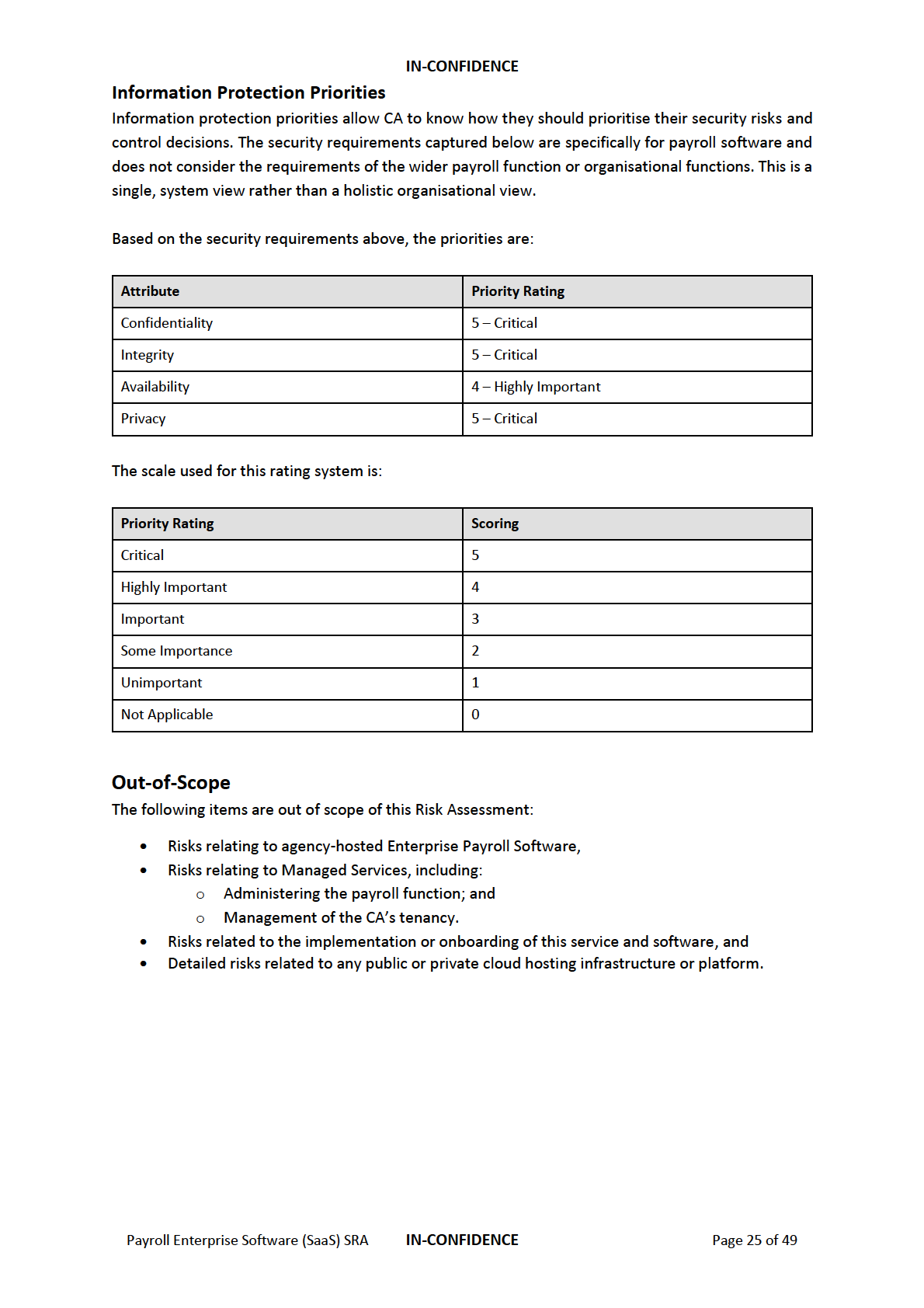

Security Requirements

The security requirements help inform the technical impact of the security risks captured, and the

requirements vary based off the confidentiality, integrity, availability, and privacy requirements of the

data used by the payroll system.

The exact security requirements will vary by CA and will require the CA to assess using their

framework. In most cases, the impacts across CA will be similar. Those impacts have been defined

below:

Confidentiality and Privacy

The payroll system will store, process, and transmit information that includes Personally Identifiable

Information (PII), and limited Classification Removedinformation that may be included in their leave, allowance, and

deduction requests. This information is considered IN-CONFIDENCE.

