HYDROGEN

Hyundai Motors New Zealand

HYDROGEN

Hyundai Motors New Zealand

Global and Local Momentum

HWR dual fuel and Hyzon’s first NZ FCEV fleet (30 x

Toyota hydrogen prototypes

Christchurch airport consortium

units combined in 2024)

and technical center NZ/AU

Hyundai Iveco JV Europe

Volvo heavy machinery & trucks

US - $7 Billion hydrogen hubs

Mercedes-Benz FCEV trucks

Australia - $2 Billion hydrogen head start program launched

Global and Local Momentum

HWR dual fuel and Hyzon’s first NZ FCEV fleet (30 x

Toyota hydrogen prototypes

Christchurch airport consortium

units combined in 2024)

and technical center NZ/AU

Hyundai Iveco JV Europe

Volvo heavy machinery & trucks

US - $7 Billion hydrogen hubs

Mercedes-Benz FCEV trucks

Australia - $2 Billion hydrogen head start program launched

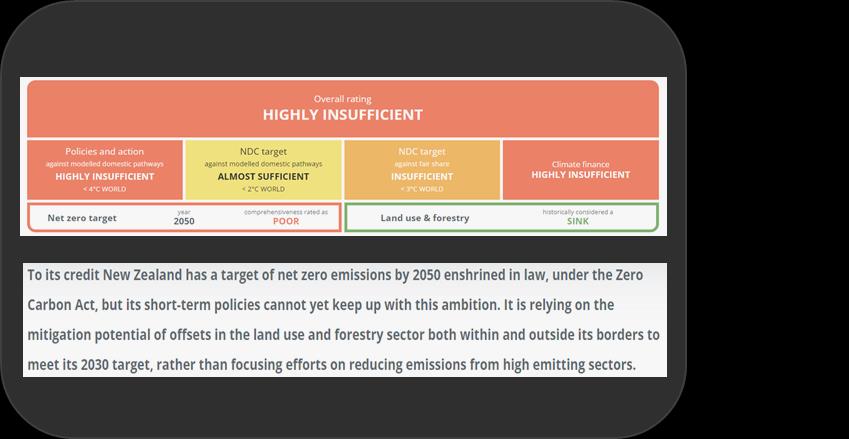

The Challenge

The Challenge

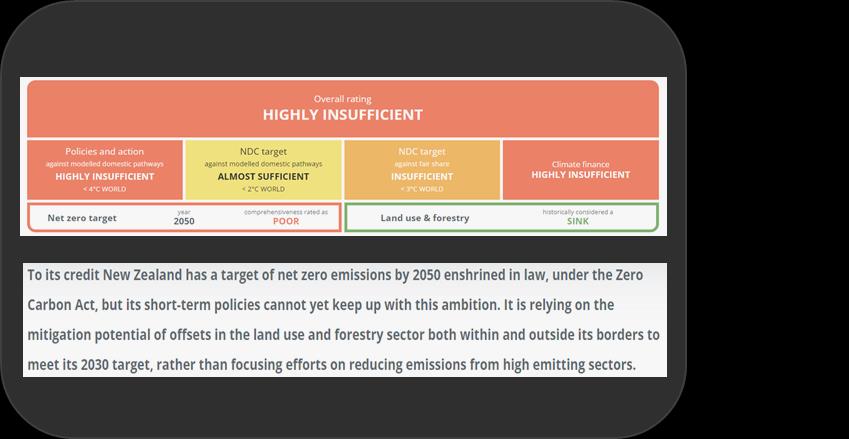

Reduce green house gas emissions from transport, inline with NZ targets:

•

25% of all transport emissions come from 4% of the fleet (heavy)

•

Currently 180,000 trucks registered, with approximately 80,000 of these being less than 10 years old doing the

majority of the work

•

The average heavy truck (40t+) 1.6 ~2.6 km / 1ltr of diesel, 100,000~200,000kms P/A (comparable Co2 to 100 ~ 200

light vehicles)

•

Prioritising heavy transport will make a bigger impact faster

Diverse fleet & applications need equally diverse solutions:

•

BEV: light and local where the grid supports

•

Hydrogen Electric: heavy and long where the fuel

network supports

•

Dual fuel excellent transition technology

Current incentives not effective:

•

Poor rate of ZE (heavy) implementation, little to no incentive to move

away from diesel

•

RUC exempt 2025 ( needs longer window or alternative)

•

Only carbon penalty 16cL at the pump (ETS), not effective loading on diesel

NZ POST Pilot

NZ POST Pilot

NZ POST Pilot (with ECCA LEVCF)

NZ POST Pilot (with ECCA LEVCF)

Hyundai Xcient FCEV

•

42t GCW truck and trailer, 32kg h2 capacity, 72 Kwh battery (equivalent to 600kwh)

