link to page 4 link to page 4 link to page 4 link to page 4 link to page 5 link to page 5 link to page 6 link to page 7 link to page 7 link to page 7 link to page 7 link to page 8 link to page 9 link to page 9 link to page 9 link to page 9 link to page 9 link to page 9 link to page 9 link to page 9 link to page 9 link to page 10 link to page 10 link to page 10 link to page 11 link to page 11 link to page 11 link to page 11 link to page 11 link to page 12 link to page 12 link to page 13 link to page 13 link to page 13 link to page 13 link to page 14 link to page 14 link to page 14 link to page 14 link to page 14 link to page 15

Foreword

Purpose

The Elected Members’ Handbook complements the consultation document and supporting information. It is

intended to support elected members in their engagement with their community throughout the Annual Budget

2022/2023 consultation period.

Table of Contents

SECTION 1 – COMMUNICATIONS AND KEY ISSUES ................................................................ 1

1.1 Key messages and issues ............................................................................................................................... 1

Overall .................................................................................................................................................................................................... 1

Climate action ...................................................................................................................................................................................... 1

Budget pressures ................................................................................................................................................................................ 2

Service prioritisation .......................................................................................................................................................................... 2

Waste management ........................................................................................................................................................................... 3

Rates Changes ..................................................................................................................................................................................... 4

Other matters for feedback.............................................................................................................................................................. 4

Tūpuna Maunga Authority .......................................................................................................................................................... 4

Changes to fees and charges ...................................................................................................................................................... 4

Increasing local board decision-making over local community services: ....................................................................... 5

1.2

Frequently asked questions ..................................................................................................................... 6

Overall ................................................................................................................................................................................................... 6

What is the Annual Budget 2022/2023? .................................................................................................................................. 6

What is included in the Annual Budget 2022/2023? ............................................................................................................ 6

Where can I go for more information? ...................................................................................................................................... 6

Climate action ..................................................................................................................................................................................... 6

Why is climate action a focus this year? .................................................................................................................................. 6

Why is the council proposing using a Climate Action Targeted Rate rather than general rates? ............................ 6

Why is the council proposing a Climate Action Targeted Rate (CATR) now? ............................................................... 6

What is the impact of the CATR on emissions? ..................................................................................................................... 7

How does this budget reduce regional emissions? ............................................................................................................... 7

How will the rate benefit my community? .............................................................................................................................. 7

Budget pressures ................................................................................................................................................................................ 8

How is the budget planning for and responding to the impacts of COVID-19? ............................................................. 8

How is the council responding to rising inflation and interest rates?.............................................................................. 8

Do rising costs mean the council will have to reduce spending on big projects? ........................................................ 8

How is the council funded? ......................................................................................................................................................... 8

Why doesn’t the council cut its own costs? ............................................................................................................................ 9

Why are Auckland's staff costs rising? ..................................................................................................................................... 9

How do we know council is delivering the value for money? ........................................................................................... 10

Why can’t the council just borrow more so ratepayers do not have to pay more? .................................................... 10

Why only increase borrowing in the short term? ................................................................................................................. 10

Does accepting Better Off funding mean accepting 3-waters reform? ......................................................................... 10

Waste management ...........................................................................................................................................................................11

Why is the council proposing to move all of Auckland to rates funded rubbish collections? ...................................11

Was pay-as-you-throw (PAYT) not effective? ........................................................................................................................11

What are the benefits of the proposed region-wide rates funded service?....................................................................11

How is the proposed rates-funded services fairer for most households? ......................................................................11

What would the rate be if the PAYT/bin tag system is scrapped, and how was this figure determined? ............. 12

link to page 15 link to page 15 link to page 16 link to page 16 link to page 16 link to page 16 link to page 17 link to page 17 link to page 17 link to page 17 link to page 17 link to page 18 link to page 18 link to page 18 link to page 18 link to page 18 link to page 20 link to page 20 link to page 20 link to page 20 link to page 21 link to page 21 link to page 22 link to page 22 link to page 22 link to page 22 link to page 23 link to page 24 link to page 24 link to page 24 link to page 24 link to page 24 link to page 24 link to page 24 link to page 25 link to page 26 link to page 26 link to page 26 link to page 27 link to page 27 link to page 27 link to page 27 link to page 28

How much could households expect to pay under a regional rates-funded service if they produce less or more

rubbish than a 'typical' household? ......................................................................................................................................... 12

When are these changes coming into effect? ....................................................................................................................... 13

Rates Changes .................................................................................................................................................................................... 13

Why have properties been revalued? ...................................................................................................................................... 13

How will revaluations affect my rates? ................................................................................................................................... 13

Does the delay in revaluation 2021 affect the council's ability to set rates in the budget? ...................................... 14

Are you confident in the revaluation process? Are these values accurate? ................................................................. 14

What if I want to object to my property valuation? ............................................................................................................. 14

What is the change to general rates for 2022/2023? .......................................................................................................... 14

What proportion of council’s budget is funded by rates? .................................................................................................. 14

Is there any help to manage a big rise in my rates bill? ...................................................................................................... 15

What progress is being made against goals set out through the Water Quality Targeted Rate (WQTR) and the

Natural Environment Targeted Rate (NETR)? ...................................................................................................................... 15

When will the new rates rise come into effect? .................................................................................................................... 15

What is being achieved with the regional fuel tax?.............................................................................................................. 15

1.3

Social media .............................................................................................................................................. 17

How to use social media to promote the consultation............................................................................................................ 17

Follow the council social media channels .................................................................................................................................. 17

Sharing content .................................................................................................................................................................................. 17

Content and resources ..................................................................................................................................................................... 18

More tips and support for using social media ............................................................................................................................ 18

SECTION 2 - LOCAL INFORMATION ...................................................................................... 19

Local board planning and funding FAQs ............................................................................................................. 19

How is funding allocated between local boards? ...................................................................................................................... 19

How do I find out exactly how much has been spent in my local board area? ................................................................. 19

Local board achievements and priorities .......................................................................................................... 20

SECTION 3 - CONSULTATION PROCESS ................................................................................ 21

Consultation information .................................................................................................................................... 21

Online.................................................................................................................................................................................................... 21

Libraries and service centres ......................................................................................................................................................... 21

Accessibility ........................................................................................................................................................................................ 21

Request a hardcopy .......................................................................................................................................................................... 21

Ways to have your say ...................................................................................................................................................................... 21

Engagement activities ..................................................................................................................................................................... 22

Have Your Say event schedule ............................................................................................................................ 23

Events under different COVID-19 alert levels............................................................................................................................ 23

Briefings .............................................................................................................................................................................................. 23

Your role as an elected member at a Have Your Say event .................................................................................................. 24

Calendar of events ........................................................................................................................................................................... 24

Other consultations ............................................................................................................................................ 24

Rating of Whenua Māori ................................................................................................................................................................. 24

Annual Budget 2022/2023 process timeline ...................................................................................................... 25

Section 1: Communications and key issues

1.1 Key messages and issues

Section 1 – Communications and key issues

1.1 Key messages and issues

Overall

• This consultation looks at where we are proposing changes for Annual Budget 2022/2023, compared with

what was included in the Recovery Budget (10-year Budget 2021-2031).