There are different ways this information’s confidentiality or privacy could be compromised: an

administrative or system user could accidently or intentionally share data exports, pay files, or reports;

the system could be mis-configured which would allow other system users to see data they shouldn’t

be allowed to see; a CA’s account could be inappropriately accessed leading to a data breach; the

Provider could have a security incident relating to their staff or the system which leads to a data

breach.

The impact of a confidentiality or privacy incident would vary, and it would depend on the amount of

information involved. If there was a small amount of information involved, the impact to the CA would

be

moderate. If there was a large of amount of information, the impact would be

significant. It could

result in:

•

Breach of laws, resulting in litigation and against the CA (and other agencies they provide

payroll services for);

•

Significant reputational and political damage;

•

Loss of confidence in the security of the software;

•

Significant ongoing operational and service delivery impact to the CA due to incident

investigation and process changes;

•

Significant financial impact due to the need for additional resources to assist with the

under the Official Information Act 1982

investigation and resolve any issues, and for any litigation fees; and

•

Minister and leadership briefing and updates.

Integrity

The payroll system is a key component of the overall payroll function within a CA. They rely on the

accuracy and integrity of the data in the system for payroll processes as well as supporting business

processing (such as financial reporting and HR).

Released

There are different ways the information’s integrity could be compromised, and most of those events

come down to access controls (including user access and data separation). The impact would also vary

and would depend on the amount of information that was modified. If there was a small amount of

information involved, the impact to the CA would be

moderate. If there was a large of amount of

information, the impact would be

significant. It could result in:

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 23 of 49

IN-CONFIDENCE

•

Breach of laws (such as Holidays Act due to incorrectly calculated pay)

•

Significant reputational and political damage;

•

Loss of confidence in the security of the software;

•

Significant ongoing operational and service delivery impact to the CA due to incident

investigation and process changes;

•

Moderate financial impact due to the need for additional resources to assist with the

investigation and resolve any issues, and for any litigation fees; and

•

Minister and leadership briefing and updates.

Availability

Payroll is a regularly occurring process and is heavily relied on by multiple stakeholders (as captured

above under Users and Stakeholders).

There are different ways the availability of the system or the information could be compromised. It

could be unavailable for a short period of time due to a breaking change or misconfiguration, or it

could be unavailable for an extended period due to a prolonged Distributed Denial of Service (DDoS),

Denial of Service (DoS), or security incident with the payroll software and Provider.

If the system were unavailable outside of the pay run part of the process (less busy period), the

impact would be

moderate. If the system were unavailable during the pay run part of the process,

the impact would be

significant. It could result in:

• The CA standing up an incident response or business continuity team to administer the pay

run without the payroll software;

• Increased operational and service delivery impacts due to manual processing and post-

incident system updates;

• Significant reputational and political damage;

• Financial impact due to additional resources needed to administer manual pay runs; or

• Leadership and Minister briefing and updates.

