Document 1

Recommended Action

Document 1

Recommended Action

We recommend that you:

(a)

Note that the legislative definition of the market interest rate for calculating fringe benefit

tax on employment related loans provided by banks and other money lenders is outdated and does

not reflect the true market rate.

Noted

Noted

(b)

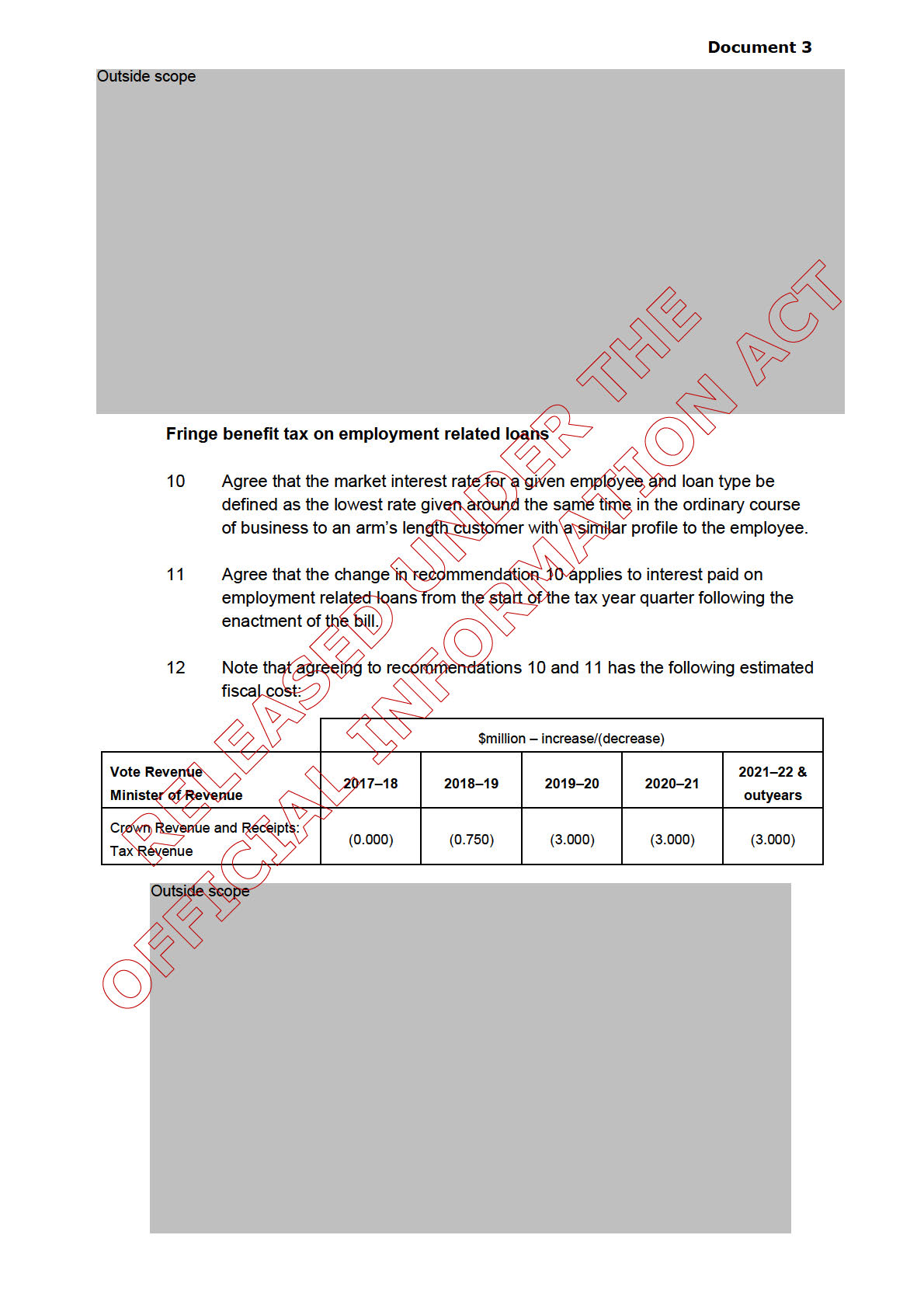

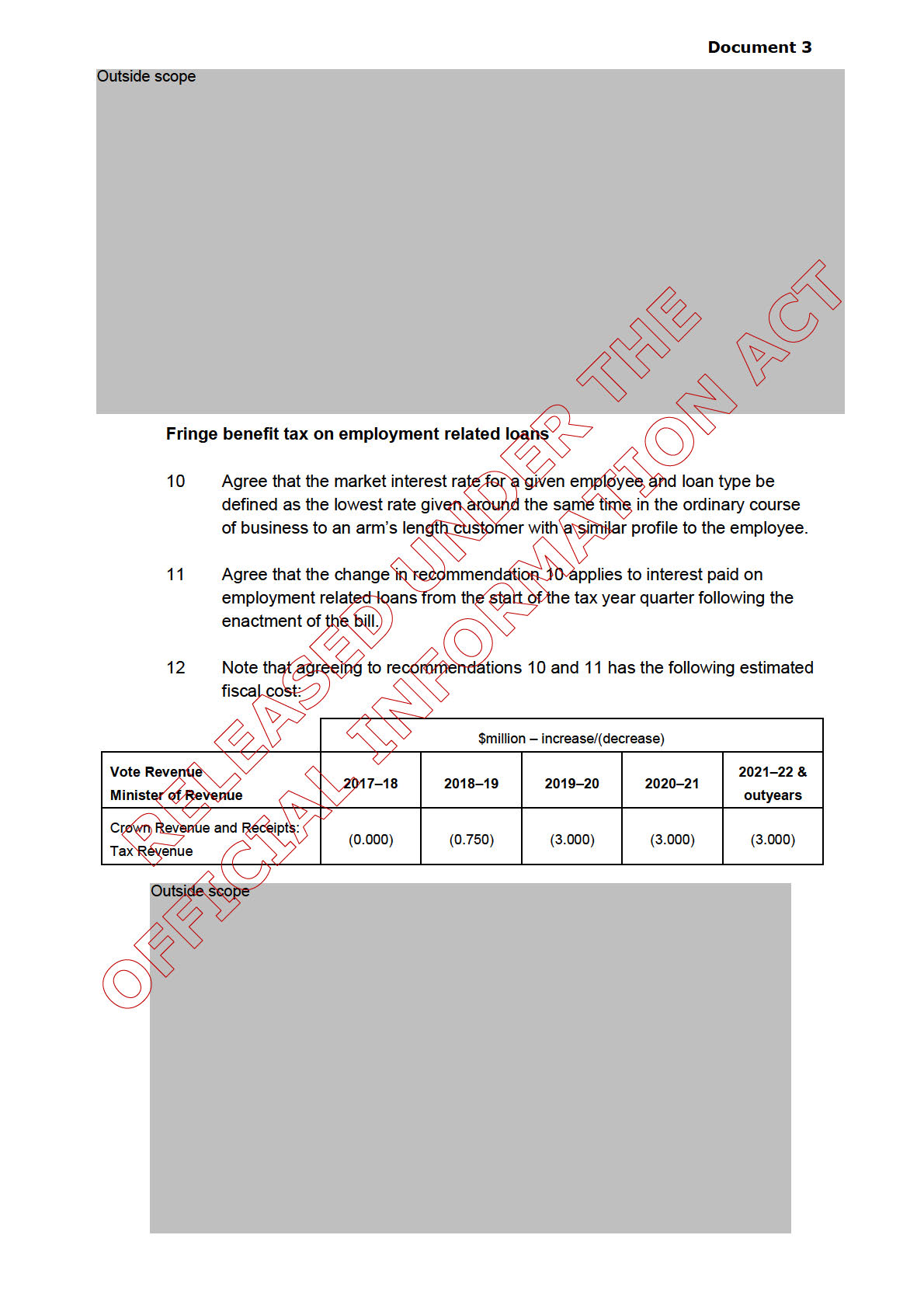

Agree that the market interest rate for a given employee and loan type should be defined as

the low

est rate given around the same time in the ordinary course of business to an arm’s length

customer with a similar profile to the employee.