• Our document supports the decision-making processes of Auckland Council in relation to our annual

budget, a change to our Waste Management and Minimisation Plan, the Tūpuna Maunga Authority

Operational Plan, updates to policies including our Revenue and Financing Policy and how we allocate

decision-making responsibilities over local community services.

• Updates to the financial policies are being consulted on separately to, but at the same time as, the annual

budget).

• The budget consultation is open from 11am Monday 28 February to 5pm Monday 28 March 2022.

Climate action

• Aucklanders have told us they want to see more and faster action to address the climate emergency.

• Last year was New Zealand’s hottest since records began a century ago, and seven of the last nine years

have been among the hottest on record, too. We must act, and act now, to protect our planet for future

generations.

• Auckland Council unanimously declared a Climate Emergency in 2019 and has unanimously adopted a

Climate Plan, but our progress towards cutting emissions has not been sufficient to meet our goal.

• We have made a start through the Emergency Budget and the Recovery Budget but we need to do more,

faster.

• This budget responds to the threat of climate change with the biggest programme of climate action in

Auckland’s history.

Climate action in the consultation document

Page in CD

Page in SI

The issue

In June 2019, Auckland Council unanimously declared a Climate Emergency and

we have developed Te Tāruke-a-Tāwhiri: Auckland Climate Plan to achieve our

climate goals. We have a short timeframe left to halve our emissions by 2030 with

transport emissions being the biggest contributor to Auckland's emissions. We

p.12

p.1-4, p.18

need to provide more frequent public transport services with low-emission buses

and ferries and better walking and cycling infrastructure. The package’s focus on

transport has been chosen as this is the area in which the council can have the

most impact on regional emissions while generating wide regional benefits and

addressing existing inequity in the provision of services.

What we are proposing for the Climate Action Package

p.13-14

p.4-15, p.19-

Investment of over $1 bil ion in buses, ferries, walking, cycling and our urban forest

22

canopy.

Information on local services

Appendix C. Climate action package investment summary

p.19-22

p.23-29

Appendix D. Al routes with service improvements funded by targeted rate

1

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

Climate action in the consultation document

Page in CD

Page in SI

How we’l fund the proposal

We propose a targeted rate that wil raise $574m over the next 10 years and we

wil seek to use this to unlock government funding. Alongside fare revenue from

the increase in public transport, this wil fund the programme. The proposed rate

wil be based on property value and is estimated to cost:

p.15

p.16-17, p.30-

• $1.12 per week (Median urban residential property)

36

• $0.88 per week (Median rural residential property)

• $1.83 per week (Median business property)

• $1.30 per week (Median farm/lifestyle property)

Budget pressures

• Uncertainty created by both the COVID-19 pandemic and unfavourable economic trends are placing

pressure on our budget. The ongoing impacts are hard to predict.

• We have a range of options to manage budget pressures including cost reductions in the form of efficiency

savings and reductions to low-priority services, carefully managing our borrowing, deferring some capital

projects, recycling non-strategic assets and making careful use of central government’s “Better Off”

funding.

• There are no plans to increase general rates beyond the 3.5 per cent proposed overall average increase for

2022/2023 signalled in the 10-year Budget.

Budget pressures in the consultation document

Page in CD

Page in SI

We have several levers and options to manage budget pressures. They include

adjusting our operational spending, borrowing, capital investment, asset recycling,

p.20-21

p.37-57

and revenue. We need to prioritise operational spending to help manage the ongoing

budget pressures, including those that could reduce, stop or change some services.

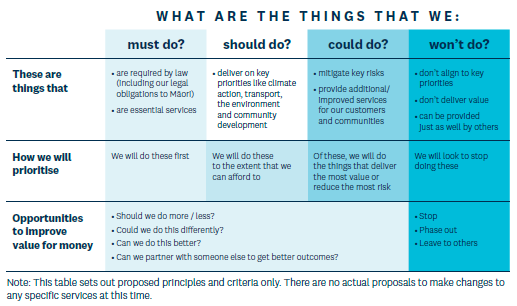

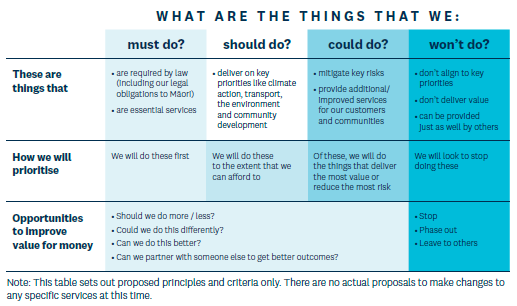

Service prioritisation

Consultation document – p.24, supporting information – p.56/57

• We need to prioritise operational spending to help manage the on-going budget pressures.

• Given the significant cost reductions already achieved and the $90 million per annum savings target

already included in our 10-year Budget, further reductions on this scale will almost certainly mean we will

have to stop, reduce or change some of the services we currently provide.

• Our prioritisation would be guided by the Auckland Plan 2050 and the legislated role for the council to

promote the social, economic, environmental and cultural well-being of our communities now and for the

future.

• Once we have worked through this, we would seek further public feedback on any significant changes

through future annual budget processes.

• When considering how and where to make service changes, we propose using the following framework and

criteria to guide us.

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

2

Section 1: Communications and key issues

1.1 Key messages and issues

Waste management

• Over the next three years we will continue to standardise waste services and charges across Auckland - as

detailed in our Waste Management and Minimisation Plan 2018.

• We propose moving to a region-wide rates-funded rubbish collection service with a choice of three bin

sizes to accommodate different household needs. This means everyone pays the same for the same size

bin no matter where you live, which is more equitable. The proposed service is also more cost effective

than the currently planned pay-as-you-throw (PAYT) model with prepaid bin tags or bags.

• Auckland aspires to be zero-waste by 2040. Zero-waste is a long-term goal, and we are steadily working

towards this.

• Auckland Central and Manukau have a rates-based service already, but for the rest of the region, this

means no more bin tags or pre-paid bags.

