Sec 9(2)(a)

From:

Compliance

Sent:

Tuesday, 22 August 2017 8:19 AM

To:

Sec 9(2)(a)

Subject:

New Reporting Standards Compliance

Dear s9(2

)(a)

Unfortunately your financial statements do not adhere to our new financial reporting standards. Your charity now

needs to submit a Performance Report instead of any other type of financial information previously suppled (e.g.

financial statements, annual accounts or bank statements) with the yearly Annual Return to Charities Services.

The Performance Report includes financial and non‐financial information about your charity. You’ll need to collect

and prepare the information for this report and compile it so that it meets the requirements of the new reporting

standards.

We require that you refurbish your financial statements in alignment with our new reporting standards. If you have

any questions regarding this, you can contact me on my details listed below.

Performance Report Format

1. Entity Information

Who are we? Why do we exist?

2. Statement of Service Performance

What did we do? When did we do it?

3. Statements of Receipts and Payments

What did it cost? How was it funded?

4. Statement of Resources and Commitments

What do we own? What do we owe?

5. Notes to the Performance Report

What other information supports our Performance Report?

A template has been created to assist charities with the Performance Report. It’s an optional template, but we

strongly recommend you use this template to create your report, at least the first time you report under the new

standards. It will help you understand what is being asked of your charity.

If you require further information please visit our website: https://www.charities.govt.nz/new‐reporting‐standards/

Regards,

s9(2)(a)

| Assistant Investigator

Charities Services Ngā Rātonga Kaupapa Atawhai

s9(2)(a)

| Help Desk: 0508 242 748

120 Victoria Street, Wellington | PO Box 30112, Lower Hutt 5040, New Zealand

www.charities.govt.nz | www.dia.govt.nz |Follow us on Facebook

Want to know more about the new reporting standards? See the new Tier 3 and Tier 4 guides on our website.

1

Reminder

Click here to view online payment instructions.

Not ready to file and pay for your Annual Return online

Moving to greater use of the internet will be a change for some charities, so there are some other options available if you

are not yet ready to file and pay for your Annual Return online:

File your Annual Return online and pay by cheque. The return will be processed on receipt of payment and matched to

your return.

File a paper-based Annual Return and pay by cheque. The return will be processed on receipt of payment and can be

matched to your return.

File a paper-based Annual Return and pay online.

A copy of the Annual Return Form is available from our website www.charities.govt.nz/resources/ or alternatively you may

request a paper form to be posted to you by phoning us on 0508 242 748 or emailing [Charities Registration Board request email].

We will be introducing a new online annual return form which will pre-populate some of your charity's information. We

encourage you to use this form for your next annual return.

If you have any questions please email us at [Charities Registration Board request email] or call us on FREE PHONE 0508 242 748

Yours sincerely

Charities Services

Department of Internal Affairs

Te Tari Taiwhenua

20171121 - Annual Return Reminder Sent html[11/01/2019 11:01:16 AM]

Reminder

Charities Services

Department of Internal Affairs

Te Tari Taiwhenua

Annual Returns under the Charities Act -

http://www.charities.govt.nz/im-a-registered-charity/annual-returns/

Annual Returns Checklist

http://www.charities.govt.nz/im-a-registered-charity/annual-returns/how-to-complete-an-annual-return/

Annual Return - help notes for completing the financial information

http://www.charities.govt.nz/im-a-registered-charity/annual-returns/how-to-complete-an-annual-return/annual-return-

financial-information-help-notes/

20180123 - Annual Return Overdue Sent html[11/01/2019 11:01:45 AM]