Agreed/Not Agreed

Agreed/Not Agreed

(c)

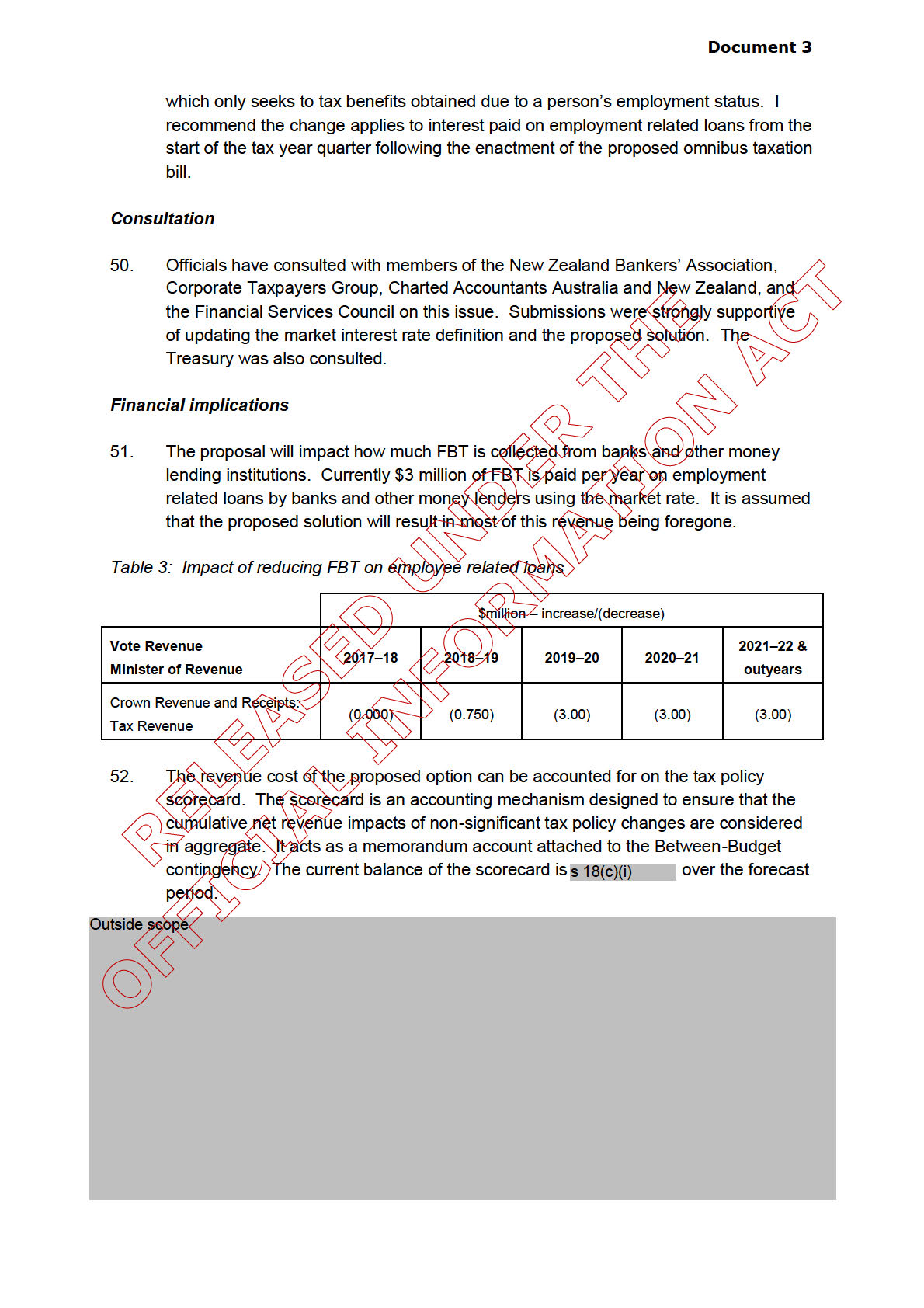

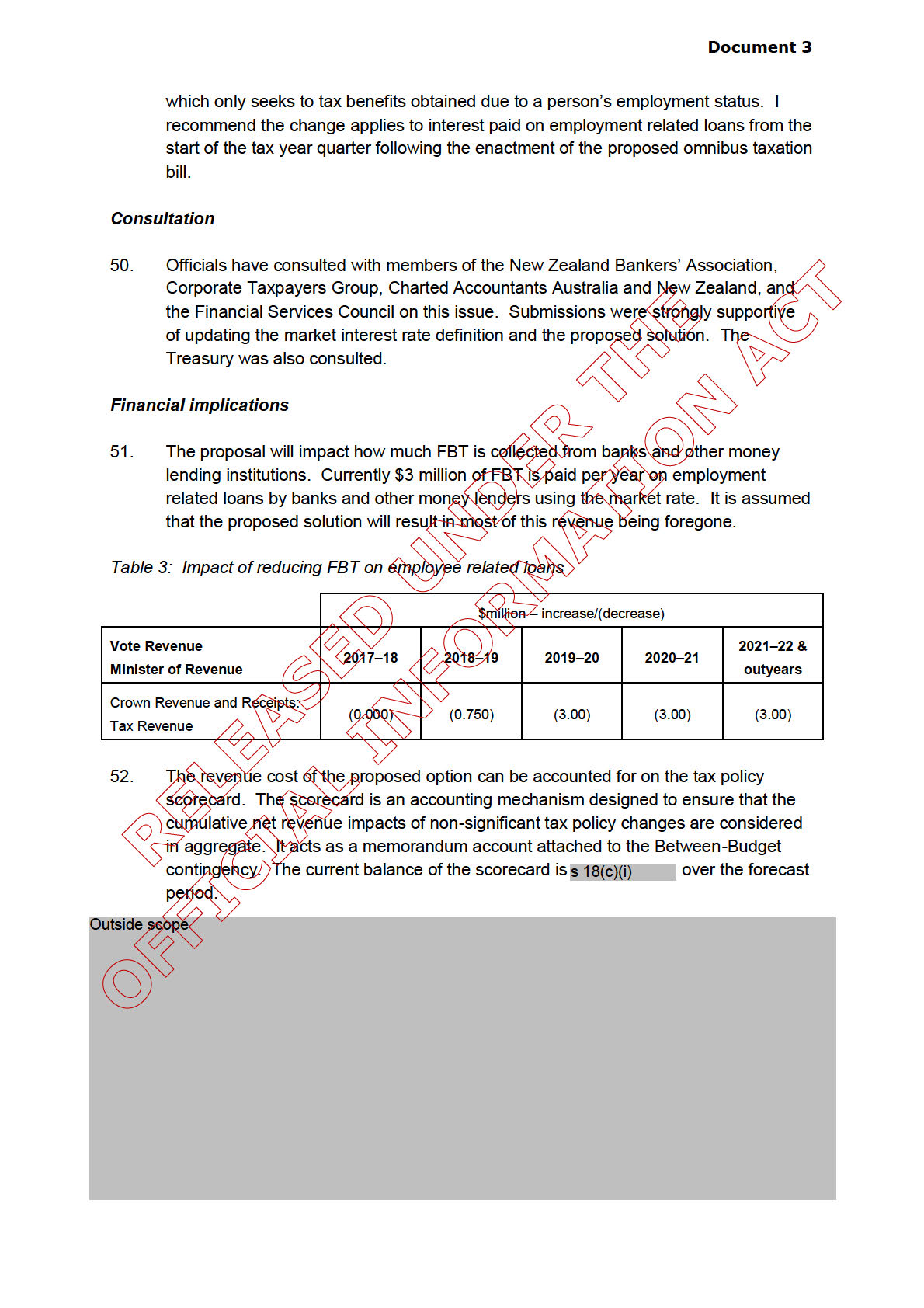

Note that the proposed option in (b) has an estimated revenue cost of $3 million per year,

which can be accounted for on the tax policy scorecard.

Noted

Noted

EITHER

(d)

If Ministers wish to include the proposed option in the first omnibus taxation bill of 2018

they should

authorise for lodgement the finalised Cabinet paper with the Cabinet Office by 29

March for discussion at the 4 April Cabinet Economic Development Committee.

Authorised for lodgement/Not authorised

Authorised for lodgement/Not authorised

OR

(e)

Agree to consider this issue as part of a wider discussion on the tax policy work

programme.

Agreed/Not Agreed

Agreed/Not Agreed

Matt Cowan

Chris Gillion

Team Leader

Policy Manager

Tax Strategy

Policy and Strategy

The Treasury

Inland Revenue

Hon Grant Robertson

Hon Stuart Nash

Minister of Finance

Minister of Revenue

/ /2018

/ /2018

Page 2

Document 3

Document 3

market rates as the market rate is based on the rates a given lender offers to its

customers.

43.

The market interest rate definition was based on the practices banks and other

lenders used at the time the rules were developed. Money lenders would advertise

rates and in general customers would receive these rates if they met the necessary