Item

Waste Management in the Consultation Document

Page in CD

Page in SI

Kerbside

A move to a region-wide rates-funded refuse col ection service

rubbish

(rather than PAYT) with a choice of three bin sizes to

payment

accommodate different household needs to be phased in from

p.26-31

p.72-77

system

2023/2024.

Rol -out of food

Continue to introduce the food scrap collection service to the

scraps service

remainder of the North Shore and Waitākere from March 2023

p.78-80

and targeted

(and for the rest of urban Auckland from July 2023). *Properties in

p.26-31

rate

the areas where the service is introduced wil pay a proportion of

*p.89-91

the Food Scraps targeted rate based on when the service starts.

Standardisation

Different rules apply in different parts of Auckland around opt-out

of waste

of waste services and targeted rates. We are proposing a

charges to

standardisation of rules for multi-unit residential developments,

p.26-31

p.80-88

specific

residential and lifestyle properties with less than ten SUIPs under

properties

one title and some non-residential properties.

3

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

Rates Changes

Consultation document – p.46-51, supporting information – p.93-98

• The average increase in general rates across all existing properties is proposed to be 3.5 per cent as set

out in the 10-year Budget 2021-2031.

• While the average general rates increase across all properties is 3.5 per cent, the average general rates

increase for an average value residential property is higher at 3.99 per cent, due to:

o a long-term strategy to lower the proportion of general rates raised from business properties

which means the proportion for residential properties is increasing

o the average residential property value rising faster than those of farm and lifestyle properties,

meaning a slightly higher share of rates will be paid by residential properties.

• For an indication of the proposed property rates of your own property go to

www.aucklandcouncil.govt.nz/ratesguide (rates calculator)

• This analysis is based on new capital values that are subject to certification by the Valuer-General and the

objection process and therefore may change.

Other matters for feedback

Tūpuna Maunga Authority

Each financial year, the Tūpuna Maunga Authority and the council must agree an annual operational plan to

provide a framework in which the council will carry out its functions for the routine management of the Tūpuna

Maunga and administered lands for that financial year, under the direction of the Tūpuna Maunga Authority.

The Tūpuna Maunga Operational Plan 2022/2023 identifies a number of projects to be delivered or commenced in

the coming financial year and the subsequent two financial years. The Tūpuna Maunga Operational Plan

2022/2023 also sets out the 10-year work programme and funding envelope confirmed through the 10-year Budget

2021-2031.

The budget for 2022/2023 and the subsequent years fits within this funding envelope. A copy of the Operational

Plan can be found at the Authority's website:

Mahere, Kaupapa here e Tikanga / Tūpuna Maunga Authority. A summary of the Tūpuna Maunga Authority’s indicative funding requirements is outlined in the supporting

information (p.142-148).

Consultation for the Operational Plan will run alongside consultation for the Annual Budget 2022/2023 from 11am

28 February to 5pm 28 March.

Changes to fees and charges

An online rates guide can be found at

www.aucklandcouncil.govt.nz/ratesguide

Item

Overview

Page in CD

Page in SI

Rating Policy

• Exclude rural zoned land on Waiheke from the Urban

changes

Rating Area.

• Accommodation Provider Targeted Rate wil not be

p.50

p.95-98

reinstated for 2022/2023.

• Residential accessways on separate titles to be rated

as residential use.

Fees and Charges

Changes to fees for animal management, cemeteries and

rainwater tanks to maintain appropriate cost recovery or to p.53

p.99-112

remove disparity in fee levels for similar services across

different locations

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

4

Section 1: Communications and key issues

1.1 Key messages and issues

Other consultation

The fol owing policies wil be consulted on separately from

items

but at the same time as the Annual Budget 2022/2023 to

give effect to the changes being consulted on part of the

Annual Budget 2022/2023 and to comply with our

obligations under the Local Government (Rating of

Whenua Māori) Amendment Act 2021;

• Revenue & Financing Policy – to give effect to the

p.50-53

proposed rating policy changes identified above.

• Rates Remission and Postponement Policy.

• Māori Land Rates Remission and Postponement

Policy – proposed policy amendments after

considering new legislative requirements to support

the principles set out in the Preamble to Te Ture

Whenua Māori Act 1993.

Increasing local board decision-making over local community services:

Overview

Page in CD

Page in SI

Proposed increases to local board decision-making responsibility

over local community services)

p. 53/54

p. 149/150

Proposed operational changes to allow local boards much

greater flexibility to make changes in their service level priorities

within their funding envelope al ocated by the Governing Body.

Changes to the Decision-Making Responsibilities of Auckland

p. 53/54

p. 151 - 170

Council’s Governing Body and Local Boards Policy are required

to transfer responsibilities for most local community service asset

decisions from the Governing Body to local boards

Proposed minor changes to the Local Boards Funding Policy to

support the proposed changes to decision-making

responsibilities

p. 53/54

p. 171 - 175

5

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

1.2 Frequently asked questions

Overall

What is the Annual Budget 2022/2023?

The annual budget sets the activities, services and investments for the following year, and details how we plan to

pay for them. This consultation looks at where we are proposing changes for the Annual Budget 2022/2023,

compared with what was included in the Recovery Budget (10-year Budget 2021-2031).

What is included in the Annual Budget 2022/2023?

The consultation document contains a message from the mayor, summarising the council’s priorities for 2022. It

has an overview of our key issues and outlines the proposed budget in the key areas of spend. In the budget you’ll

also find an outline of changes to rates and how that impacts business and households as well as specific local

board priorities. Of course, the consultation document outlines how you can give us your ideas and feedback.

Where can I go for more information?

For more information and to access the full consultation documents for the Annual Budget 2022/2023 go to:

akhaveyoursay.nz/budget

You can also use the links below to download the consultation document and supporting information:

Consultation document:

www.aucklandcouncil.govt.nz/budgetdocument

Supporting information:

www.aucklandcouncil.govt.nz/supportinginformation

Climate action

Why is climate action a focus this year?

Aucklanders have told us they want to see more and faster action to address the climate emergency.

2021 was officially New Zealand’s hottest year on record and the council believes that unless we work together to

reduce our carbon emissions, we will be leaving a legacy of climate disaster for our children and grandchildren.

We need to act now. And we must act fast. We have less than a decade to dramatically reduce our emissions and

avoid the worst impacts of climate change. The package’s focus on transport has been chosen as this is the area

where the council can have the most impact on regional emissions while generating wide regional benefits and

addressing existing inequity in the provision of services.

Why is the council proposing using a Climate Action Targeted Rate rather than general rates?

A targeted rate enables funding to be ringfenced and spent on the purpose for which it is collected, and therefore

improves transparency.

Why is the council proposing a Climate Action Targeted Rate (CATR) now?