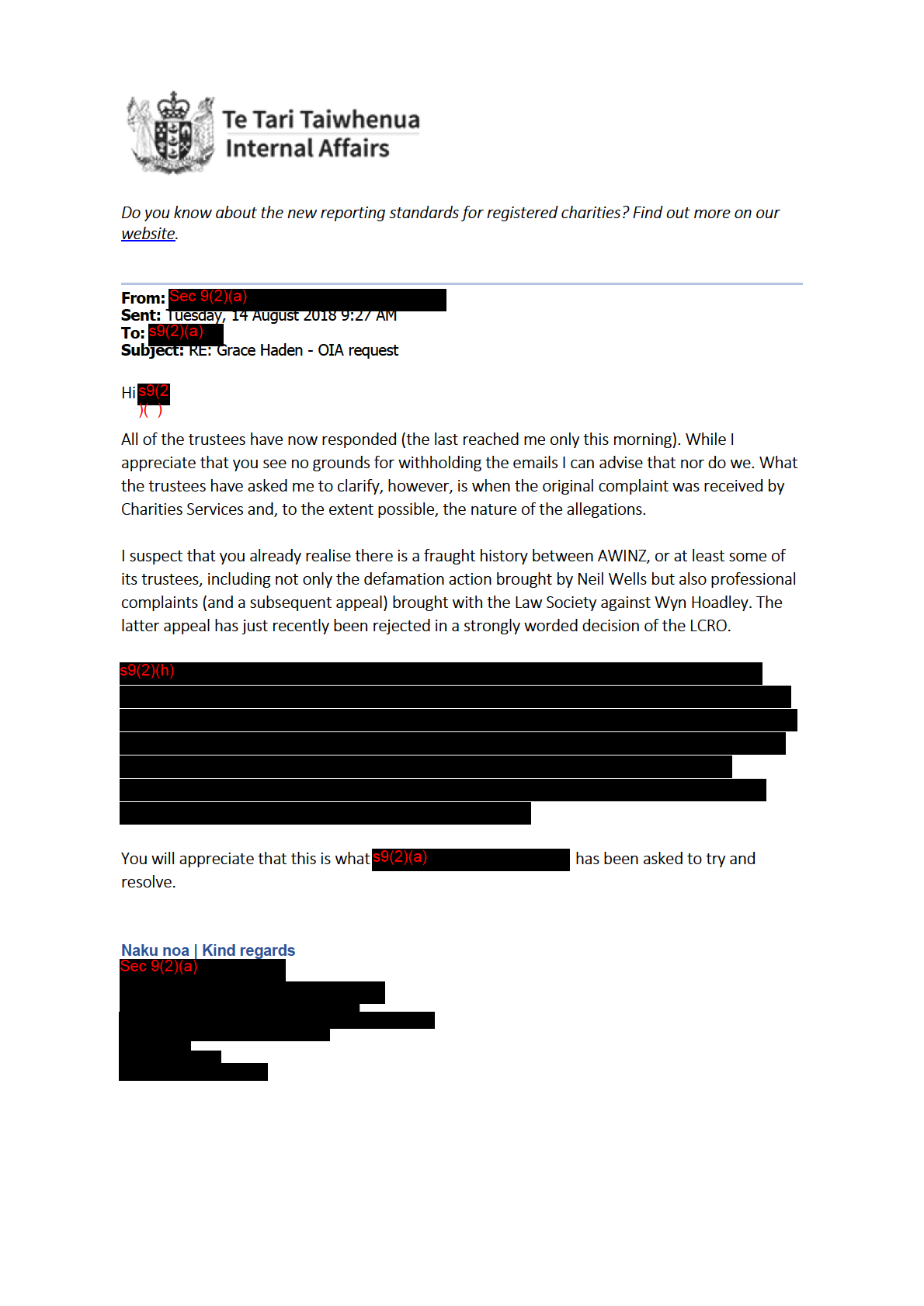

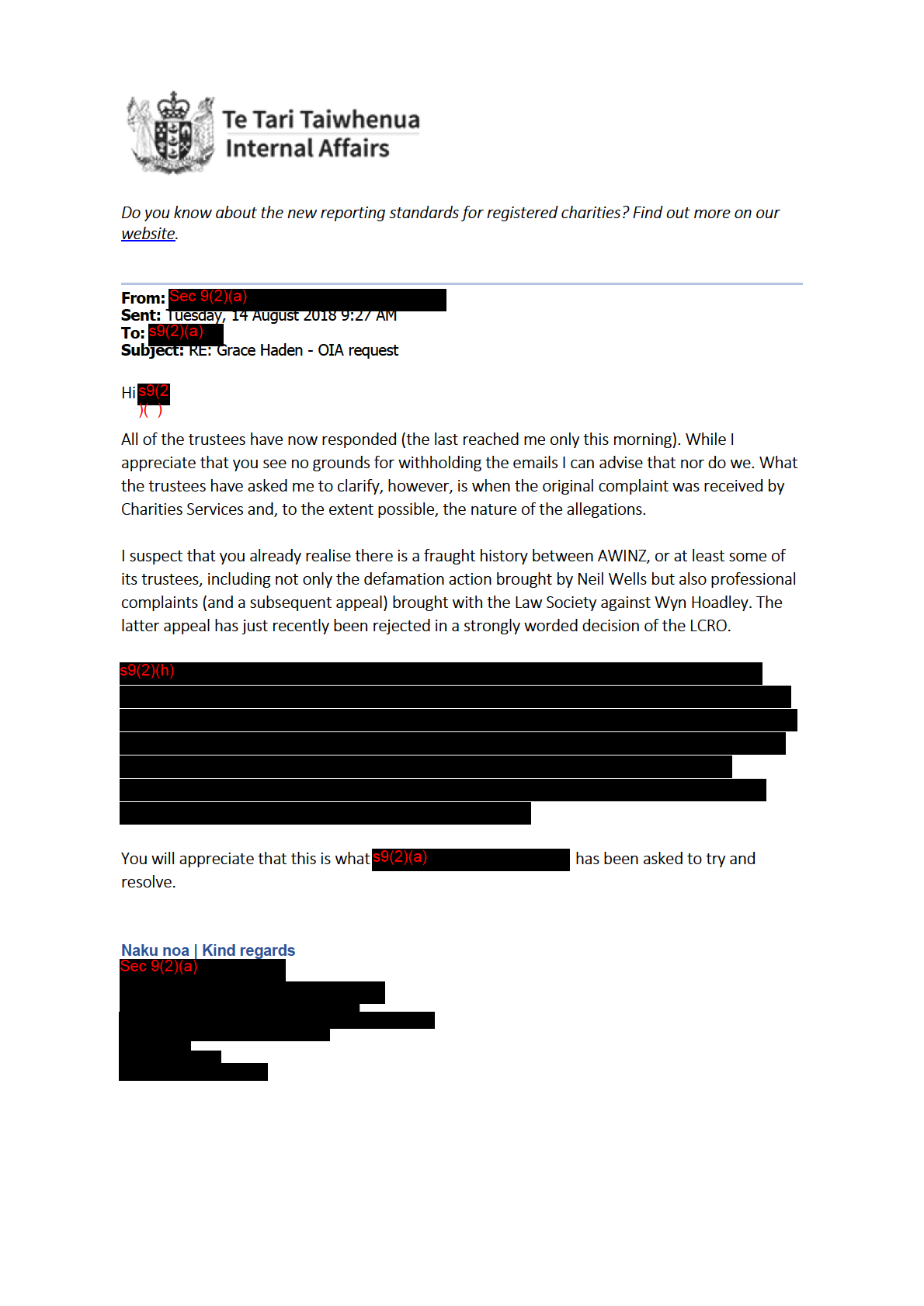

From:

Sec 9(2)(a)

To:

Sec 9(2)

Subject:

RE: Grace Haden - OIA request

Date:

Tuesday, 14 August 2018 4:31:04 PM

Attachments:

image002.png

Sec 9(2)(a)

Thank you for your email the contents of which I note.

Firstly I can confirm the redactions have been made as discussed.

Complaint history

Grace first filed a complaint with Charities Services in relation to AWINZ in 2012, then again in

2014 and 2017. The nature of her complaints have remained consistent; that charitable fund

were being used for private pecuniary gain, specifically, that they were funding the legal

proceedings which were outside the scope of the Trust deed.

All of Grace’s complaints have been assessed on information provided, and have not met the

threshold to proceed to an investigation.

As a part of our assessment process, Charites Services have at different times gathered

information from the Trust so that we may make an informed determination on the outcome of

the complaint.

Charities Services have advised Grace a number of times that we are satisfied that AWINZ was

not engaging in serious wrongdoing as per section 4 of the Charities Act 2005 and we were also

satisfied that AWINZ remained qualified to be a registered charity.

The latest complaint from Grace was received in 2018 following the death of Neil Wells. Grace

stated that AWINZ had not updated their officer’s details to remove Ms Wells. Charities Services

has then contacted AWINZ to remind them of their obligations as per the Section 40 of the

Charities Act 2005. This complaint was closed 31 May 2018 and is not included in the scope of

the OIA.