conditions for a loan. However, some lenders would also offer discounts to certain

groups of customers. For example a bank may have offered employees of a local

respected employer a discount of 0.3 percentage points below the advertised rates.

The market interest rate rules would allow either the advertised rates or the group

discount rates to be offered to employees as the market interest rate without banks

and other similar lenders incurring FBT.

44.

However, it is now common practice for banks and other similar lenders to individually

negotiate loan rates with customers. Individually negotiated loans cannot be used for

determining the market rate as the rates received by customers through this process

have not been offered to a group.

45.

As such, the true market rate, being the interest rate an arm’s length customer

receives, is likely lower than the market rate calculated under the current legislation.

This can result in the over-taxation of employment related loans. Furthermore,

because of this over-taxation many employees of banks and other money lenders

may be able to receive better loan rates from competitors than from their employer.

46.

The rules around the market interest rate were introduced to rectify the problem of

FBT arising even when the employer is charging an employee the true market rate.

As such, changing the definition of the legal market rate to more appropriately reflect

the true market rate would be consistent with the original policy intent.

Comment

47.

I recommend the market rate for a given employee and loan type should be defined

as the lowest rate received around the same time by an arm’s length customer with a

similar profile to the employee. Employers would not, however, be permitted to

create an artificially low market rate by providing a single customer with an

exceptionally discounted loan rate. Instead, the market rate would need to be based

on loans offered in the ordinary course of business.

48.

For example, Carlos, an employee of XYZ Bank, wants to receive a fixed rate home

loan from his employer. The lowest rate XYZ bank has offered on this type of loan to

arm’s length customers who meet similar lending criteria as Carlos is 4%. As such,

the market rate for Carlos will be 4% and FBT will only be payable if Carlos receives

a rate below this.

49.

This proposed solution will prevent the over-taxation of employment related loans that

occurs under the status quo. Instead, loans made to employees will only be subject

to FBT if a genuine discount compared to the rates received by arm’s length

customers has been provided. This is consistent with the broader FBT framework