Time is running out to address climate change. We must act now if we are to have any chance of meeting our

emissions reduction goals and averting a climate disaster. There is never a good time in the life of a council to have

to raise extra revenue, and with the impact of COVID-19 reducing our income, it makes it tougher at present. But

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

6

Section One: Communications and key issues

1.2 Key messages and issues

long after COVID-19 ceases to be a major threat to us, there will be the ongoing crisis caused by climate change.

Auckland Council recently unanimously declared a climate emergency and also committed to Auckland’s

ambitious climate plan, we can’t afford to put off any longer the action needed to avoid a climate disaster.

What is the impact of the CATR on emissions?

It is challenging to estimate emissions reductions as a result of transport interventions due to the complex nature

of the transport system and behaviour change.

The package’s focus on transport has been chosen as this is the area where the council can have the most impact

on regional emissions while generating wide regional benefits and addressing existing inequity in the provision of

services. Based on current modelling assumptions, it is estimated that the transport components of the package

could reduce emissions by 47,000 tonnes of CO2 over 10 years. However, a number of additional transport

interventions and policy settings are expected that will increase the emissions reduction resulting from the

package. This includes policies and interventions, and changes to the wider transport environment such as

congestion pricing, the Parking Strategy, increasing fuel costs and urban intensification, that encourage a shift

from private vehicles to public transport, walking and cycling.

Because of the complexity and the current uncertainty about broader transport interventions, we can’t be

definitive about the emissions reductions at this time and therefore have not included this as a defined target in

consultation material. However, the Consultation Document does describe the relationship between making low

emissions transport options available, and the reduction in emissions this will facilitate through replacing private

car trips.

Regardless of any final emissions reduction number, the Climate Action Targeted Rate proposal is an essential

component of the change that needs to occur to transform to a low carbon transport system that provides more

accessible transport options for Aucklanders. The emissions reductions from the proposal will be relatively small

in the context of Auckland’s regional emissions but are part of a bigger picture and are necessary to create a

transport system that supports a just transition to a low carbon future.

How does this budget reduce regional emissions?

The proposed investments in public transport and active networks seek to reduce transport emissions, by

reducing private light vehicle trips. In Auckland, cars are responsible for around 30 per cent of regional emissions.

This focus on urban transport options has been chosen as the area where council can have the most impact on

regional emissions while generating wide regional benefits and addressing inequity in the provision of services.

How will the rate benefit my community?

As well as protecting Tāmaki Makaurau from the impacts of climate change for future generations, investments

through the Climate Action Targeted Rate (CATR) will have immediate and meaningful impacts on our

communities. The rate will improve bus services in all Auckland wards, including 10 new frequent routes serving

South Auckland, West Auckland, Ōrākei, Tāmaki and New Lynn to Onehunga via Mount Roskill, and an extension of

frequent services on the Northern Express to Hibiscus Coast station. The vast majority of bus routes will be

upgraded to ensure they operate at least every 30 minutes from early in the morning until late in the evening, 7

days per week. There will also be an addition of 79 low-emission buses and 6 to 7 low-emissions ferries. The rate

will enable 35km of walking improvements, including improvements to footpaths, more pedestrian crossings,

improved accessibility and better pedestrian lighting in key locations across Auckland and allow 14,800 native

trees to be planted in areas of heat vulnerability.

7

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

Budget pressures

How is the budget planning for and responding to the impacts of COVID-19?

Our revenues have been especially impacted by COVID-19 impacts such as reduced revenues from public transport

usage, parking fees, usage of our facilities and events-related income and dividends from Auckland Airport and

earnings from Ports of Auckland.

This budget seeks to build in flexibility to manage the uncertain ongoing impact of these conditions. Prudently

managing the budget will position the council to cope with the immediate impacts related to COVID and the wider

financial shifts that are emerging.

This budget proposes a two-phase approach to our budget challenges. The availability of $127 million for Auckland

in the coming financial year as the first tranche of the Government’s ‘Better Off’ funding package alleviates the

pressure to take drastic actions now. To address the ongoing operating budget impacts the council is proposing to

implement $15 million of permanent cost reductions in the form of efficiency saving and low priority service

reductions across the Auckland Council group in 2023/2024, growing to $30 million per annum from 2024/2025

onwards. To support this, we are consulting on a set of draft expenditure prioritisation criteria. Further action

including operating cost reductions, capital deferrals and sale of non-strategic assets over the next three years

may be required if further budget risks materialise.

How is the council responding to rising inflation and interest rates?

The impact of COVID-19 and changing economic conditions such as increasing interest and inflation rates, labour

scarcity and supply chain challenges, are all likely to have impacts on the medium to long term financial

projections set out in last year’s Recovery Budget.

Finance teams are considering the impact of actual inflation trends and the latest Consumer Price Index (CPI)

result and other projections as they become available.

The finance team provides guidance about the macroeconomic picture and works across the group to prepare

budgets that reflect and respond to any specific pressures we are experiencing. The responses could include

further use of the Government's Better Off funding in the short term but over the longer term will need to consider

cost reductions through adjustments to service levels or increases to council revenue levels.

Do rising costs mean the council will have to reduce spending on big projects?

Rising costs mean that sizeable amounts of capital investment will likely need to be delayed to ensure investment

levels remain within the Recovery Budget settings.

We can reduce operating costs such as interest, running costs, maintenance and depreciation by deferring some

capital projects and project deferrals may be needed simply to offset the impact of rising construction costs.

Delaying investment could make it more costly for us to deliver that investment in the future. Ultimately, delivering

the service and facilities that are important to Aucklanders is the priority for the council so our finance teams and

delivery are carefully prioritising which projects we could delay whilst we manage budget pressures.

How is the council funded?

While one source of funding is general rates charged to homes and businesses, most of Auckland Council's revenue

(around 60 per cent) comes from non-rates income such as:

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

8

Section One: Communications and key issues

1.2 Key messages and issues

• water charges

• public transport fares

• consenting fees

• dividends

• central government subsidies

• contributions from developers.

We also borrow for much of our investment in infrastructure, including roads, footpaths, pipes, and libraries. These

are long life assets and by using borrowings, we spread the cost over the generations that use them.

Why doesn’t the council cut its own costs?

Providing value for money for Aucklanders is always front of mind for the council. From amalgamation to

2019/2020, the council achieved $1.9 billion of savings, with $316 million annual ongoing savings locked in. On top

of this, for the 2020/2021 financial year as a response to COVID-19, the council set a new target of finding an

additional $120 million. This was exceeded by $6 million in May 2021.