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 24 of 49

under the Official Information Act 1982

Released

IN-CONFIDENCE

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN-CONFIDENCE

Page 26 of 49

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

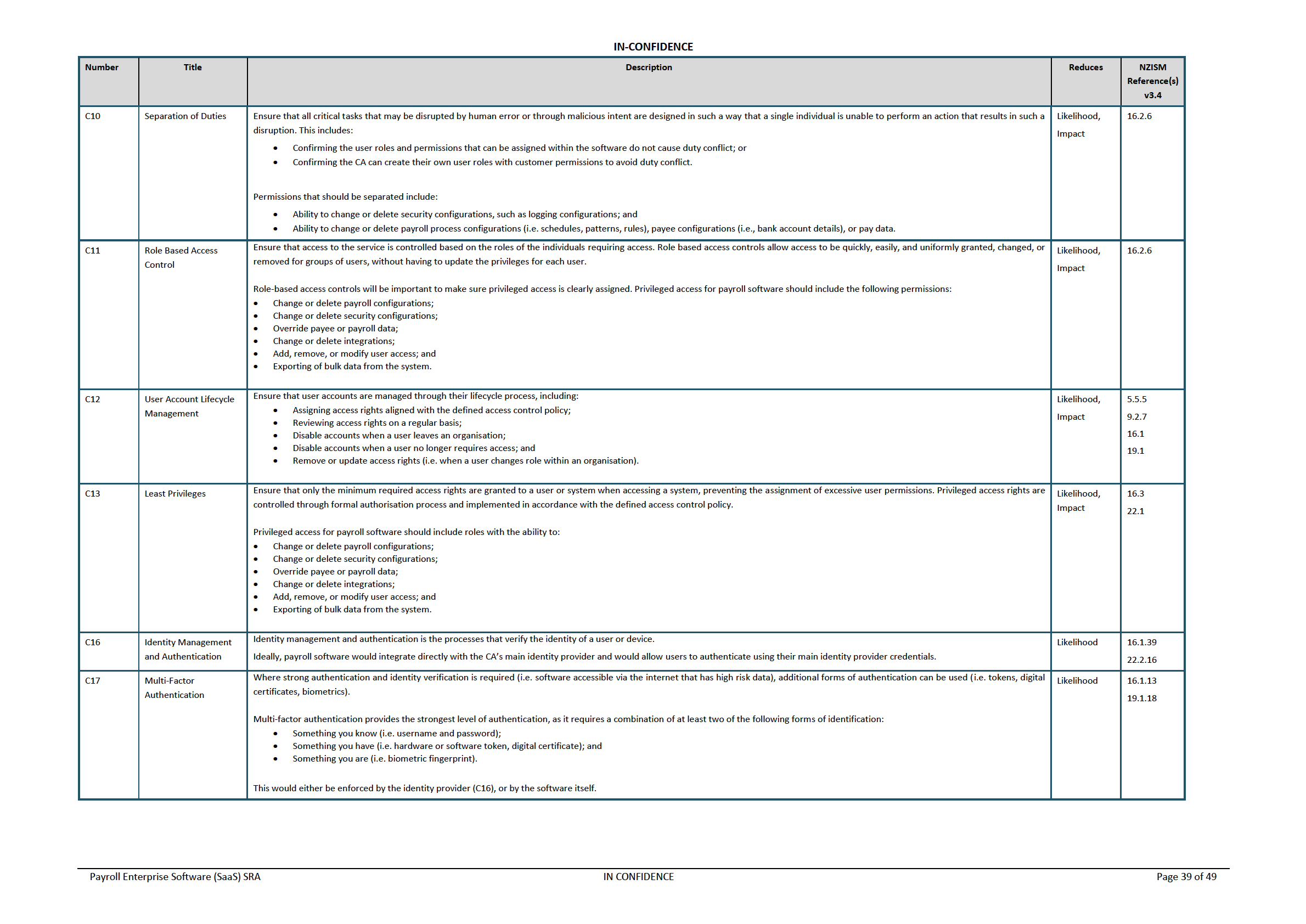

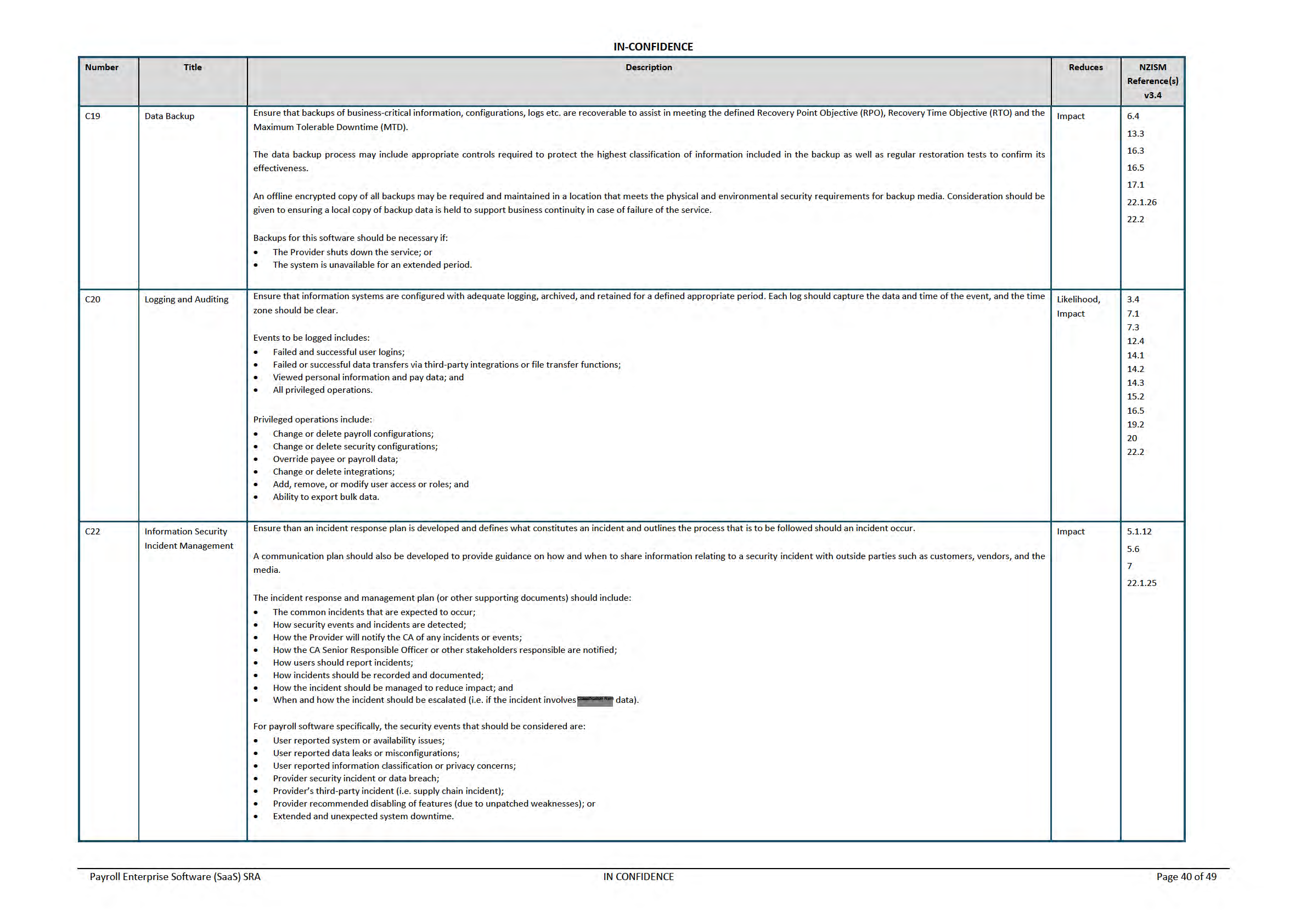

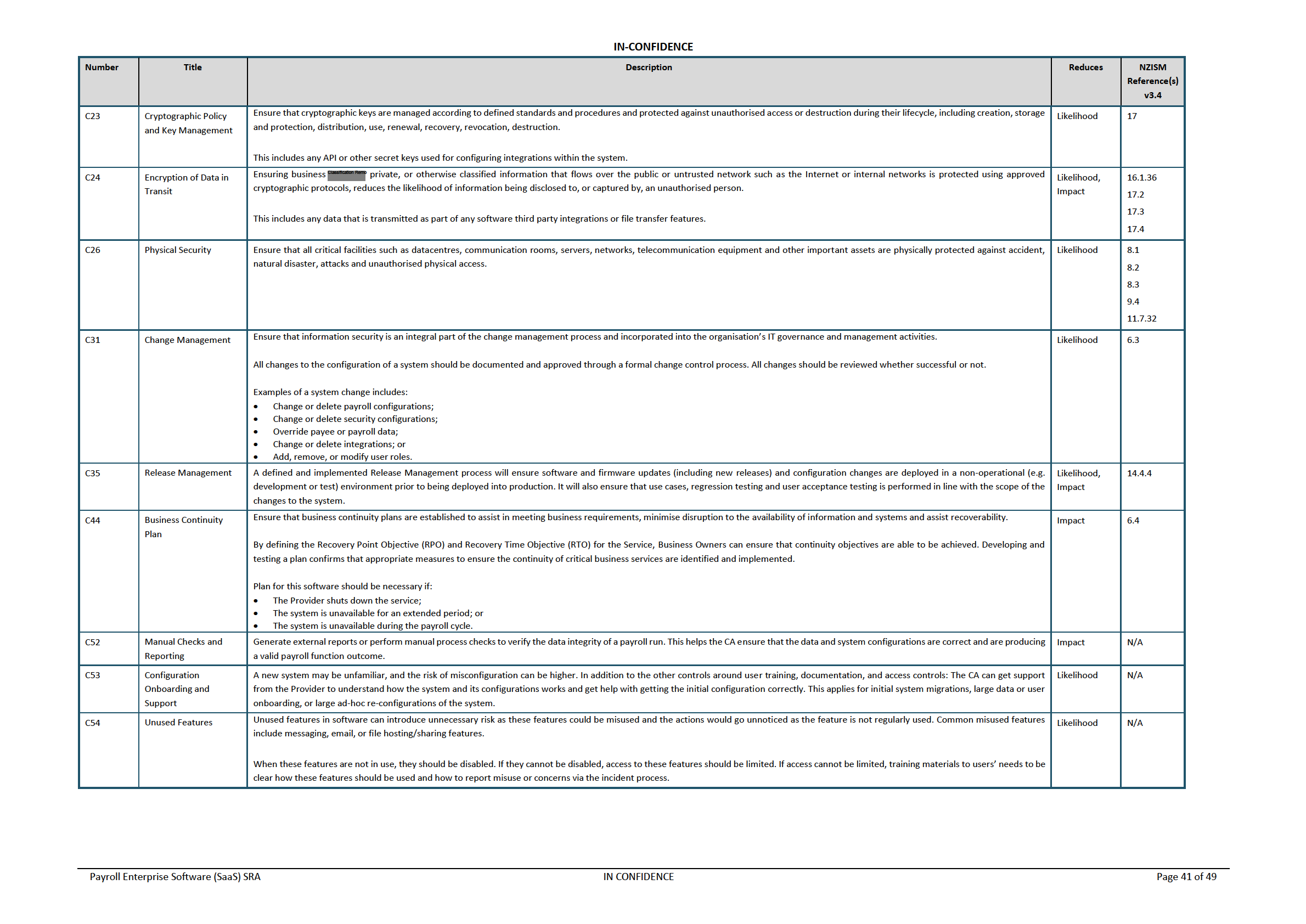

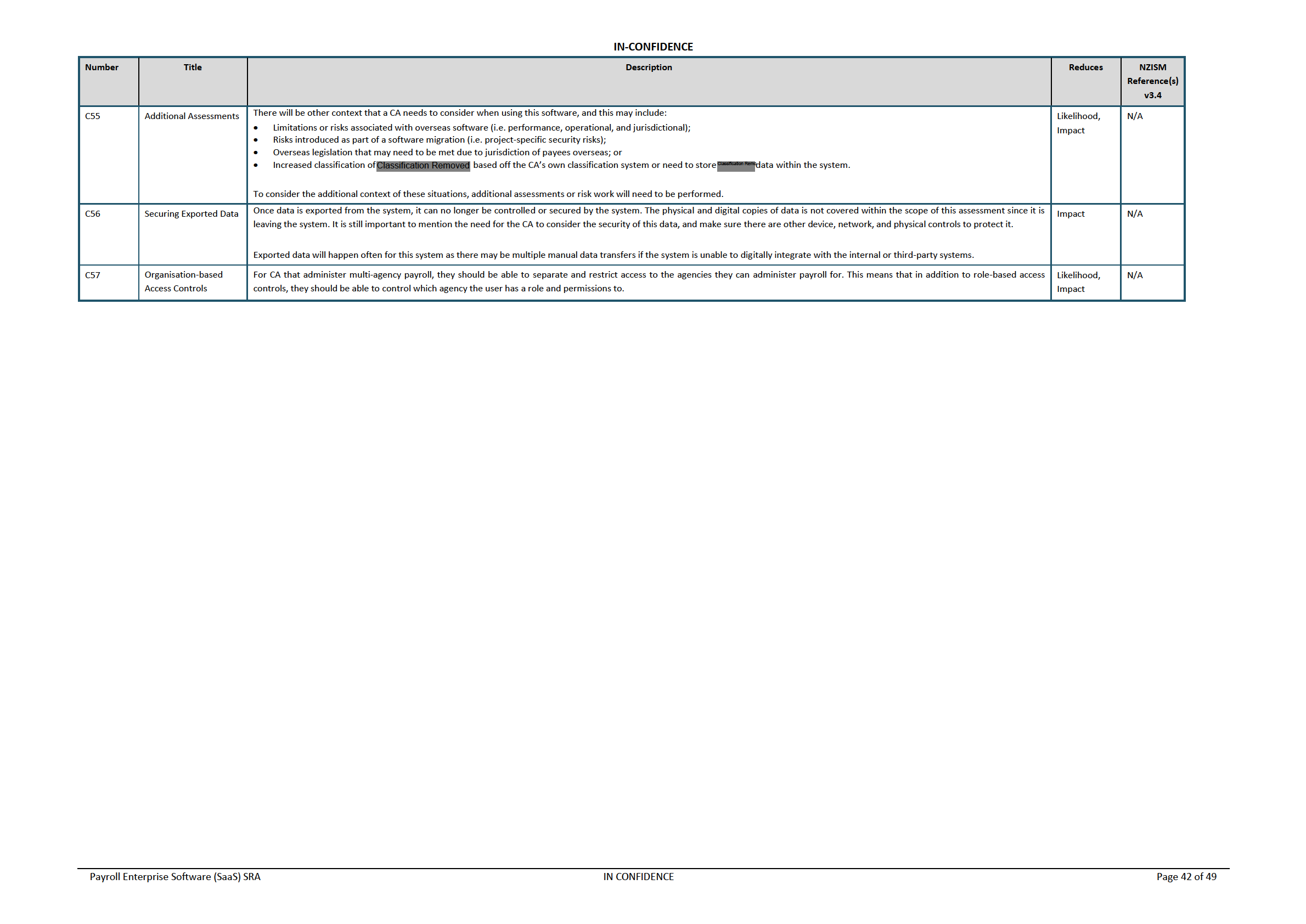

IN-CONFIDENCE

Table 6 – Controls to Risk Mapping

Table 6 shows which controls (that are recommended for both the Provider and CA) are related to

each risk from Table 4.

9(2)(k)

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN CONFIDENCE

Page 43 of 49

under the Official Information Act 1982

Released

IN-CONFIDENCE

Appendix B – Project Overview

Scope

Marketplace is an AoG initiative that enables New Zealand and international businesses offer their

products and services directly to New Zealand government agencies. Marketplace links business with

government, making the procurement process easier for all. For more details, please visit