I can confirm that there are no current complaints or investigations open in relation to AWINZ.

If you have any questions, please don’t hesitate to get in touch.

Nga mihi

s9(2)(a)

| Assistant Investigator

Nga Ratonga Kaupapa Atawhai | Charities Services

Direct Dial: Sec 9(2)(a)

| Help Desk: 0508 242 748

45 Pipitea Street, Wellington, 6011| PO Box 30112, Lower Hutt 5040, New Zealand |

www.charities.govt.nz

Charities Services is part of the Department of Internal Affairs

Sec 9(2)(a)

This email is confidential. If this email is not intended for you, you must not use, disclose, distribute, retransmit or copy

this communication or any of its contents.

FROM 1 JULY 2018 WE MUST REQUEST PERSONAL INFORMATION FROM OUR CLIENTS.

This is because the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT) now

applies to us (and most other lawyers). For more information, click the following

link: https://www.lawsociety.org.nz/

data/assets/pdf file/0016/117520/Why-we-need-to-ask-you-for-

information.pdf

From: s9(2)(a)

@dia.govt.nz>

Sent: Friday, 10 August, 2018 3:38 PM

To: Sec 9(2)(a)

Cc: Sec 9(2)(a)

Subject: Grace Haden - OIA request

Hi Sec

9(2)

Thanks for your call just now.

As discussed, please find attached the bundle of email correspondence between Charities

Services and AWINZ in relation to Grace Haden’s 2017 complaint (unredacted).

As I have said, Charities Services is happy for the contact details and the information about

AWINZ’s legal counsel to be redacted under Section 9 (a), but we are of the view there is no

reasonable grounds for the substance of these emails to be withheld.

I look forward to hearing from you in due course.

Kind regards,

Sec 9(2)(a)