Given the significant cost reductions already achieved and the $90 million per annum savings target already

included in our 10-year Budget, further reductions of scale will almost certainly mean we will have to stop, reduce

or change some of the services we currently provide.

We are proposing to implement $15 million of additional permanent cost reductions in the form of efficiency saving

and low-priority service reductions across the group in 2023/2024, growing to $30 million per annum from

2024/2025 onwards. These targets, along with other measures, may need to be reviewed if more budget pressures

eventuate.

Our prioritisation would be guided by the Auckland Plan 2050 and the legislated role for the council to promote

the social, economic, environmental and cultural well-being of our communities now and for the future.

Once we have worked through this, we would seek further public feedback on any significant changes through

future annual budget processes.

Why are Auckland's staff costs rising?

The main reason for increases in staff over time is significant growth in Auckland’s population and the demand

that puts on the need for infrastructure and services.

Changes to staffing in recent years have also been driven by increasing services for water quality and the natural

environment (funded by targeted rates), transferring external contractor roles in-house which reduce the overall

cost to ratepayers; recruiting new staff in functions where the costs are recovered through user fees (e.g.

regulatory or commercial activities); and supporting the unprecedented growth of the Auckland region (e.g.

consenting and civil engineering).

An example of the impact of this growth on staffing needs is in building consents which are running at 20,000 a

year whereas a decade ago they averaged 5,000. The work is complex and intensive and skilled and experienced

people are required to process them.

In terms of salary changes Auckland Council roles are banded using best practice job sizing methodology. The

salary ranges are regularly reviewed against market data from both private and public sector organisations. This

9

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

ensures staff are paid a fair rate for the work they undertake and allows us to retain the talent we need to deliver

our services.

Delivering value for money for Aucklanders is a priority for the council and we are always looking at where we can

create efficiencies as part of that goal. The chief executive’s performance objectives include progressing a

strategic workforce planning project which will provide a longer-term forecast of future workforce needs required

to meet customer demand.

How do we know council is delivering the value for money?

In the Annual Report 2020/2021, our savings for the year were an unprecedented $126 million, against the $120

million Emergency Budget savings target as a result of tight controls on discretionary spend and organisational

efficiencies.

One example of value delivered is in the area of reducing the cost of delivering our data centre infrastructure. We

have moved data processing and storage from on-site servers to outsourced centres (the cloud) and this has

reduced costs from $17.7 million in 2015 financial year to a forecast $4.7 million in the 2021 financial year.

Opportunities to improve value for money is a key consideration in our service prioritisation proposal. We are

proposing to implement $15 million of additional permanent cost reductions in the form of efficiency saving and

low-priority service reductions across the group in 2023/2024, growing to $30 million per annum from 2024/2025

onwards. These targets may need to be reviewed if more budget pressures eventuate.

Once we have worked through this, we would seek further public feedback on any significant changes through

future annual budgets processes.

Why can’t the council just borrow more so ratepayers do not have to pay more?

A key principle the council works to is to fund operating expenditure from operating revenue in the same period,

this is a part of our commitment to financial prudence and long-term financial sustainability.

The key policy settings that ensure financial prudence are set out in our 10-year Budget and include our debt-to-

revenue limit and our balanced budget approach. A weakening of this commitment could lead to a credit rating

downgrade which would increase interest costs and make it more difficult for us to access capital funding when

needed to help deliver on key strategic objectives.

There is no proposal to change or depart from our key financial prudence policy settings.

Why only increase borrowing in the short term?

Increasing borrowing in the short term will help us to continue investing in the facilities and services Auckland

needs, but it would be unsustainable to borrow even more for ongoing operational expenditure and in a raising

interest rate environment would lead to additional and on-going interest costs would need to be paid for somehow.

We need to be careful that our borrowing does not overly burden future ratepayers or adversely impact our credit

rating (which would make future borrowing more expensive). We must also leave ourselves enough headroom to

deal with future shocks should they occur.

Does accepting Better Off funding mean accepting 3-waters reform?

Auckland Council has been clear about concerns regarding 3-waters reform and will continue to advocate that any

new water entity should be kept accountable and responsive to the public through their elected council

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

10

Section One: Communications and key issues

1.2 Key messages and issues

representatives and that Auckland, as the provider of 93 per cent of the proposed new water services entity’s

assets, should have the majority of control over the new water services entity. Reform has been mandated by

central government for all councils which means that Auckland Council cannot opt-out of 3-waters reform.

Whether the council accepts or refuses funding won’t change the mandatory nature of the reform, and in those

circumstances, council considers that refusing available funding would not benefit Aucklanders. The government

has advised that Better Off funding will be available June 2022 onwards and can be used for both operational and

capital expenditure.

Waste management

Why is the council proposing to move all of Auckland to rates funded rubbish collections?

Council is proposing to move all of Auckland to a rates funded rubbish collection service because based on current

evidence it is the simplest, most cost-effective, equitable and climate friendly option to achieve waste

minimisation outcomes.

Was pay-as-you-throw (PAYT) not effective?

For the majority of Aucklanders, Pay-as-you-throw is not driving waste minimisation as anticipated although it

does benefit some households who are very low waste producers.

In fact, a detailed analysis that compared households of similar demographics in rates funded and PAYT areas

found little overall difference in the average annual refuse tonnages between the areas on each payment systems.

This indicates that the financial disincentive created by PAYT is not strongly influencing consumption behaviour.

Our research found that the "user pays" system (currently using bin tags) does not uniquely influence waste

minimisation. There are households in both rates-funded areas and "user pays" areas that hardly ever fill a rubbish

bin. The benefits of reducing your waste extend far beyond disposal costs, so people who are driven to maintain

good waste minimisation habits do so regardless of which neighbourhood they live in.

What are the benefits of the proposed region-wide rates funded service?

With everyone on the same service, council's general operating costs per household for all three services are lower.

Those cost savings are passed on to the customer under this proposal. It also means that the council can

encourage customers to take full advantage of the diversion services - recycling and a future food scraps recycling

service. When using the three-bins efficiently together, many households will find that they can comfortably move

to the smaller 80L bin, and save even more money that way, as the 80L refuse bin will be offered at a reduced rate.

The introduction of the food scraps recycling service is a game-changer for Auckland in terms of reducing waste to

landfill and reducing our emissions from landfill gas. But to be successful, people need to use it. Having the

majority of customers on a rates-funded model gives Auckland the greatest opportunity to achieve a high uptake

of the food scraps recycling service and reducing our emissions.

How is the proposed rates-funded services fairer for most households?