https://marketplace.govt.nz

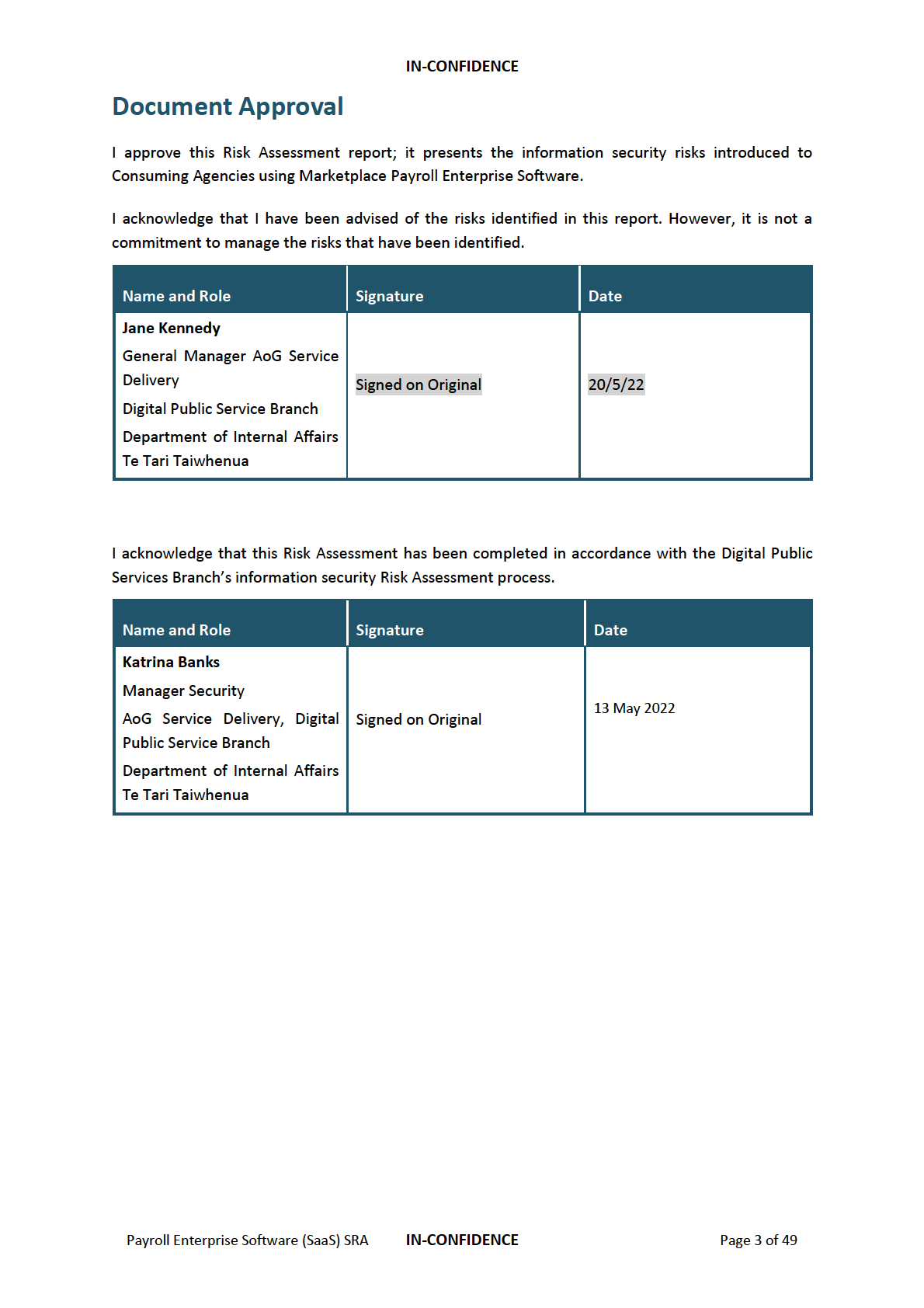

The Department of Internal Affairs (DIA), as Government Chief Digital Officer (GCDO), have performed

and completed this Risk Assessment report and Controls Validation Plan (CVP) to support the CAs who

plan to use this Marketplace-listed catalogue service.

The objective was to create a generic Risk Assessment and CVP that would cover most of the security

risks and controls that would apply regardless of Supplier, technology, or specific context. The intent

is that this would set a baseline for the CAs to use and then apply their own internal risk management

frameworks and accredit the service for their own use.

Marketplace has a list of catalogue items and suppliers that are categorised in Tier 1, Tier 2, and Tier

3. The Tier 3 a is lower entry bar for small products and suppliers where, Tier 1 is for enterprise grade

products and applier that requires highest assurance.

For the purposes of this work, it was assumed the Payroll Enterprise Software (provider-hosted)

product would have a minimum Tier 1 rating.

The minimum Tier rating is based on:

• Risk profile of the service;

• Use / delivery of cloud-based tools to deliver Managed Services;

• Reliance on Agency controls, particularly for people and process controls; and

• Claims made by the Supplier in the service description.

Tier 3: Baseline Index — Suppliers respond to security questions which can include the Cloud Risk

Assessment Tool (GCIO105). Assessment is based on self-assertions and not independent reviews.

SaaS go through a Confidence and Risk Index (CRI) rating by McAfee MVision.

under the Official Information Act 1982

Tier 2: Design and Control Analysis — Suppliers must provide independent security assurance

information that Consuming Agencies will be able to review. This can include ISO27001 or SOC2 Type

2 audit reports, and penetration testing reports. This information will be reviewed and confirmed

appropriate by the GCDO before Tier-2 endorsement.

Tier 1: Design and Control Effectiveness — To obtain this rating, suppliers must provide additional

information and receive Certification from the GCDO. Certification is based on Risk Assessment and

demonstration of controls effectiveness can be supported from an organisation having ISO 27001 or

Released

SOC2 Certification or going through an audit by an auditor from the SRS panel.

Payroll Enterprise Software (SaaS) SRA

IN CONFIDENCE

Page 45 of 49

IN-CONFIDENCE

Approach

The Risk Assessment followed the GCDO risk framework based on the AS/NZS ISO 31000:2009 and

ISO/IEC 27005:2011 risk management standards. The assessment was conducted as a series of

workshops and document reviews, including:

• Consumption of documentation provided by DIA;

• Identification of risks and controls associated with the use of provider-hosted Payroll

Enterprise Software;

• Development of a Risk Assessment report in draft;

• Review of risks and ratings through a risk validation workshop; and

• Issuance of a final Risk Assessment report.

under the Official Information Act 1982

Released

Payroll Enterprise Software (SaaS) SRA

IN CONFIDENCE

Page 46 of 49

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released

under the Official Information Act 1982

Released