•

Replaced a 520 Hp truck that used 1L diesel every 2.4 km

•

12 hours shifts, one break at 5.5 hours

•

Typical day is 360kms (actual range per tank is 420~460kms)

Key data

•

Mileage to date: 66,000kms

•

Co2 avoided: 73,700 kg

•

Average H2 consumption: 12.5 kms / 1 KG

•

Air purified: 42,000kg (Daily intake for 3800 New Zealanders)

•

Diesel avoided: 27,500 ltrs

•

Daily fuel: 27~30kg, will move to will move to 50~90kg with

•

Fast fill network delay choke point

double shift

Next steps

•

Double shift 20+ hours work , 15~20 minute refuel, 800~1200kms daily (night line haul/ day metro)

•

Fulfill balance of vehicles under LEVCF agreement

•

Scale up vehicles and operations. HMNZ have supply immediately available

NZ POST Pilot

NZ POST Pilot

Key learnings

•

Schedules are critical

•

Cruising speed 86~88 kms seems optimum, same schedules could be maintained even at the slightly lower speeds

•

A typical day - 5.5-hour shift - 30-minute break - 5.5-hour shift

•

Average speeds of 65~72kph and FCEV refuel requirements suits a 5.5hr break

•

Driving style impact is more significant than ICE

•

Fuel network critical for success (a-b-c-a) and regular offtake

•

Apart from the temporary fueling at HMNZ – no operational compromises were needed

•

Hydrogen electric fuel cell trucks will work well for NZ Post and majority of lighter heavy freight (40t) and logistics

•

Higher mileage regional and line haul ( 42t GCW)

•

High utilization 20+ hours metro/ highway

•

Higher energy metro – freezer, etc.

•

Where infrastructure supports H2 over BEV

NZ’s Hydrogen future in Transport

NZ’s Hydrogen future in Transport

New Zealand has a unique advantage:

•

Long and narrow major trucking routes which can be covered with few

Fuel Network Potential

stations

•

Hiringa network should be a

Road pressure limits, range, payload (productivity), fast fuel (utilization) are

world class network with

well matched to hydrogen

national coverage by 2028

•

High level of renewables

Hiringa network is world class:

•

Base network of stations cover key heavy transport routes

•

Onsite production

•

Ability to hub & spoke + scale

❖ HWR and Obayashi – complementing network

❖ BP and Z both poised to invest on proof of demand

Hydrogen network is a key enabler to low emission transition:

1.

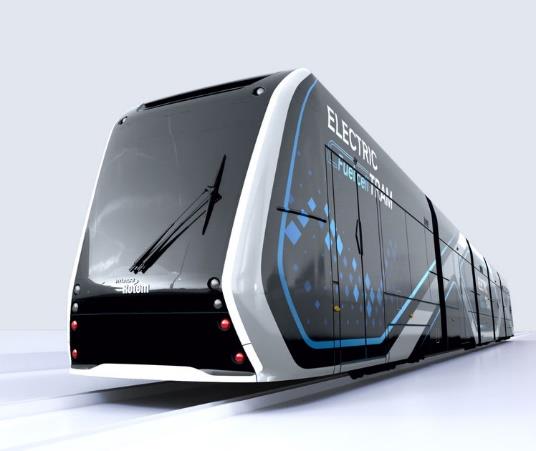

FCEV heavy trucks

2.

FCEV Bus

3.

Dual fuel

4.

Strategic station high capacity BEV recharge with FC generator 0.5-1.0 MW

Specialist equipment

5.

BEV equipment; FC generator (construction ~ forestry, etc.)

Policy

Policy

Government commitment to accelerate with a longer term view (10 years):

•

Stations are big investments which need offtake and competition

•

Vehicle and equipment suppliers need to make long term planning and volume commitments

•

Operators need certainty of financials to align with commercial contracts

•

Finalise Hydrogen road map

Effective incentive for operators to transition:

•

Hydrogen consumption and ZE seed funding was a good start, but not enough

•

No real disincentive for diesel (carbon and pollution)

ETS potentially holds a solution:

•

At $60 a tonne / 16c ets charge on fuel at pump

•

8c per liter returned to transport could support a 10% transition of heavy vehicles per annum

Summary

Summary

•

NZ has become a priority market for Hyundai BEV and FCEV Heavy vehicle products. As a result of first mover program,

Hyundai Australia will join and aggregate volumes for future product and price

•

We need to maximise results from the Govt supported pilots; Hiringa / Halcyon / HWR / GVB / AT / Toyota & Hyundai

•

New Government commitment to accelerate programs that are in a 10~15 year window – big assets need certainty

•

Hydrogen is a critical enabler for BEV, Dual fuel and FCEV

THANK YOU