When planning our services, Auckland Council must meet the needs of the whole community. The PAYT system

risks further disadvantaging households that are on low incomes, are very large (and therefore produce more

waste), or both. Most households will continue to use the 120L bin (medium-sized) bin, but the choice of a larger

(240L) and smaller (80L) rubbish bin size (with different pricing for each) will accommodate different household

needs.

11

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

Concerns have been raised about the impact moving to a PAYT system would have on low-income renters whose

waste charges are currently paid for in the rates. For this reason, Kāinga Ora provided feedback that the

organisation supported a transition to a regional rates-funded refuse service. In Auckland, Māori families have a 20

per cent lower rate of homeownership. Moving to a rates-funded model may help renters as landlords are more

likely to pay a rates charge than to provide bin tags or bags for a pay as you throw system.

Some landlords who own rental properties in PAYT areas have expressed concern that the cost of the tenants'

waste services will be loaded into the rates bill and that they will have to increase rents to cover it. If landlords do

pass on this cost to tenants as part of the rent (see table below for estimated weekly cost by bin size), it will

merely be a shift in costs for tenants rather than an additional cost. It is to be noted that landlords already pay for

some waste services in the rates (recycling and a base rate that funds the inorganic collection, resource recovery

network (RRN) and other regional services such as litter). It is also important for them to understand that rents in

rates-funded parts of the region are not higher because they include waste charges; evidence shows that rents are

driven by supply and demand, rather than land taxes.

The overall cost to operate a regional PAYT service is higher than a regional rates-funded service. As per current

evidence, the PAYT model had fewer environmental benefits and did not sufficiently incentivise waste

minimisation to justify the additional complexity and financial risks this model brings. Importantly, under a rates-

funded service Aucklanders are still incentivised to reduce waste through the different sizes of bins available. Bags

will still be available in rural areas and central Auckland where bins aren’t suitable.

What would the rate be if the PAYT/bin tag system is scrapped, and how was this figure

determined?

Rates are set based on the cost of collection and disposal. The estimated annual cost for a typical household

(using a 120L refuse bin) in 2024/2025 (adjusted for inflation and waste levy increases) under each of the delivery

models would be:

Move to common regional weekly refuse

Continue with current hybrid weekly refuse

service

service

Rates only

PAYT only

Rates areas

PAYT areas

Total (Rubbish +

$314

$353

$323

$329

Recycling)

Total (inc Food

$375

$415

$385

$391

Scraps)

How much could households expect to pay under a regional rates-funded service if they produce

less or more rubbish than a 'typical' household?

Once fully implemented, the estimated annual rate for ‘three-bins’ service would be:

Service

Regional rates-funded

Base Rate (inc recycling, applicable base charge subsidy) (Al properties)

$127

Food Scraps (Al properties)

$61

80-litre refuse bin

$124 ($2.38/week)

Smal Bin

3-BIN COST TOTAL (SMALL)

$312

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

12

Section One: Communications and key issues

1.2 Key messages and issues

Service

Regional rates-funded

120-litre refuse bin

$187 ($3.60/week)

Medium Bin

3-BIN COST TOTAL (MEDIUM)

$375

240-litre refuse bin

$276 ($5.31/week)

Large Bin

3-BIN COST TOTAL (LARGE)

$464

When are these changes coming into effect?

The kerbside food scraps service is on track to start in urban Auckland in March 2023 and will be phased in over

the course of that year. Customers will be charged for the food scraps service on a pro-rata basis as the service

rollout is staggered across the first year.

Subject to approval, the move to a regional rates-funded refuse service could start in April 2024 in Papakura and

Franklin and continue for the North Shore and Waitākere throughout 2024/2025, with a rates-funded refuse

service starting in Rodney at the same time.

We propose to apply the waste management targeted rates on a per SUIP basis to all residential and lifestyle

properties with less than ten SUIPs under one title from 1 July 2022.

Timing of proposed opt outs:

• A minimum targeted rate charge to cover the cost of our regional initiatives will apply to all eligible

rateable SUIPs across Auckland that are not currently paying from 2023/2024.

• Residential: multi-unit residential developments of ten or more units will be able to opt out of the refuse,

recycling and food scraps charge if we cannot provide a service, effective 1 July 2022 for central Auckland

and from 1 July 2023 for the rest of the region.

• Non-residential: business and farm properties (excluding lifestyle properties) will be able to opt out of

council waste services and waste charges at their request, effective 1 July 2023.

Rates Changes

Why have properties been revalued?

We are required by law to carry out property revaluations, usually every three years, for the purpose of setting

rates. This ensures that properties of the same value pay the same rates as values move over time. The

requirement for Auckland Council to undertake a revaluation in 2020 was deferred until November 2021 due to the

uncertainty in the housing market caused by COVID-19. As we know, the property market is dynamic which is why

these values change over time and so revaluations ensure that over time, similar value properties are paying

similar rates.

How will revaluations affect my rates?

New valuations don’t affect the amount of money the council collects from rates - it just helps us work out

everyone’s share of rates. An increase in your property value does not necessarily mean you pay more in rates. It

will vary depending on how much your property value changes compared with other properties. A property whose

value rises by more than the average will have a rates increase above the general rates increase. The opposite is

true for a property with a value change below average.

13

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

Does the delay in revaluation 2021 affect the council's ability to set rates in the budget?

The COVID-19 pandemic added layers of complexity which affected the council’s ability to complete the

revaluation in 2021.

For full context on the revaluation delay and its impact on Annual Budget 2022/23, please refer to the memo you

have received from the rates team on this.

Are you confident in the revaluation process? Are these values accurate?

The council’s team of experienced, qualified and registered valuers work closely with independent valuation

contractors to ensure a robust process. Before valuations are finalised, they are legally required to be audited and

approved by the independent Valuer-General, who is responsible for authorising rating valuations for the

government across New Zealand.

What if I want to object to my property valuation?

Objection information will be included on your valuation notice. You can also go to our website to see your

objection options. If you don’t agree with the details held for your property, for example, it shows the wrong

number of bathrooms, you can request to update your property file by requesting a Ratings Information Database

(RID) objection form – available on our website. If you don’t agree with all or some of the components in your

updated valuation, for example you disagree with the value itself, the process for making an objection will be

clearly displayed on your revaluation notice.

What is the change to general rates for 2022/2023?

The average general rates increase across all properties is 3.5 per cent. The average general rates increase for the

average-value residential property is higher at 3.99 per cent, due to:

• a long-term strategy to lower the proportion of general rates raised from business properties which means

the proportion for residential properties is increasing. This accounts for about 0.39 per cent of the

average-value residential property rates increase

• the average residential property value rising faster than those of farm and lifestyle properties, meaning a

slightly higher share of rates will be paid by residential properties. This accounts for about 0.10 per cent of

the increase.

For an indication of the proposed rates for your property go to

www.aucklandcouncil.govt.nz/ratesguide

What proportion of council’s budget is funded by rates?

Property rates provide around 40 per cent of our funding and contribute to operating costs rather than capital

spend. This will be the third year in a row the share of the budget funded by rates is maintained around 40 per

cent. Your rates help us provide the things that make Auckland a great place to live and work. These include:

• collecting rubbish

• improving public transport

• organising and facilitating events

• maintaining parks

• running our libraries and other community facilities.

More than half of our operating revenue comes from other sources, including:

• water charges

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

14

Section One: Communications and key issues

1.2 Key messages and issues

• public transport fares

• consenting fees

• central government subsidies

• contributions from developers.

The average increase in general rates across all existing properties is proposed to be 3.5 per cent as set out in the

10-year Budget 2021-2031.

Is there any help to manage a big rise in my rates bill?

We know rates increases can be stressful for households where every dollar counts. If you’re worried about paying

your rates, please get in touch with the council, we have options to help you. There is a rates rebate for low-

income earners, rates postponement for those with sufficient equity, and flexible payment timing options which

allow you to pay weekly, fortnightly, monthly or quarterly.

What progress is being made against goals set out through the Water Quality Targeted Rate

(WQTR) and the Natural Environment Targeted Rate (NETR)?

The Water Quality Targeted Rate (WQTR) will continue to be used to help fund the capital costs of investment in

cleaning up Auckland’s waterways. Since the beginning of the programme, four major infrastructure projects have

been completed, 5,929 inspections have been conducted at construction sites to protect our waterways from

sediment, 120 stormwater outlets have been tested across 13 beaches and 9,844 onsite wastewater inspection

records have been checked for compliance.

The Natural Environment Targeted Rate (NETR) will continue be used to help fund the capital and operating costs

of investment to deliver enhanced environmental outcomes. Since the beginning of the programme the rate has

allowed for 33.5km across 13 tracks to be reopened in regional parks by bringing them up to kauri safe standard.

Pest plant control has occurred over 1,689ha across the region and 1,600+ traps have been set for stoat

eradication on Waiheke. We’ve provided $12.4 million to supporting 369 community initiatives.

The projects underway are good news for the environment, and for our people.

When will the new rates rise come into effect?

The new rates apply from 1 July 2022 and will be reflected in the first rates invoices you will receive at the

beginning of August.

What is being achieved with the regional fuel tax?

Money raised through the Regional Fuel Tax (RFT) is collected by Waka Kotahi and remitted to Auckland Council

on a monthly basis. The revenue is ring-fenced by legislation for expenditure only on transport projects jointly

approved by the council and central government, and all money raised is spent on transport-related work. The key

projects funded by the RFT are:

• bus priority improvements

• city centre bus infrastructure

• improving airport access

• Eastern Busway

• Downtown ferry terminal and redevelopment

• road safety

15

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.2 Frequently asked questions

• active transport

• road corridor improvements.

RFT funding is allocated to major infrastructure projects which take considerable time to plan, designate, design

and build. Before this work starts, there needs to be certainty that revenue will be available to complete the

projects, which is why most RFT projects had limited work undertaken on them prior to inclusion in the RFT

scheme. Spending will ramp up as projects move into the construction phase and all money raised for transport

infrastructure will be spent for that purpose.

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

16

Section One: Communications and key issues

1.3 Social media

1.3 Social media

How to use social media to promote the consultation

During the consultation period, we will be using official council social media channels to promote the consultation

and encourage Aucklanders to have their say.

If comments are available on social media campaign posts from the official council Facebook or Instagram pages,

they will be collected as feedback if they use #AkHaveYourSay alongside the comment. This feedback will be

included in analysis and reports.

However, the AKHaveYourSay website remains our primary and preferred destination for feedback and allows us

to capture the views of Aucklanders more effectively. If someone replies to a post you have shared, please

encourage them to head to

akhaveyoursay.nz/budget so their feedback can be captured. Social media should be

used primarily to start a conversation and direct people to our standard tools to submit in full.

Follow the council social media channels

If you don’t already, we encourage you to follow and subscribe to notifications for the council’s social media

channels. That way you will be able to see when we post things relevant to the consultation.

Twitter

• @AklCouncil

•

twitter.com/aklcouncil

Facebook

• @AklCouncil

•

facebook.com/aklcouncil

Instagram

• @AklCouncil

•

Instagram.com/aklcouncil

LinkedIn

•

linkedin.com/company/auckland-council

Sharing content

The council will leverage social media in various ways during the consultation. Once you are following the council’s

social media channels you can retweet and share relevant content.

We will publish articles on consultation topics t

o OurAuckland.nz. These will be shared on our social media

channels.

Local boards holding Have Your Say events will be using their social media channels to publicise the events. Share

those dates to encourage attendance.

We encourage you to scan this content for interesting facts, visuals or insights that could connect with your

followers and trigger conversation and sharing. The more that Aucklanders interact with you about consultation

17

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

Section One: Communications and key issues

1.3 Social media

topics on social media, the greater chance their friends, family and colleagues will learn of the consultation and be

encouraged to submit feedback.

Please note the council will not be able to see feedback on a shared post. Please remind your followers they must

submit their feedback on th

e akhaveyoursay.nz/budget website.

Content and resources

• All the material and documentation will be online at

akhaveyoursay.nz/budget

• Articles and more information will be availab

le at OurAuckland.nz.

•

Auckland Council Social Media Guidelines

Make sure you follow and check the official #AkHaveYourSay hashtag on Facebook, Twitter and Instagram.

More tips and support for using social media

• Comments on social media will be collected as feedback if it is shared to official council Facebook pages

or via Twitter and Instagram to @aklcouncil and using #AkHaveYourSay

• How to make the most of Twitter -

support.twitter.com/categories/281

• Facebook help -

www.facebook.com/help/

• Instagram help

- help.instagram.com

• Auckland Council’s social media team o

n [email address]

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

18

Section Two: Local information

Local board planning and funding FAQs

Section 2 - Local information

Local board planning and funding FAQs

How is funding allocated between local boards?

The local boards funding policy, which is included in the supporting information (page 176-217) of the Annual

Budget 2022/2023 consultation document, sets out the principles, methodology and formulae for fund allocation

for local activities.

Most of the local board funding relates to local assets and facilities. The Governing Body makes the initial

investment decisions and then local boards oversee the budgets and operations.

Local boards are also allocated discretionary funding to deliver assets, programmes and initiatives.

The actual budget for each year is agreed with the Governing Body through the annual Local Board Agreement.

How do I find out exactly how much has been spent in my local board area?

Auckland Council is not able to track all expenditure by ward or local board as not all costs are identified on such a

specific basis.

Costs, however, can generally be broken down into three types:

1 Costs that are incurred quite specifically for a piece of work, which can then be identified and allocated to

a local area (examples include operating a specific library, sealing a particular stretch of road, or building a

standalone water treatment plant);

2 Costs that are incurred on a regional basis and provide services for the entire region (examples include

running elections, preparing unitary plans, customer contact centre, public transport planning, civil

defence and emergency management); and

3 Costs that are incurred for works including specific locations, but where the costs are charged on a wider

basis within contracts that have gained council savings through economies of scale (examples include

parks maintenance, facilities management).

Therefore, a substantial portion of costs incurred by the council group cannot be identified as belonging to a

specific local area and the only way to do so would be to allocate costs across the region on some arbitrary basis

(e.g. population, area, rates income).

19

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

link to page 24

Section Two: Local information

Local board planning and funding FAQs

Local board achievements and priorities

Local board

Page in CD

Page in SI

Albert-Eden Local Board

p.57

p.176

Aotea/Great Barrier Local Board

p.58

p.178

Devonport-Takapuna Local Board

p.59

p.180

Franklin Local Board

p.60

p.182

Henderson-Massey Local Board

p.61

p.184

Hibiscus and Bays Local Board

p.62

p.186

Howick Local Board

p.63

p.188

Kaipātiki Local Board

p.64

p.190

Māngere-Ōtāhuhu Local Board

p.65

p.192

Manurewa Local Board

p.66

p.194

Maungakiekie-Tāmaki Local Board

p.67

p.196

Ōrākei Local Board

p.68

p.198

Ōtara-Papatoetoe Local Board

p.69

p.200

Papakura Local Board

p.70

p.202

Puketāpapa Local Board

p.71

p.204

Rodney Local Board

p.72

p.206

Upper Harbour Local Board

p.73

p.208

Waiheke Local Board

p.74

p.210

Waitākere Ranges Local Board

p.75

p.212

Waitematā Local Board

p.76

p.214

Whau Local Board

p.77

p.216

For more details on local board achievements and priorities, please visit

akhaveyoursay.nz/budget

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

20

Section Three: Consultation process

Consultation information

Section 3 - Consultation process

This section details what information supporting the annual budget is available, where to find it and how we are

raising public awareness. We have also included a schedule of Have Your Say events and next steps.

Consultation information

Online

The following documents and resources are availab

le at akhaveyoursay.nz/budget

• consultation document

• supporting information

• local board information

• feedback form

• online rates guide

• list of all Have Your Say events

• videos

• summaries of the consultation document, feedback form and information videos are also available in:

o Te Reo Māori

o New Zealand Sign Language

o traditional and simplified Chinese

o Samoan

o Tongan

o Korean.

Libraries and service centres

Hard copies of the following documents will be made available on-site for members of the public:

• consultation document

• supporting information (reference copy only)

• feedback forms.

Accessibility

The consultation document will be available as a PDF accessible document for those who use screen readers. This

document will be available at

www.aucklandcouncil.govt.nz/budgetdocument. The supporting information will

also be available at

www.aucklandcouncil.govt.nz/supportinginformation.

Request a hardcopy

Anyone can request a hardcopy of the documents available by emailing

[email address]

or by calling the council on 09 301 0101.

Ways to have your say

• online

at akhaveyoursay.nz/budget

• at Have Your Say events

• social media – using #AkHaveYourSay on Facebook and Instagram

21

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

link to page 25

Section Three: Consultation process

Consultation information

• emai

l [email address]

• filling out a hard copy submission form and scanning/emailing to

[email address]

or posting it to Auckland Council using the freepost authority address

• if a member of the public is unable to provide feedback via any of the above channels they can call 09 301

0101 and an appointment will be made for them to give feedback over the phone.

Engagement activities

We are holding a range of events (face to face and online) as per the schedule below.

Note: webinars are an opportunity for members of the public to hear from and ask questions of subject matter

experts and elected members – they are not a method of giving feedback. Participants will be encouraged to go

online to akhaveyoursay.nz and complete a feedback form at the end of the webinar.

Targeted letters/emails will be sent out to those affected by the following proposals:

• Multi-unit Residential Developments of 10 or more units (MUDs) body corporates - Auckland City

• Multi-unit Residential Developments of 10 or more units (MUDs) body corporates - Non Auckland City

• Non-Residential (excluding lifestyle) Properties - Manukau

• Non-Residential Multi- SUIP

1 • Multi-SUIP residential properties with less than ten SUIPs

• Waiheke Urban Rating Area

• Rating of whenua Māori.

Information sessions, workshops and other activities will be held by our community partners to engage our diverse

and hard-to-reach groups to increase participation with these communities.

A presentation and discussion of the engagement plan was held with the demographic advisory panels at the co-

chair’s forum in November. They will continue to be involved in the process and will be given the opportunity to

comment on the consultation material.

Leveraging our existing relationships with corporate partners (e.g. Countdown) to raise awareness and increase

participation with Aucklanders by using their channels to communicate with staff/customers where applicable (e.g.

through newsletters, posters, etc)

Information about the annual budget including the opportunity to participate will be sent out to various internal

and CCO databases including:

• the rates database

• library patrons

• Peoples Panel

• AT Hop cardholder database

• local board databases

• AK Have Your Say participant database

• Auckland Conversations.

1 A separately used or inhabited part of a rating unit (SUIP) is ‘any part of a rating unit that is separately used or inhabited by the ratepayer,

or by any other person having a right to use or inhabit that part by virtue of a tenancy, lease, licence or any other agreement’. An example

would be a rating unit that has a shop on the ground floor (which would be rated as business SUIP) and a residence upstairs (rated as a

residential SUIP).

Auckland Council Annual Budget 2022/2023

Elected Members’ Handbook

22

Section Three: Consultation process

Other consultation

Have Your Say event schedule

Have Your Say (HYS) events provide an opportunity for Aucklanders to provide spoken feedback (either in person

or online) on regional and local issues and to be heard by elected members. HYS events will be supported by

councillors, local board members and staff. A range of council organised HYS events or existing events spread

across the Auckland region have been organised to offer members of the public various opportunities to have their

say. Please note that should we still be in a red traffic light setting, many of these will be online or in some cases

may be cancelled (for non-council run events).

The live event schedule can be found here:

https://akhaveyoursay.aucklandcouncil.govt.nz/annual-budget-events

If you are unable to access this, please emai

l [email address]. Please check with your support advisor

for more information as they have access to the live calendar.

There are different styles for the HYS events: